UOB PayAnything is a payment solution exclusively offered to UOB Credit card holders. The service allows you to pay any expense using your credit card limit and transfering fund to your destinated saving account with a minimal fee of 1.5% of transaction amount. You will receive UOB Rewards Points/cash rebate*, just like how you normally spend your credit card. There are 3 channels for you to request UOB PayAnything transaction and it takes only 1 business day* to complete transfering expense to destinated saving account.

Spend as necessary and pay the total outstanding balance per due date to avoid interest rate of 16% per year

Benefits

Enhance your financial flexibility

Allows you to pay any expense using your credit card limit

Receive UOB Rewards Points or cash rebate*

just like how you normally spend your credit card

Fast Transfer

Destinated saving account receives payment within 1 business days*

Installment Plan

Convert your transaction into installment plan upto 36 months

Get Lotus's gift card up to 2,500 THB

exclusively for UOB PayAnything first transaction

| UOB PayAnything

accumulated transaction amount /credit card/month |

Receive Lotus gift card |

| 80,000 - 129,999 THB | 100 THB |

| 130,000 - 199,999 THB | 400 THB |

| 200,000 - 399,999 THB | 800 THB |

| 400,000 - 599,999 THB | 1,800 THB |

| 600,000 THB or above | 2,500 THB |

For transaction during 1 Jan - 31 Mar'24 To register campaign, type UPA followed by last 12 digits of your credit card and send SMS to 4545111 (3 THB/ SMS)

Enroll on UOB Line Connect

Add friend @UOBThai on LINE application for exclusive access through LINE alert, LINE Enquiry and many more features

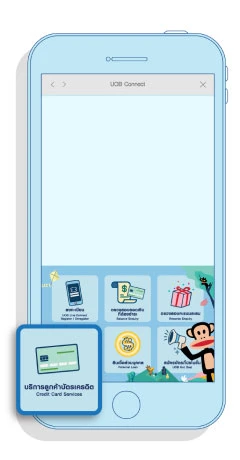

1. Select "Credit Card Customer Service" button on the Main Menu

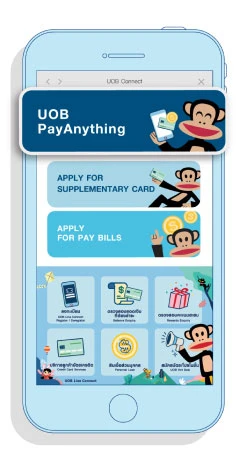

2. Select Sub-Menu "UOB PayAnything" appearing on screen

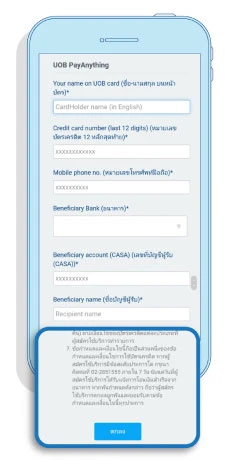

3. Fill out cardholder information, recipient's saving account and transaction amount

4. Review and confirm information

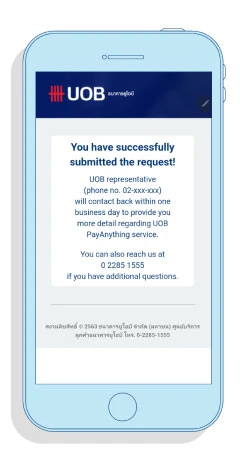

5. Wait for system to confirm the message "Transaction submit successfully"

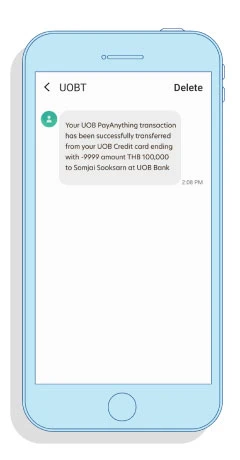

6. The bank will notify customer via SMS when the transaction is completed

UOB PayAnything's Terms and Conditions

UOB PayAnything's Terms and Conditions

- UOB PayAnything is a payment service to recipient's saving account using your available credit line. The terms and conditions are as approved by UOB (“Bank”).

- UOB PayAnything is available to all primary UOB credit card holders and UOB customers holding an existing primary Citi-branded card (“Member”), except corporate credit card

- To enroll UOB PayAnything, members need to provide transaction details according to bank's specification with a maximum per transaction of THB 699,999 or upto your available credit limit, whichever is lower.

- Once after completion. your UOB PayAnything request is approved, the bank will transfer payments from the member's credit limit to prepay into recipient's account. The members must ensure sufficient available credit line, covering transaction amount and fee. The payment transfer is typically completed within 1 business days after member confirm transaction detail with Bank representative. The bank will notify members of the successful transfer via SMS.

- In the event of UOB PayAnything transactions for purchasing goods and/or services, the bank is not involved in the sale of products or provision of services by merchants. For any damages or defects, please contact the merchant directly.

Fee and interest charged

- The UOB PayAnything service incurs a fee of up to 1.5% of the transaction amount (inclusive of value-added tax). Members may be offered varying fee based on promotional campaigns, subject to periodic updates communicated by the bank through sales channels and advertisements, whether initiated by the bank or external service providers such as online media, etc. The applicable fee will be charged to the member's credit card used for UOB PayAnything transaction.

- If a member has an outstanding credit card balance from previous billing cycle or in the current billing cycle, at the time of enrolling UOB PayAnything, which may be resulted from non-payment, minimum payment, or partial payment, or if a member makes only partial payment for this UOB PayAnything transaction, the interest calculation for UOB PayAnything transactions will follow credit card interest calculation criteria. For more details on interest calculation, please visit https://www.uob.co.th/personal/cards/credit/4styles.page

UOB Rewards Points or Cash Rebate from UOB PayAnything Transaction

- UOB PayAnything is considered a type of transaction on member's credit card and is eligible for UOB Rewards points (for credit card with UOB Rewards program) or cashback (for credit card with cashback program), based on the terms and conditions of the specific credit card used for this transaction.

- Transaction amount eligible for UOB Rewards Points/cashback is capped at THB 100,000/account/billing cycle. In the event that transactions occurred one day before or on the billing cycle date, these transations will be calculated and accumulated for UOB Rewards Points/cashback in the next billing cycle, whereas the total transaction amount in such billing cycle cannot exceed THB 100,000/account.

UOB PayAnything - Frequently Asked Questions

What is UOB PayAnything?

UOB PayAnything is a payment solution exclusively offered to UOB Credit card holders. The service allows you to pay any expense using your credit card limit and transfering fund to your destinated saving account with a minimal fee of 1.5% of transaction amount. You will receive UOB Rewards Points/cash rebate*, just like how you normally spend your credit card. There are 3 channels for you to request UOB PayAnything transaction and it takes only 3 business days to complete transfering expense to destinated saving account.

Who can I pay with UOB PayAnything?

You can use UOB PayAnything to make payment to anyone. It covers all types of expenses, including rental fees, tuition fees and purchases of goods and services by simply converting your UOB credit card credit line into a fund transfer to recipient's saving account. The recipient does not have to be a UOB customer.

What cards can I use for this service?

You can pay with UOB PayAnything with all primary UOB credit cards, and primary Citi-branded UOB credit card, except corporate credit card.

Do I earn reward point or cashback on my UOB PayAnything transaction?

Yes, you will earn Rewards Points/cashback from UOB PayAnything transaction depending on type of credit card used for the transaction. The transaction amount eligible for UOB Rewards Points/cashback is capped at THB 100,000/account/billing cycle. In the event that transactions cccurred one day before or on the billing cycle date, these transactions will be calculated and accumulated for UOB Rewards Points/cashback in the next billing cycle, whereas the total transaction amount in such billing cycle cannot exceed THB 100,000/account.

When will the bank charge UOB PayAnything transaction?

The bank will pre-authorise your credit card limit for the transaction amount and fee one business day prior to the payment transfer date. The actual transaction will be reflected in your credit card account once the payment transfer from credit card limit is successfully completed.

How long do payments take to reach my recipient?

The payment transfer is typically completed within 1 business days after member confirm transaction detail with Bank representatuve.

Is there a fee for using UOB PayAnything?

Yes, the UOB PayAnything service incurs a fee of up to 1.5% of the transfer amount (inclusive of value-added tax). Members may be offered varying fee based on promotional campaigns, subject to periodic updates communicated by the bank through sales channels and advertisements, whether initiated by the bank or external service providers such as online media, etc. The applicable fee will be charged to the member's credit card used for UOB PayAnything transaction.

Is there a cap to the amount I can transact via UOB PayAnything?

There is a transaction limit of up to THB 699,999/transaction or up to your available credit limit, whichever is lower.

How do I know that my UOB PayAnything transaction is successful?

You will receive a notification via SMS after a successful payment transfer from your credit card limit. In the event of an unsuccessful transfer, a bank representative will contact you to confirm and assist with initiating a new transaction.

Can I amend or cancel my transaction after I have confirmed it?

If you have confirmed the transaction with bank representative, you will not be able to modify or cancel your transaction.

How will my UOB PayAnything payments be reflected on my credit card statement?

Your payment will appear as "PAYANYTHING" on your credit cards statement with your recipients name e.g., "PAYANYTHING - CHOKCHAI"

Pay anything, anywhere

Apply now