Start UOB TMRW

Online registration for UOB TMRW

1. Online registration for Credit/ Cash Plus cardholders (no deposit accounts)

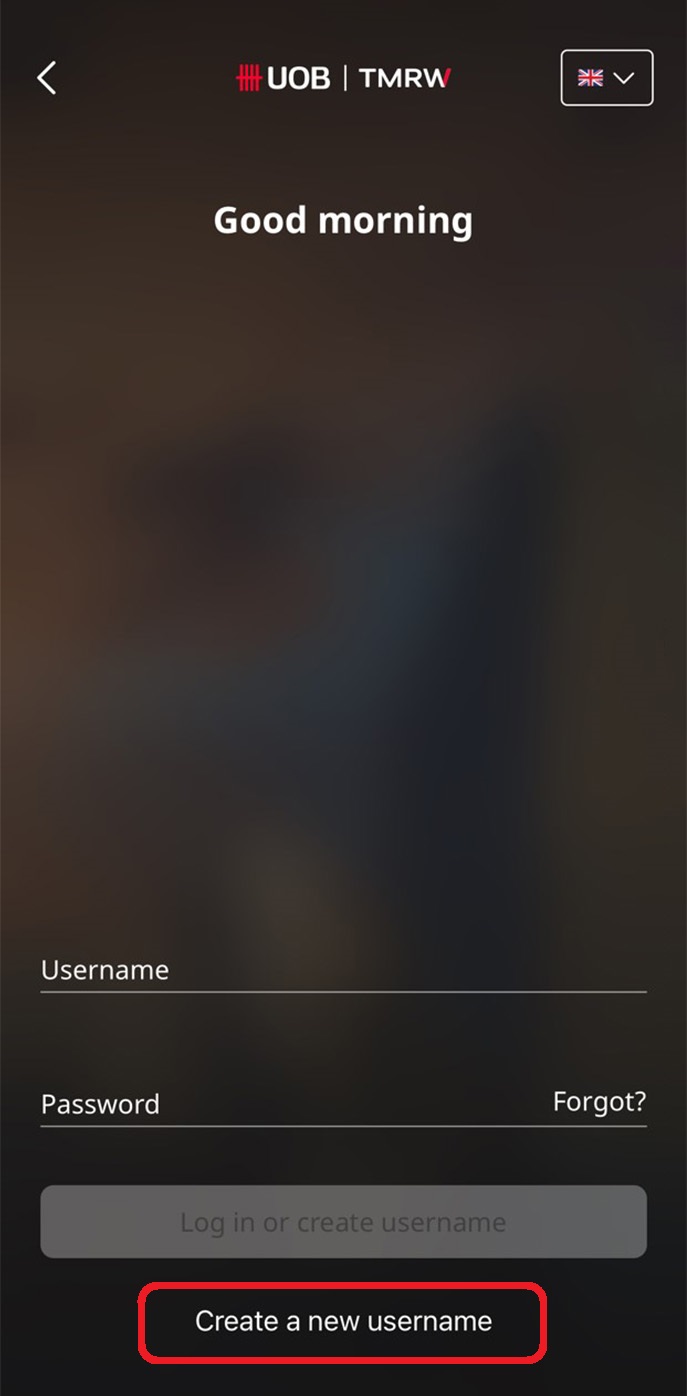

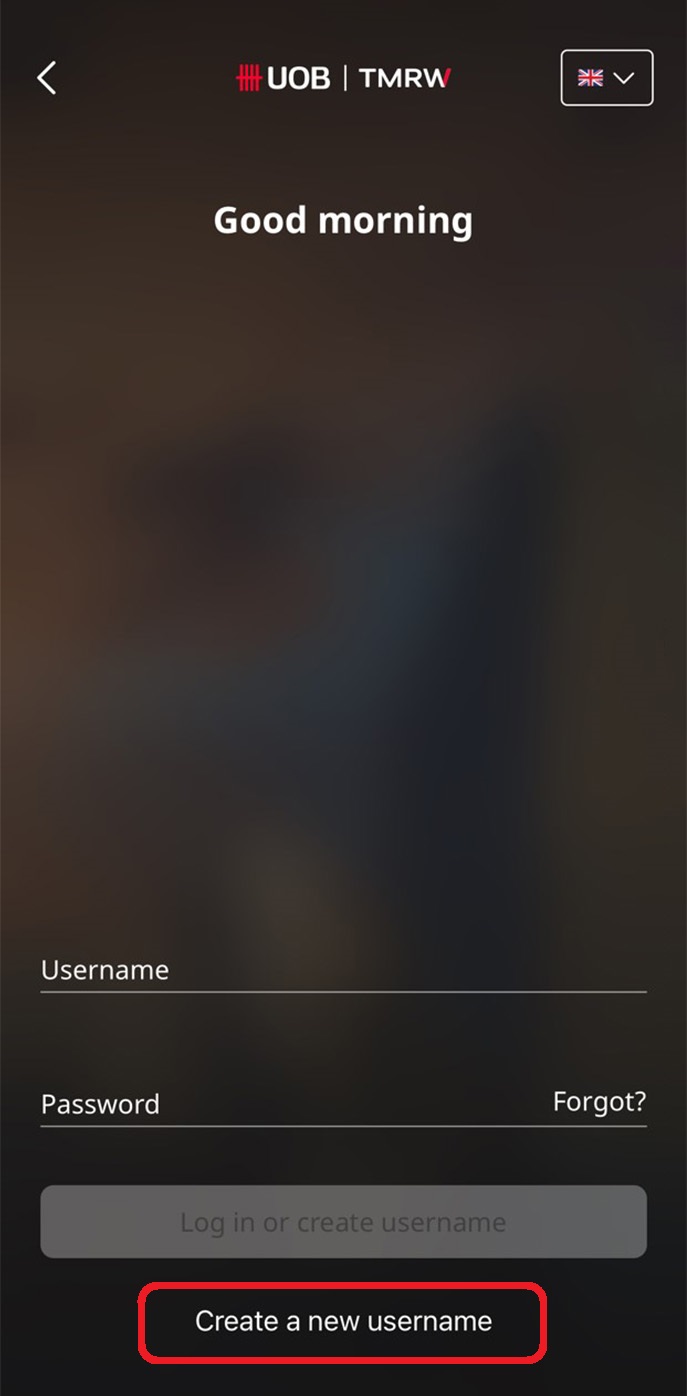

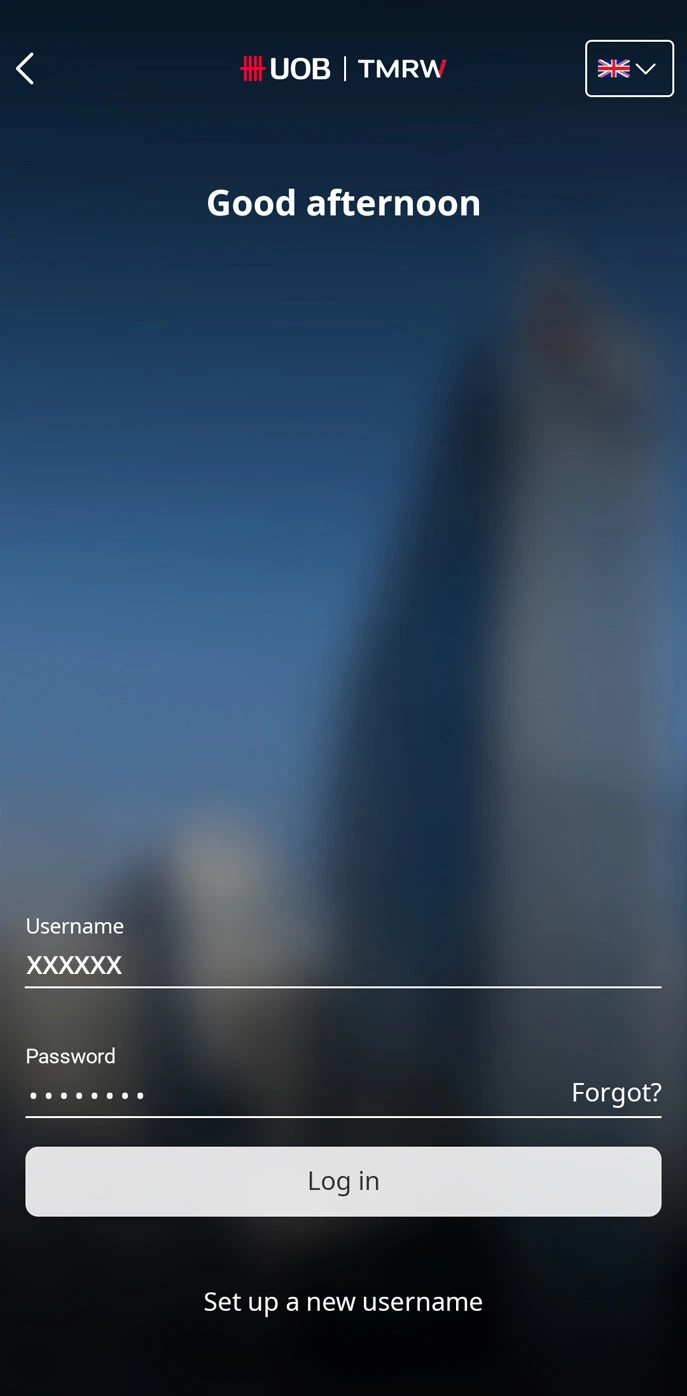

1. Launch UOB TMRW app and select “Log in or create username”.

2. Select “Create a new username”.

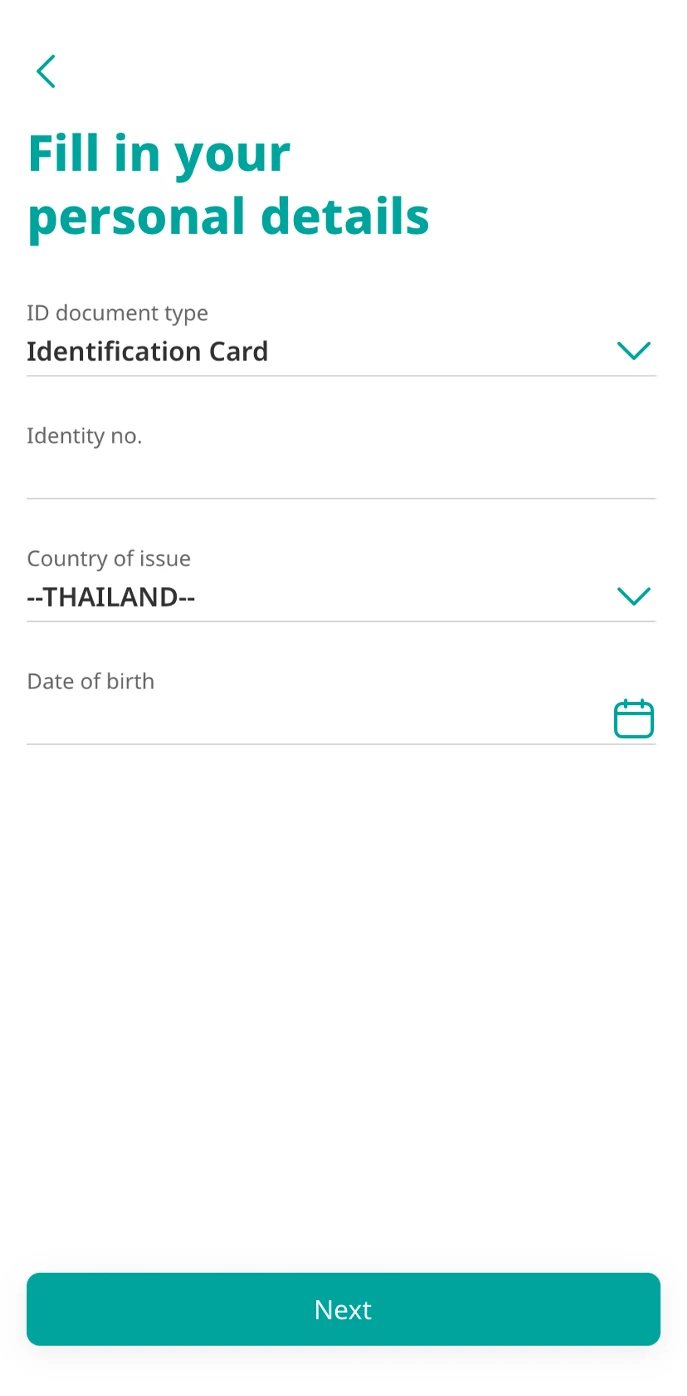

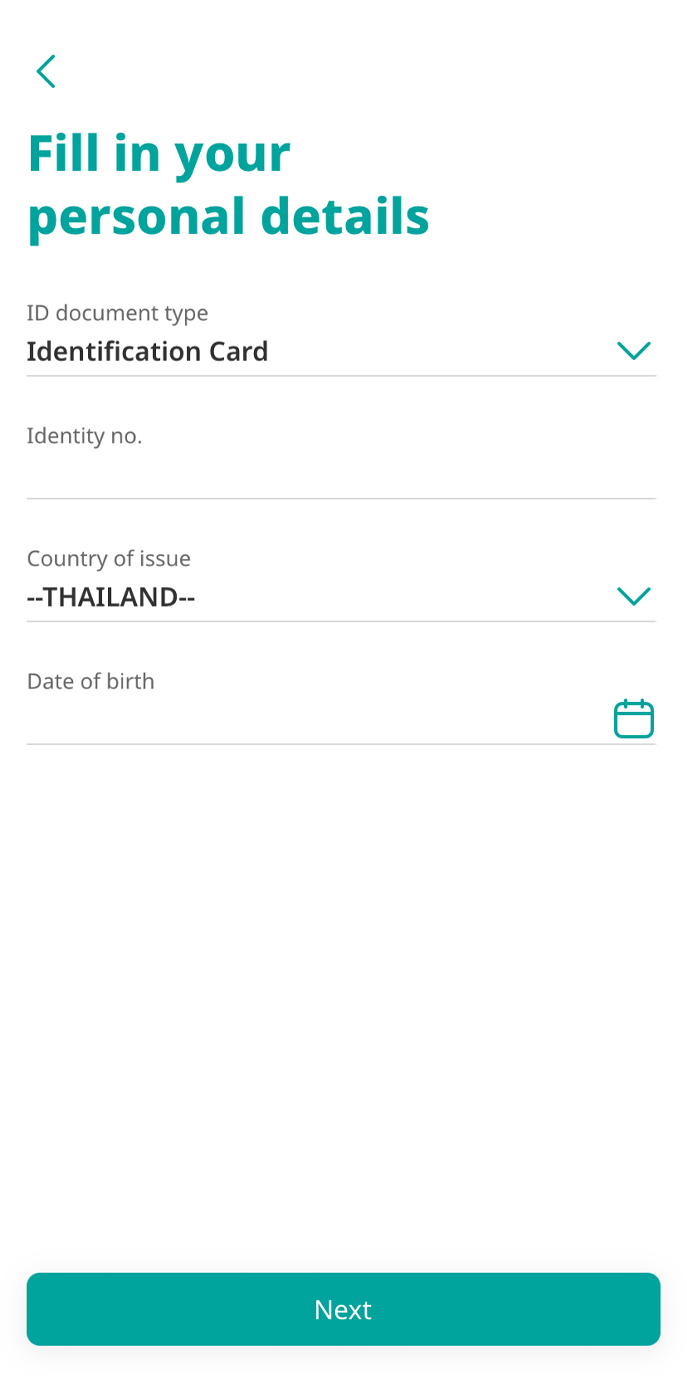

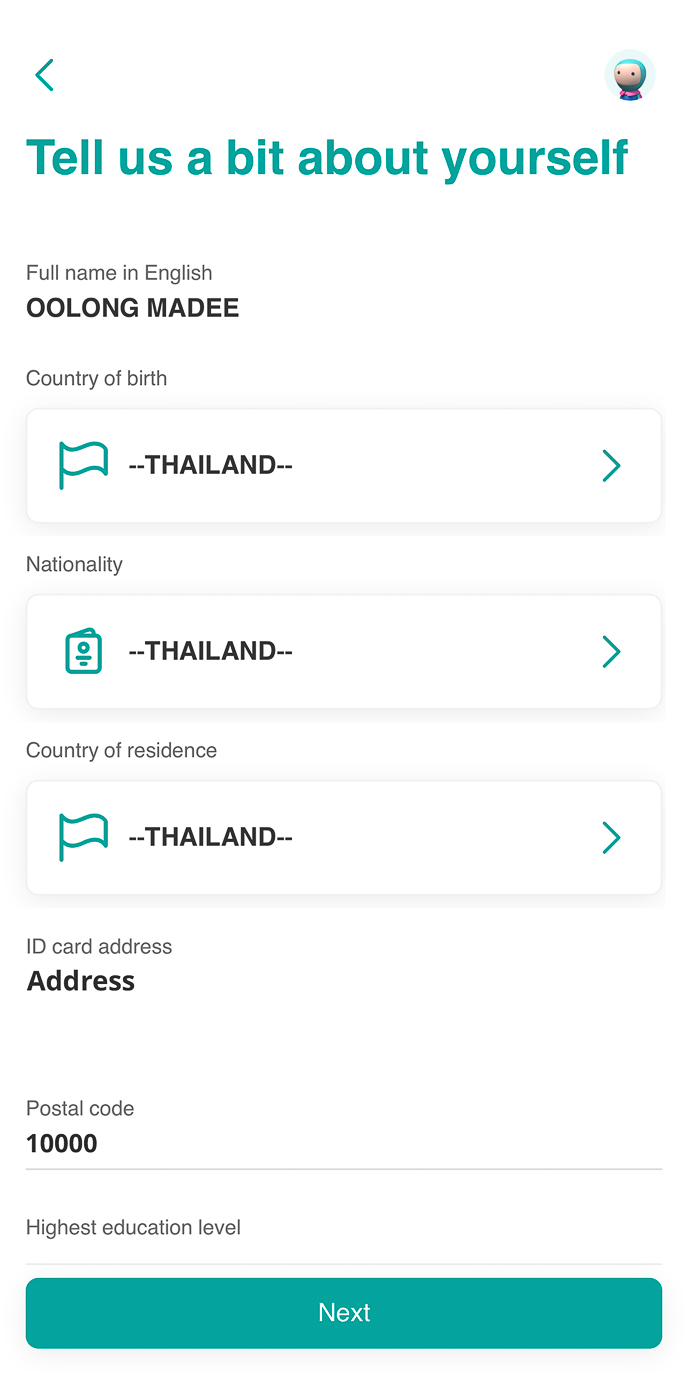

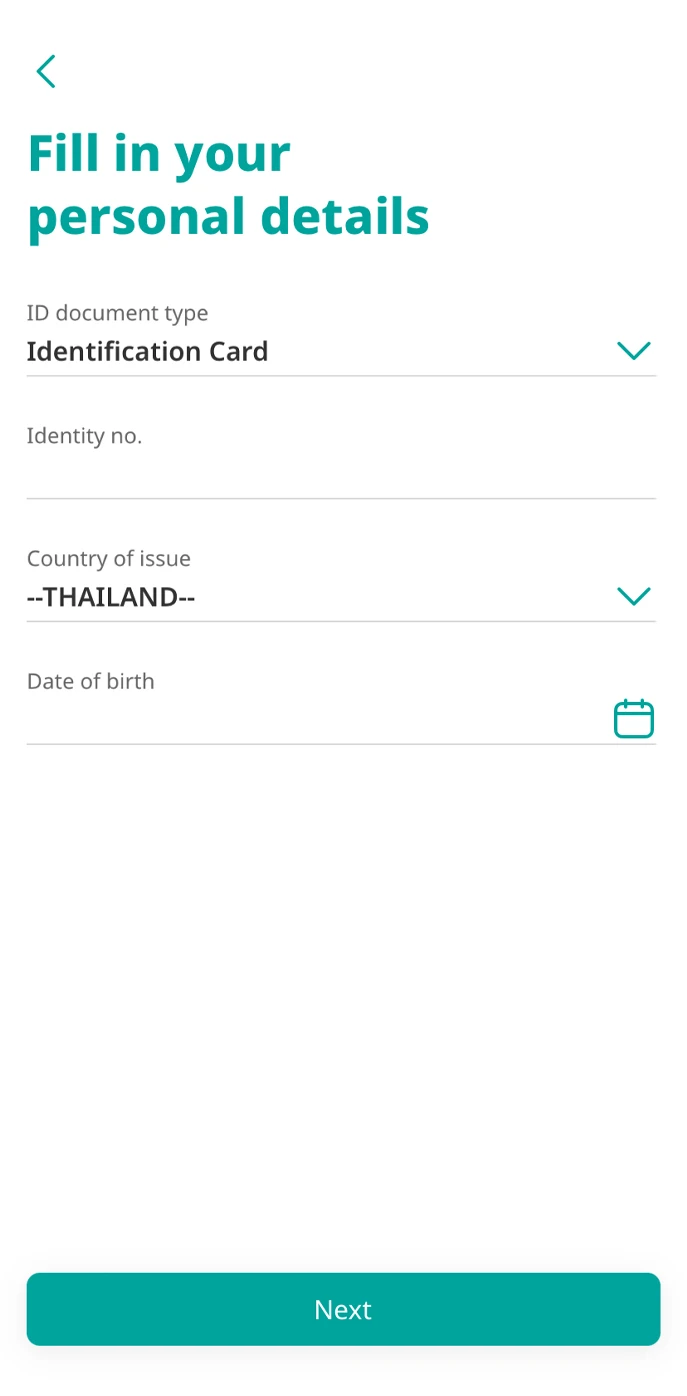

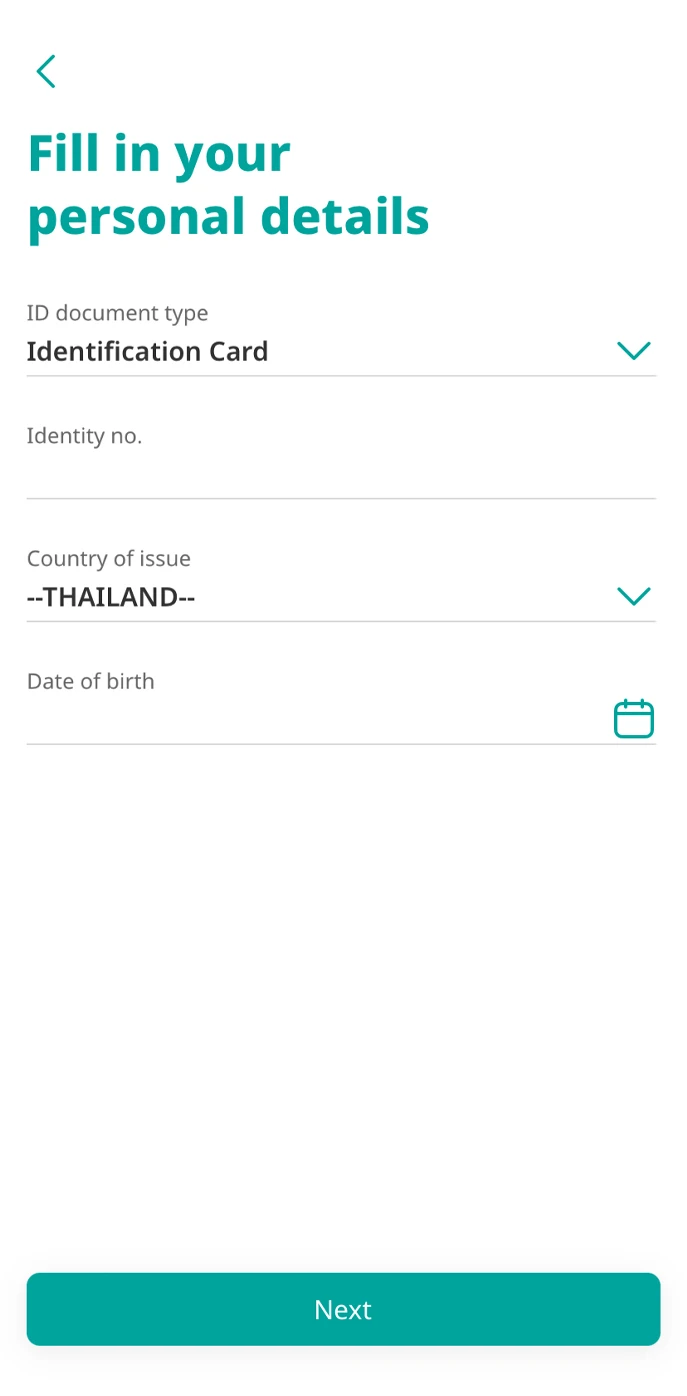

3. Fill in your personal details.

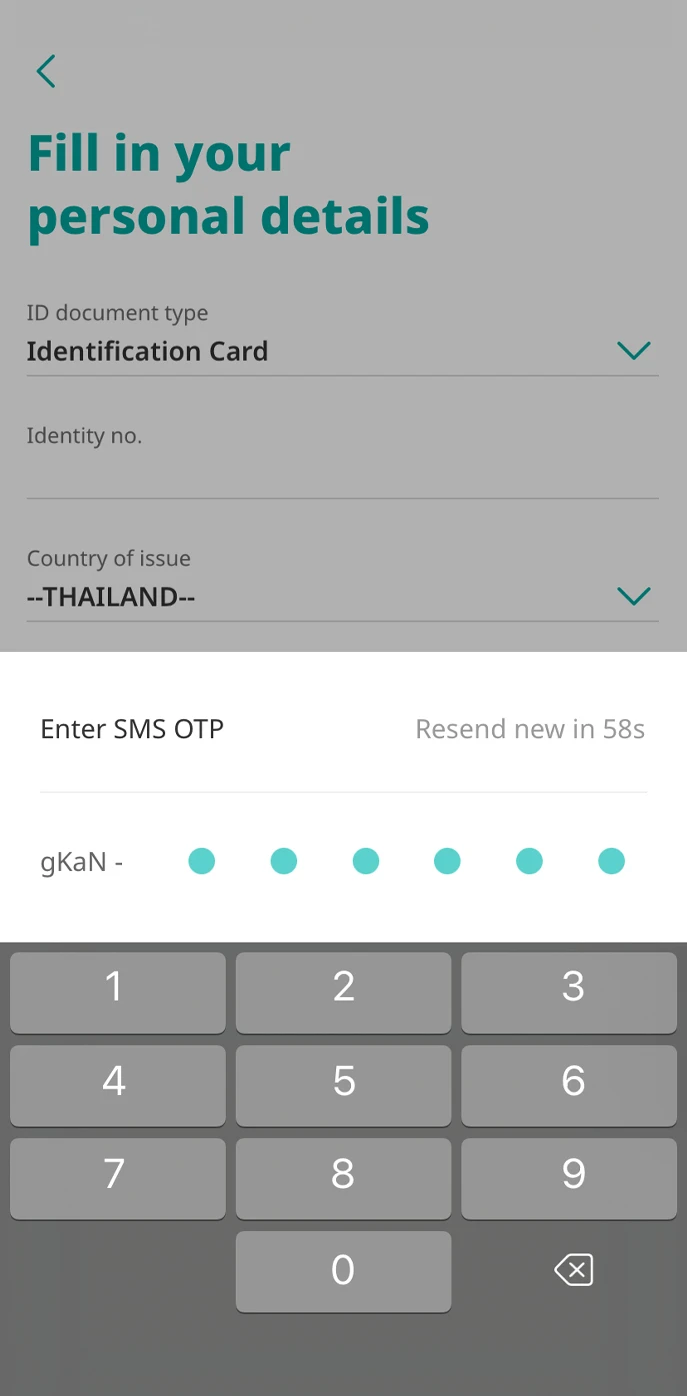

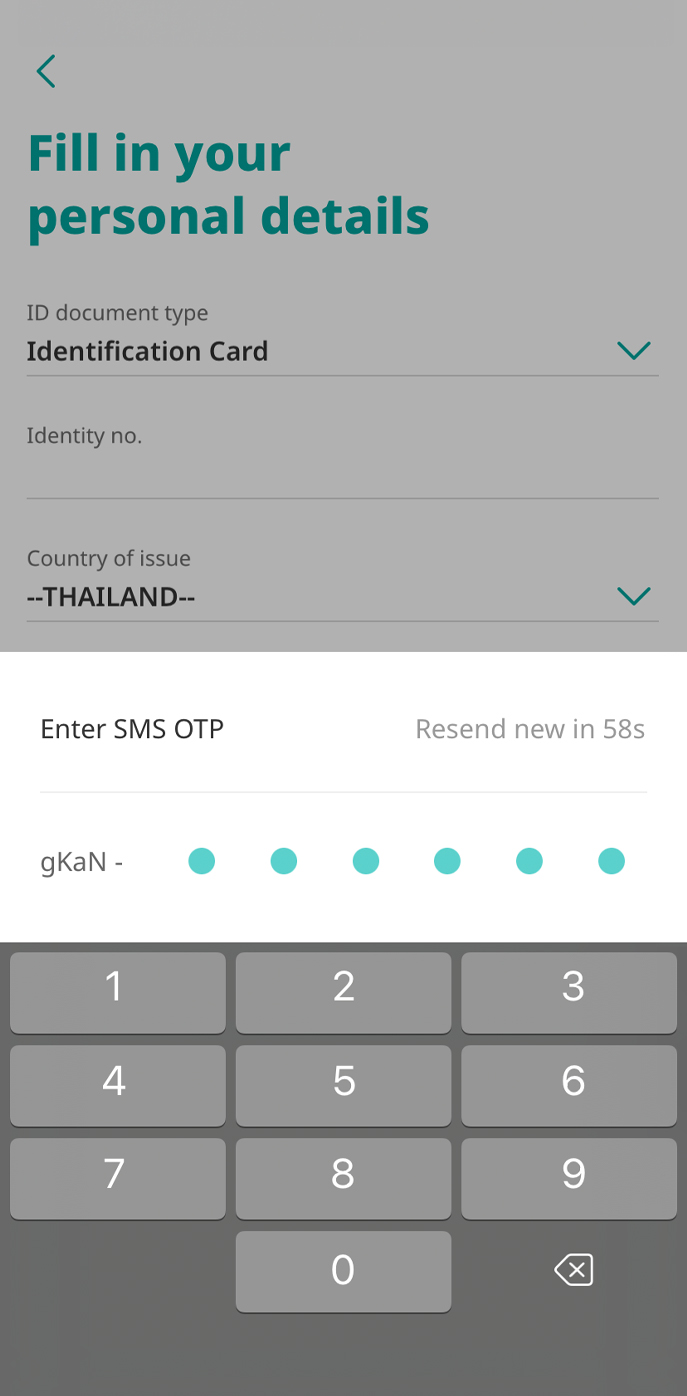

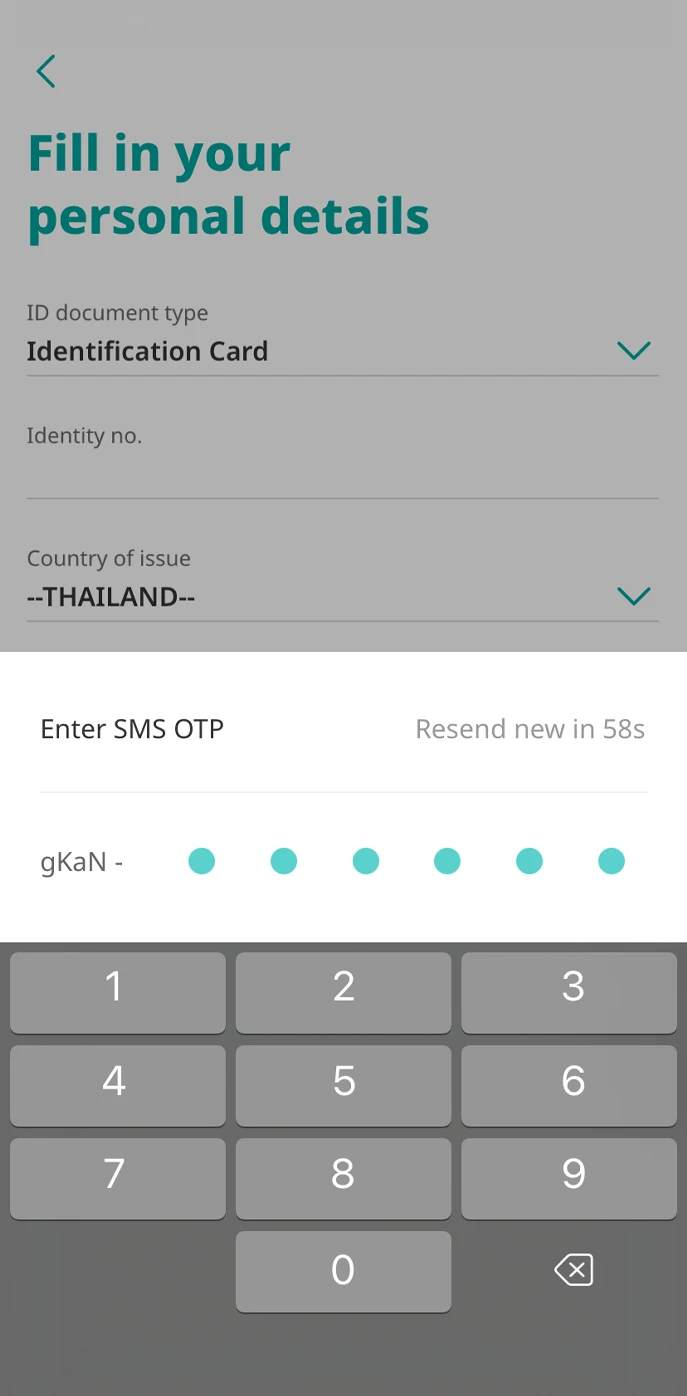

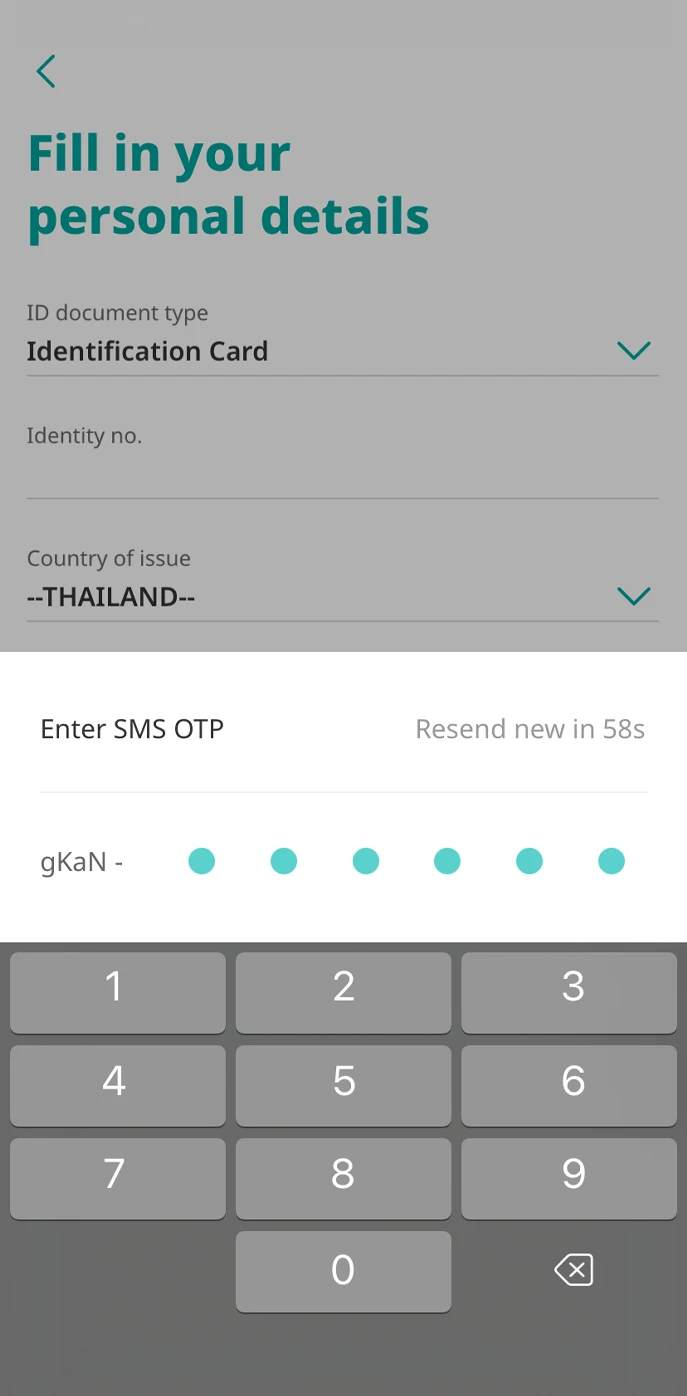

4. Enter SMS OTP.

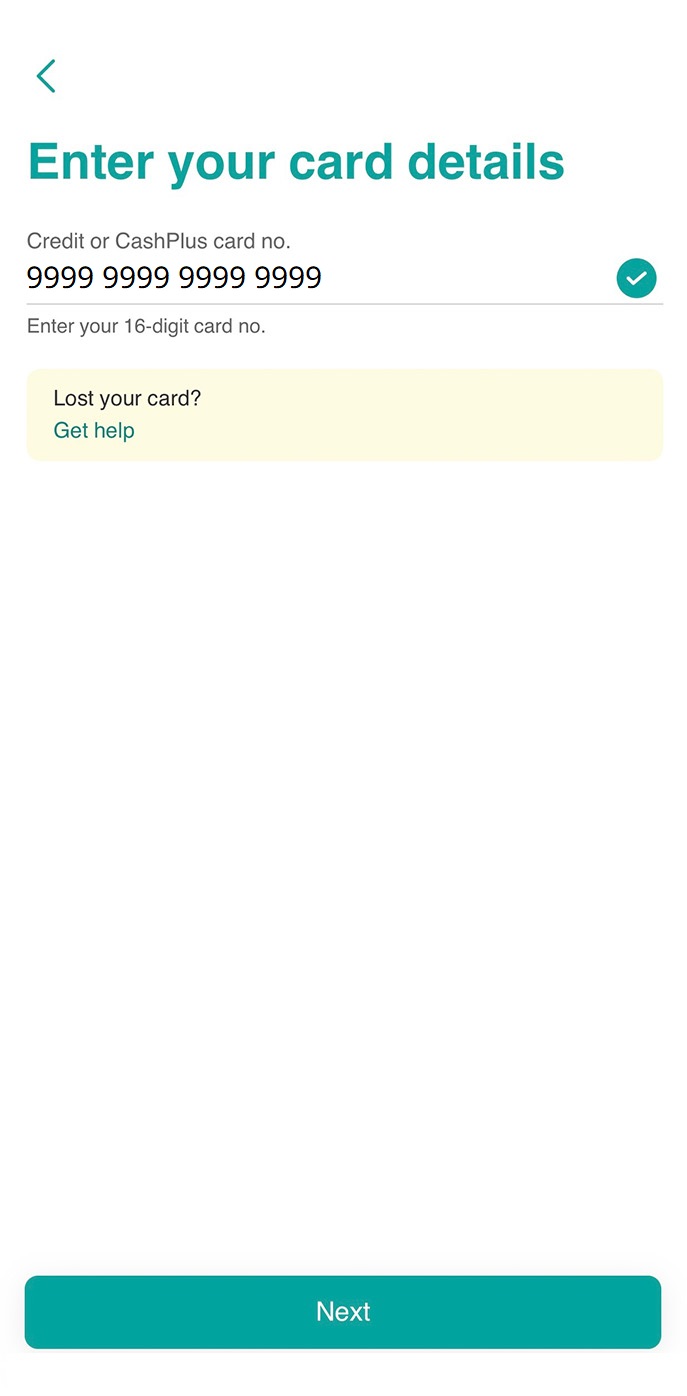

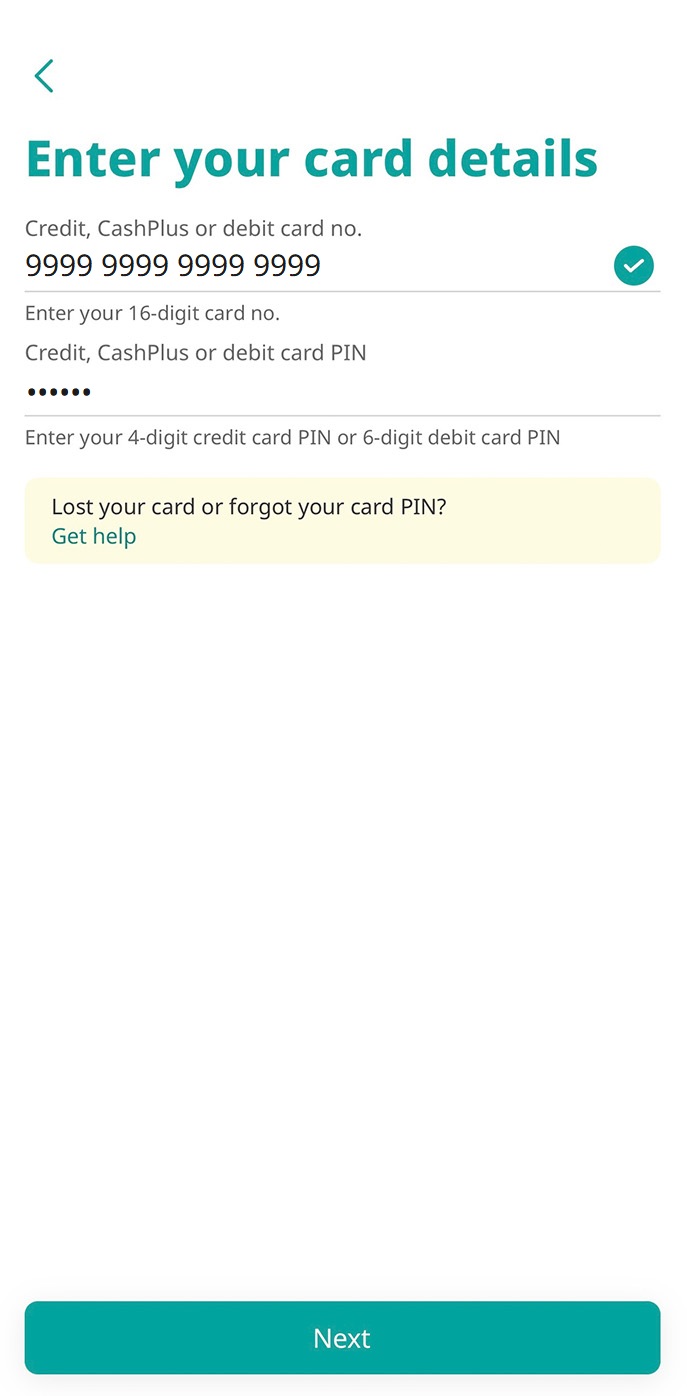

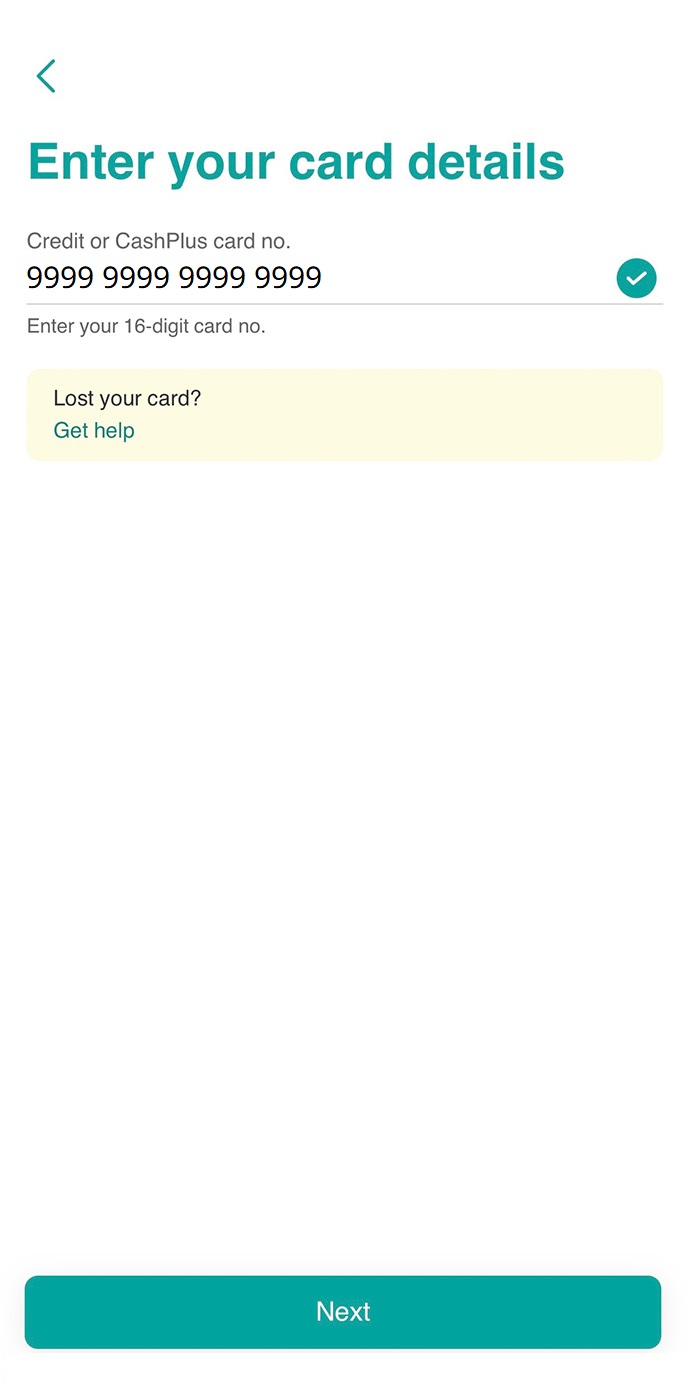

5. Enter your Credit or Cash Plus card number.

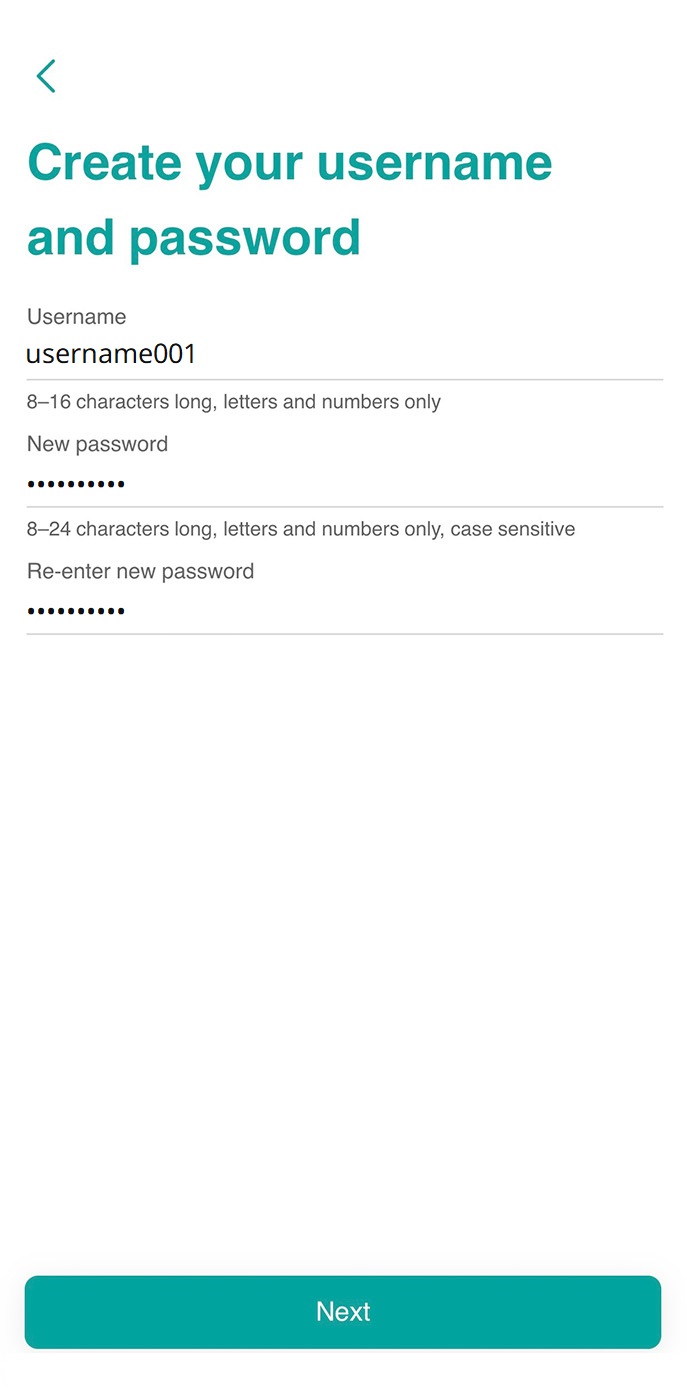

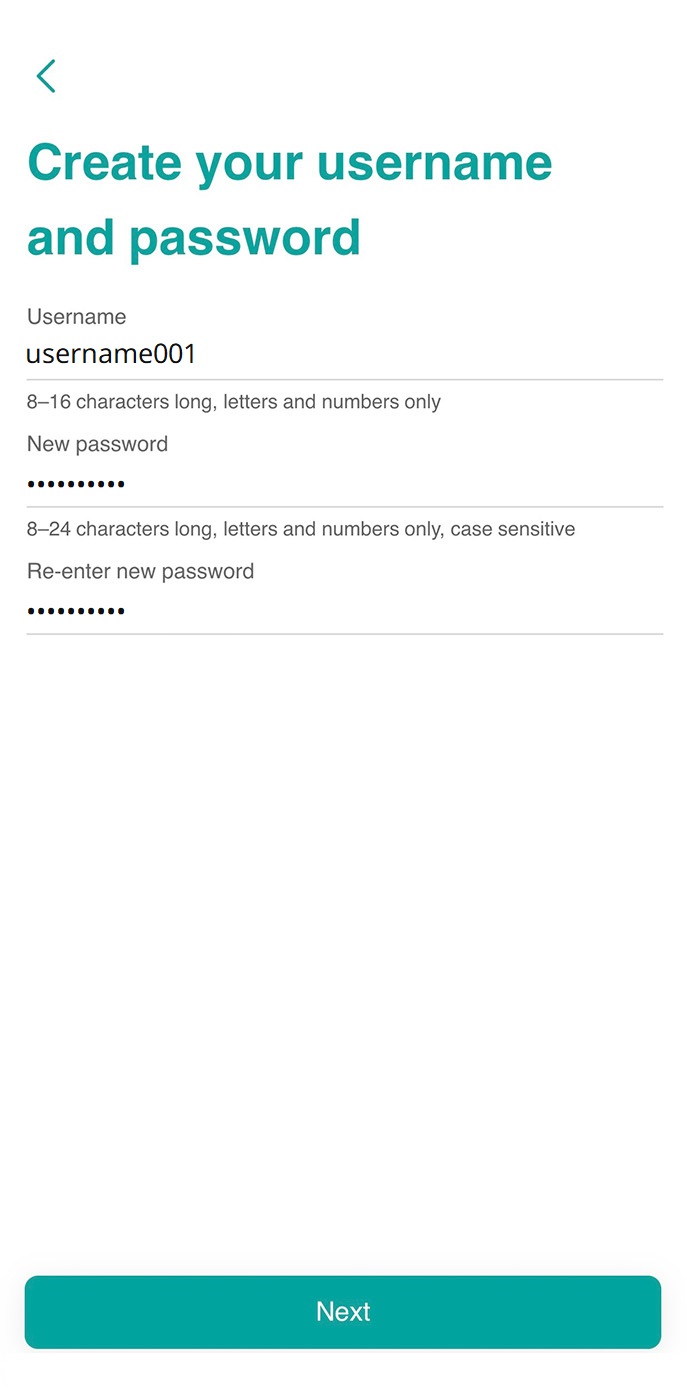

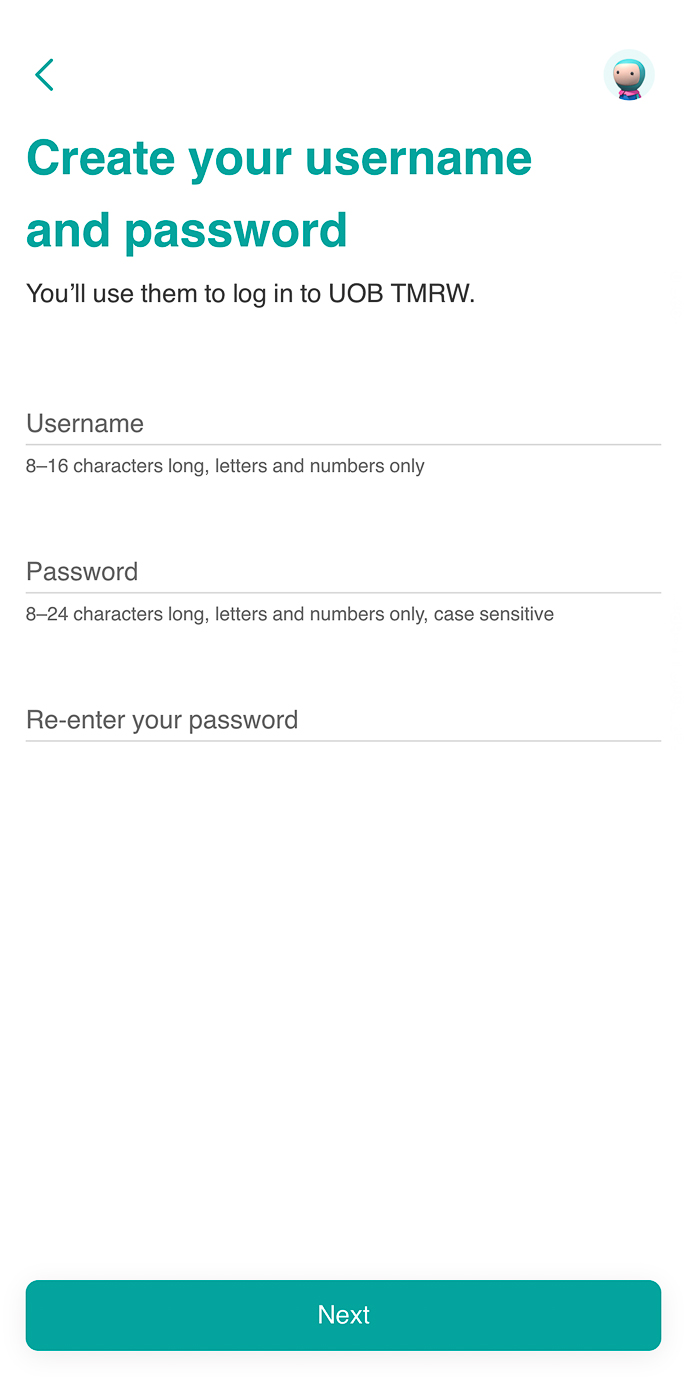

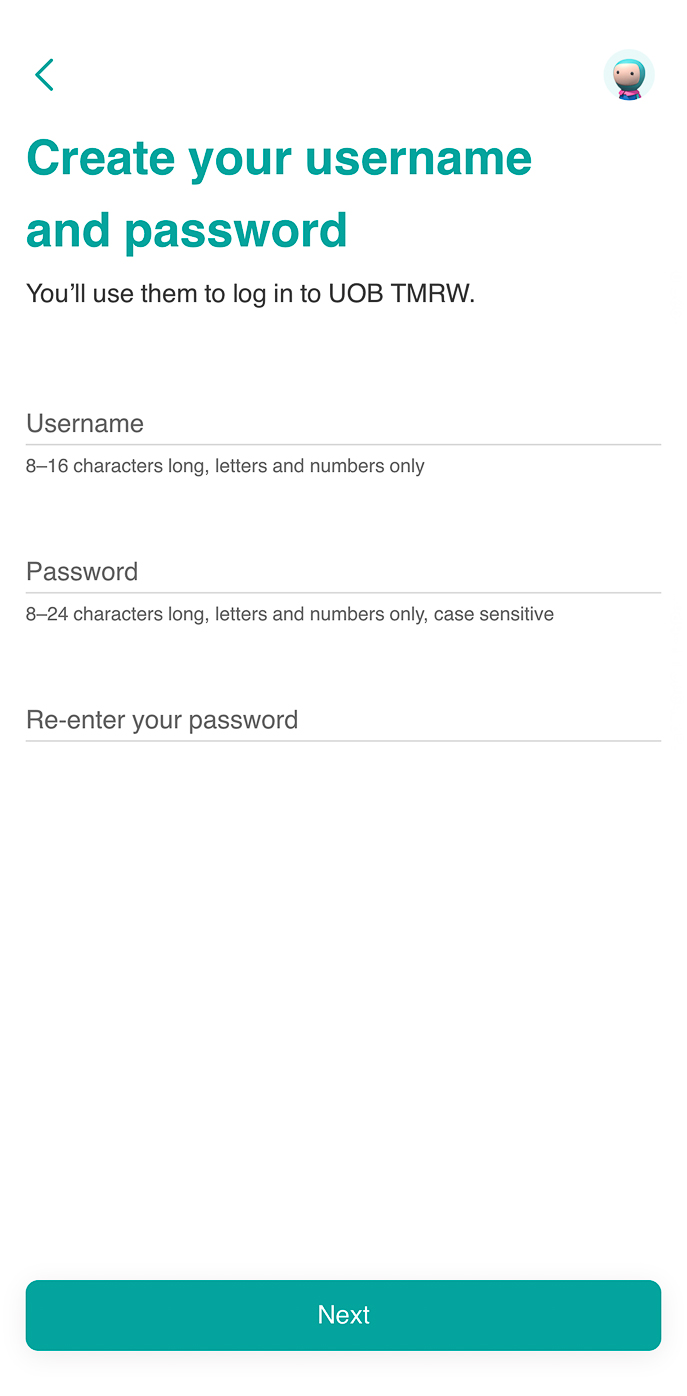

6. Accept UOB TMRW’s T&Cs, then create your username and password.

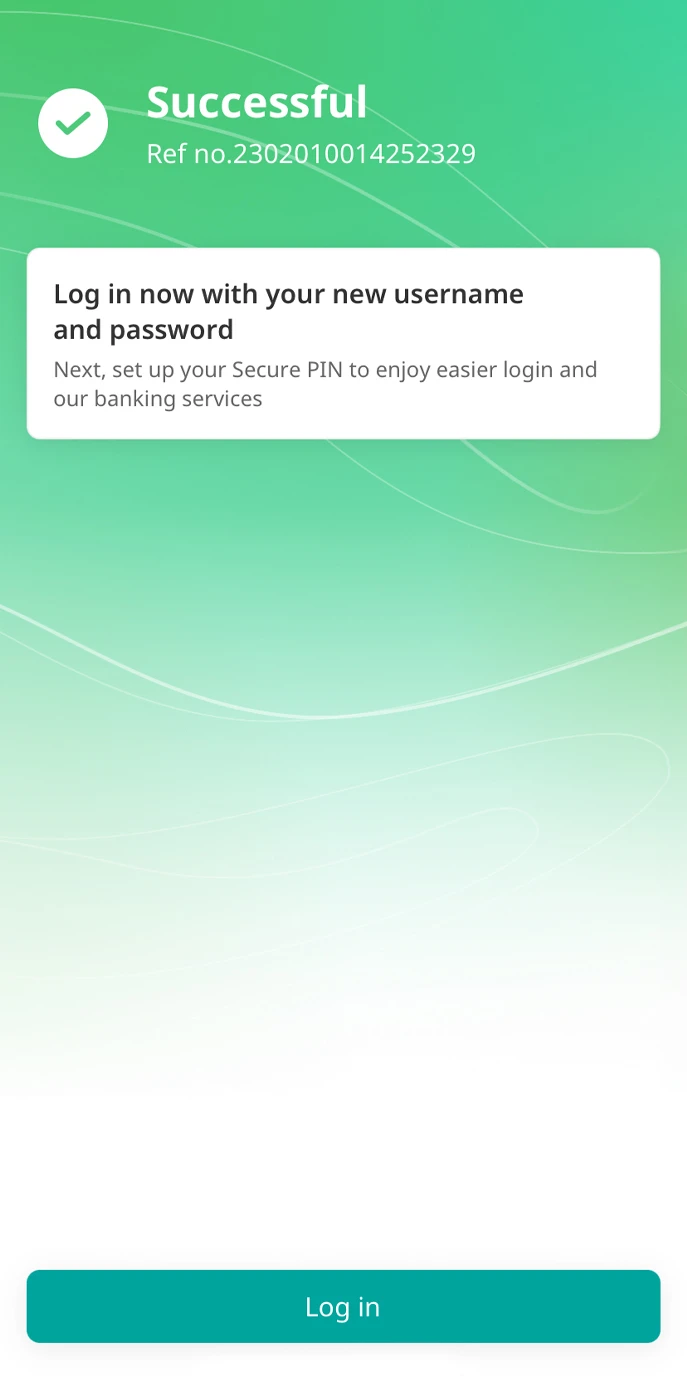

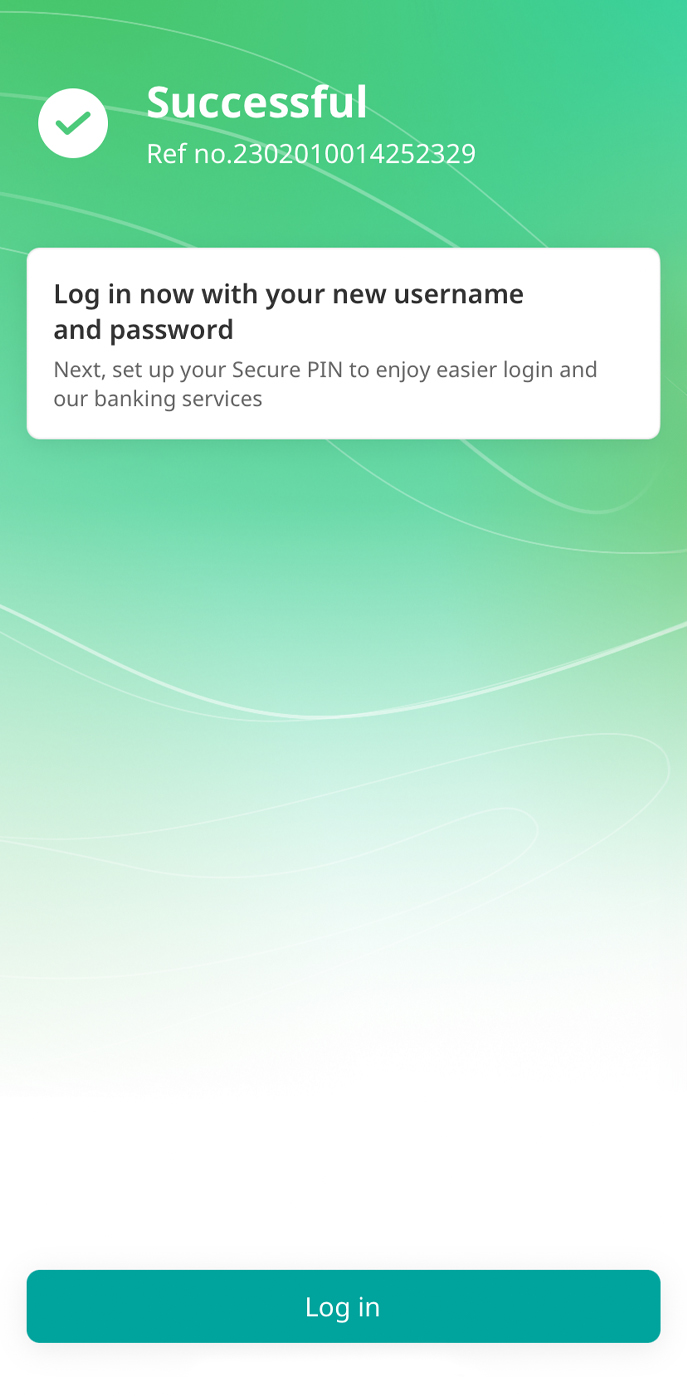

7. Tap on “Log in” to continue with first-time login and secure PIN setup.

2. Online registration for deposit account customers with Debit/ Credit card or Cash Plus (card PIN required)

1. Launch UOB TMRW app and select “Log in or create username”.

2. Select “Create a new username”.

3. Fill in your personal details.

4. Enter SMS OTP.

5. Enter your Debit/ Credit/ Cash Plus card number and card PIN (ATM PIN).

6. Accept UOB TMRW’s T&Cs, then create your username and password.

7. Tap on “Log in” to continue with first-time login and secure PIN setup.

Apply for new products via UOB TMRW for new app users

1. Open a deposit account (single product application)

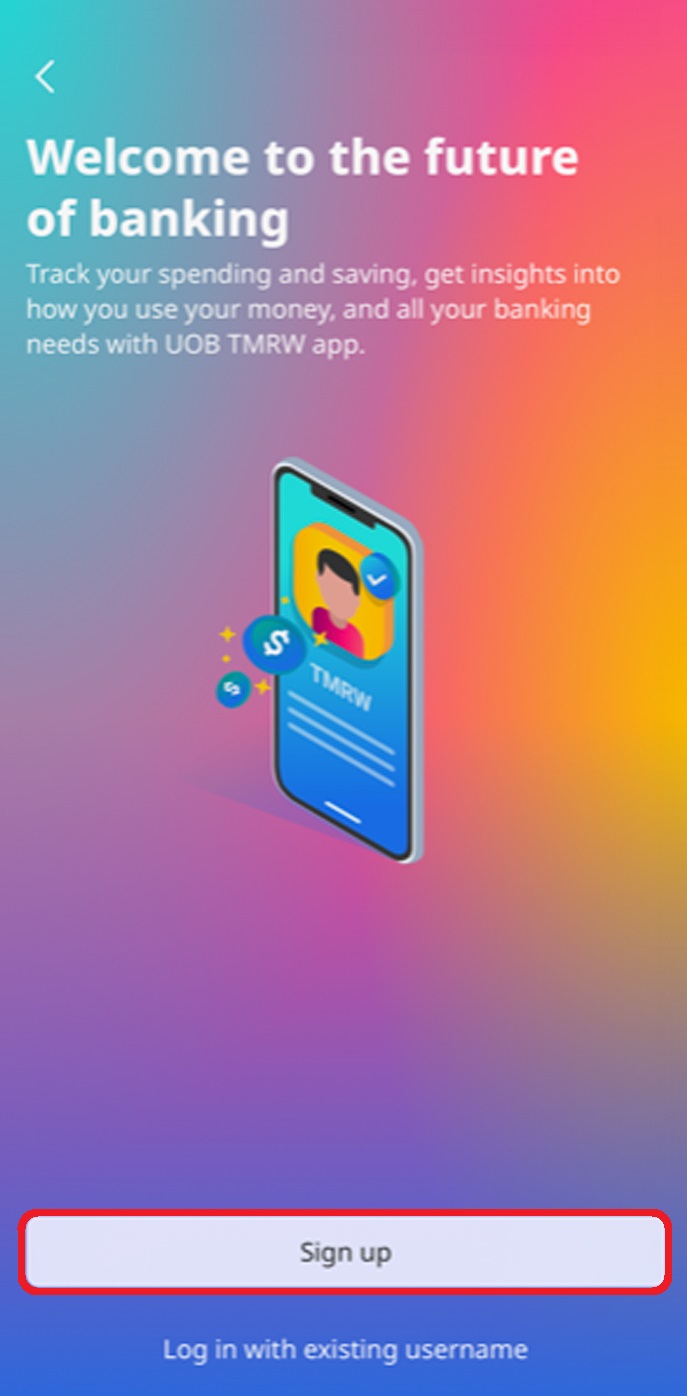

1. Open UOB TMRW app and select “Open an account now”.

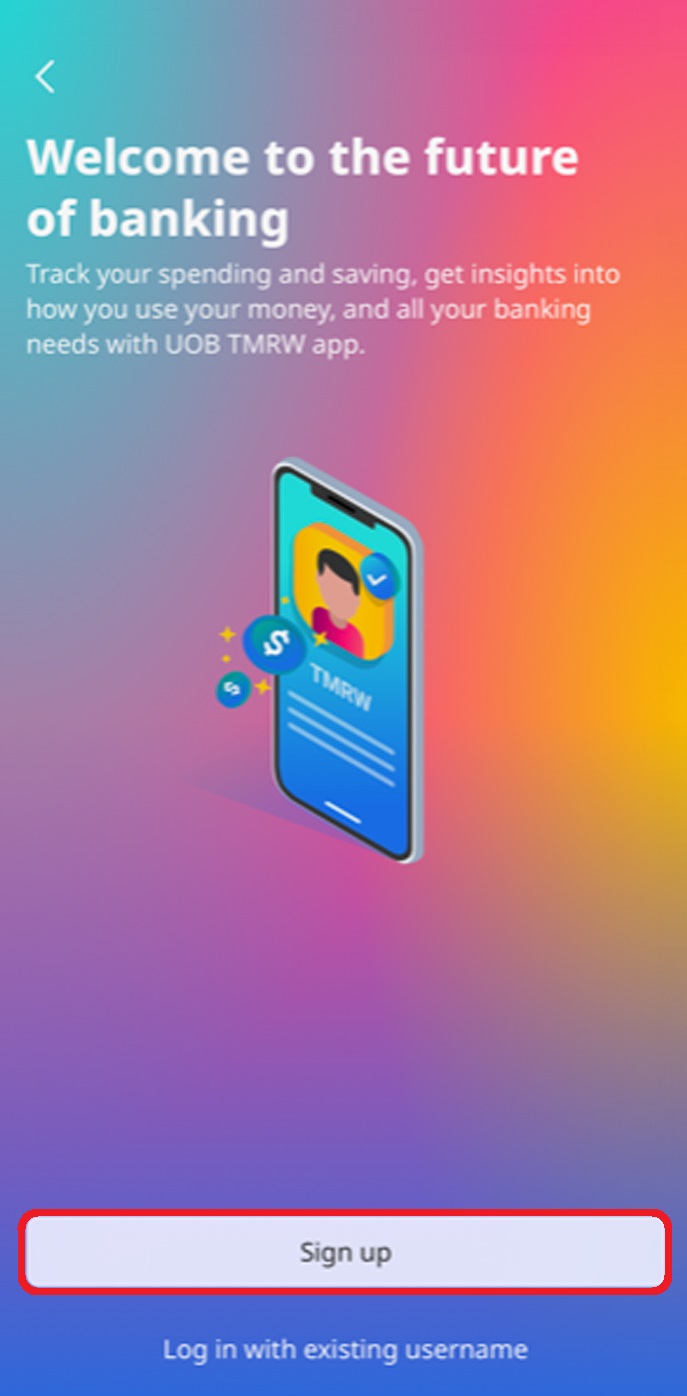

2. Select “Sign up” button.

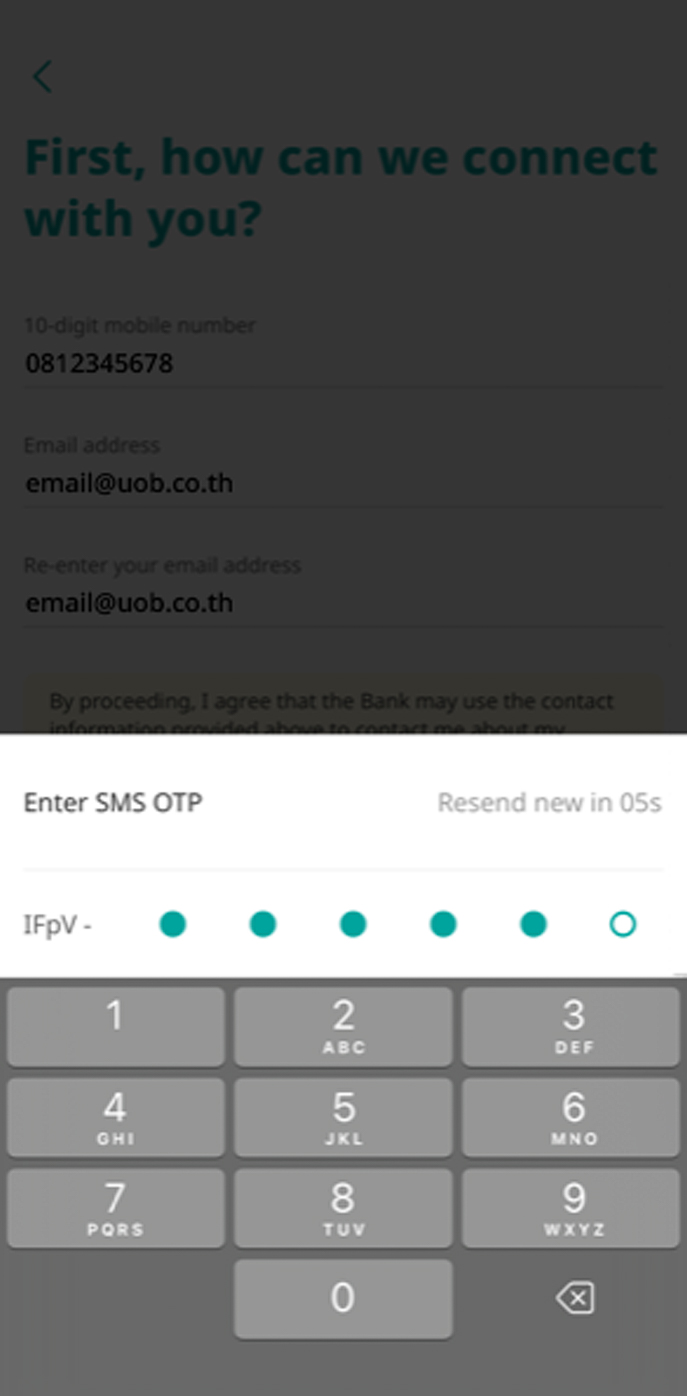

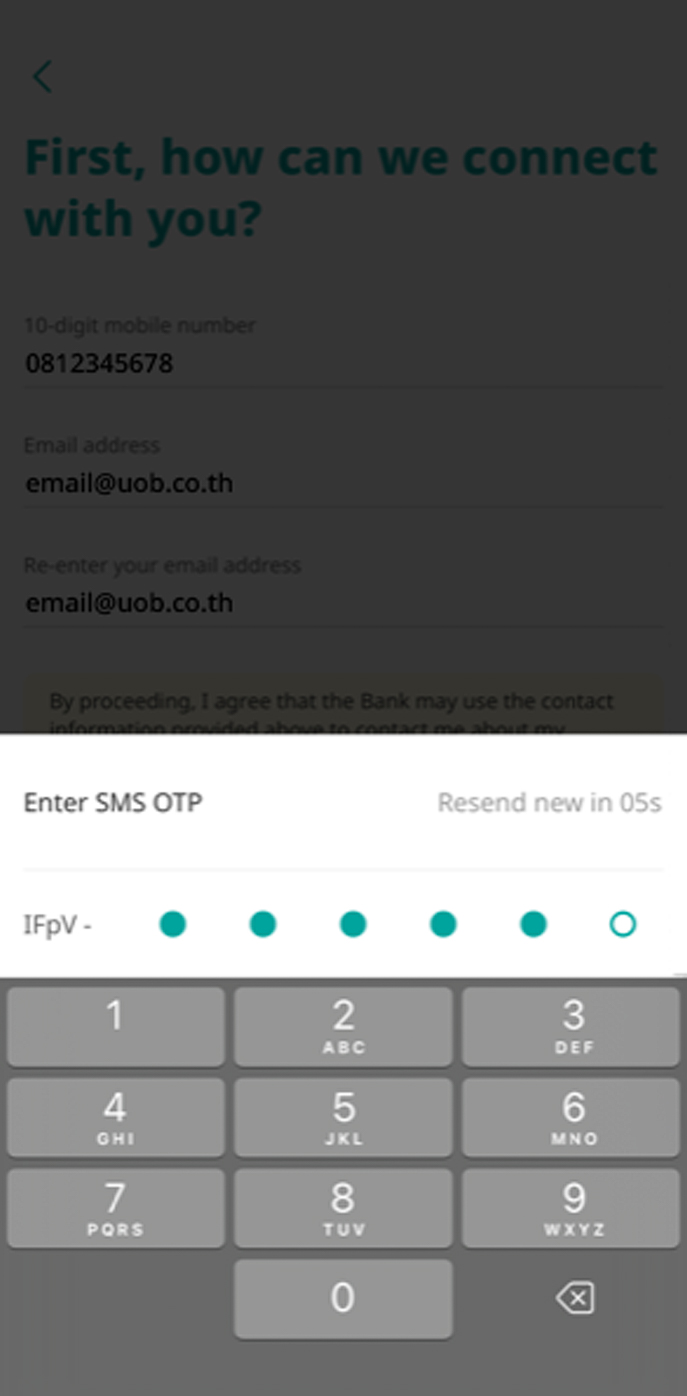

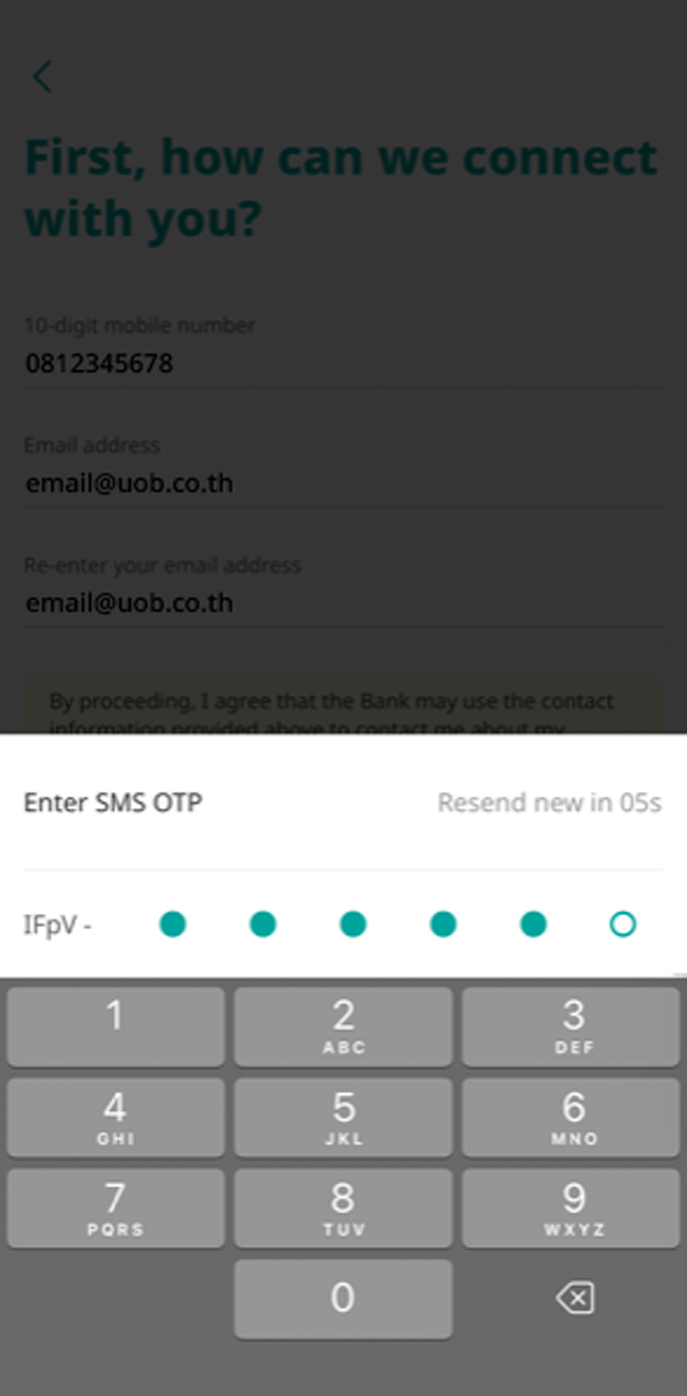

3. Enter your mobile number and email. Confirm OTP via SMS.

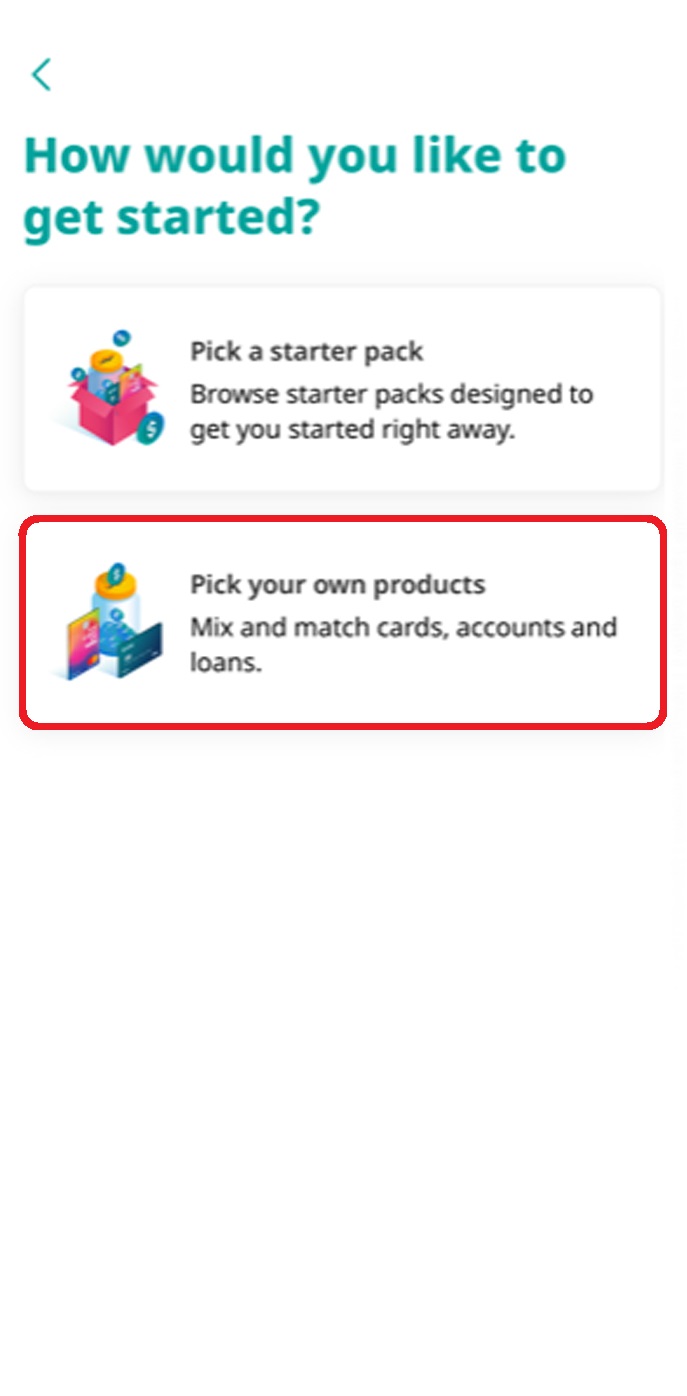

4. Select Pick your own products from product application listing.

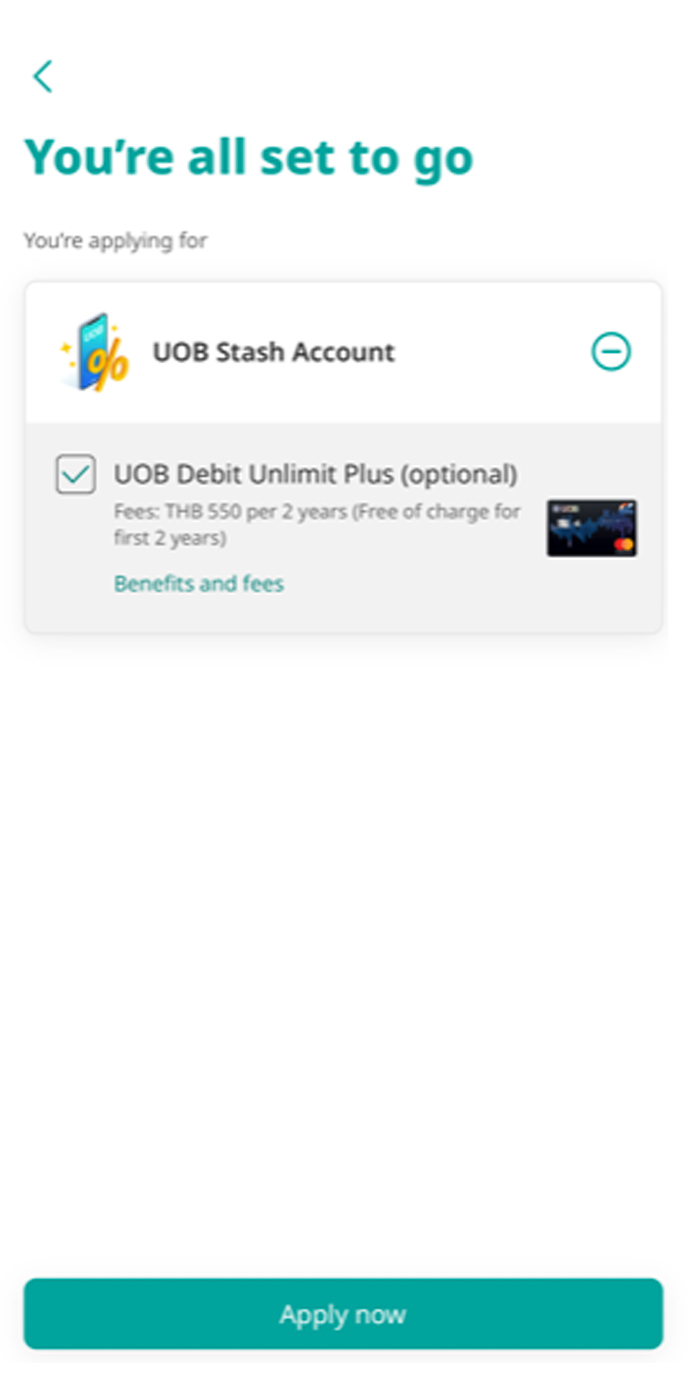

5. Select the product you wish to apply for.

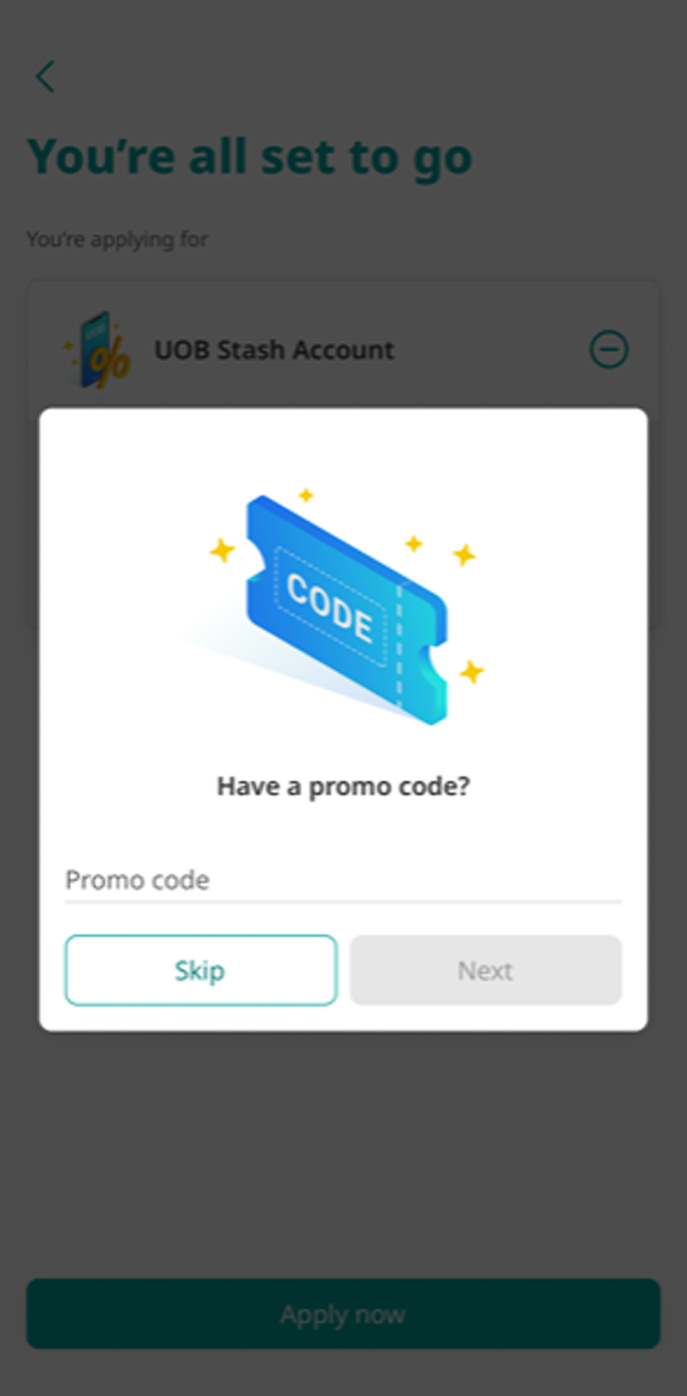

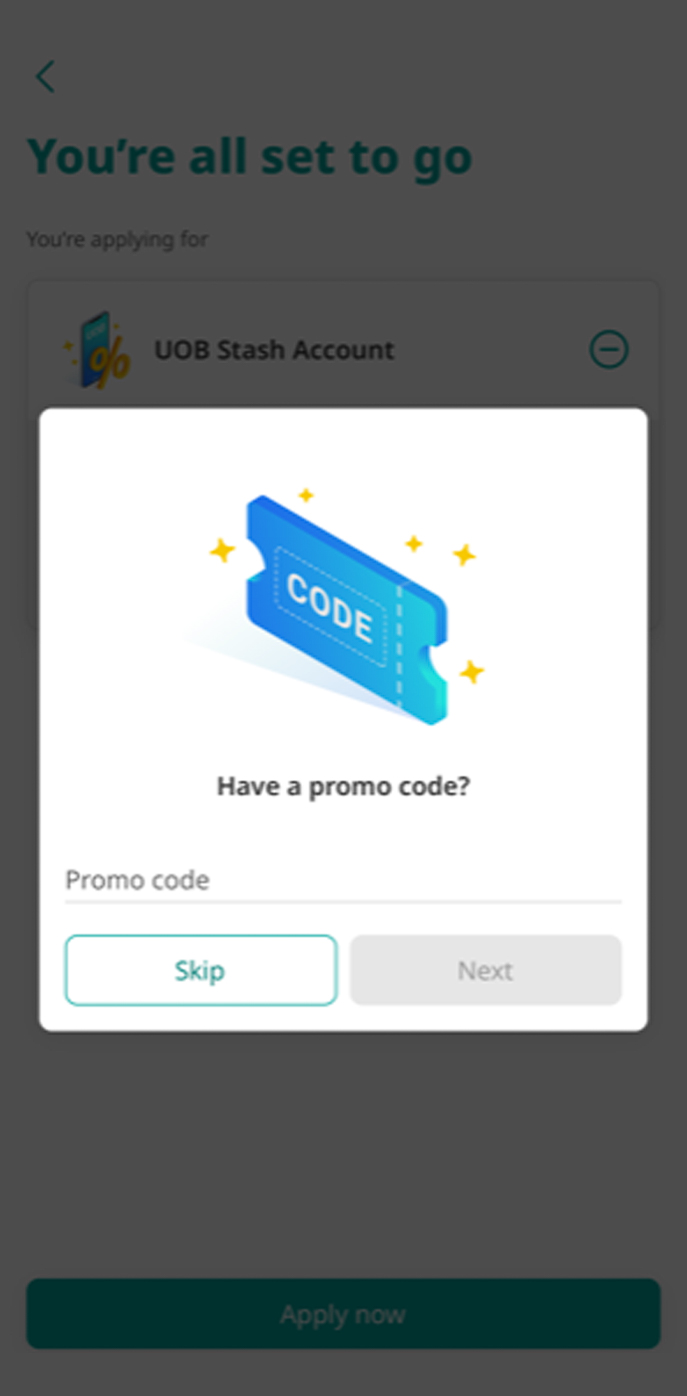

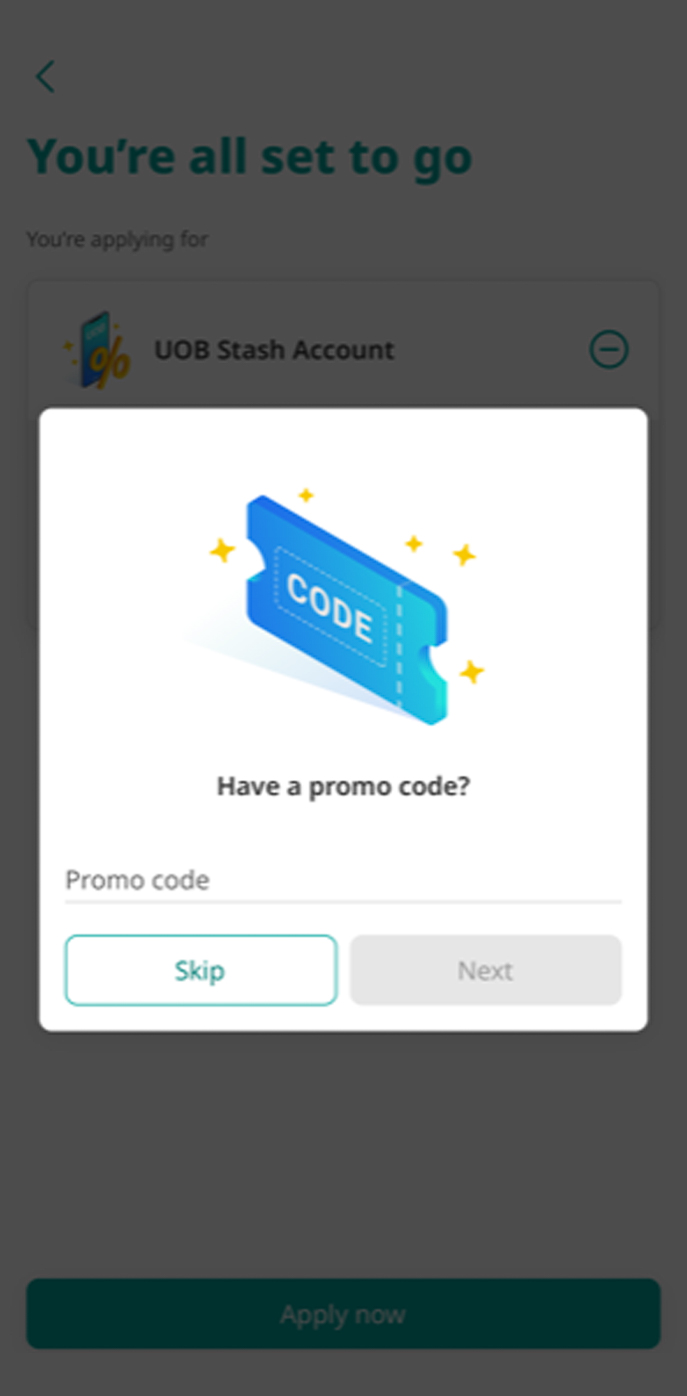

6. Enter promo code (if any), then press “Next”. Otherwise, press “Skip”.

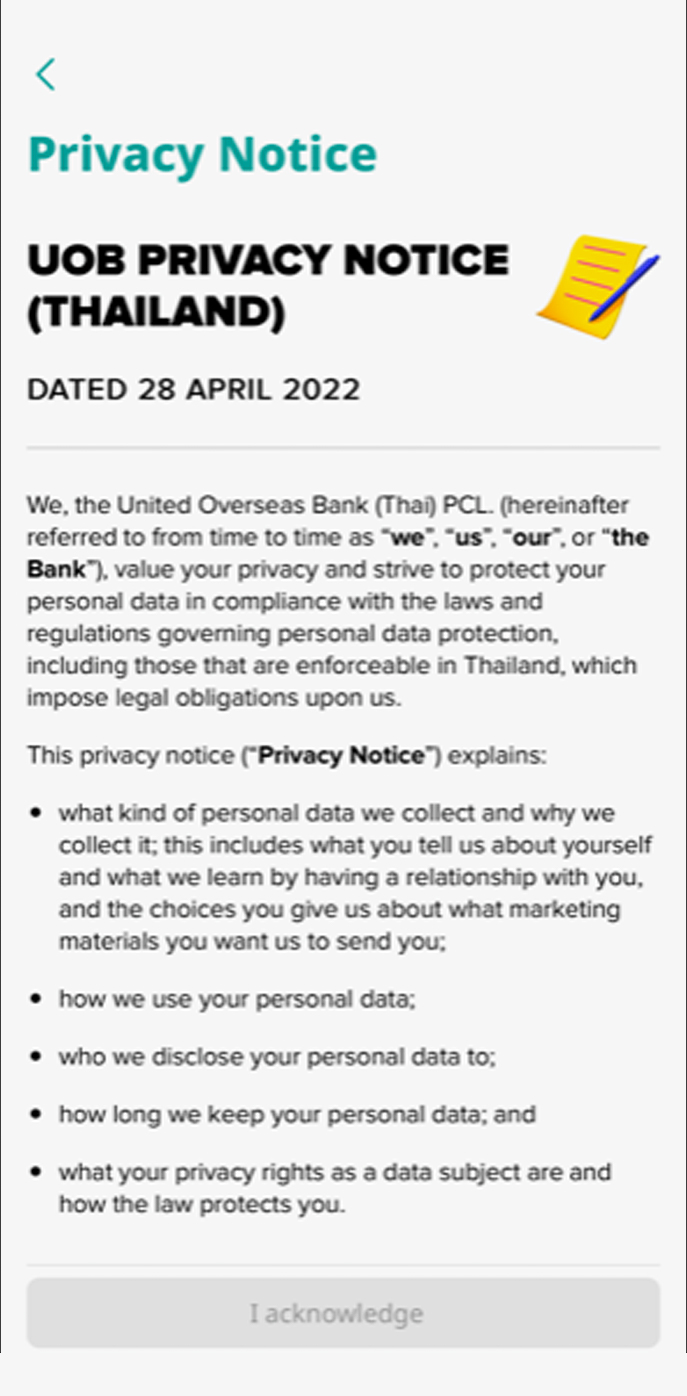

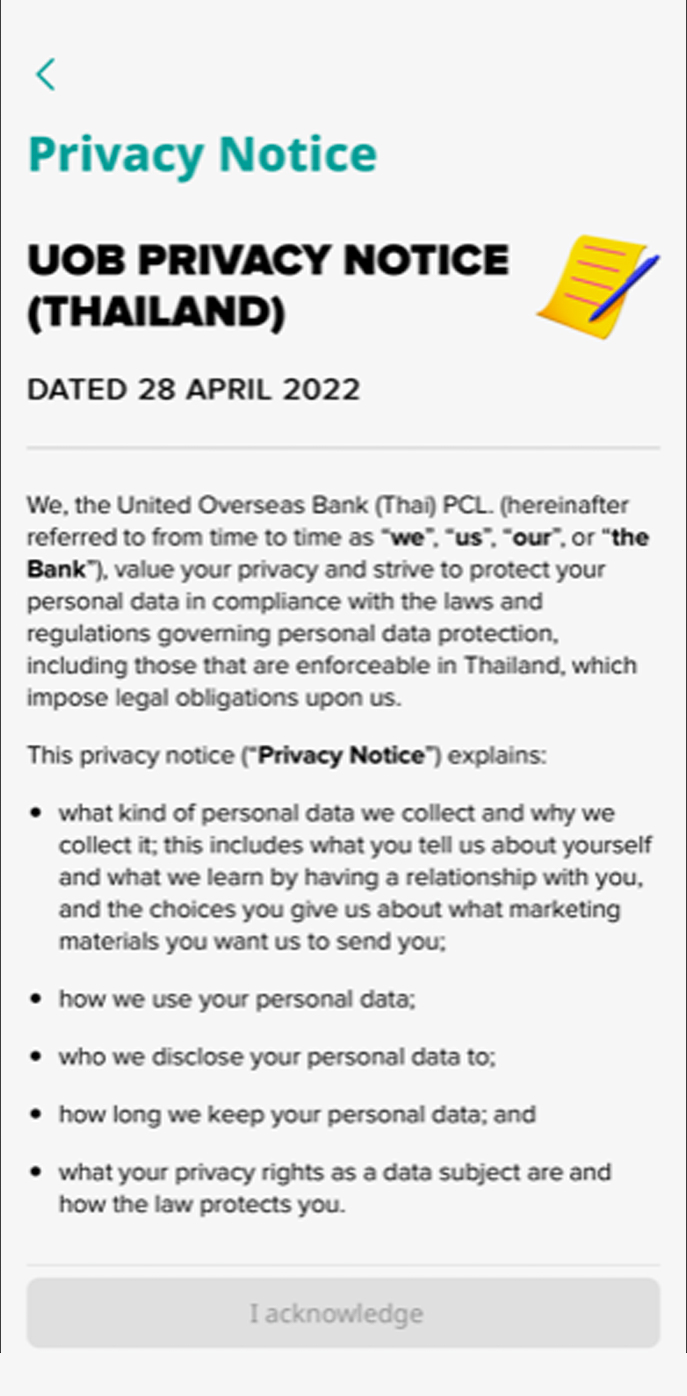

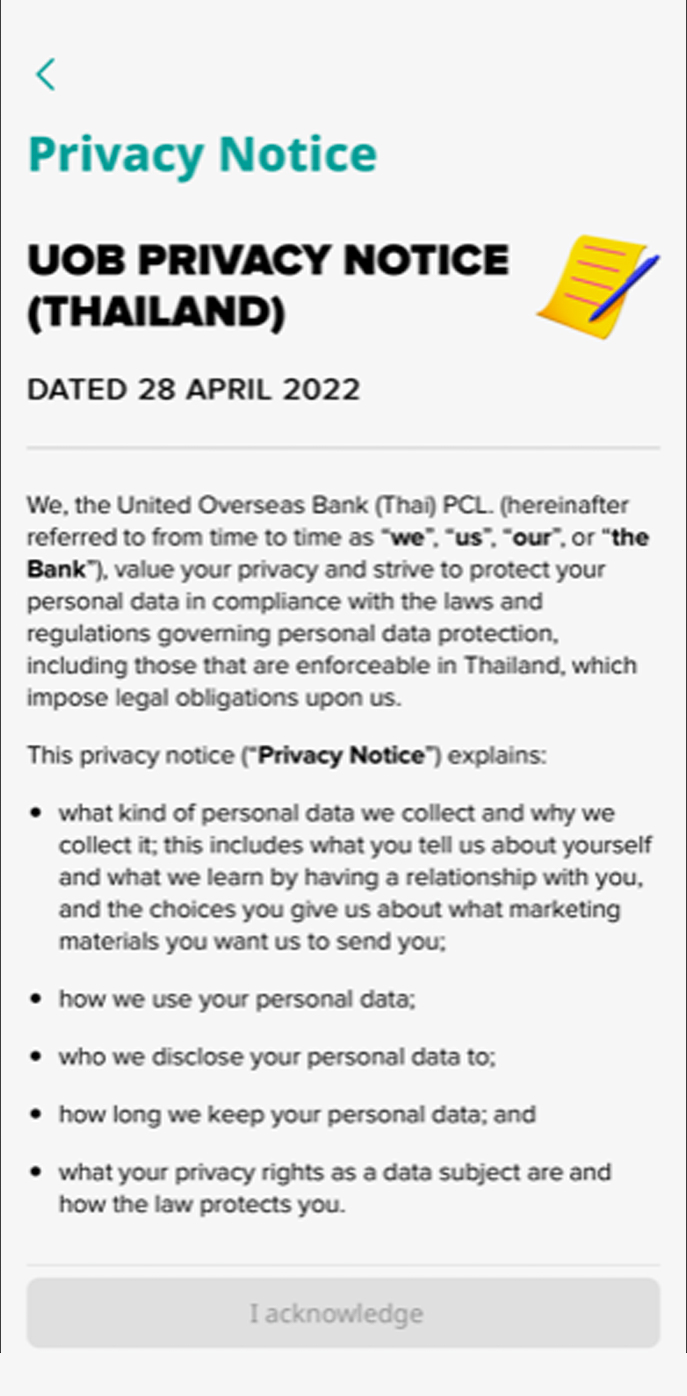

7. User to read and acknowledge “Privacy Notice” before applying.

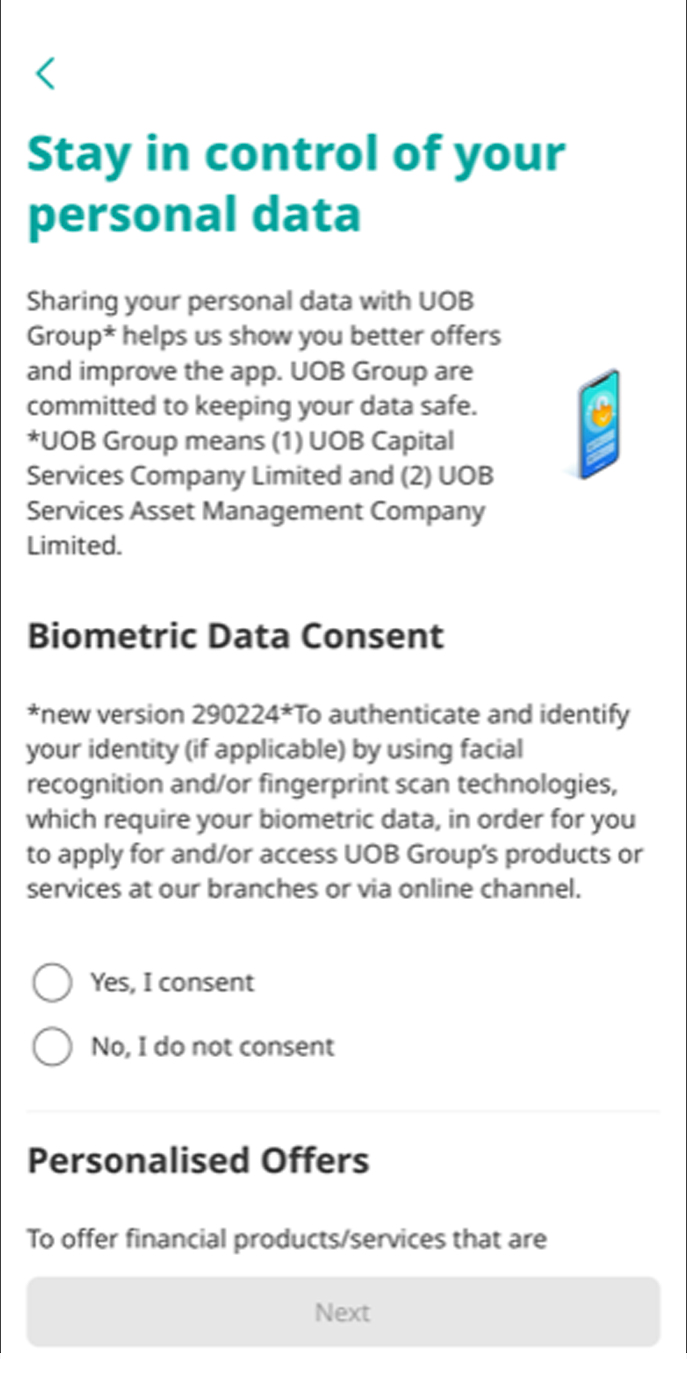

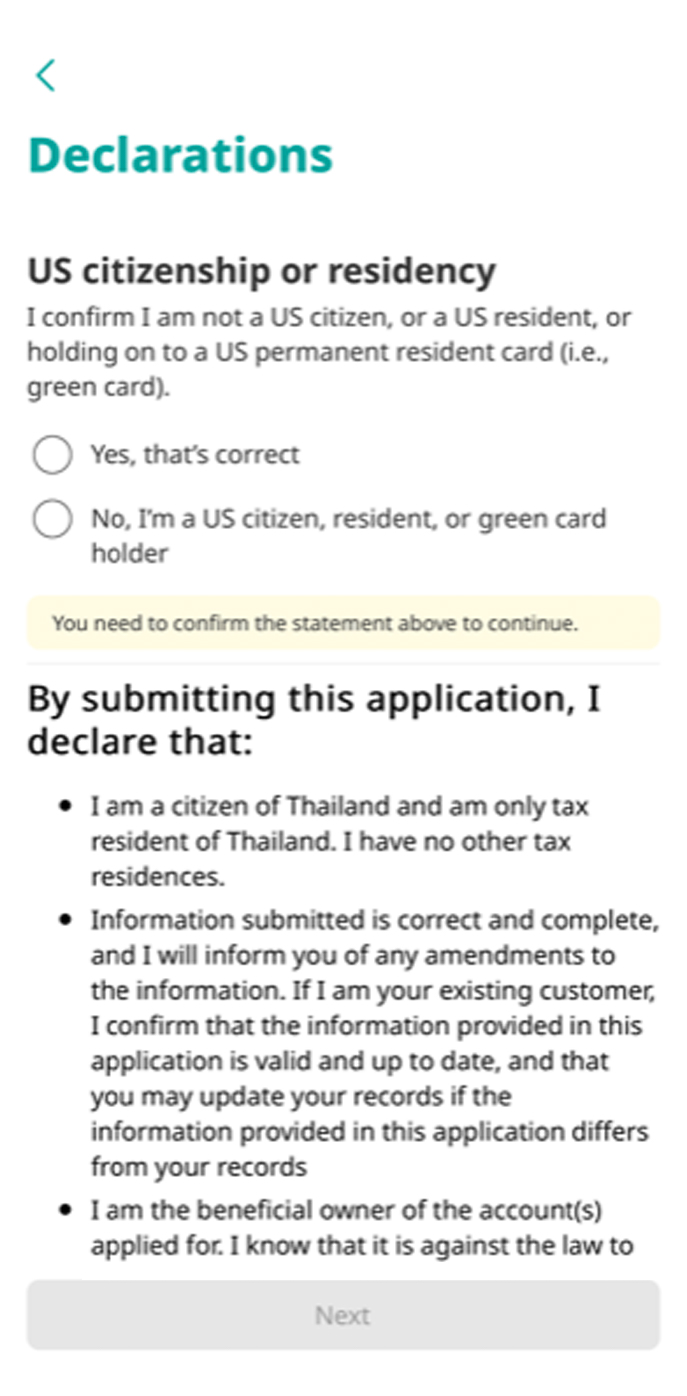

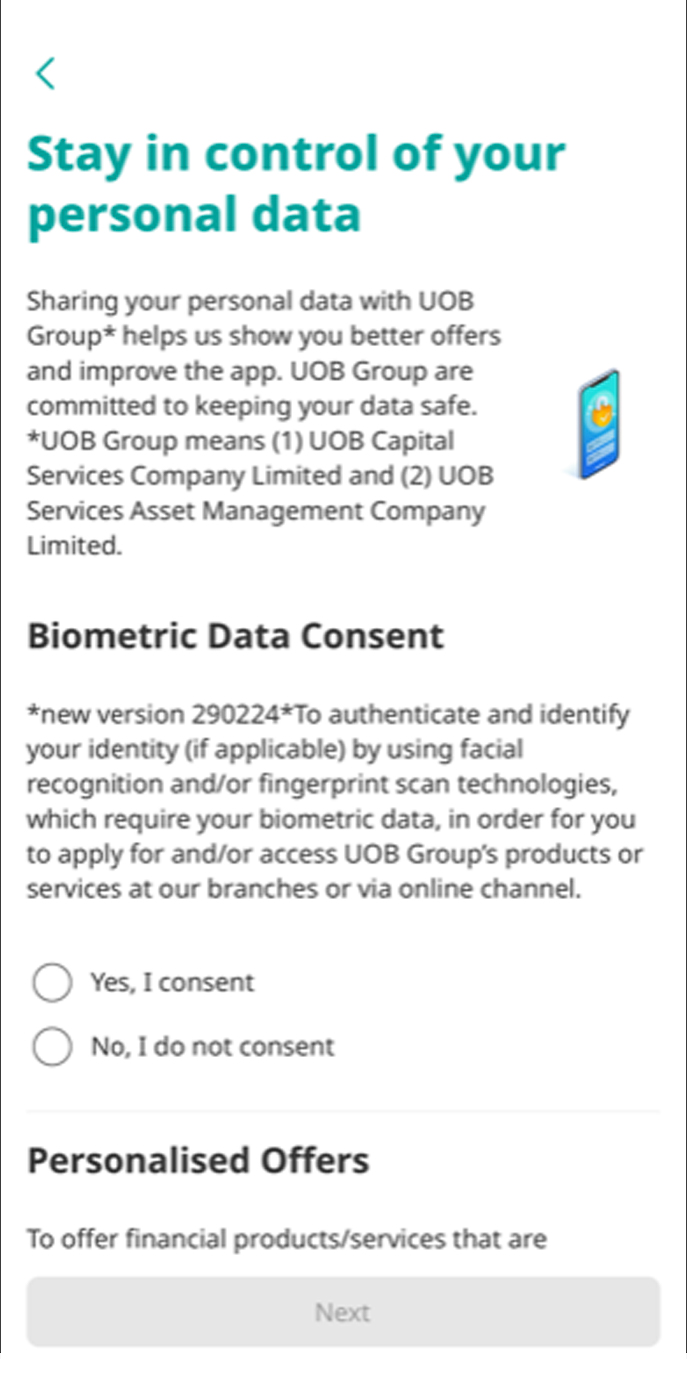

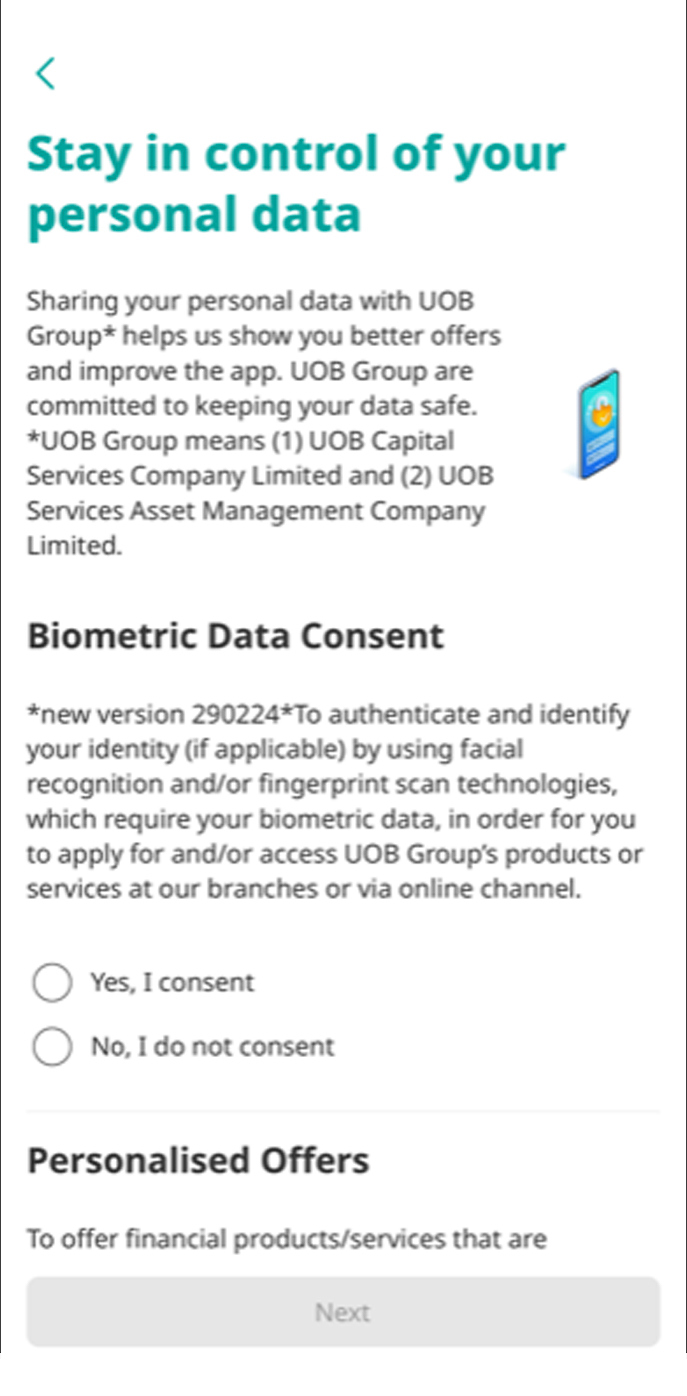

8. User’s consent is required to comply with applicable personal data protection law.

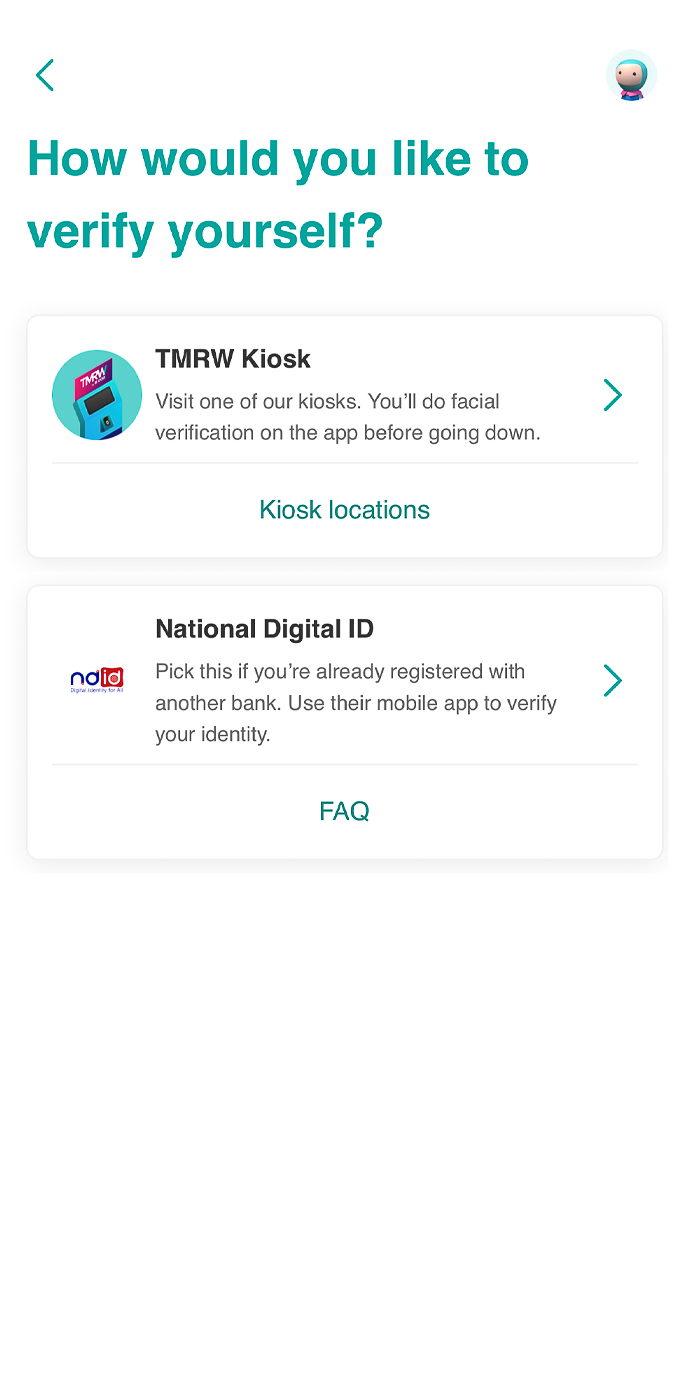

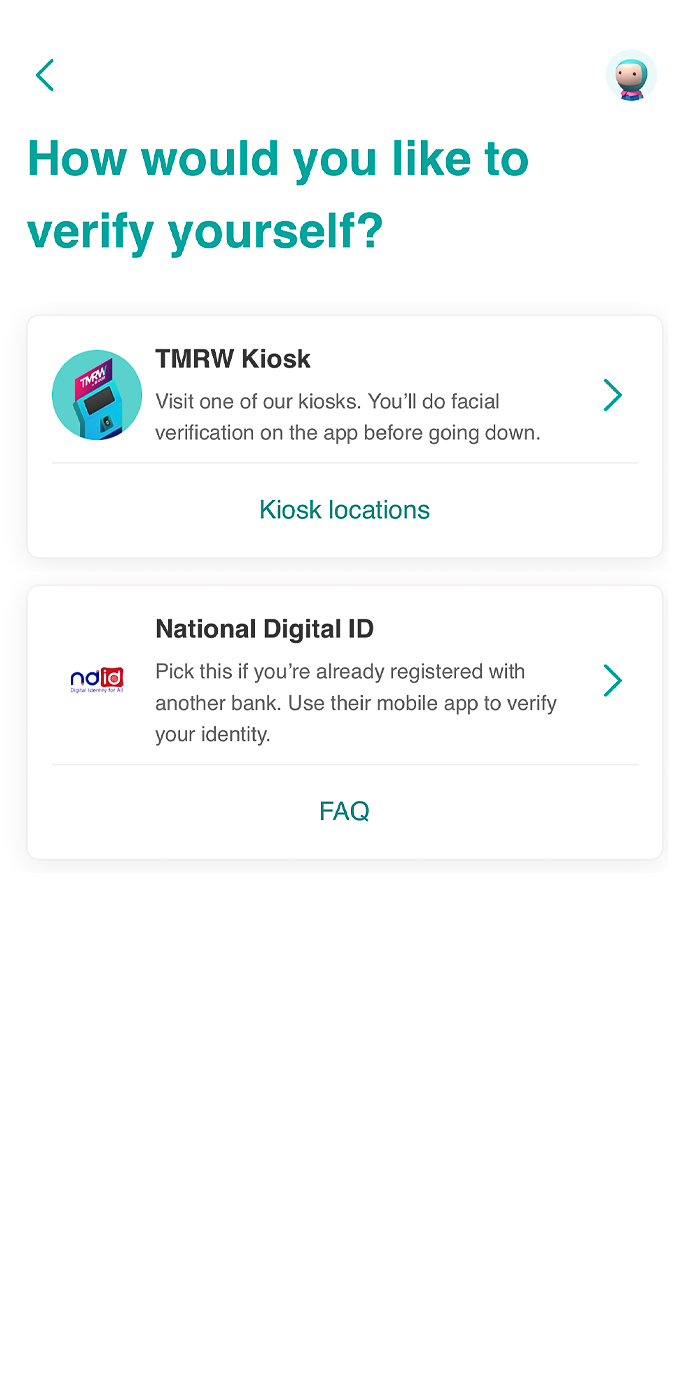

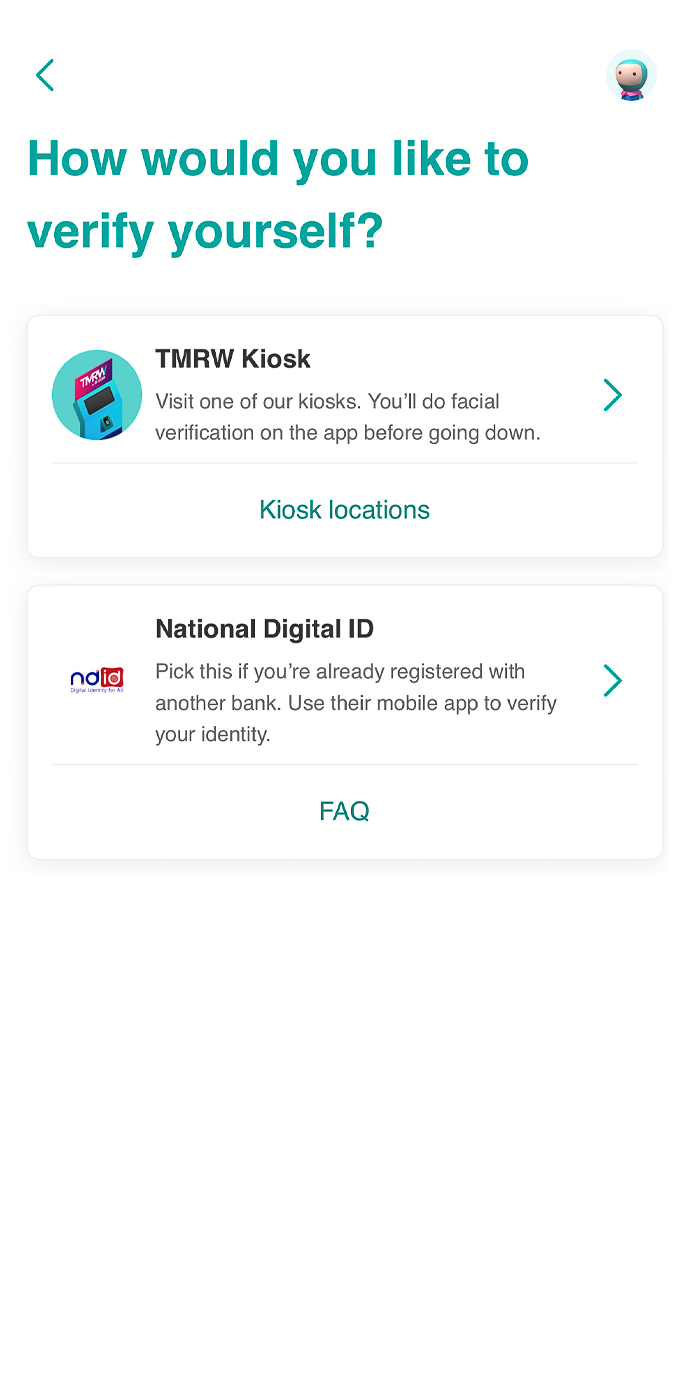

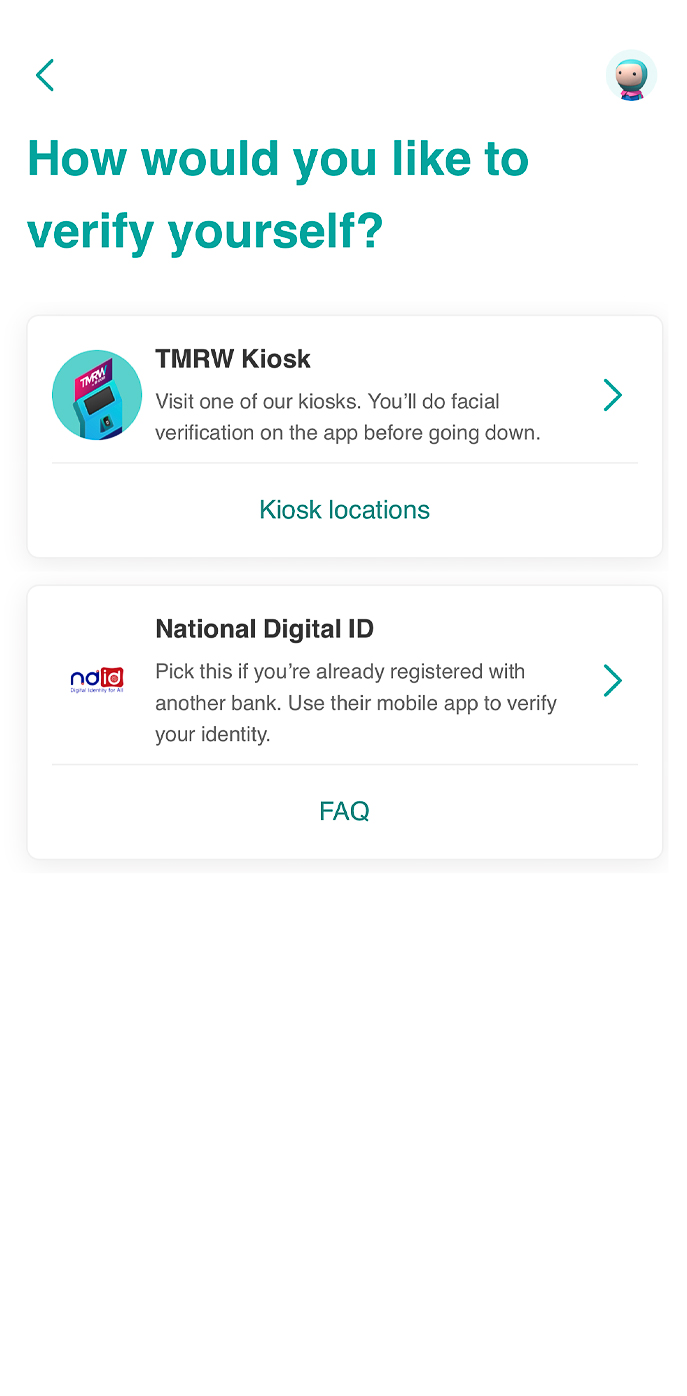

9. Select from 2 types of identity verification methods

(1) TMRW Kiosk

(2) NDID

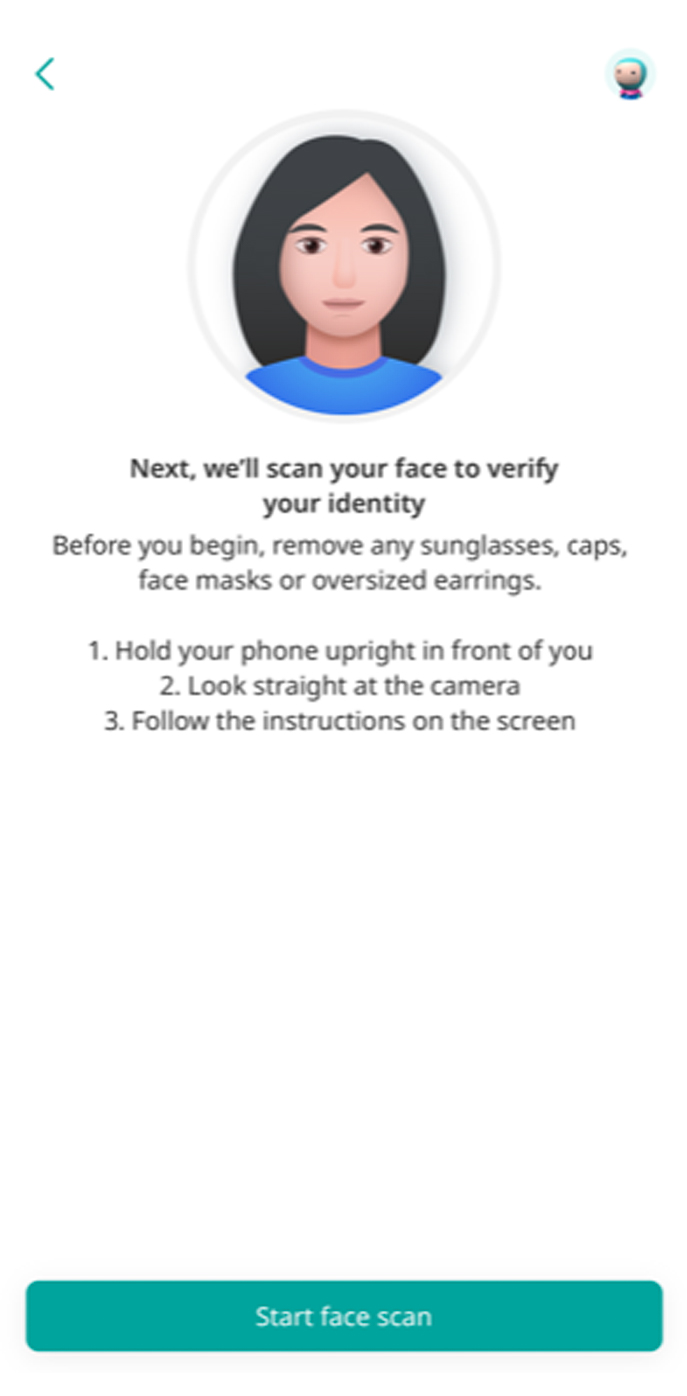

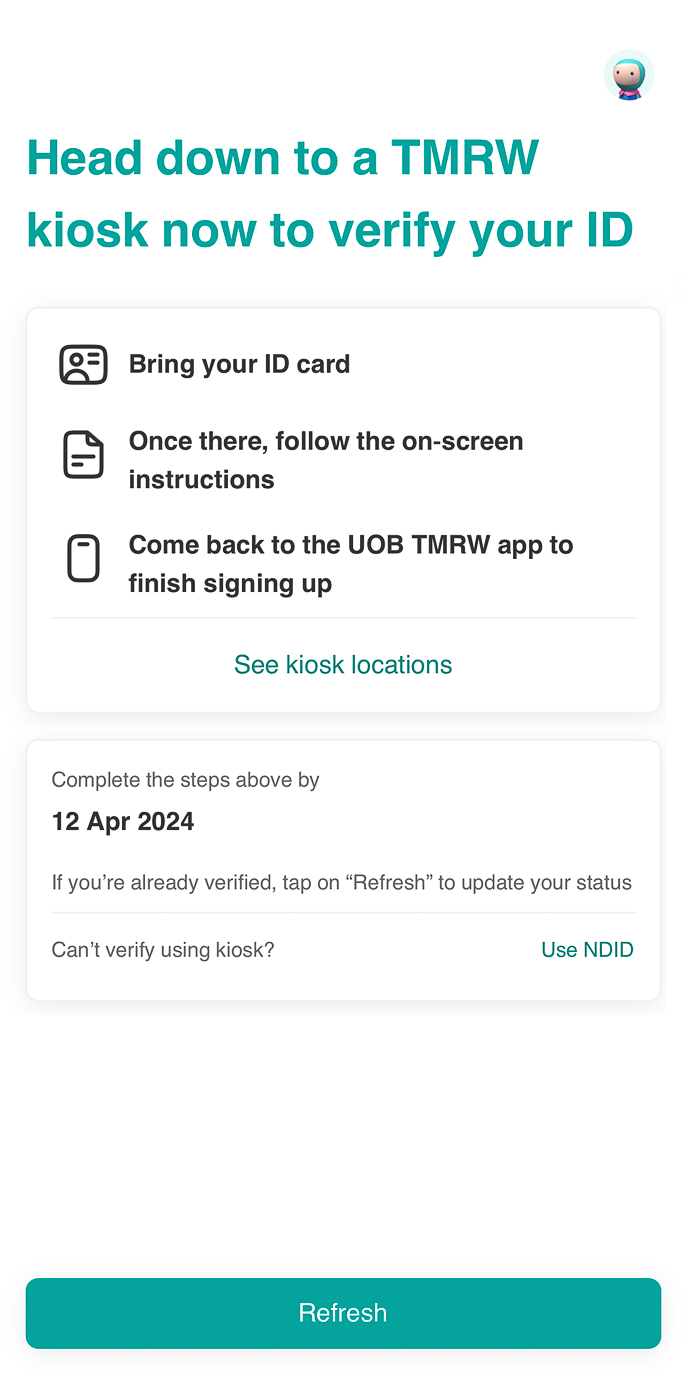

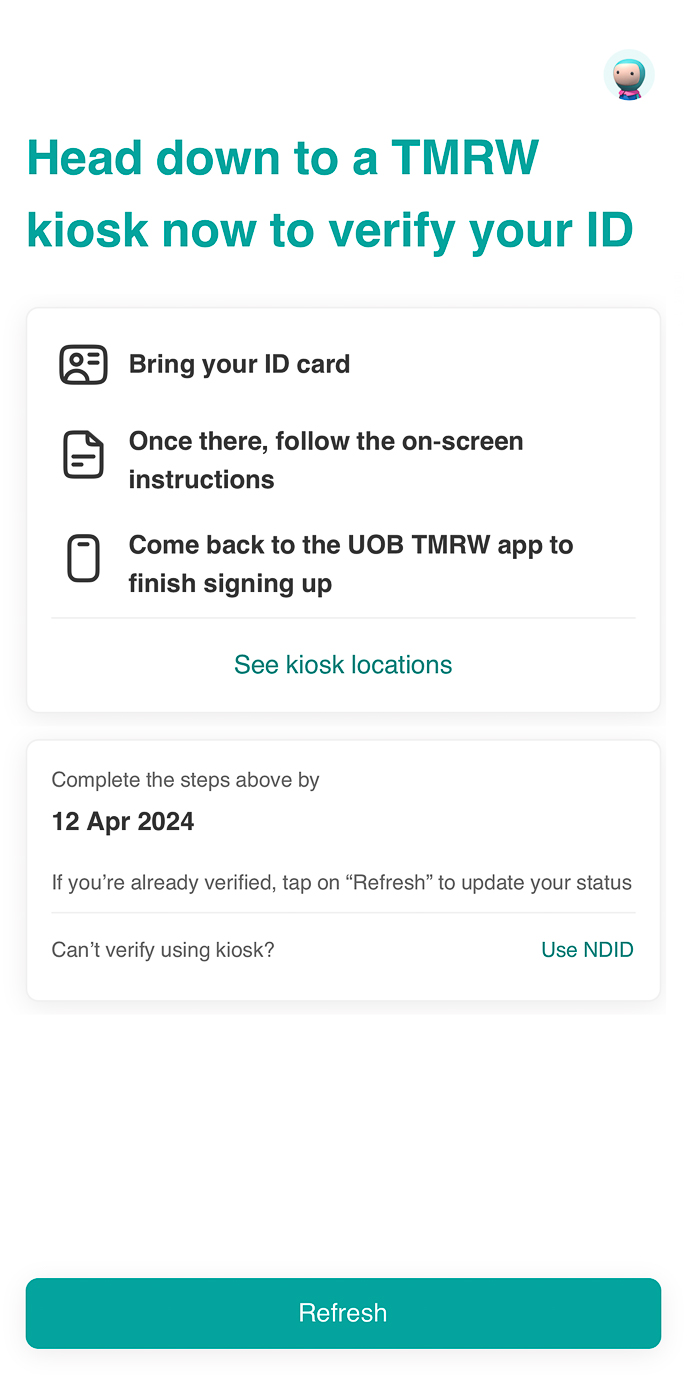

10A. In case select TMRW Kiosk – follow the facial scanning steps and continue filling out the application until step 16. Then bring your ID card to verify your identity at the TMRW Kiosk within 28 days.

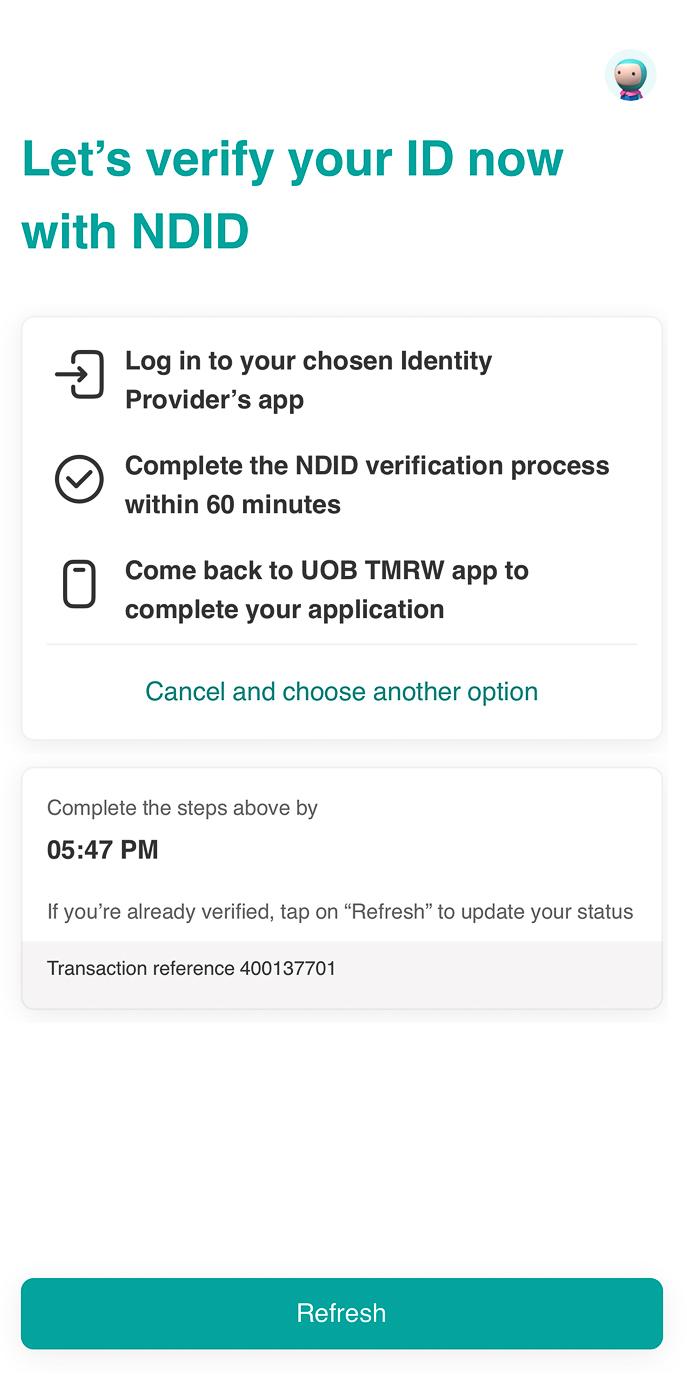

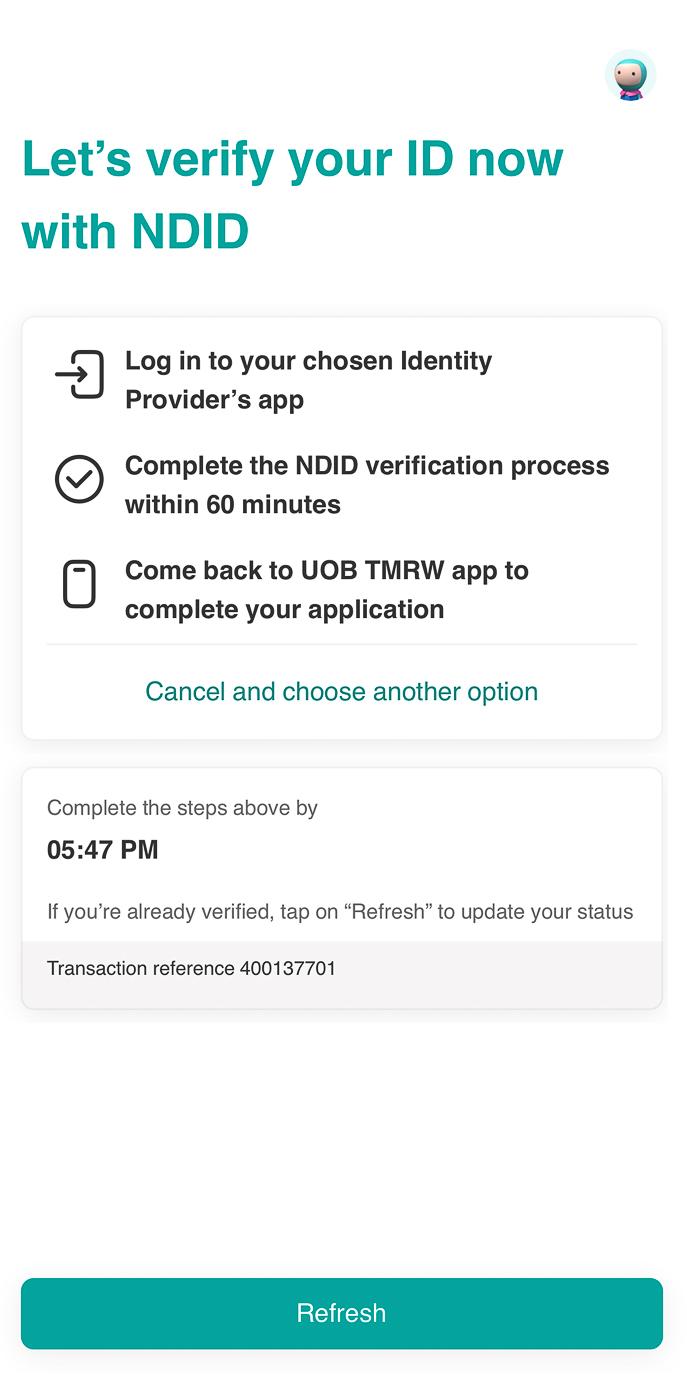

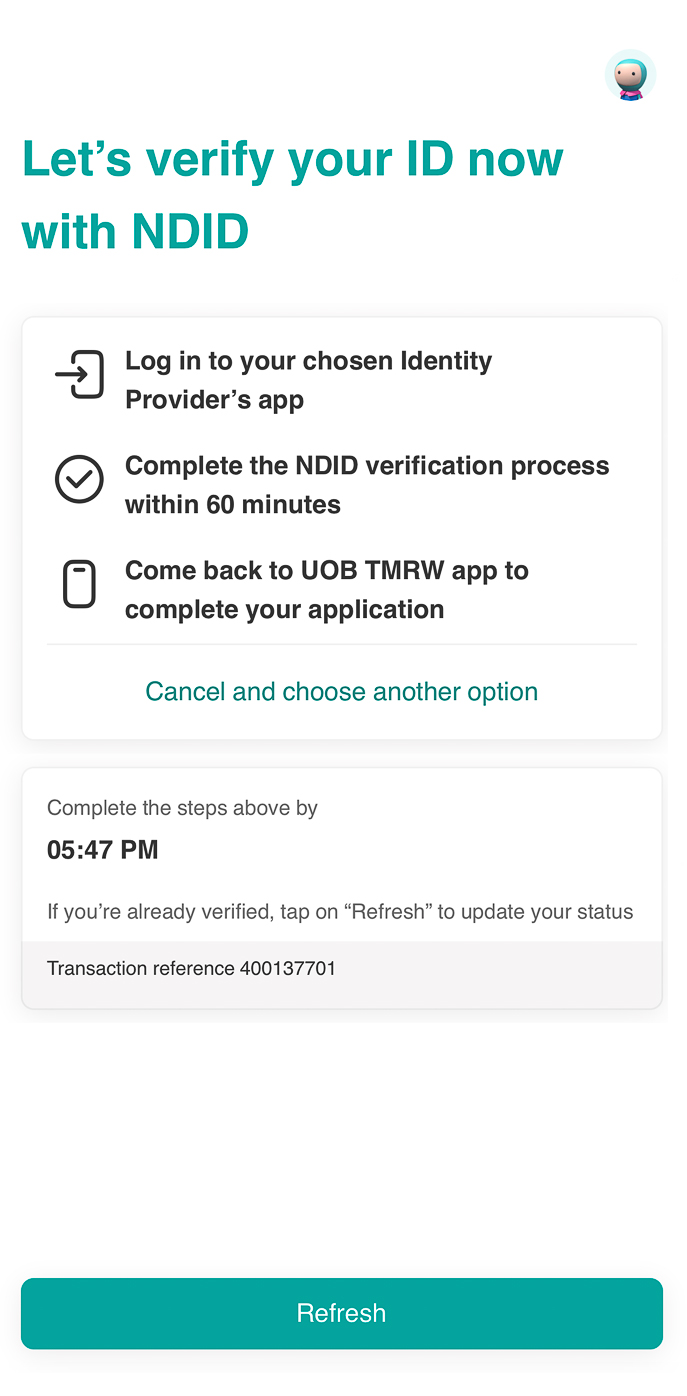

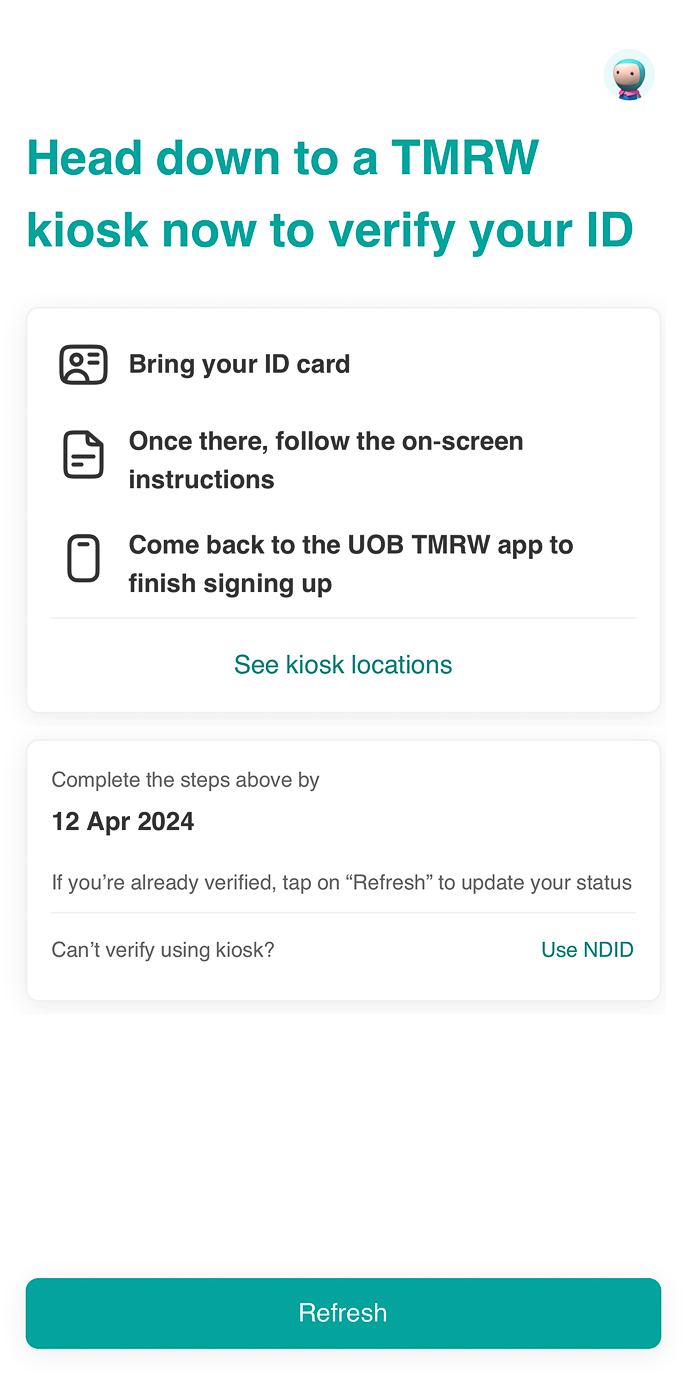

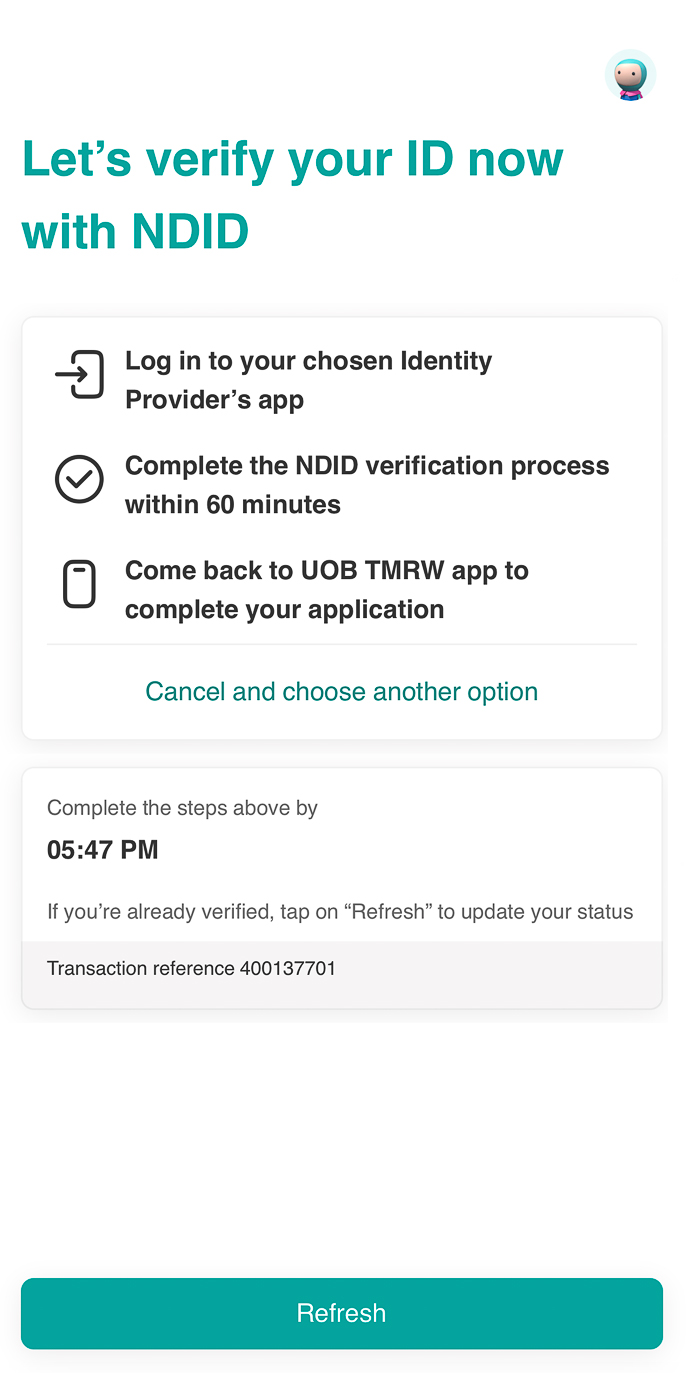

10B. In case select NDID – accept terms and conditions. Select your identity verification provider and follow the steps. Continue filling out the application form in the app.

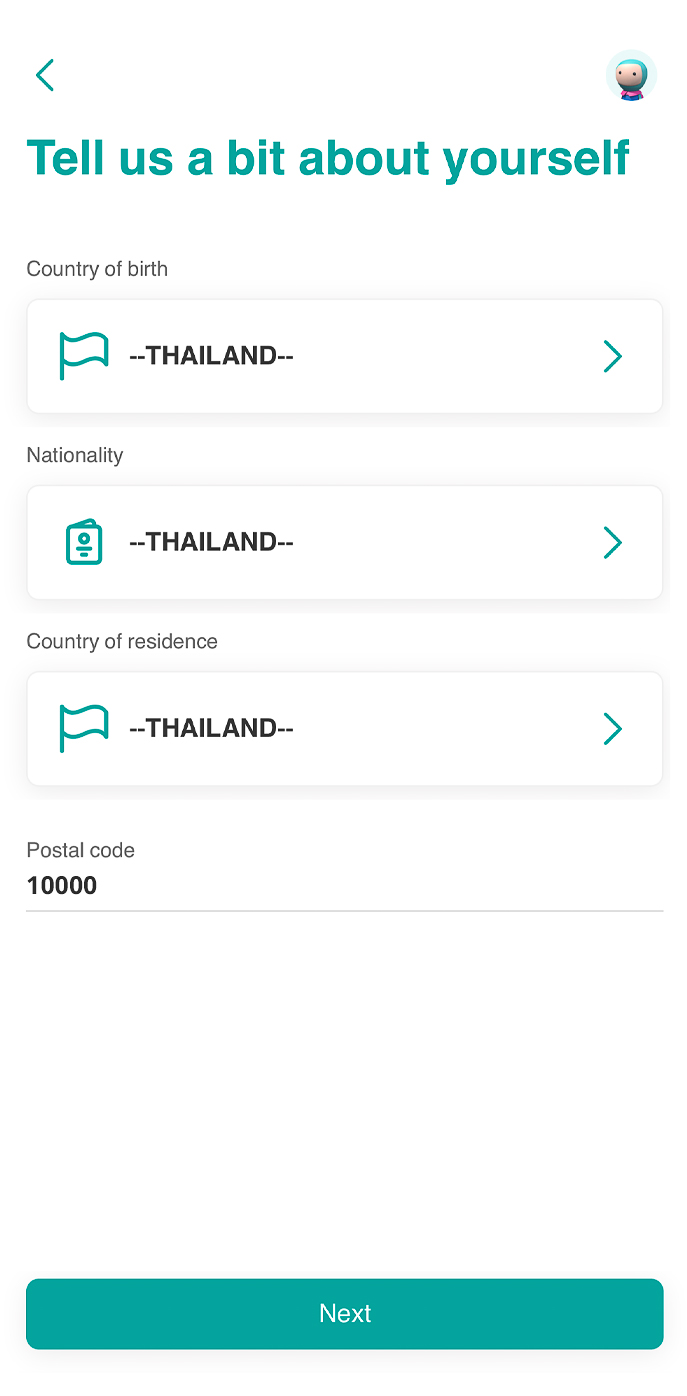

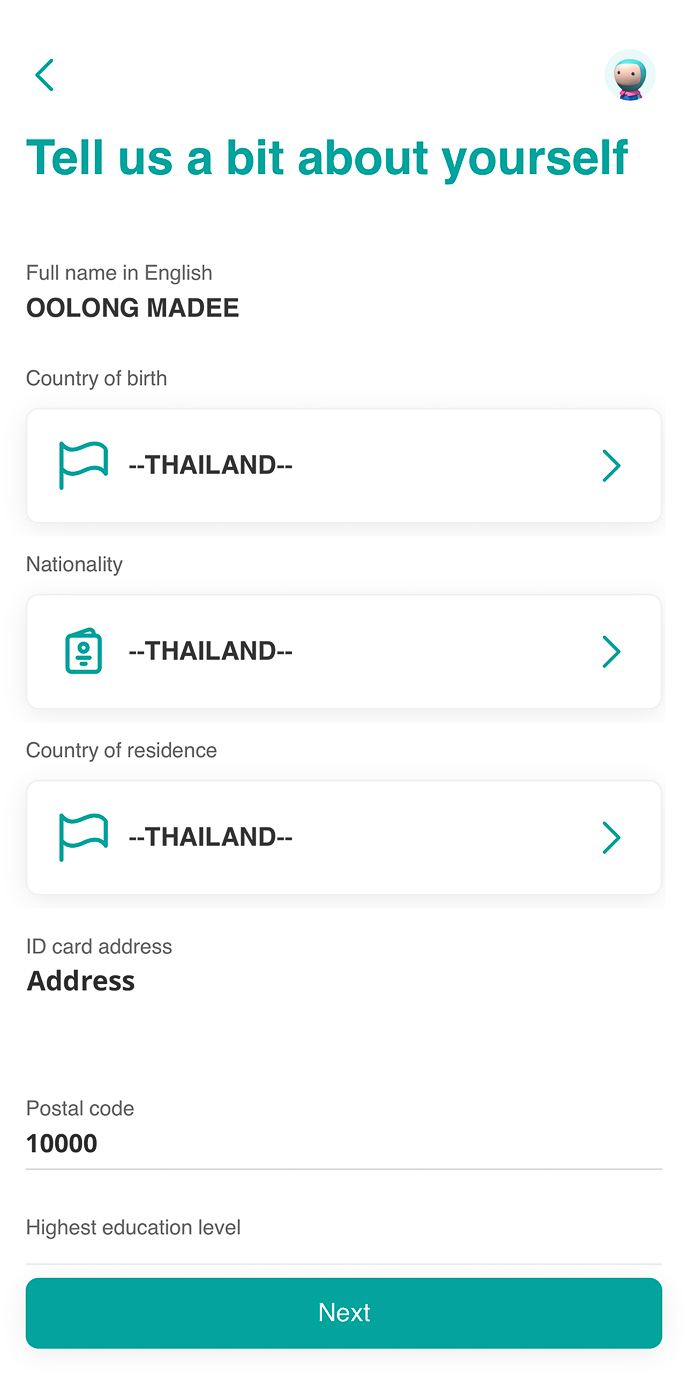

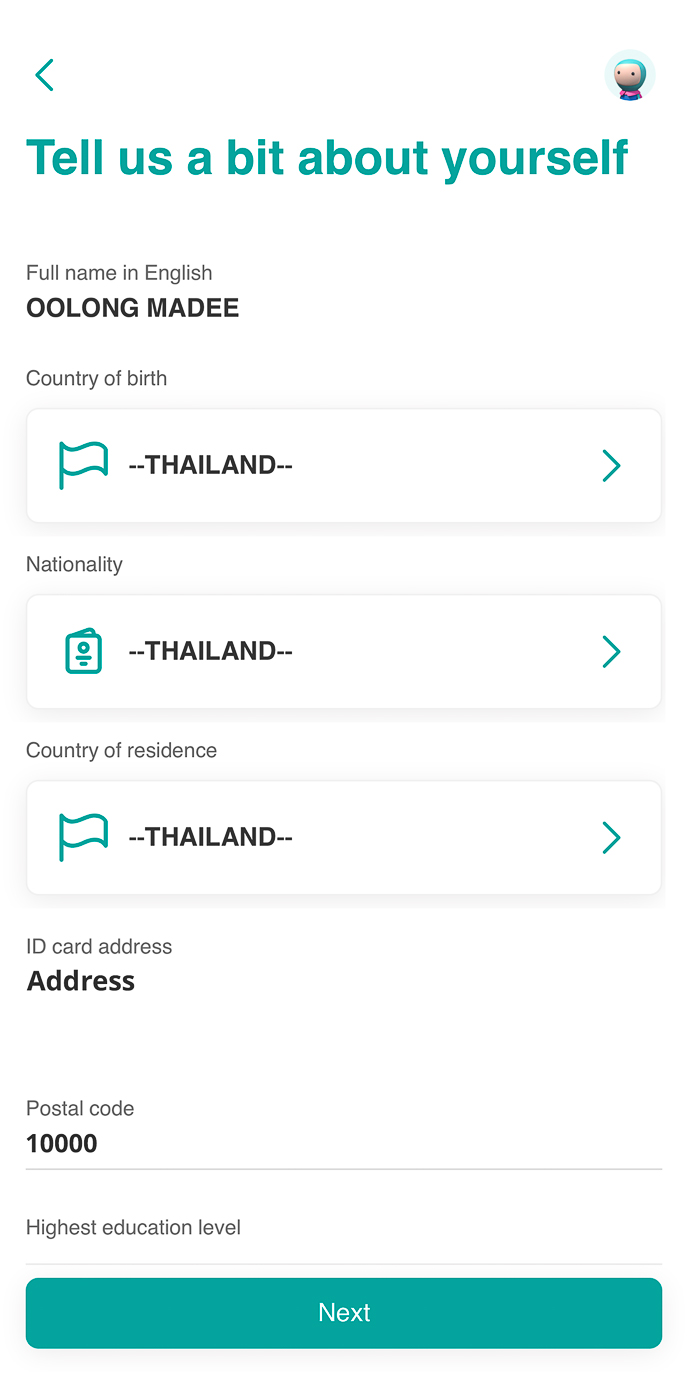

11. Fill in additional information and provide postal address for delivery of documents and cards.

12. Create your Username and Password.

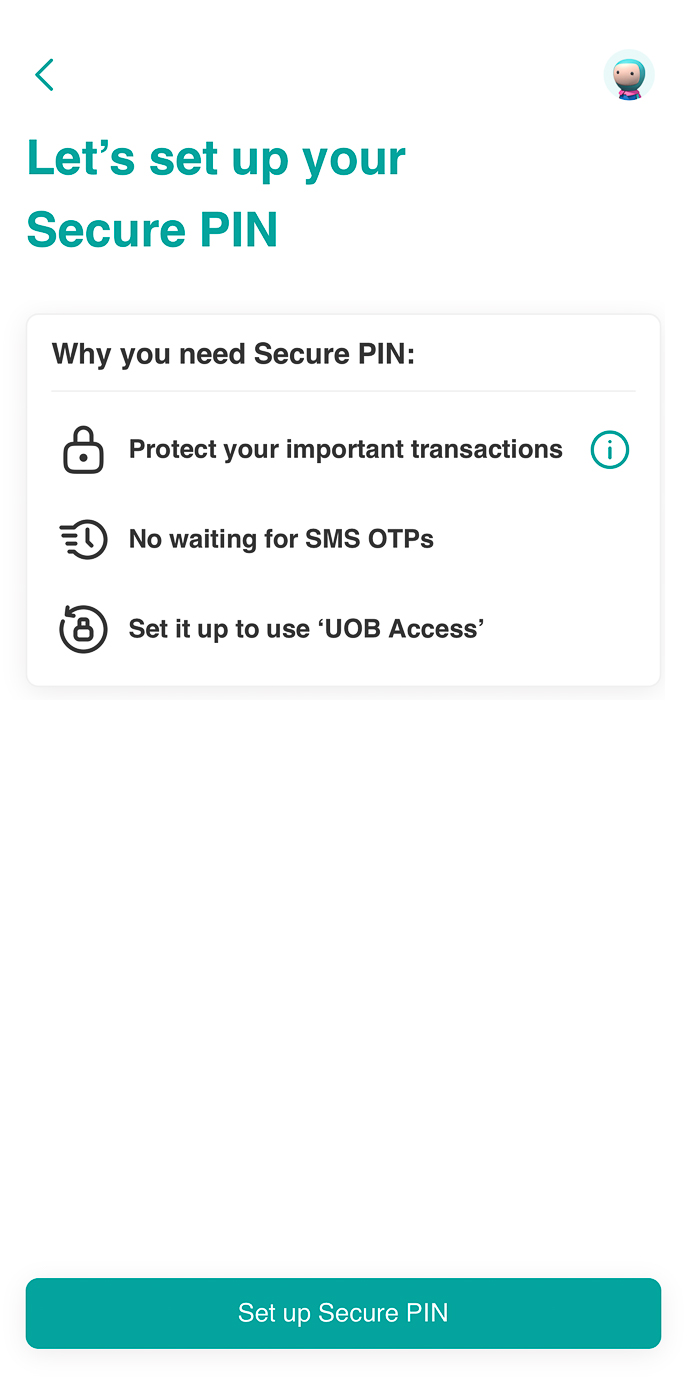

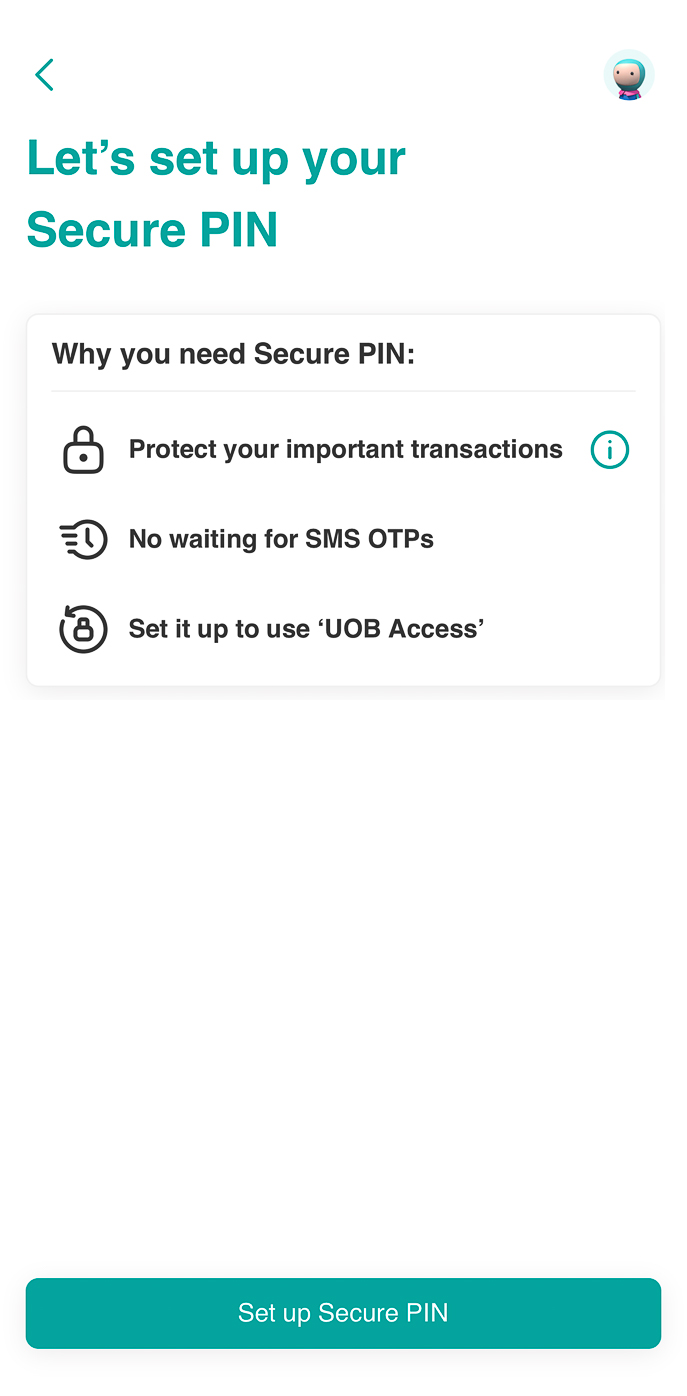

13. Set a 6-digit PIN code for secured transaction via app

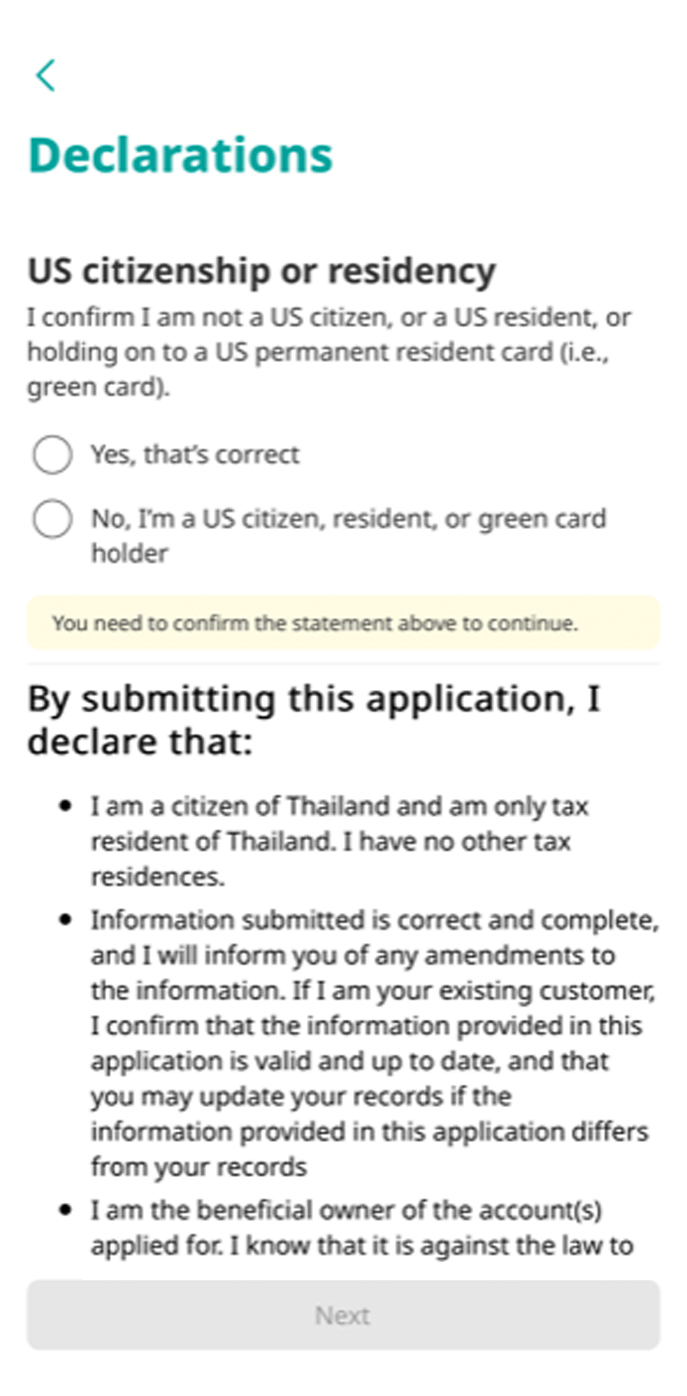

14. Confirm personal information and agree to terms and conditions.

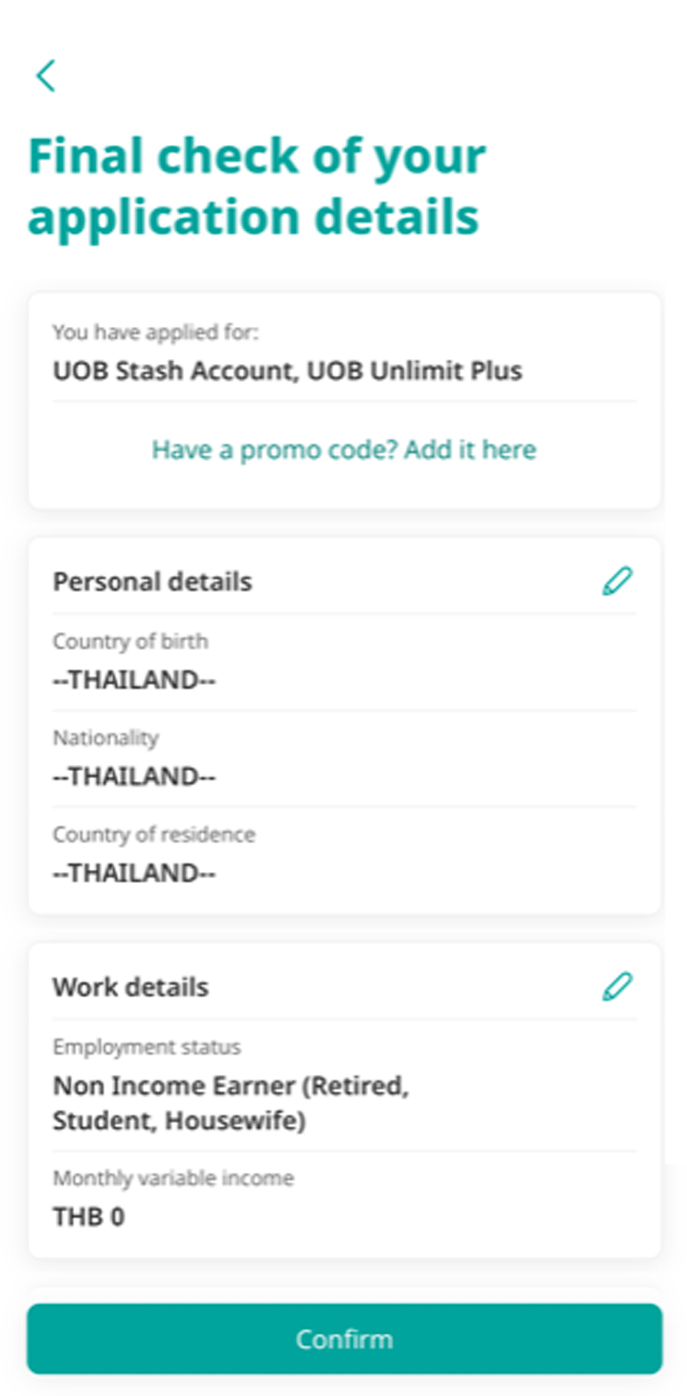

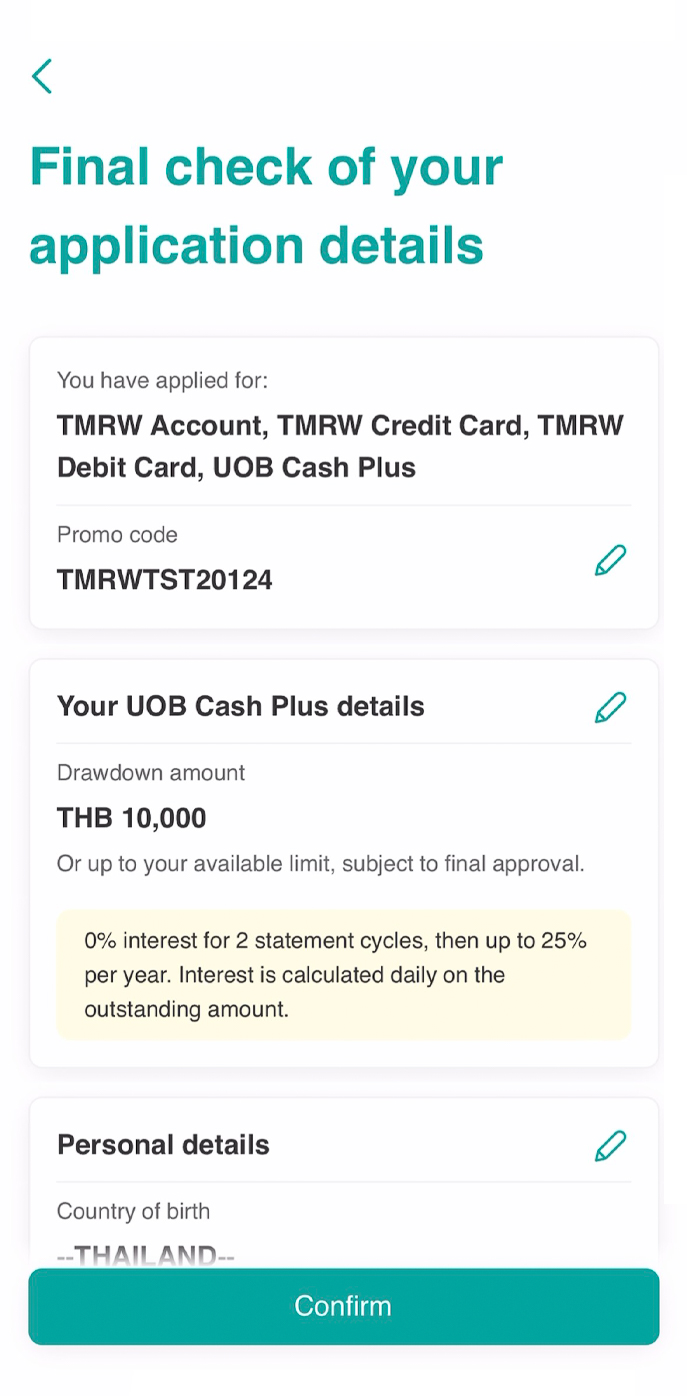

15. Verify application information and press “Confirm”.

16. Application process is complete. Please wait for SMS/Notification informing you of the application status.

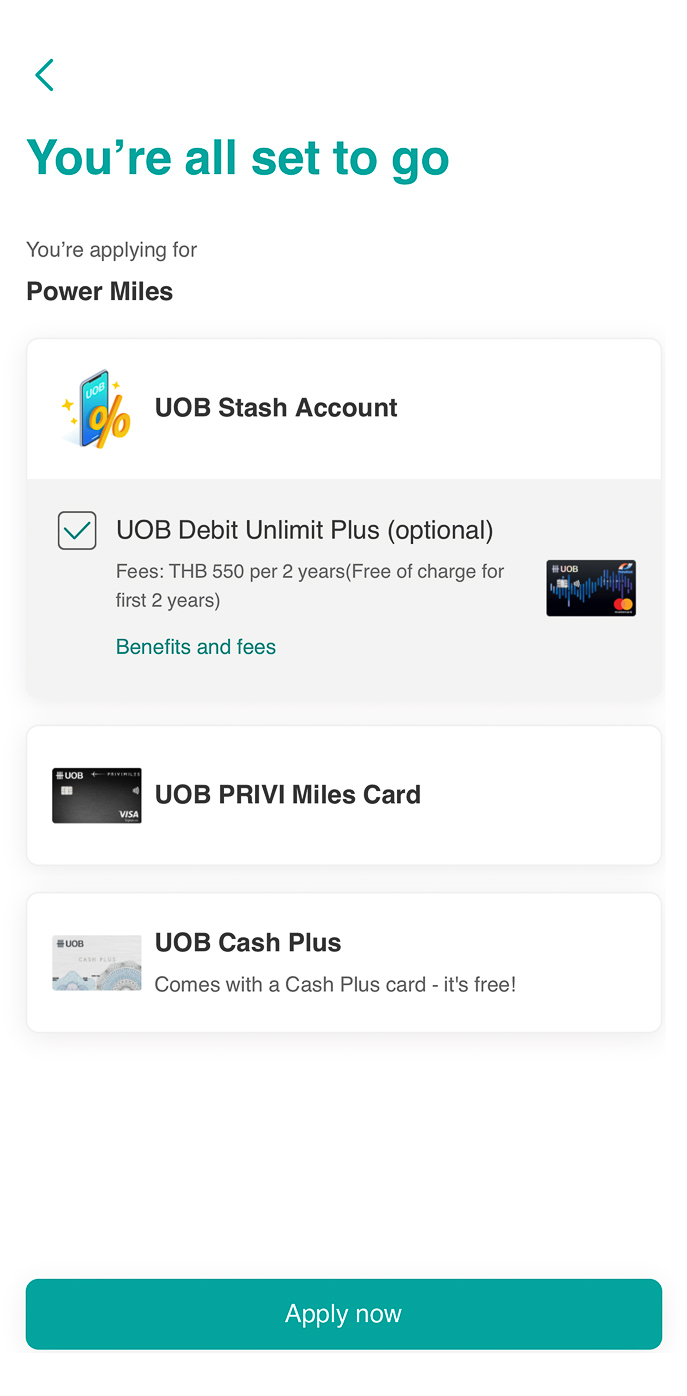

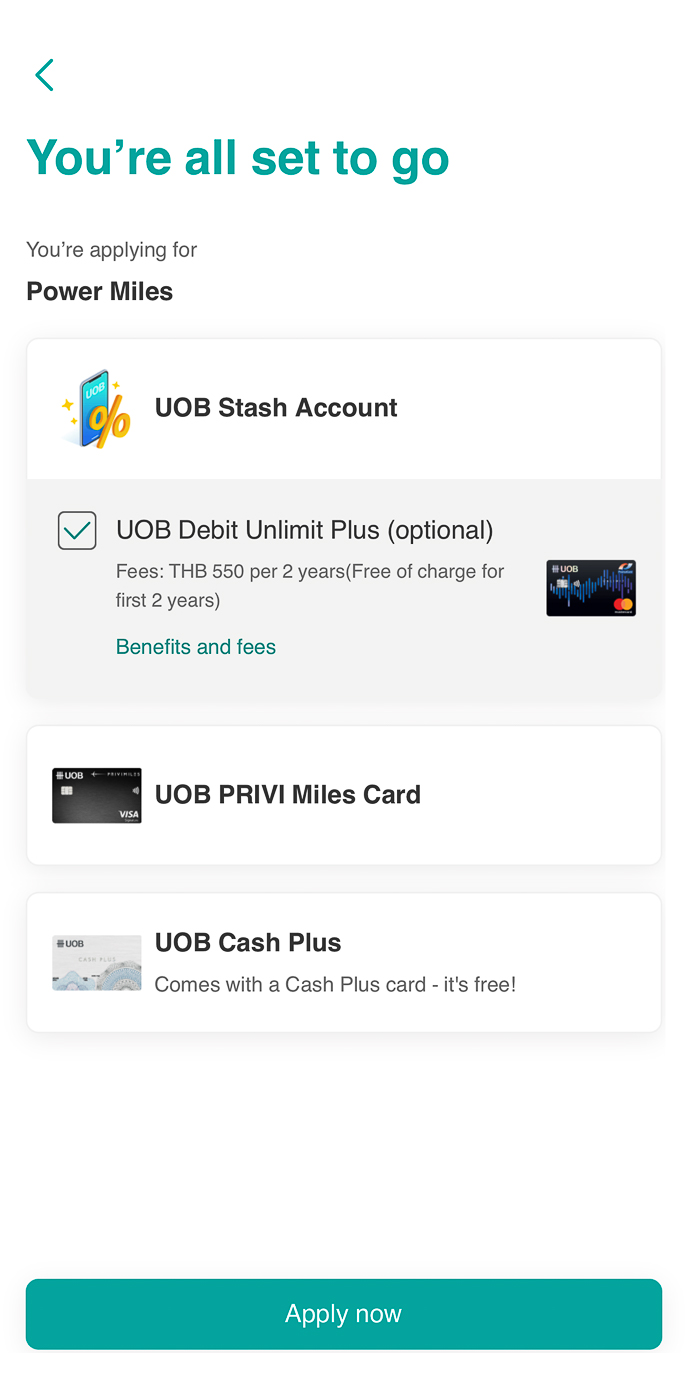

2. Apply for multiple products – deposit account, credit card, and UOB Cash Plus

1. Open UOB TMRW app and select “Open an account now”.

2. Select “Sign up” button.

3. Enter your mobile number and email. Confirm OTP via SMS.

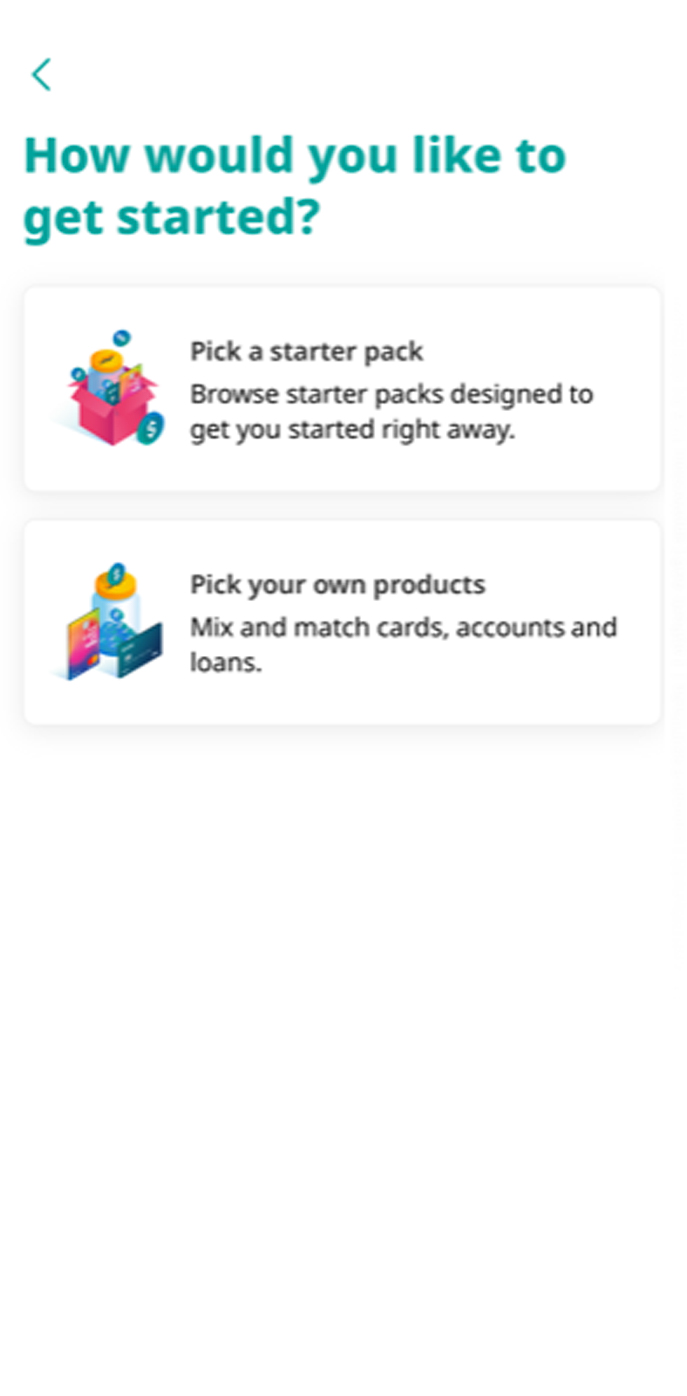

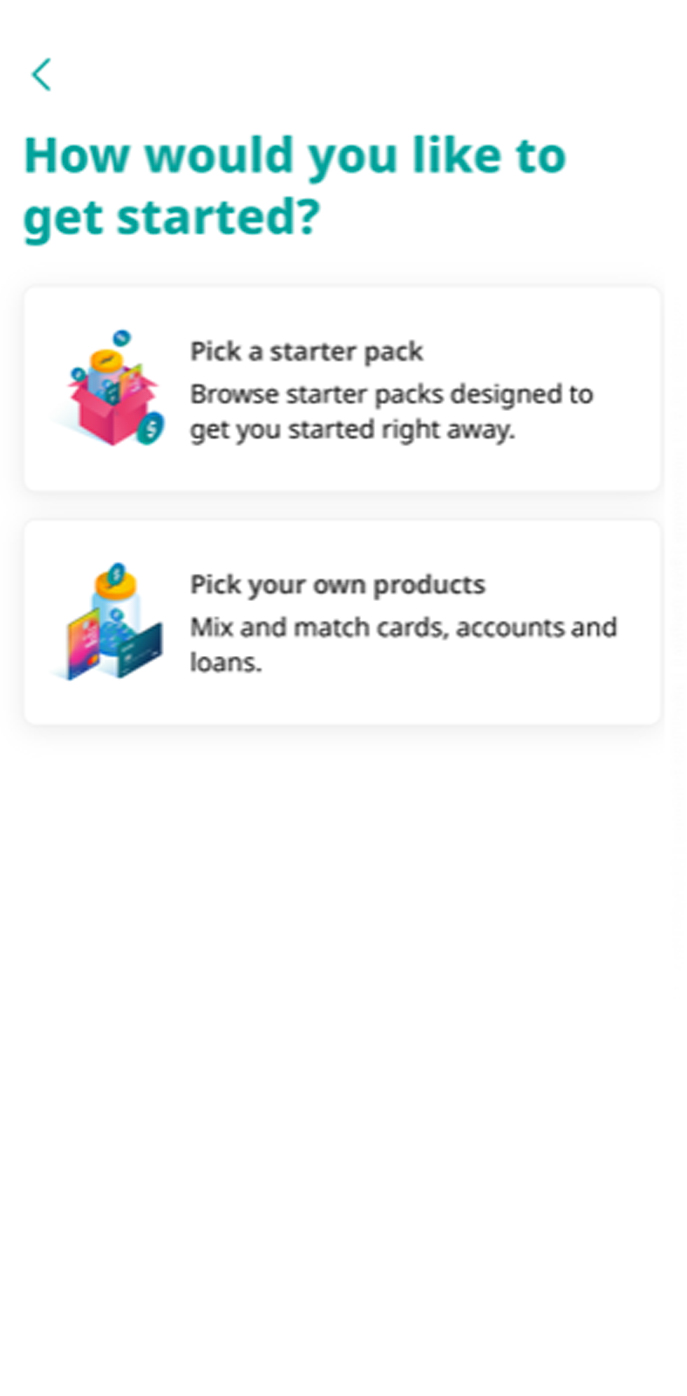

4. Select from 2 product application formats

(1) Starter pack or

(2) Pick your own products

5. Select the products you wish to apply for.

6. Enter promo code (if any), then press “Next”. Otherwise, press “Skip”.

7. User to read and acknowledge “Privacy Notice” before applying.

8. User’s consent is required to comply with applicable personal data protection law.

9. Select from 2 types of identity verification methods

(1) TMRW Kiosk

(2) NDID

10A. In case select TMRW Kiosk – follow the facial scanning steps in the app, then bring your ID card to verify at TMRW Kiosk. Proceed with filling up the application form in the app.

10B. In case select NDID – accept terms and conditions. Select your identity verification provider and follow the steps. Continue filling out the application form in the app.

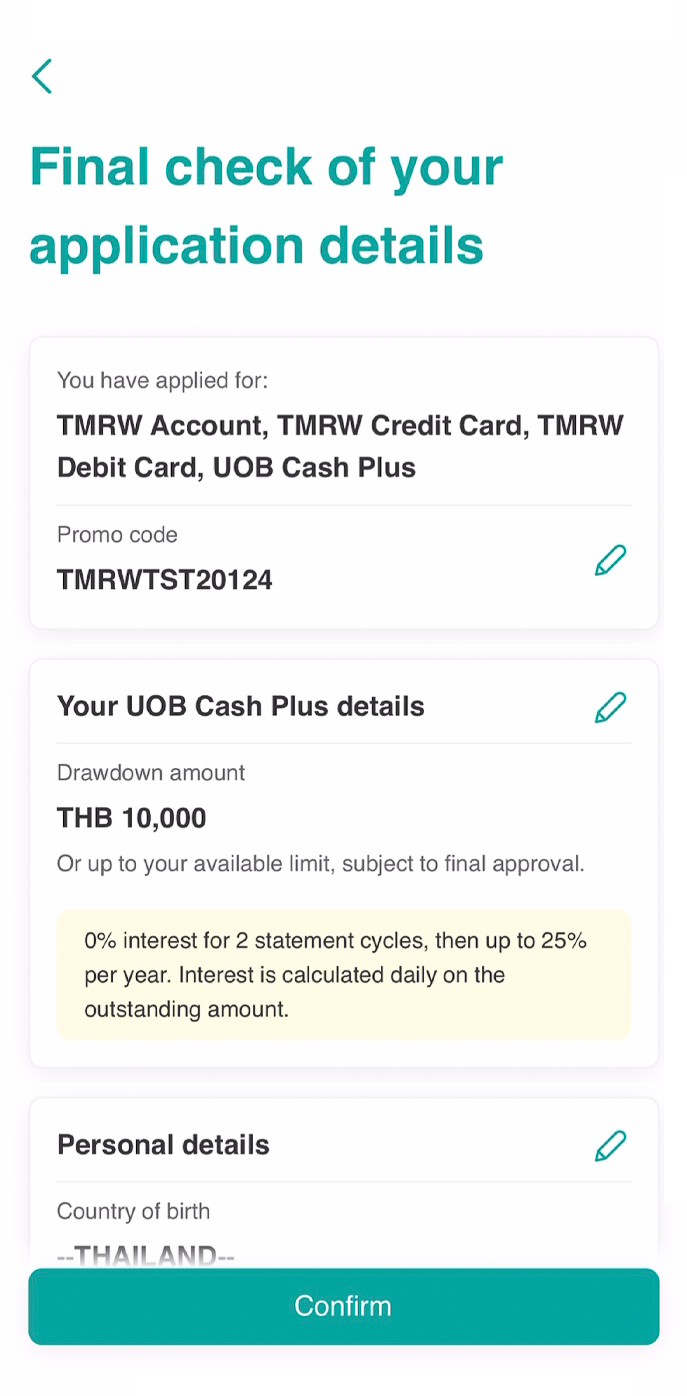

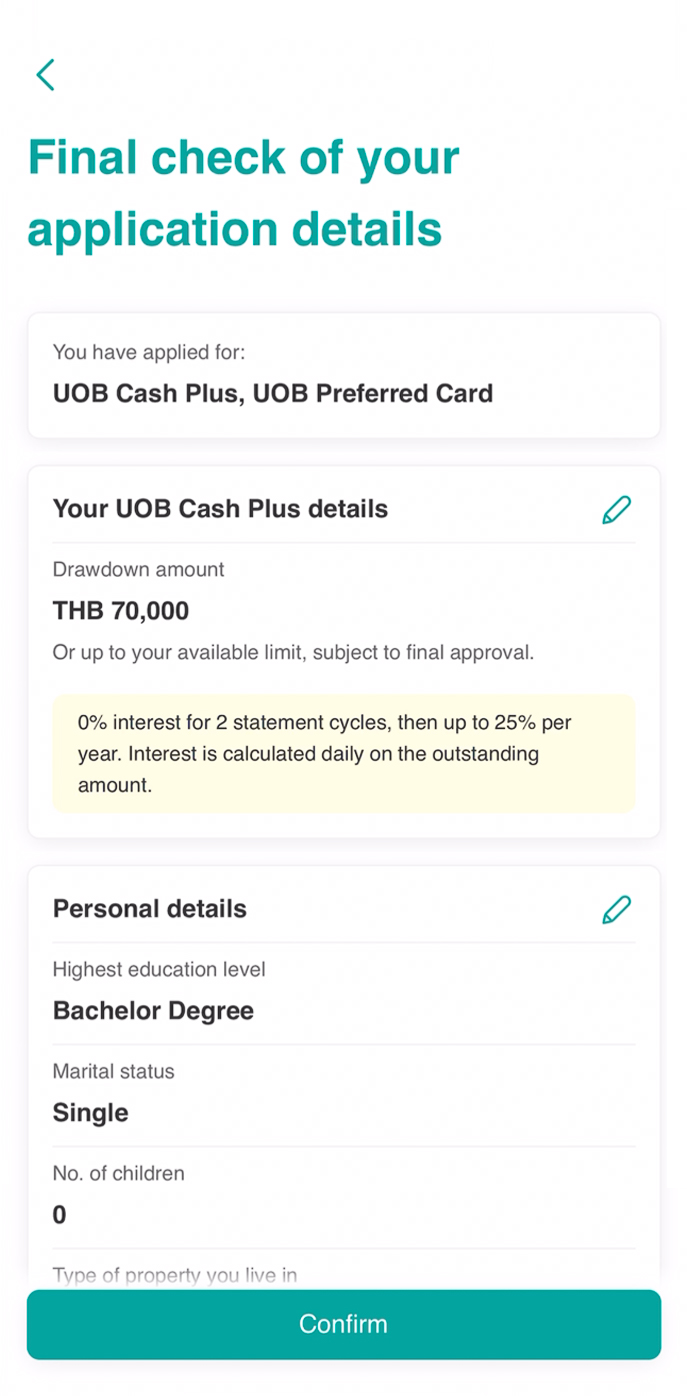

11. Fill in additional information, upload proof of income documents, and provide postal address for delivery of documents and cards.

12. Create your Username and Password.

13. Set a 6-digit PIN code for secured transaction via app.

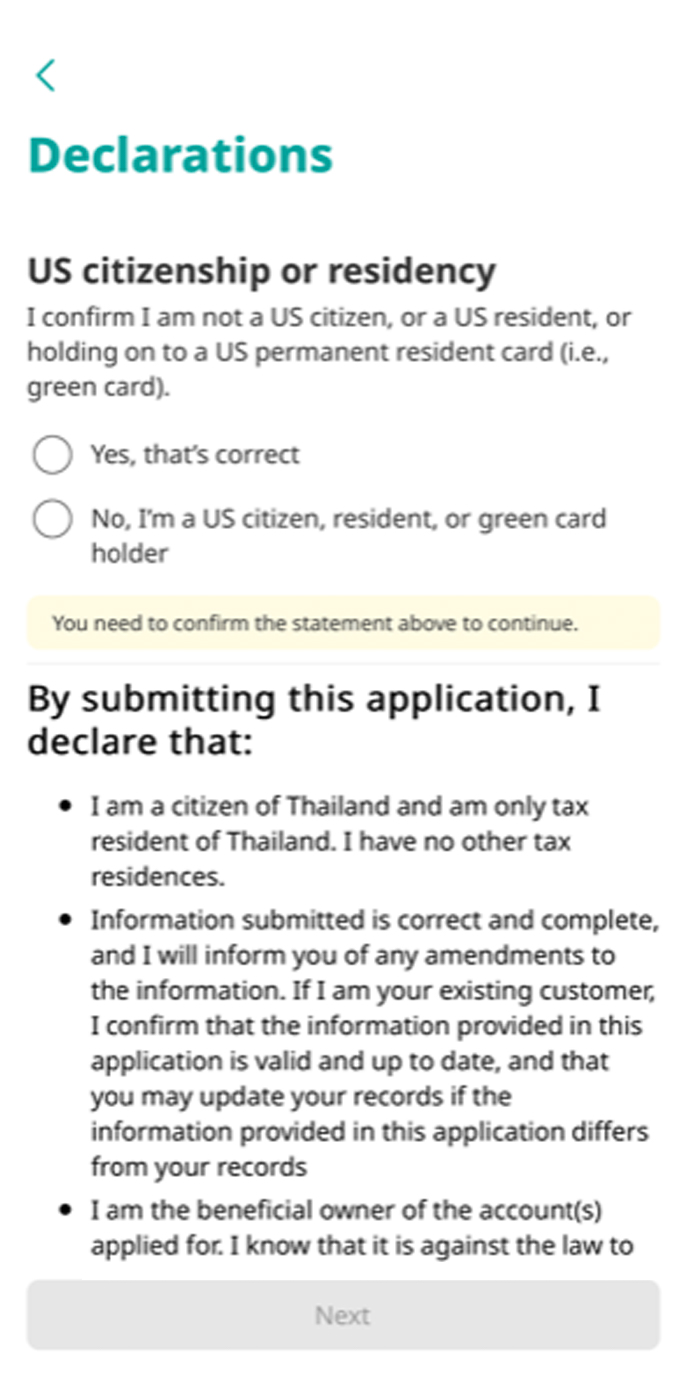

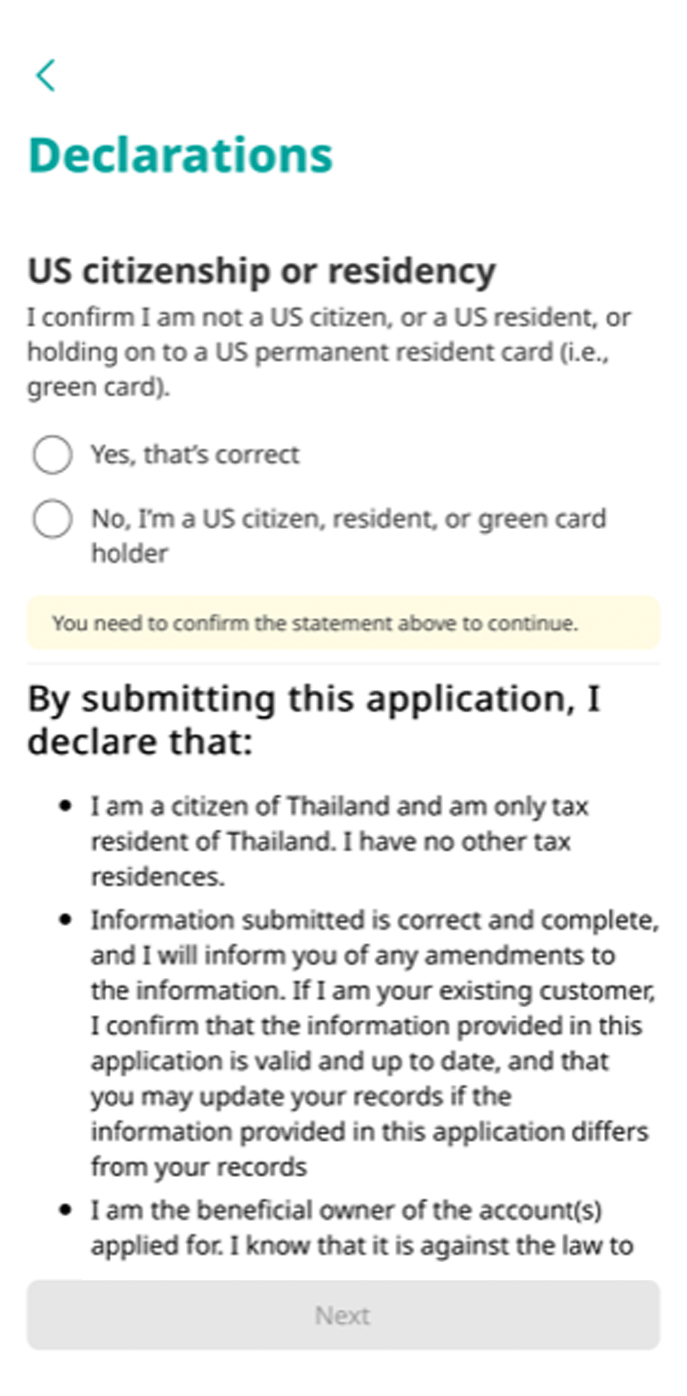

14. Confirm personal information and consent to be provided to declare information to Credit Bureau.

15. Verify application information and press “Confirm”.

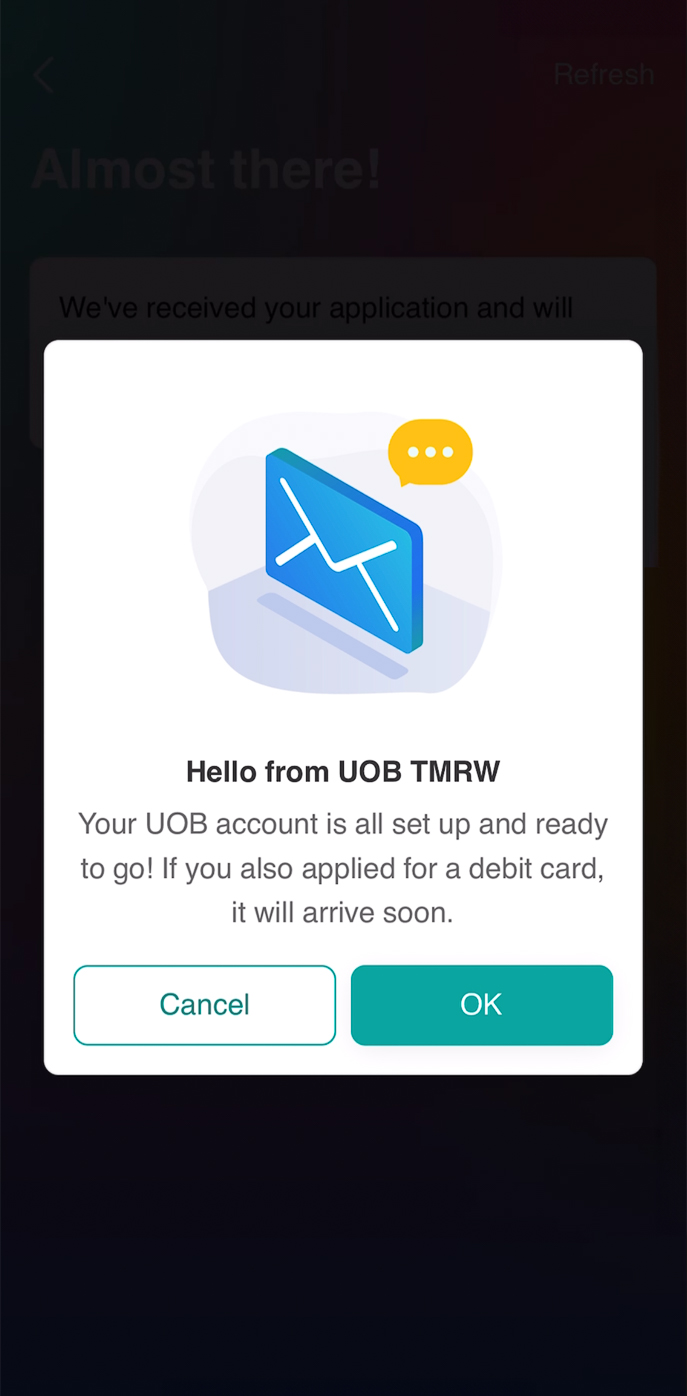

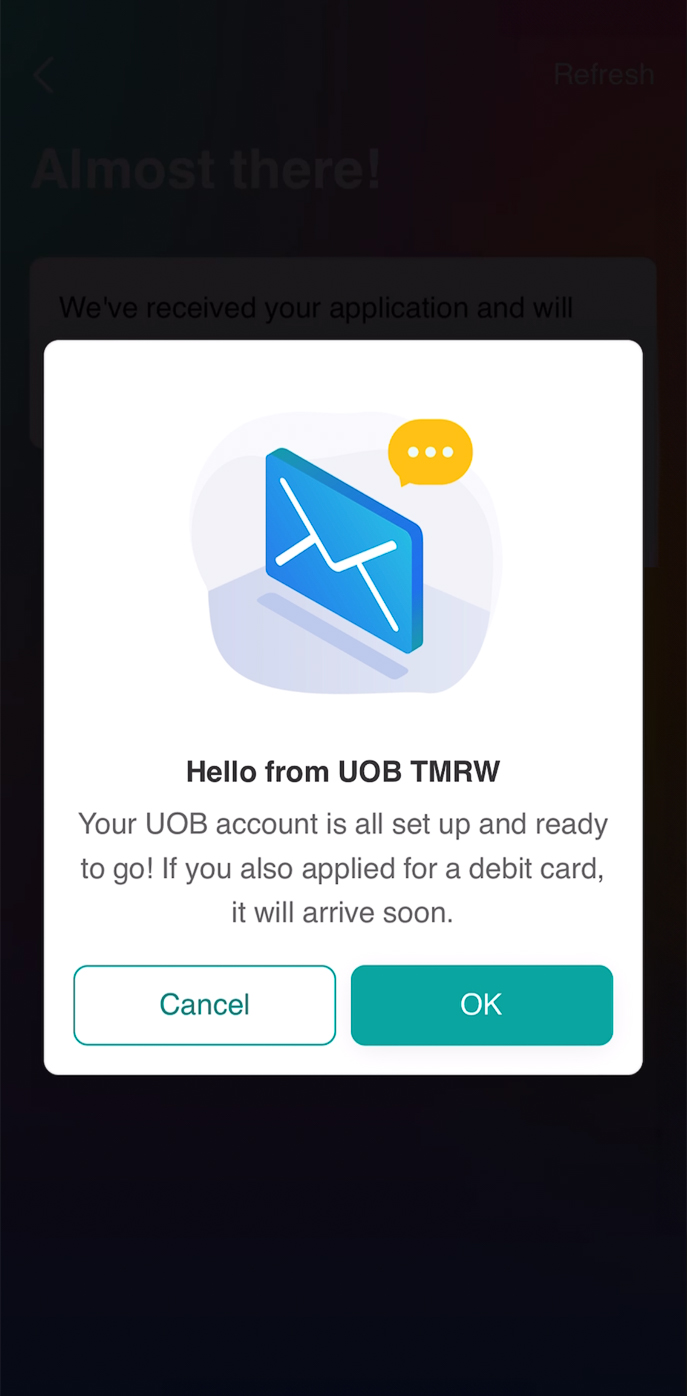

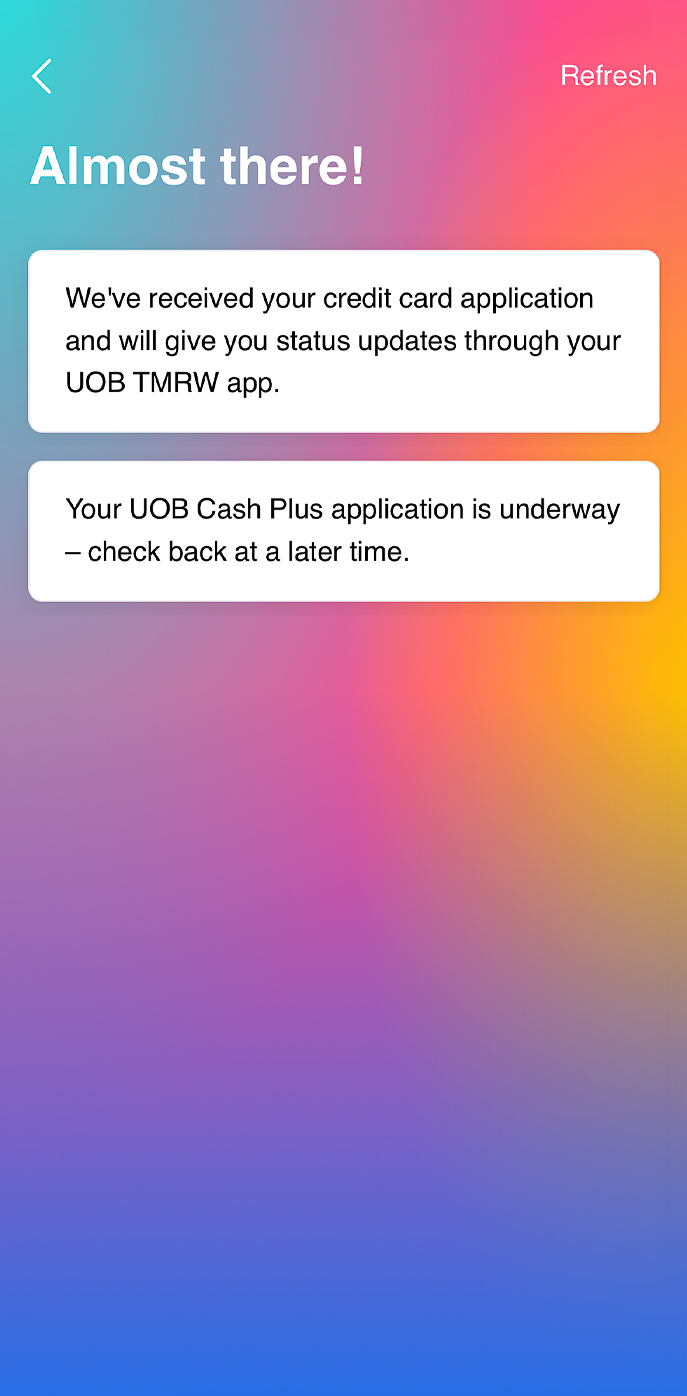

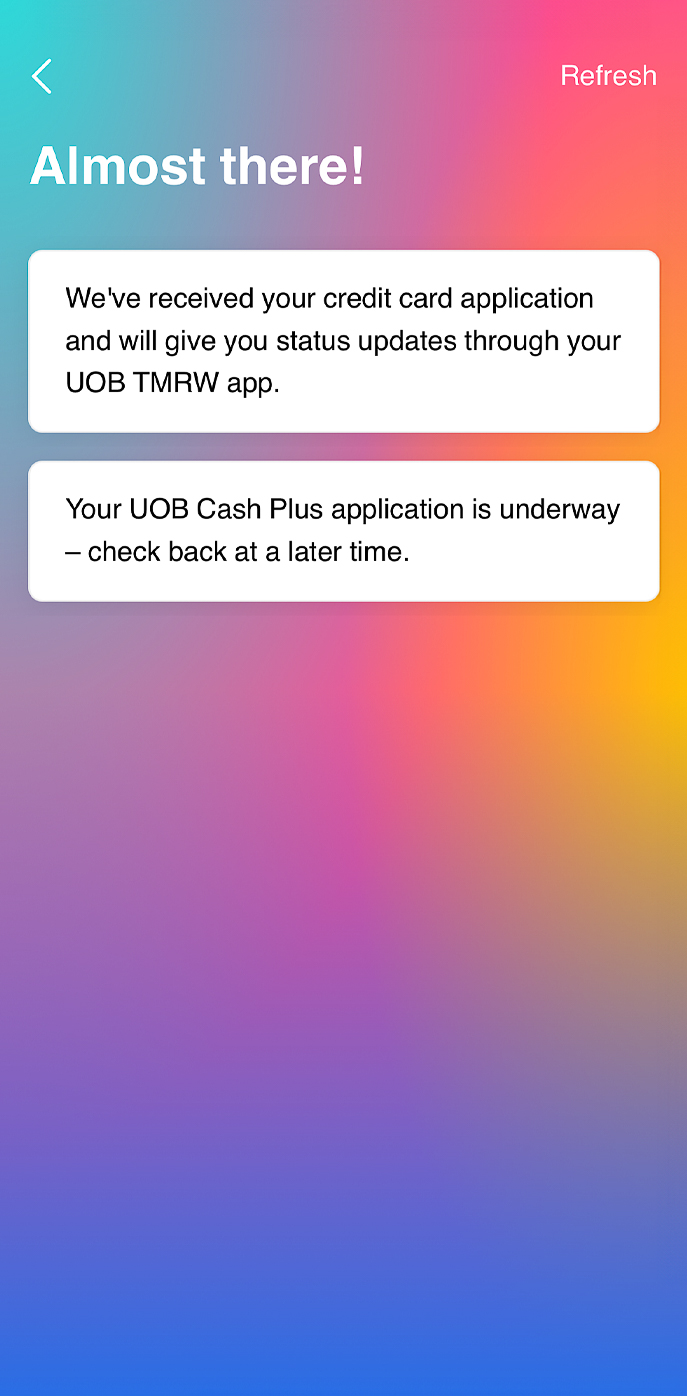

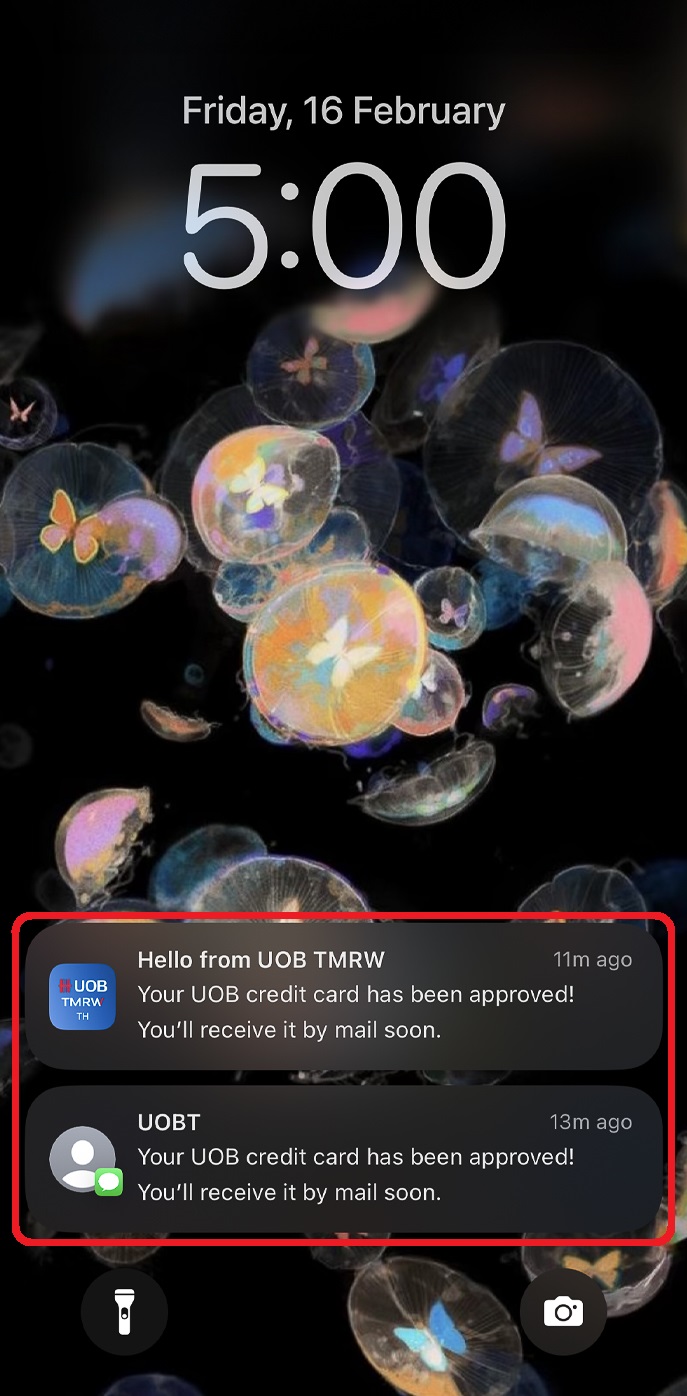

16. Application process is complete. Please wait for SMS/Notification informing you of the application status.

Apply for additional products via UOB TMRW for existing app users

1. Open an additional deposit account with option to add on card products

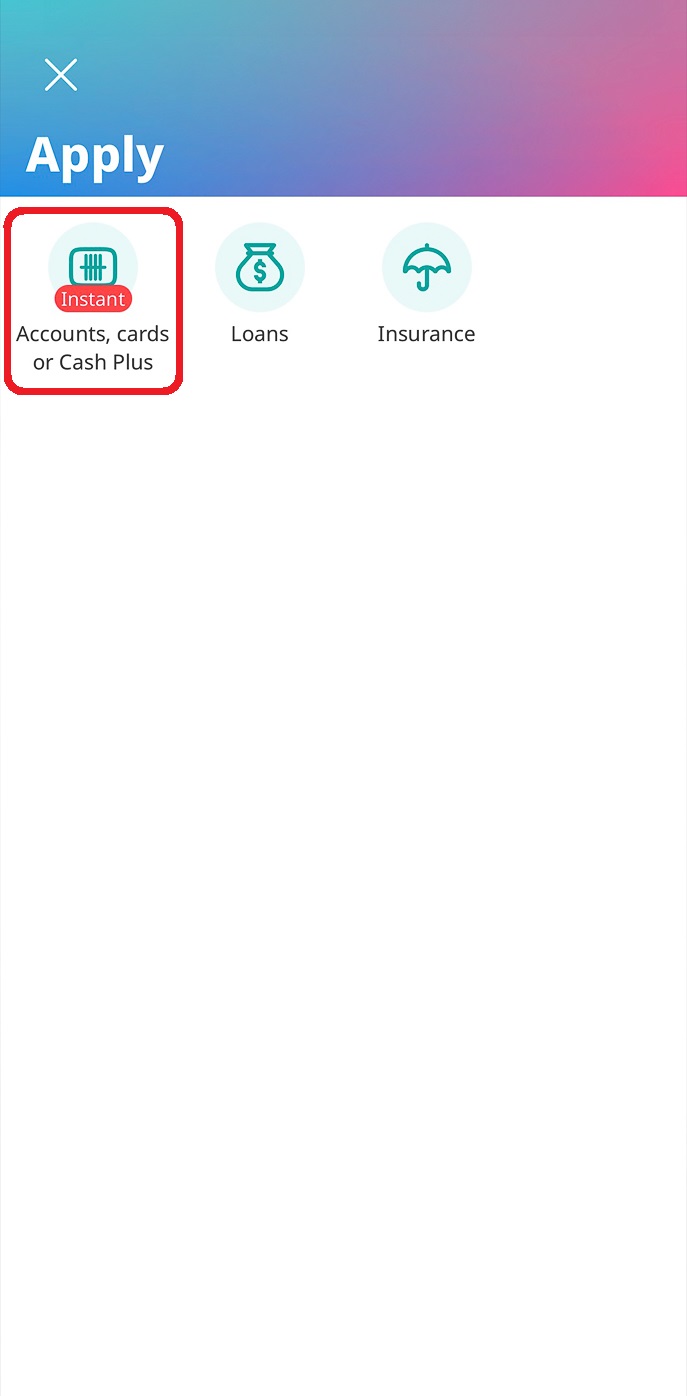

1. Open UOB TMRW app and select “Apply” (without login).

2. Select “Accounts, cards or Cash Plus”.

3. Enter your mobile number and email. Confirm OTP via SMS.

4. Select from 2 product application formats

(1) Starter pack or

(2) Pick your own products

5. Select the product(s) you wish to apply for.

6. Enter promo code (if any), then press “Next”. Otherwise, press “Skip.

7. Read and acknowledge “Privacy Notice” before applying.

8. User’s consent is required to comply with applicable personal data protection law.

9. Select from 2 types of identity verification methods

(1) TMRW Kiosk

(2) NDID

10A. In case select TMRW Kiosk – follow the facial scanning steps in the app and then bring your ID card to verify your identity at the TMRW Kiosk within 28 days. Then continue filling out the application. (If opening only a deposit account, ID verification is the last step).

10B. In case select NDID – accept terms and conditions. Select your identity verification provider and follow the steps. Continue filling out the application form in the app

11. Fill in additional information, upload proof of income documents, and provide postal address for delivery of documents and cards.

12. Confirm personal information and consent to be provided to declare information to Credit Bureau.

13. Verify application information and press “Confirm”.

14. Application process is complete. Please wait for SMS/Notification informing you of the application status.

2. Apply for additional credit card and/or UOB Cash Plus (without opening a new deposit account)

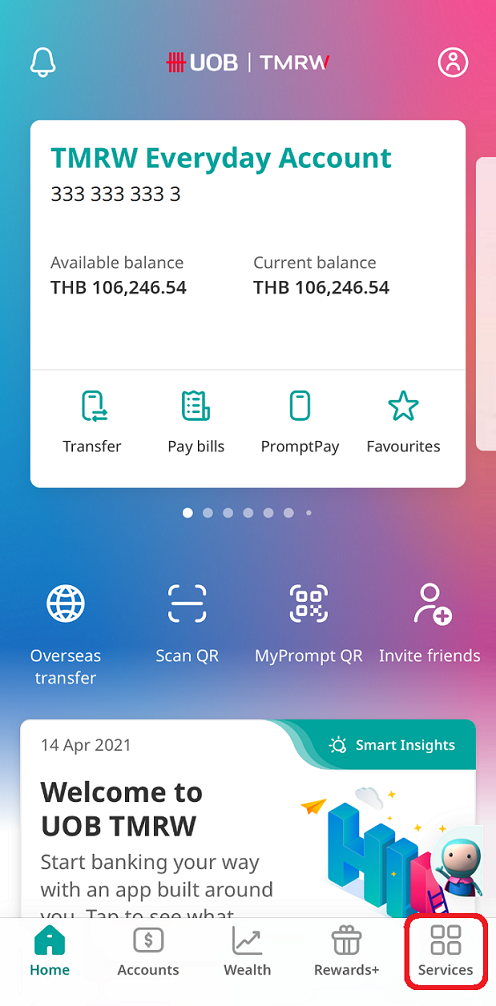

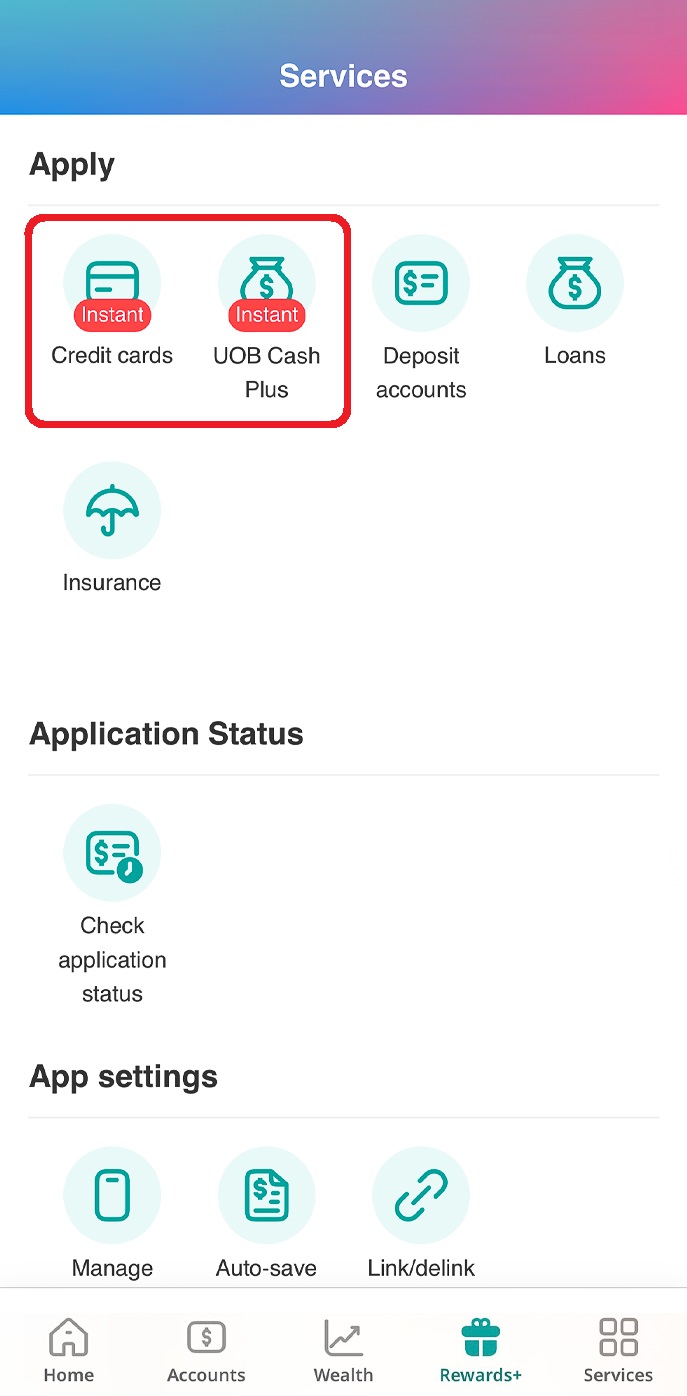

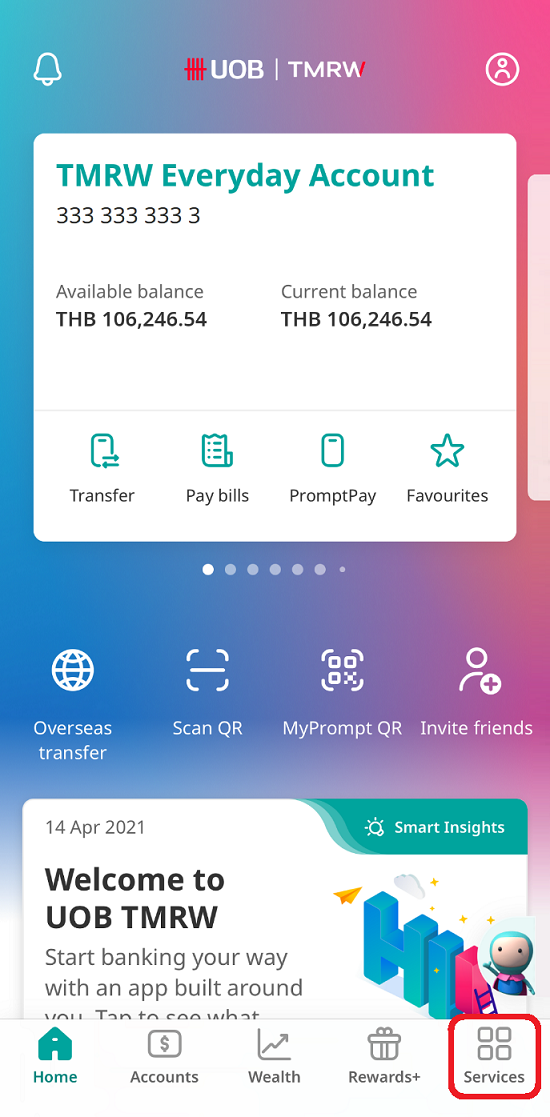

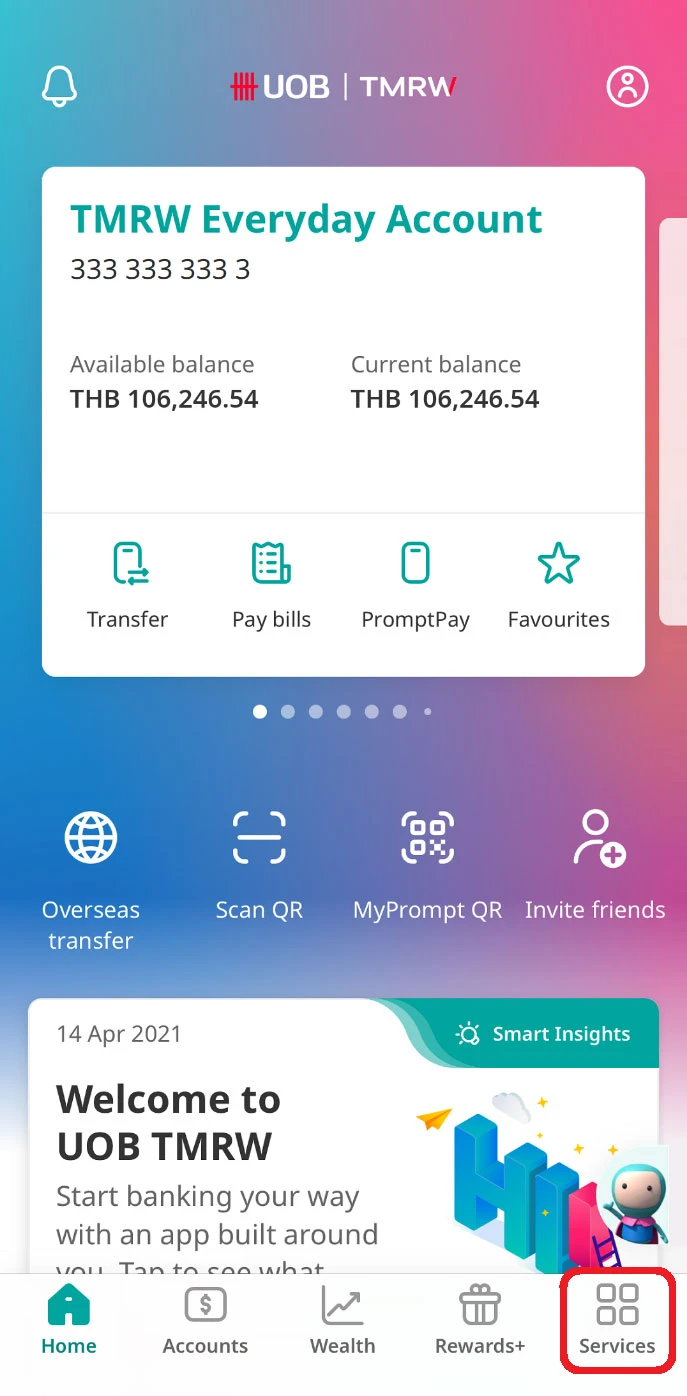

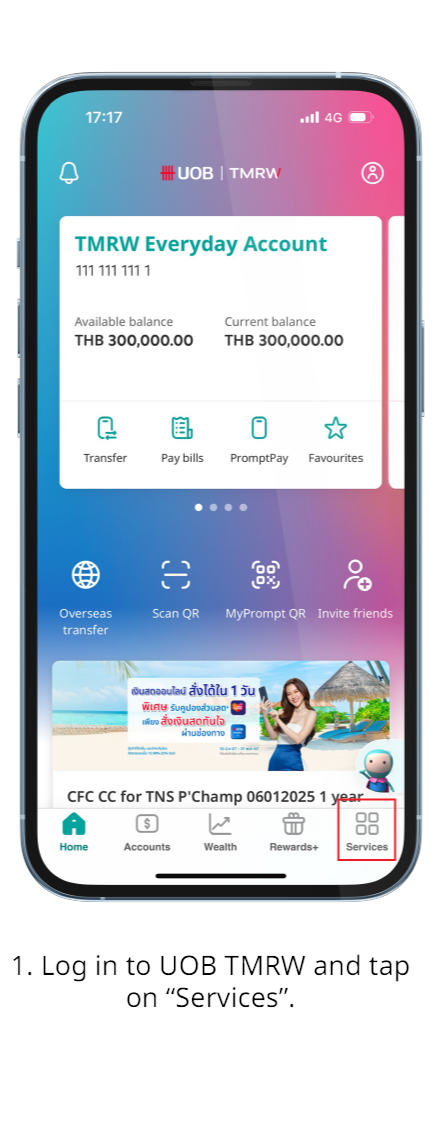

1. Login to UOB TMRW app and select “Services” at the bottom right.

2. Select to apply for Credit card or UOB Cash Plus.

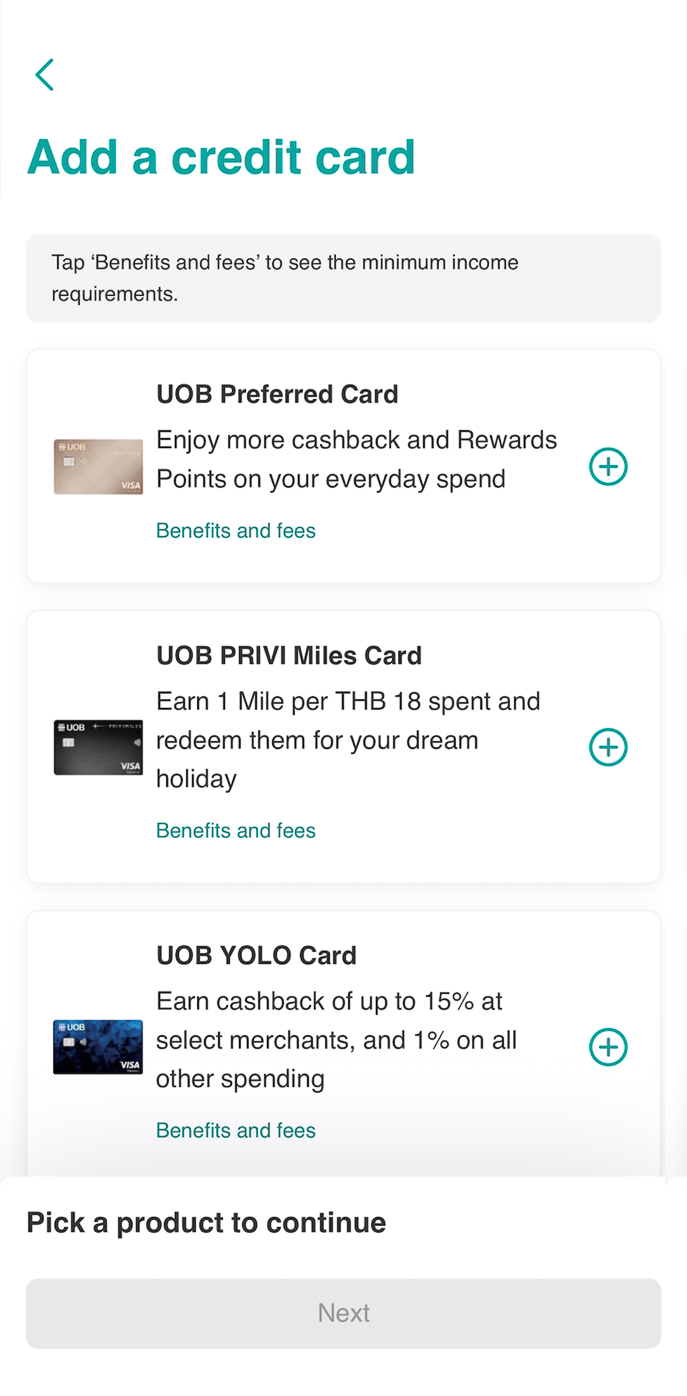

3. Select the desired credit card / cash card.

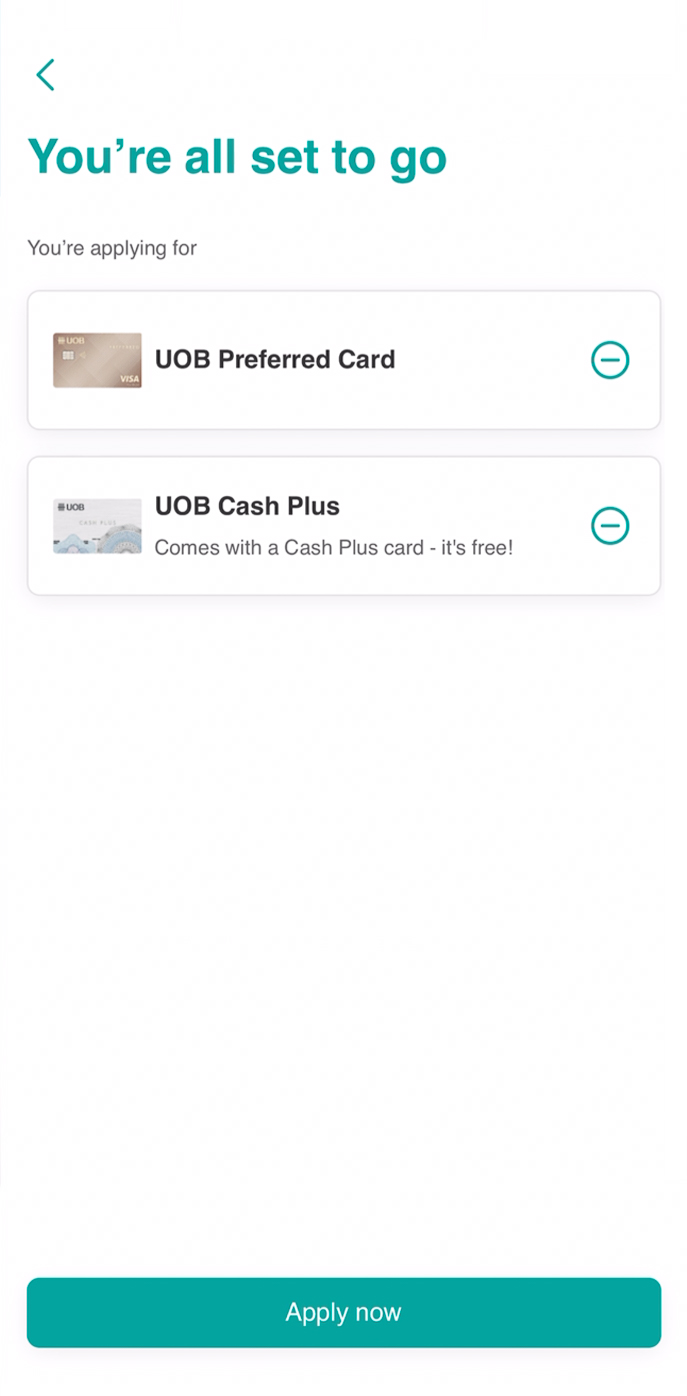

4. Check out the product list and start applying.

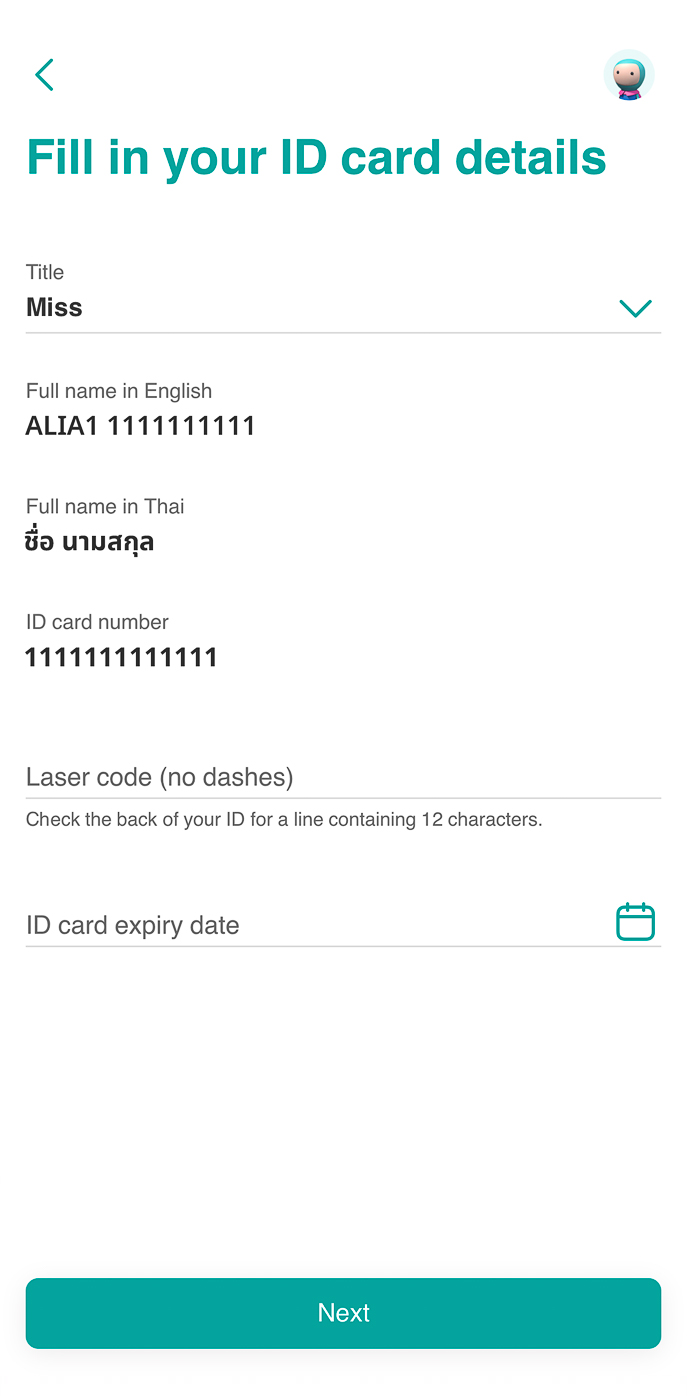

5. Verify and enter information according to National ID card.

6. Select from 2 types of identity verification methods

(1) TMRW Kiosk

(2) NDID

Note: If you have previously verified your identity at TMRW Kiosk, then system will automatically ask for facial scan before continuing with application form.

7A. In case select TMRW Kiosk – follow the facial scanning steps in the app and then bring your ID card to verify your identity at the TMRW Kiosk within 28 days. Then continue filling out the application.

7B. In case select NDID – accept terms and conditions. Select your identity verification provider and follow the steps. Continue filling out the application form in the app.

8. Fill in additional information, upload proof of income documents, and provide postal address for delivery of documents and cards.

9. Confirm personal information and consent to be provided to declare information to Credit Bureau.

10. Verify application information and press “Confirm”.

11. Application process is complete. Please wait for SMS/Notification informing you of the application status.

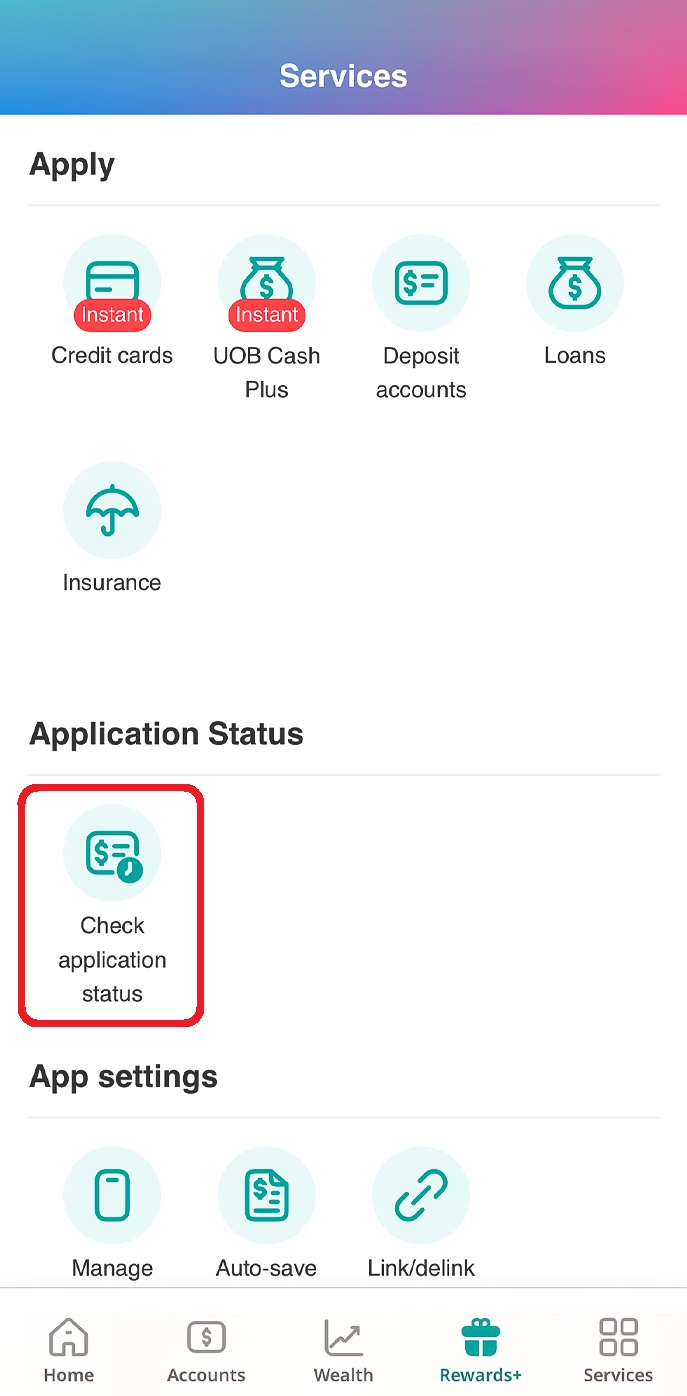

Check application status via UOB TMRW

1. Check application status for the product applied via the app

1. Log in to UOB TMRW and select “Services” on the bottom right corner.

2. Select “Check application status” under Application Status.

3. Track your application status on this page.

4. The results of application will be notified via app and SMS.

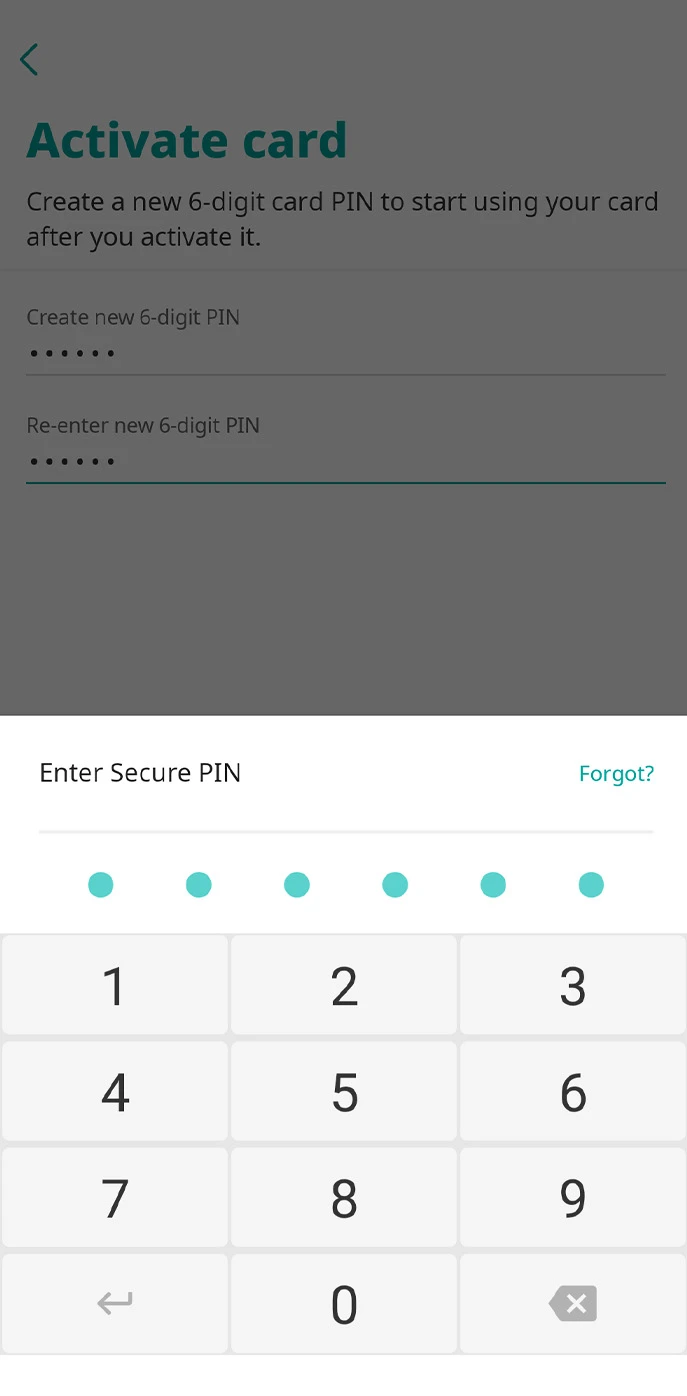

Set up UOB TMRW for first-time login

1. Set up app login settings and activate Secure PIN

1. Launch UOB TMRW app and log in with your username and password, then enter SMS OTP.

2. Set up face or fingerprint login to log in faster.

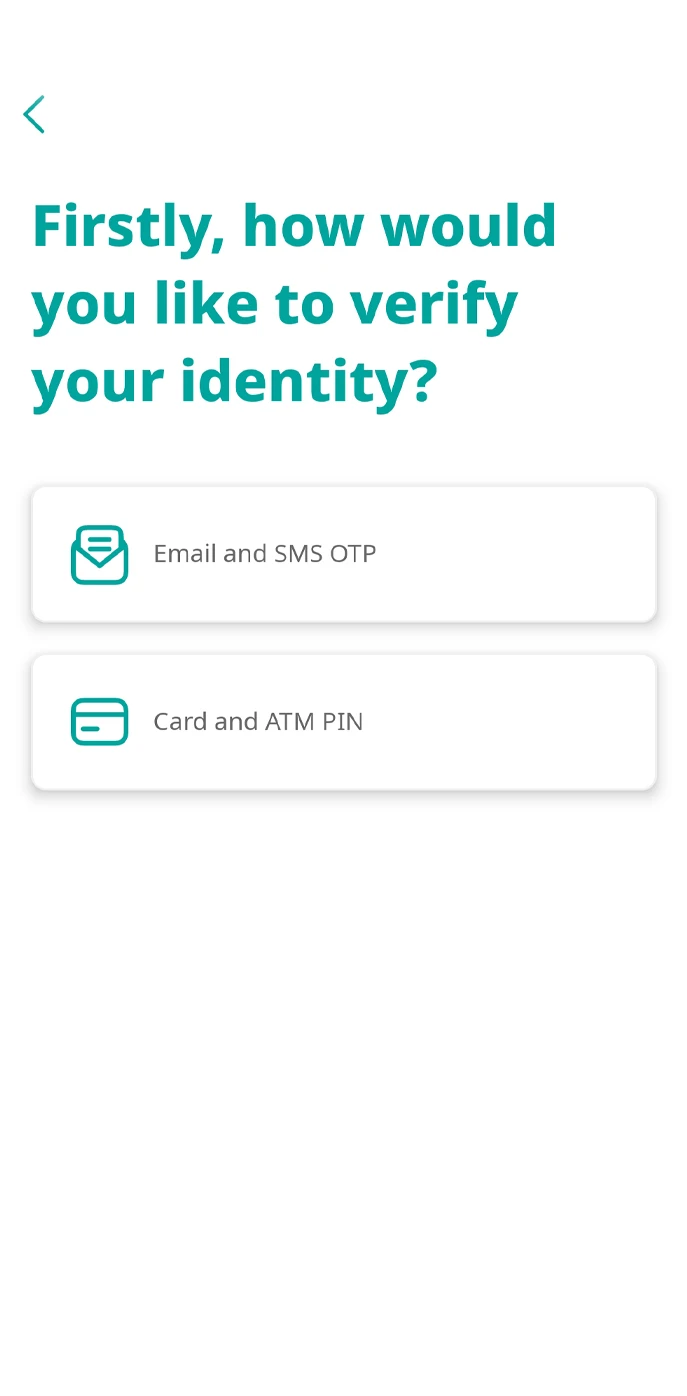

3. Start setting up Secure PIN, choose a verification method:

- (1) Email and SMS OTP

- (2) Card and ATM PIN

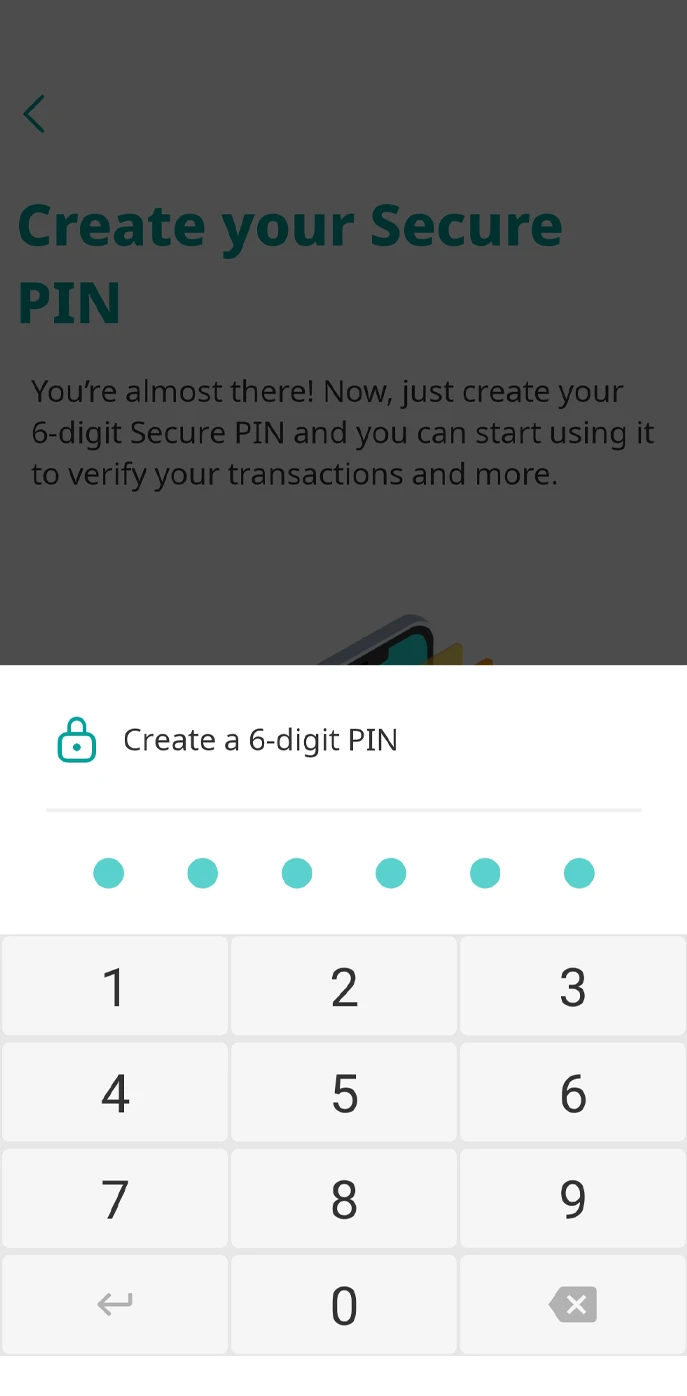

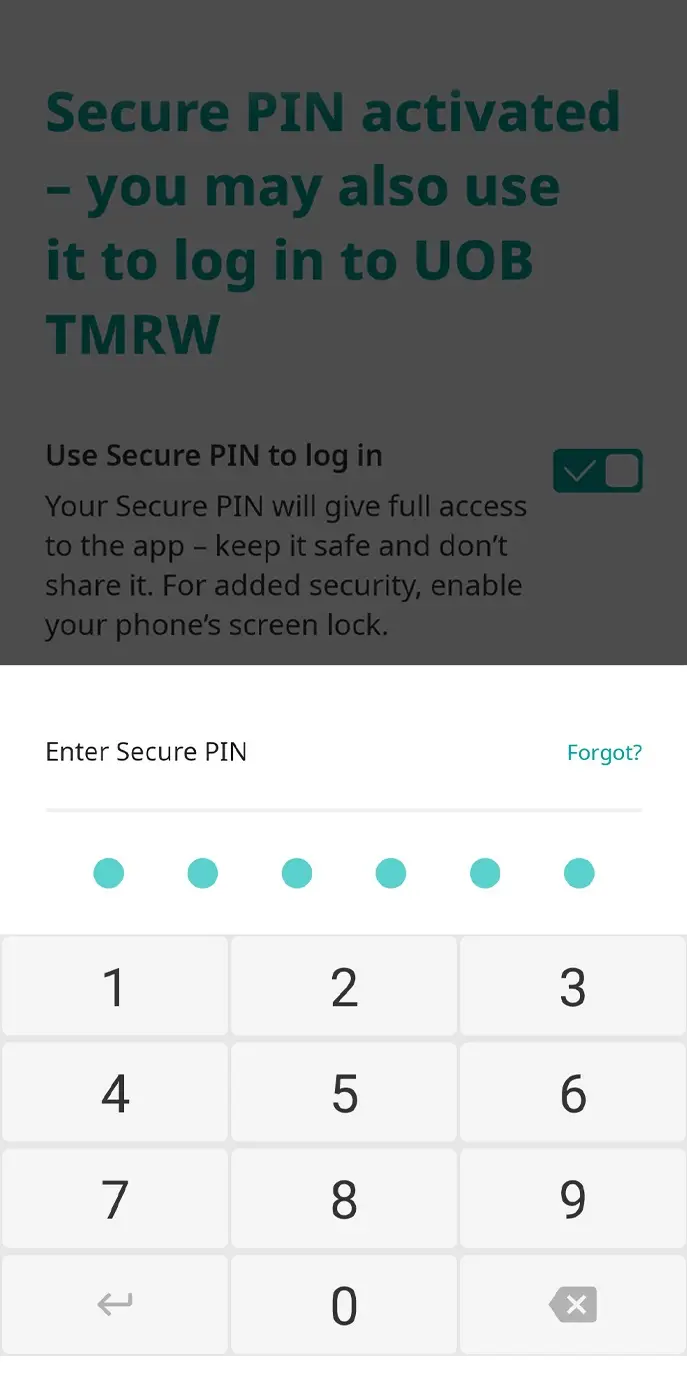

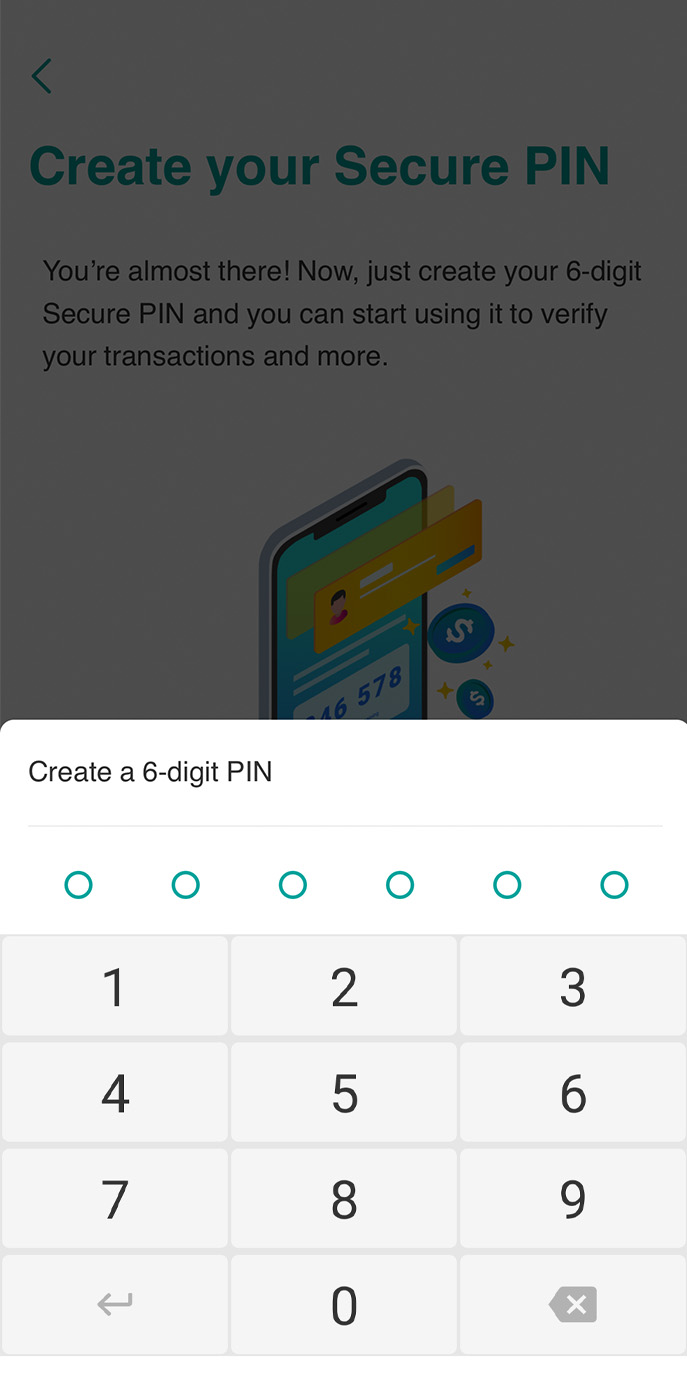

4. Create your 6-digit Secure PIN.

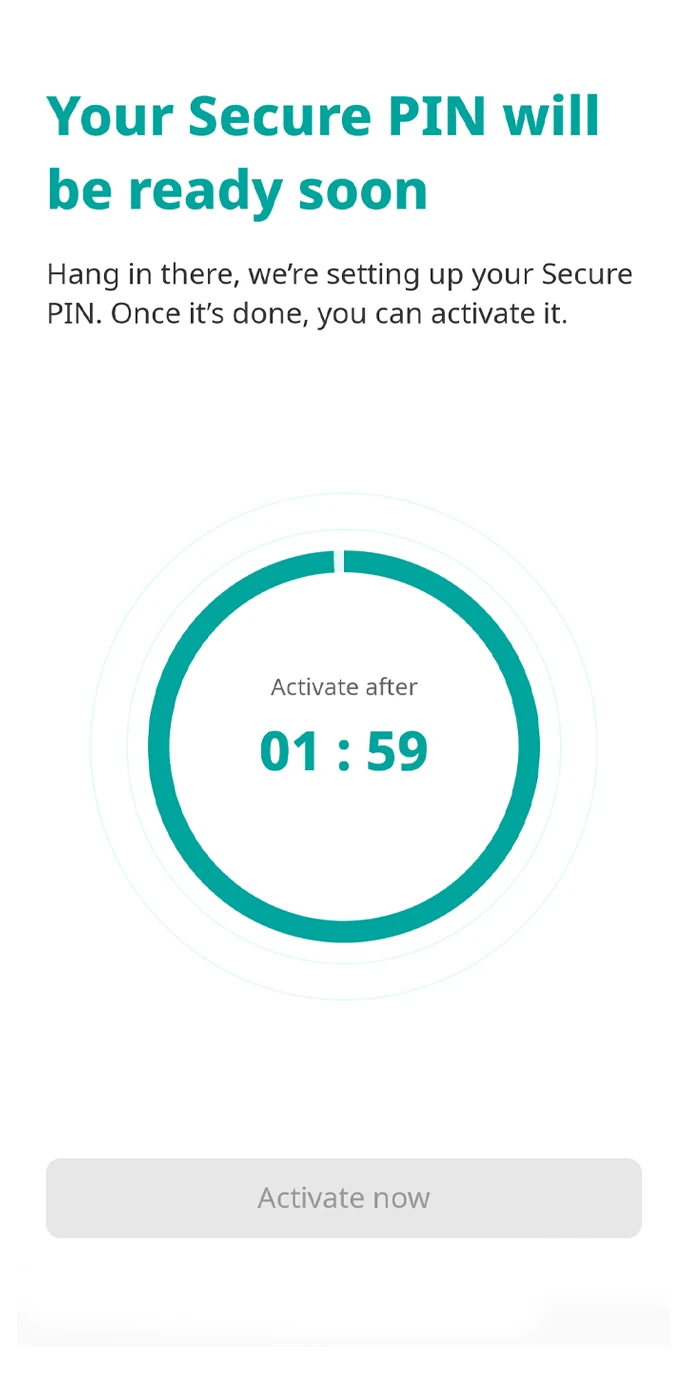

5. Wait for 2 minute to activate your Secure PIN, confirming with SMS OTP.

6. Set up to use your Secure PIN for app login.

7. Confirm the setup with your Secure PIN.

8. First-time login and Secure PIN setup successful.

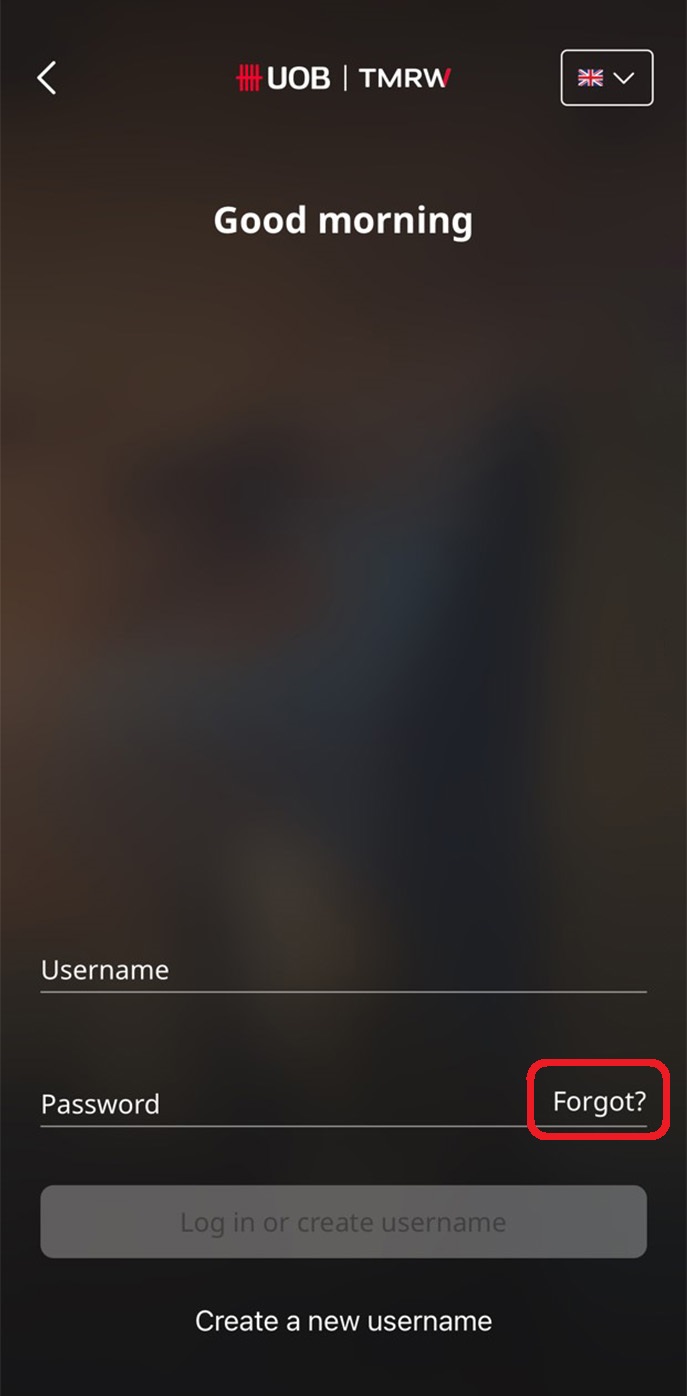

Forgot your username or password?

1. Retrieve username and reset password for Credit/ Cash Plus cardholders (no deposit accounts)

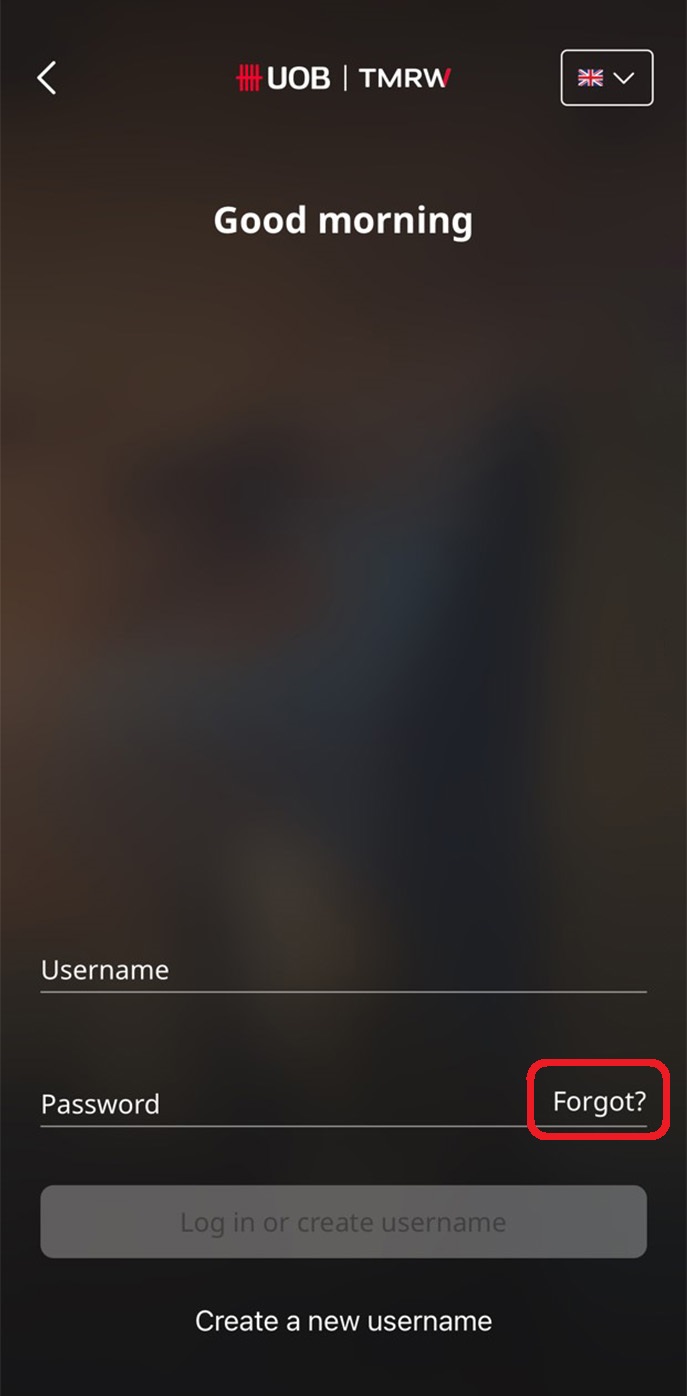

1A. For newly installed UOB TMRW app – Launch the app and select log in, then tap on “Forgot?”.

1B. For UOB TMRW app already set up and logged in – Launch the app and choose Password login, then tap “Forgot?”.

2. Fill in your personal details.

3. Enter SMS OTP.

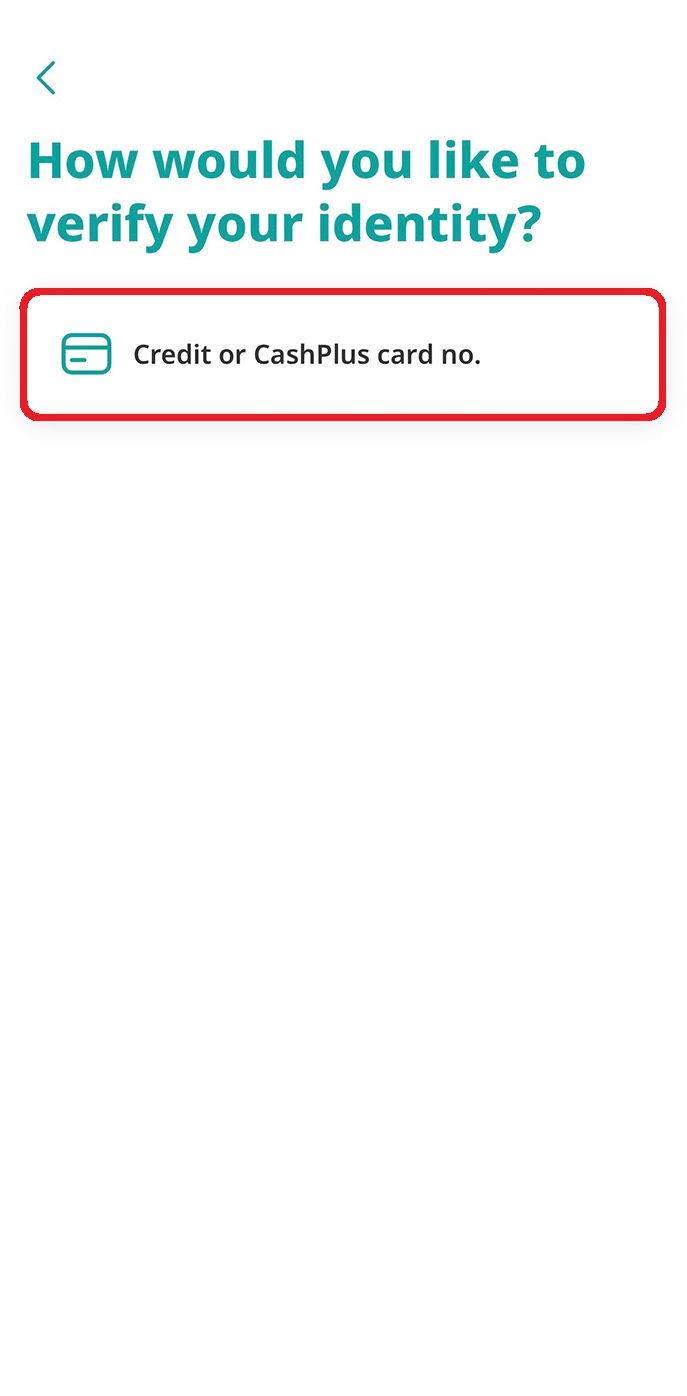

4. Select “Credit or CashPlus card no.” to verify your identity.

5. Enter your Credit or Cash Plus card number.

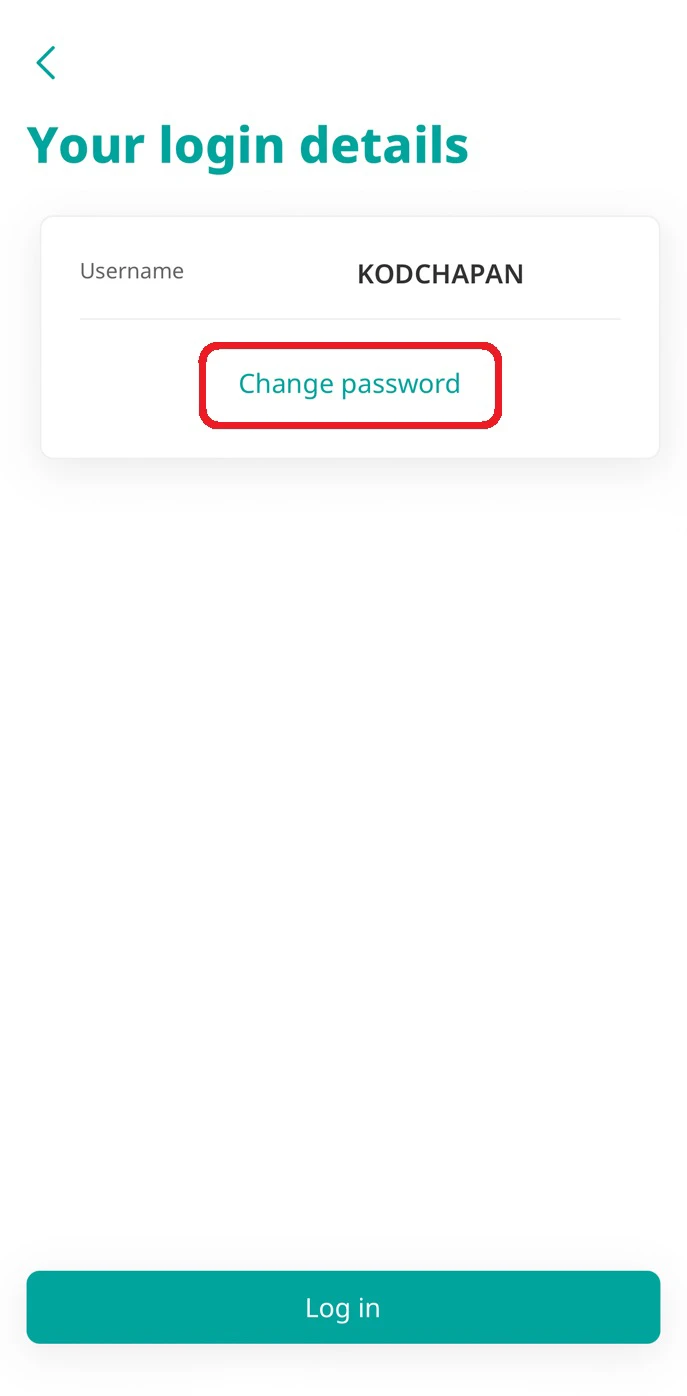

6. Your username will be shown along with the option to change password and log in instantly.

2. Retrieve username/reset password for deposit account customers with debit/credit card or Cash Plus (card PIN required)

1A. For newly installed UOB TMRW app – Launch the app and select log in, then tap on “Forgot?”.

1B. For UOB TMRW app already set up and logged in – Launch the app and choose Password login, then tap “Forgot?”.

2. Fill in your personal details.

3. Enter SMS OTP.

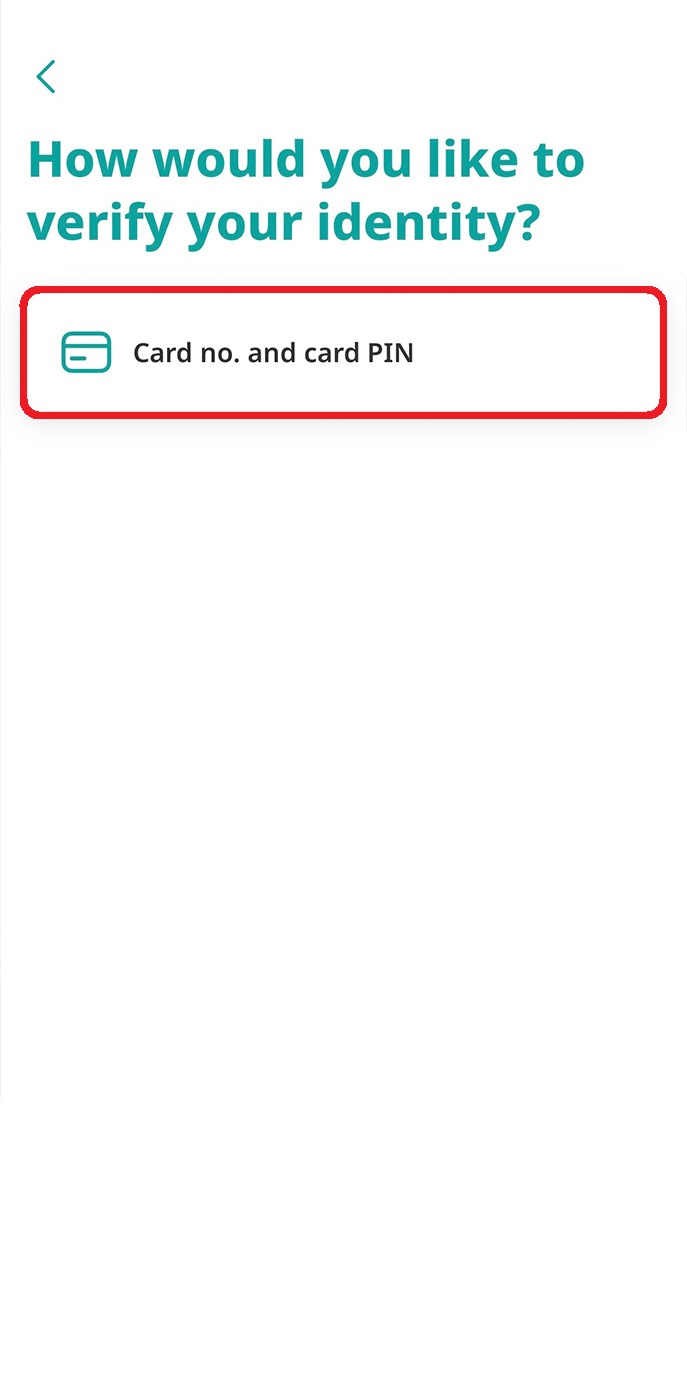

4. Select “Card no. and card PIN” to verify your identity.

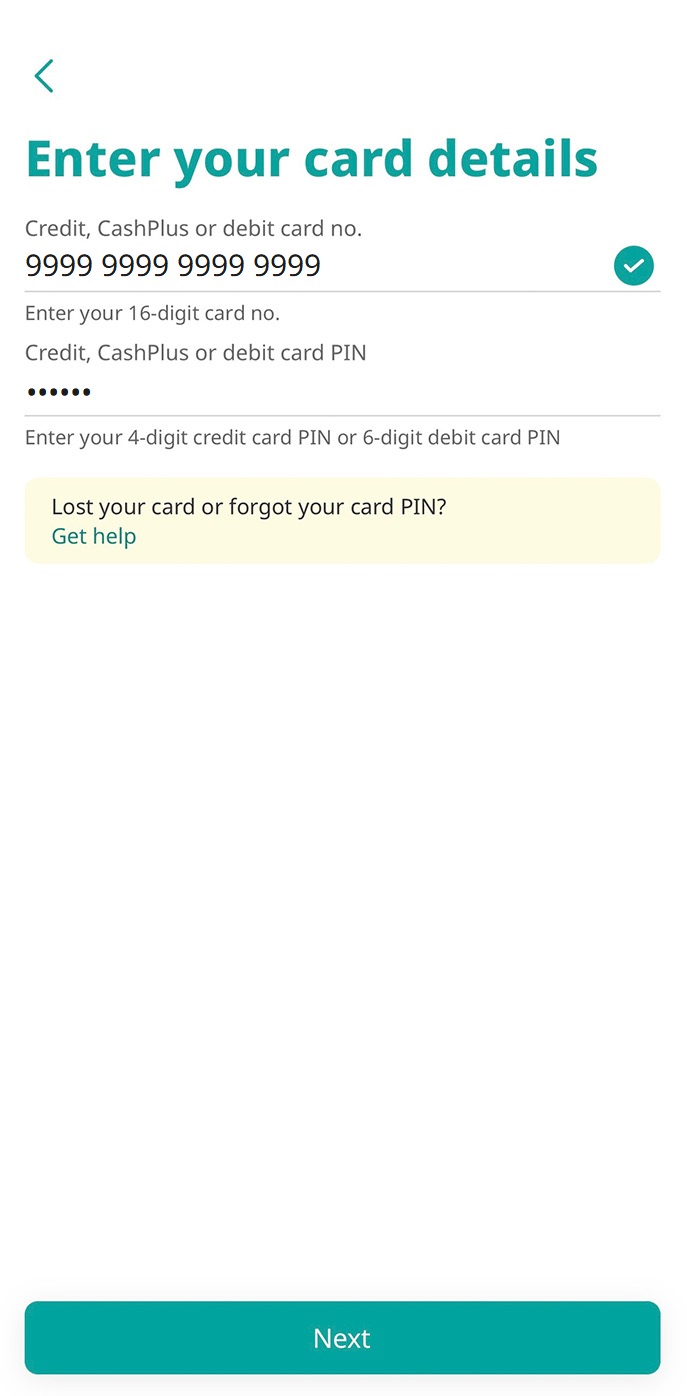

5. Enter your Debit/ Credit/ Cash Plus card number and card PIN (ATM PIN).

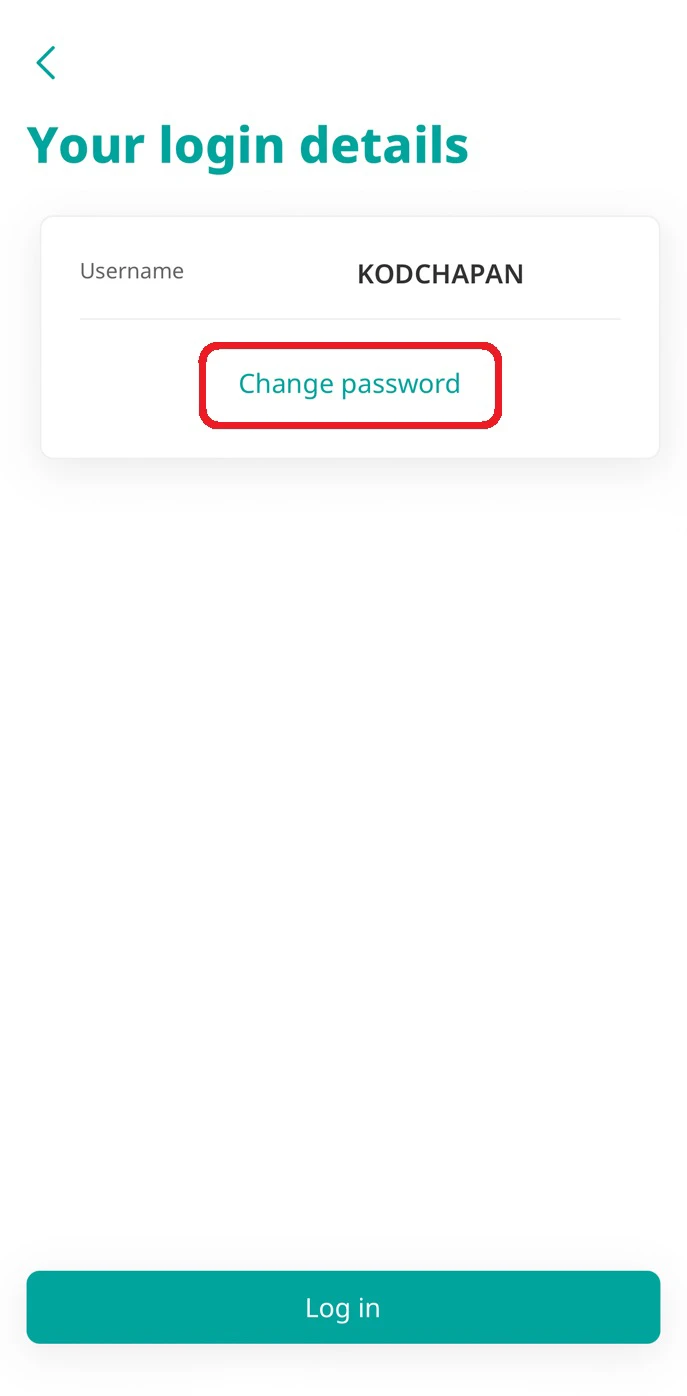

6. Your username will be shown along with the option to change password and log in instantly.

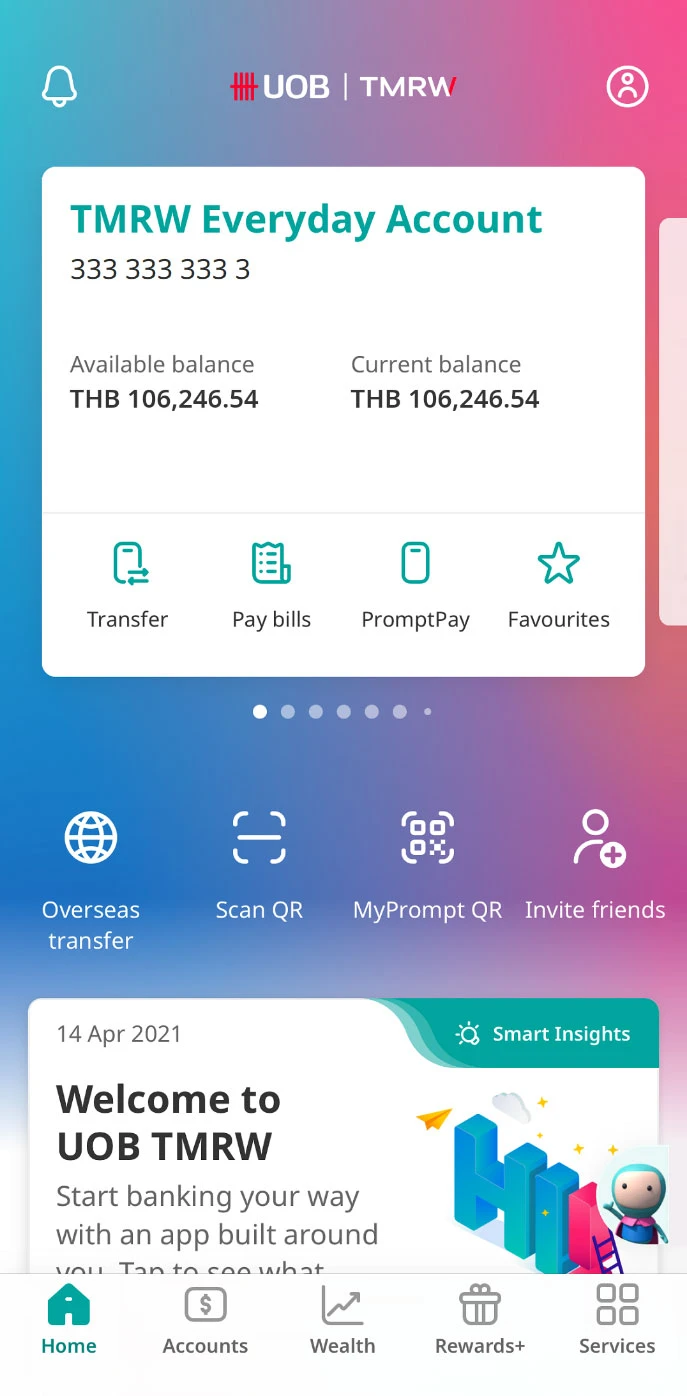

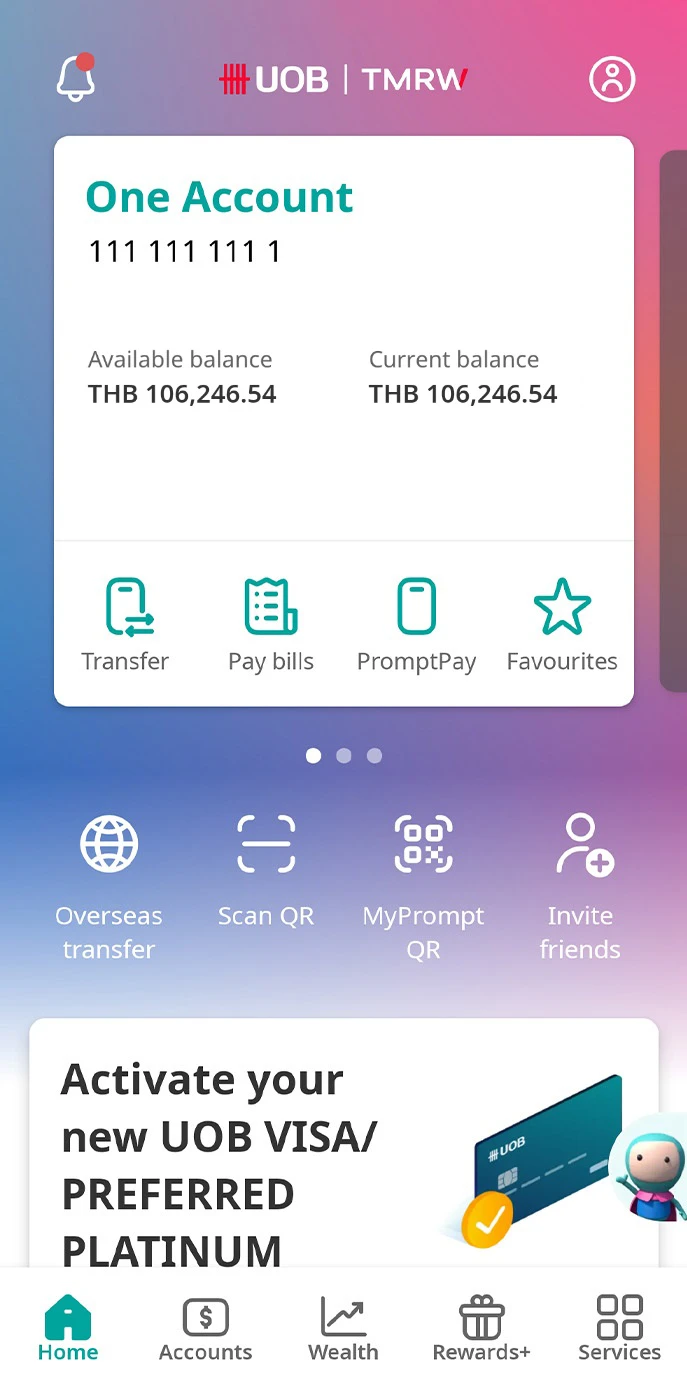

Manage Accounts & Payments

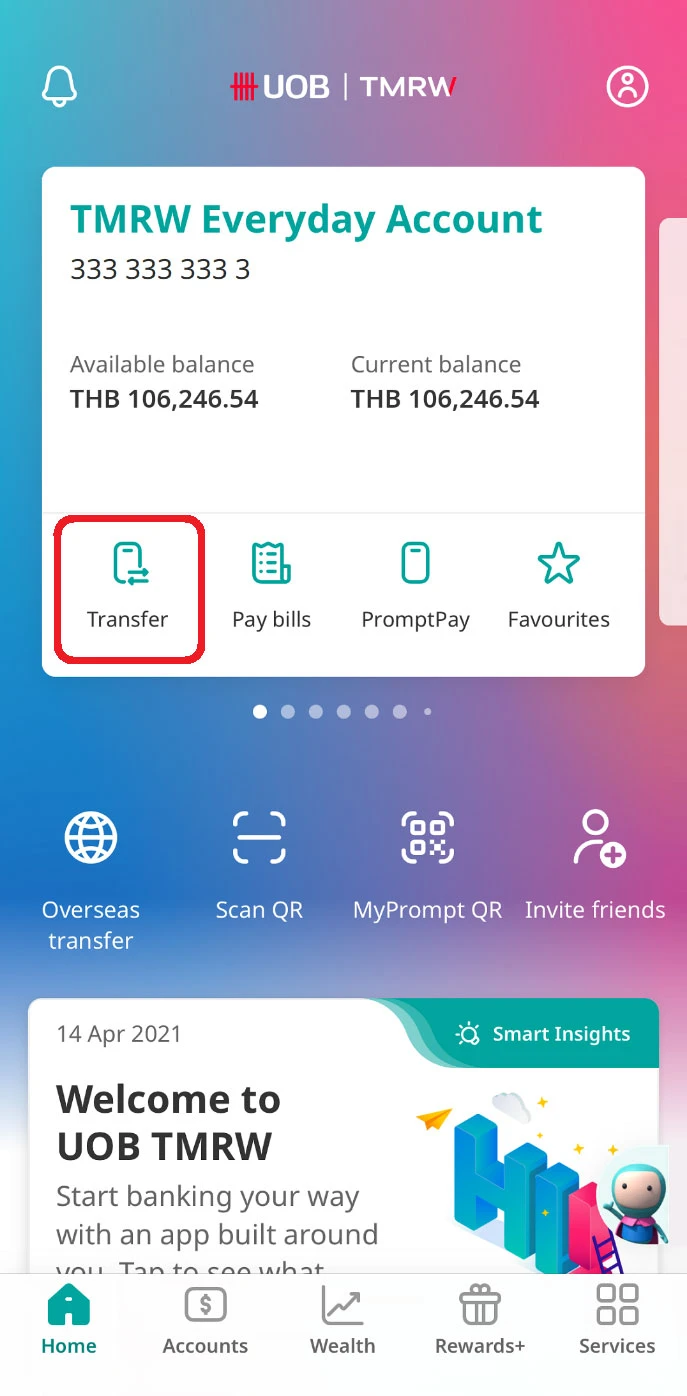

Funds transfers

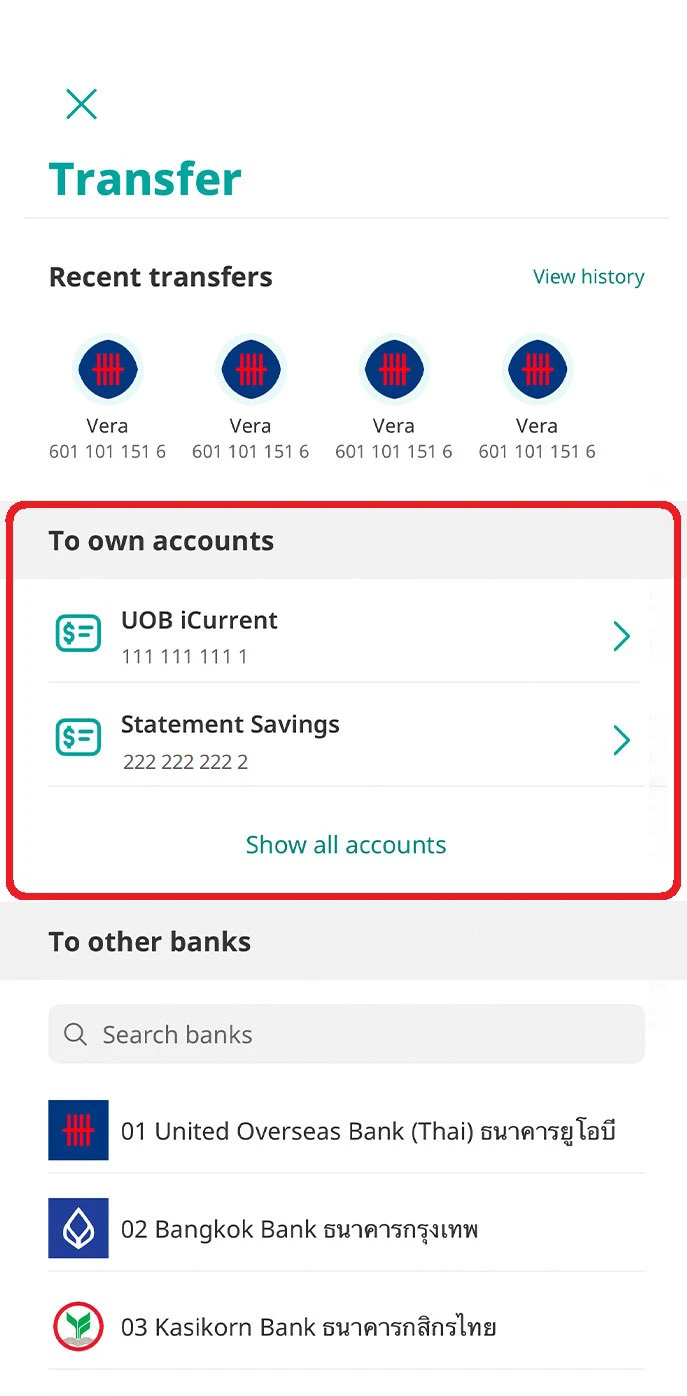

1. Transfer to own UOB accounts

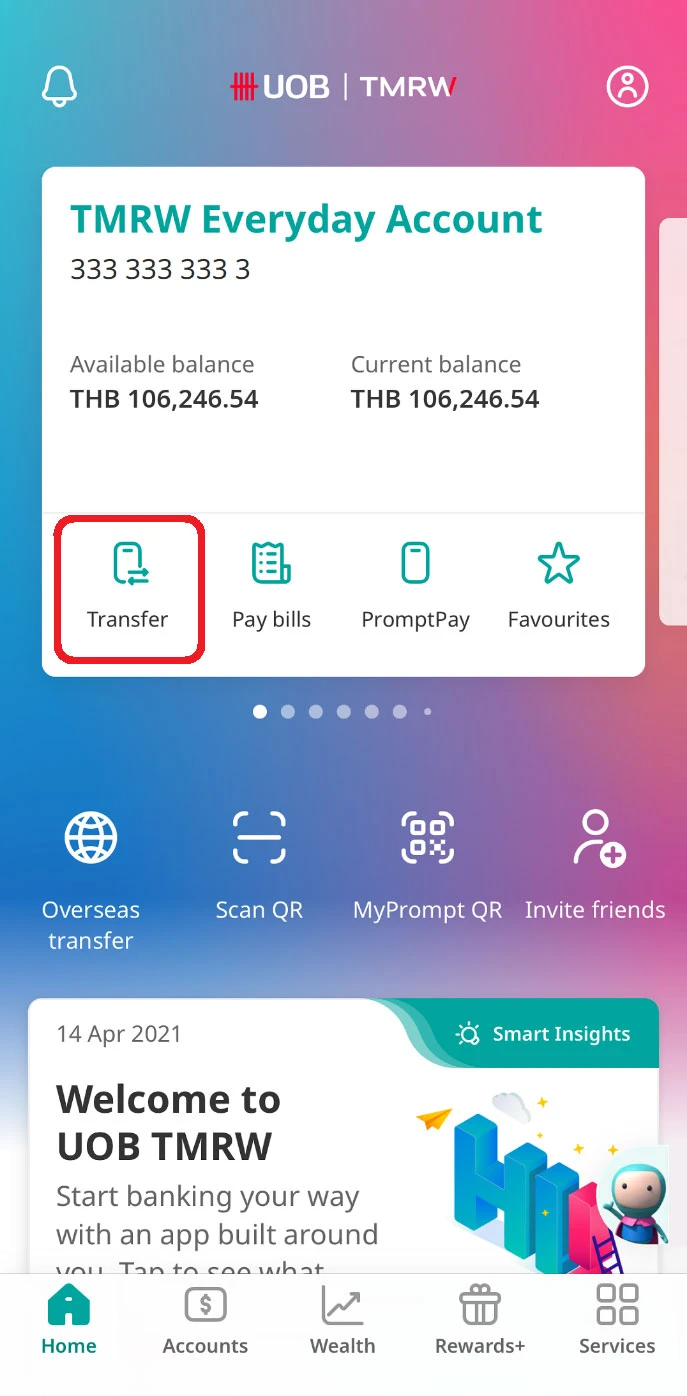

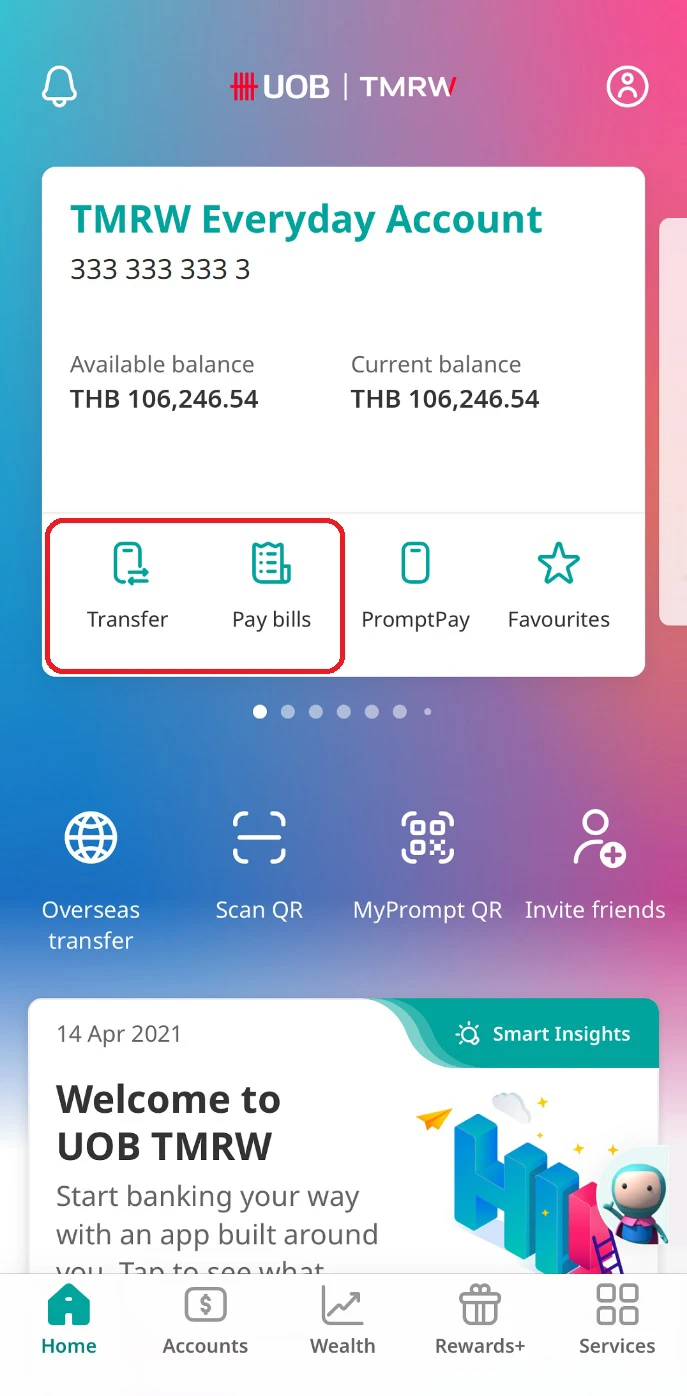

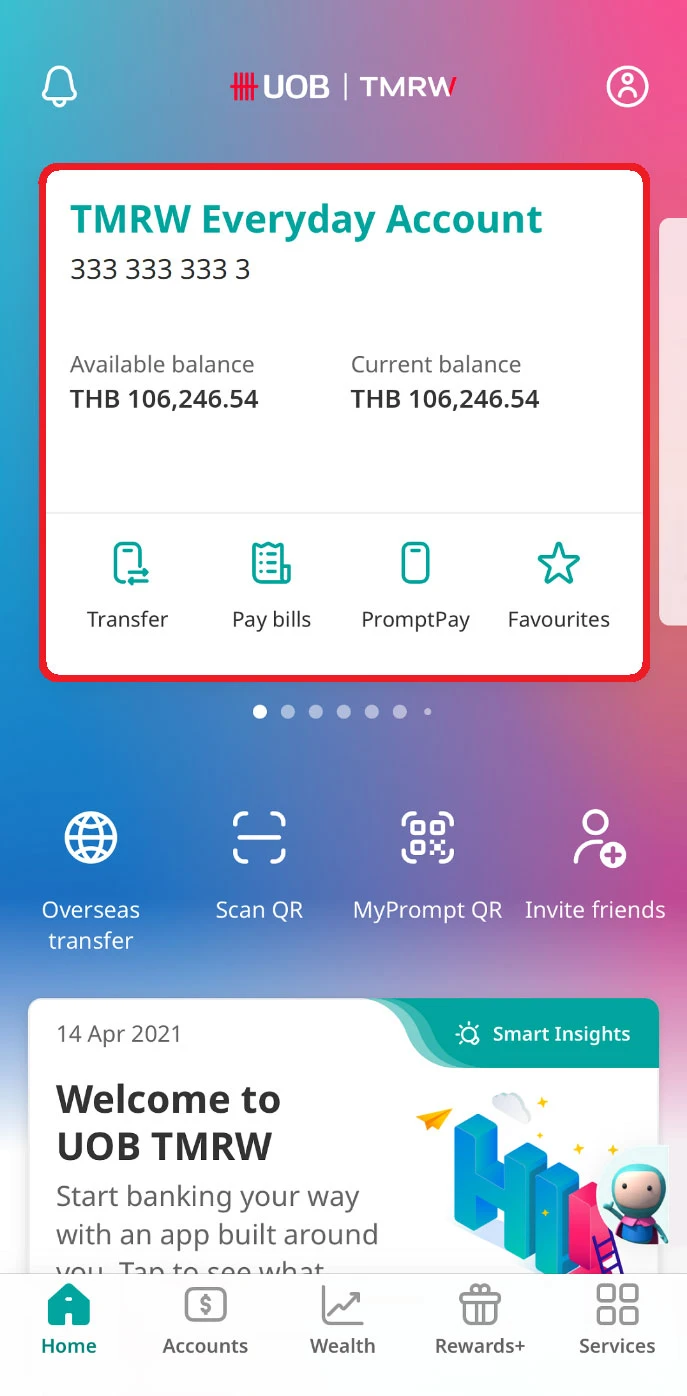

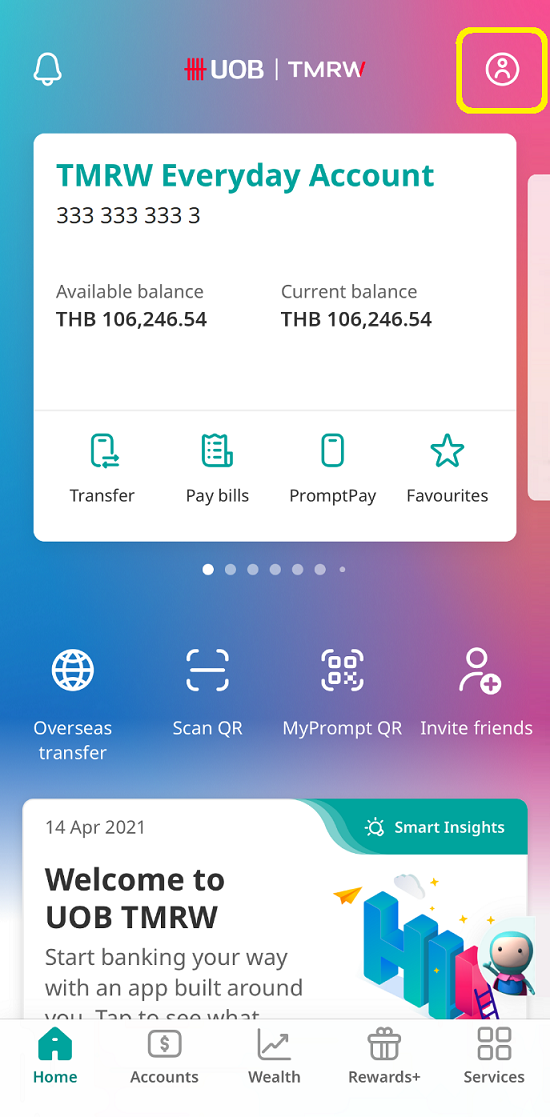

1. Log in to UOB TMRW and tap “Transfer” on the account to make a transfer from.

2. Select your own UOB account you wish to transfer to.

3. Enter the amount and date of transfer.

4. Review the details and swipe to confirm your transaction.

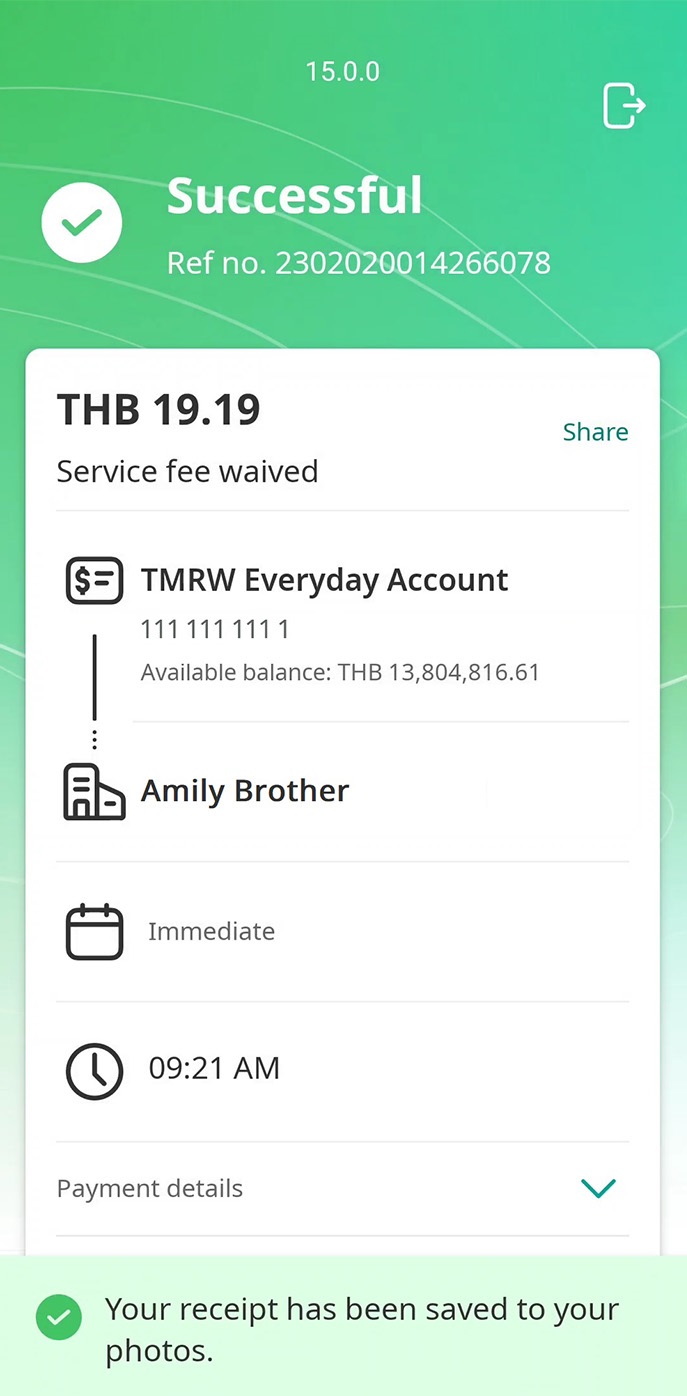

5. Transfer successful, receipts are saved in your photo album.

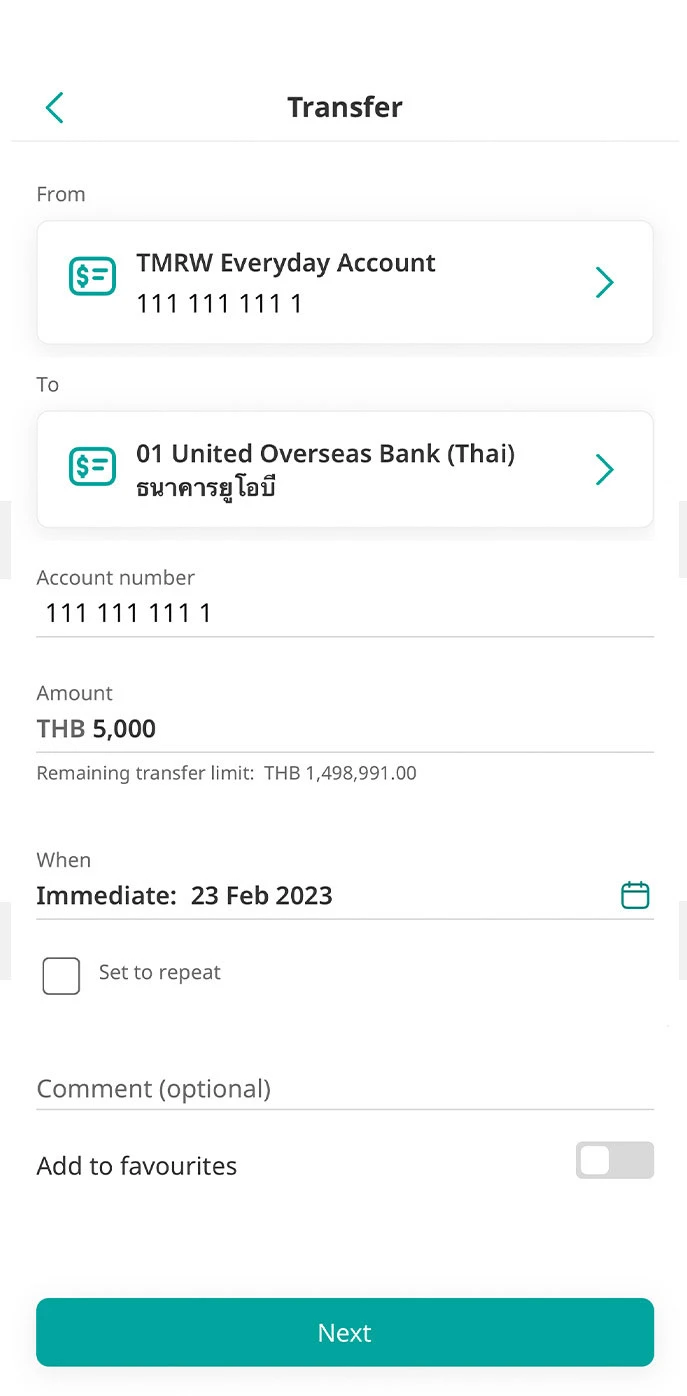

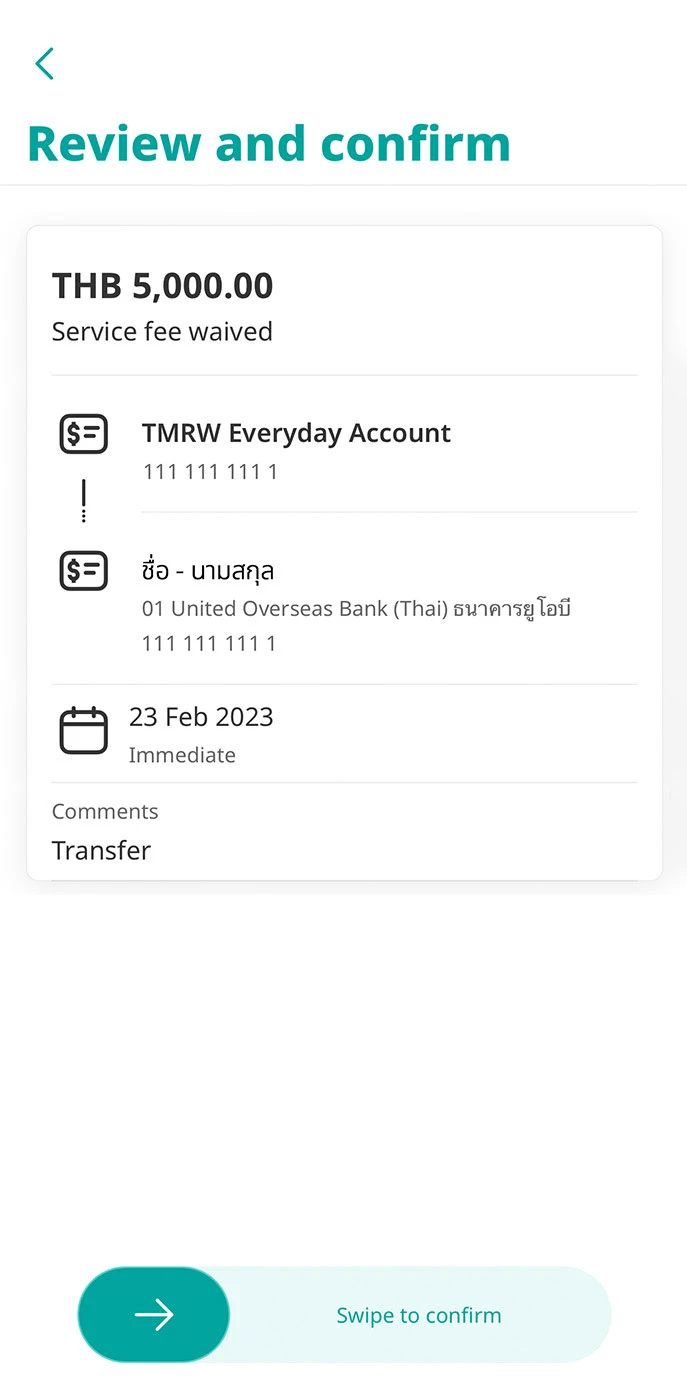

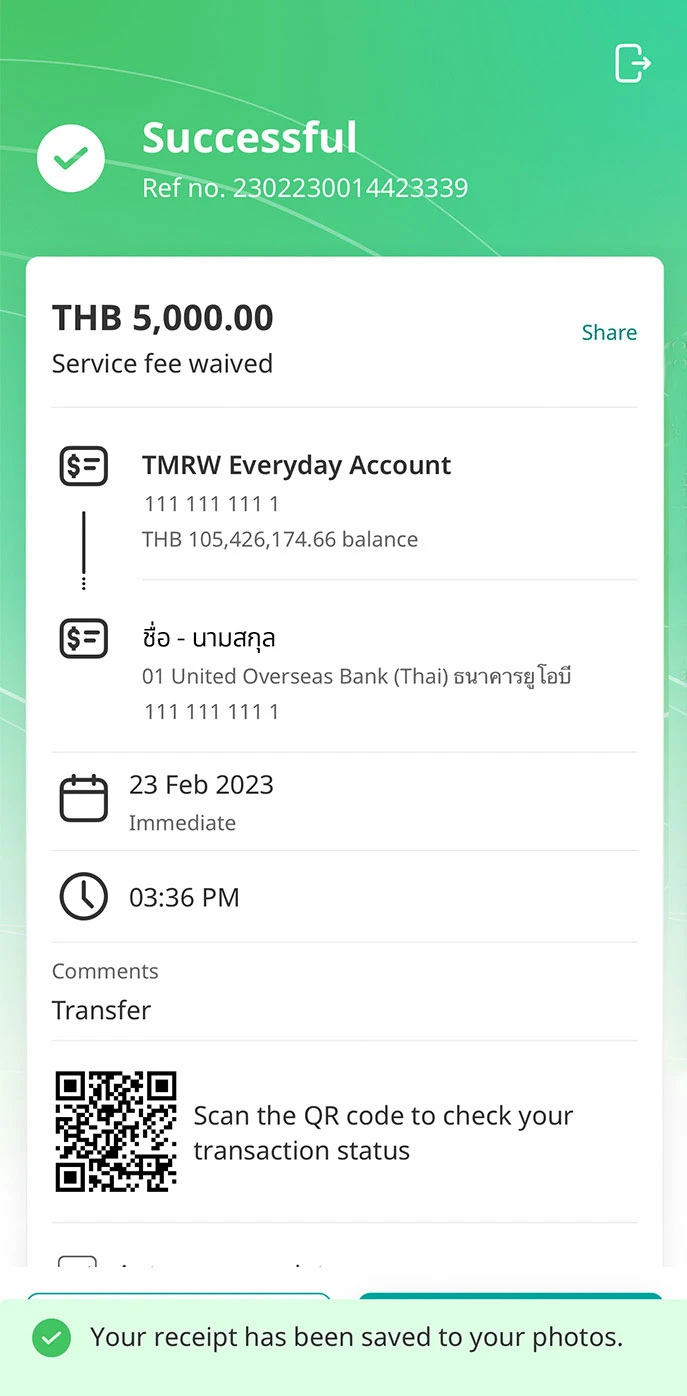

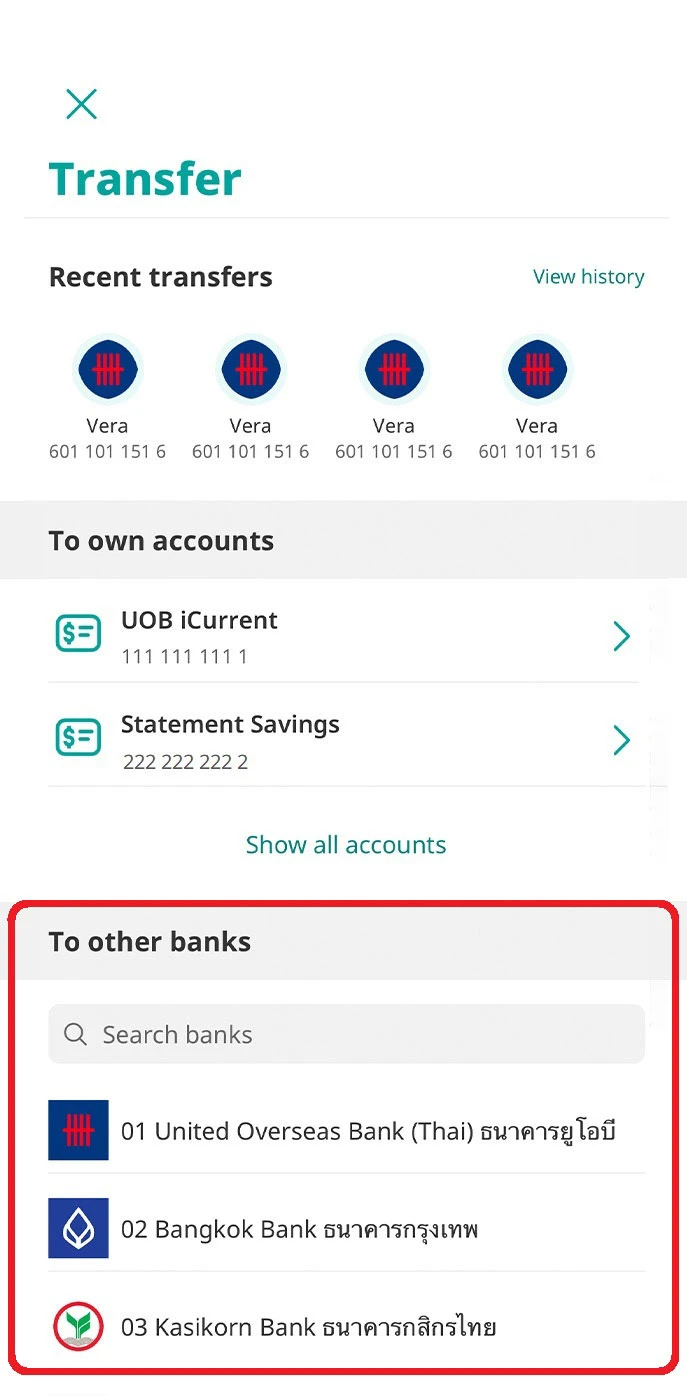

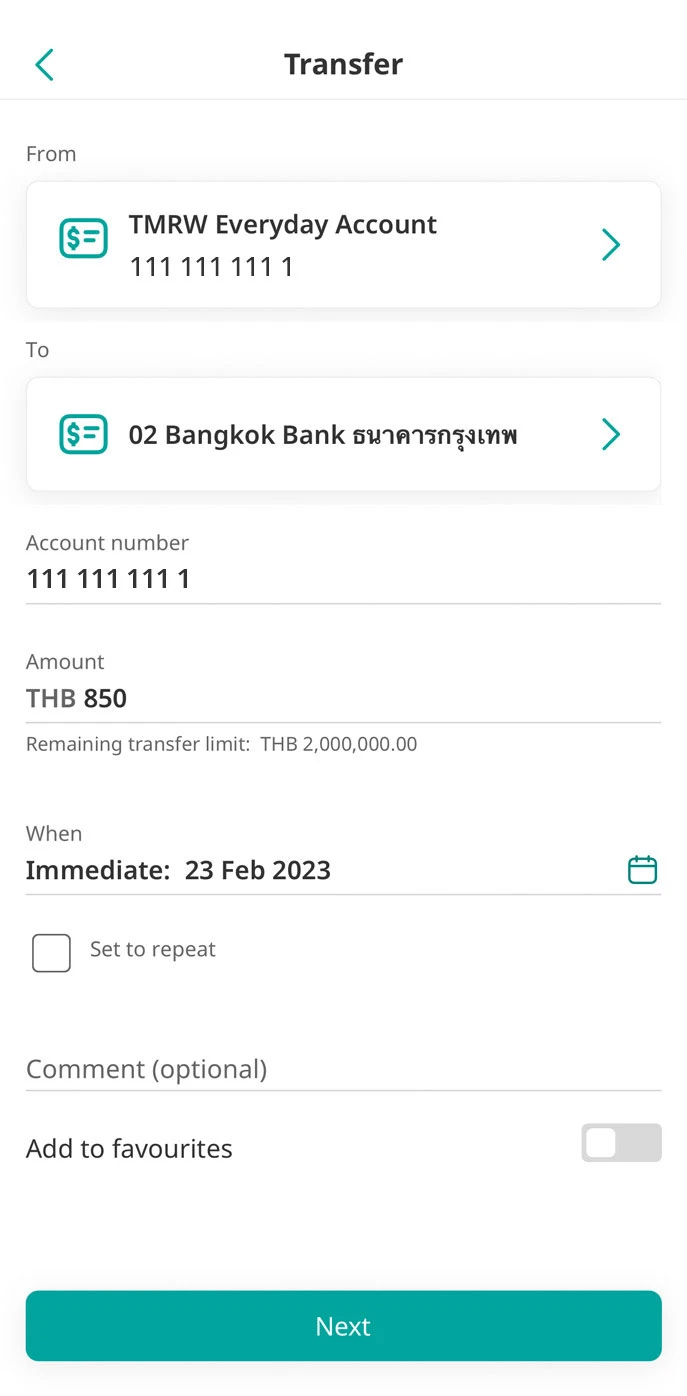

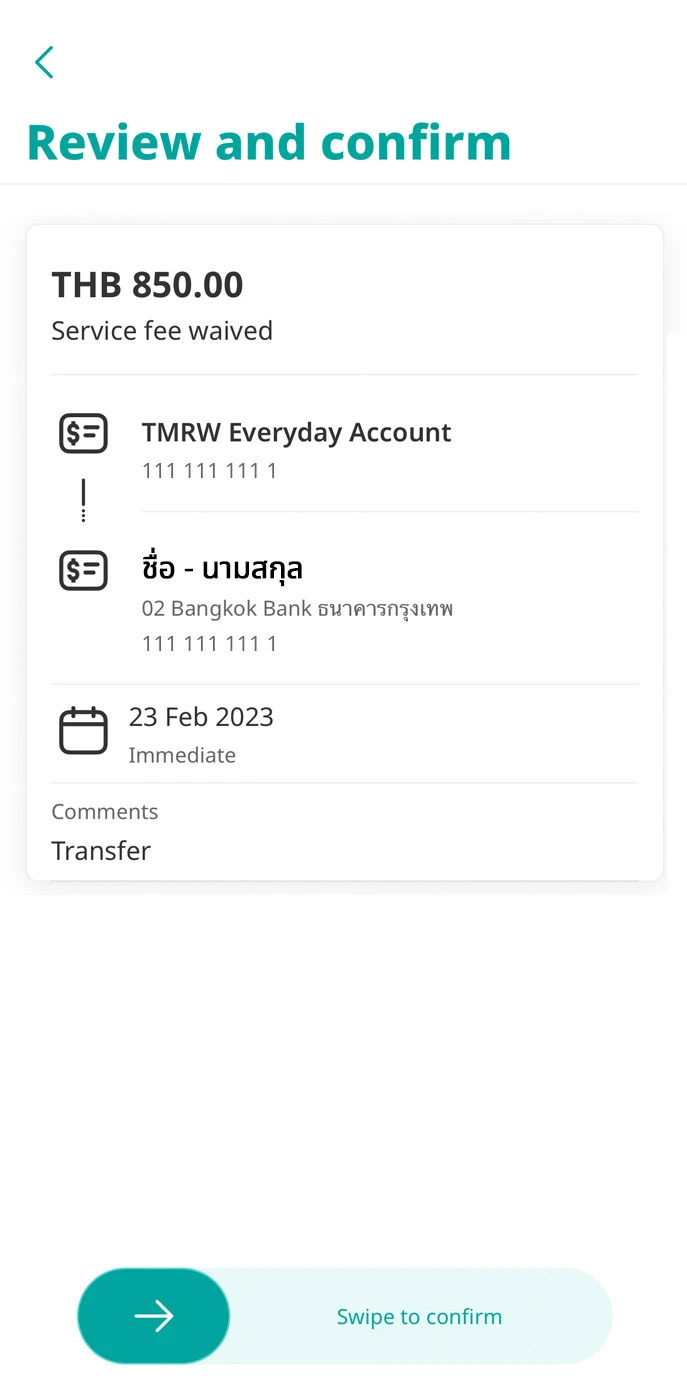

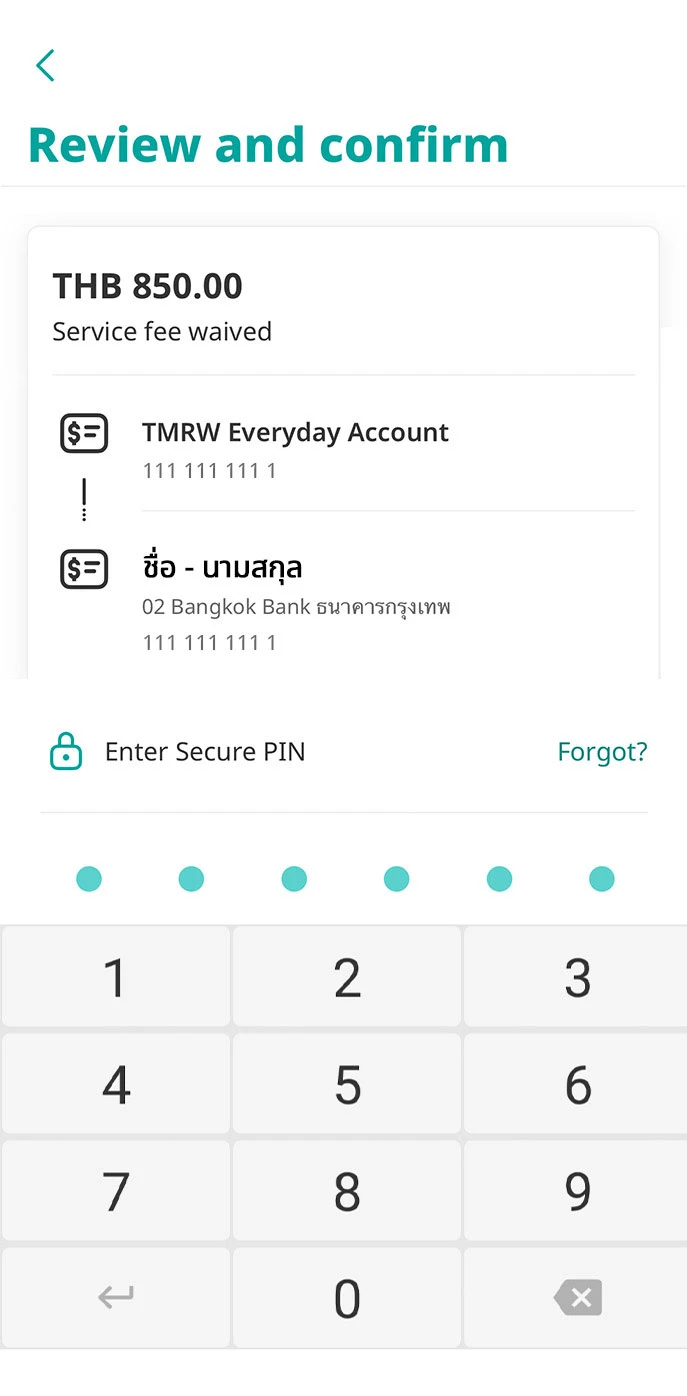

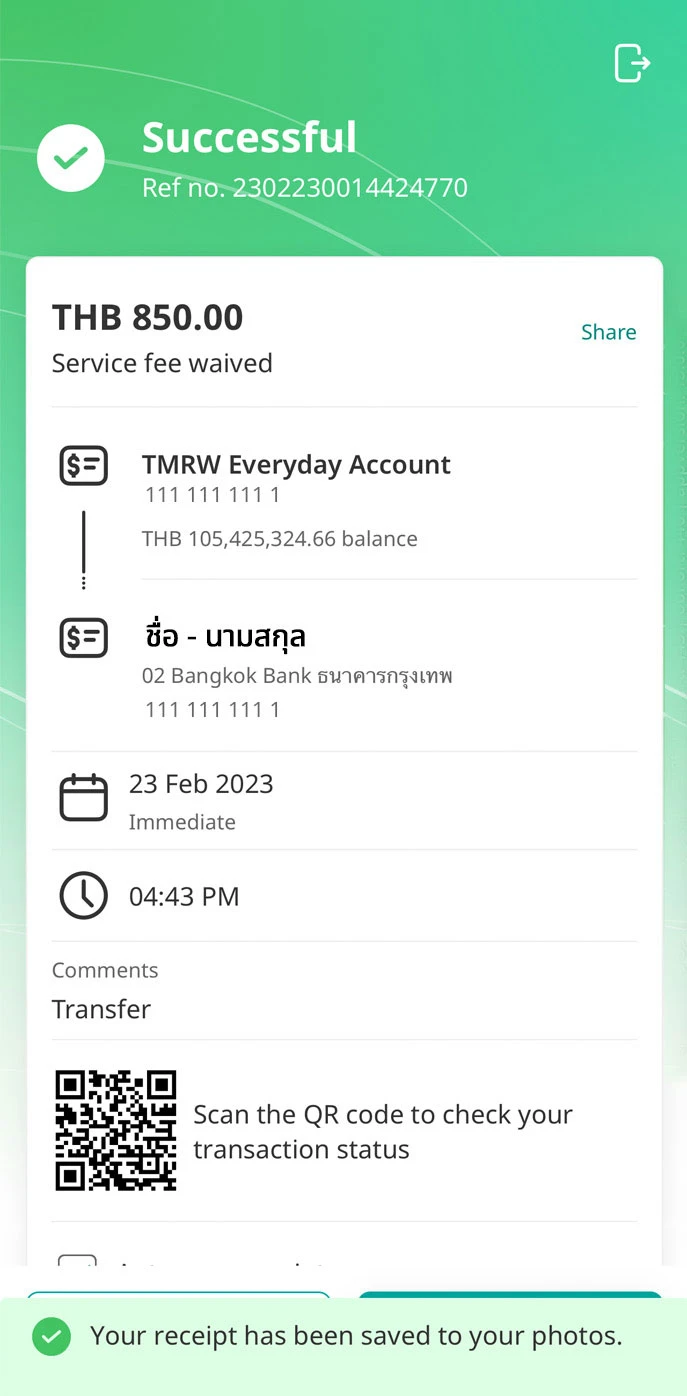

2. Transfer to other UOB accounts and other banks

1. Log in to UOB TMRW and tap “Transfer” on the account to make a transfer from.

2. Select the bank name of the account to transfer to.

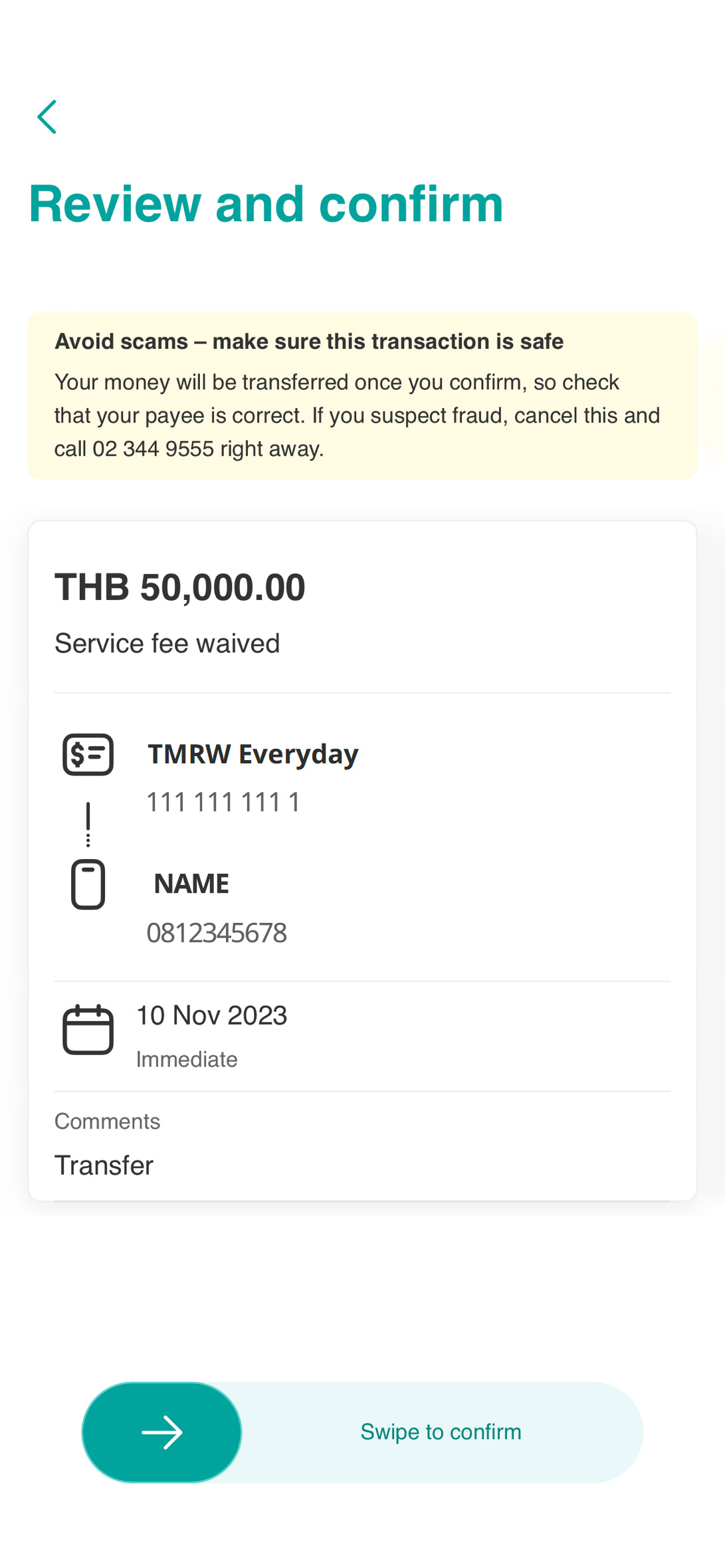

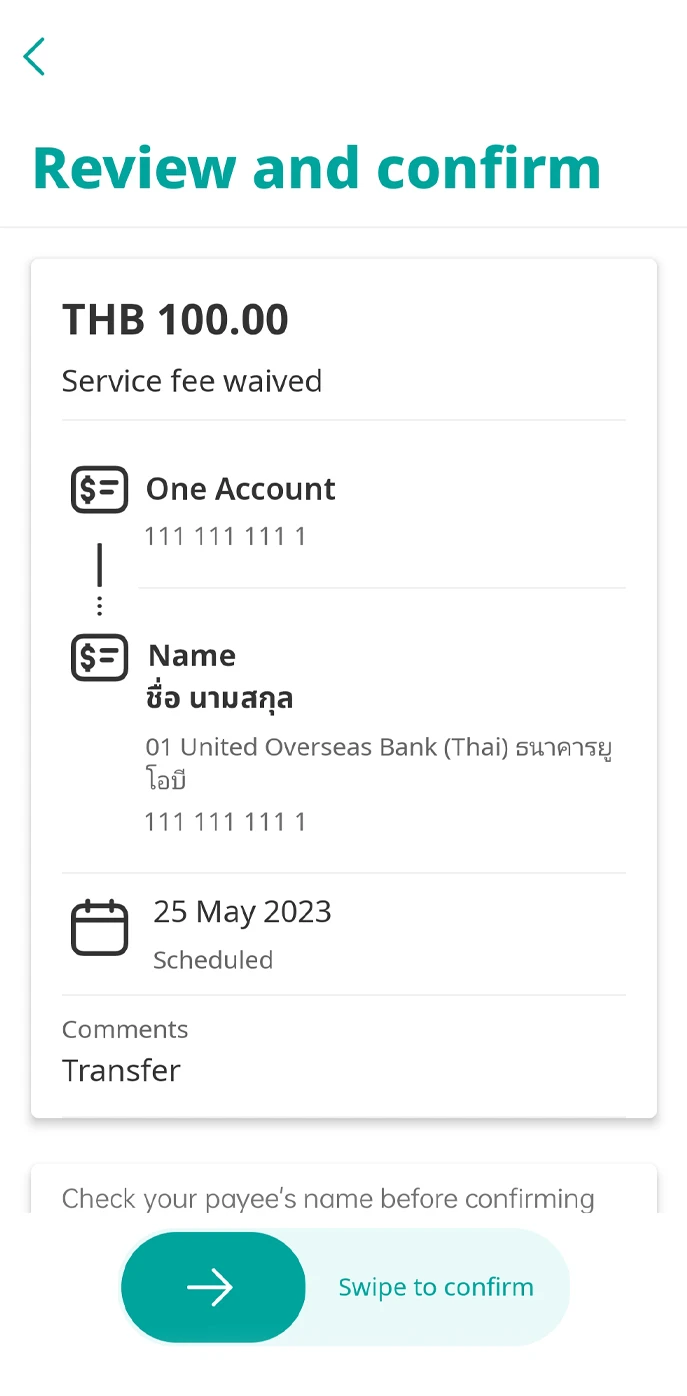

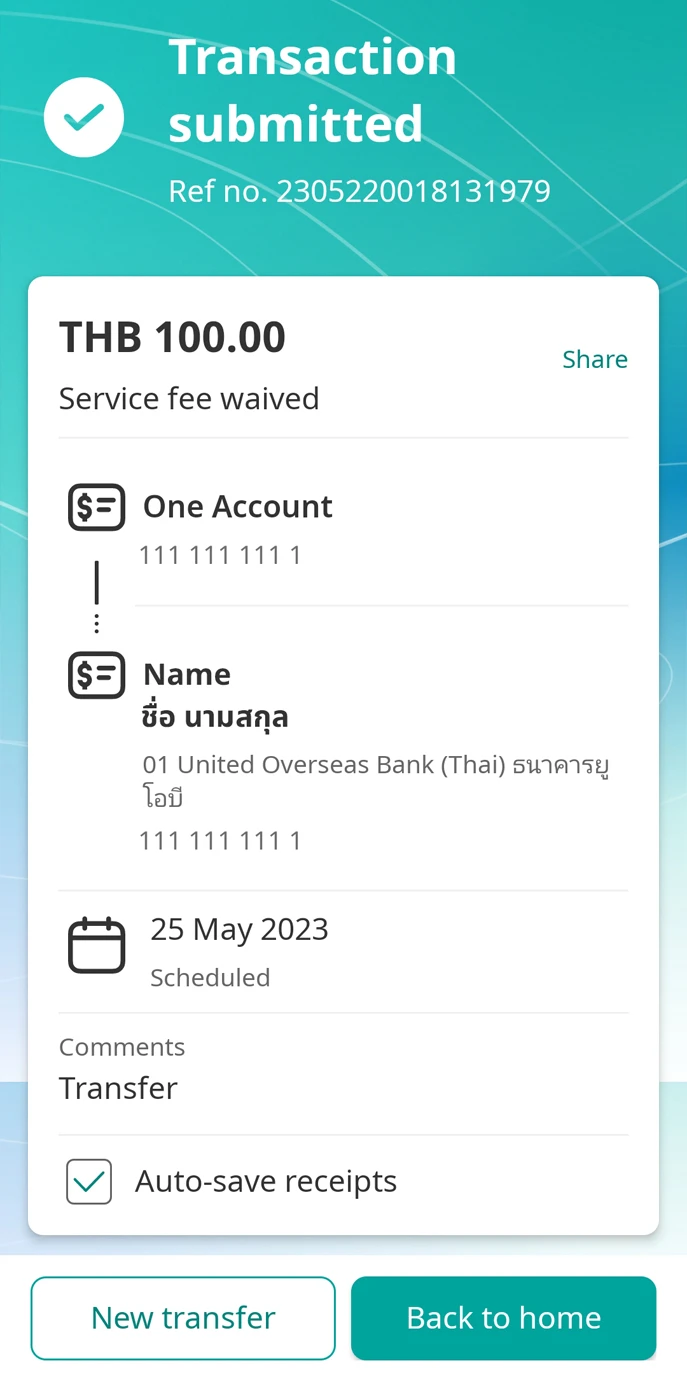

3. Enter the account number, amount and date of transfer.

4. Review the details and swipe to confirm your transaction.

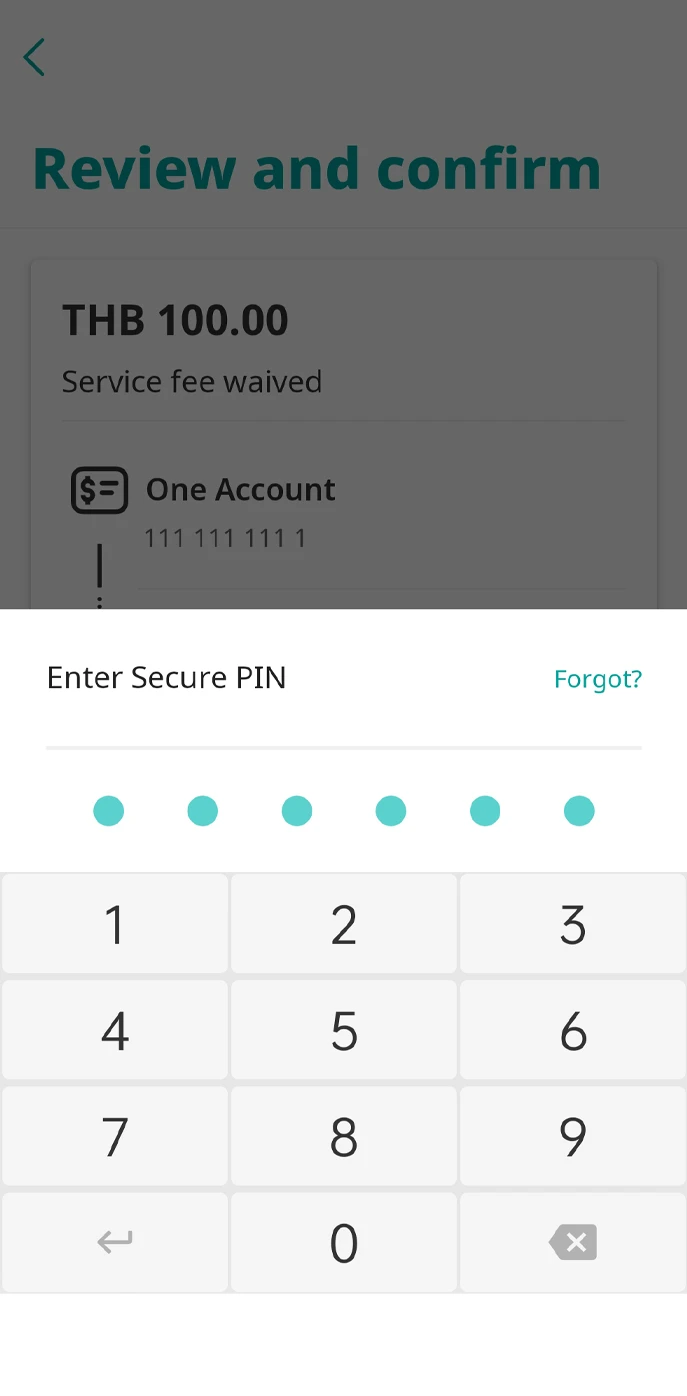

5. Enter your Secure PIN (required when the amount reaches the set transaction signing limit).

6. Transfer successful, receipts are saved in your photo album.

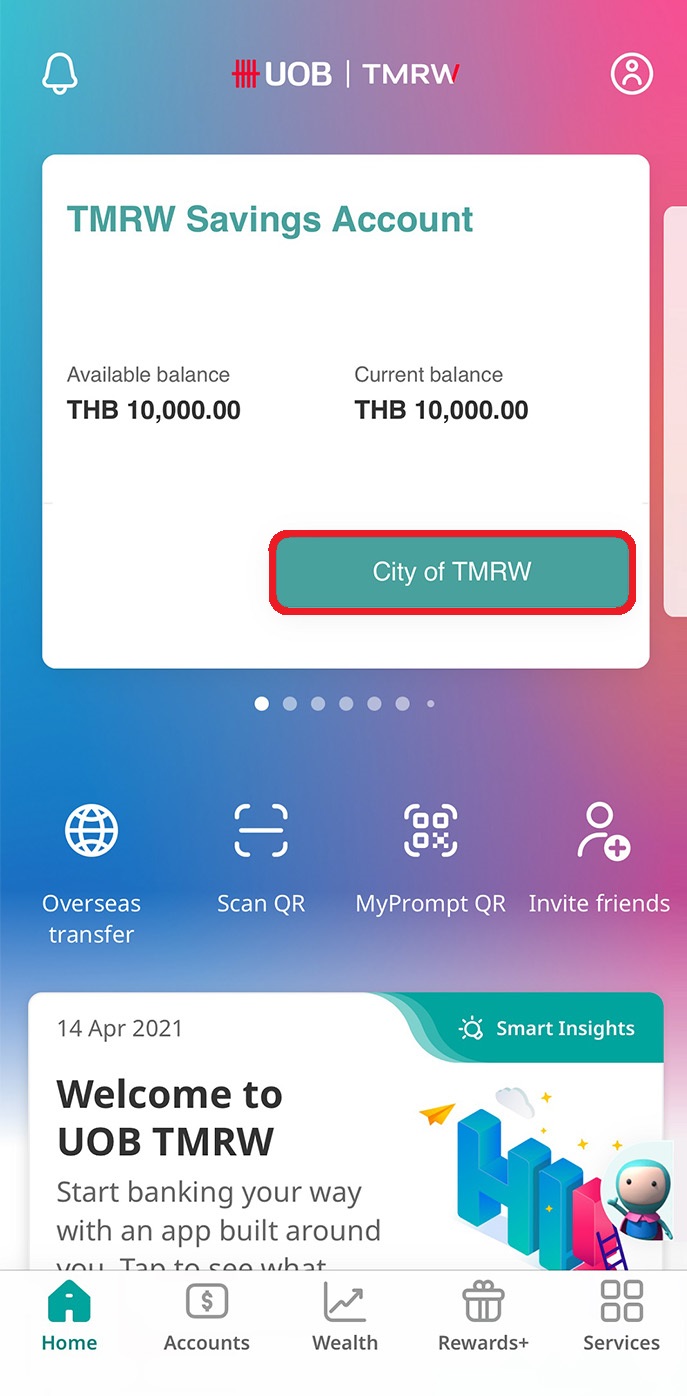

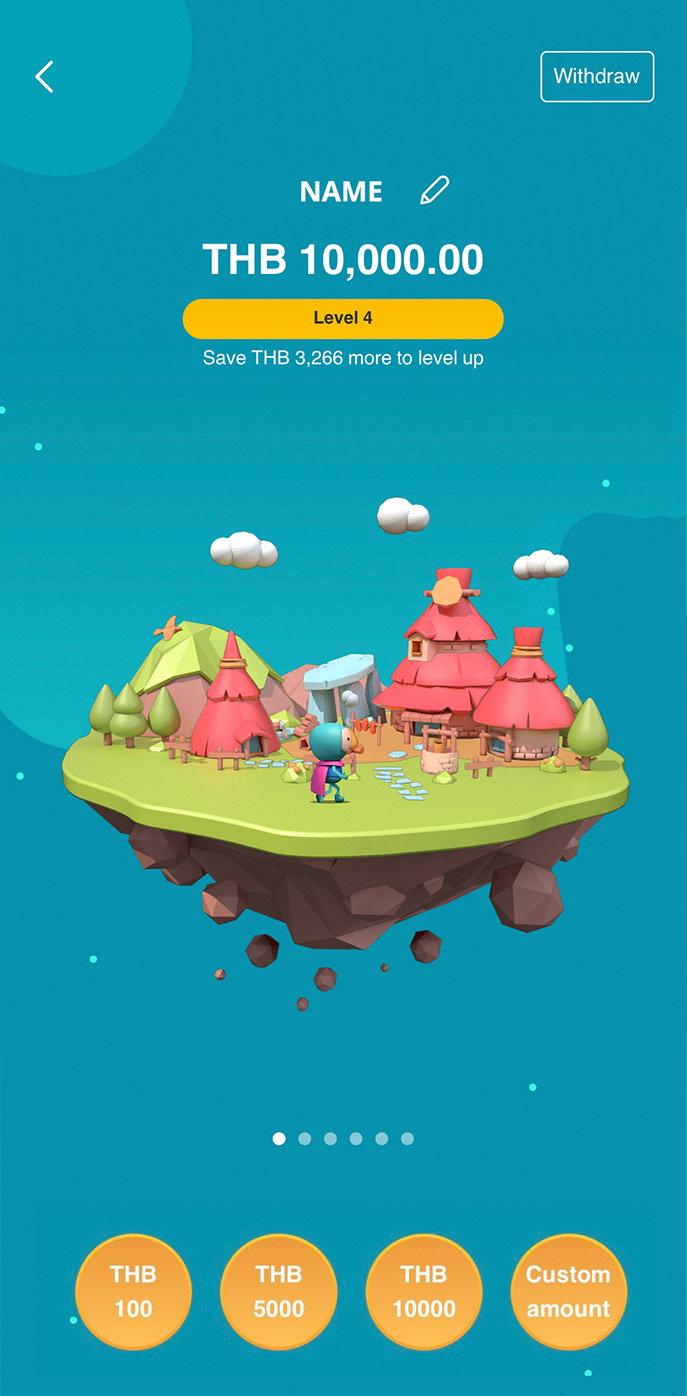

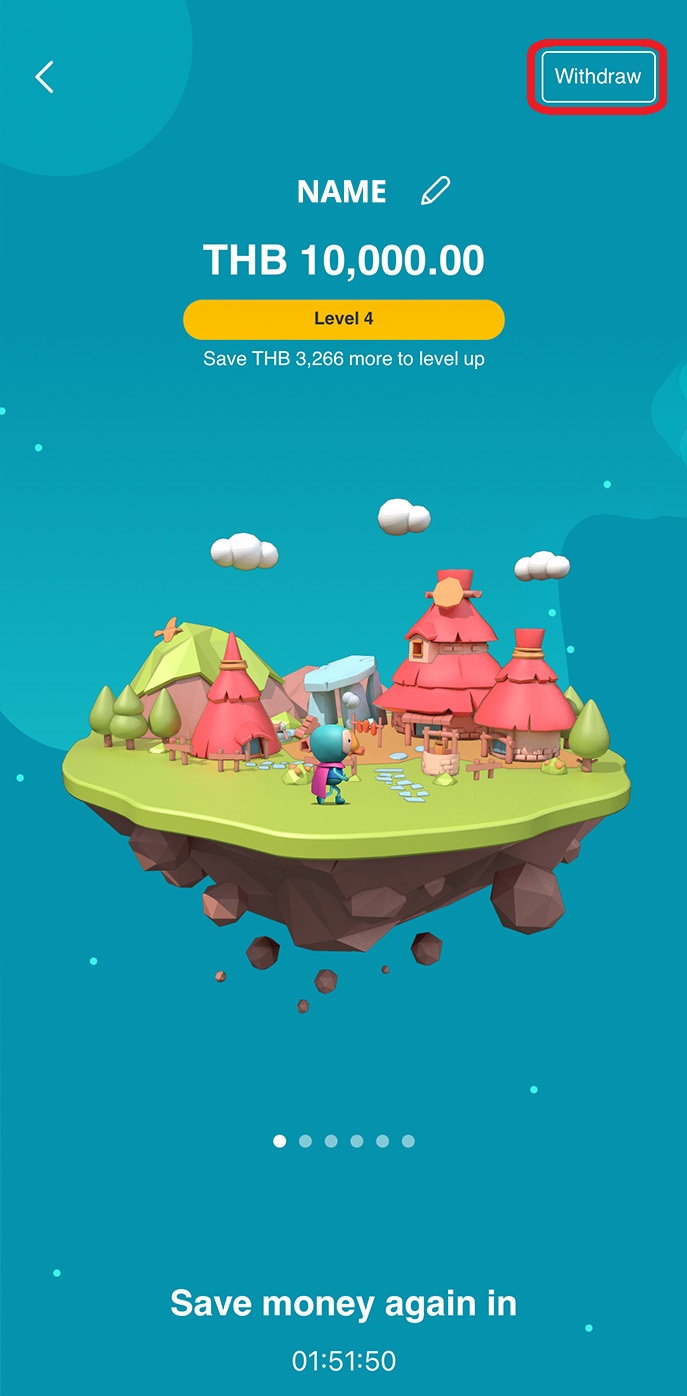

3. Transfer money between TMRW Everyday Account and TMRW Savings Account

1. Log in to UOB TMRW and tap on “City of TMRW” button on your TMRW Savings Account.

2. Select or customize amount for deposit (transfer from TMRW Everyday Account only once a day).

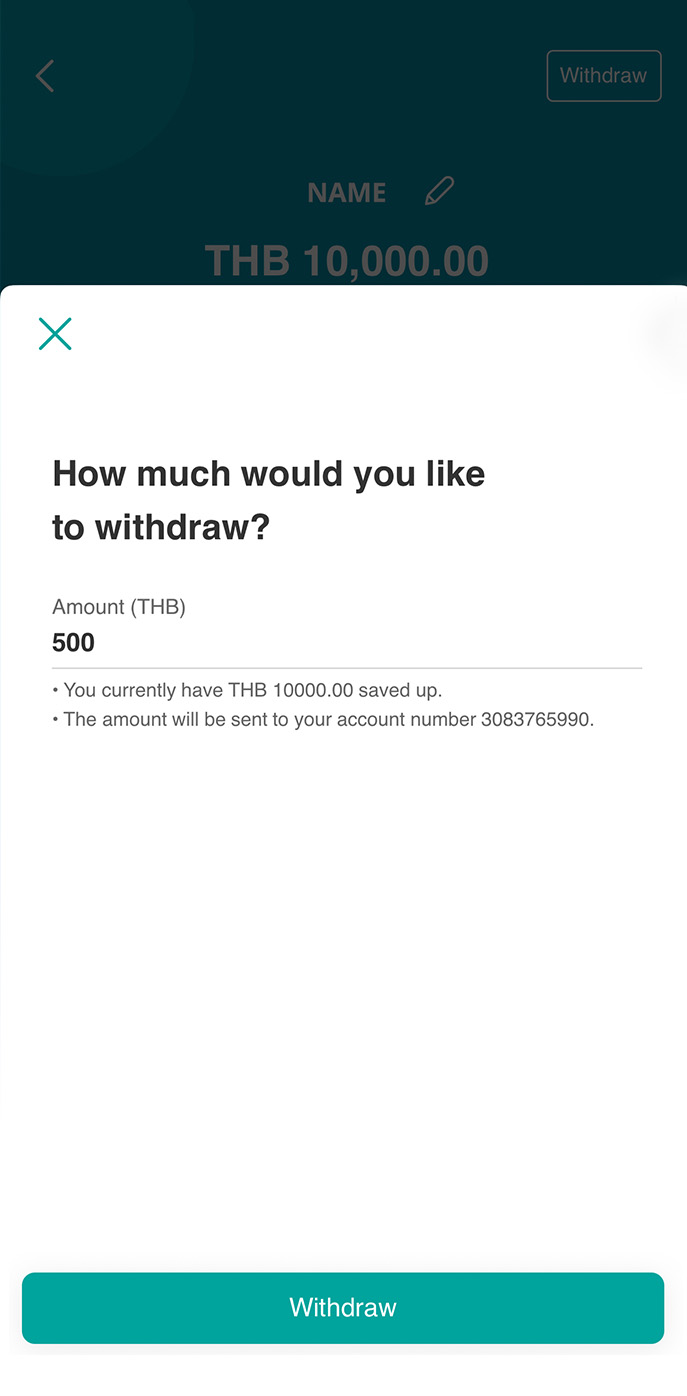

3. To withdraw money from City of TMRW, tap on “Withdraw” at the top right corner.

4. Enter desired amount to withdraw. The money will be transferred to your TMRW Everyday Account.

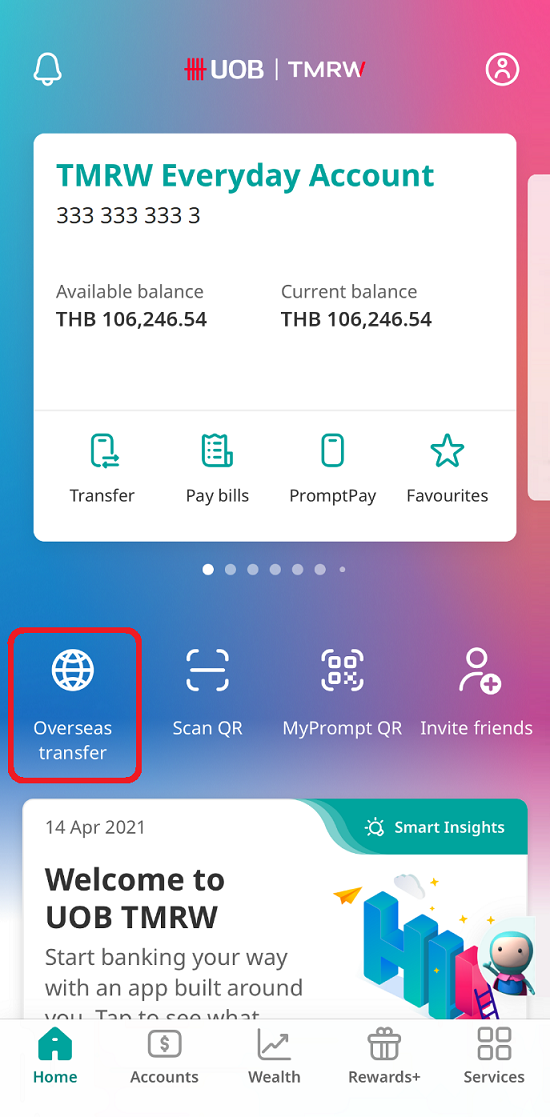

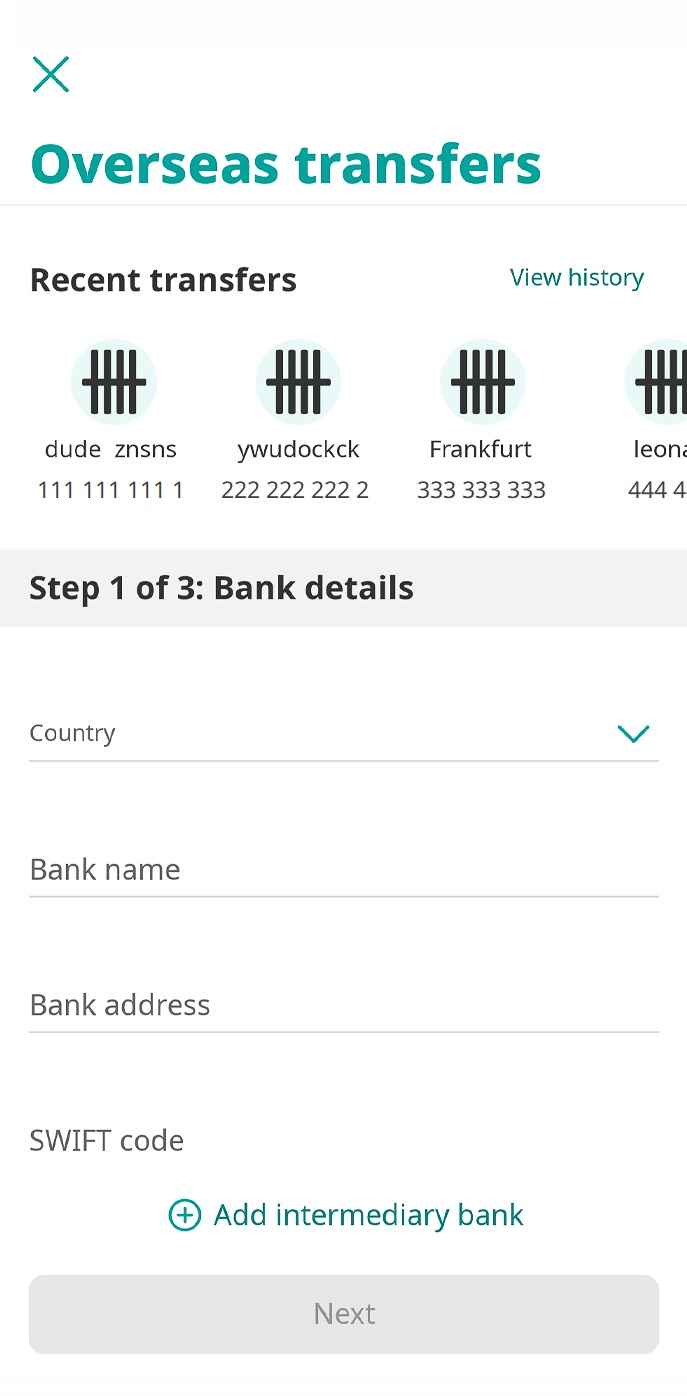

4. Overseas transfer

1. Log in to UOB TMRW and tap on “Overseas transfer” from Home screen.

Note: Overseas transfer in UOB TMRW is available on business days during 08:30 – 16:30 Bangkok time.

2. Input details of the overseas bank (country, bank name and address, SWIFT code).

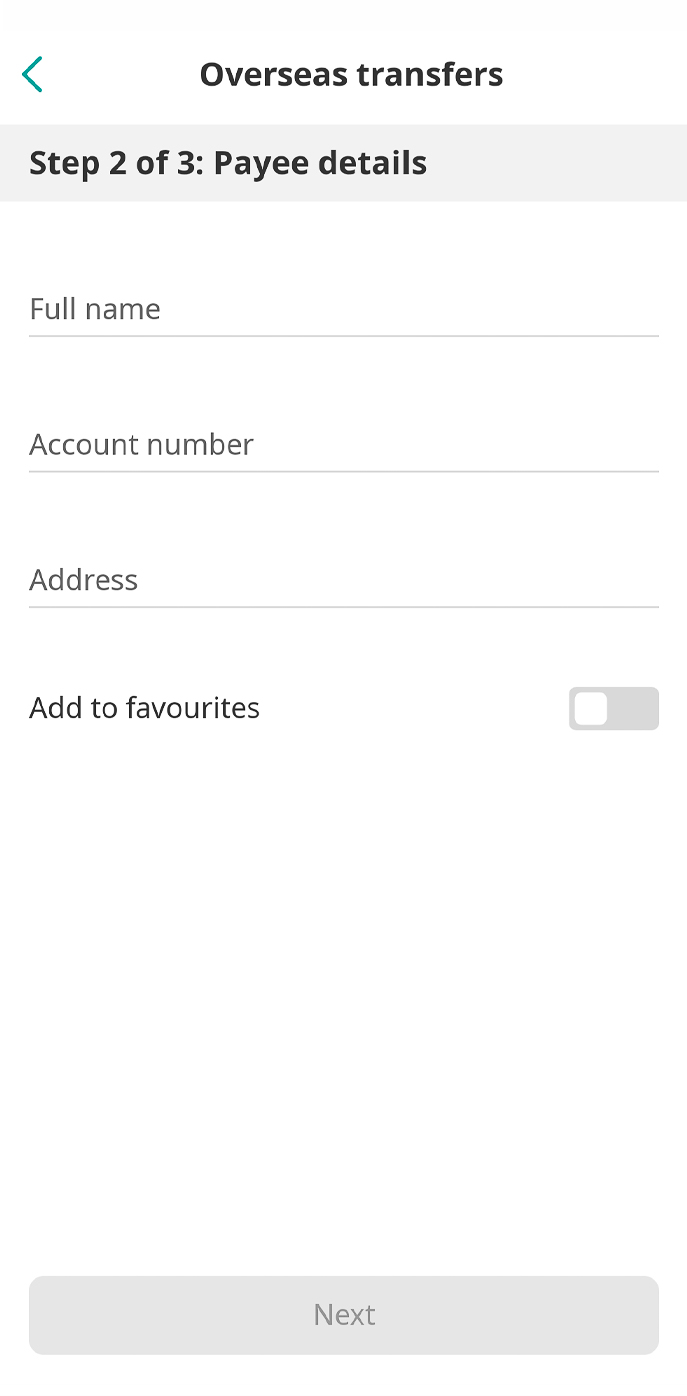

3. Input details of the recipient (name, account number, address).

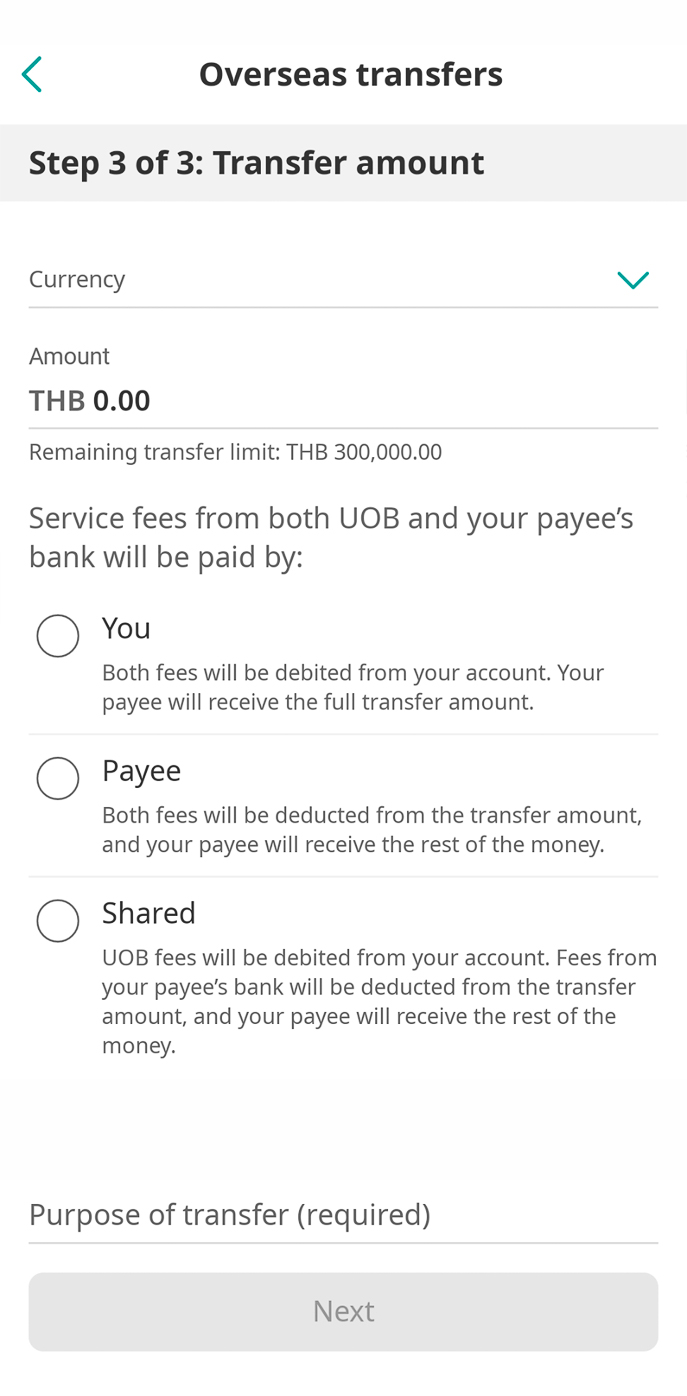

4. Select your deposit account to transfer money from then input details of the transfer (currency, amount, service fee payment option, purpose of transfer).

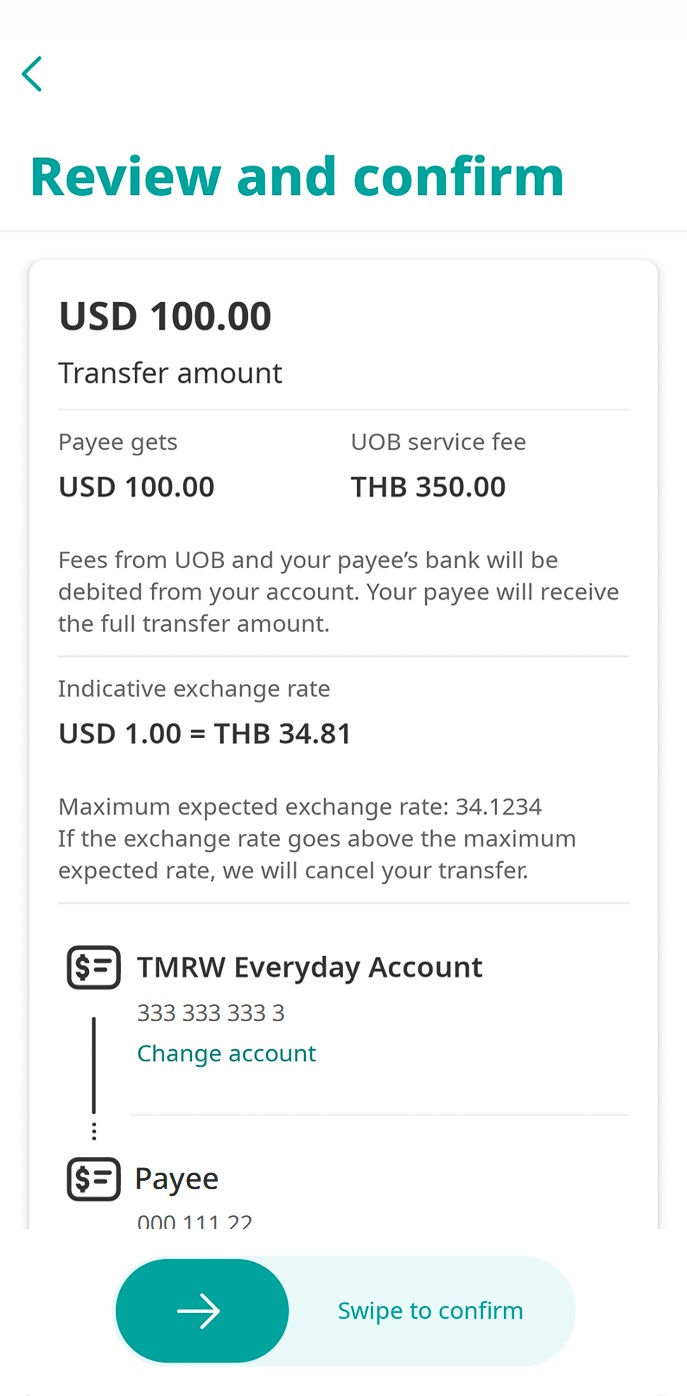

5. Review the details and swipe to confirm with your Secure PIN (required when the amount reaches the set transaction signing limit).

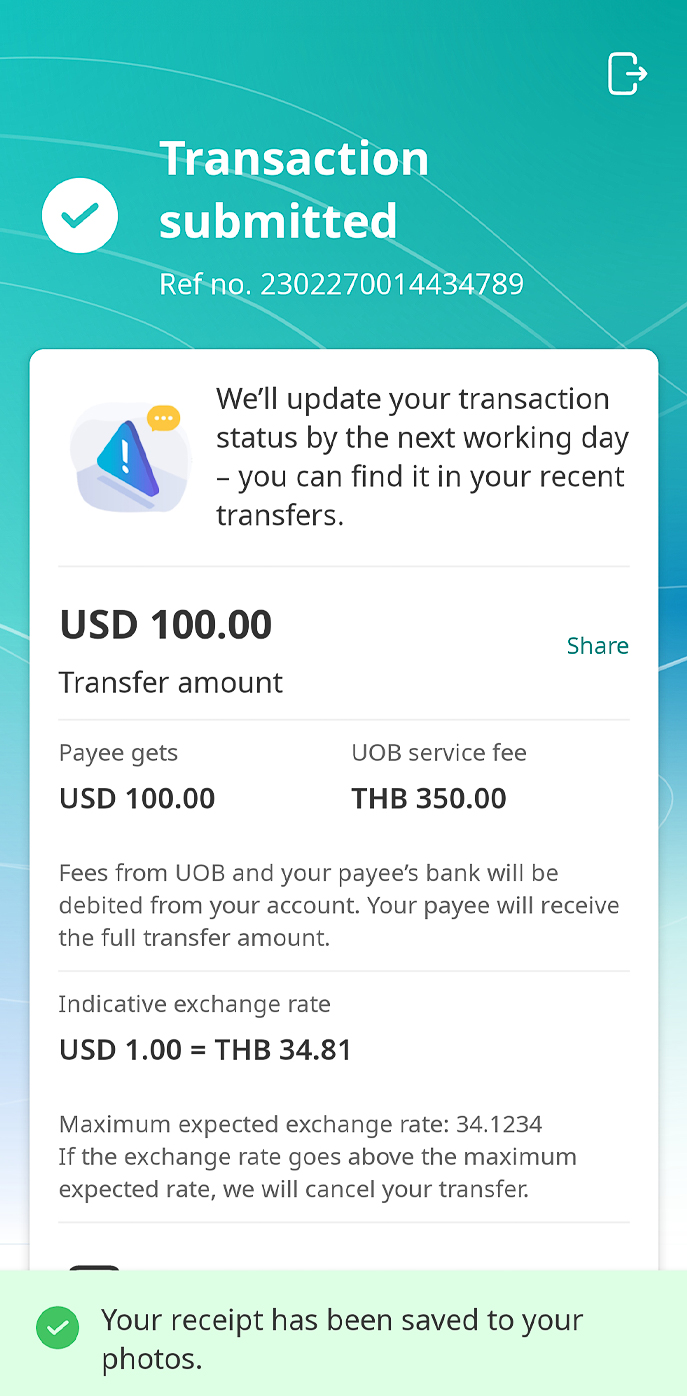

6. Transaction order submitted and can be checked for status update in your transaction history on the next business day.

If the transaction is rejected, you’ll be notified via SMS.

PromptPay transfer and QR payment

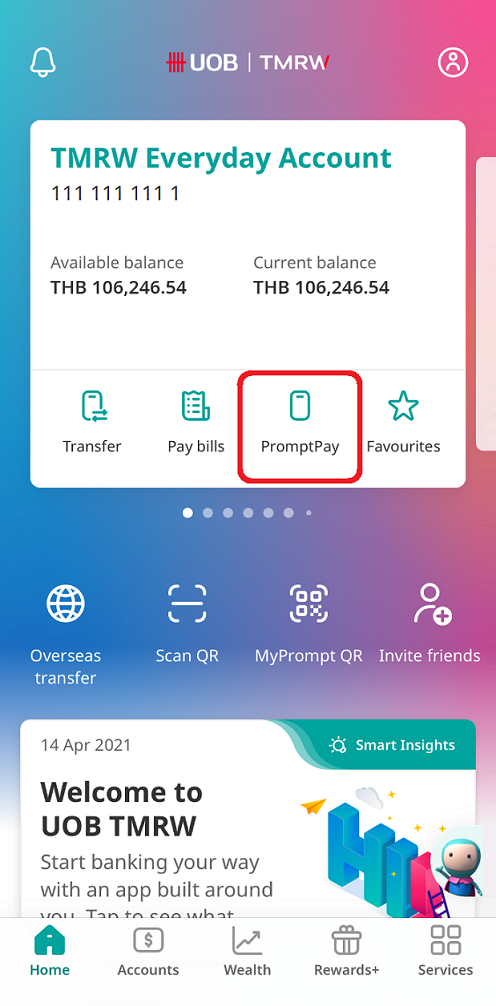

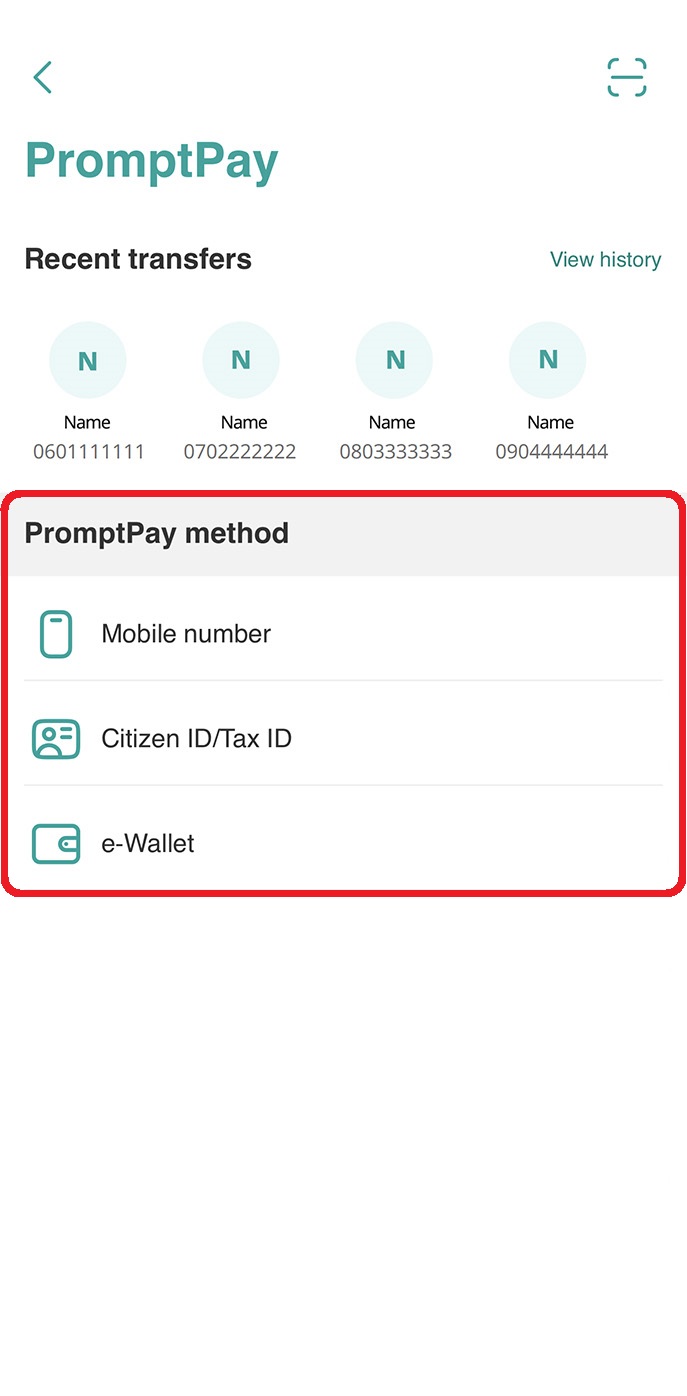

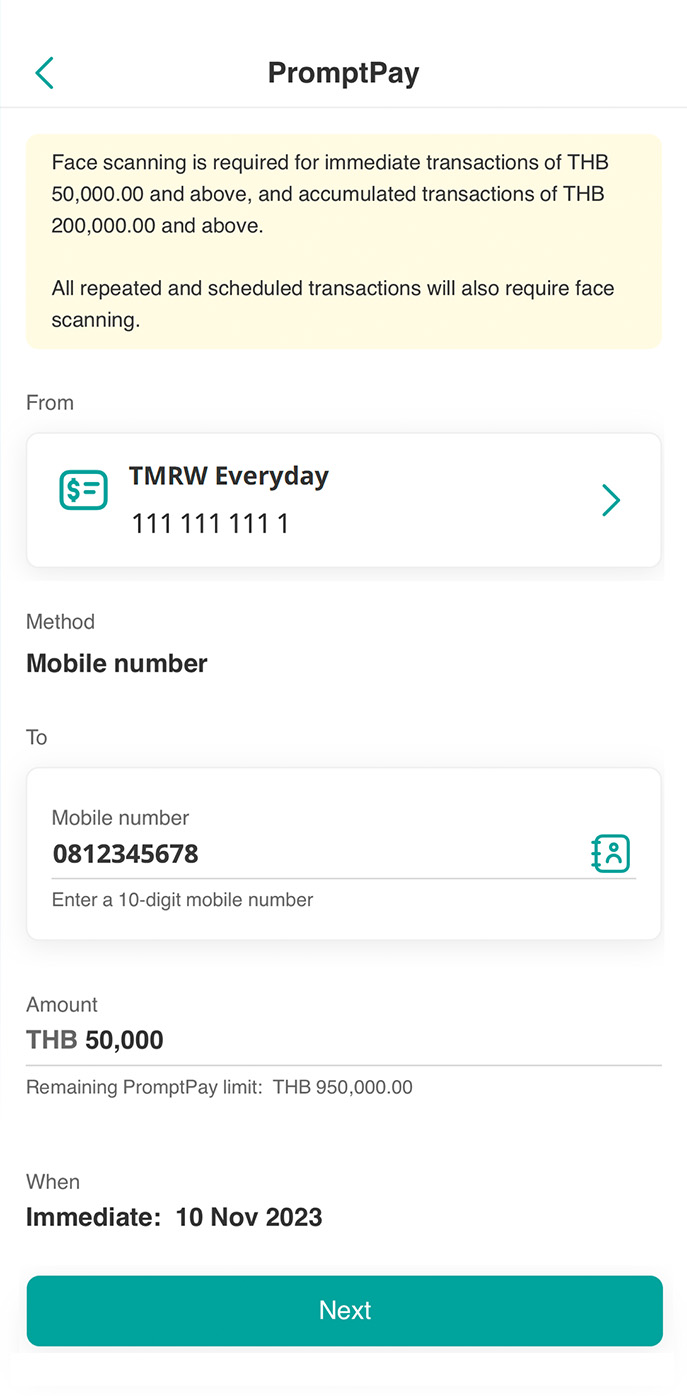

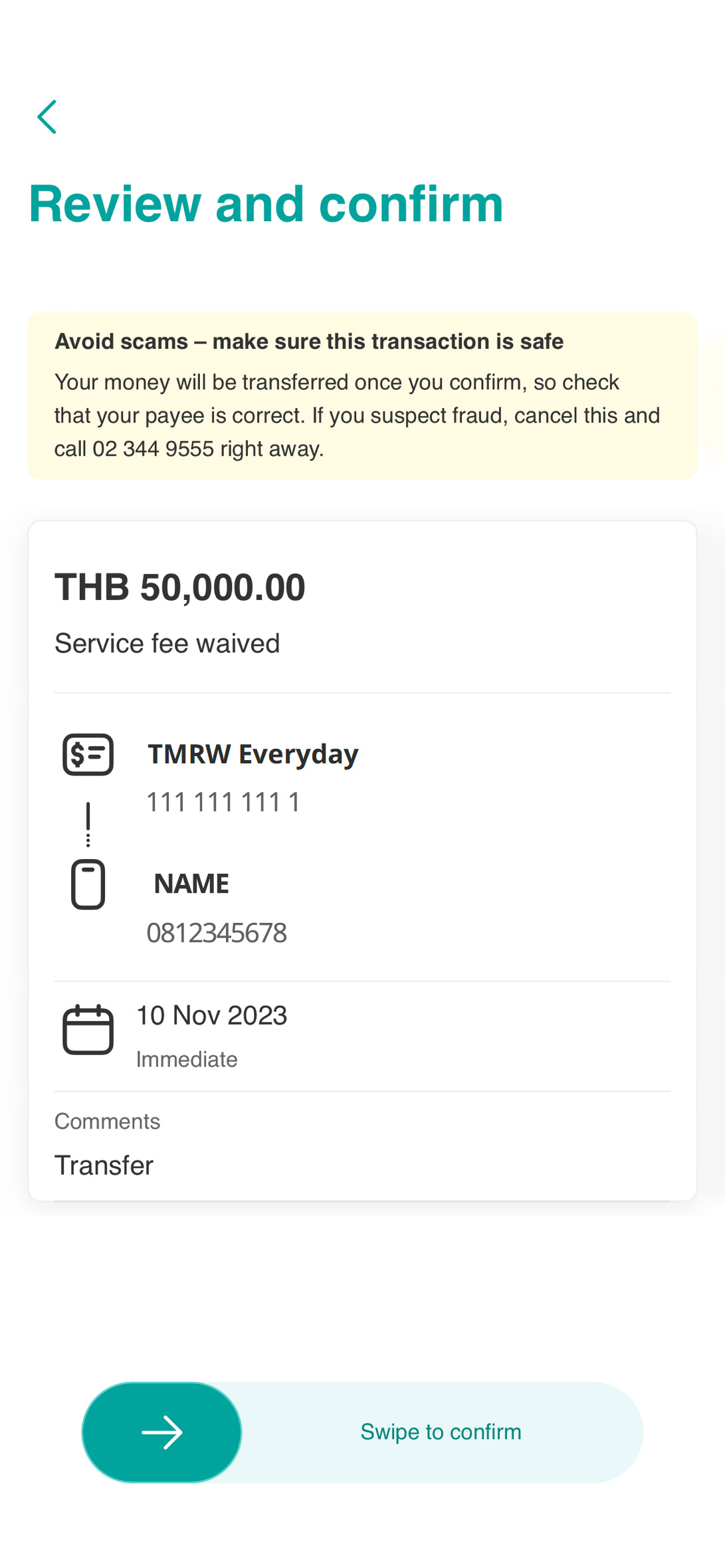

1. Transfer money via PromptPay

1. Log in to UOB TMRW and select “PromptPay” on the deposit account to make a transaction.

2. Select the method of PromptPay account.

3. Input the payee detail, amount and date of transfer.

4. Review the details and swipe to confirm your transaction.

5. Transaction successful, receipts are saved in your photo album.

2. Scan QR/ barcode to pay from UOB deposit account

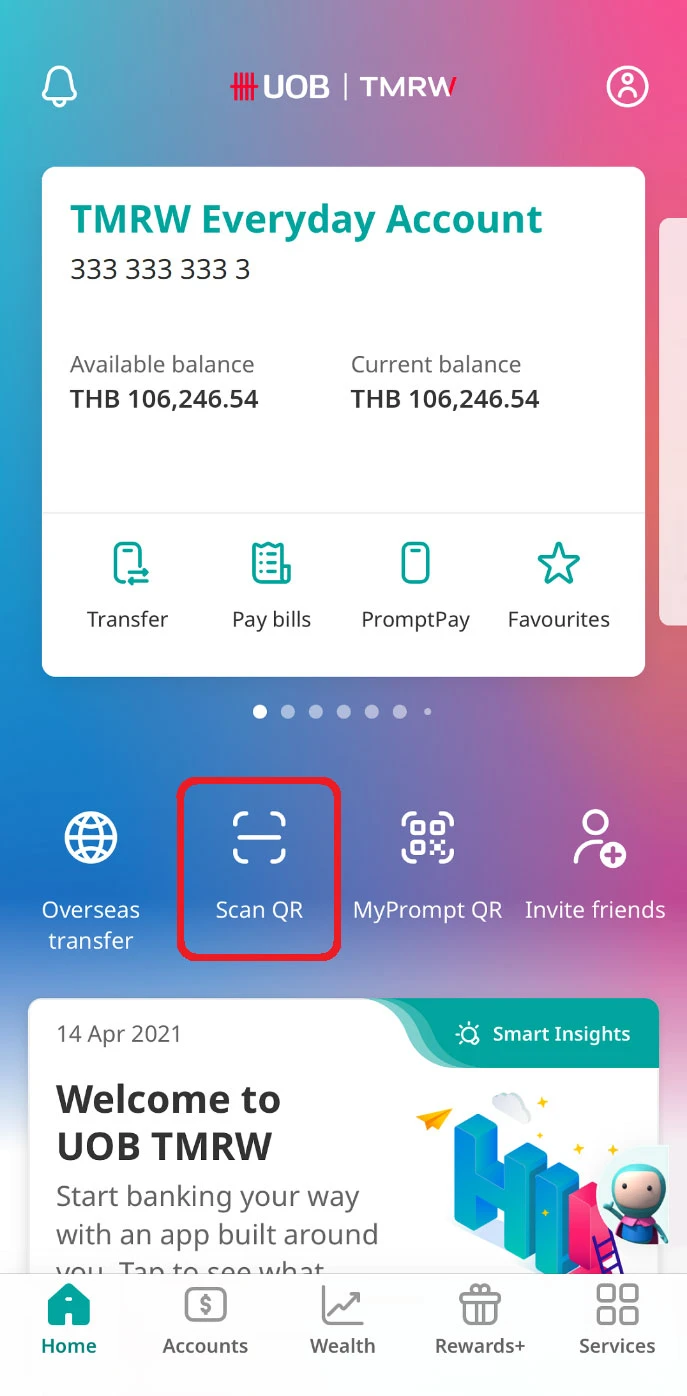

1. Log in to UOB TMRW and tap on “Scan QR” from Home screen.

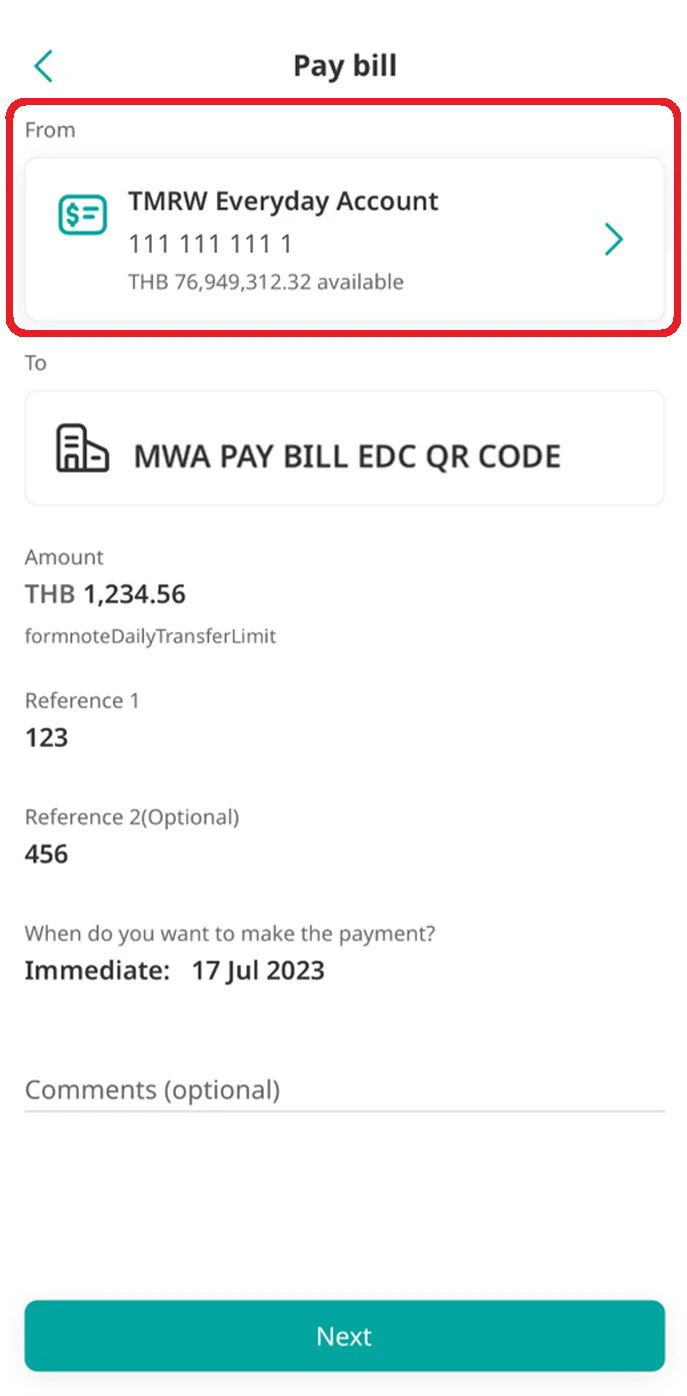

2. Select QR code or barcode to scan or upload from photos.

3. Select the debiting account to pay from and complete details of payment.

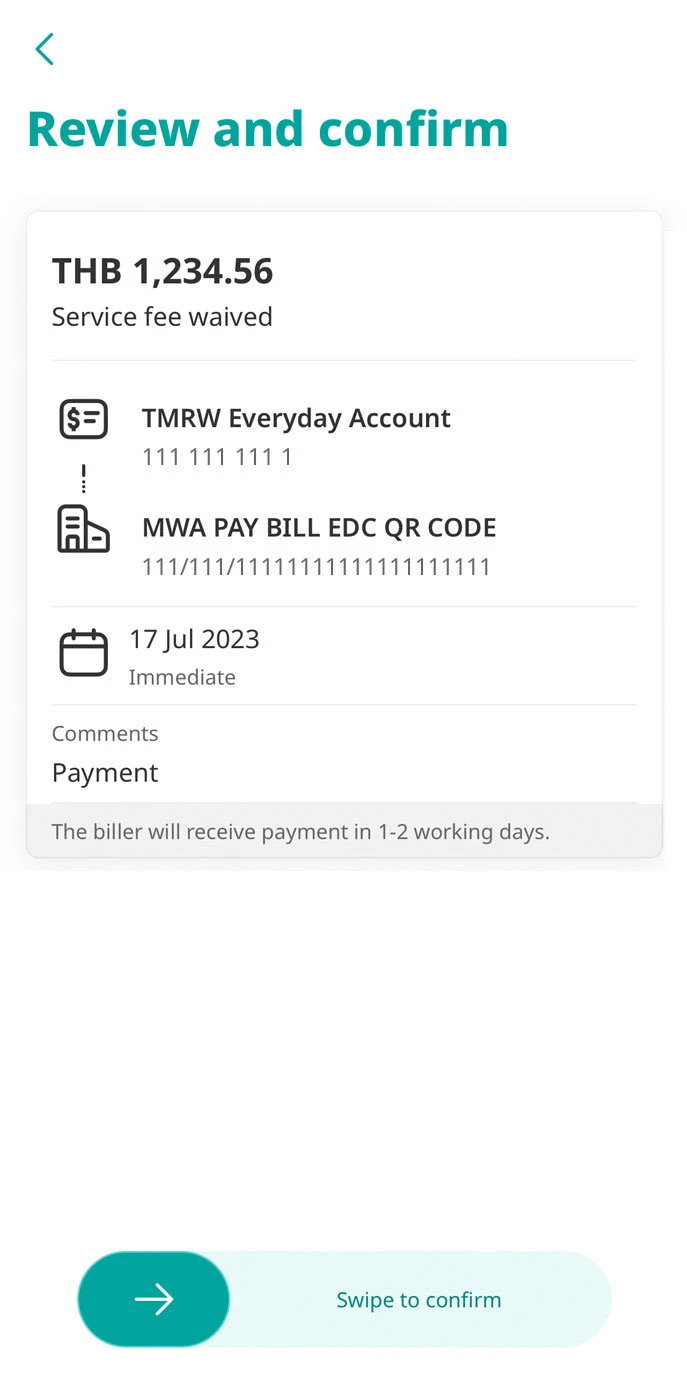

4. Review the details and swipe to confirm your transaction.

5. Transfer successful, receipts are saved in your photo album.

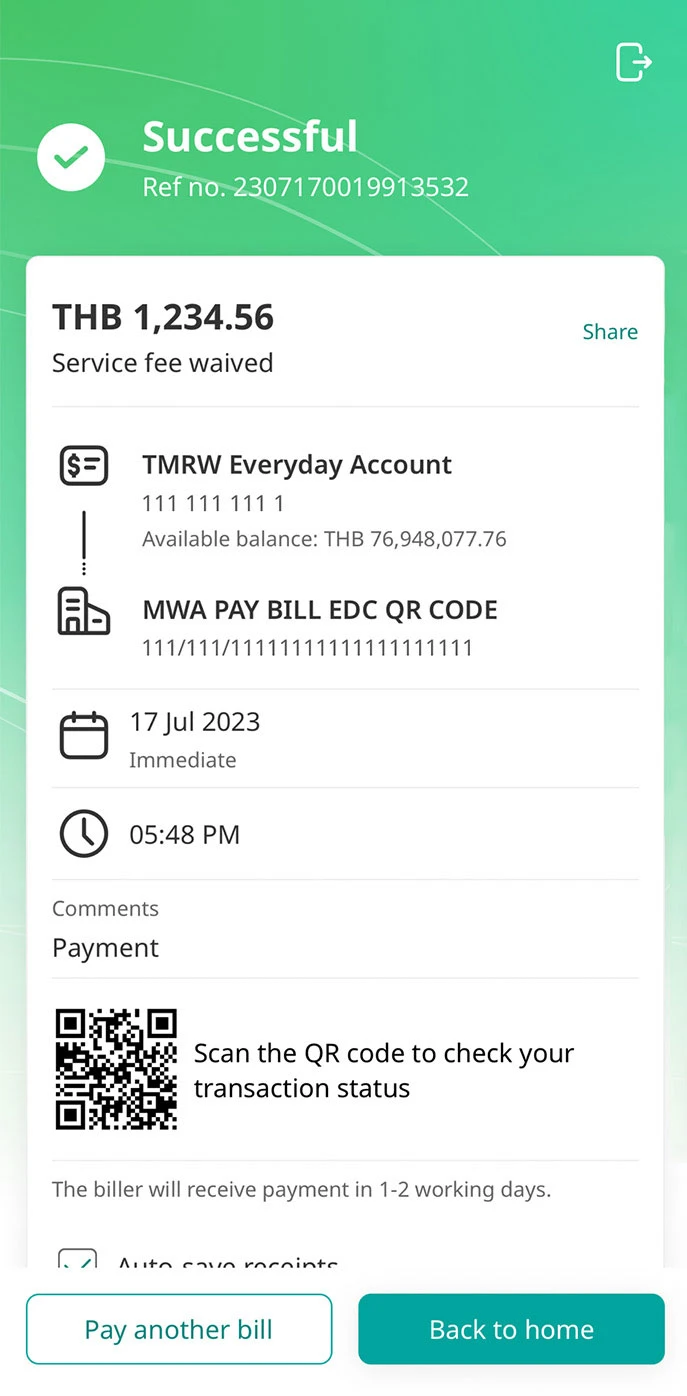

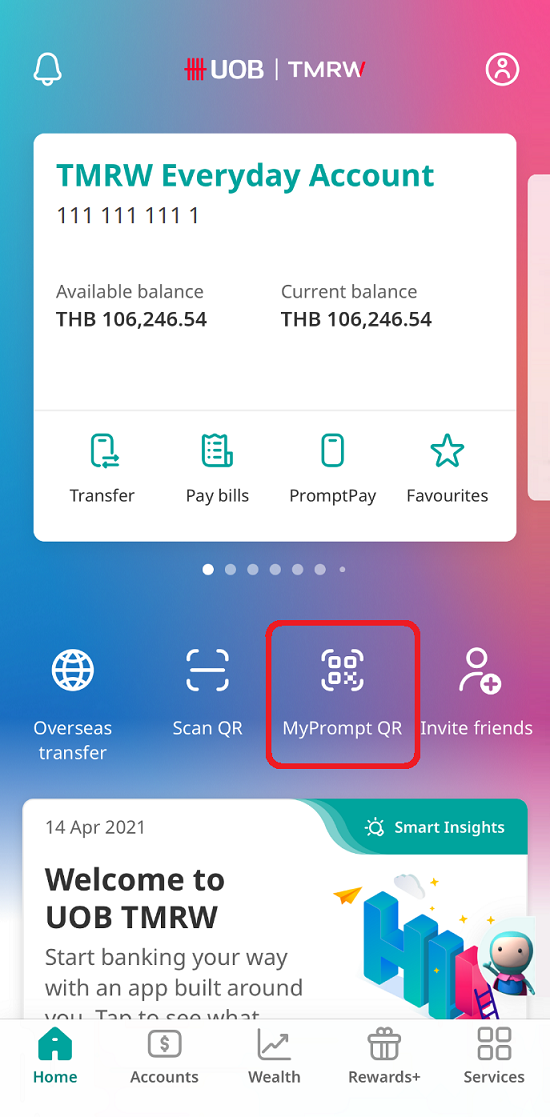

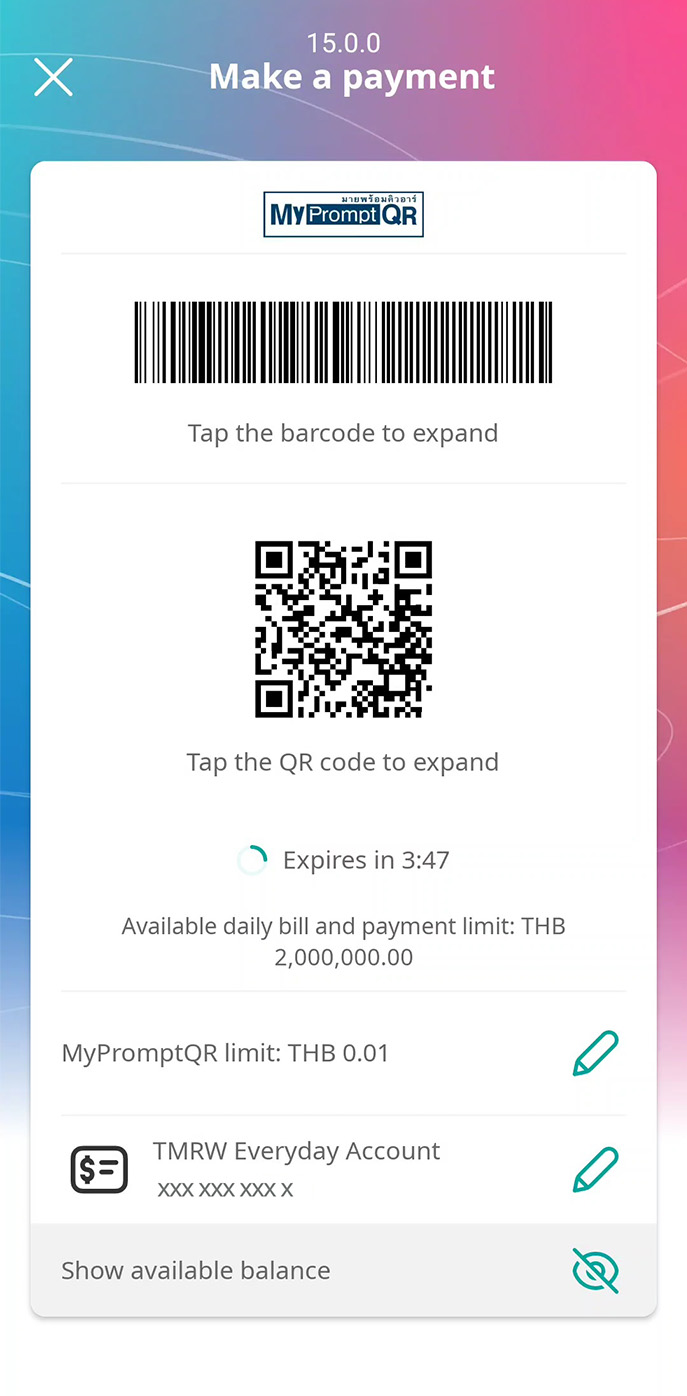

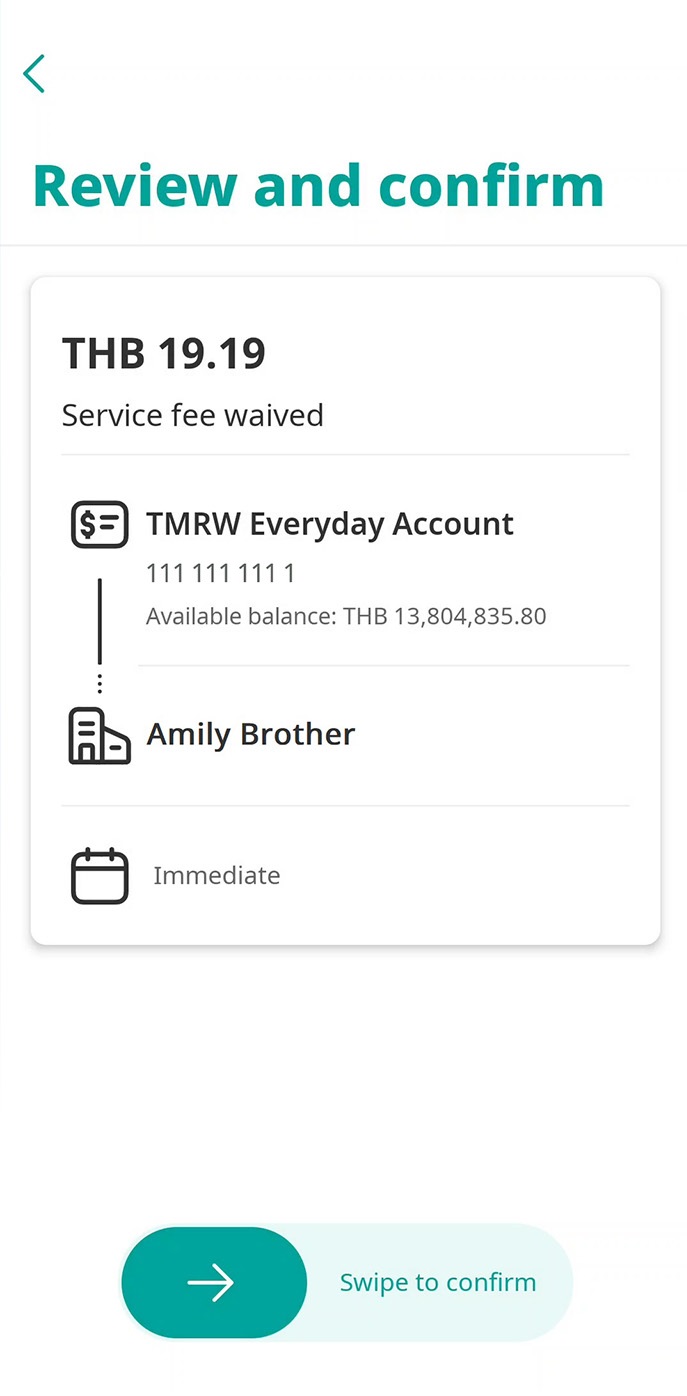

3. Generate MyPrompt QR to pay from UOB deposit account

1. Log in to UOB TMRW and tap on “MyPrompt QR” from Home screen.

2. Show the QR/ Barcode to scan and deduct money from your UOB deposit account (tap on the pencil icon to change to a different account).

3. Review the details and swipe to confirm your transaction.

4. Transaction successful, receipts are saved in your photo album.

Manage scheduled transfers and payments

1. Set up scheduled transfers and payments

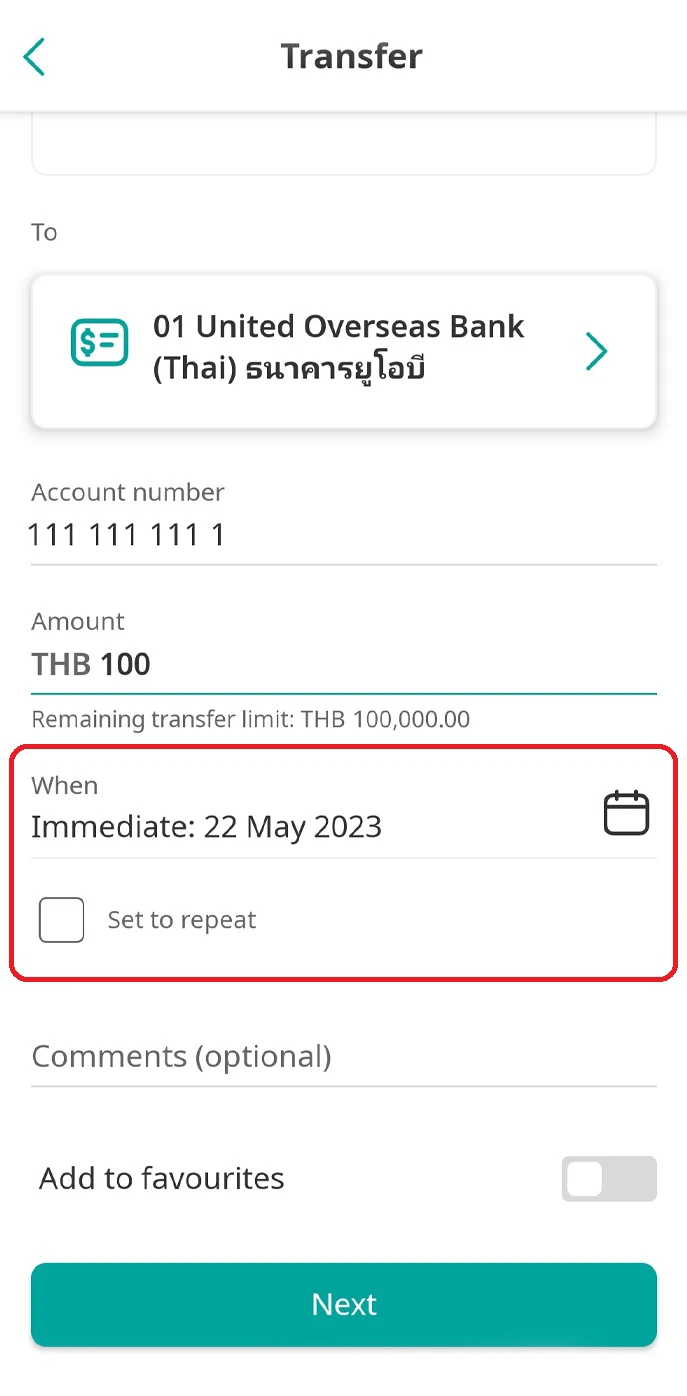

1. Log in to UOB TMRW and tap “Transfer” or “Pay bills” on the account to make a transaction from.

2. Enter recipient/biller details and amount, then tap on the calendar icon to select the date or select “Set to repeat” to set up a recurring transaction.

3. Review the details and swipe to confirm your transaction.

4. Enter your Secure PIN (required when the amount reaches the set transaction signing limit).

5. Transaction successful, receipts are saved in your photo album.

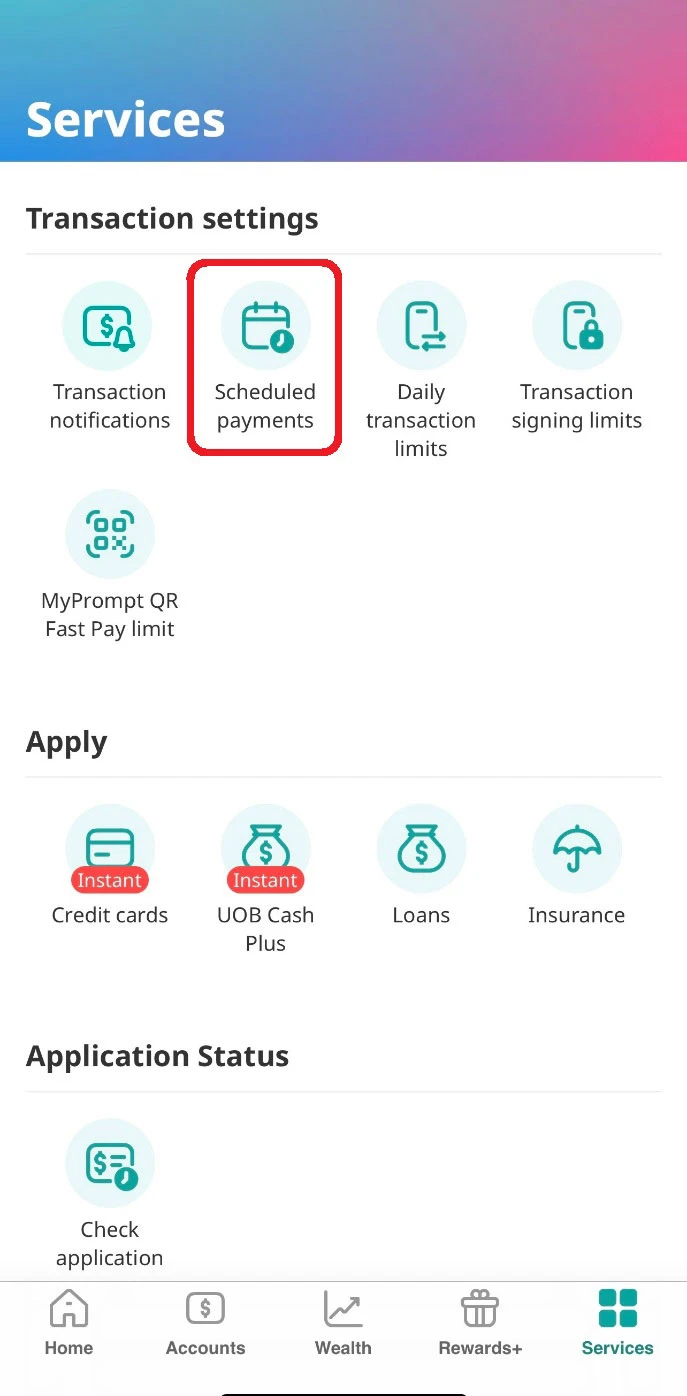

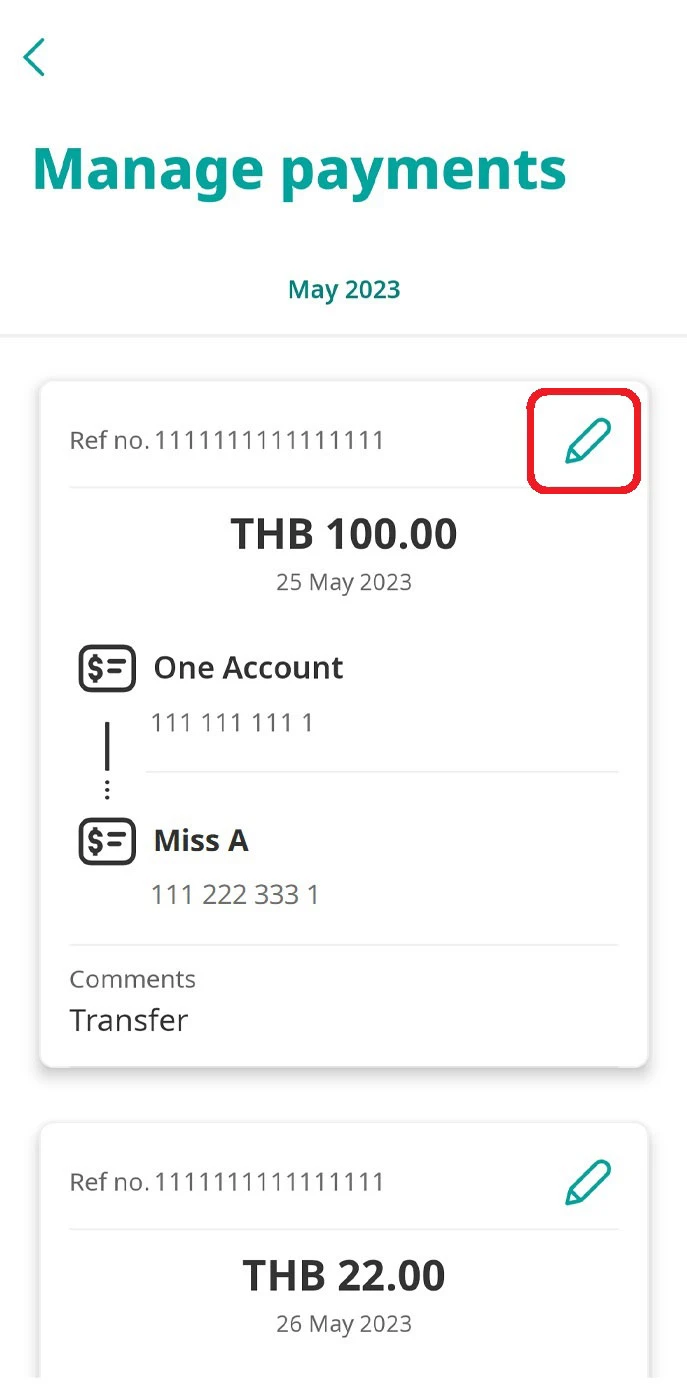

2. View and edit scheduled transfers and payments

1. Log in to UOB TMRW and tap on “Services”.

2. Select “Scheduled payments”.

3. View your scheduled transactions and tap on the pencil icon to edit.

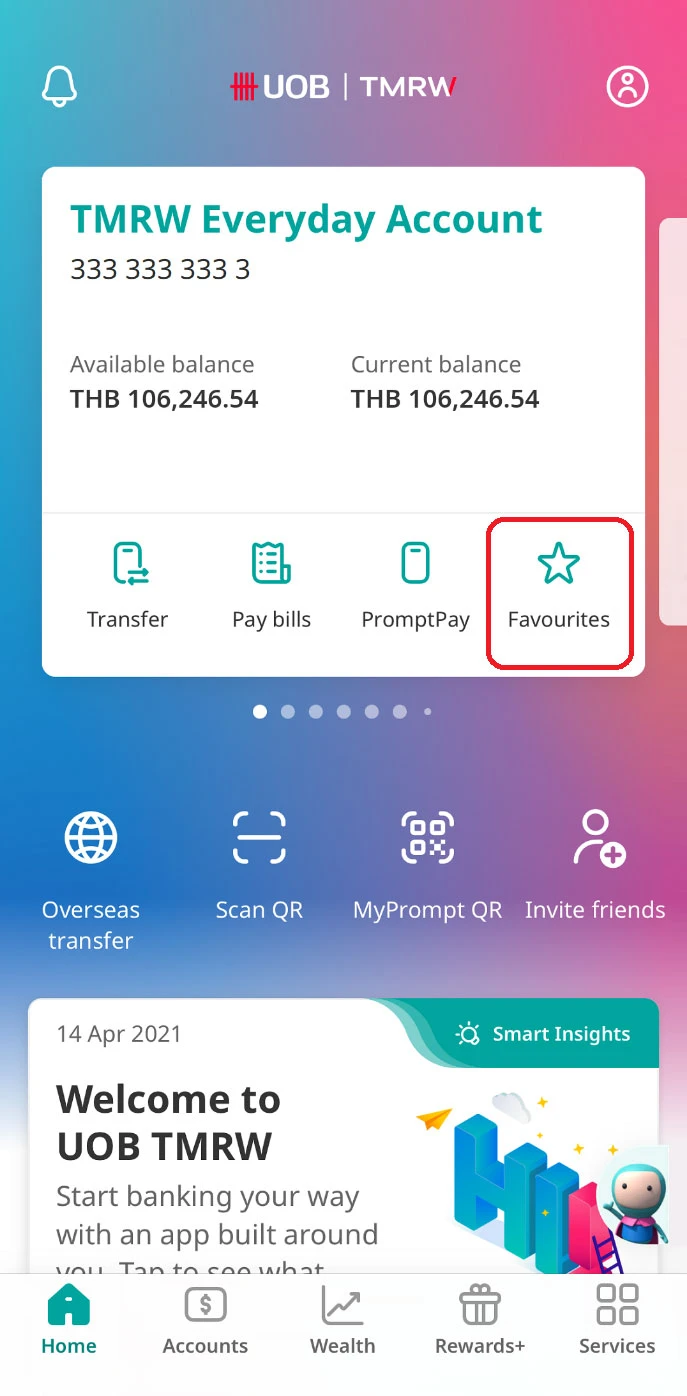

Add payees or billers to Favourites

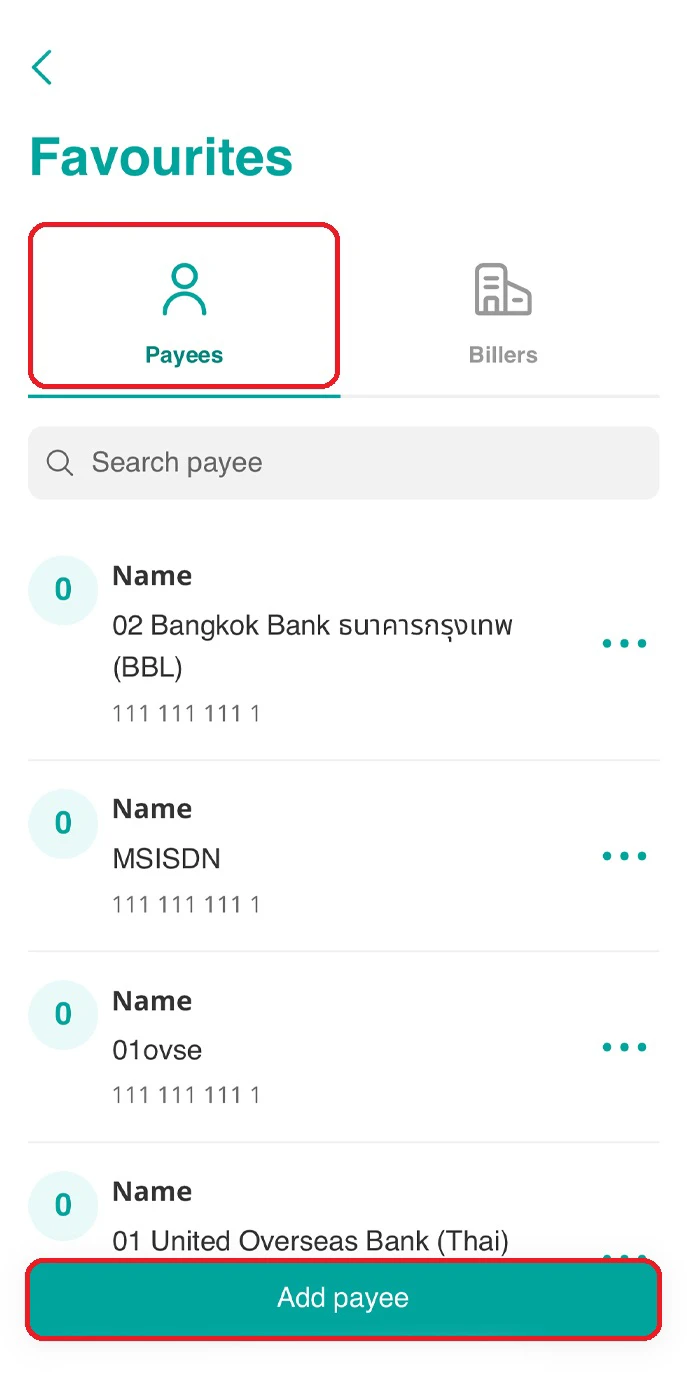

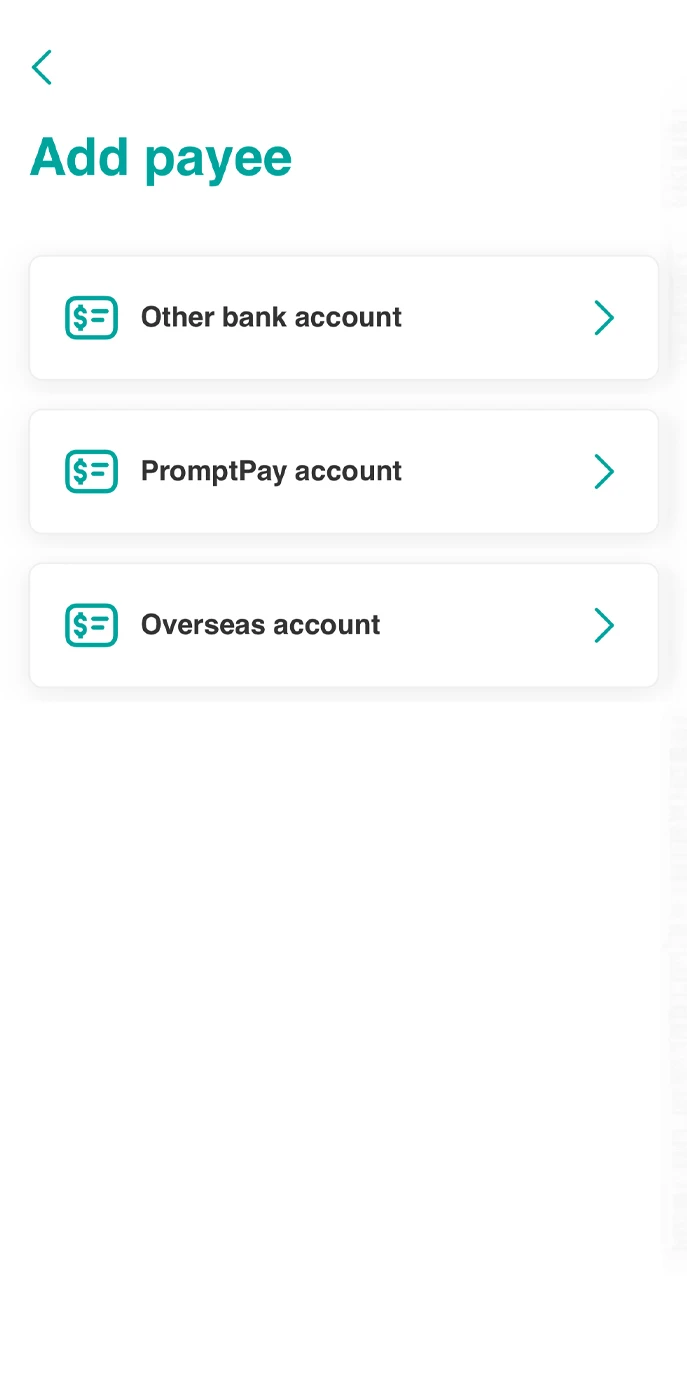

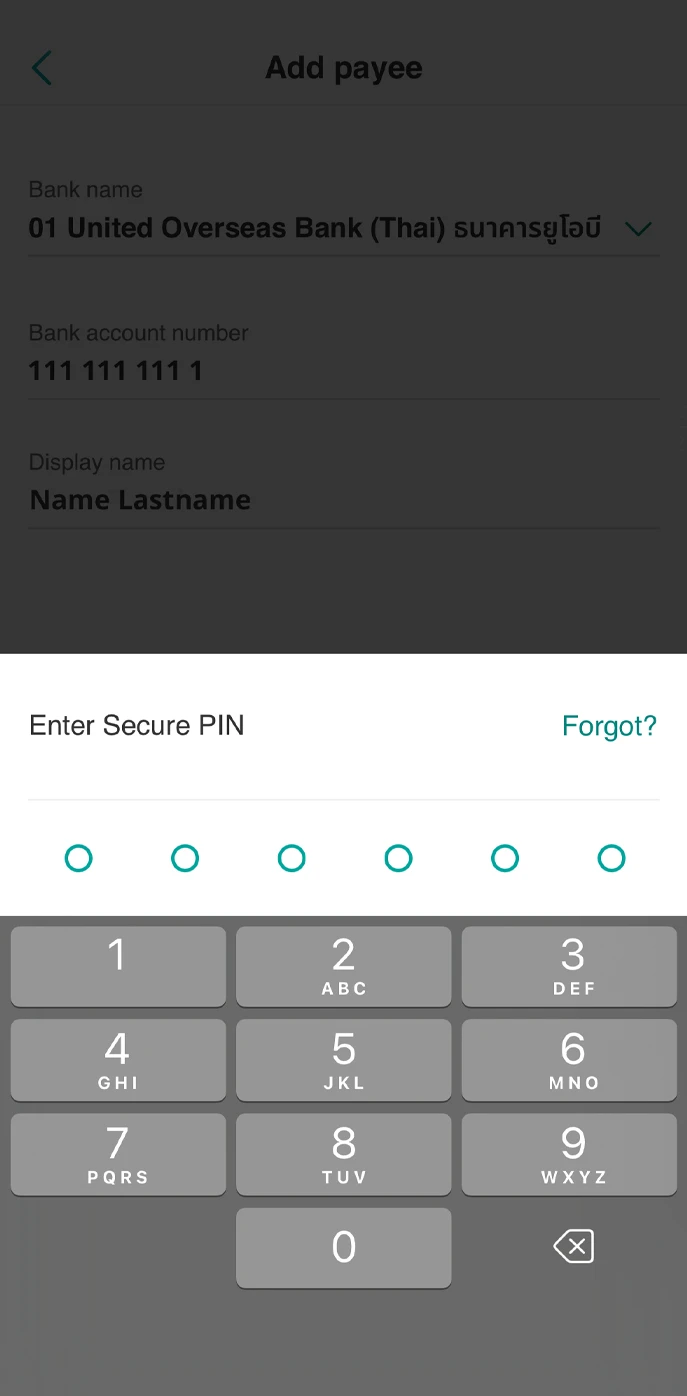

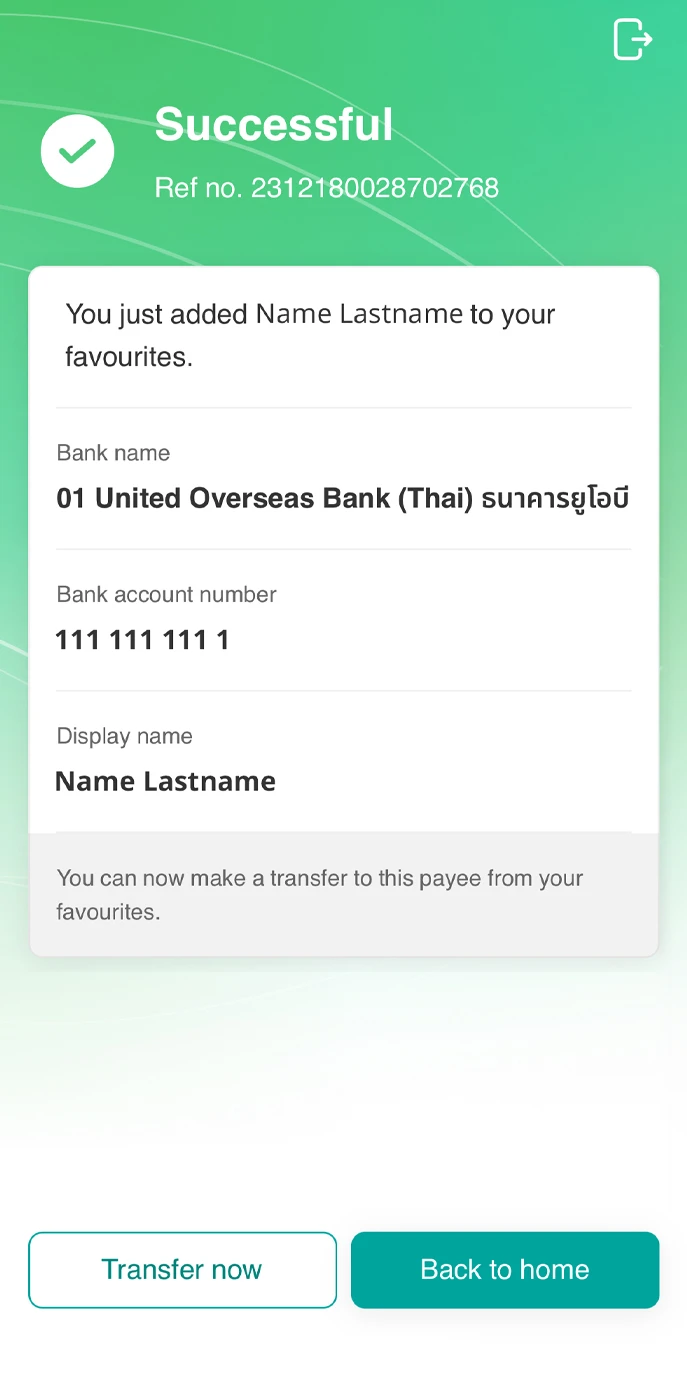

1. Add favourite payee

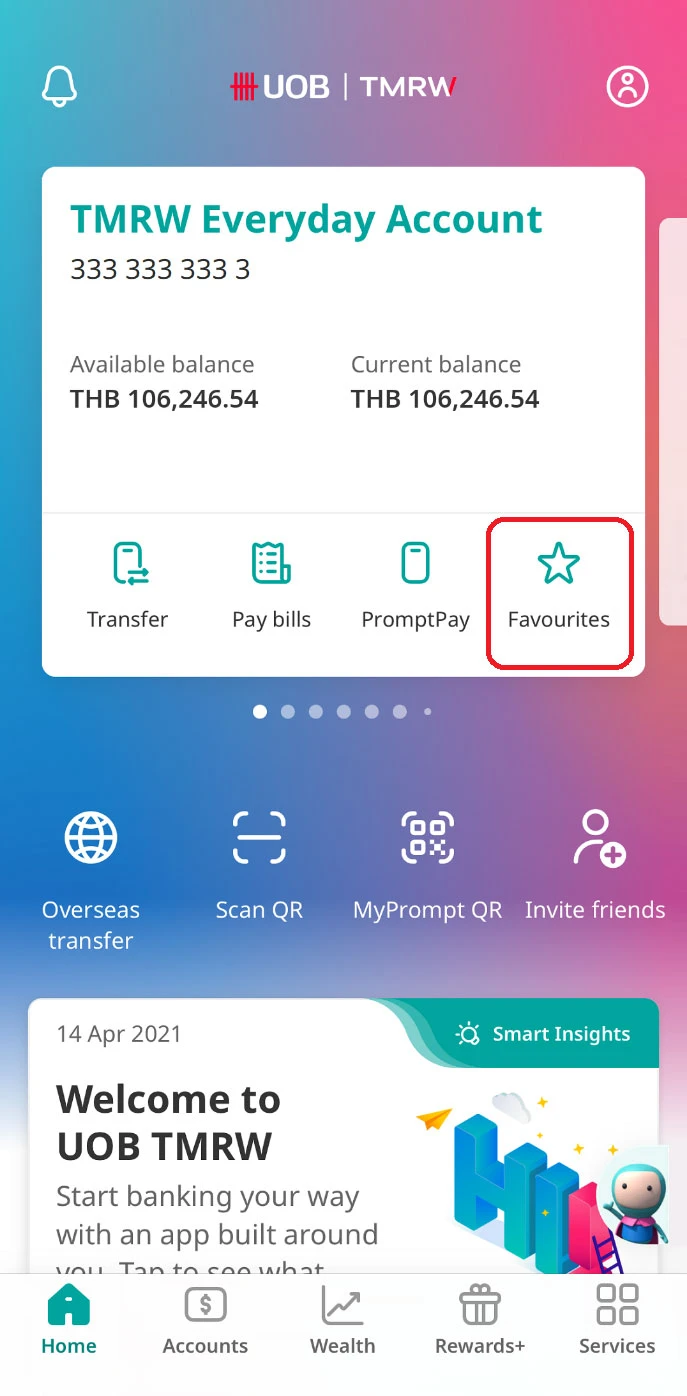

1. Log in to UOB TMRW and tap on “Favourites”.

2. Under “Payees”, tap on “Add payee” at the bottom of the screen.

3. Select the payee account type.

4. Enter payee details, then confirm with your Secure PIN.

5. Successfully added a payee to Favourites.

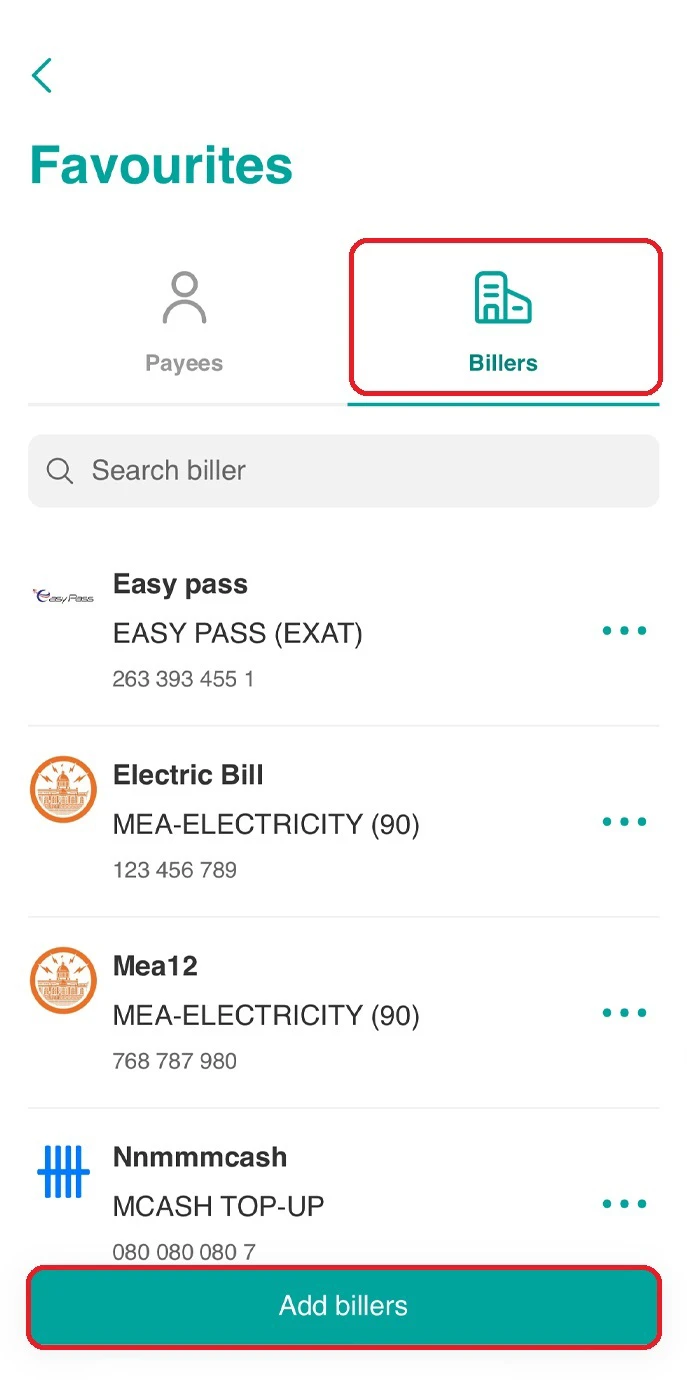

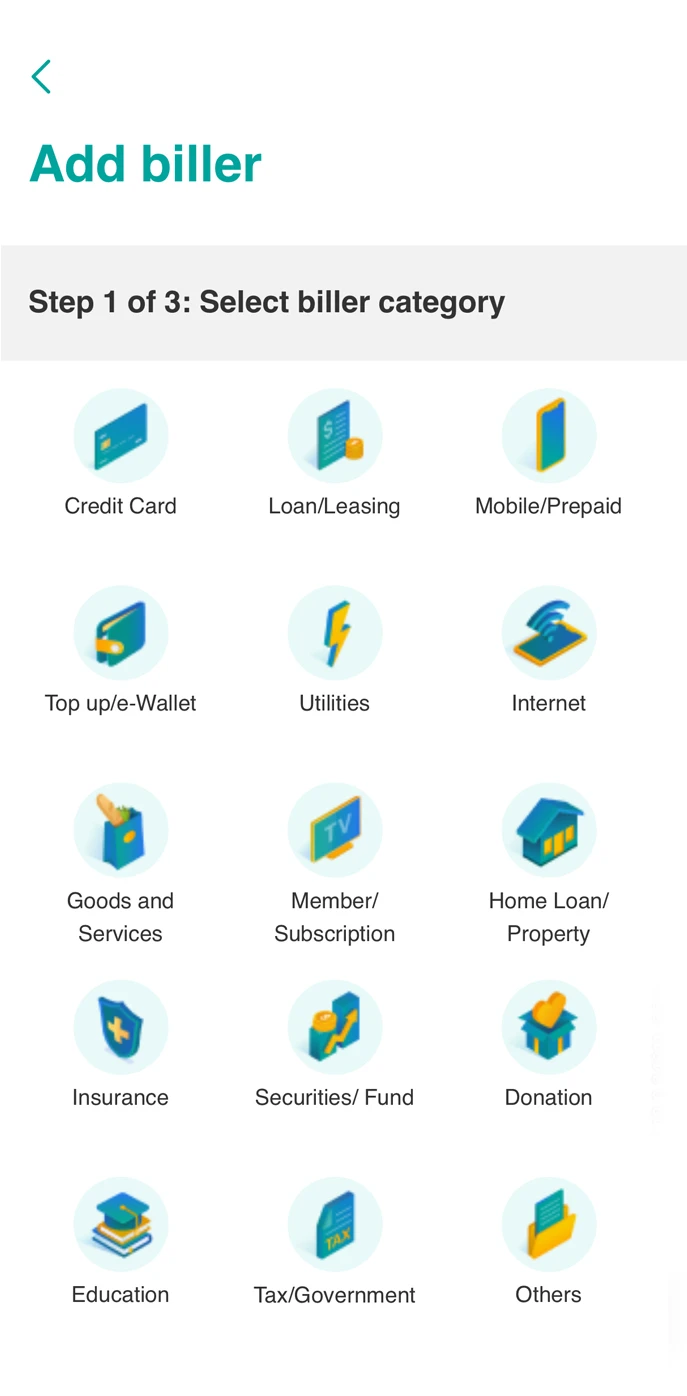

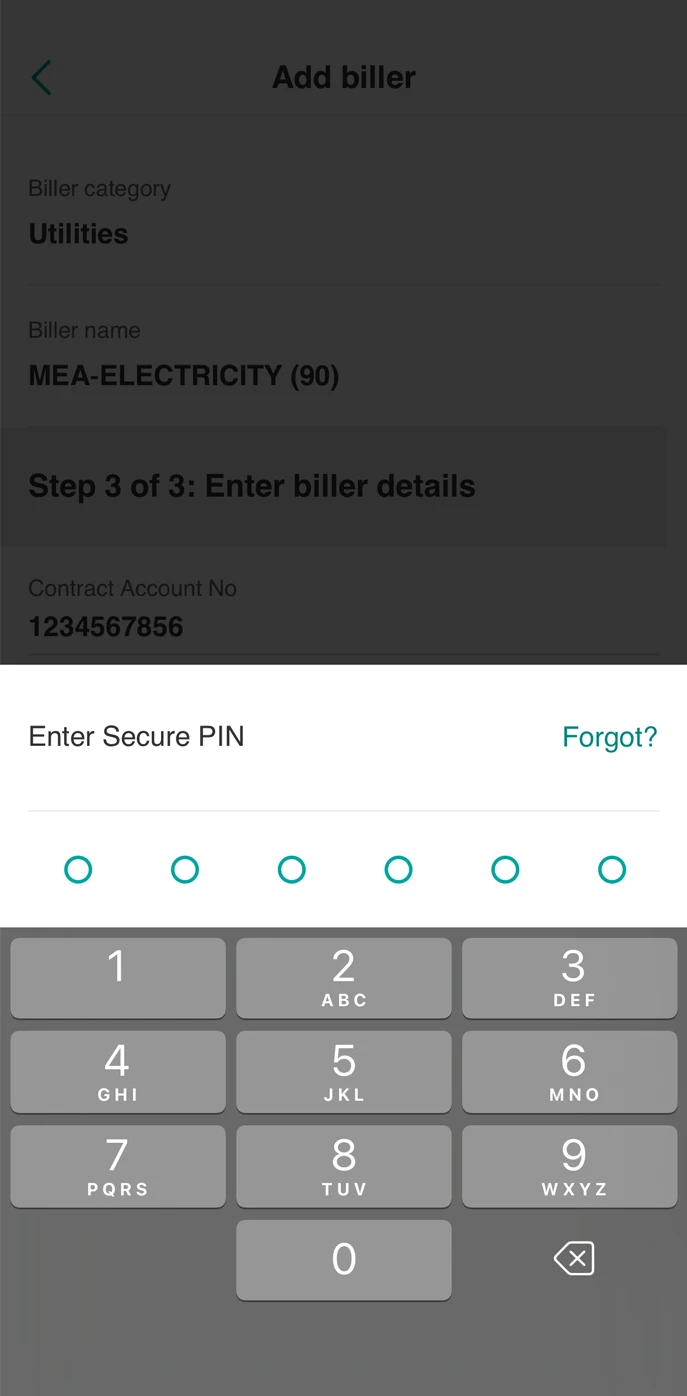

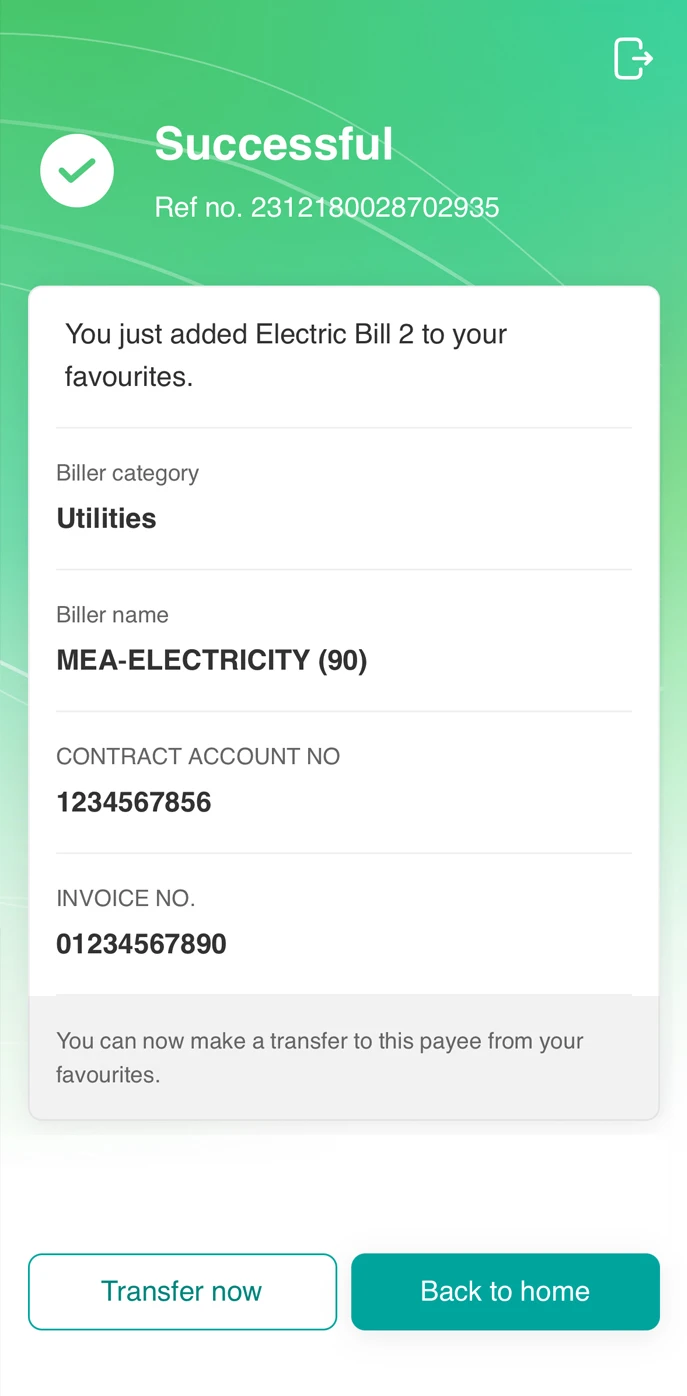

2. Add favourite biller

1. Log in to UOB TMRW and tap on “Favourites”.

2. Under “Billers”, tap on “Add billers” at the bottom of the screen.

3. Select biller category, then select biller name.

4. Enter biller details, then confirm with your Secure PIN.

5. Successfully added a biller to Favourites.

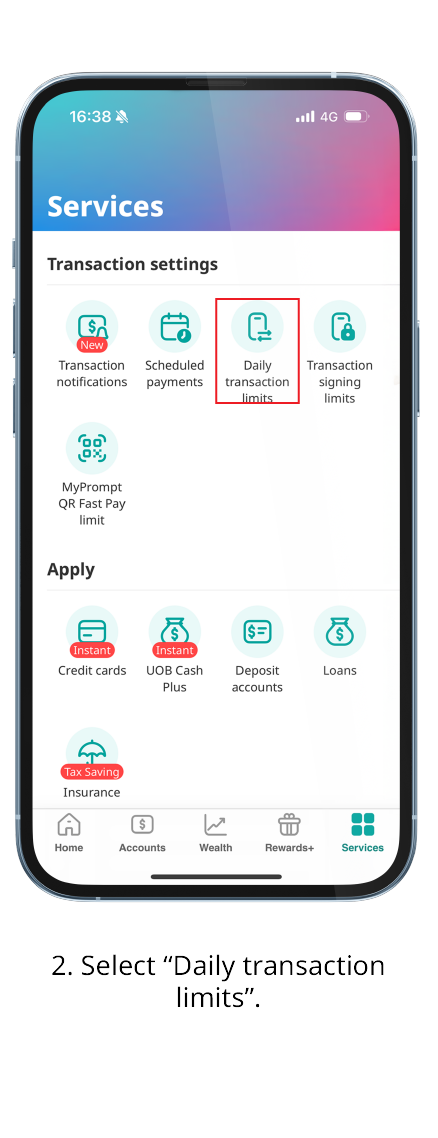

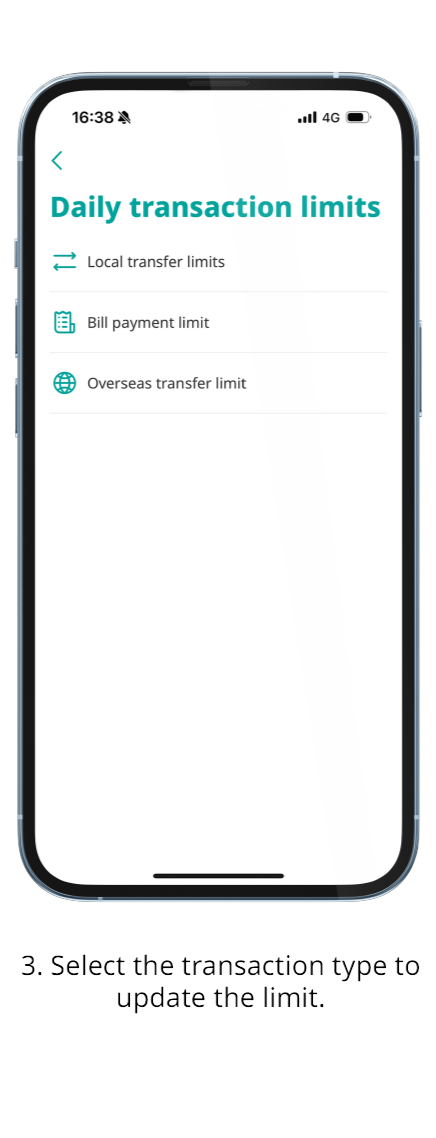

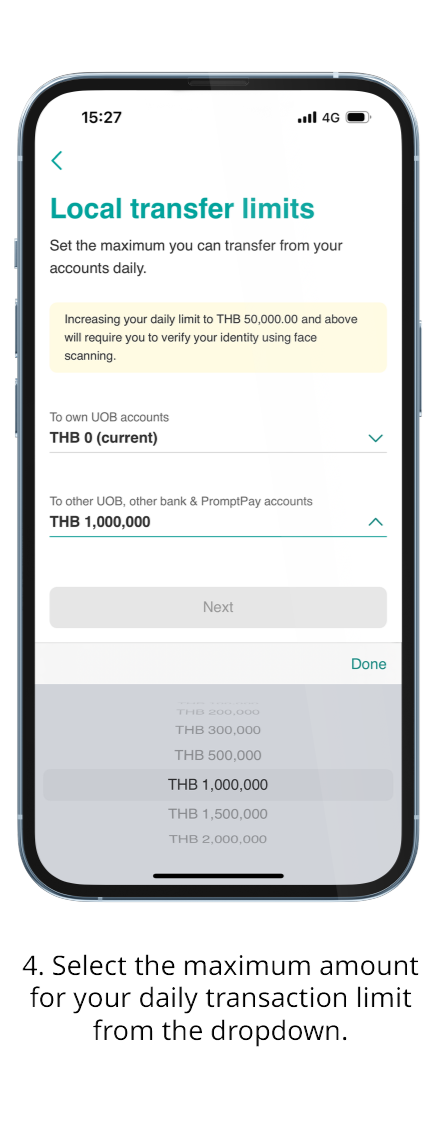

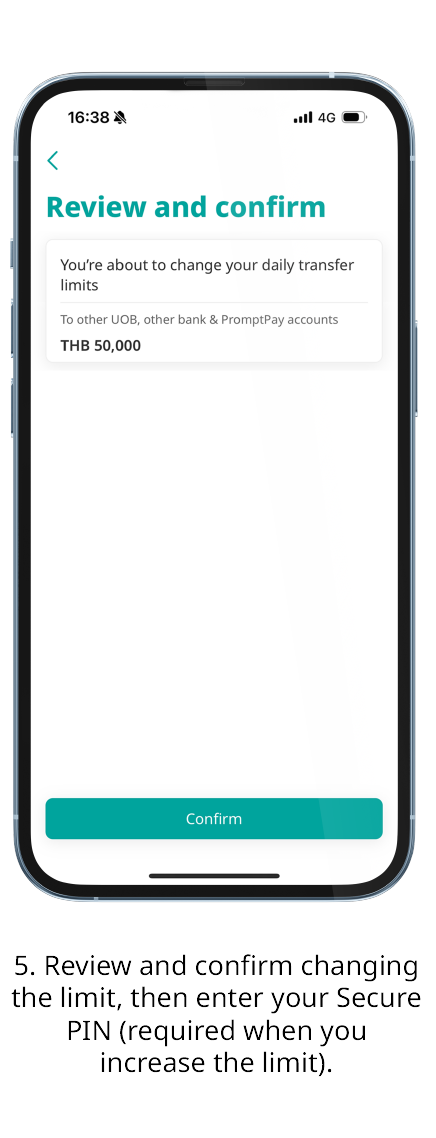

Manage limits for transfers and bill payments

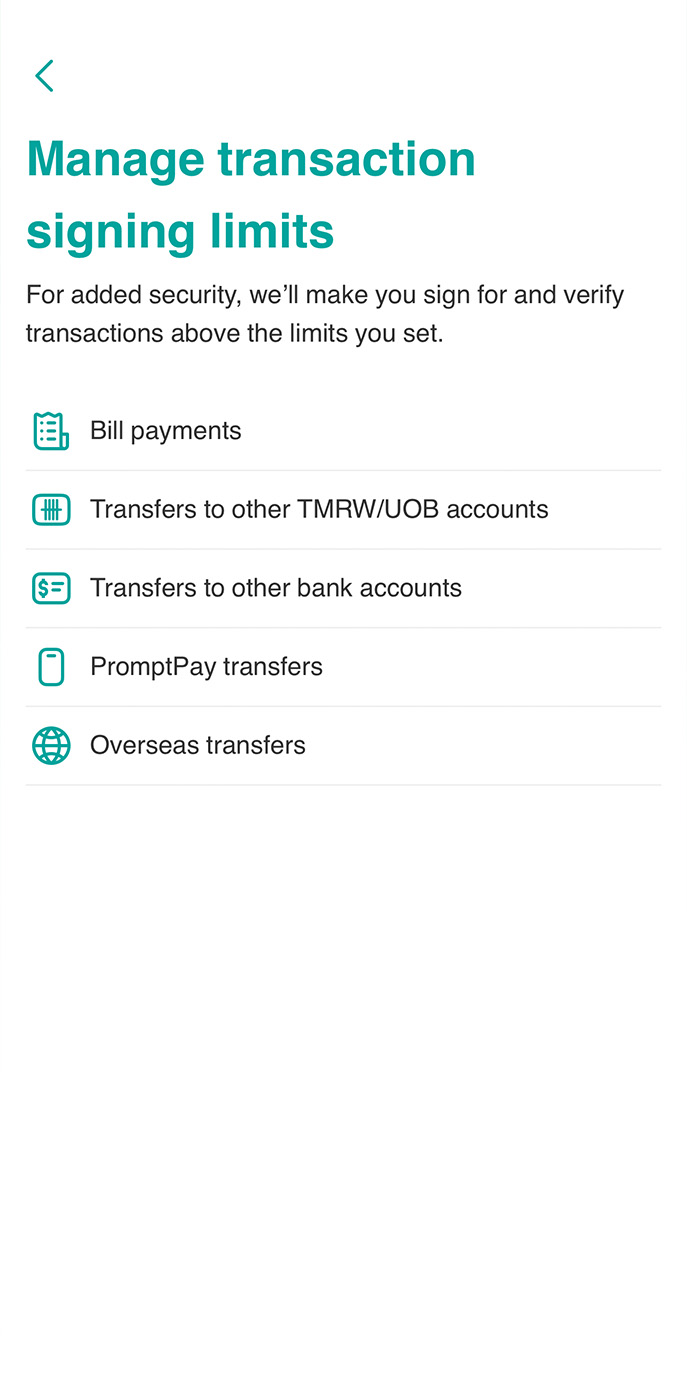

1. Change daily transaction limits

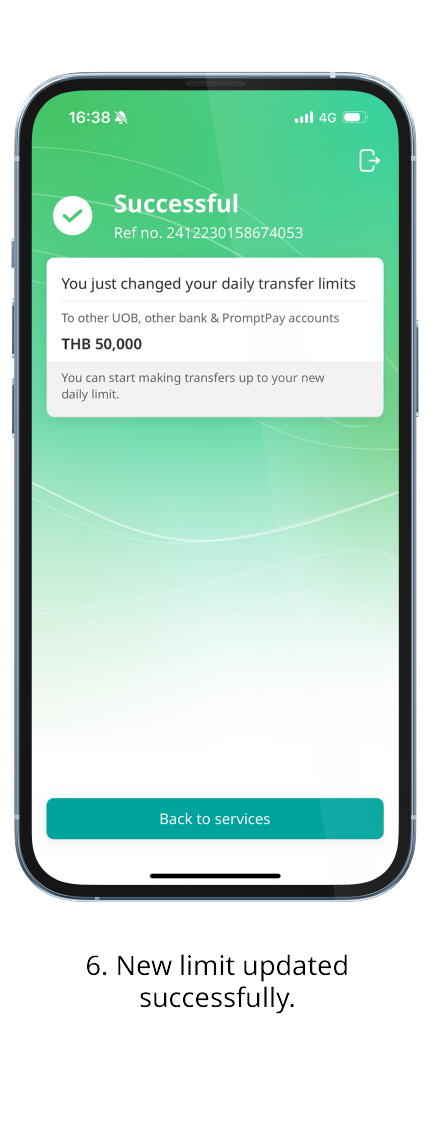

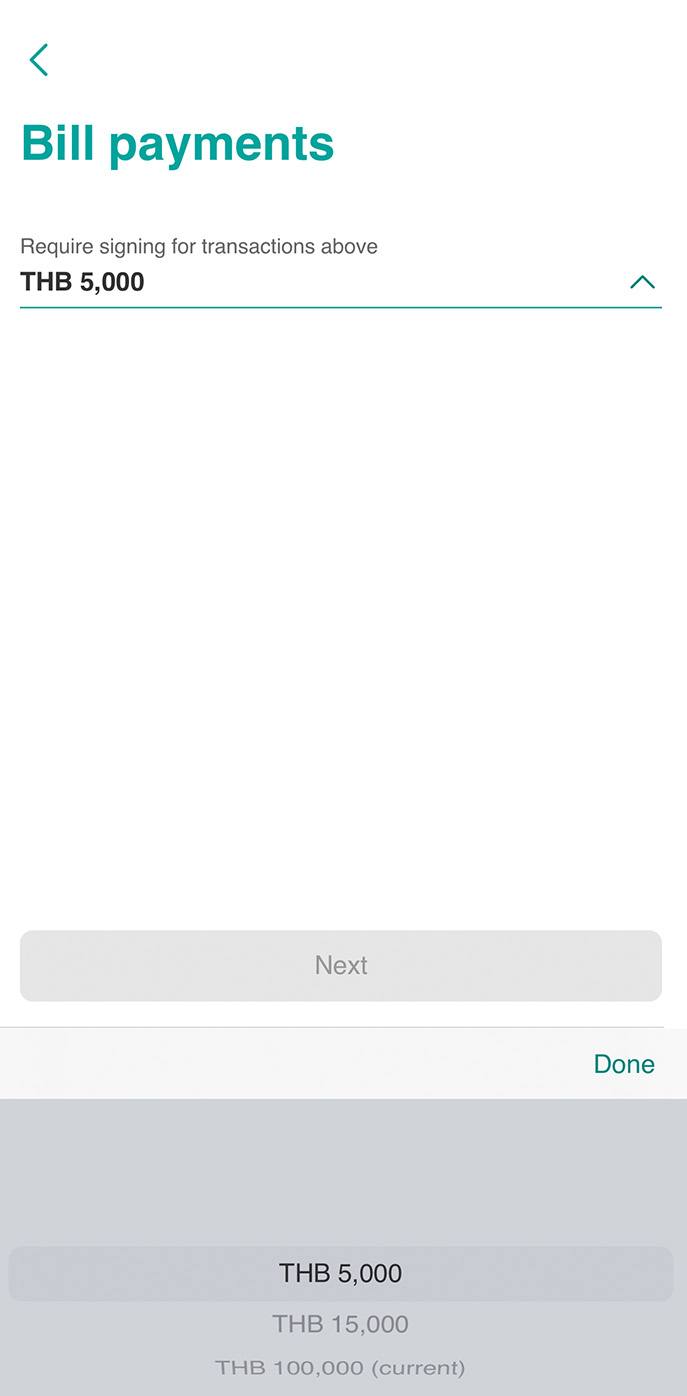

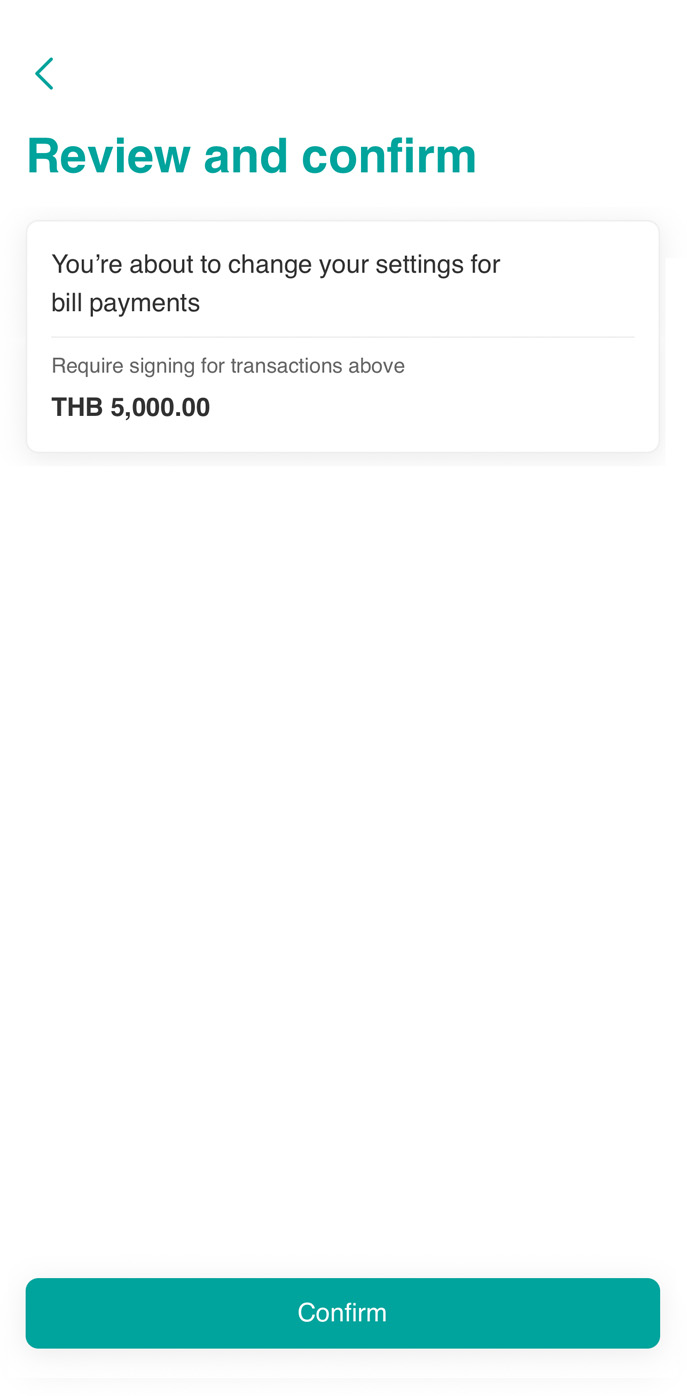

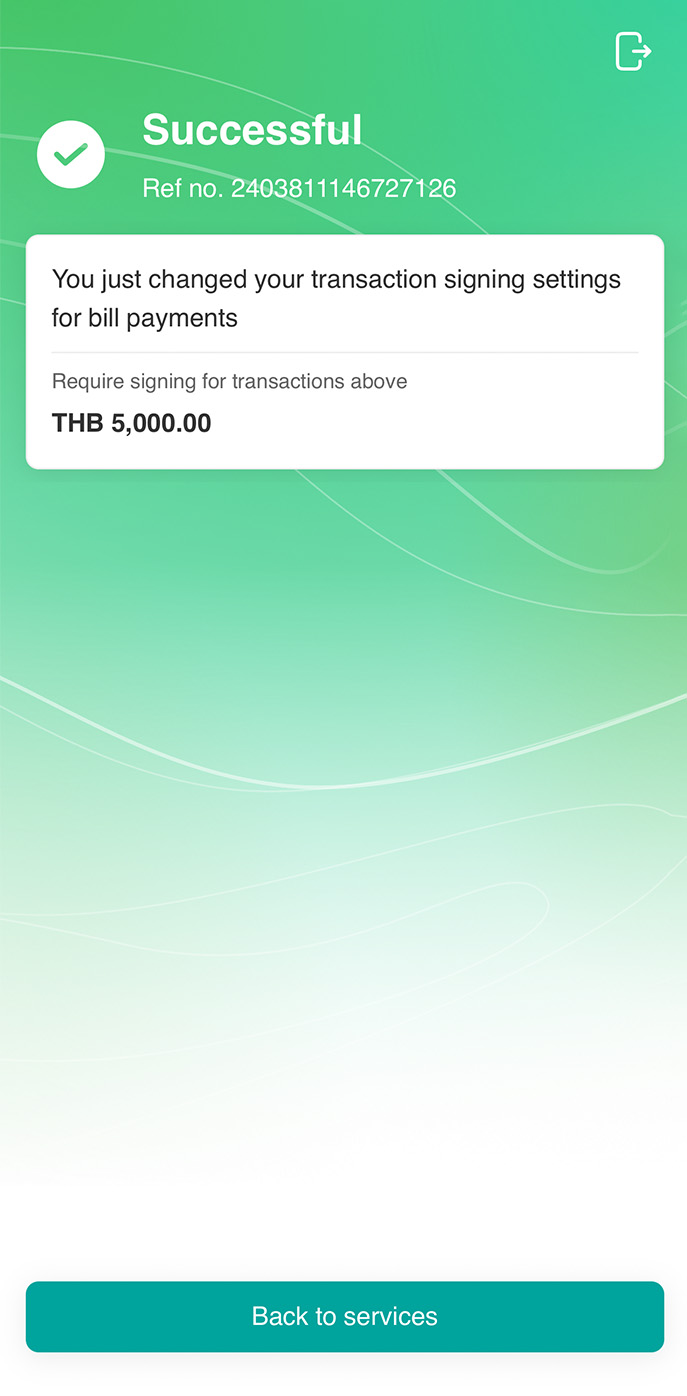

2. Change transaction signing limits

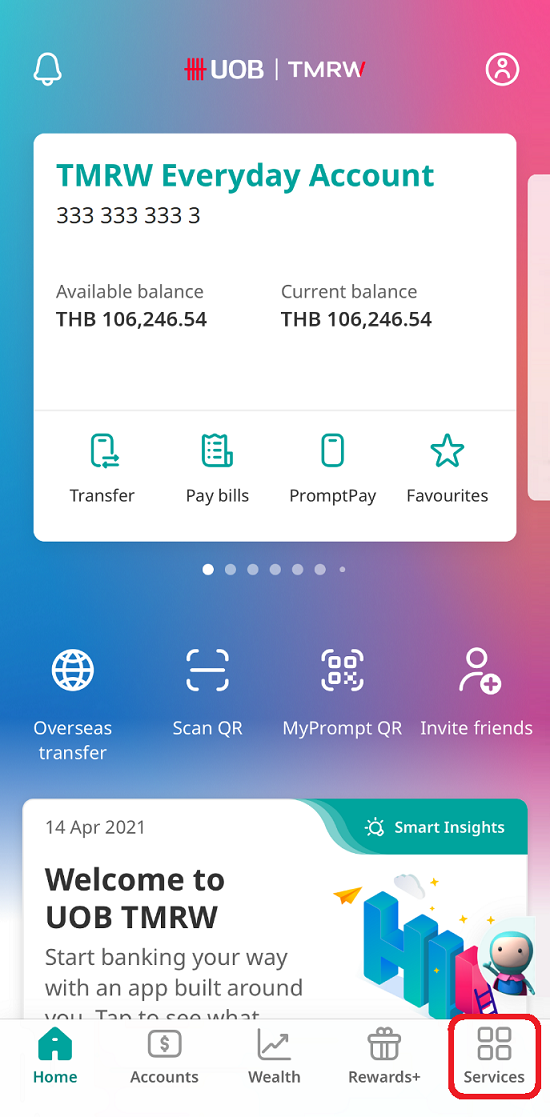

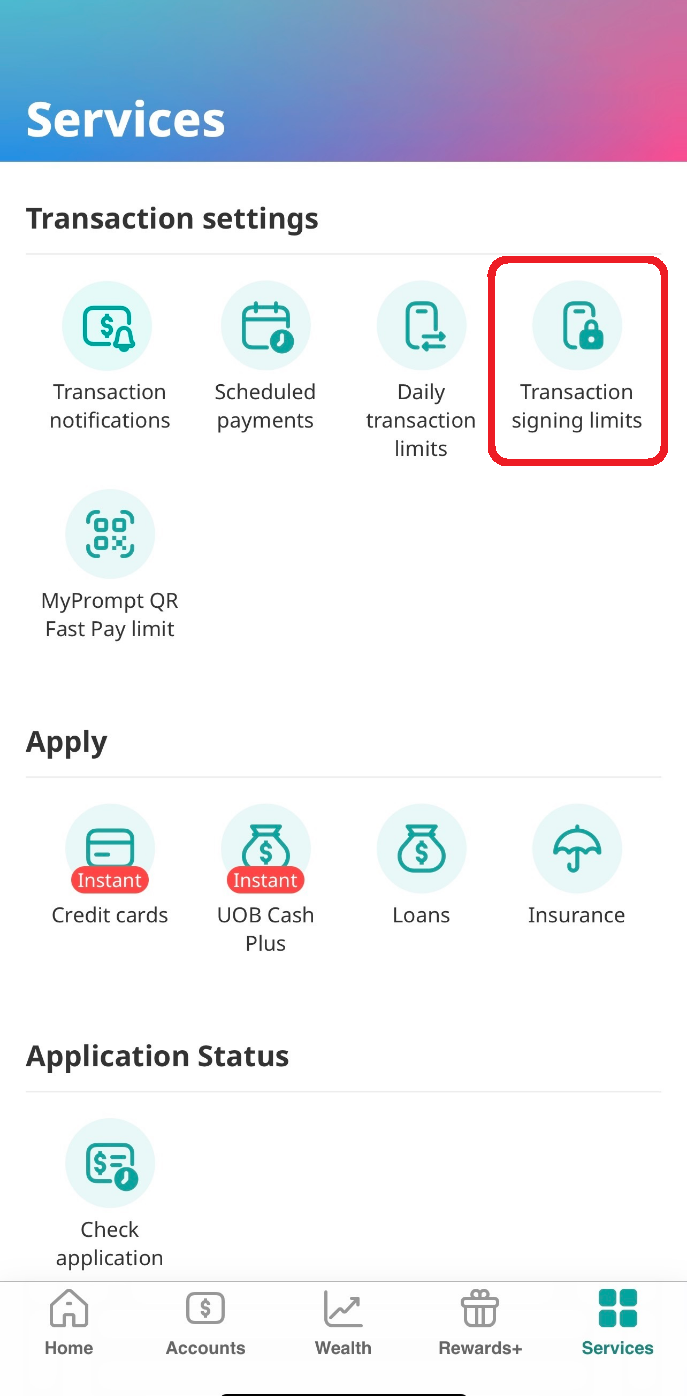

1. Log in to UOB TMRW and tap on “Services”.

2. Select “Transaction signing limits”.

3. Select the type of transaction you wish to edit the signing limit.

4. Set the amount required to use Secure PIN to approve transaction.

5. Review and confirm details (in case of limit increasing, you’ll be prompted to enter Secure PIN to confirm).

6. New limit setting is now changed with immediate effect.

Make loan payment with own UOB deposit account

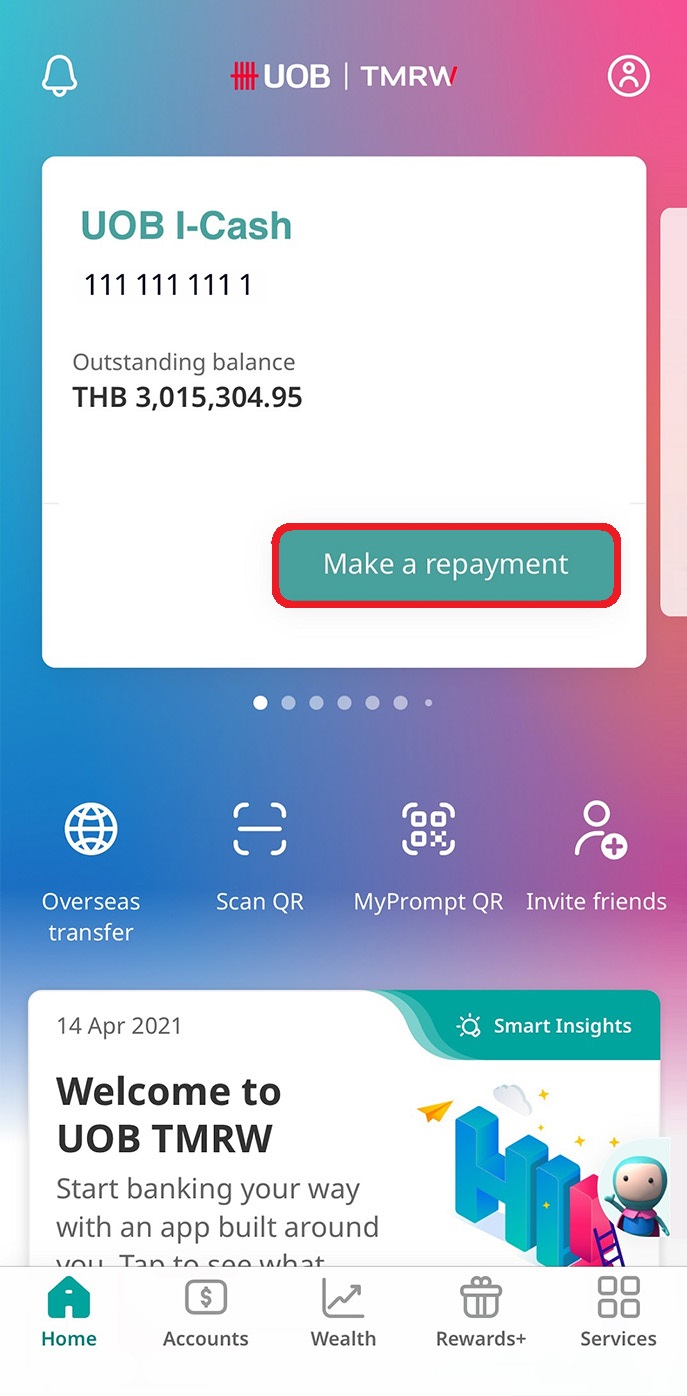

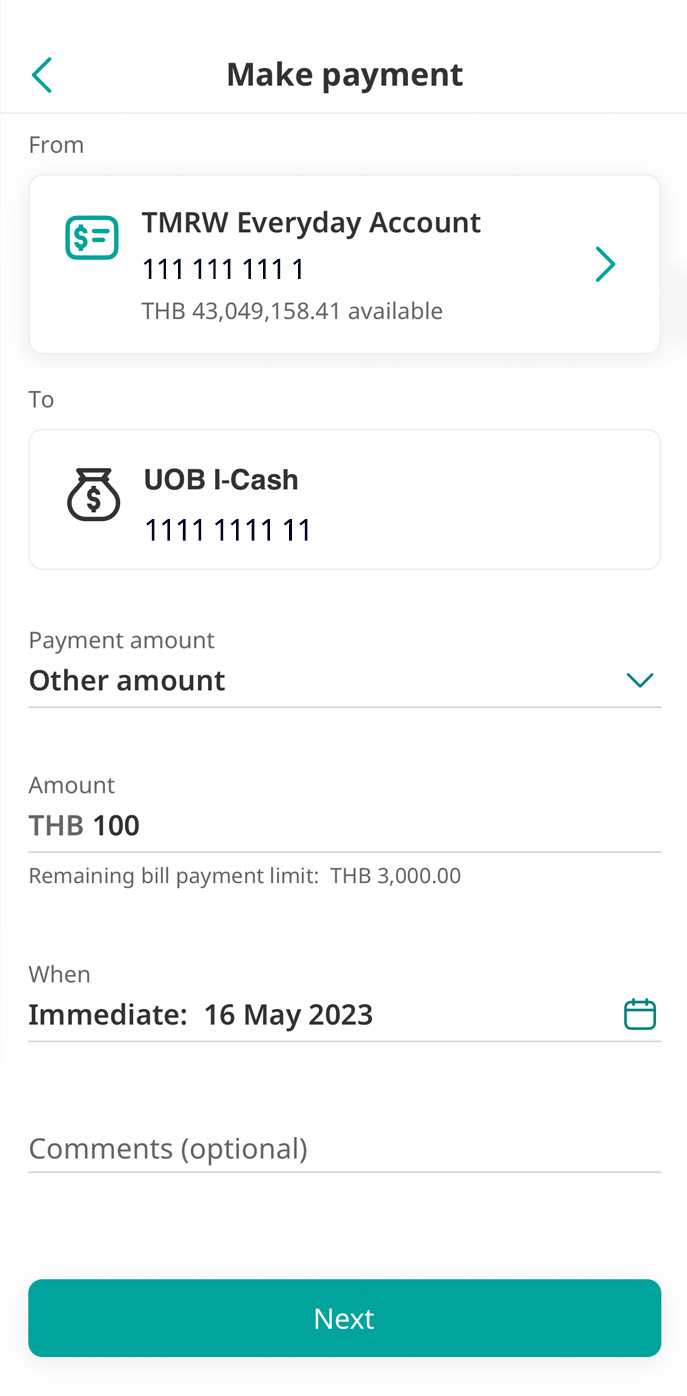

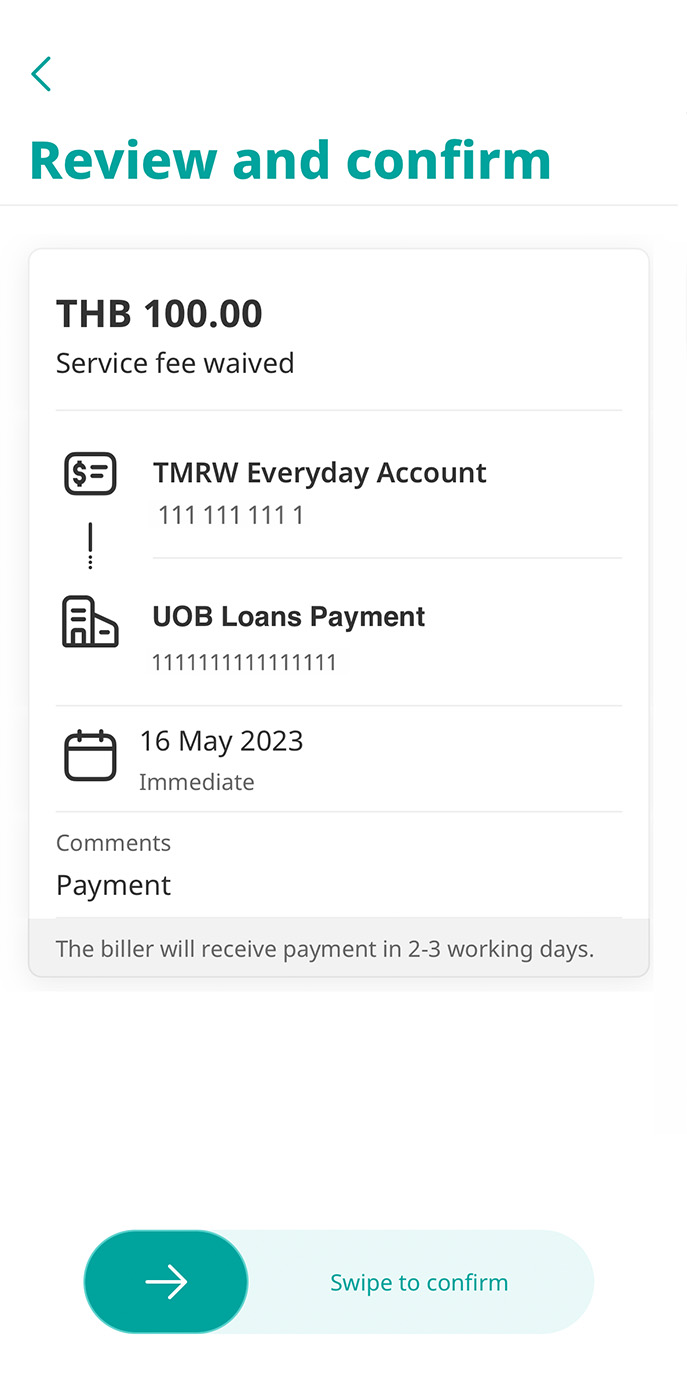

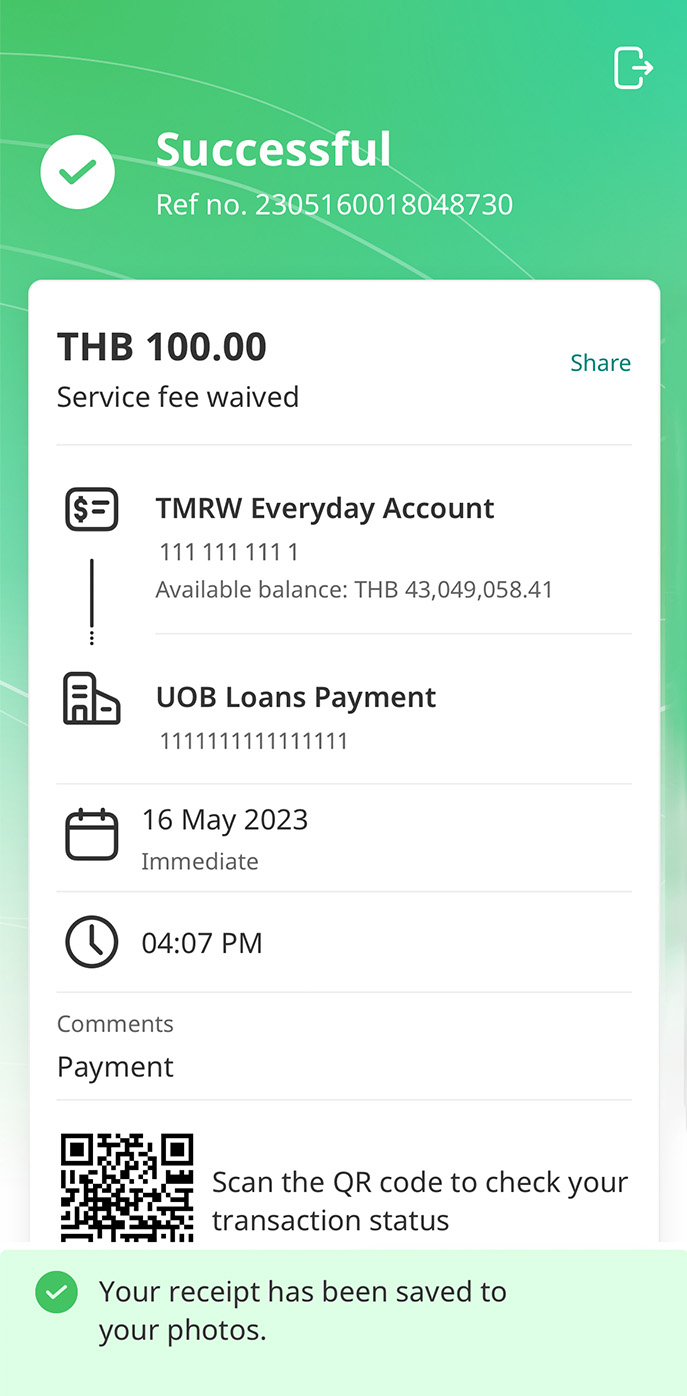

1. Pay for UOB I-Cash personal loan

1. Log in to UOB TMRW and navigate to your UOB I-Cash account and select “Make a repayment” button.

2. Select your UOB deposit account to pay from. Input or set the amount and date of payment.

3. Review the details and swipe to confirm your transaction.

4. Payment successful, receipts are saved in your photo album.

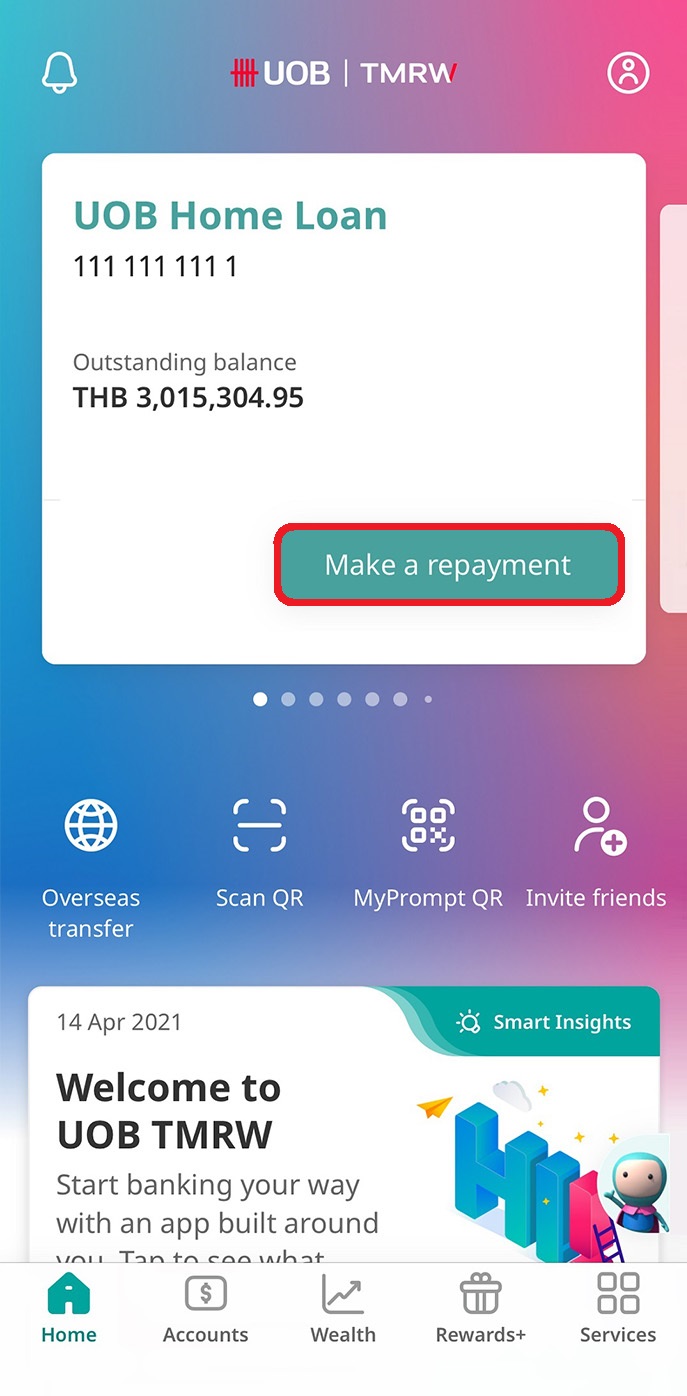

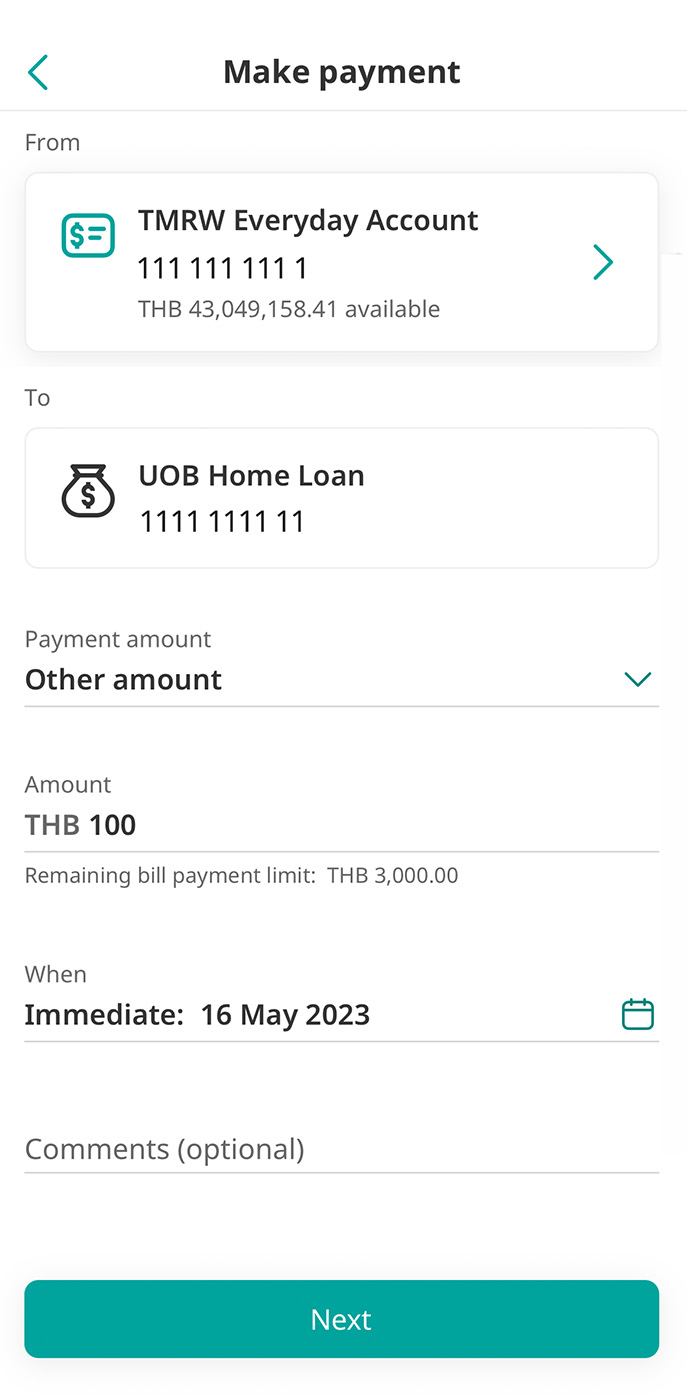

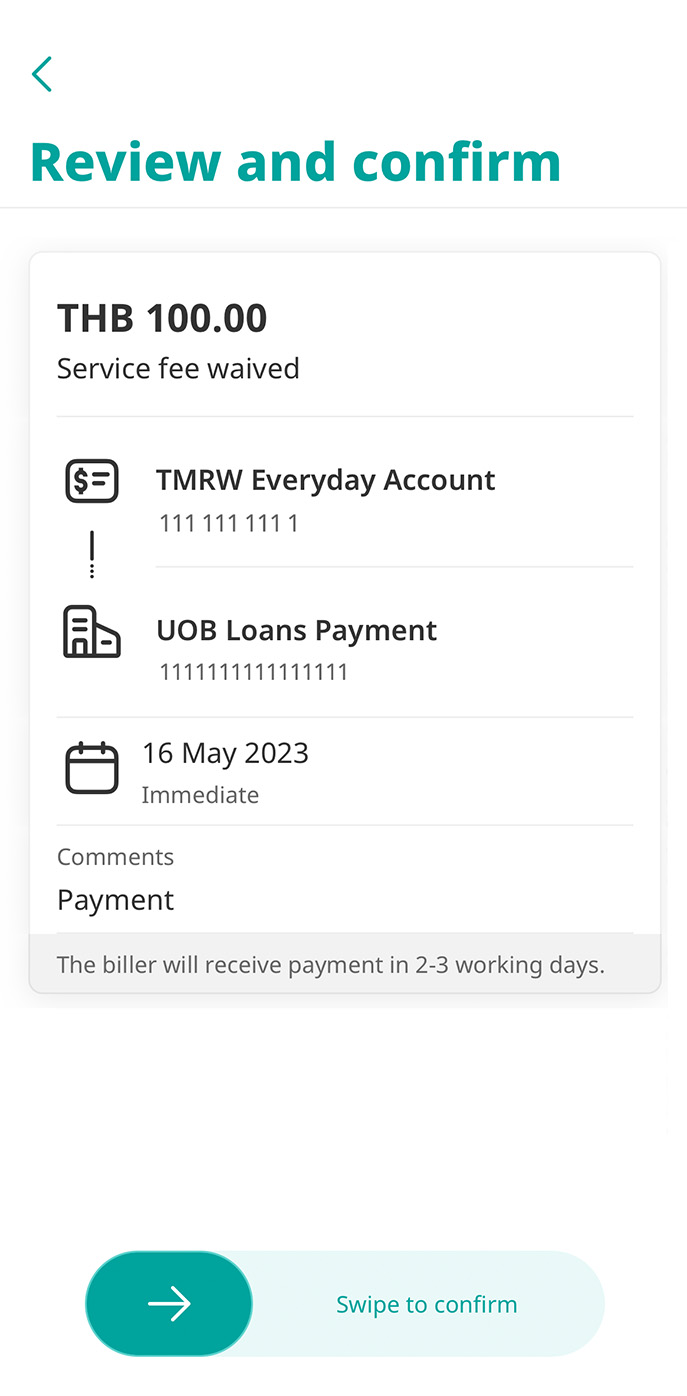

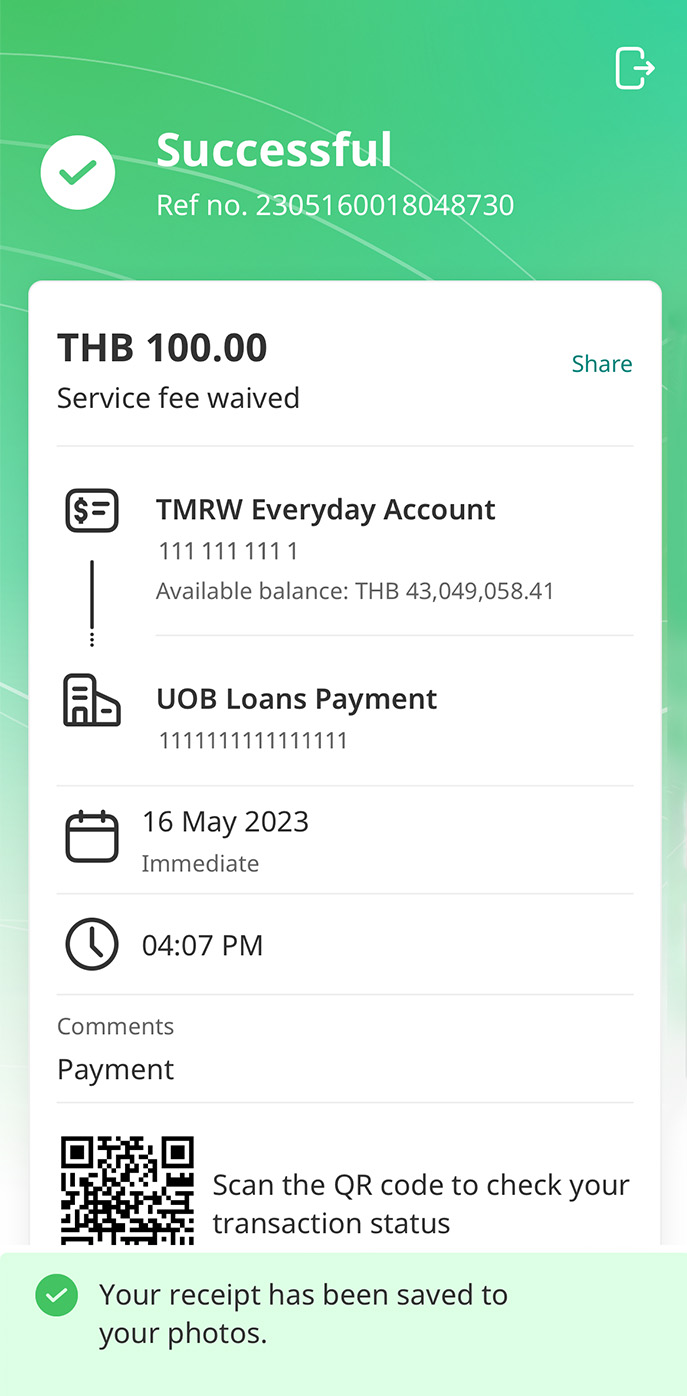

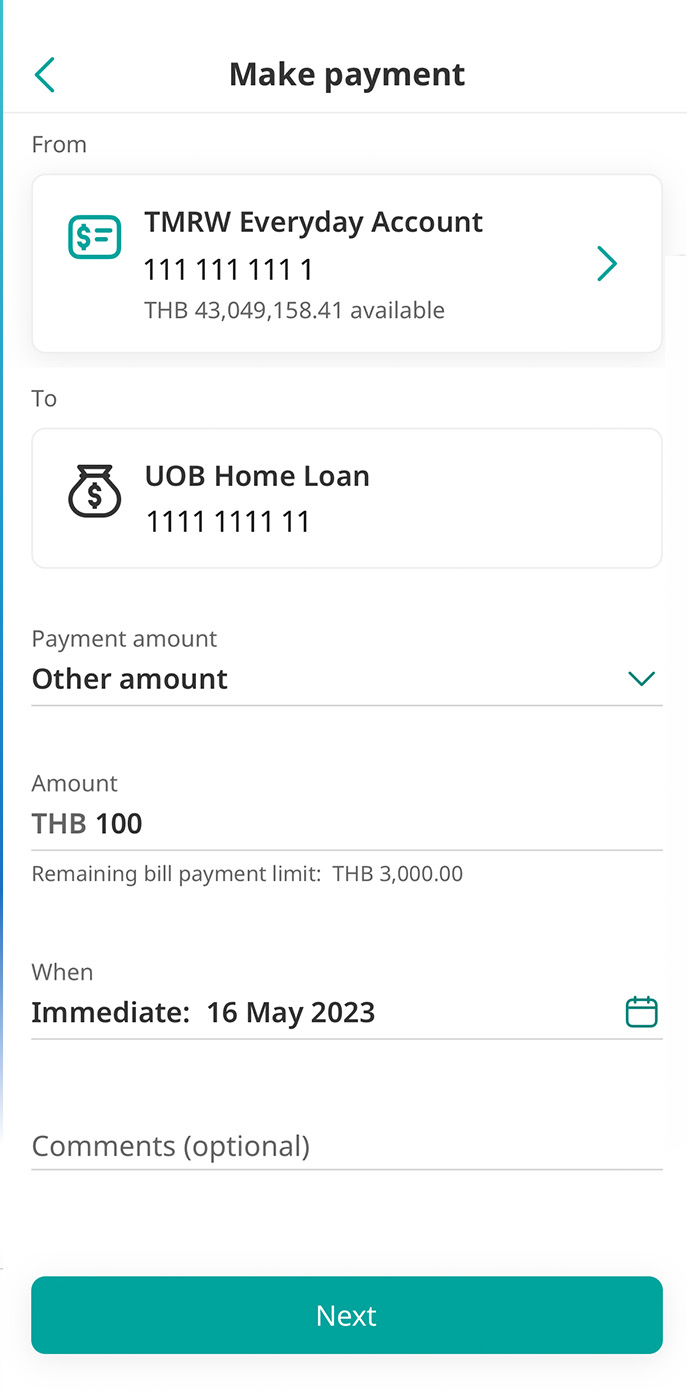

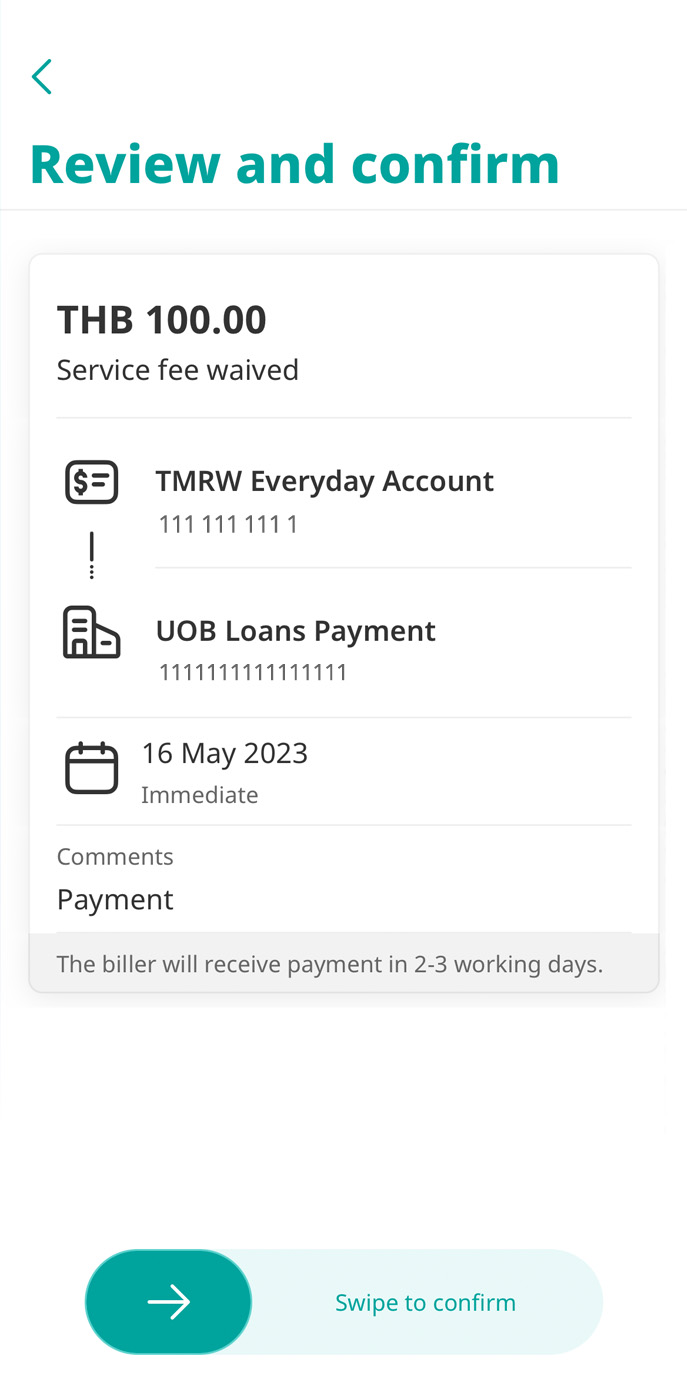

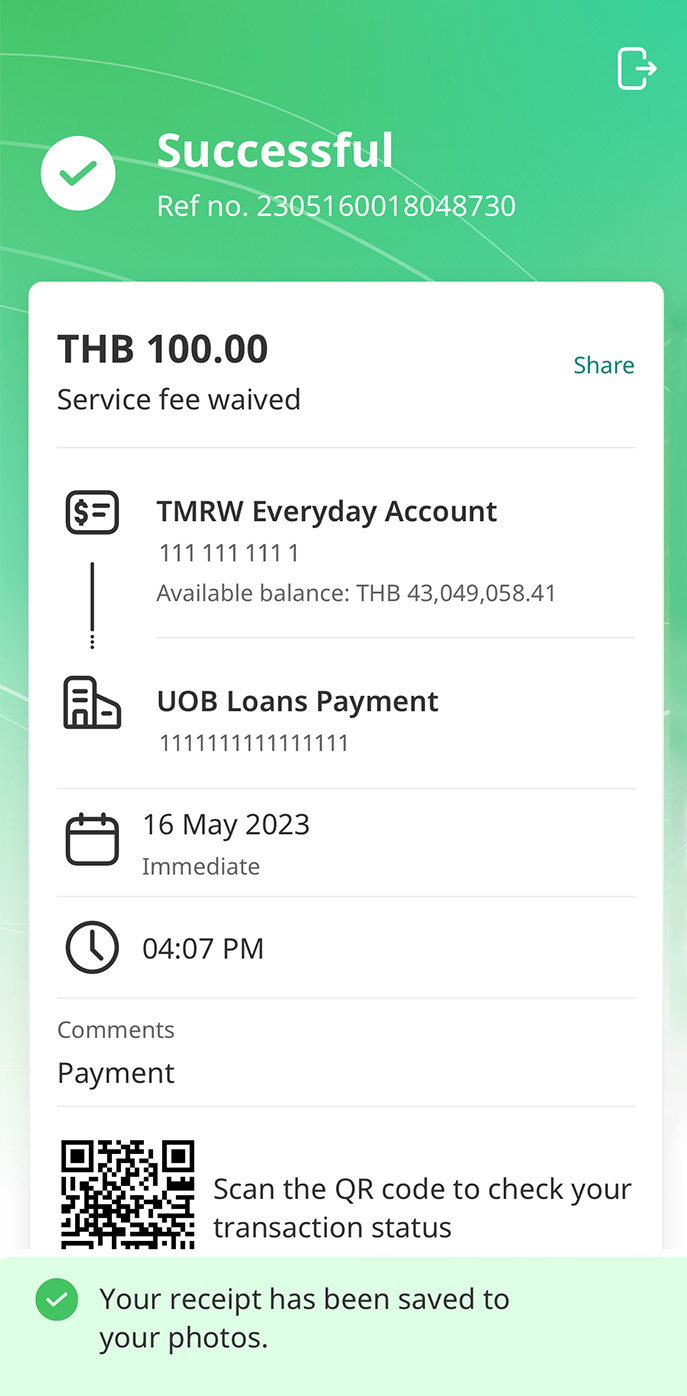

2. Pay for UOB Home Loan

1. Log in to UOB TMRW and navigate to your UOB Home Loan account and select “Make a repayment” button.

2. Select your UOB deposit account to pay from. Input or set the amount and date of payment.

3. Review the details and swipe to confirm your transaction.

4. Payment successful, receipts are saved in your photo album.

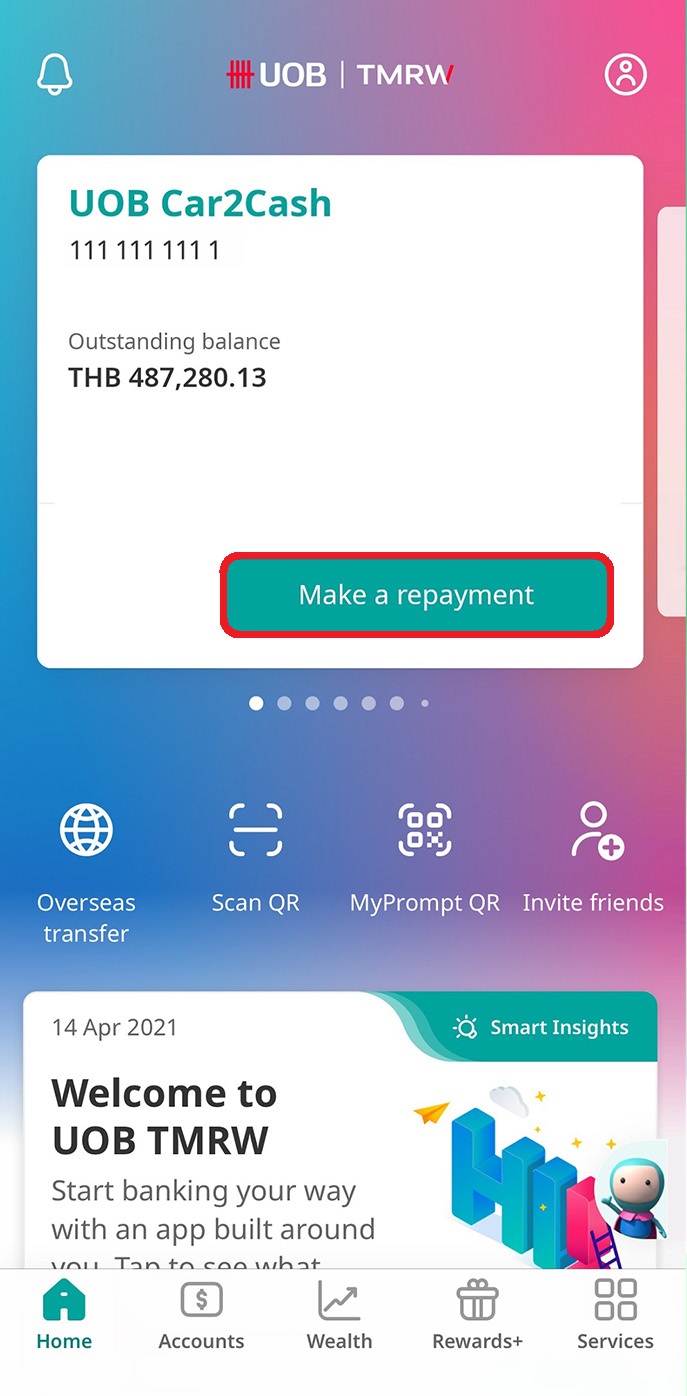

3. Pay for UOB Car2Cash loan

1. Log in to UOB TMRW and navigate to your UOB Car2Cash account and select “Make a repayment” button.

2. Select your UOB deposit account to pay from. Input or set the amount and date of payment.

3. Review the details and swipe to confirm your transaction.

4. Payment successful, receipts are saved in your photo album.

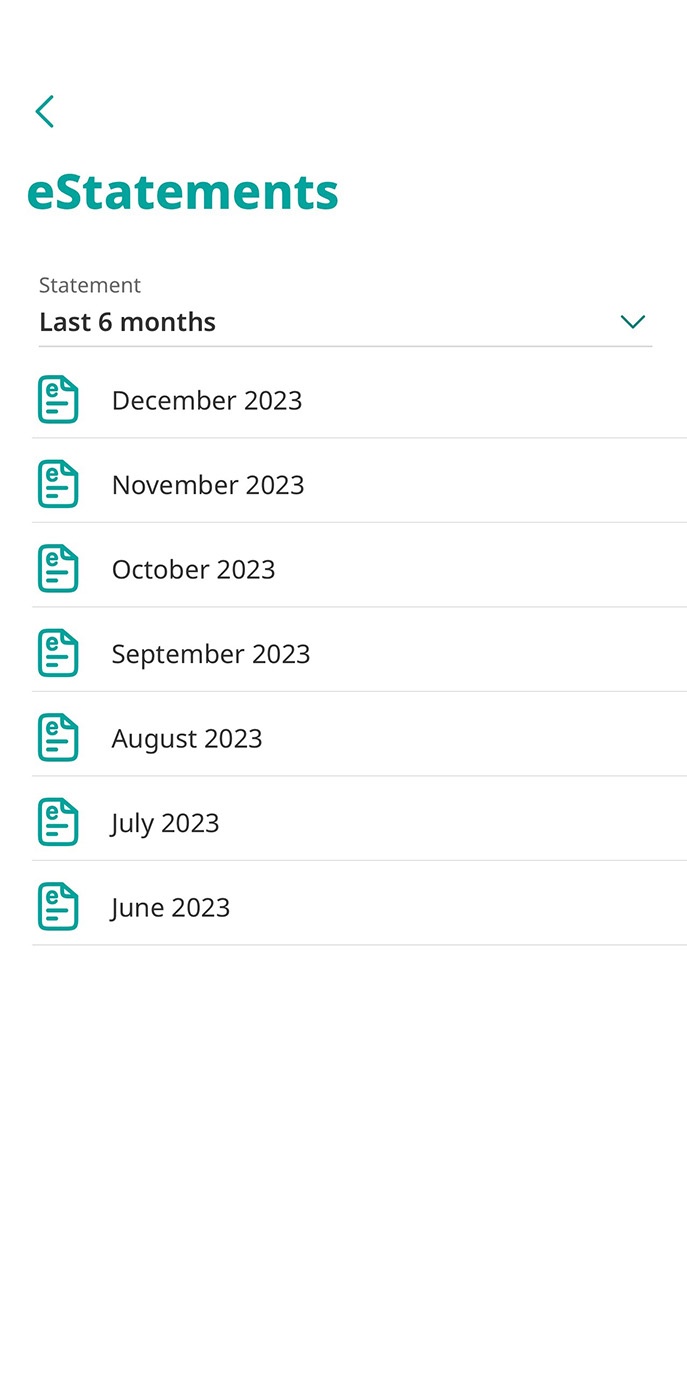

Monthly statements for deposit accounts (eStatements)

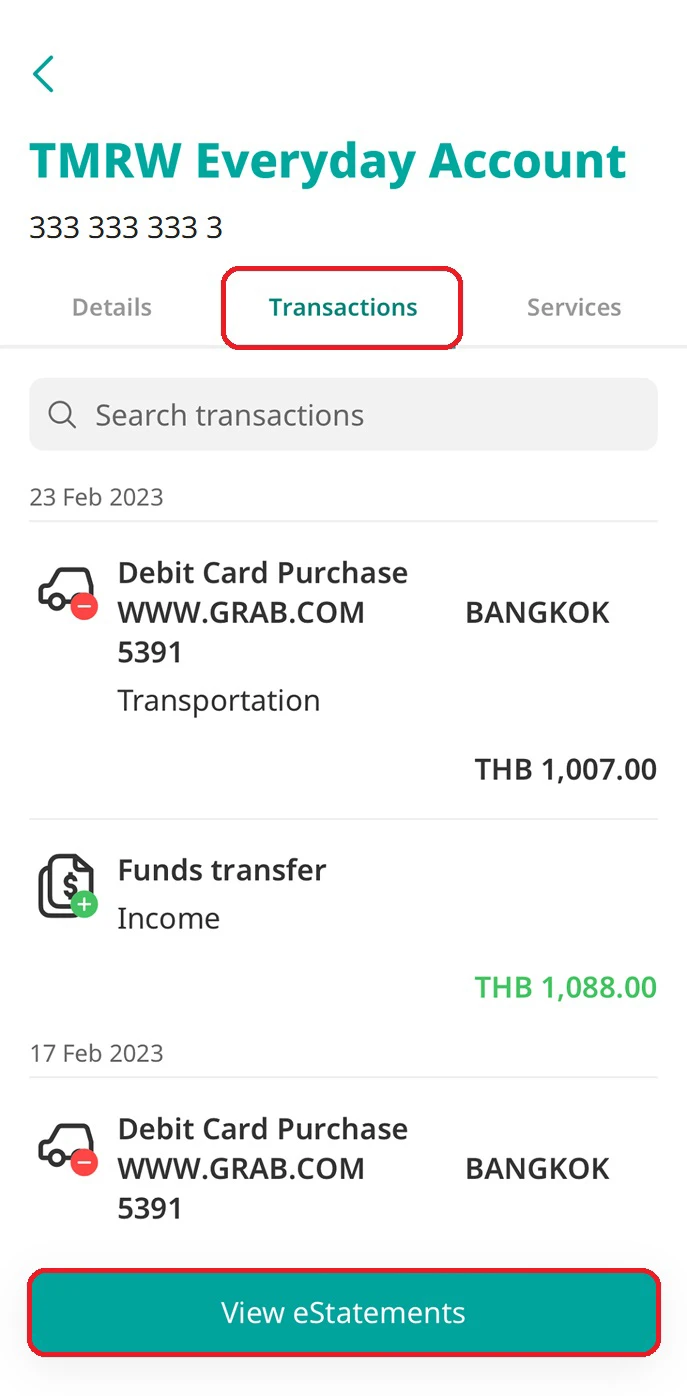

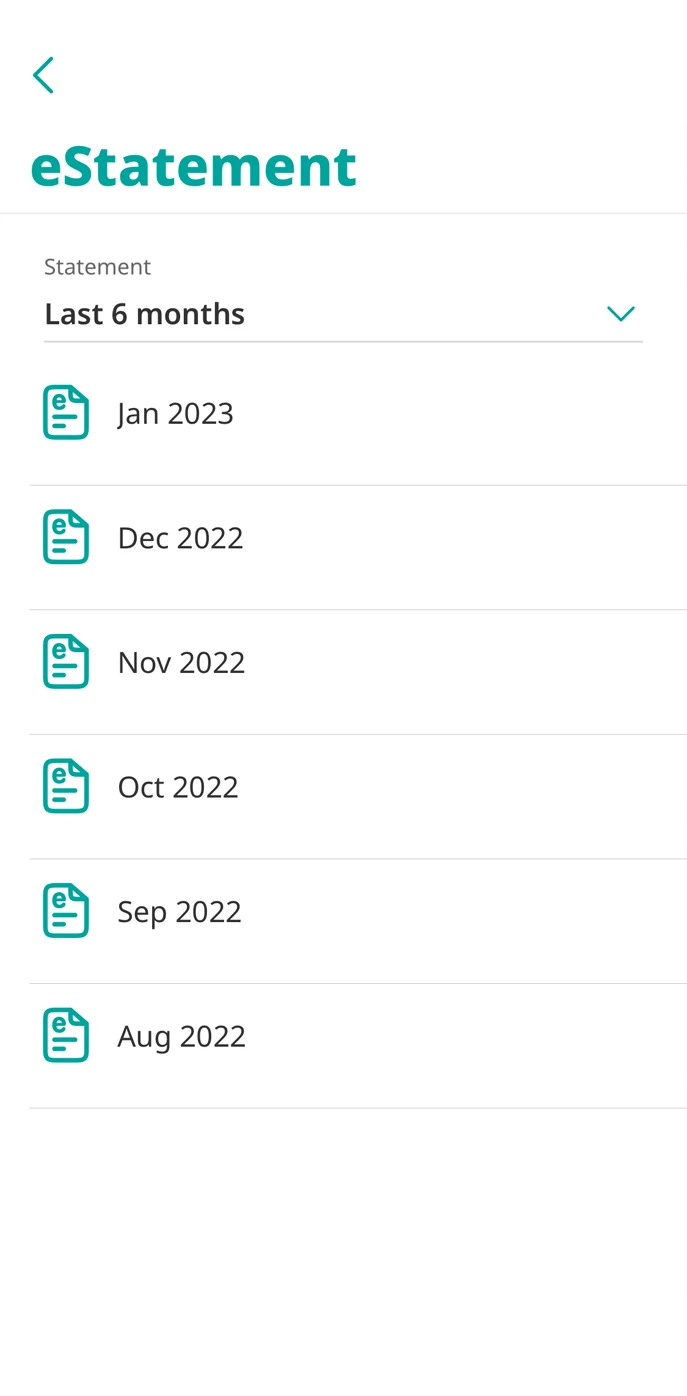

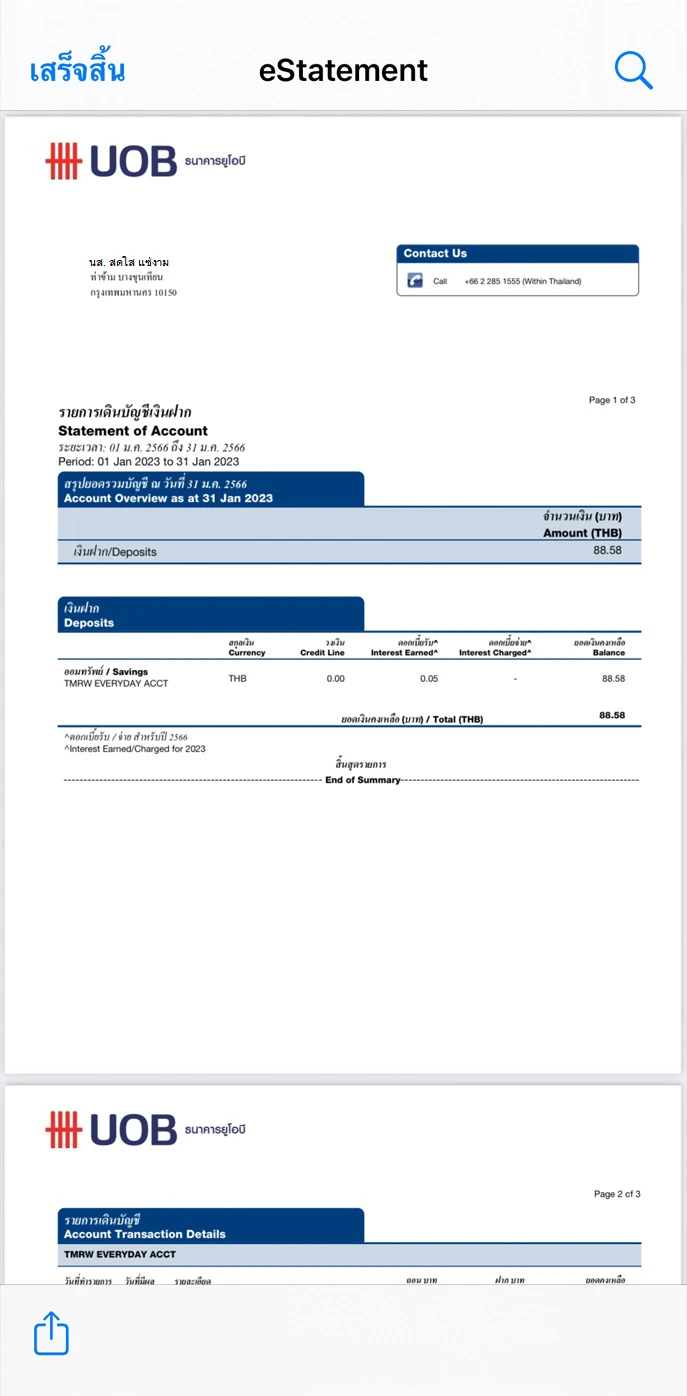

1. View eStatements for deposit accounts without passbooks

1. Log in to UOB TMRW and select your deposit account to view eStatements (accounts with passbooks won’t have eStatements).

2. Select “Transactions”, then tap on “View eStatements” at the bottom of the screen.

3. Select the month to view details.

4. The PDF of your eStatement can be downloaded or shared via email instantly.

Card Services

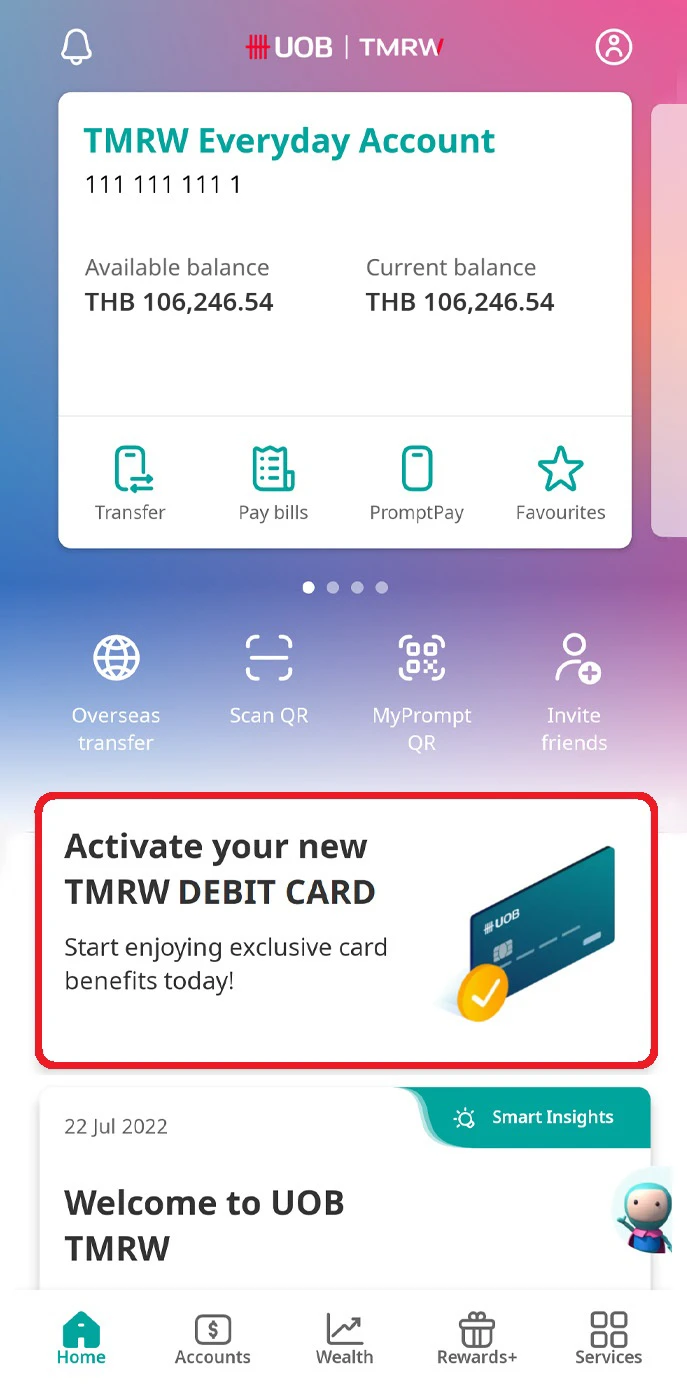

Card activation via UOB TMRW

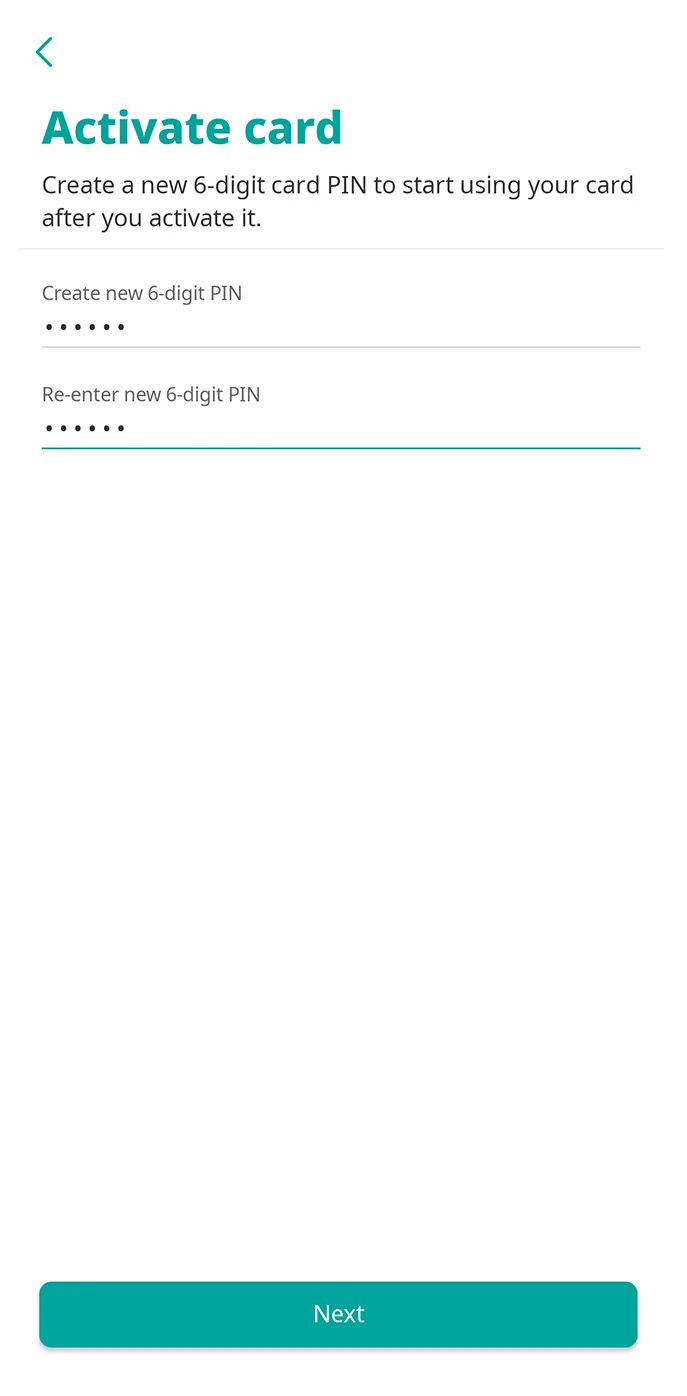

1. Activate debit card

1. Log in to UOB TMRW and tap on Card Activation insight card on the Home screen.

2. Create new 6-digit ATM PIN (you can use this newly created PIN and ignore the PIN mailed to you).

3. Enter your Secure PIN for authentication.

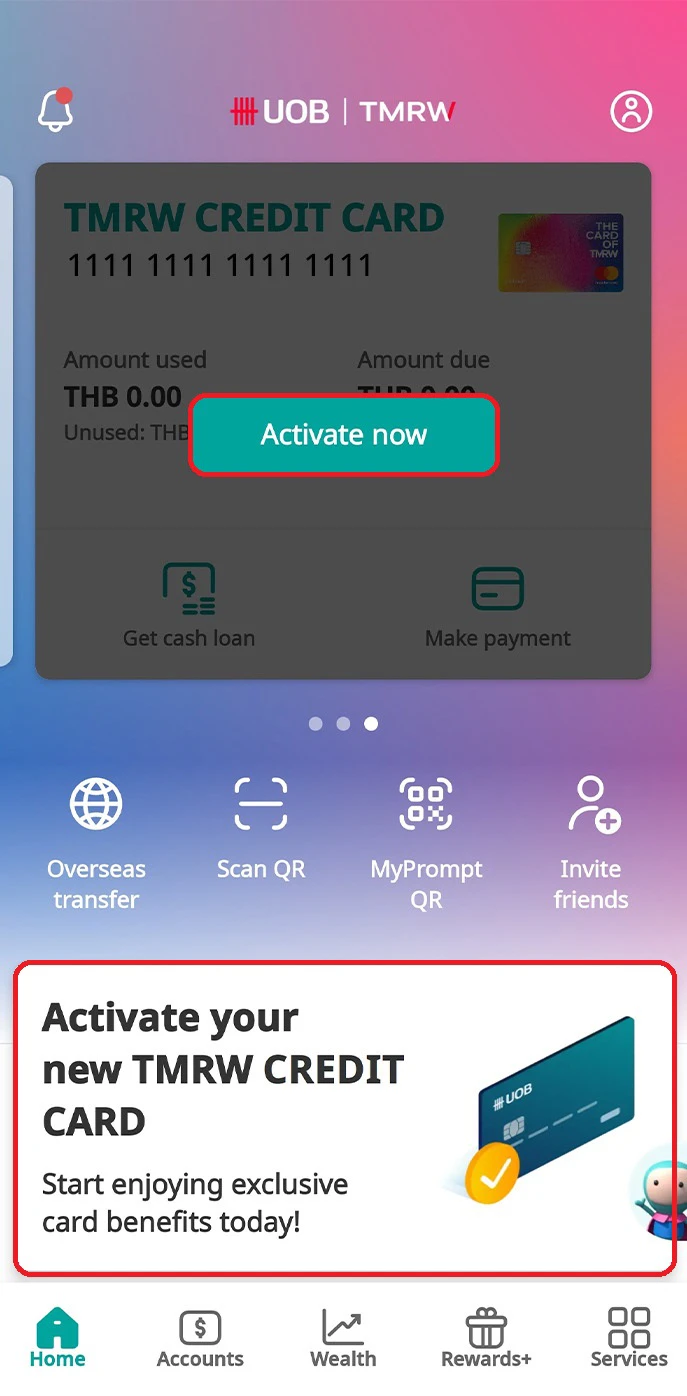

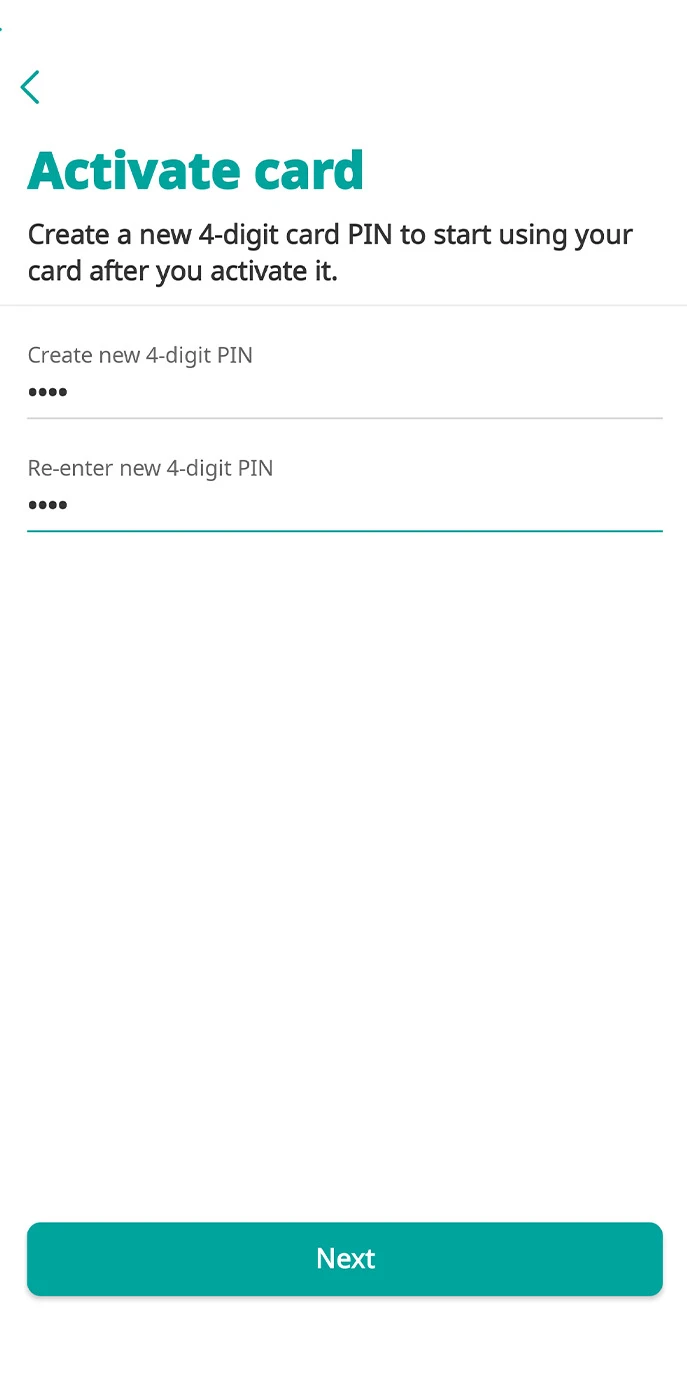

2. Activate credit card

1. Log in to UOB TMRW and tap on “Activate now” on your credit card account OR tap on Card Activation insight card on the Home screen.

2. Create new 4-digit ATM PIN (you can use this newly created PIN and ignore the PIN mailed to you).

3. Enter your Secure PIN for authentication.

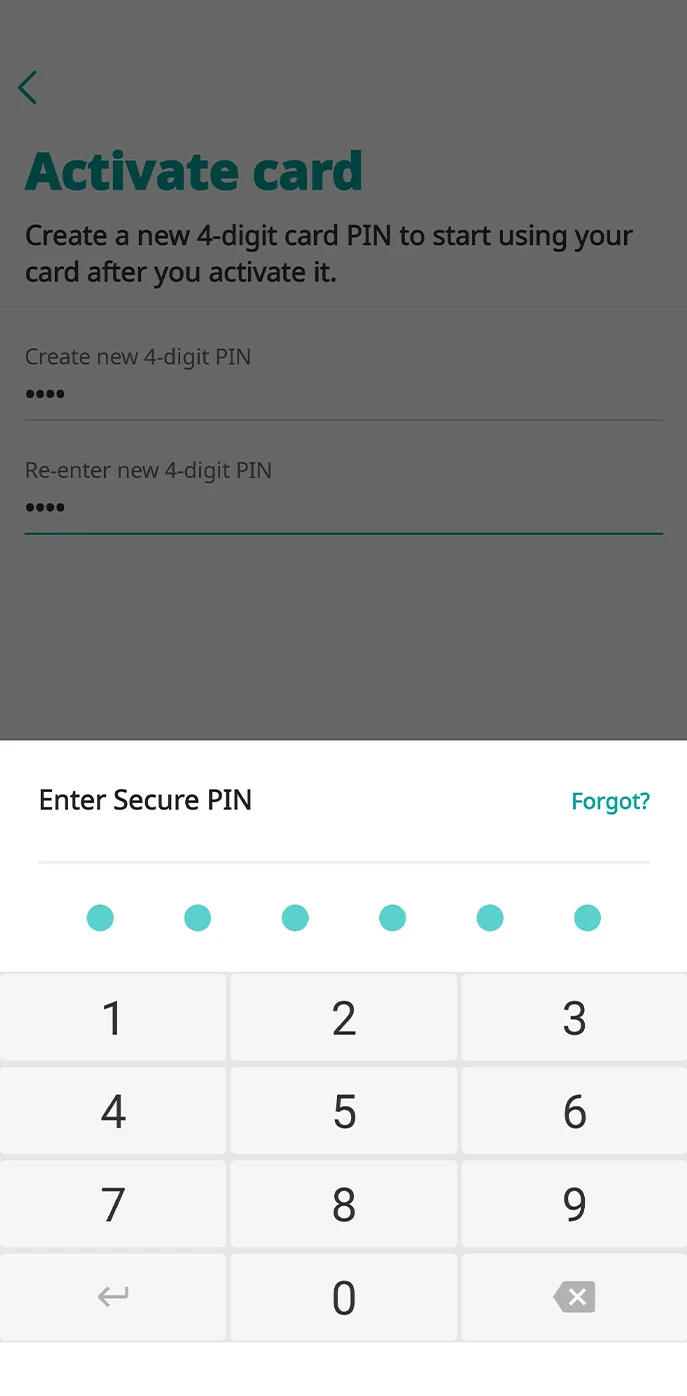

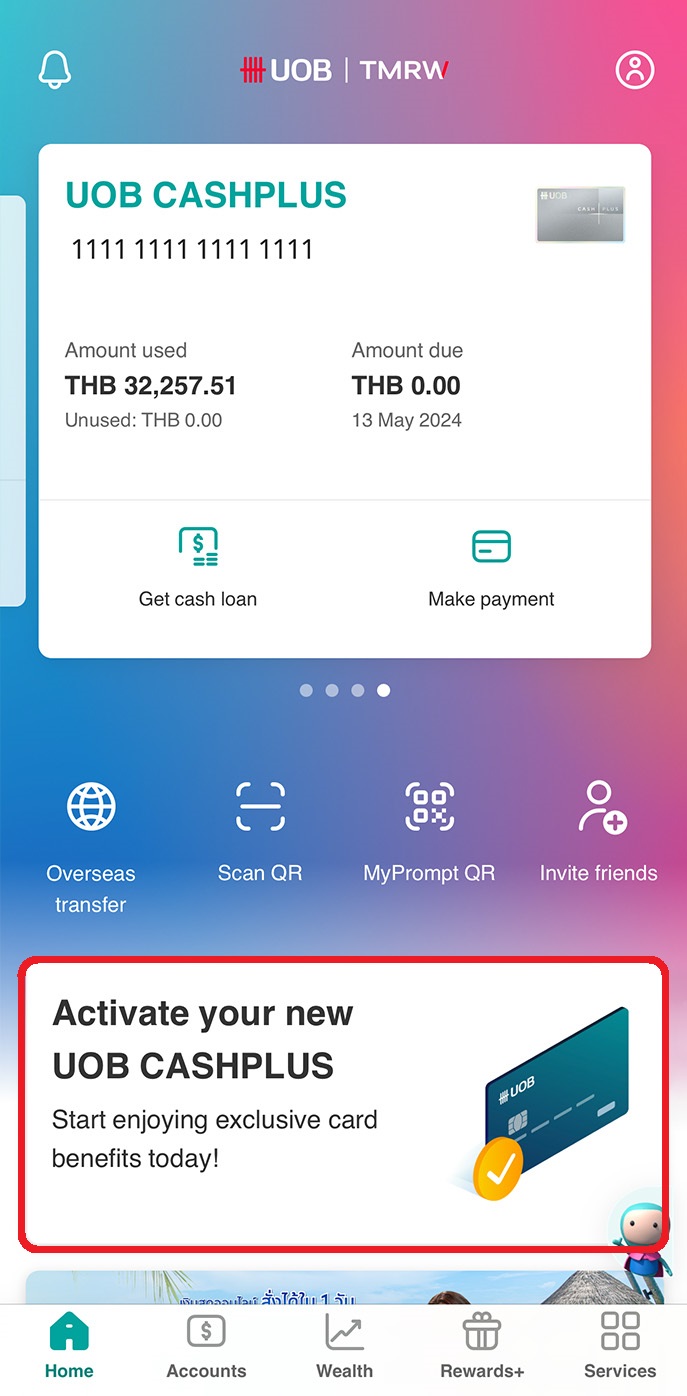

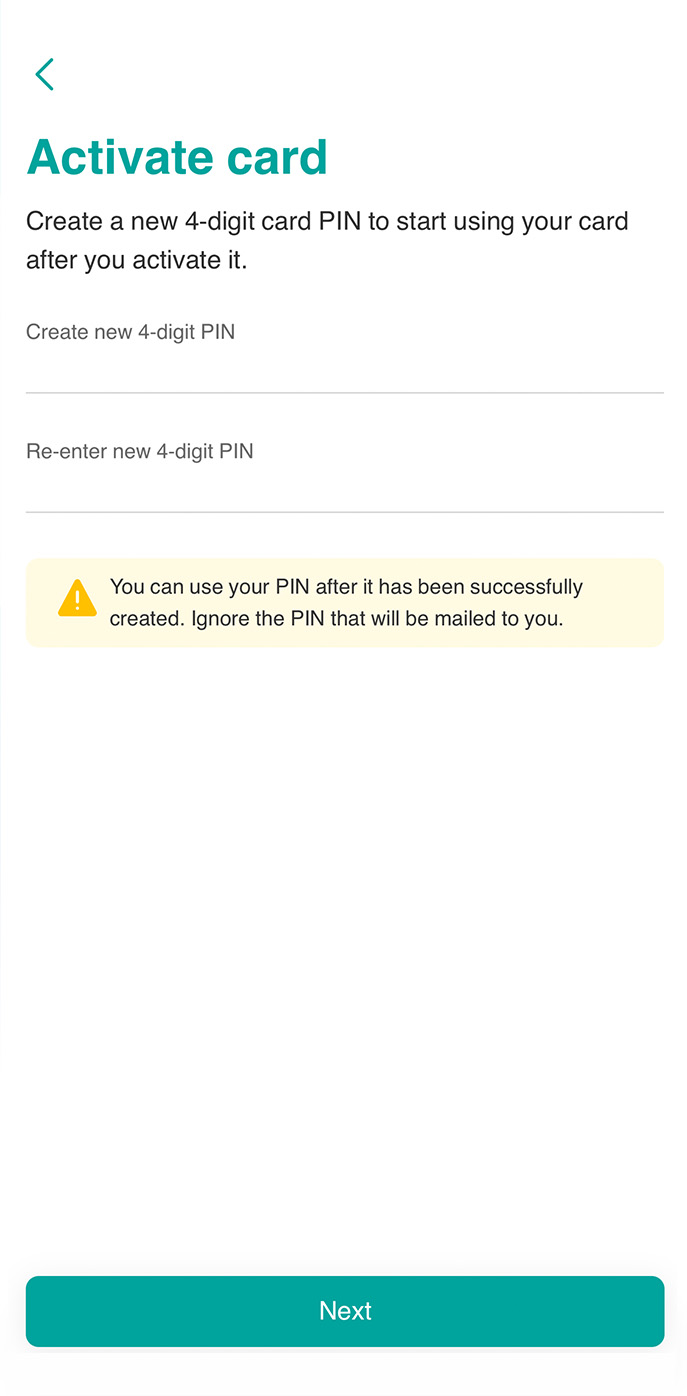

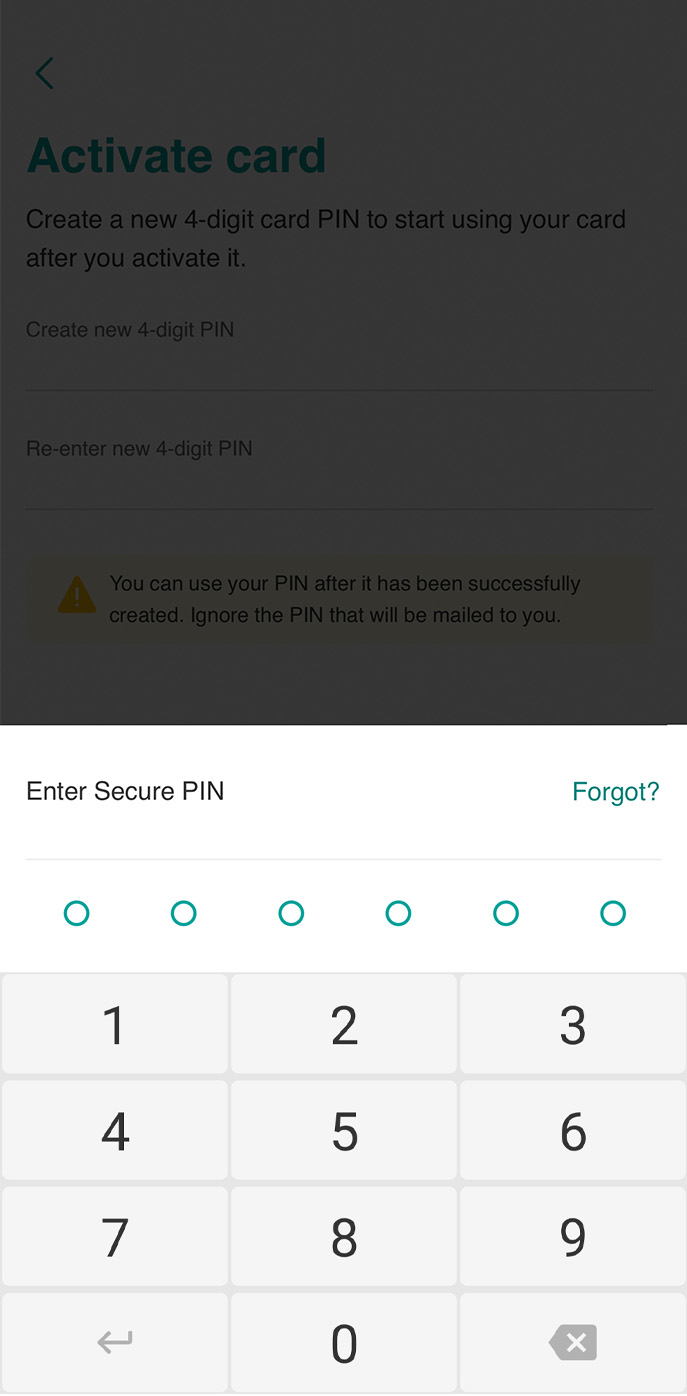

3. Activate UOB Cash Plus card

1. Log in to UOB TMRW and tap on Card Activation insight card for UOB Cash Plus on the Home screen.

2. Create new 4-digit ATM PIN (you can use this newly created PIN and ignore the PIN mailed to you).

3. Enter your Secure PIN for authentication then your card is ready.

Set card PIN for ATM withdrawal

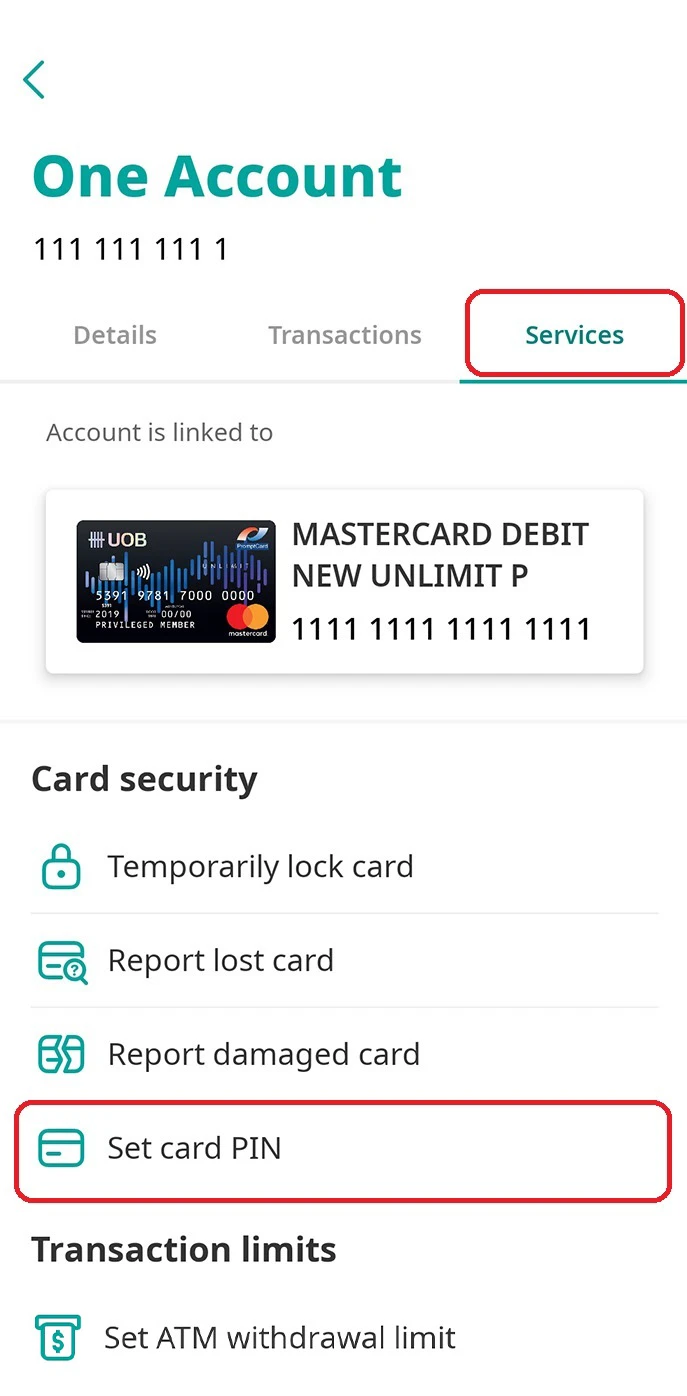

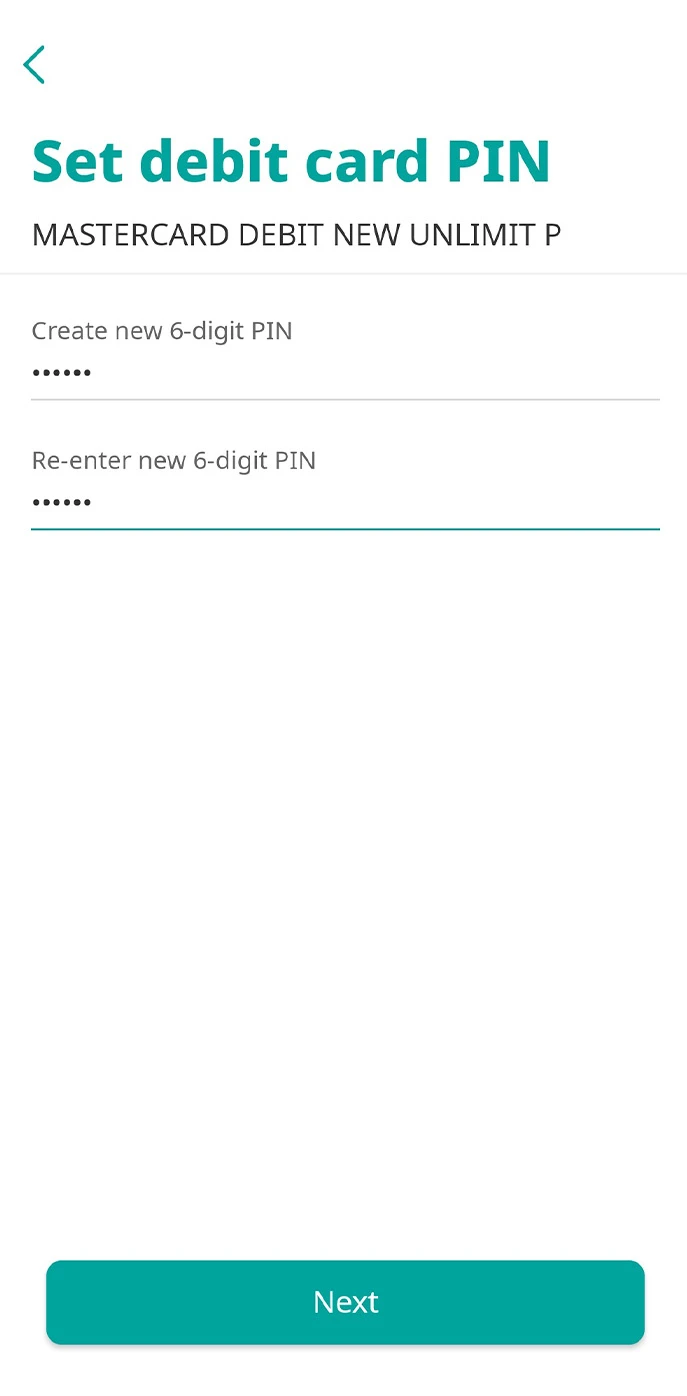

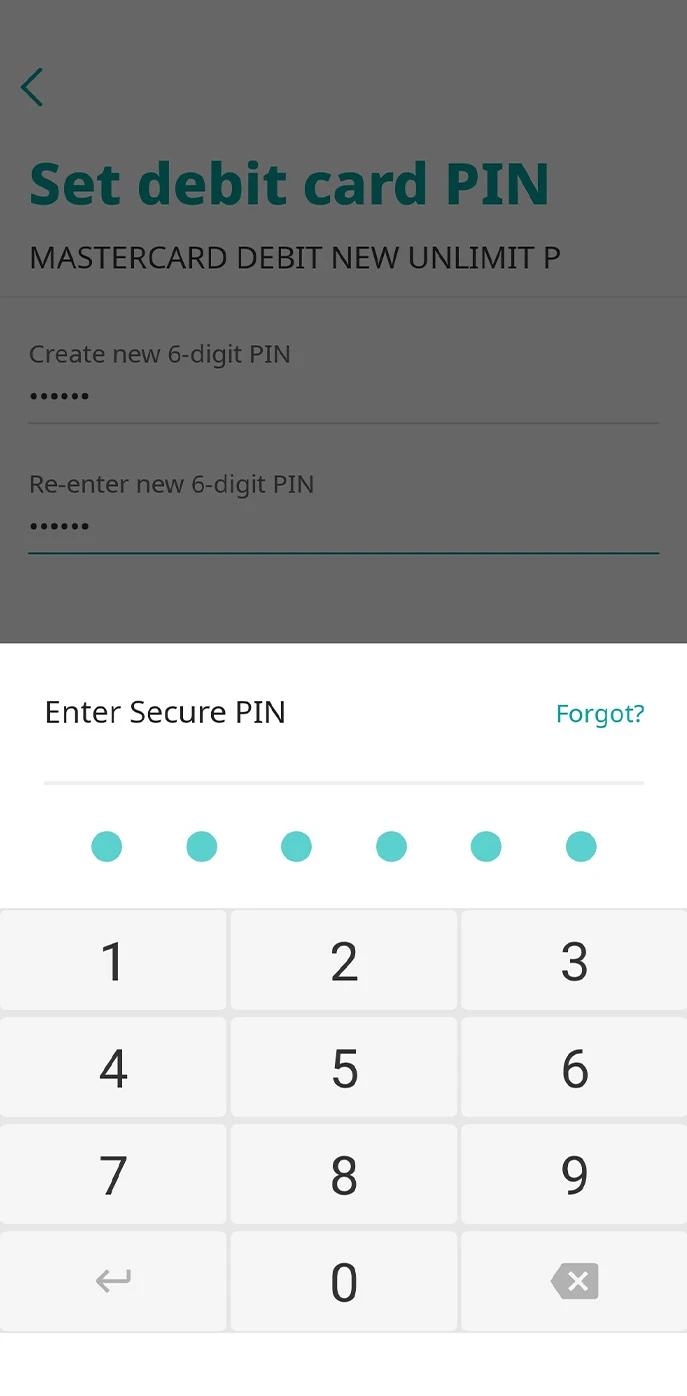

1. Set debit card PIN

1. Log in to UOB TMRW and select the account linked to the debit card you wish to set ATM PIN.

2. Tap on “Services” and select “Set card PIN”.

3. Enter new 6-digit PIN and confirm the new PIN.

4. Enter your Secure PIN for authentication.

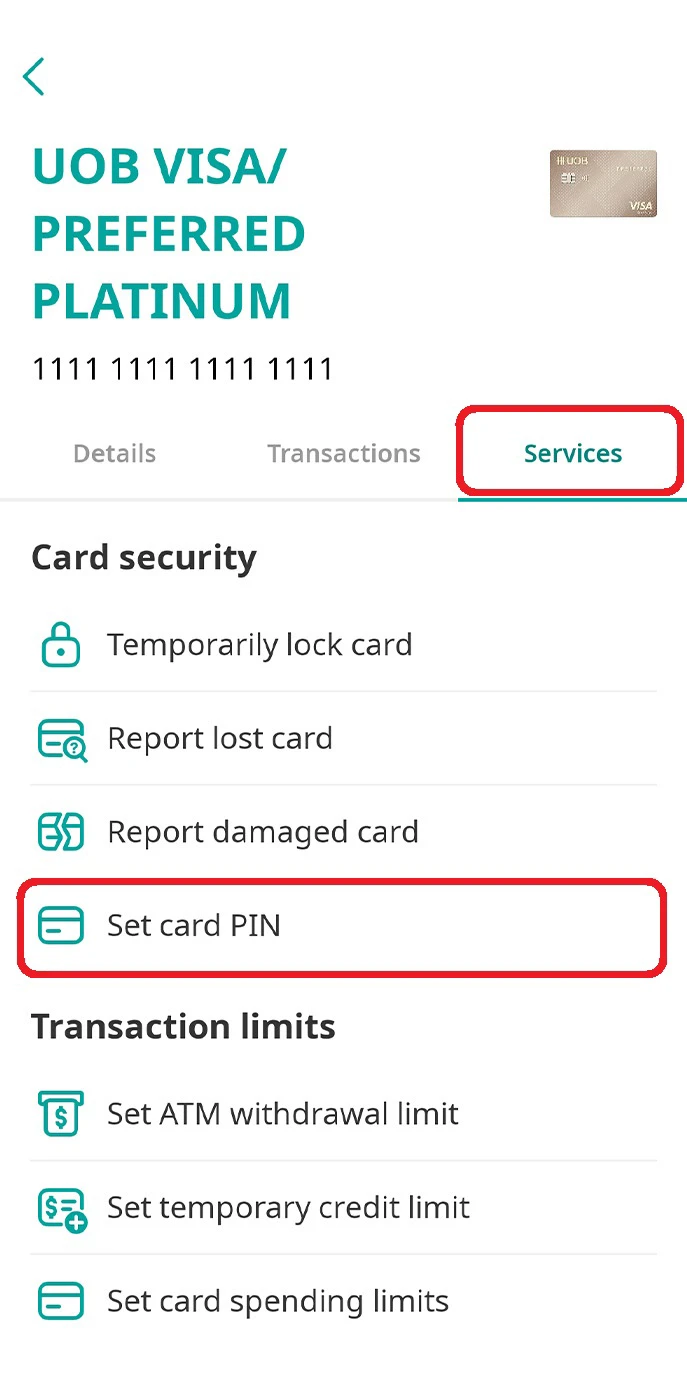

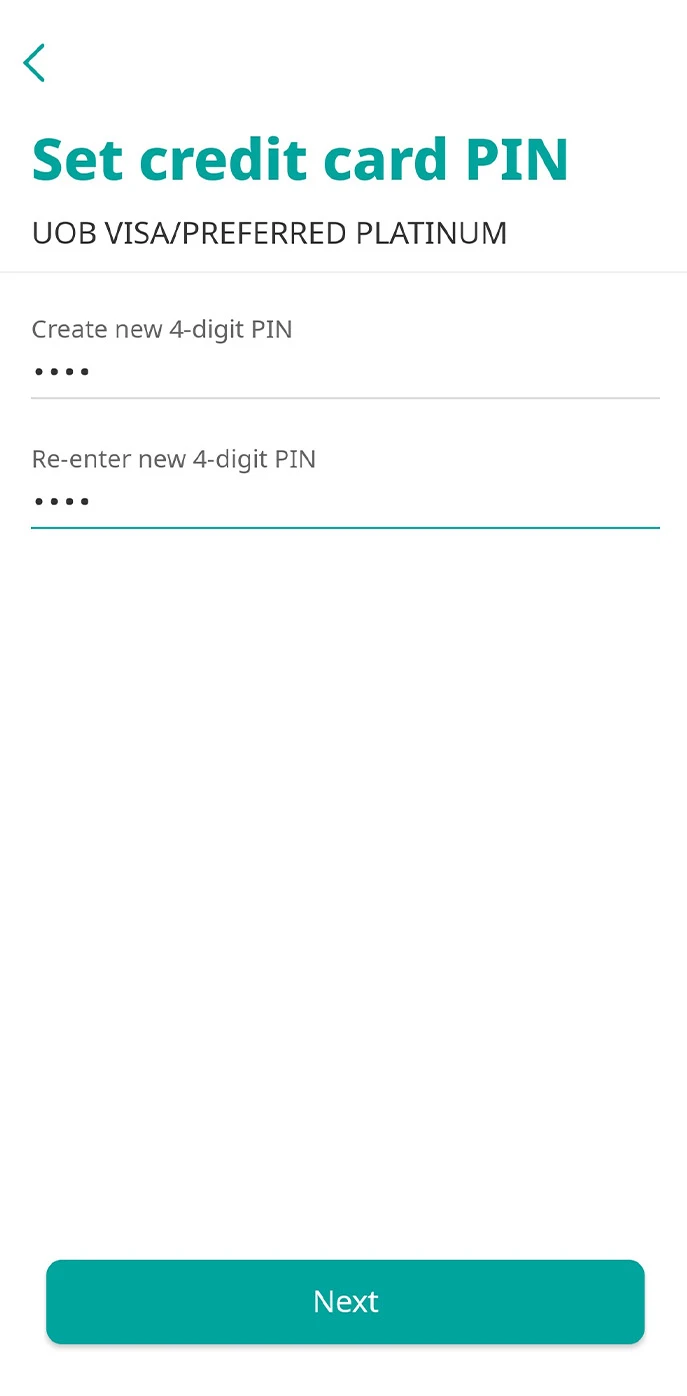

2. Set credit card PIN

1. Log in to UOB TMRW and select the credit card you wish to set ATM PIN.

2. Tap on “Services” and select “Set card PIN”.

3. Enter new 4-digit PIN and confirm the new PIN.

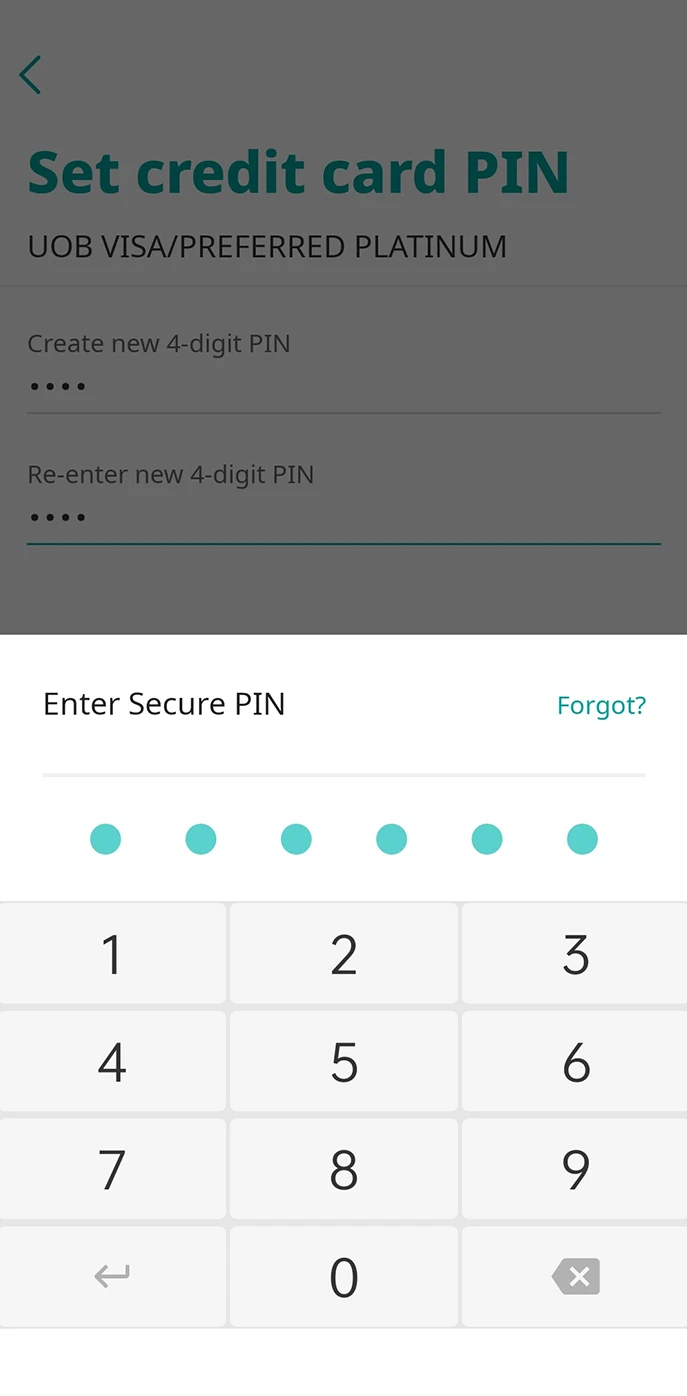

4. Enter your Secure PIN for authentication.

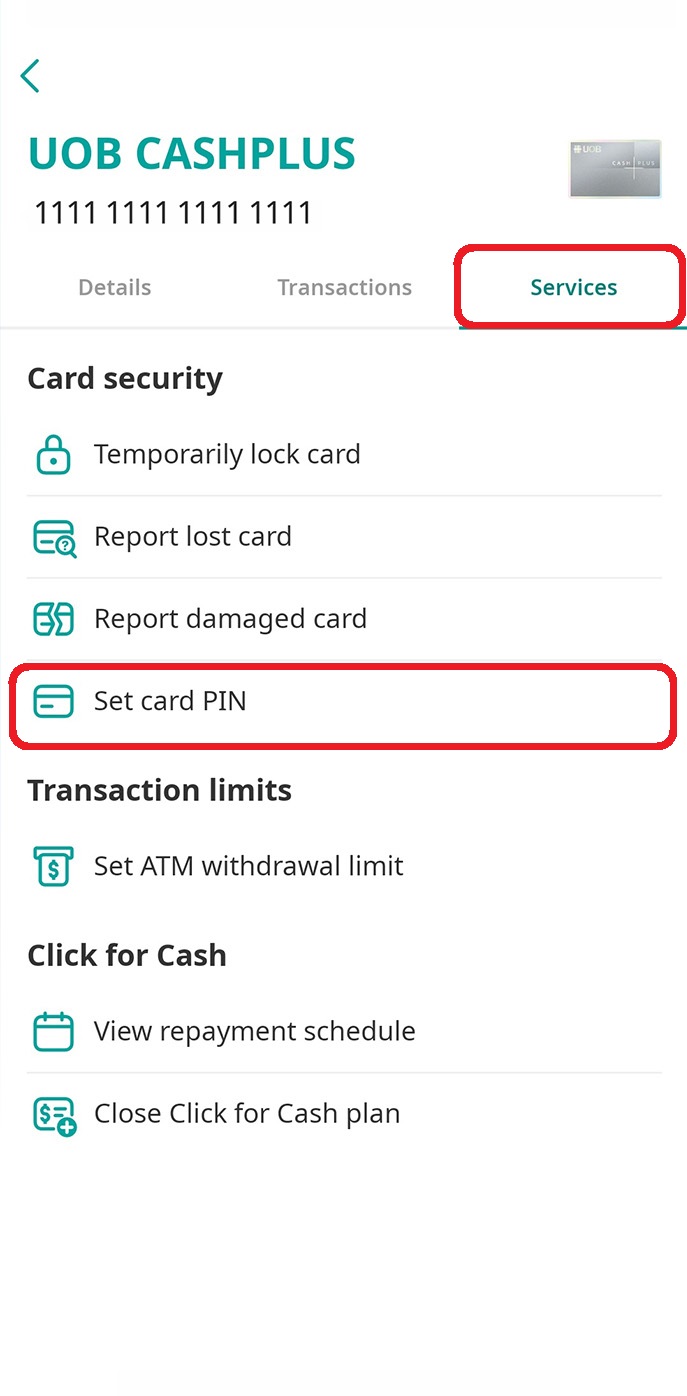

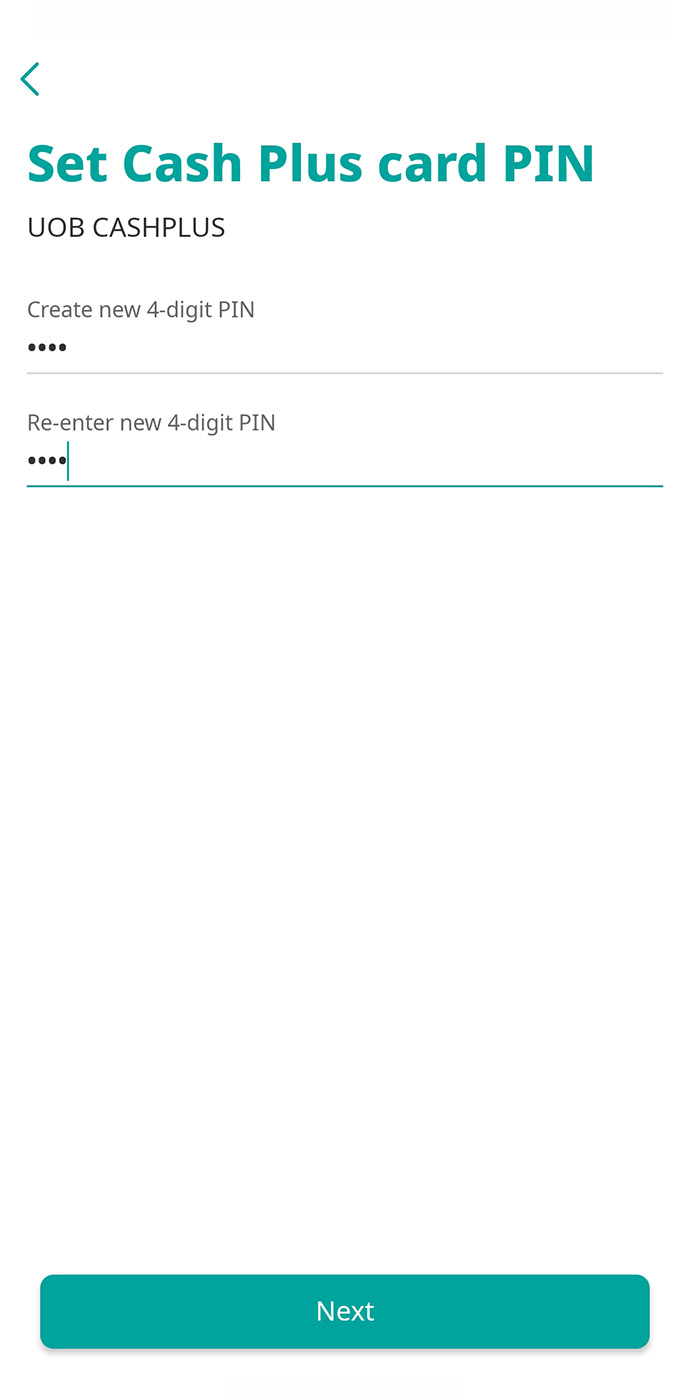

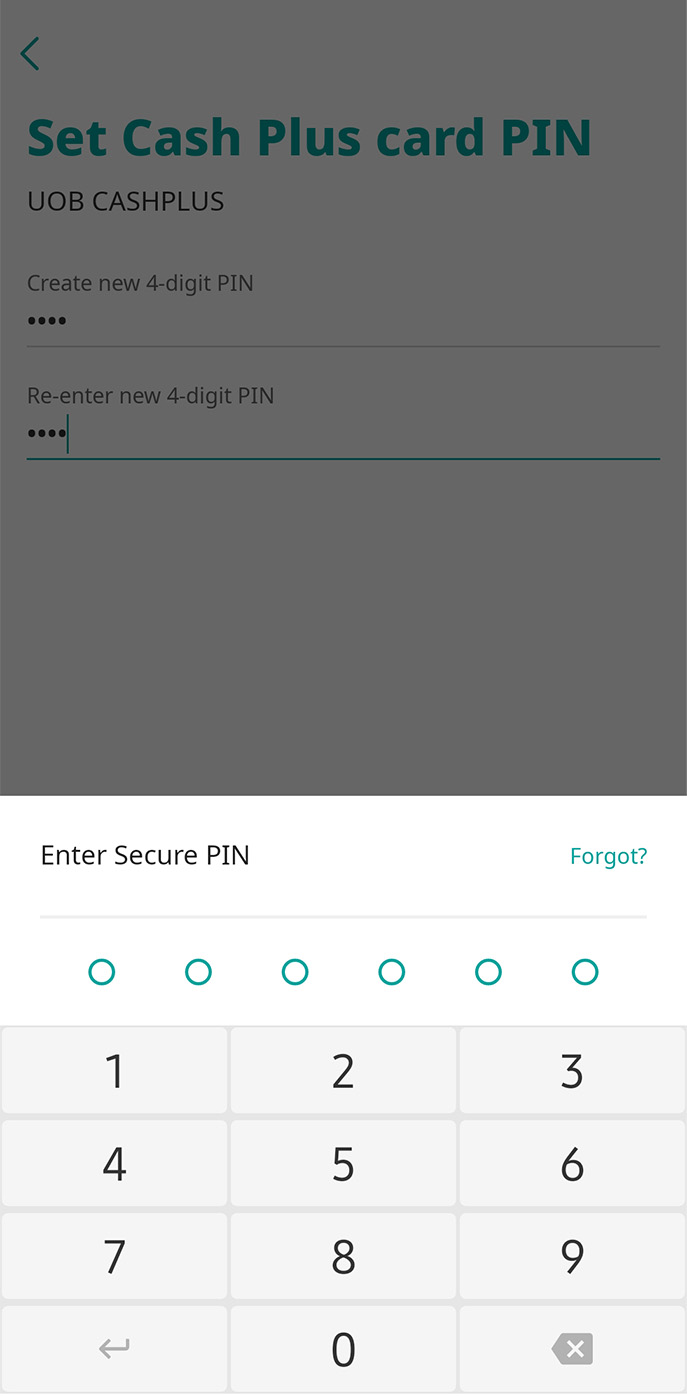

3. Set UOB Cash Plus card PIN

1. Log in to UOB TMRW and select UOB Cash Plus account.

2. Tap on “Services” and select “Set ATM PIN”.

3. Enter new 4-digit PIN and confirm the new PIN.

4. Enter your Secure PIN for authentication.

Lock or unlock card, report and replace lost or damaged card

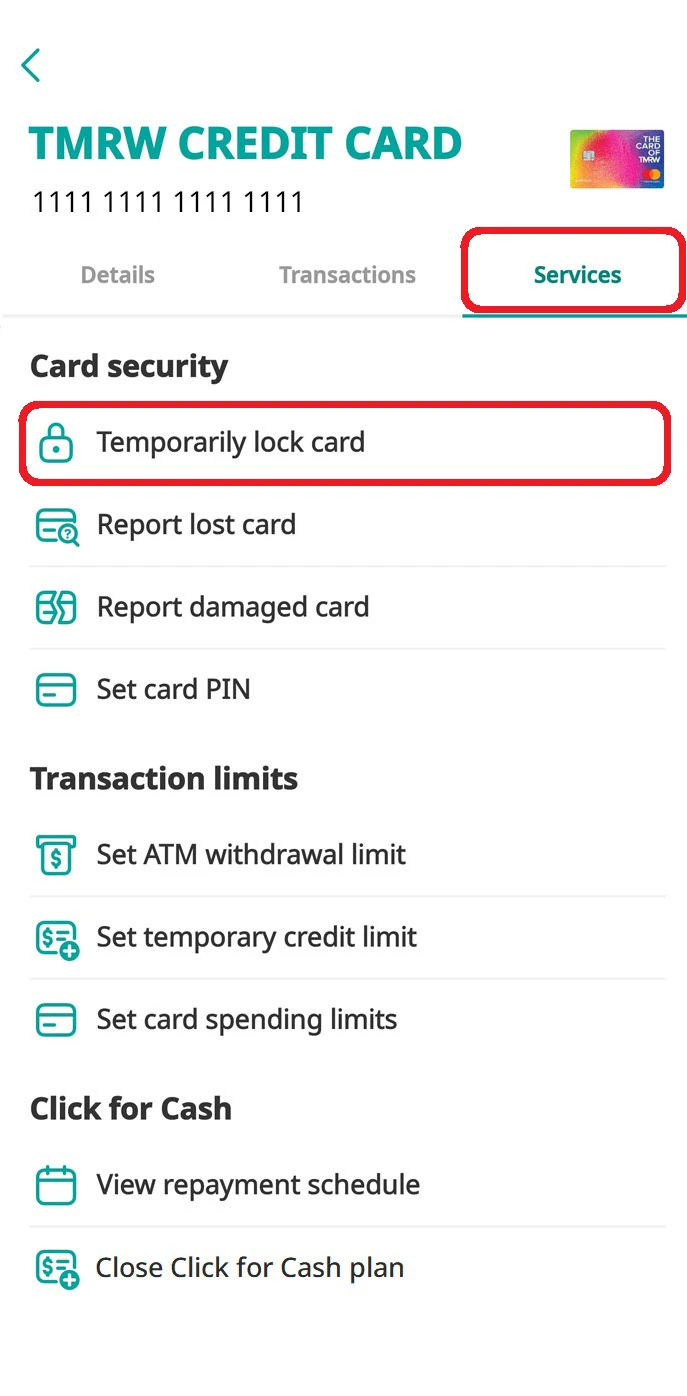

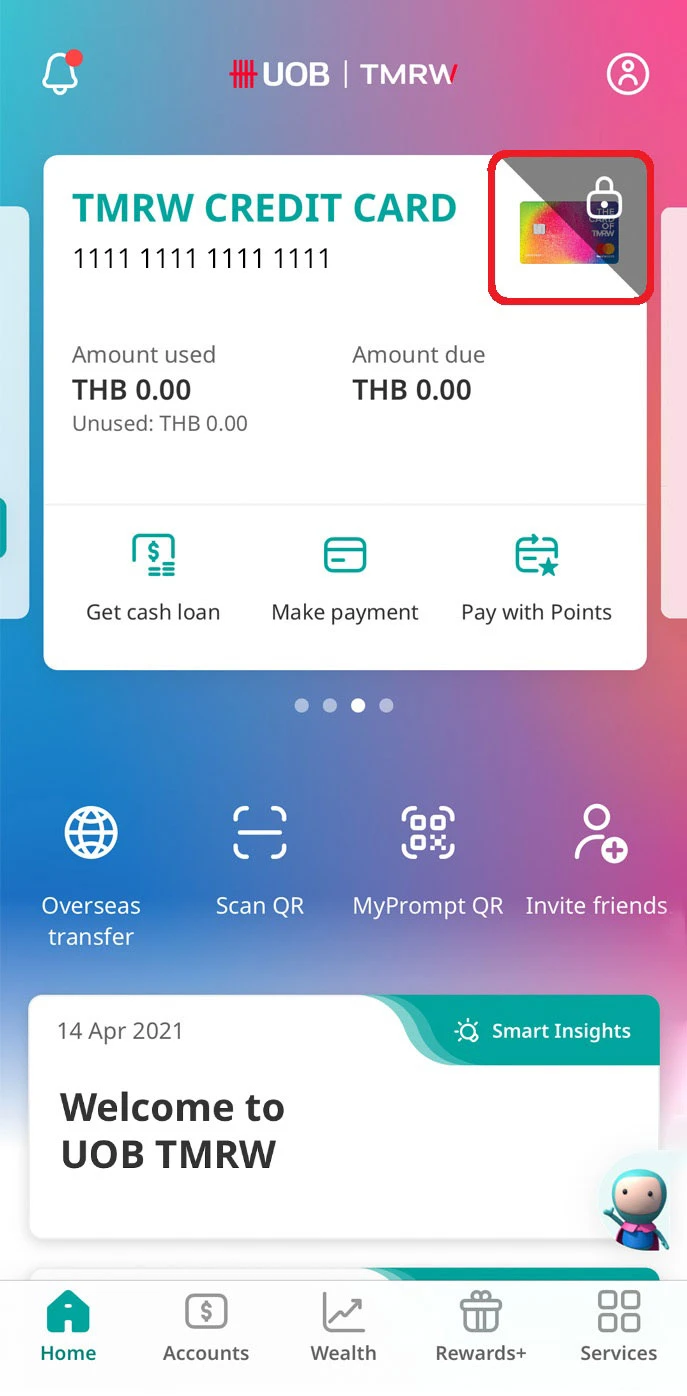

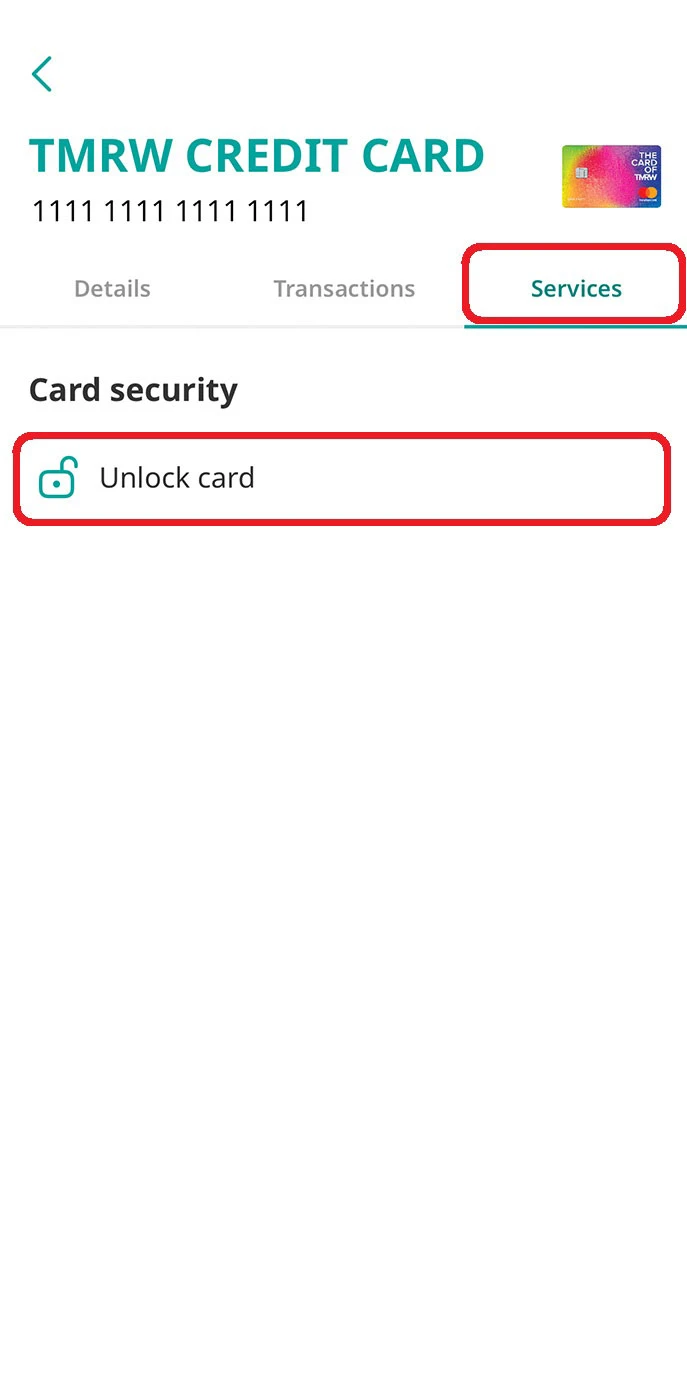

1. Temporarily lock and unlock card

1. Log in to UOB TMRW and select the credit card or account linked to the debit card to temporarily lock or unlock.

2. Go to “Services” tab and select “Temporarily lock card”.

3. Once confirmed, a lock symbol will show on the card being temporarily locked.

4. To unlock, select the card to unlock and go to “Services” then tap on “Unlock card”.

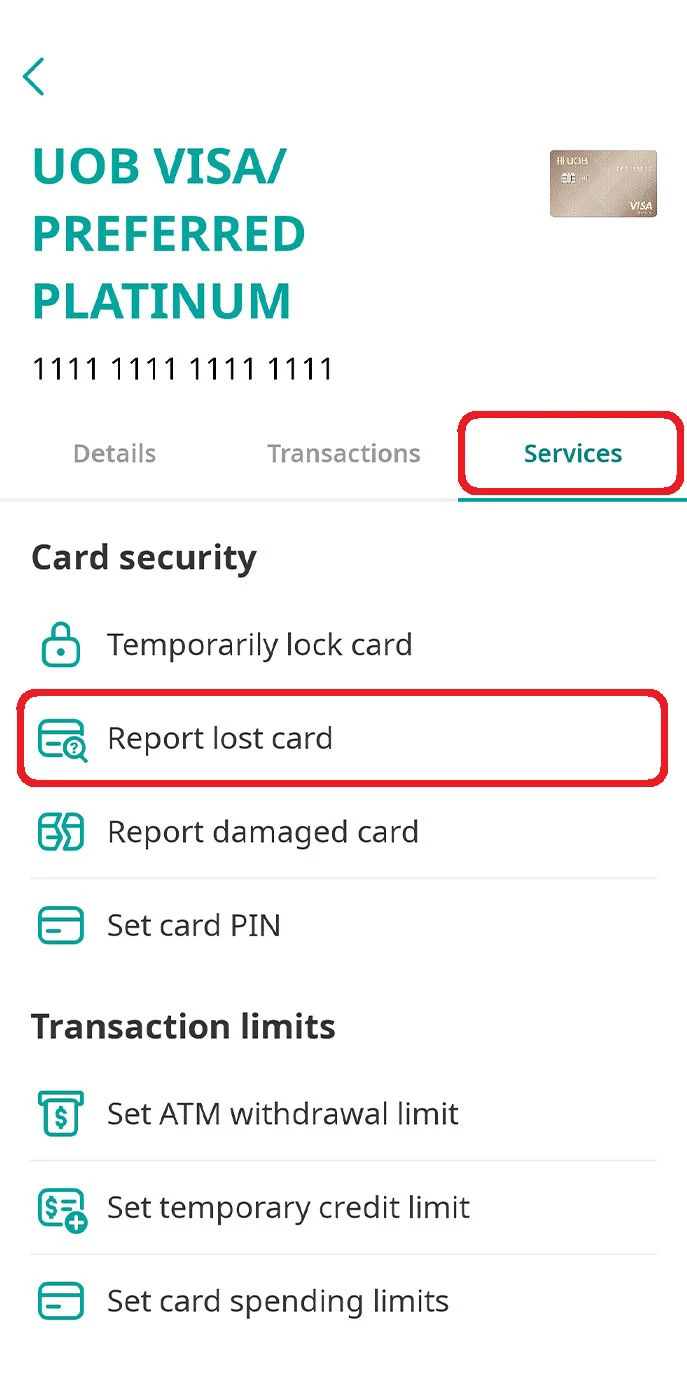

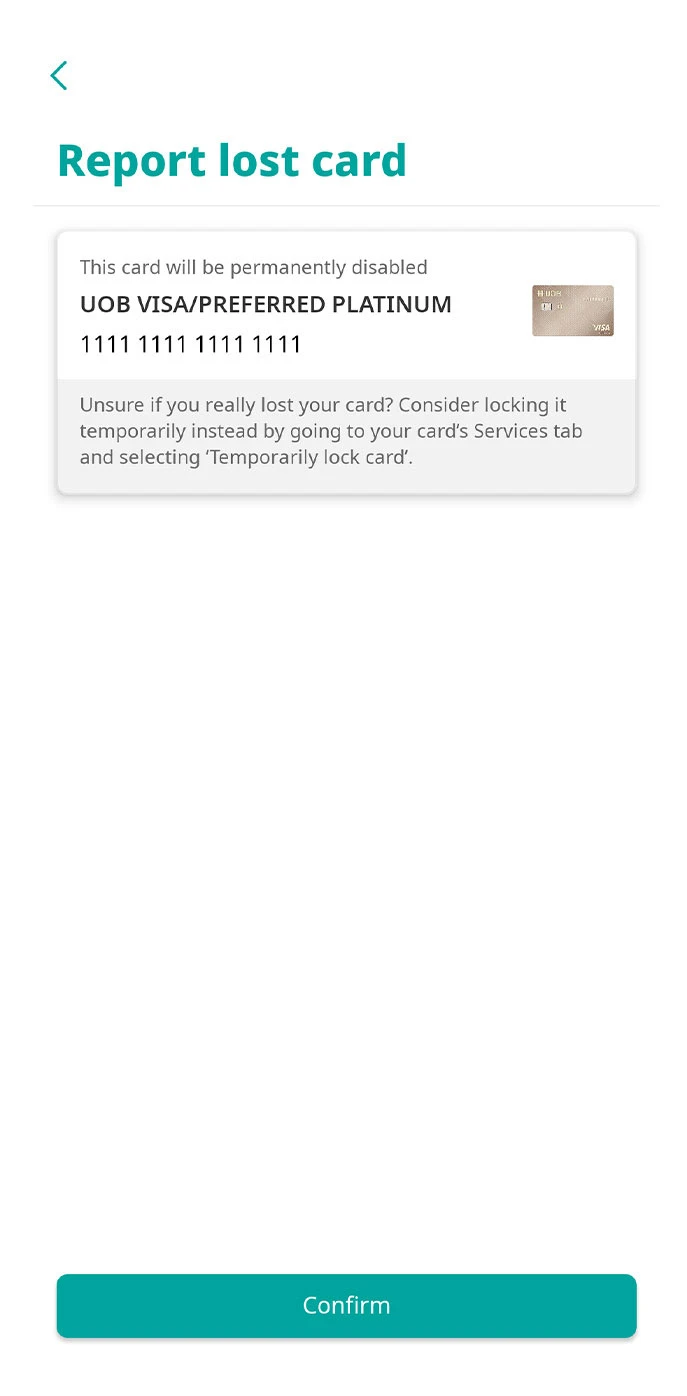

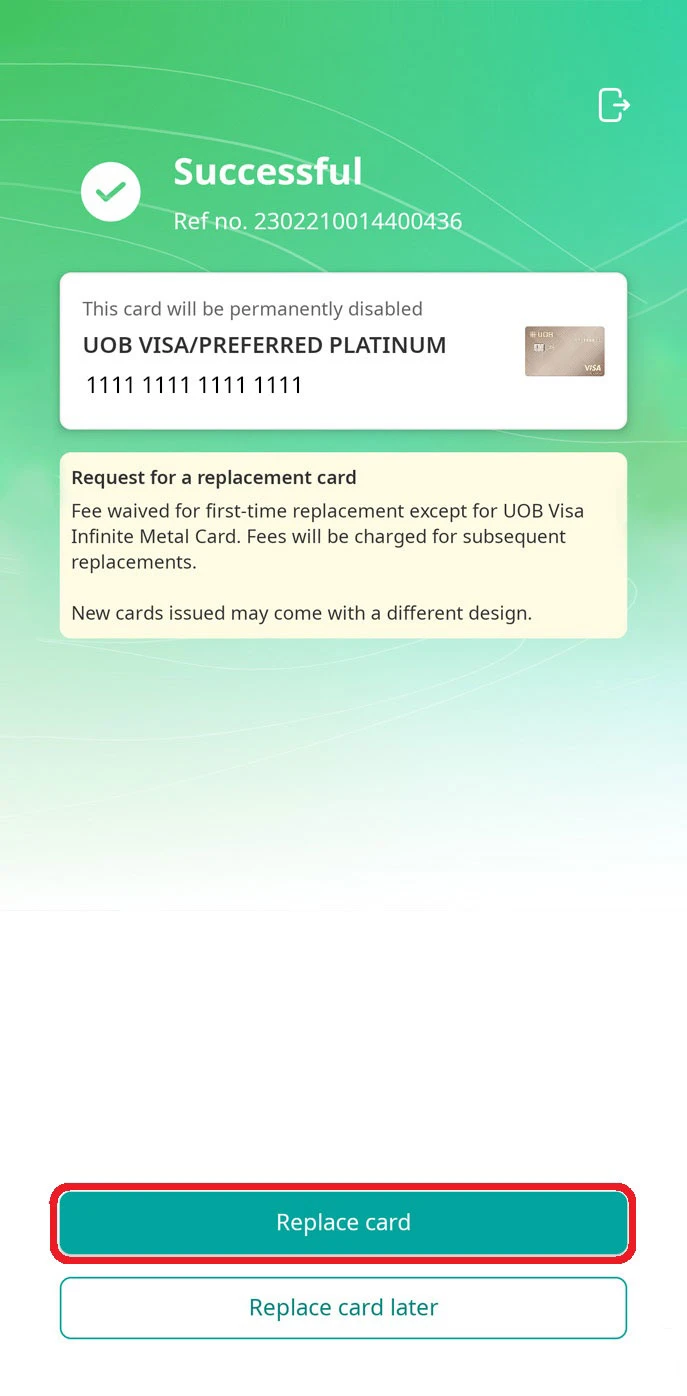

2. Report lost card and request for card replacement

1. Log in to UOB TMRW and select the credit card or account linked to the debit card to report and replace.

2. Go to “Services” tab and select “Report lost card”.

3. Tap confirm to permanently block the card.

4. Tap “Replace card” to continue with replacement card request.

5. Review and confirm your mailing address.

6. Replacement card requested successfully.

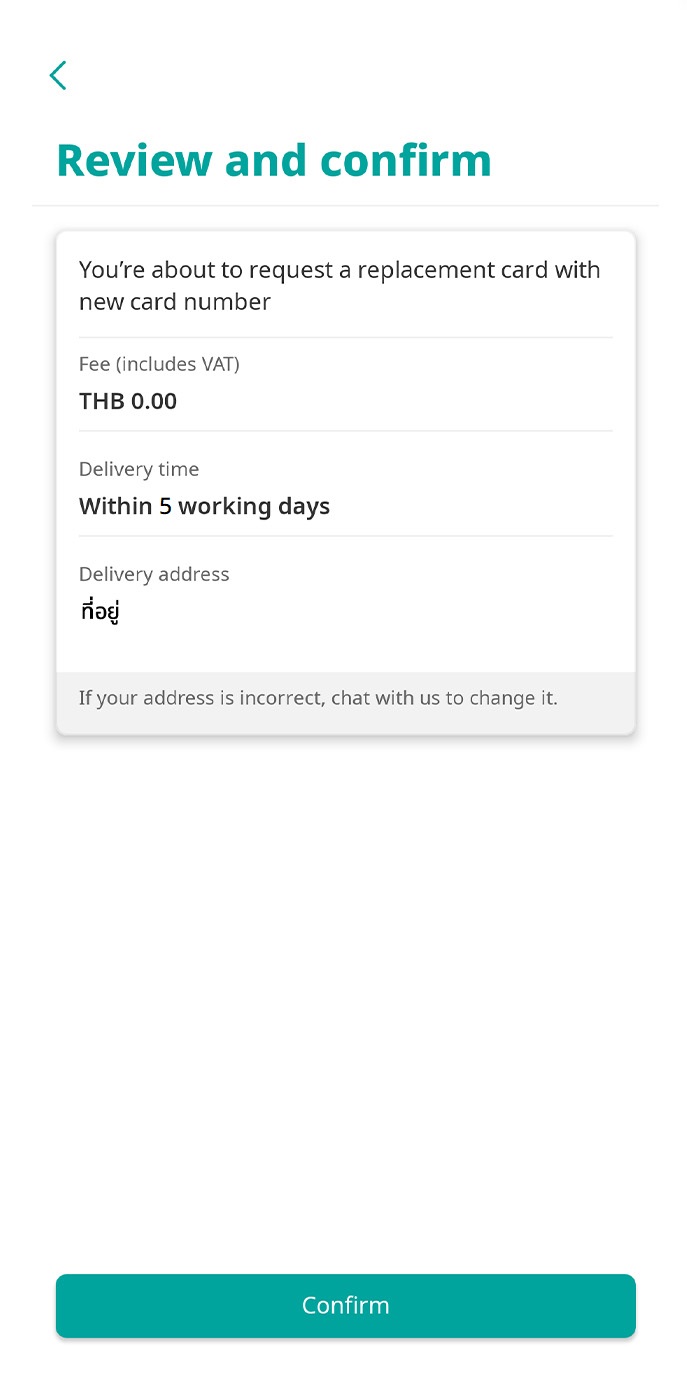

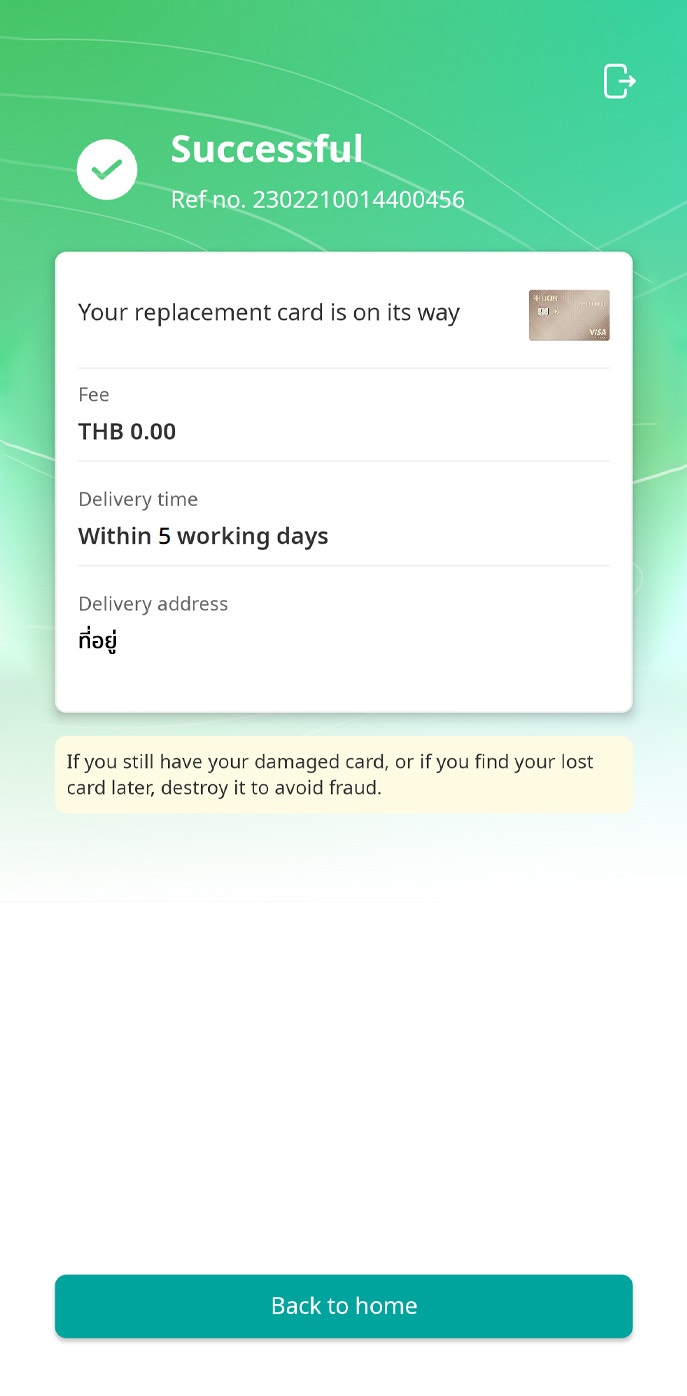

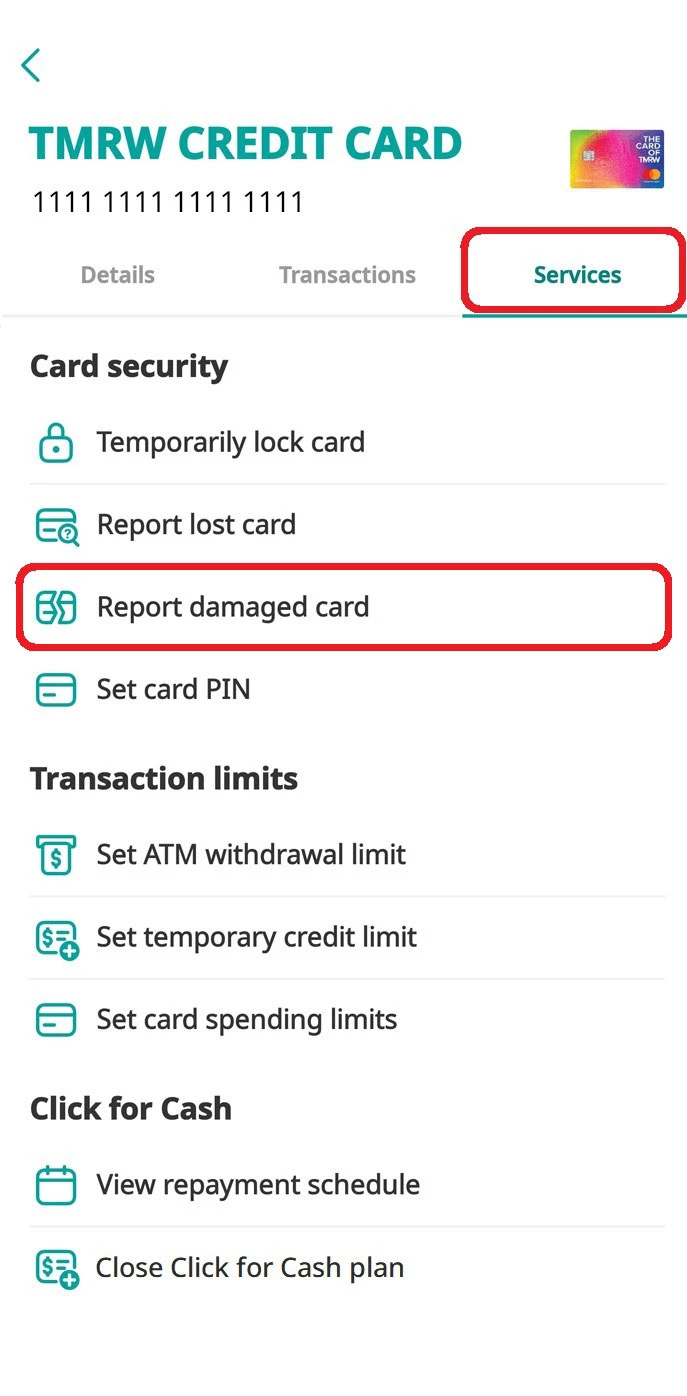

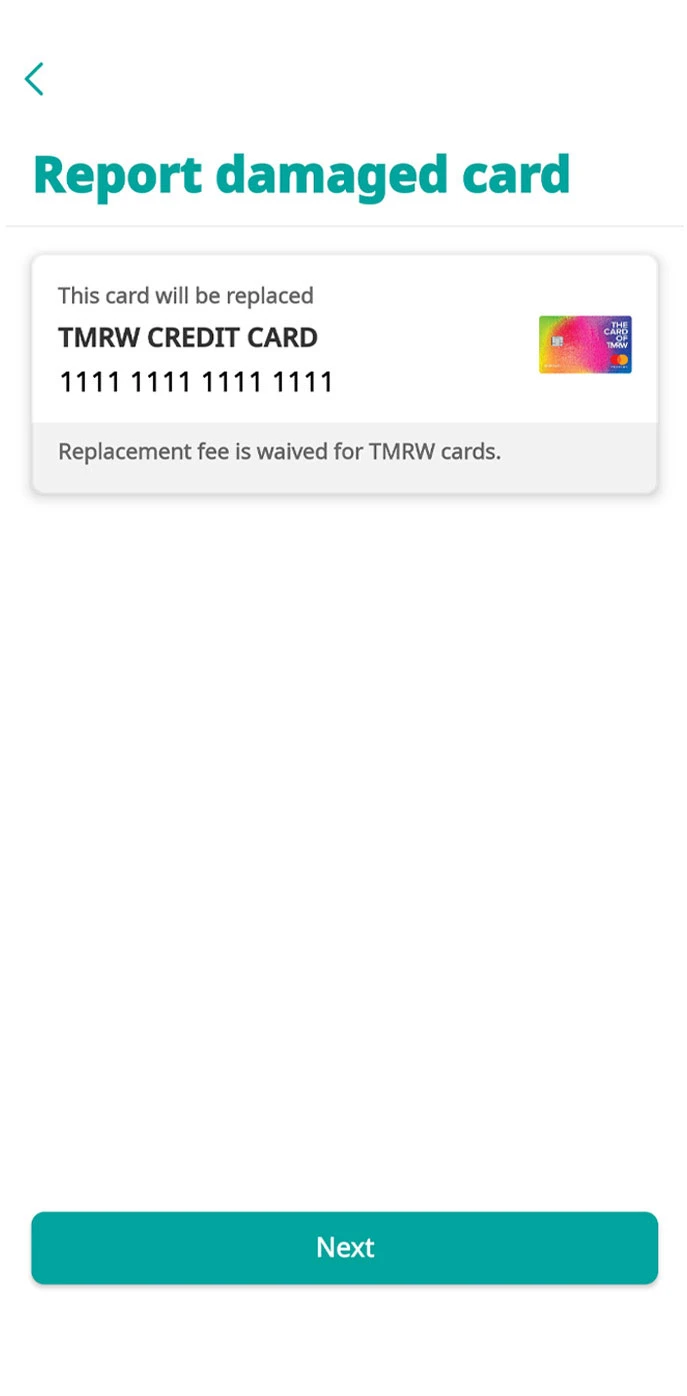

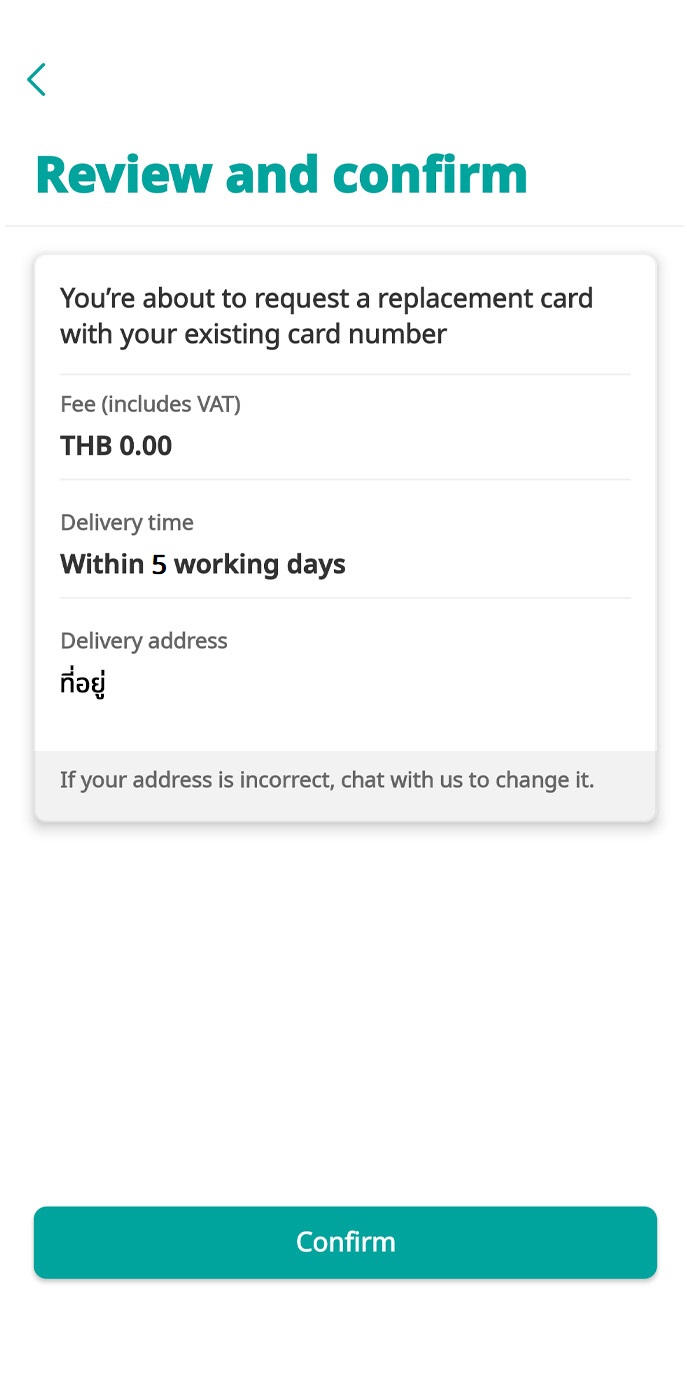

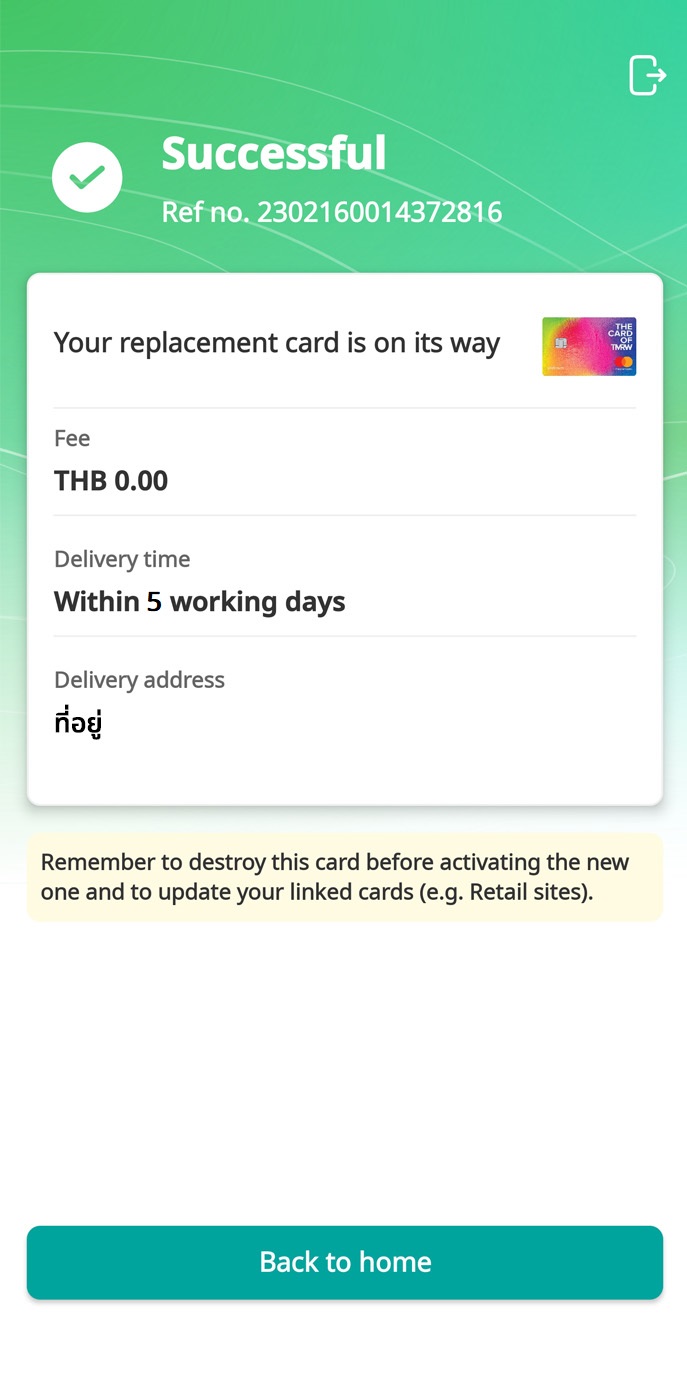

3. Request for card replacement for damaged card

1. Log in to UOB TMRW and select the credit card or account linked to the debit card to report and replace.

2. Go to “Services” tab and select “Report damaged card”.

3. Tap next to continue with replacement card request.

4. Review and confirm your mailing address.

5. Replacement card requested successfully.

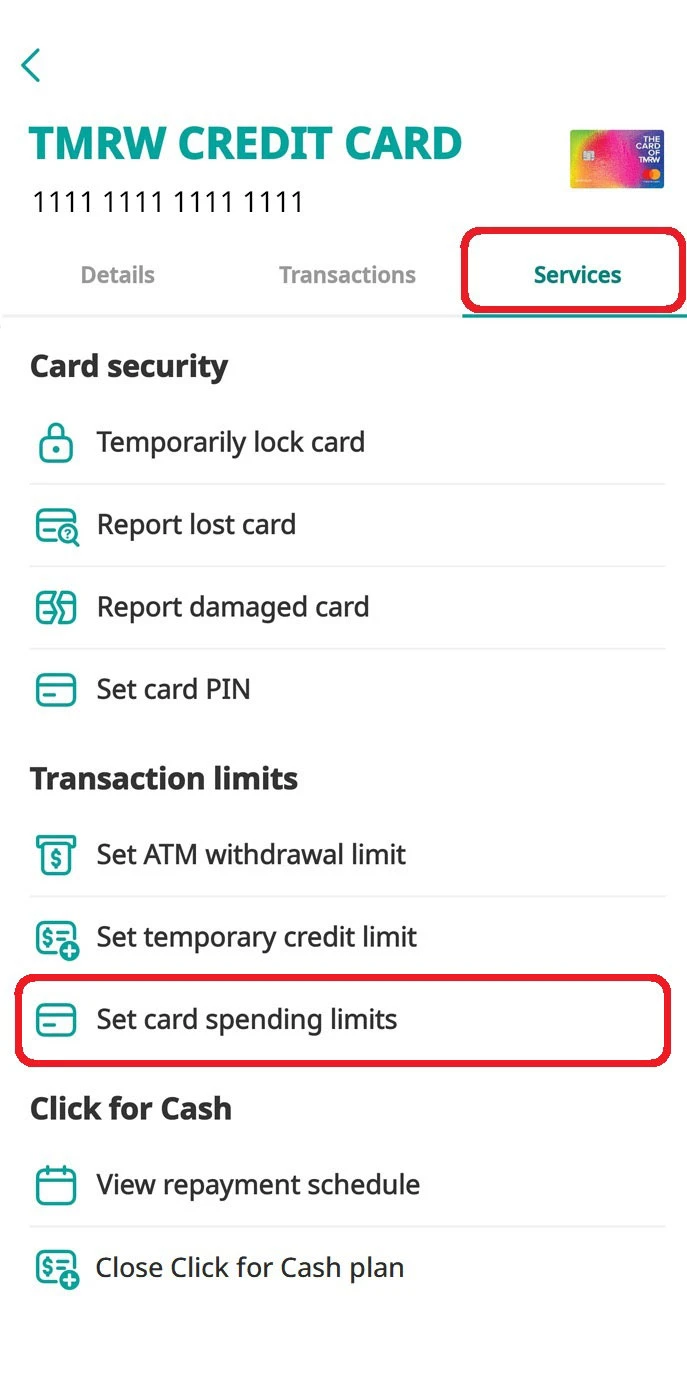

Manage card transaction limits

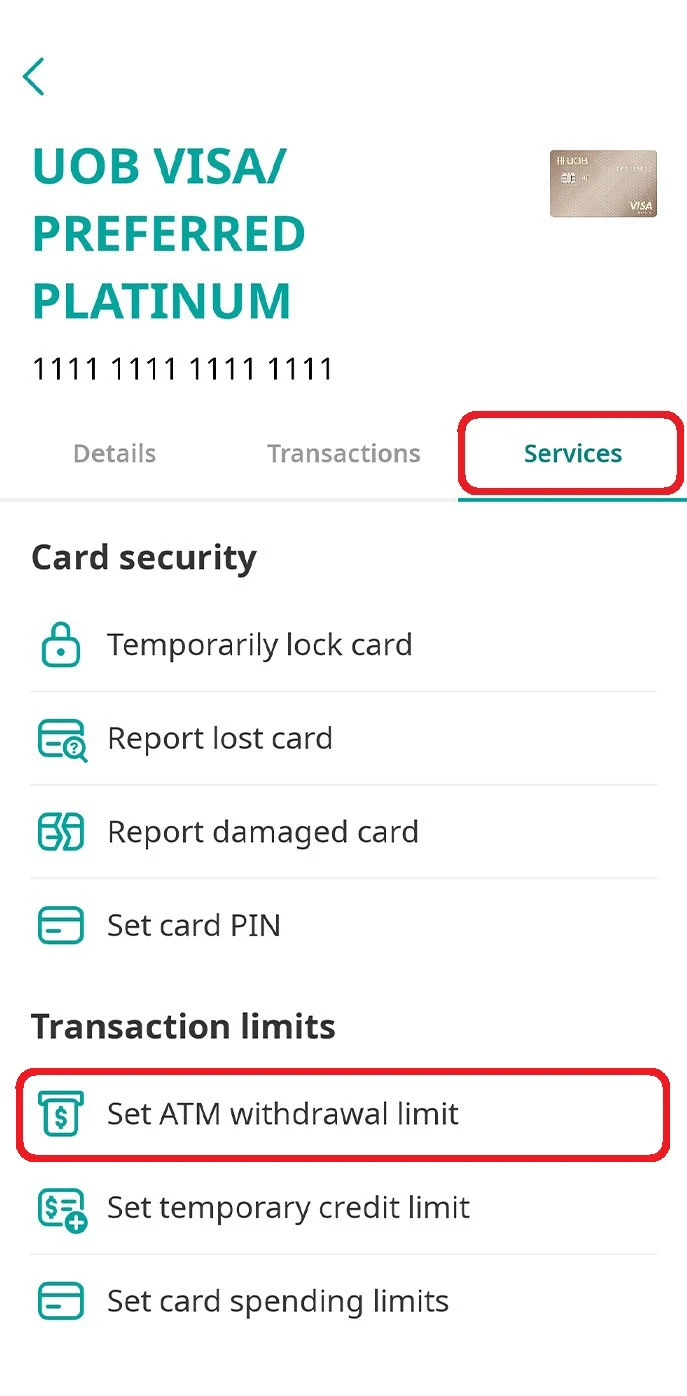

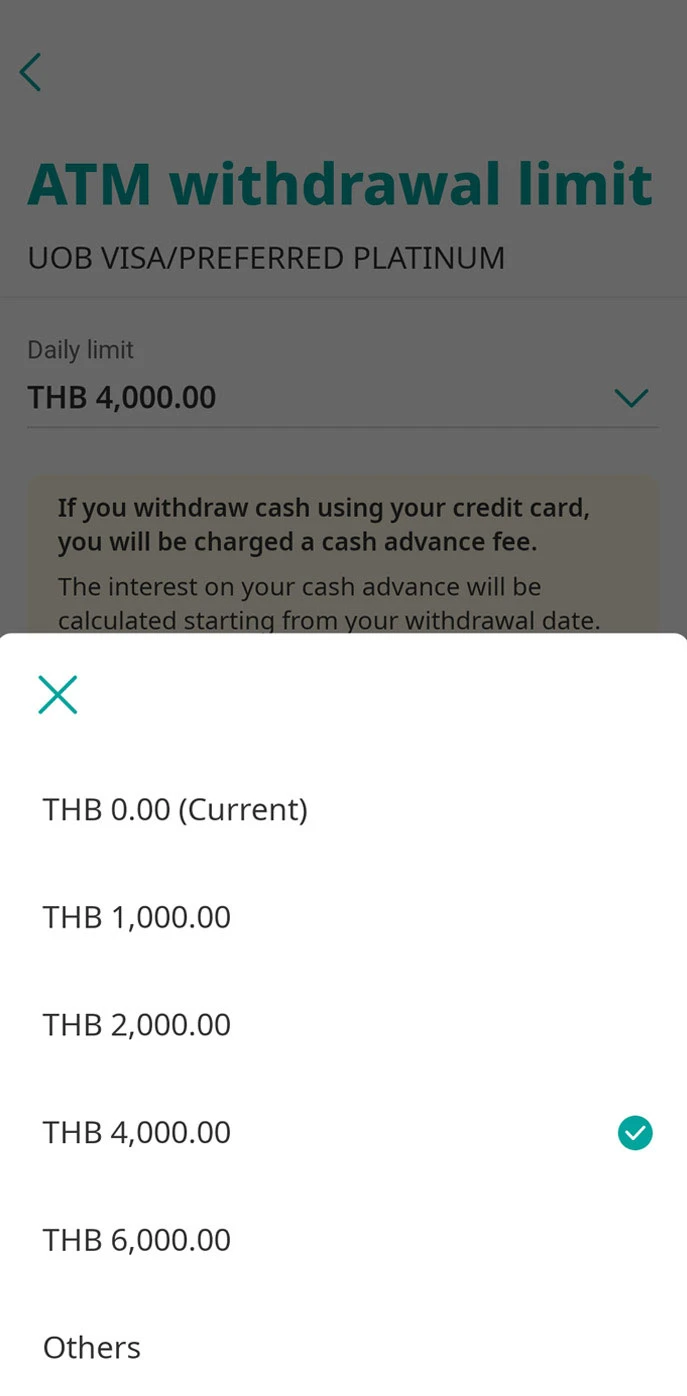

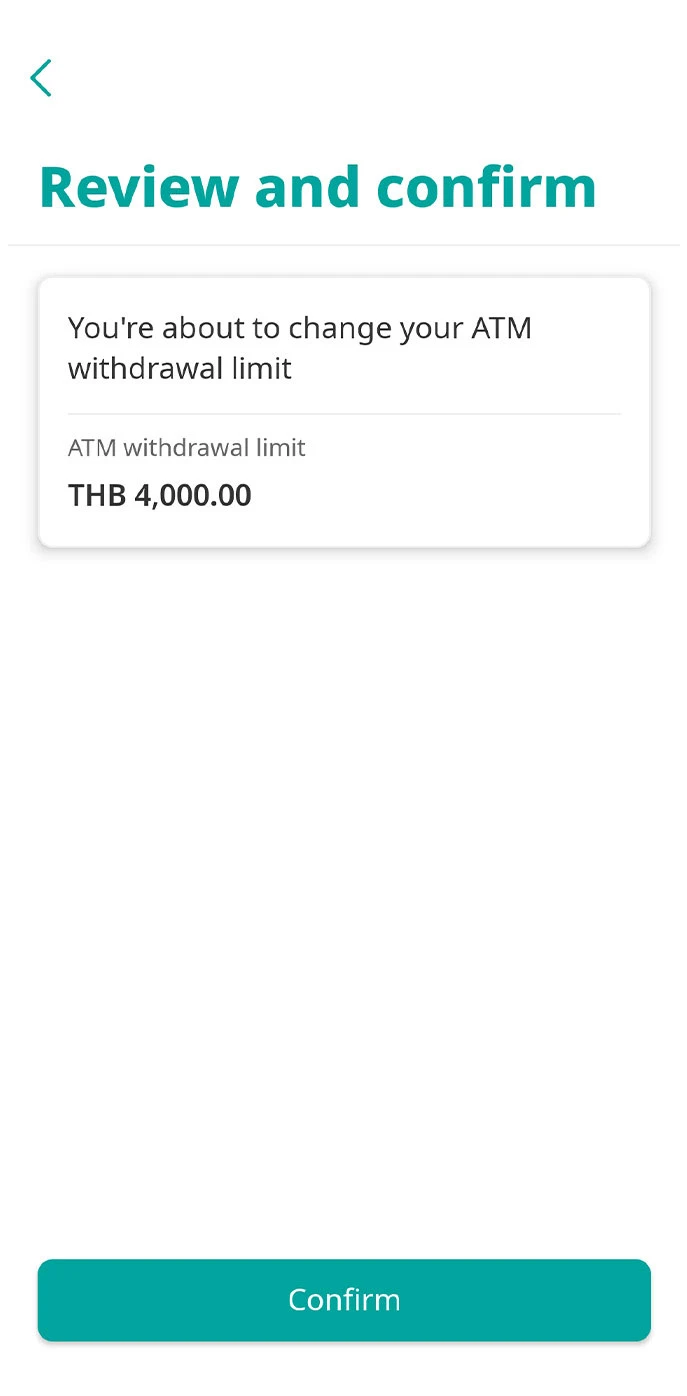

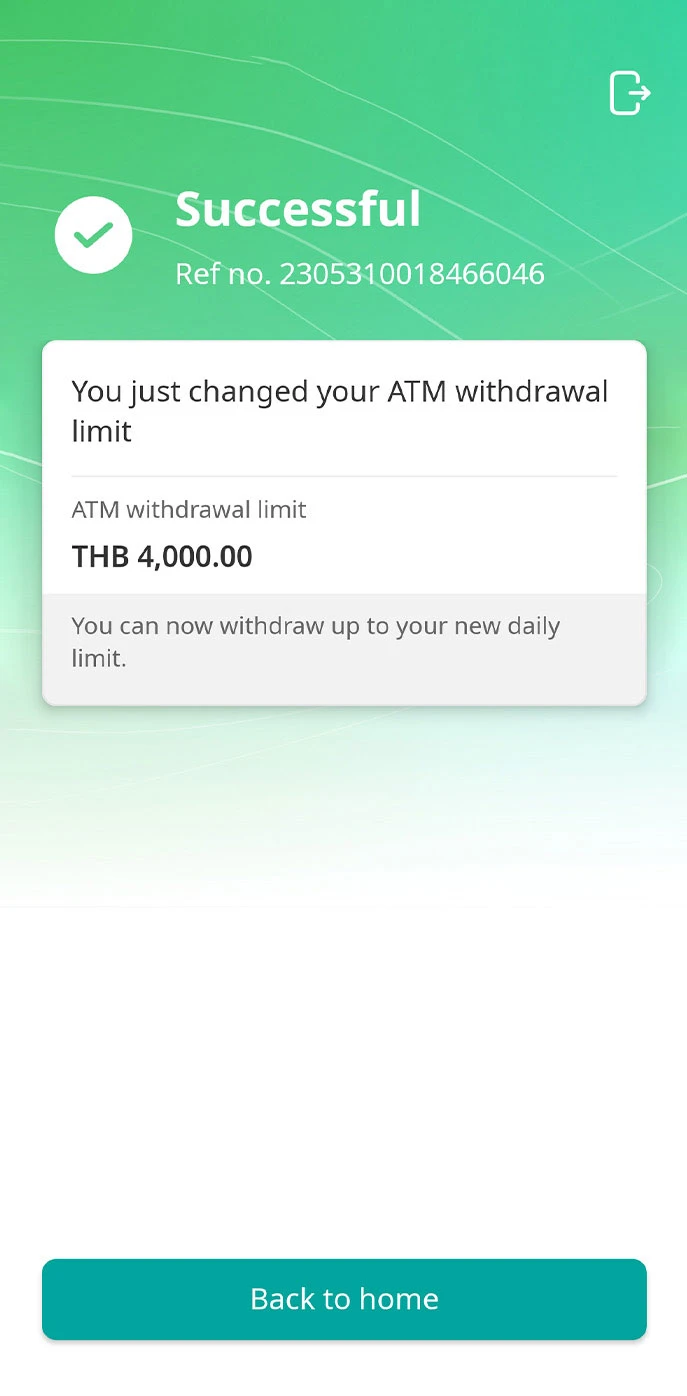

1. Set ATM withdrawal limit

1. Log in to UOB TMRW and select the credit card or account linked to the debit card to change ATM withdrawal limit.

2. Go to “Services” tab and select “Set ATM withdrawal limit”.

3. Select the transaction limit amount from the dropdown.

4. Review and confirm changing the limit, then enter your Secure PIN (required when you increase the limit).

5. New limit updated successfully.

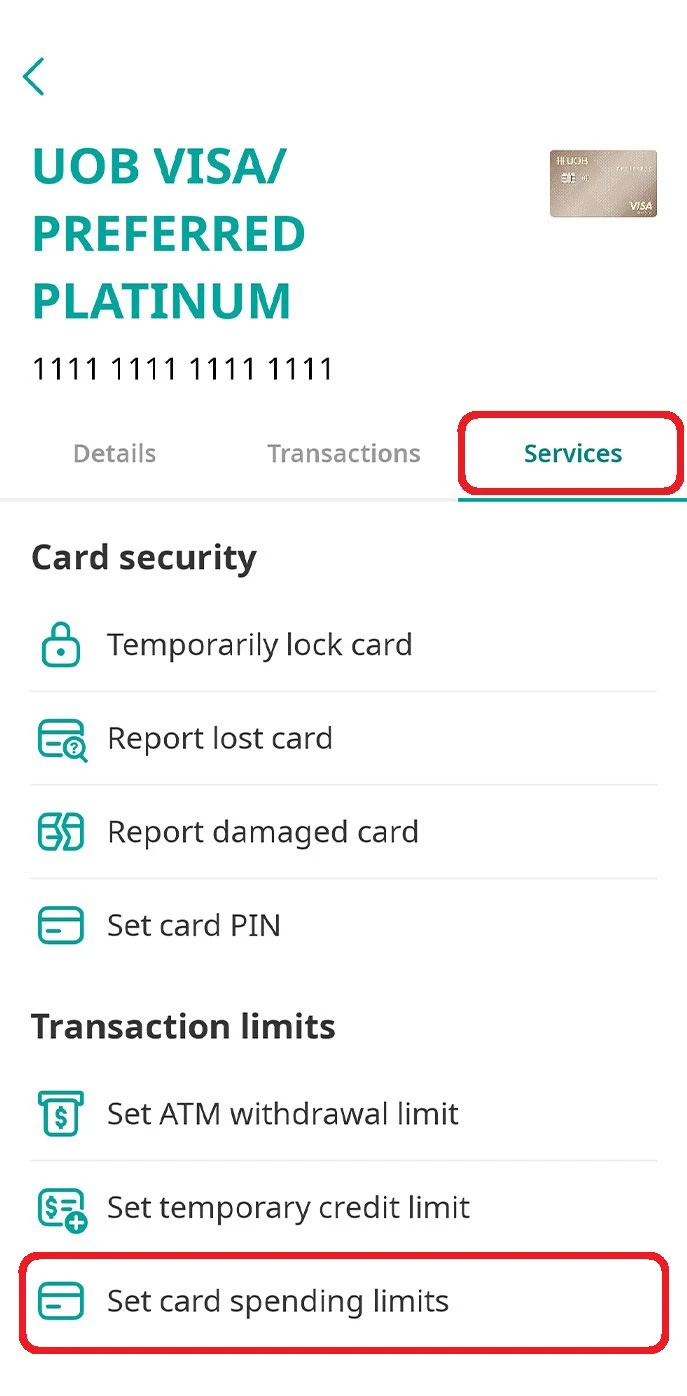

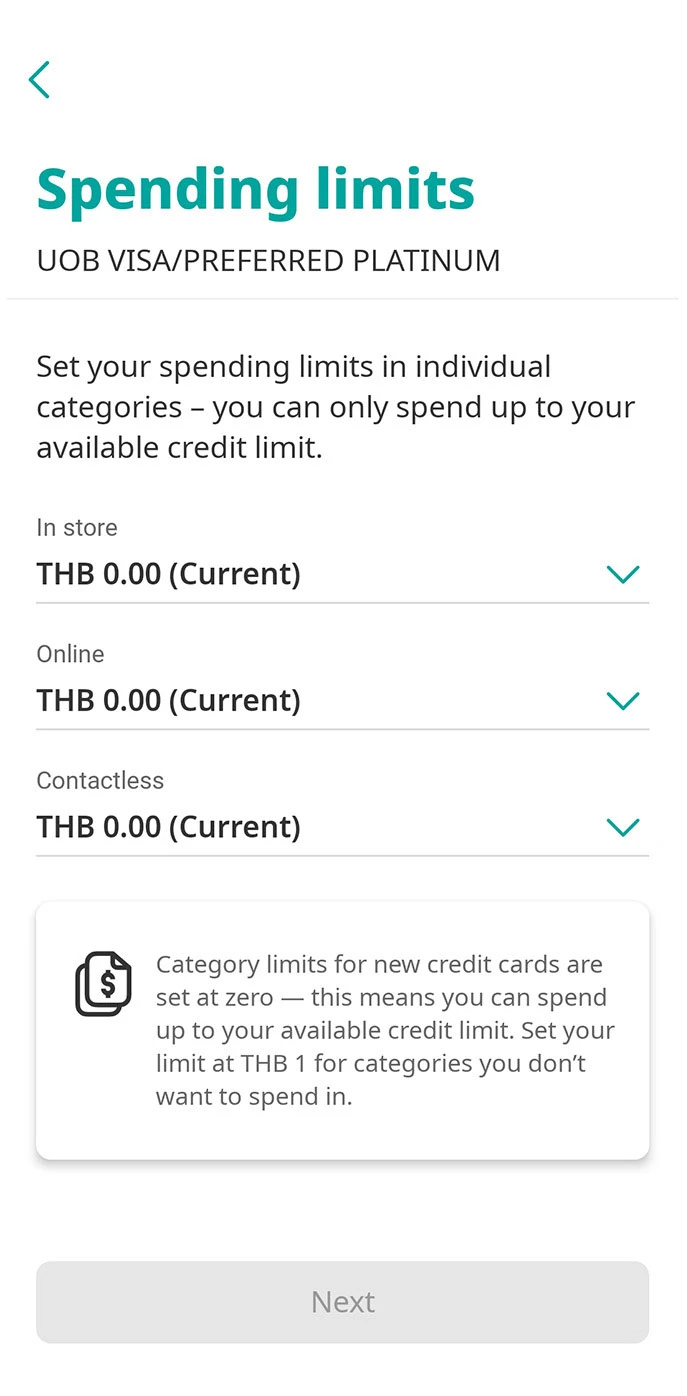

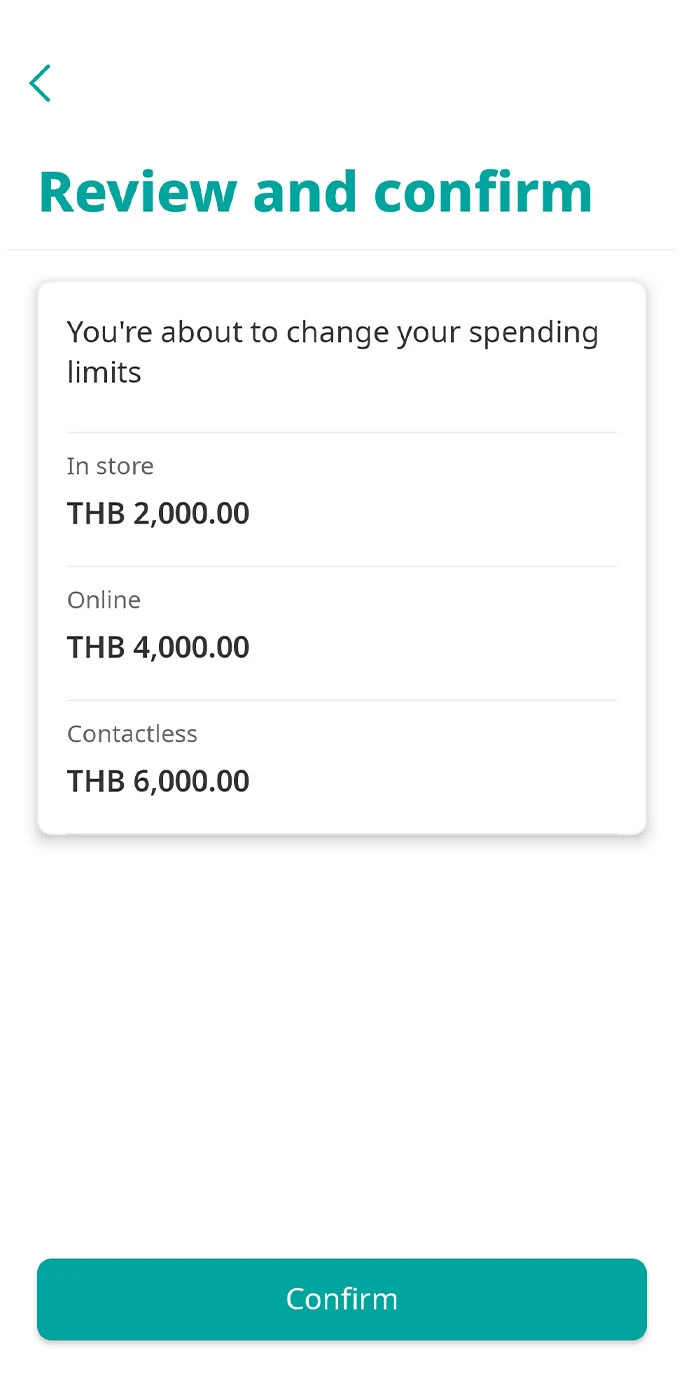

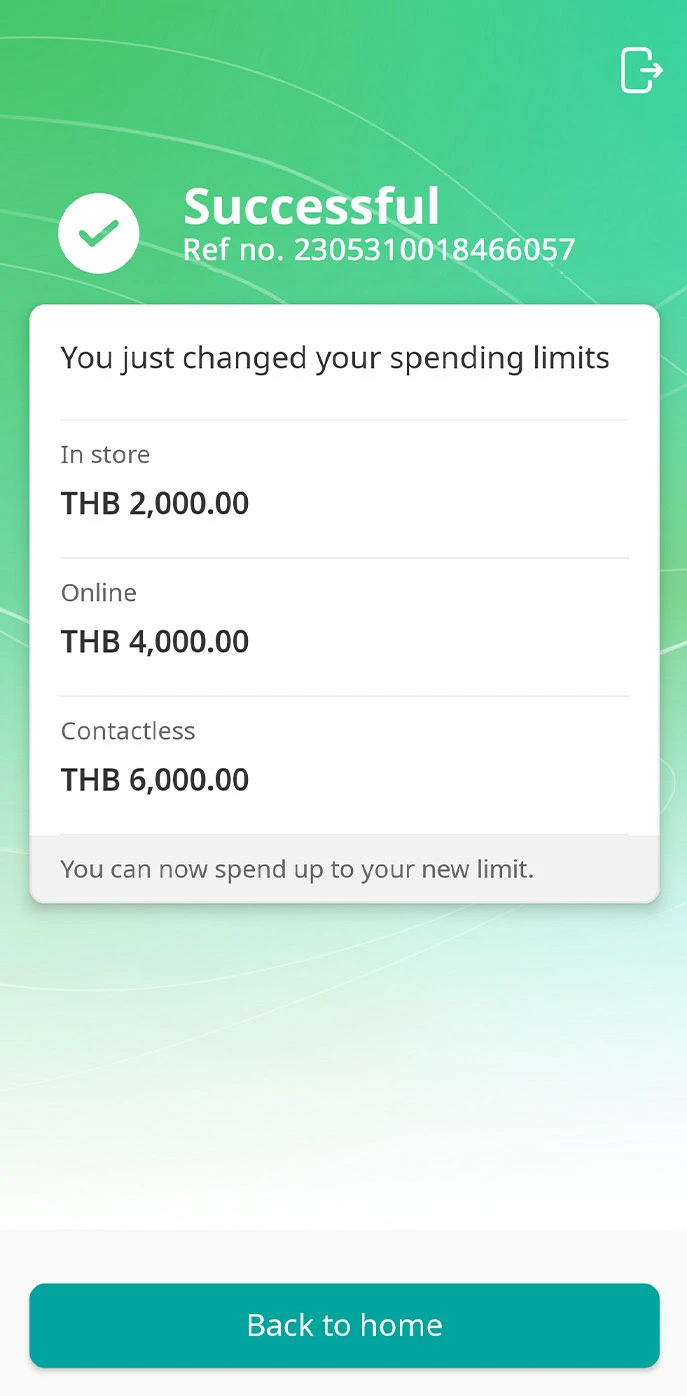

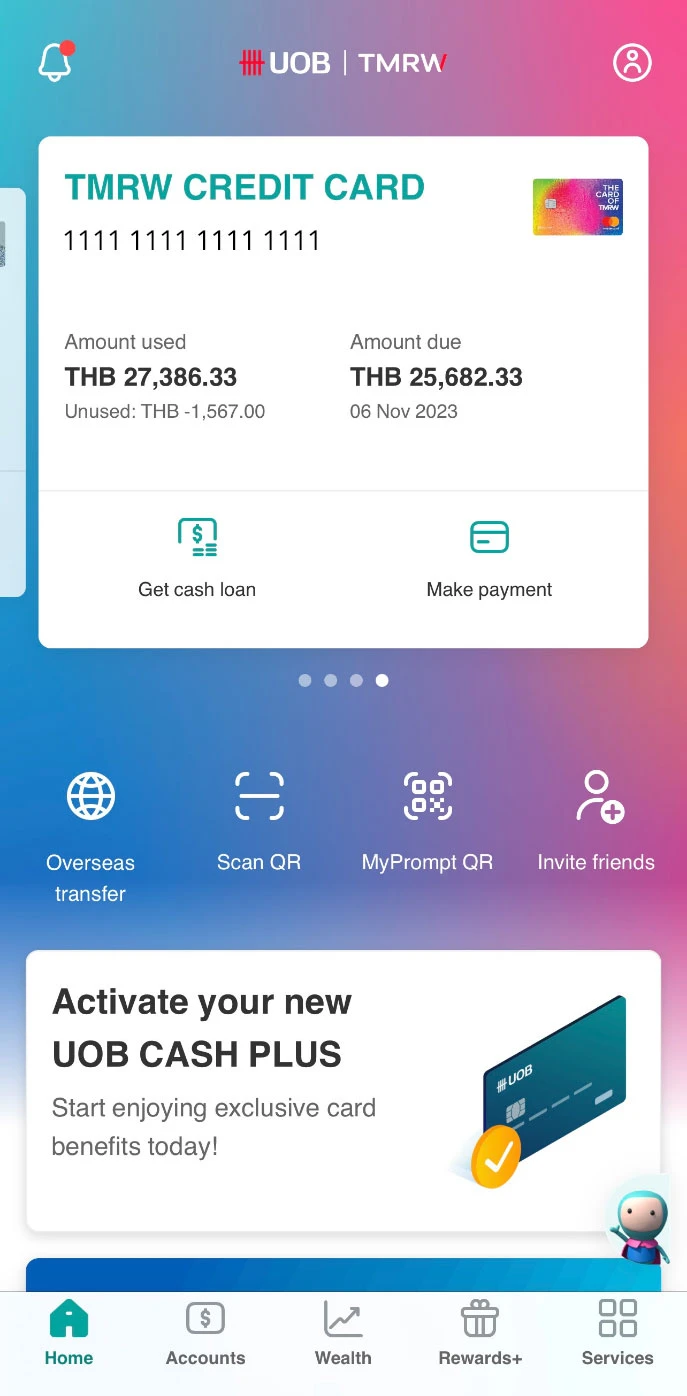

2. Set card spending limits

1. Log in to UOB TMRW and select the credit card or account linked to the debit card to change card spending limits.

2. Go to “Services” tab and select “Set card spending limits”.

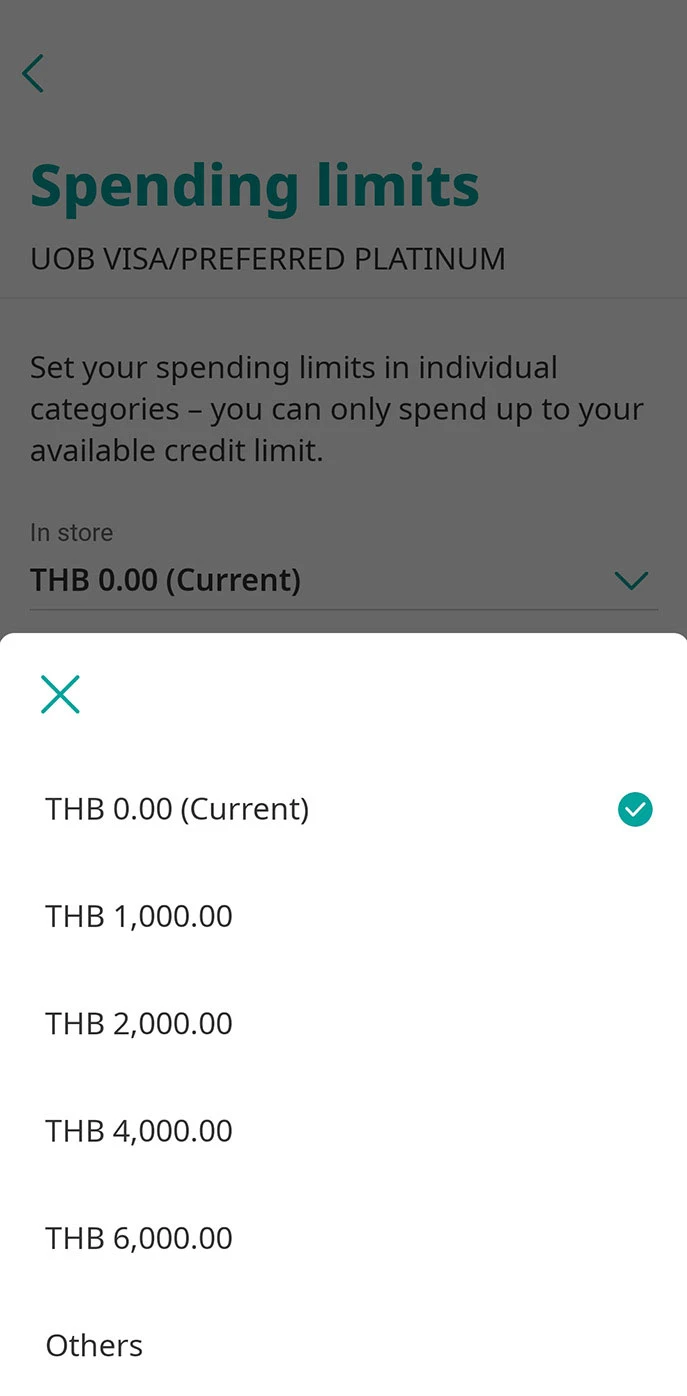

3. You can set spending limits for

- (1) In store

- (2) Online

- (3) Contactless

4. Select the transaction limit amount from the dropdown.

5. Review and confirm changing the limit, then enter your Secure PIN (required when you increase the limit).

6. New limit updated successfully.

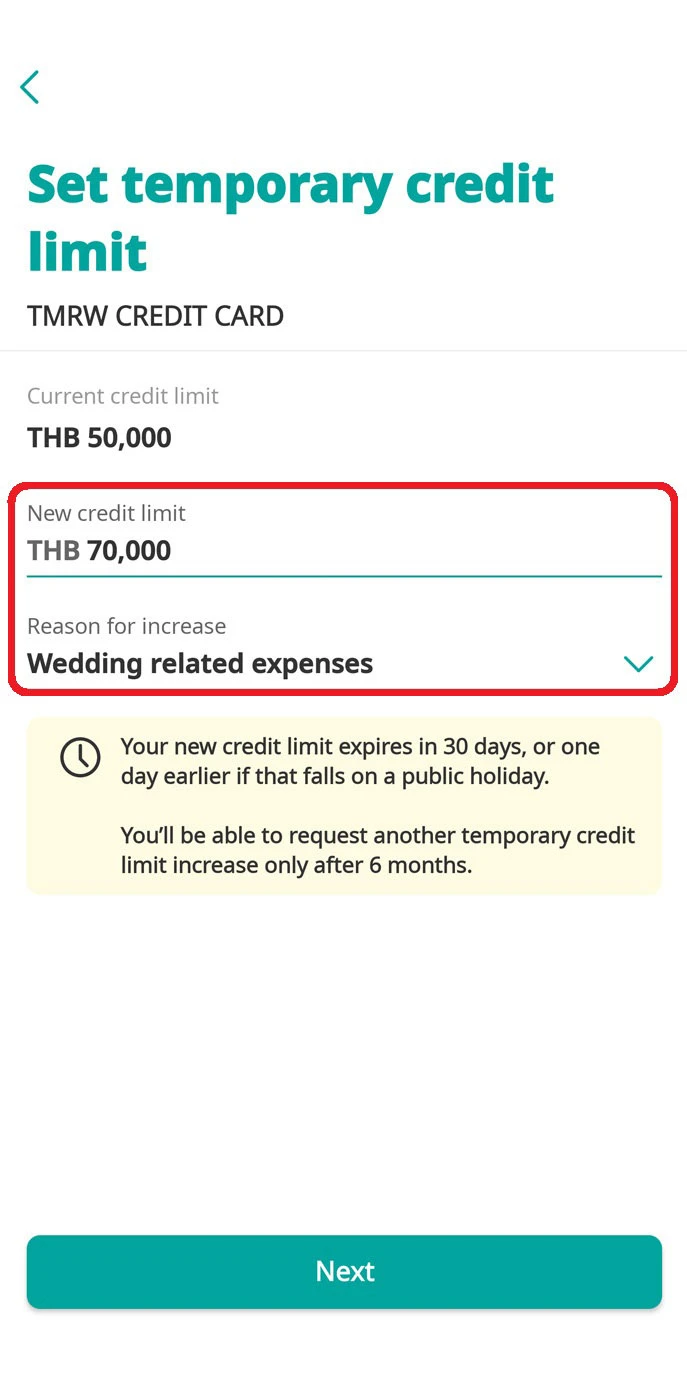

3. Request for temporary credit limit increase

1. Log in to UOB TMRW and select the credit card to increase credit limit temporarily.

2. Go to “Services” tab and select “Set temporary credit limit”.

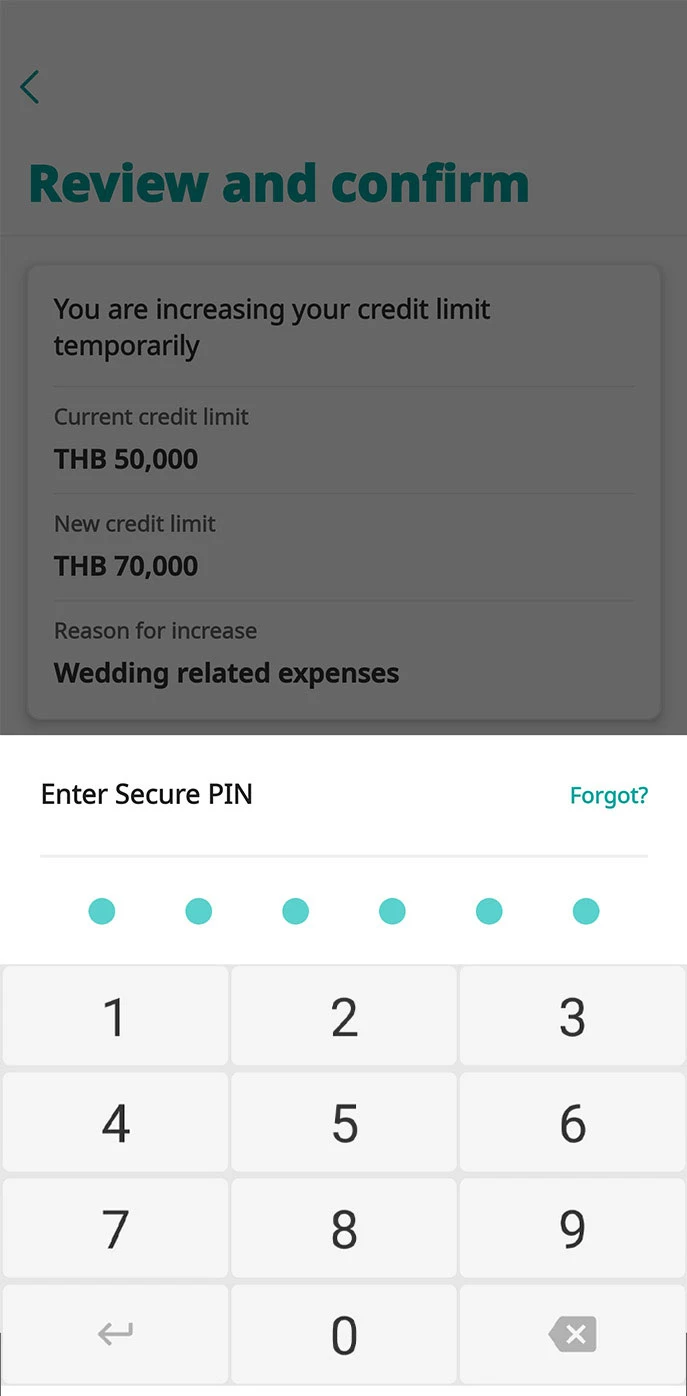

3. Enter new credit limit amount and select the reason for increase from the dropdown.

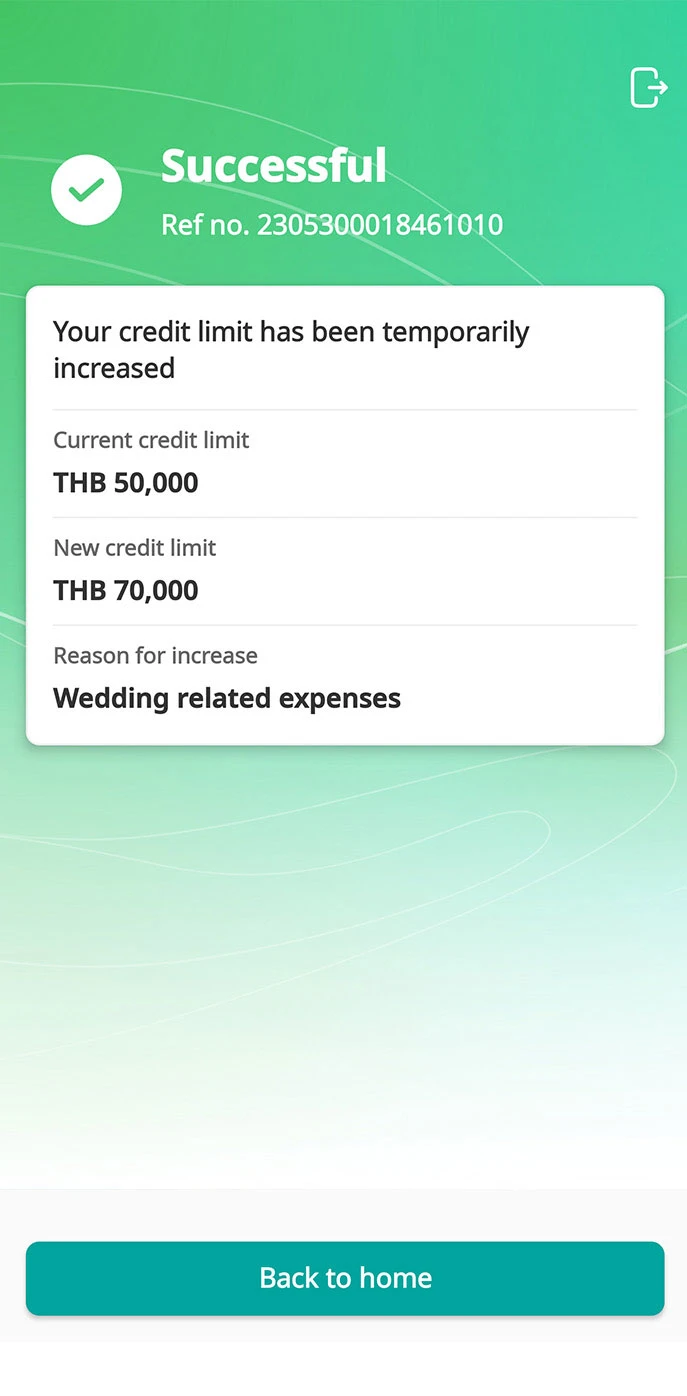

4. Review and confirm details, then enter your Secure PIN for authentication.

5. Temporary credit limit increased successfully.

Cash advances

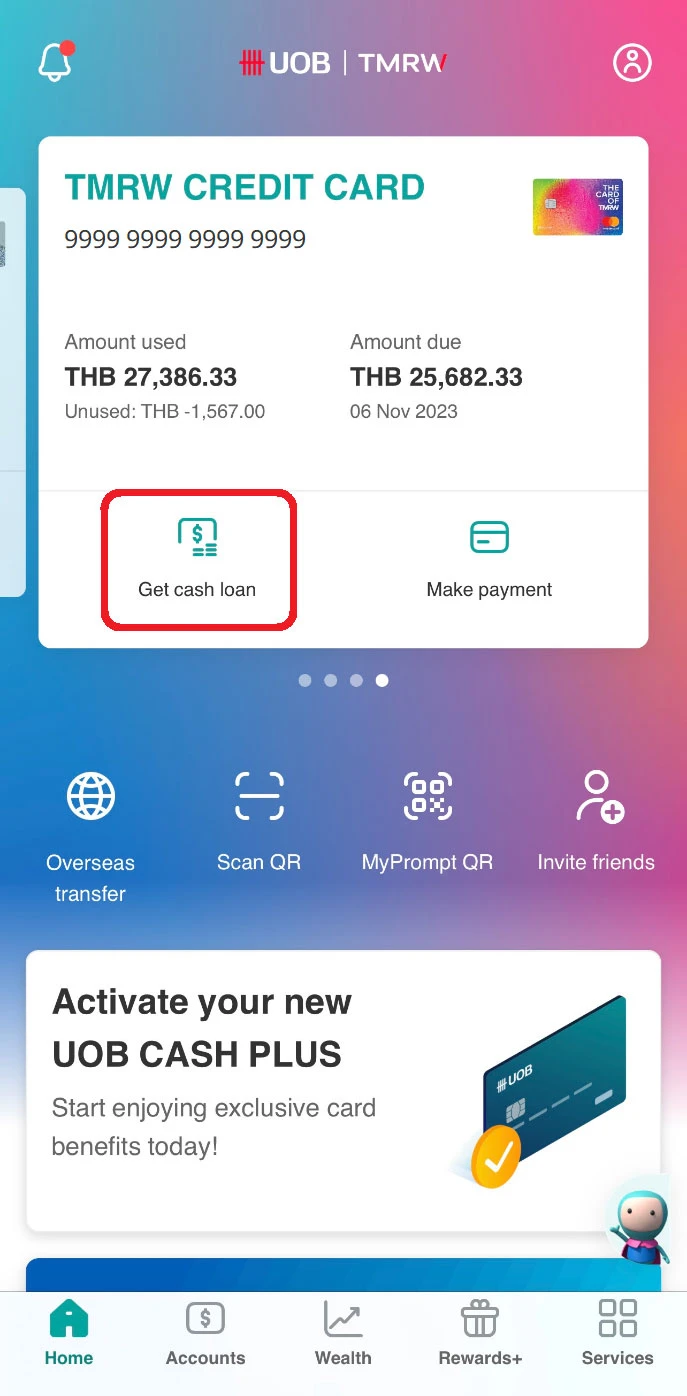

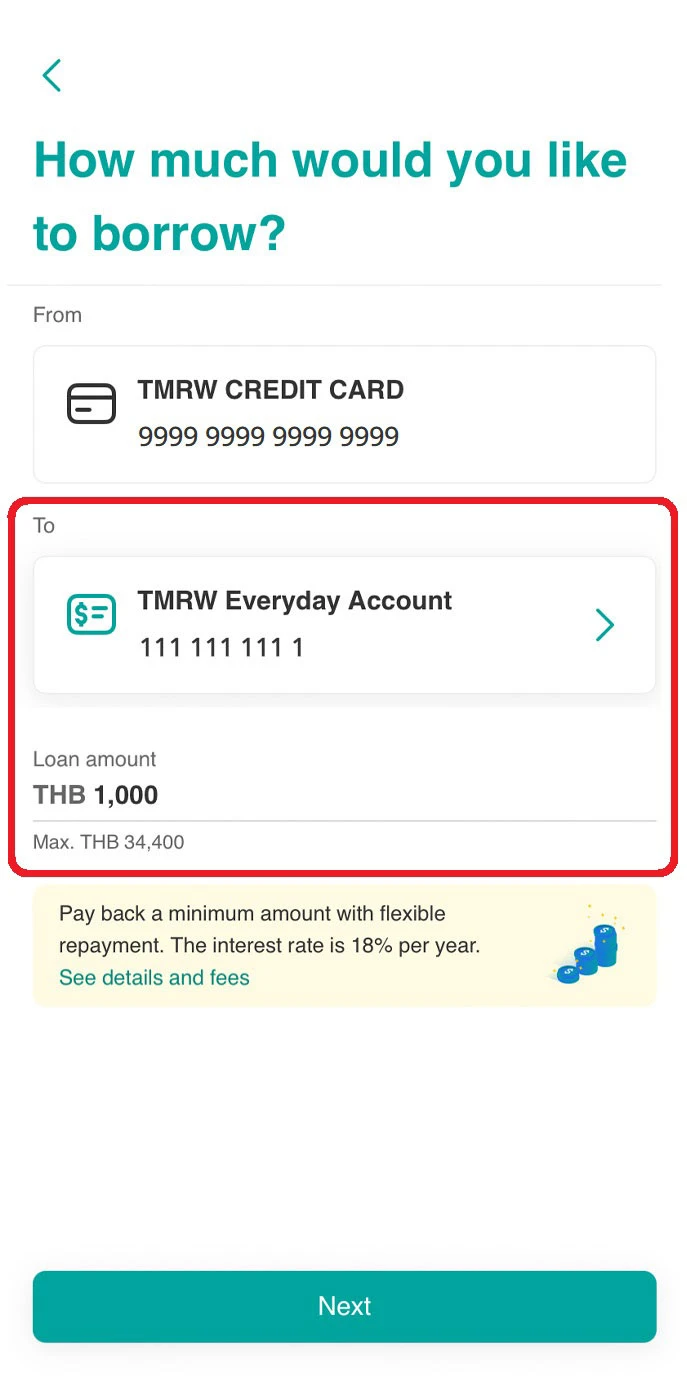

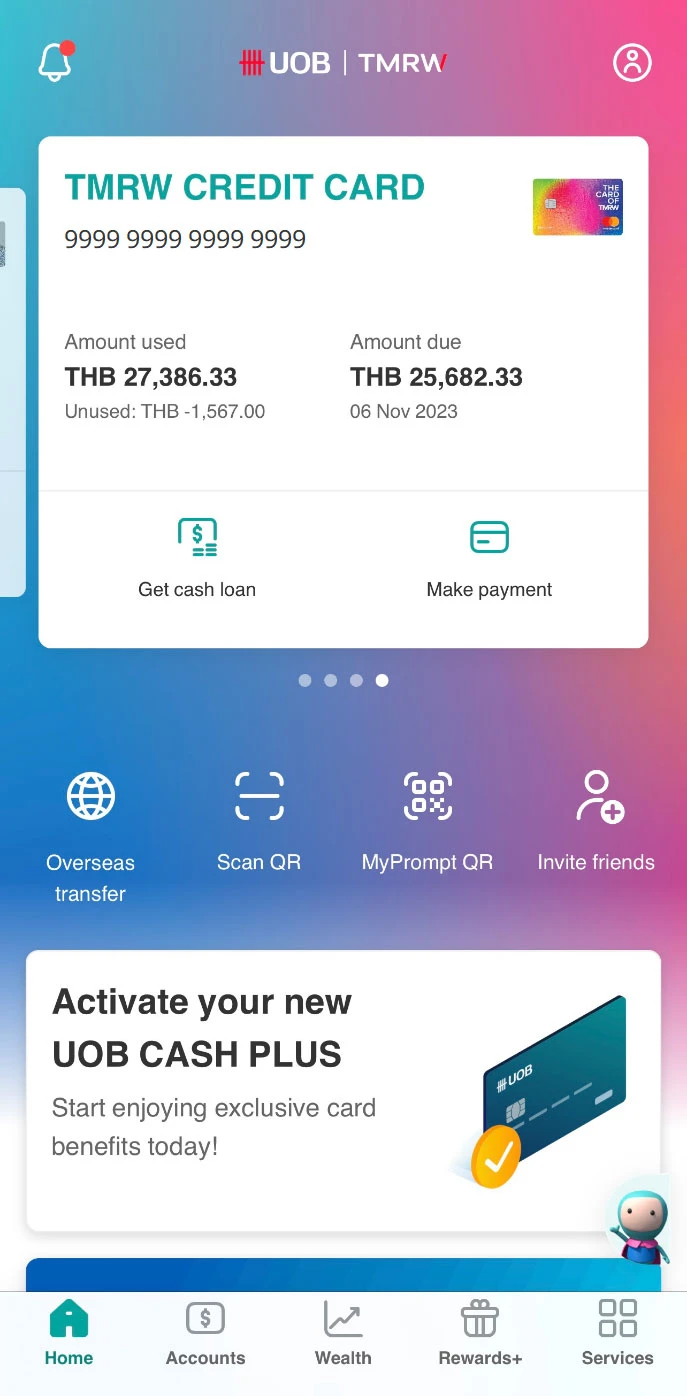

1. Get cash loan from your credit card (transfer funds online to your UOB deposit account)

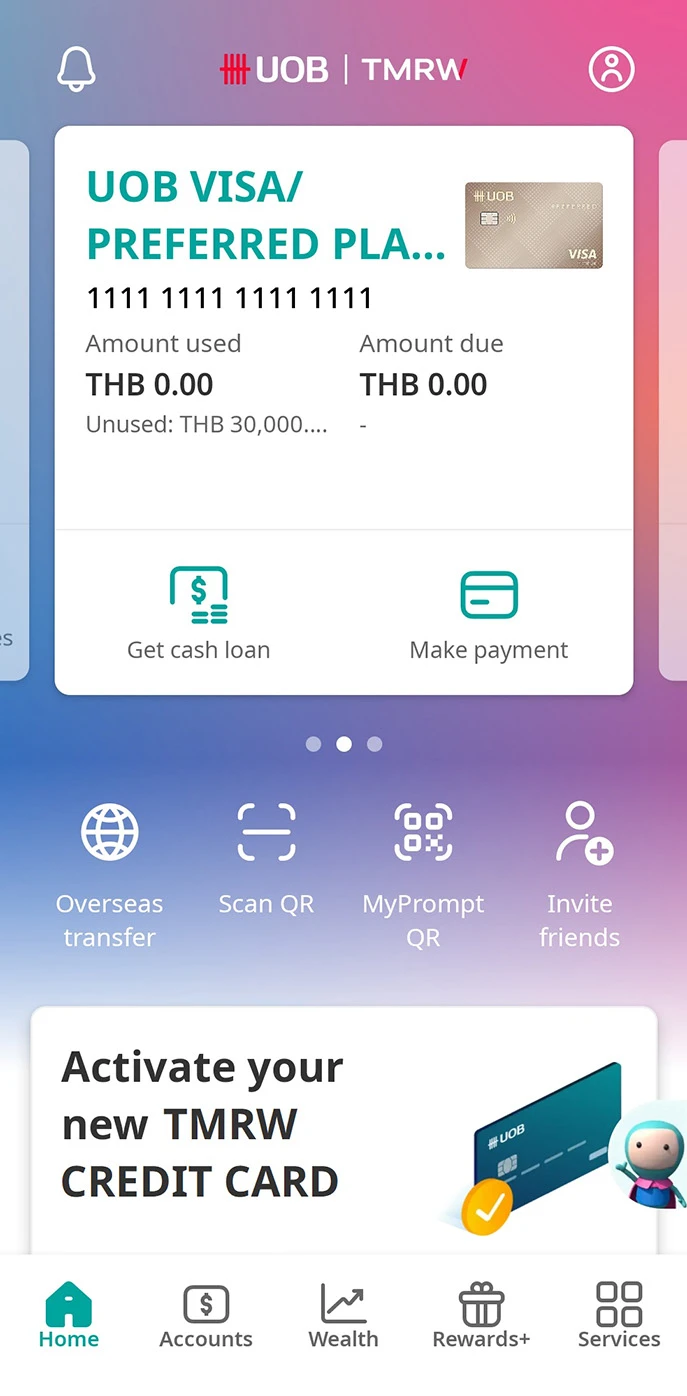

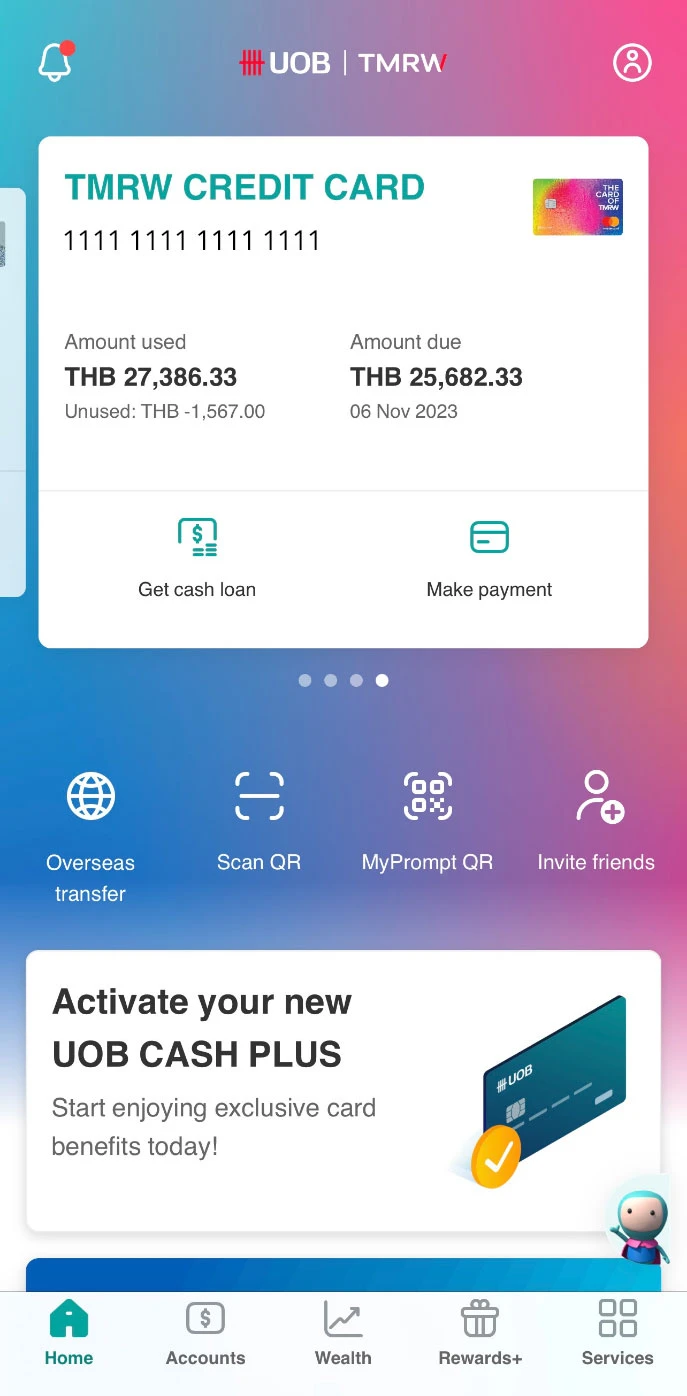

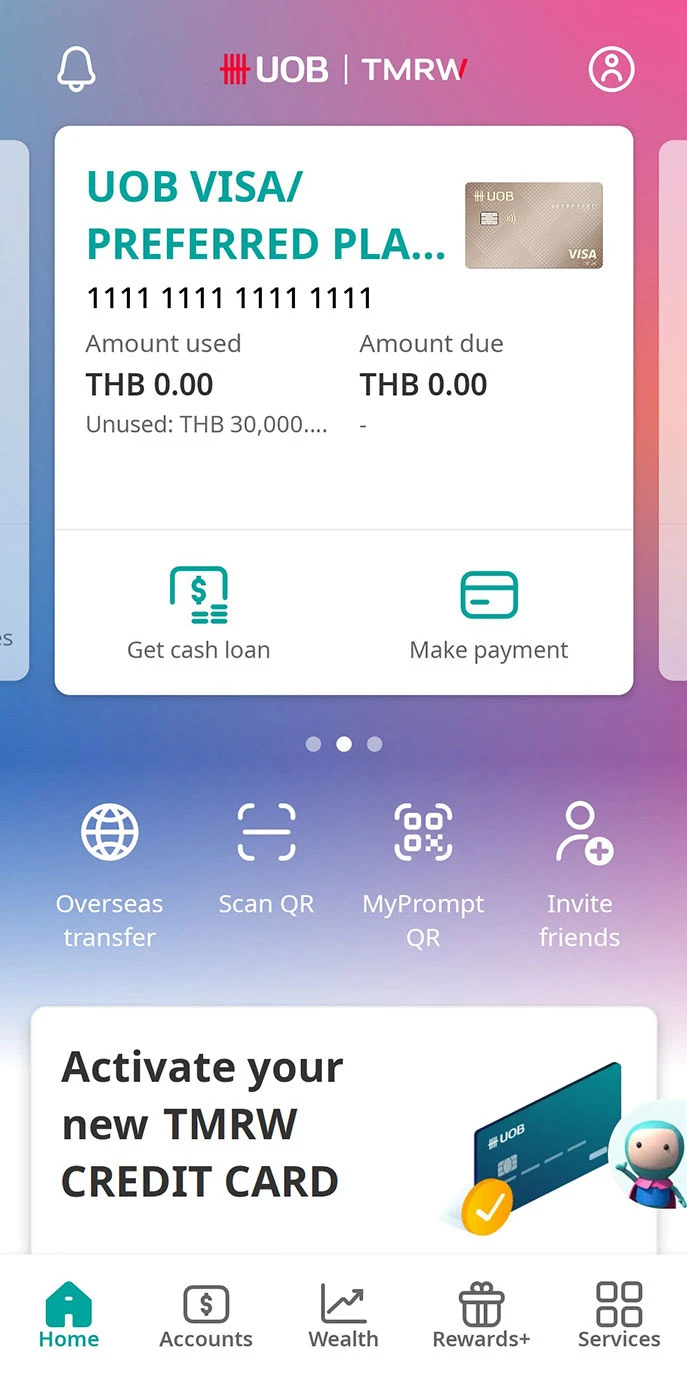

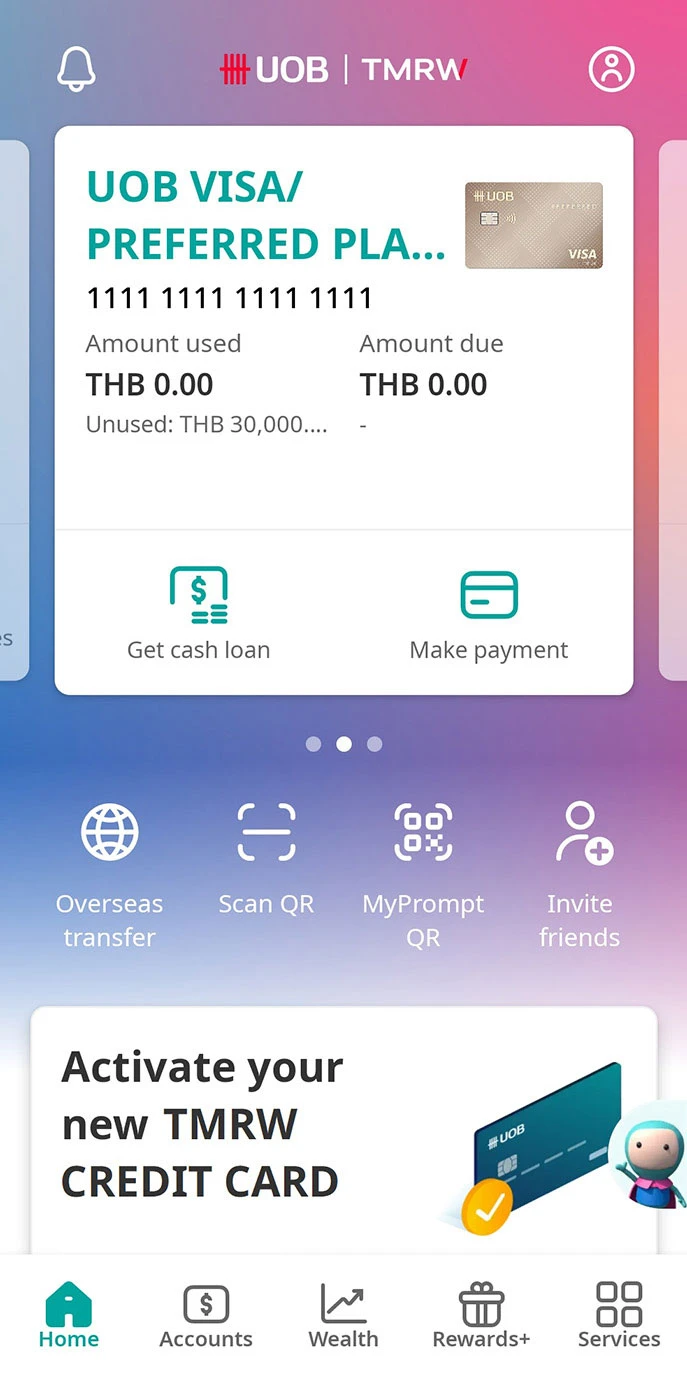

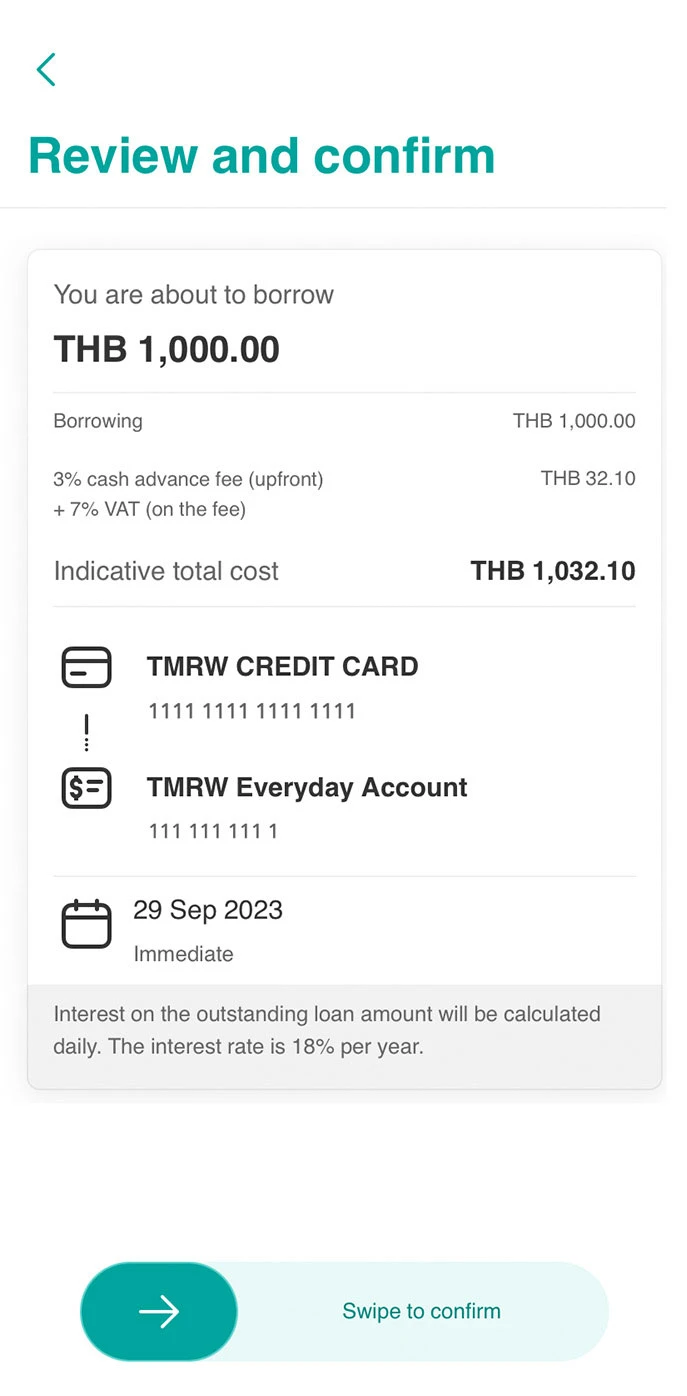

1. Log in to UOB TMRW and swipe to the credit card to take out cash advance from, then tap on “Get cash loan”.

2. Select your UOB deposit account to receive the funds transfer and enter the amount.

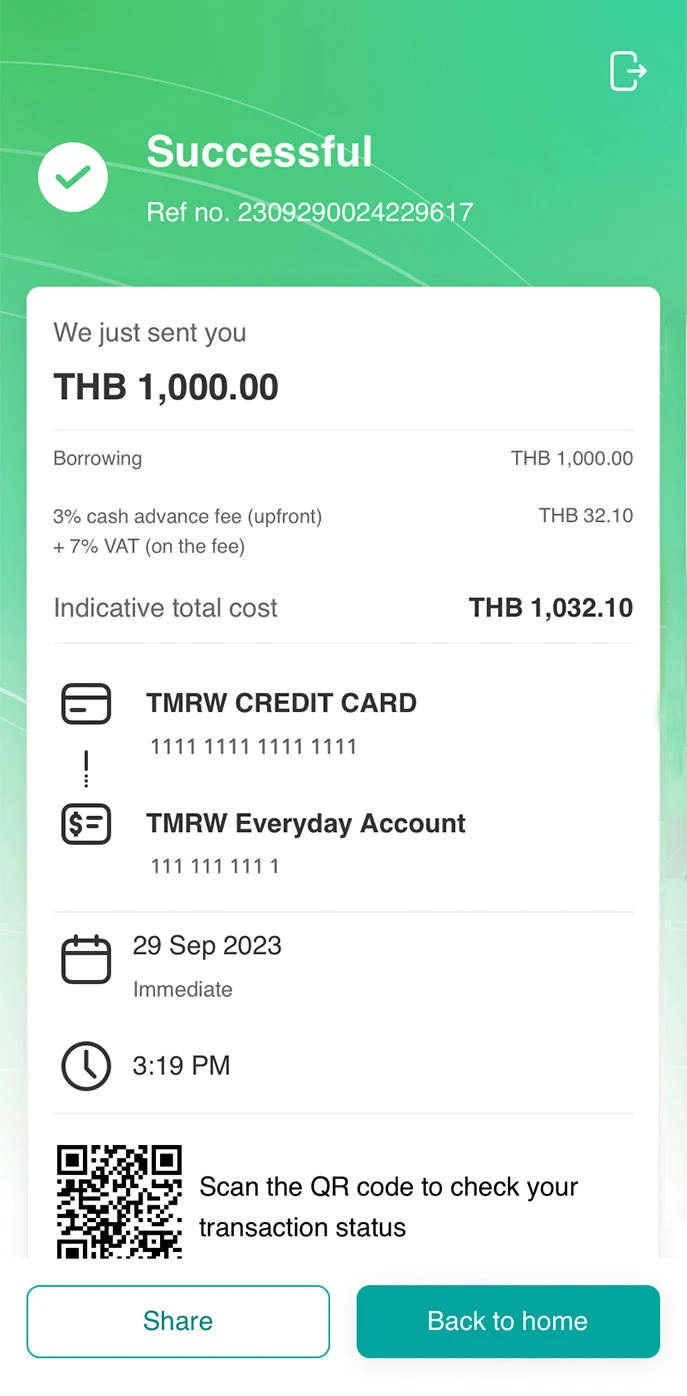

3. Review the details and swipe to confirm your transaction.

4. Cash advance amount successfully transferred to your selected deposit account.

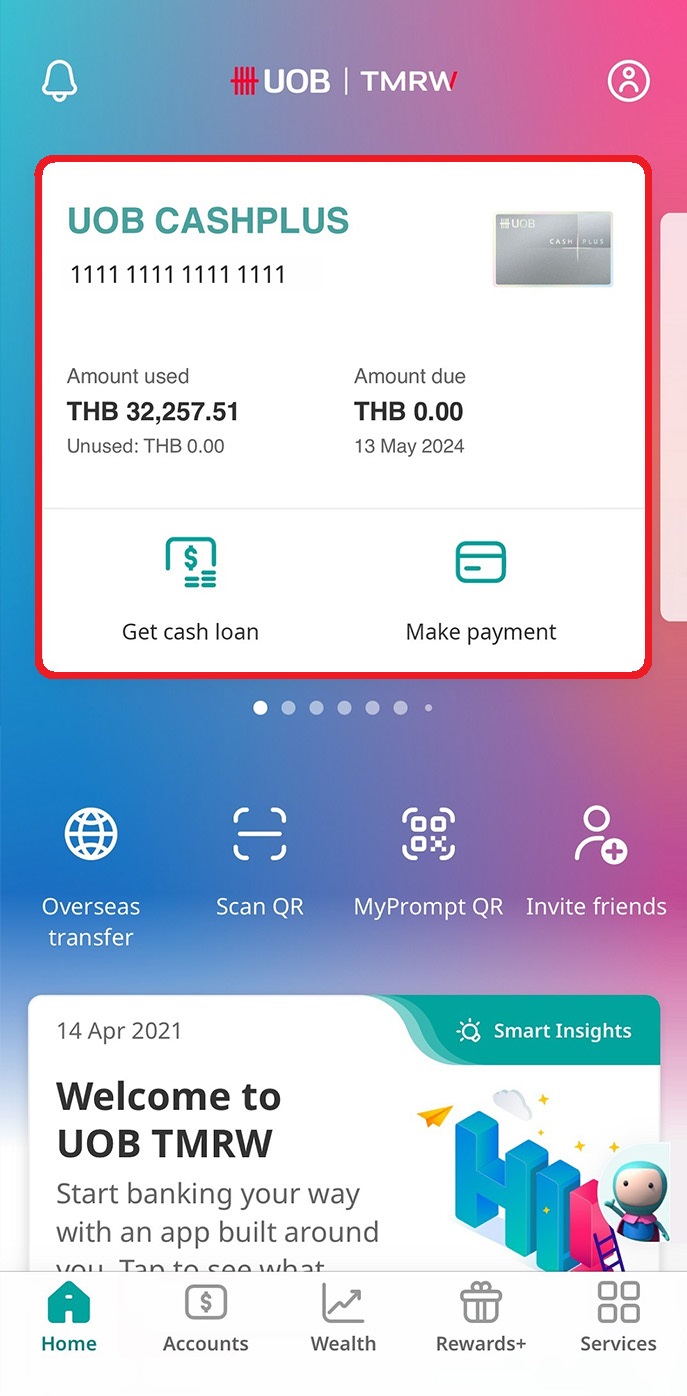

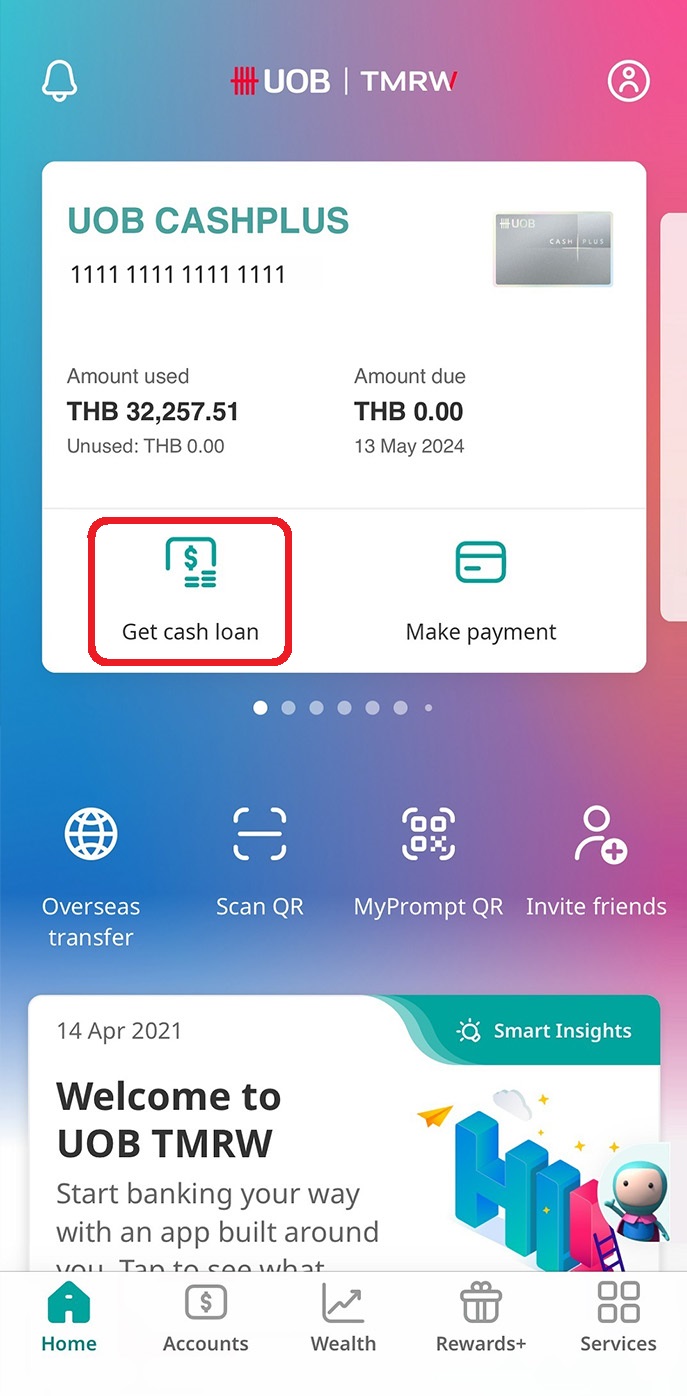

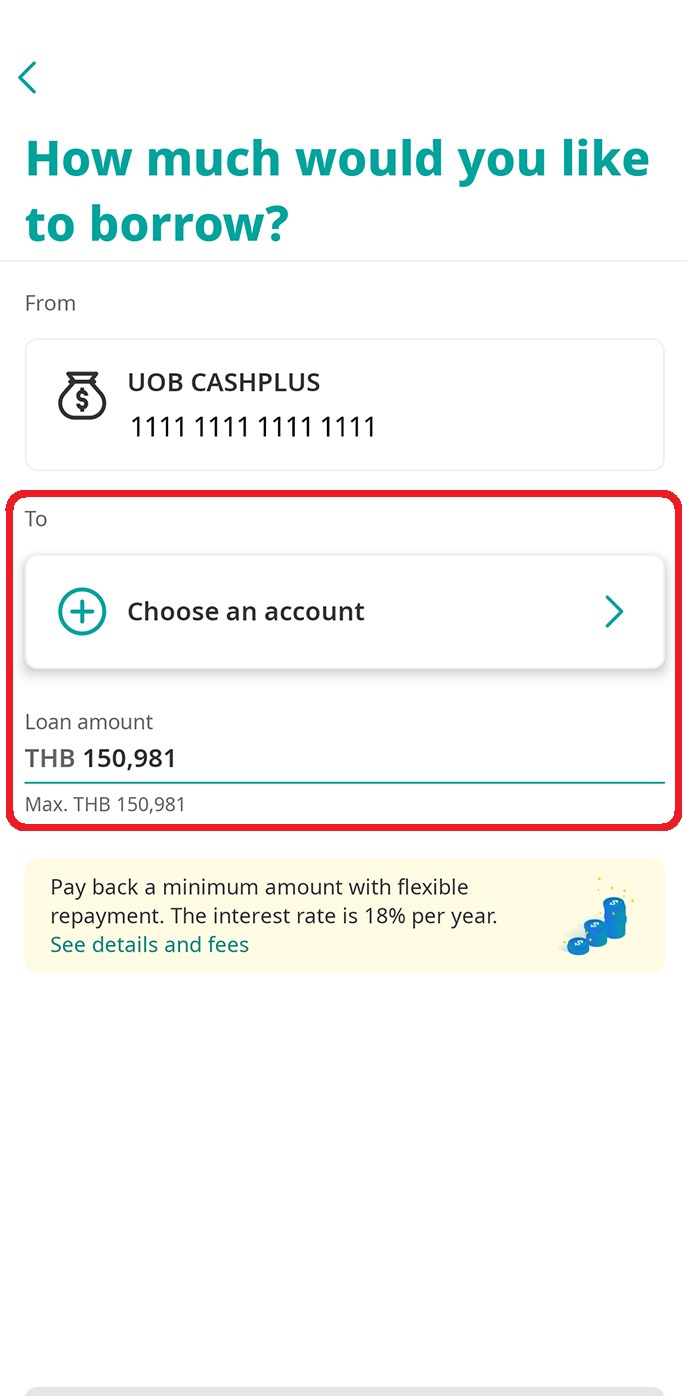

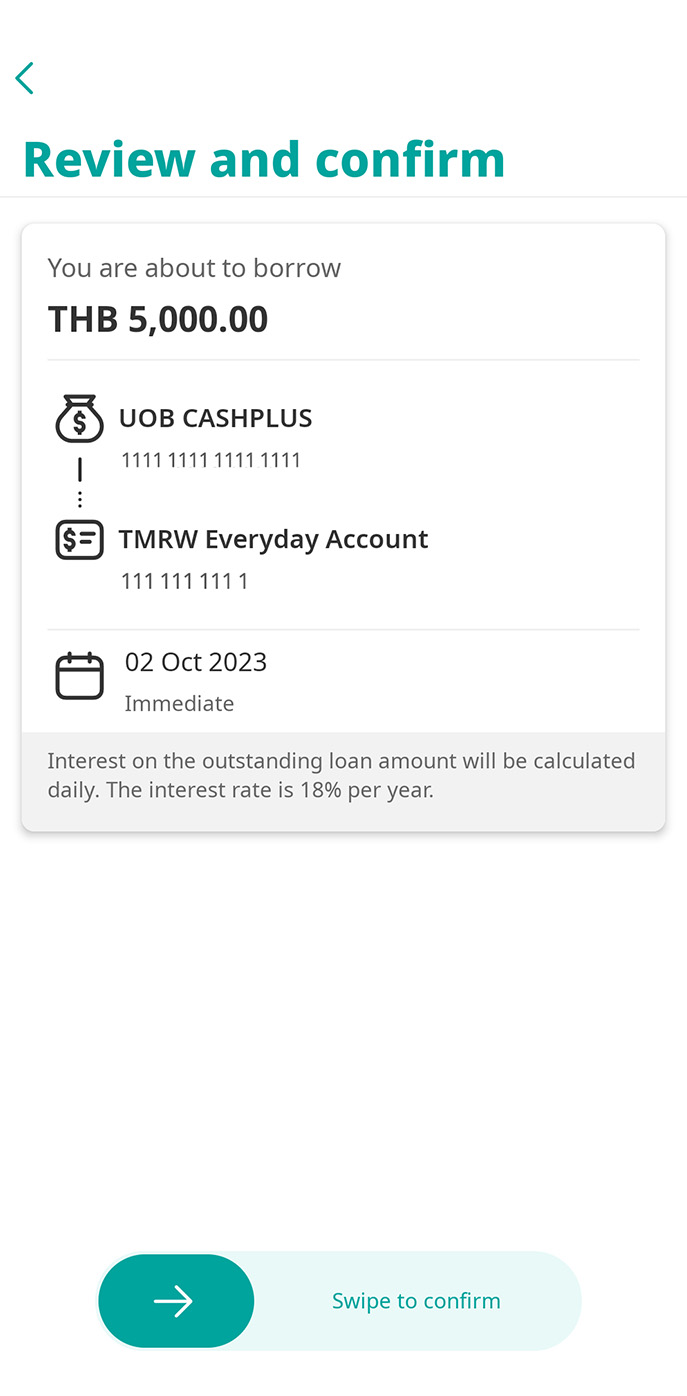

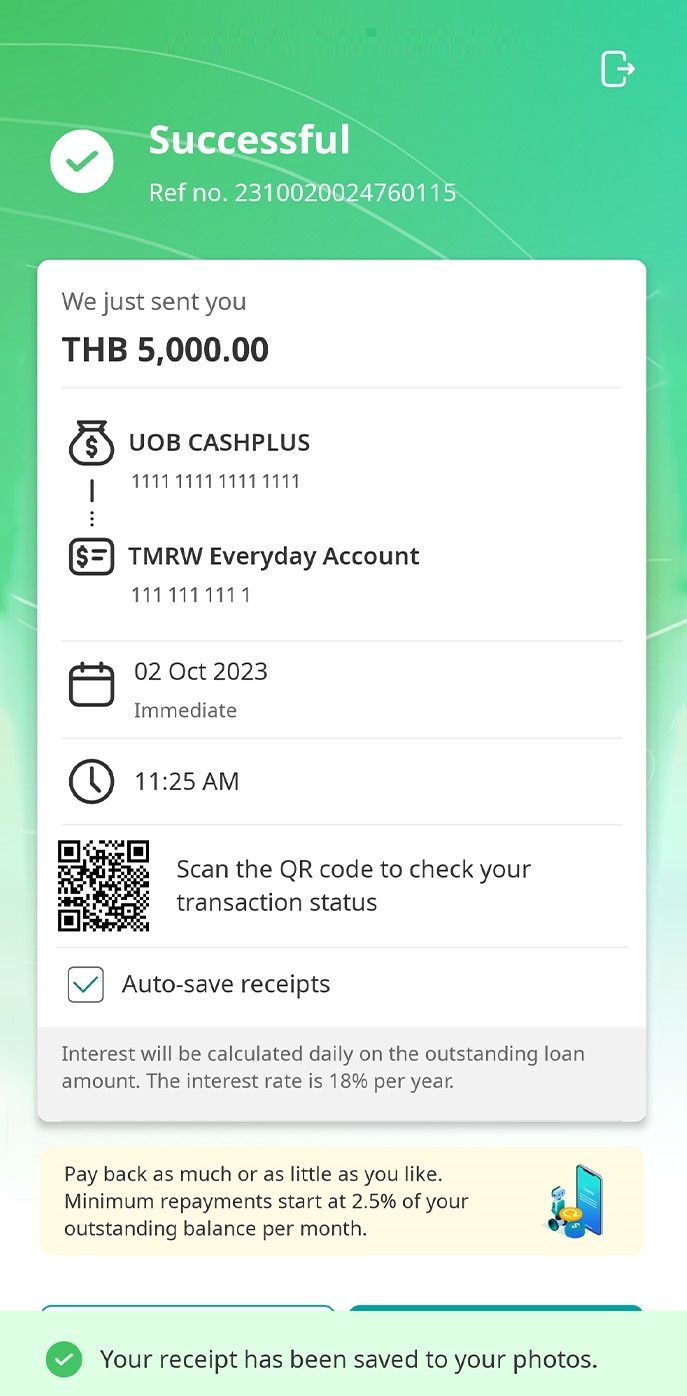

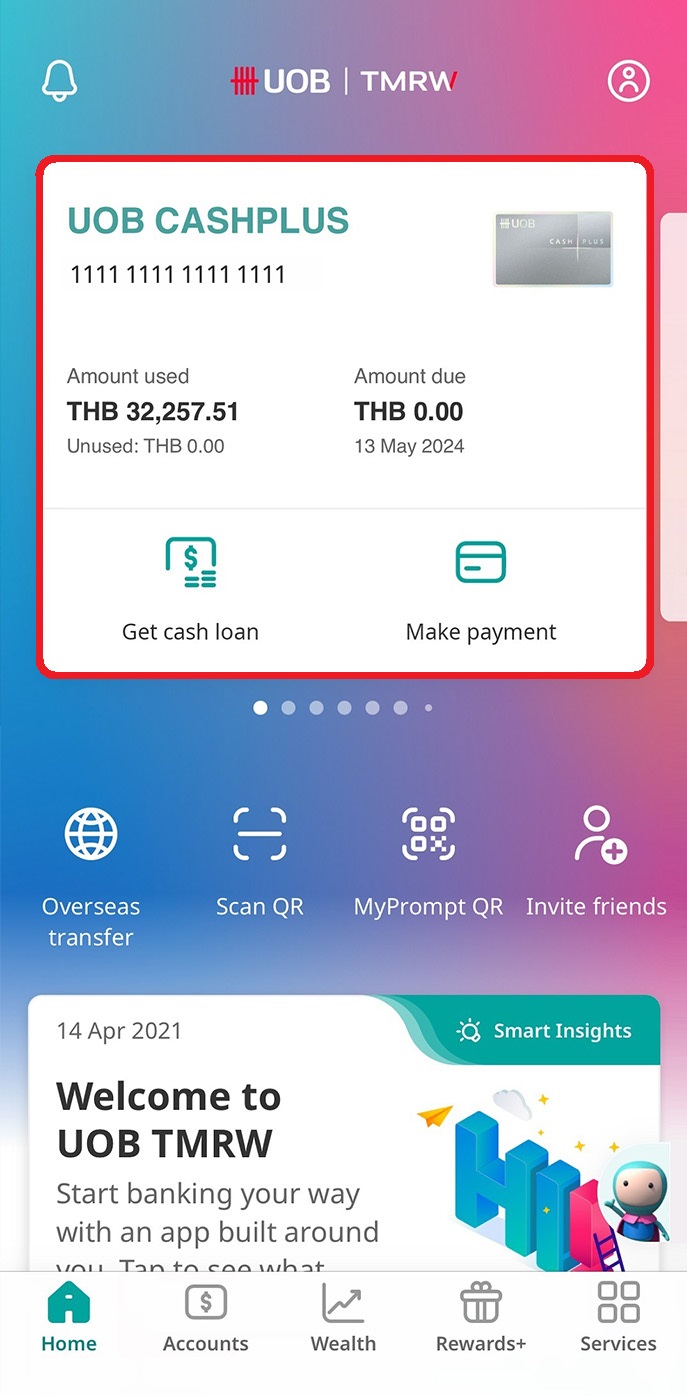

2. Get cash loan from your UOB Cash Plus (transfer funds online to your UOB deposit account)

1. Log in to UOB TMRW and select “Get cash loan” on your UOB Cash Plus account.

2. Select your UOB deposit account to receive the funds transfer and enter the amount.

3. Review the details and swipe to confirm your transaction.

4. Cash advance amount successfully transferred to your selected deposit account.

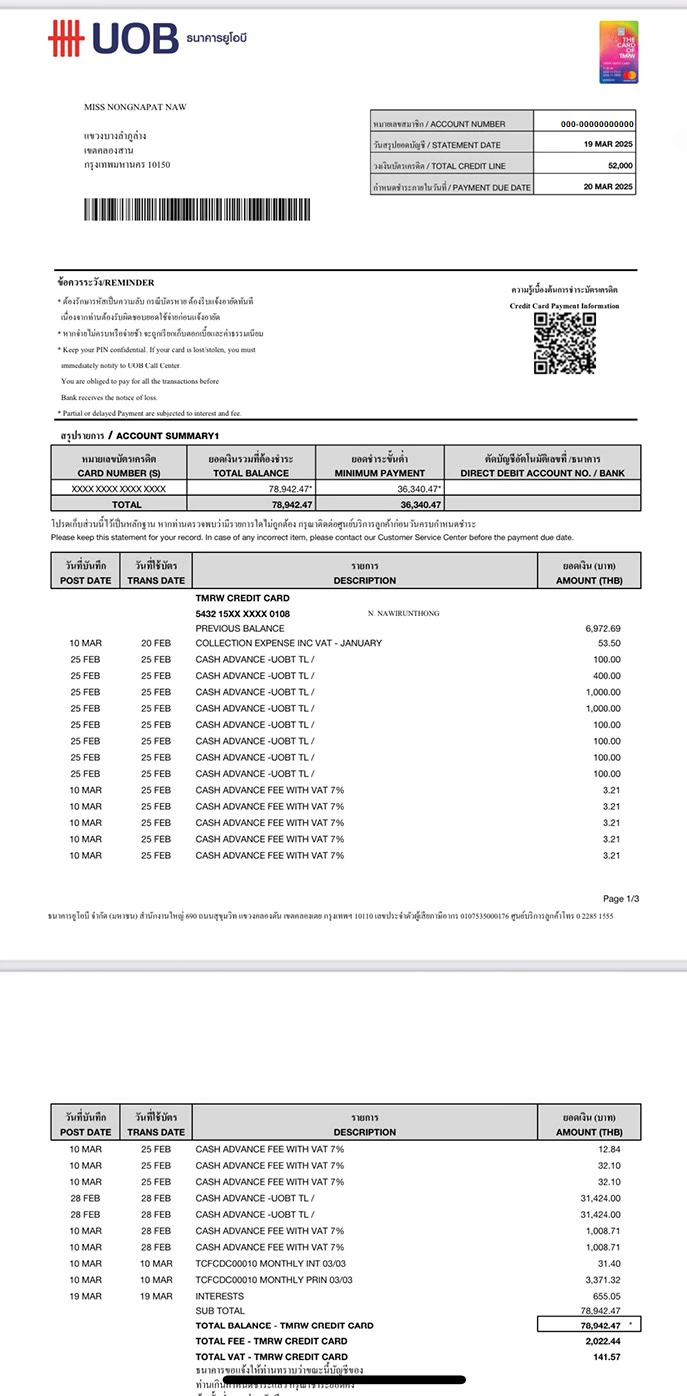

Monthly statements for credit card/ UOB Cash Plus (eStatements)

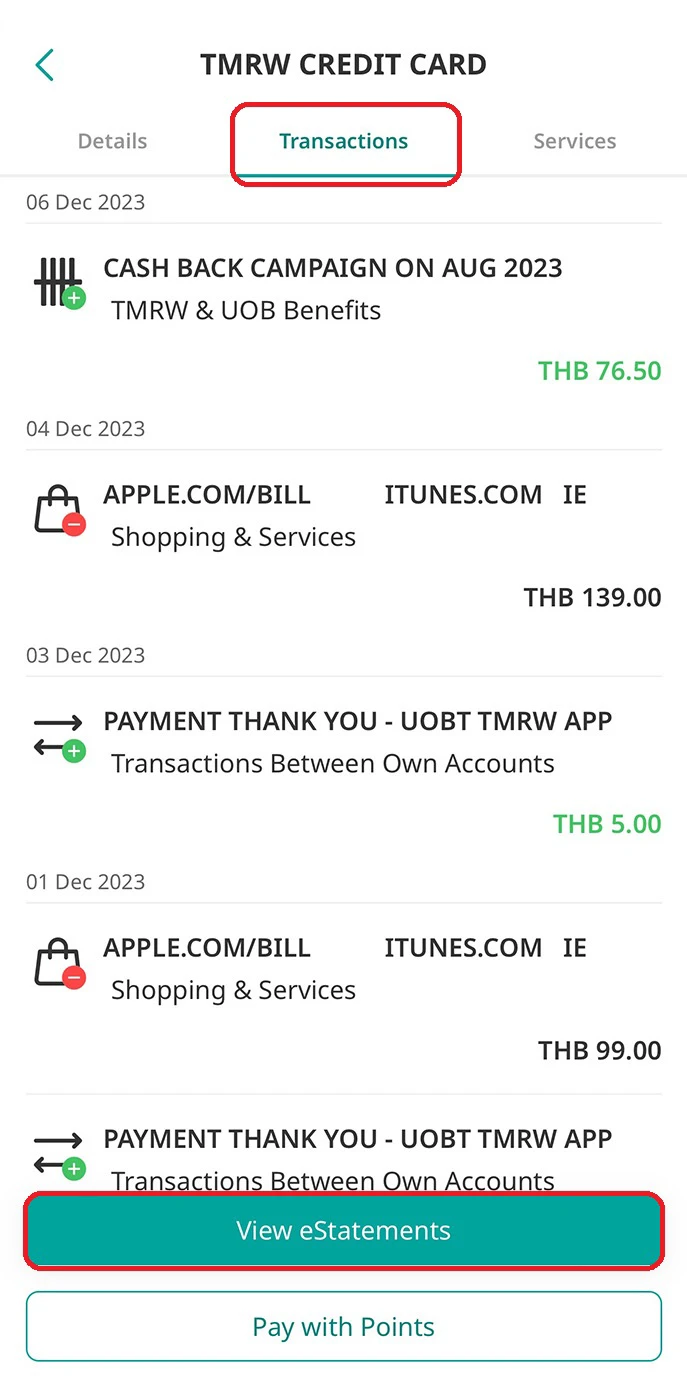

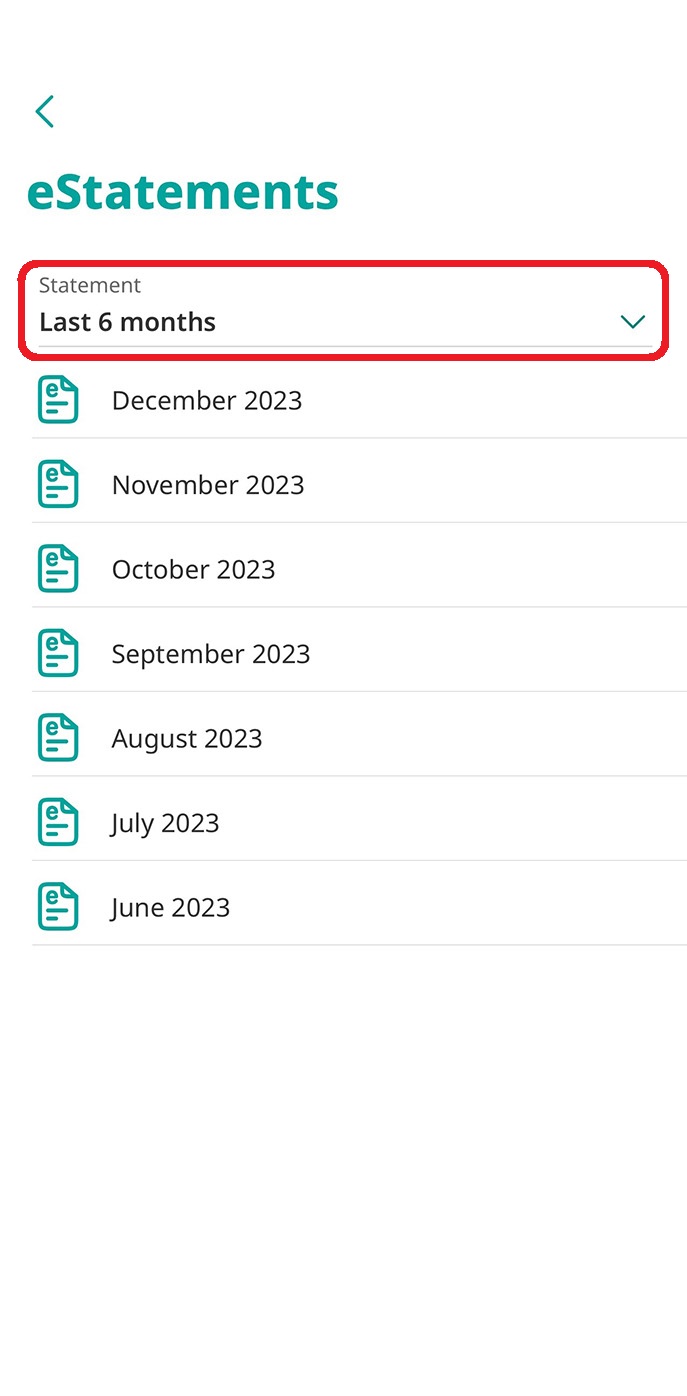

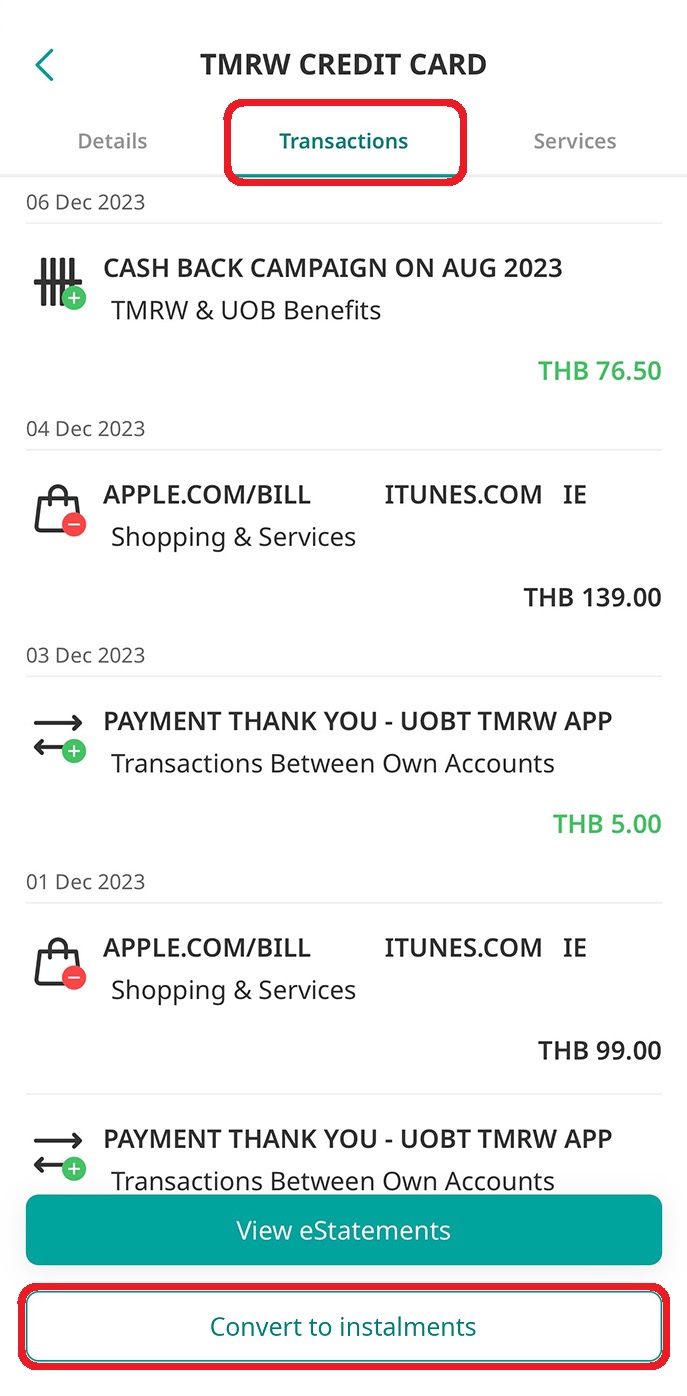

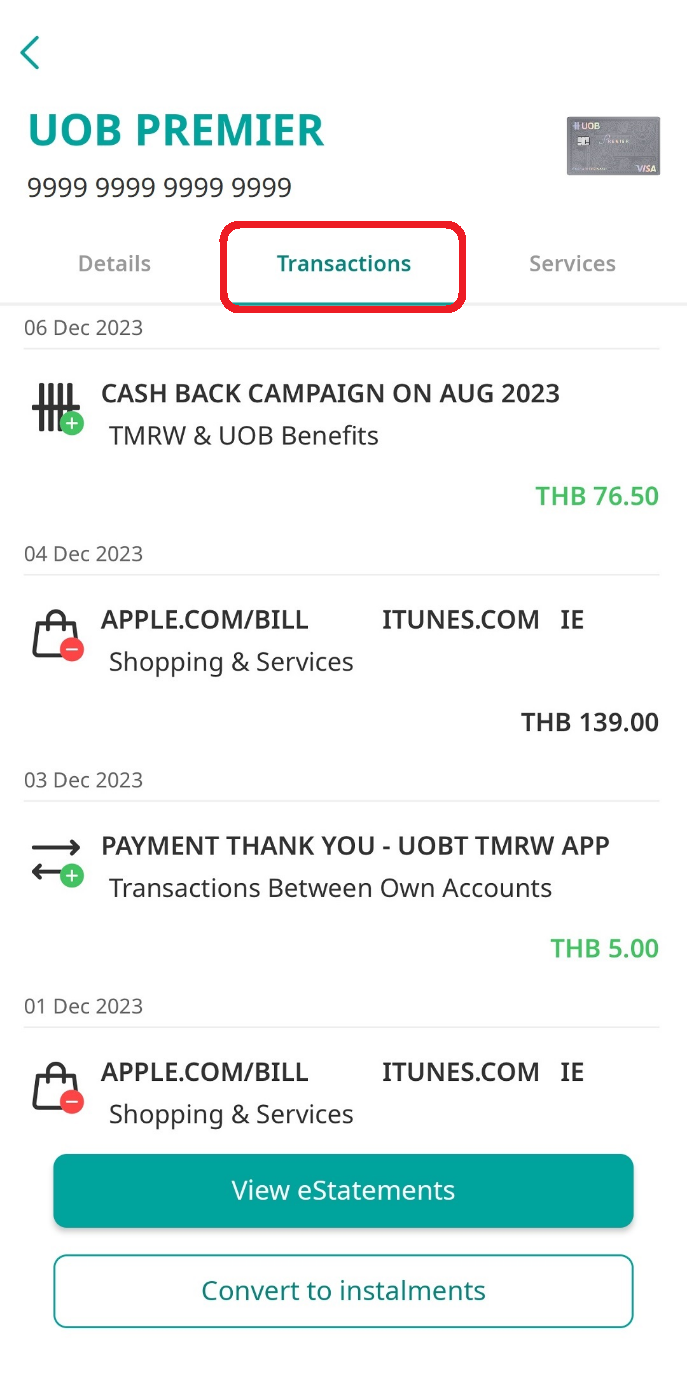

1. View eStatements for credit card

1. Log in to UOB TMRW and select the credit card to view eStatements.

2. Select “Transactions”, then tap on “View eStatements” at the bottom of the screen.

3. Select the month to view details from last 6 months or choose the year from the dropdown list, available up to last 5 years.

Note: Your eStatements will only be available on the UOB TMRW app starting from the bill cycle after you’ve successfully registered for app service or eStatement service.

4. The PDF of your eStatement can be downloaded or shared via email instantly. QR/ Barcode for payment can be found on the last page.

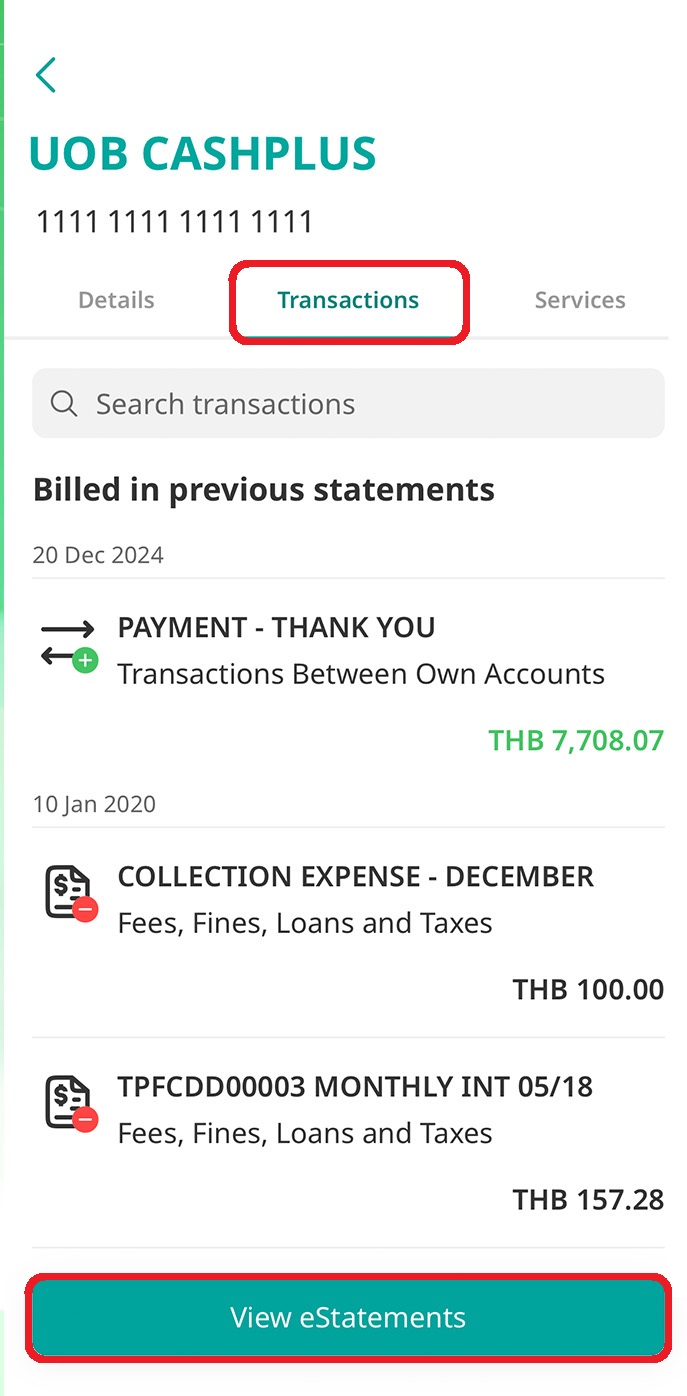

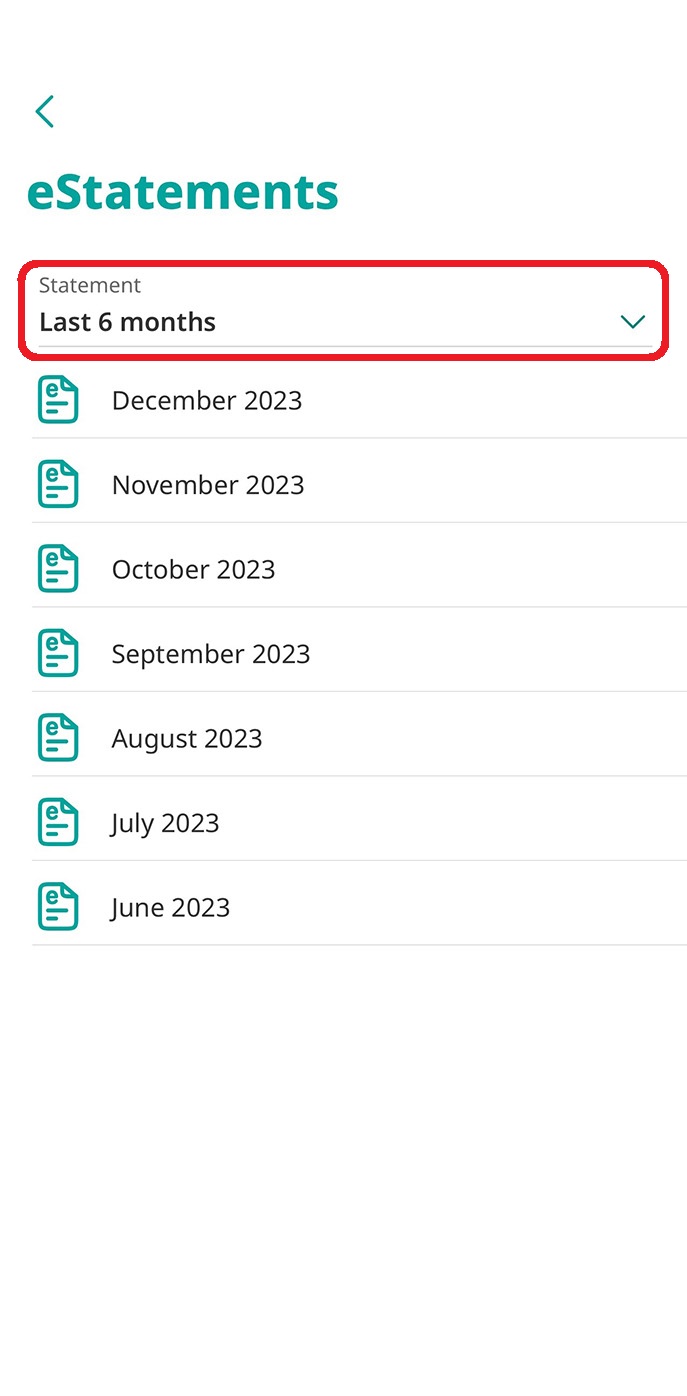

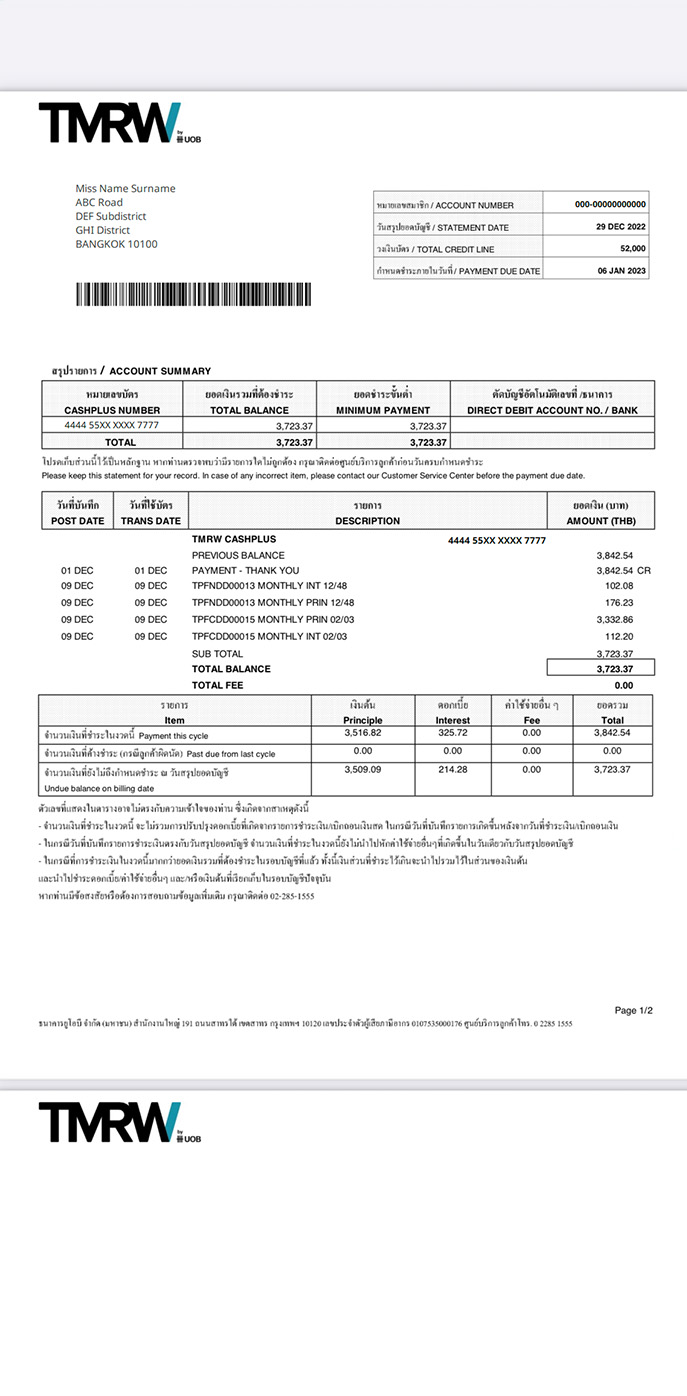

2. View eStatements for UOB Cash Plus

1. Log in to UOB TMRW and select your UOB Cash Plus account.

2. Select “Transactions”, then tap on “View eStatements” at the bottom of the screen.

3. Select the month to view details from last 6 months or choose the year from the dropdown list, available up to last 5 years.

Note: Your eStatements will only be available on the UOB TMRW app starting from the bill cycle after you’ve successfully registered for app service or eStatement service.

4. The PDF of your eStatement can be downloaded or shared via email instantly. QR/ Barcode for payment can be found on the last page.

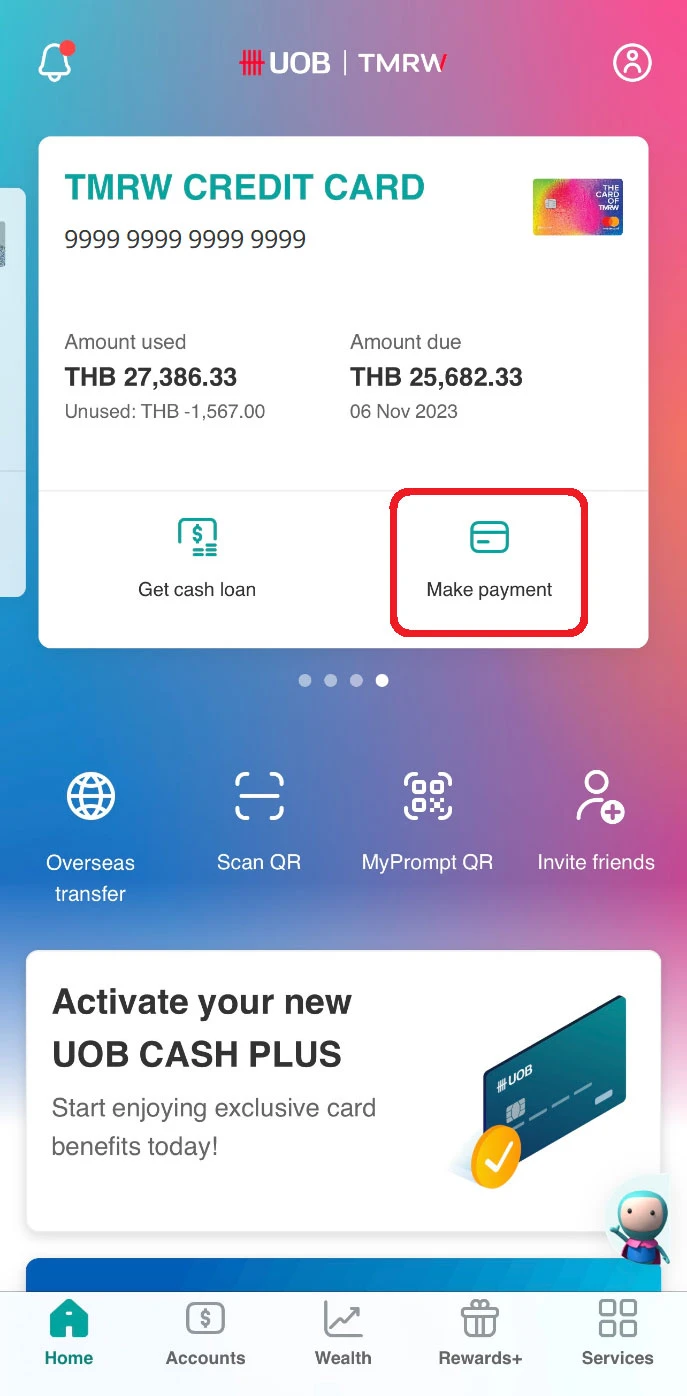

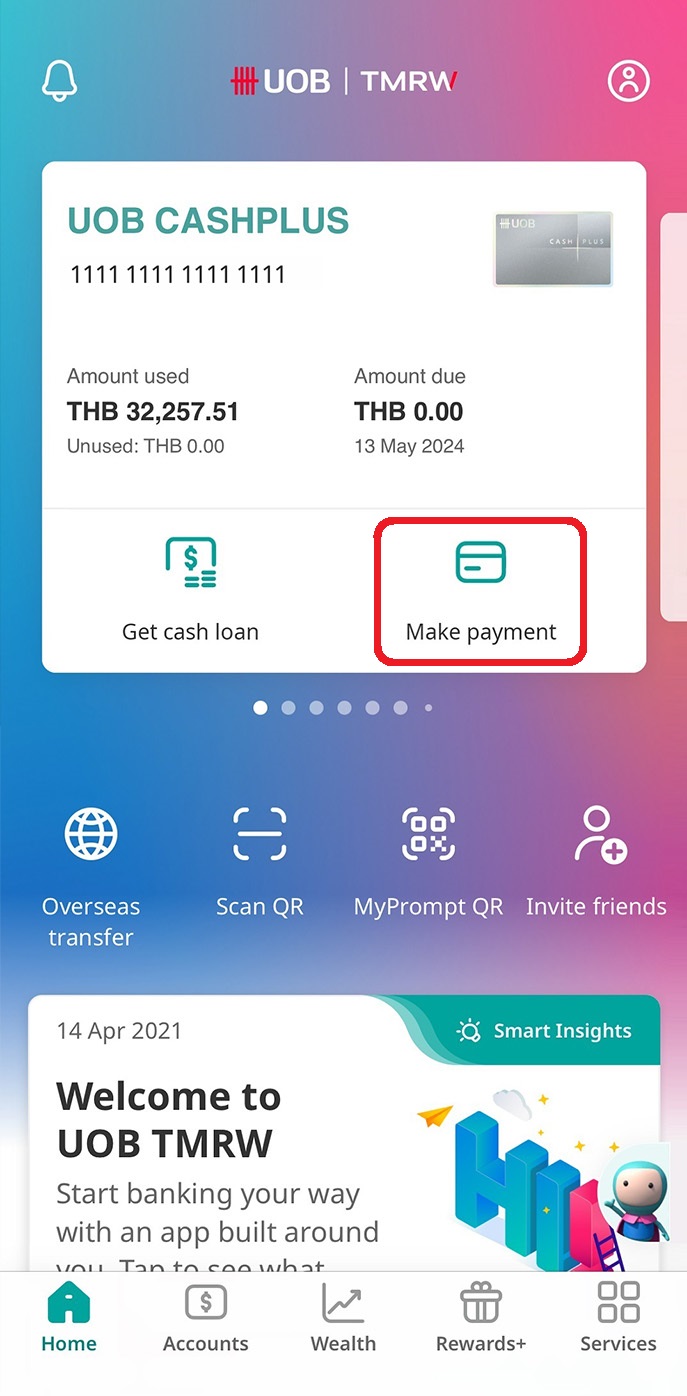

Make payment for credit card/ UOB Cash Plus

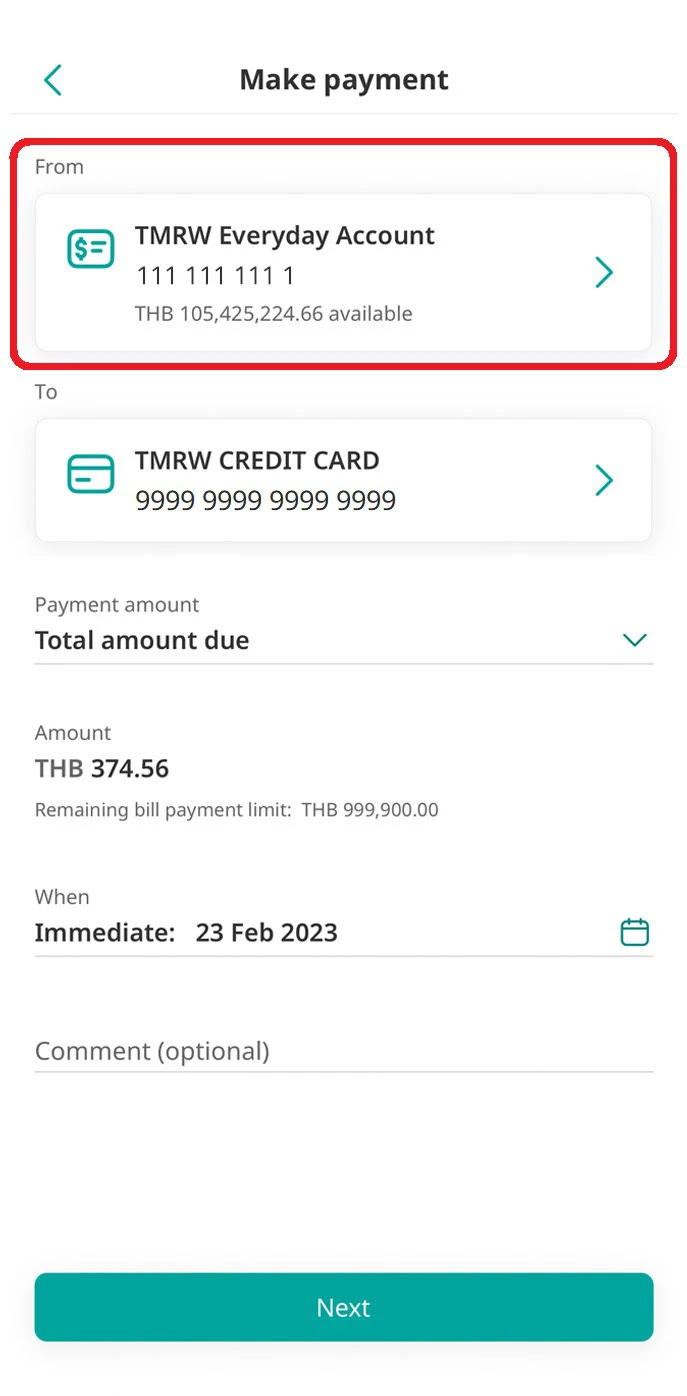

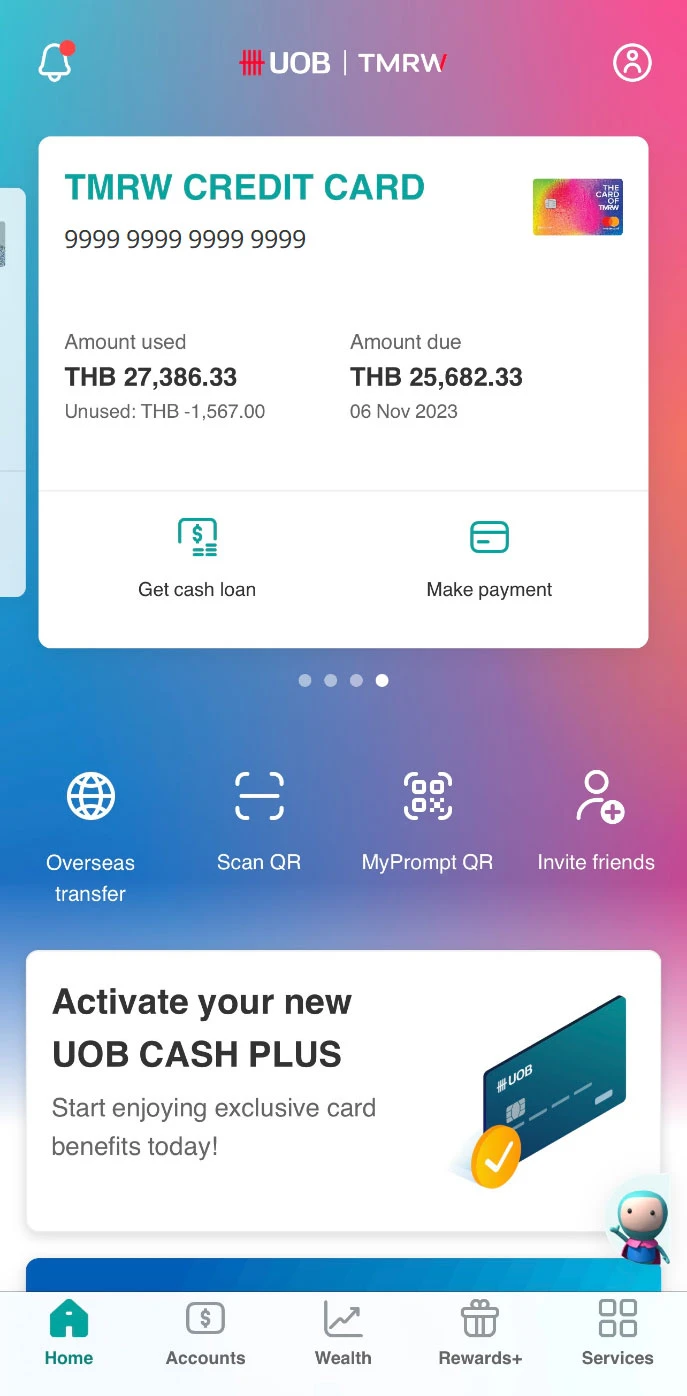

1. Pay your UOB credit card bill from your UOB deposit account

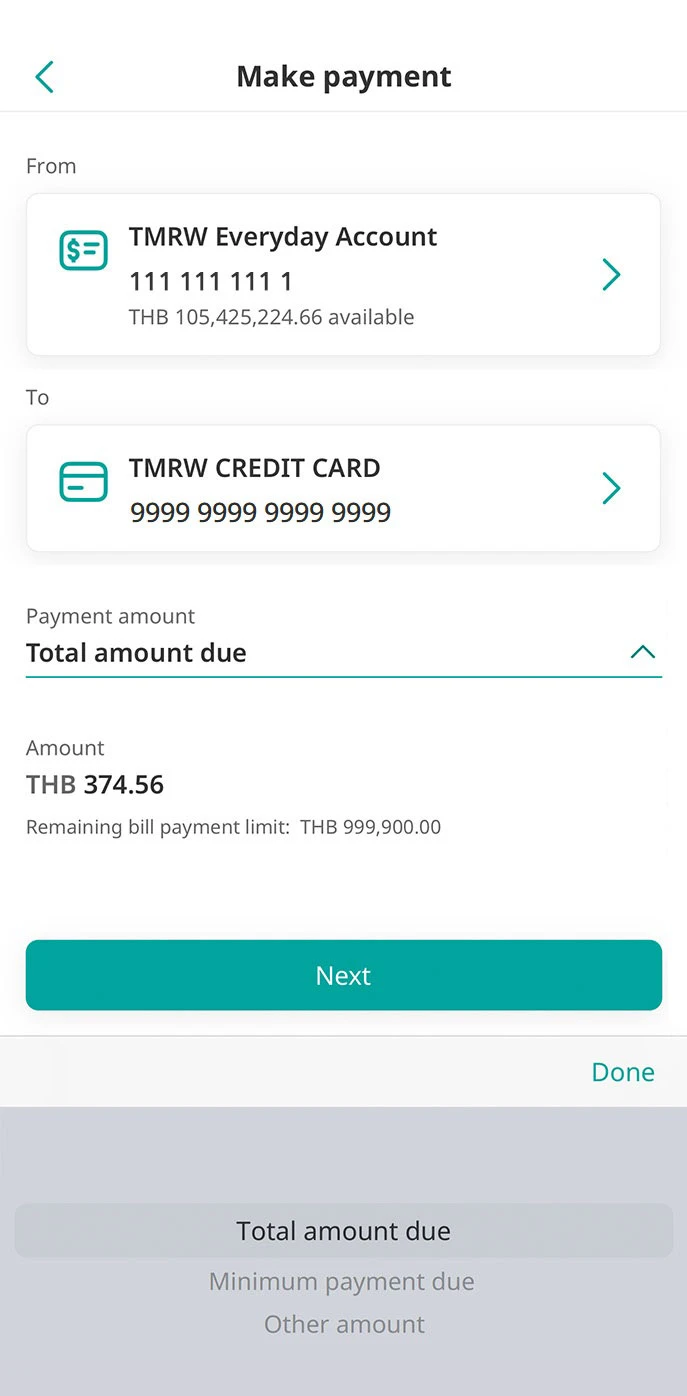

1. Log in to UOB TMRW and swipe to the credit card to pay off, then tap on “Make payment”.

2. Select your UOB deposit account to pay from.

3. Select the amount and date of payment.

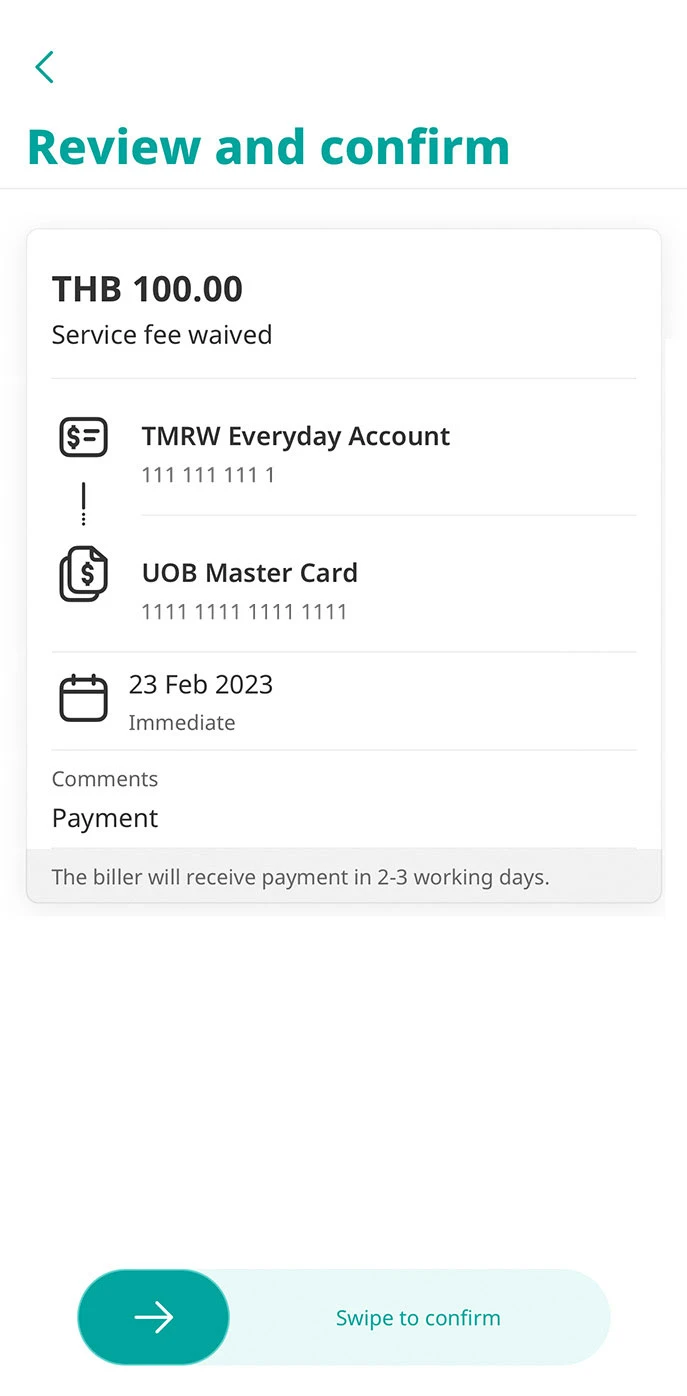

4. Review the details and swipe to confirm your transaction.

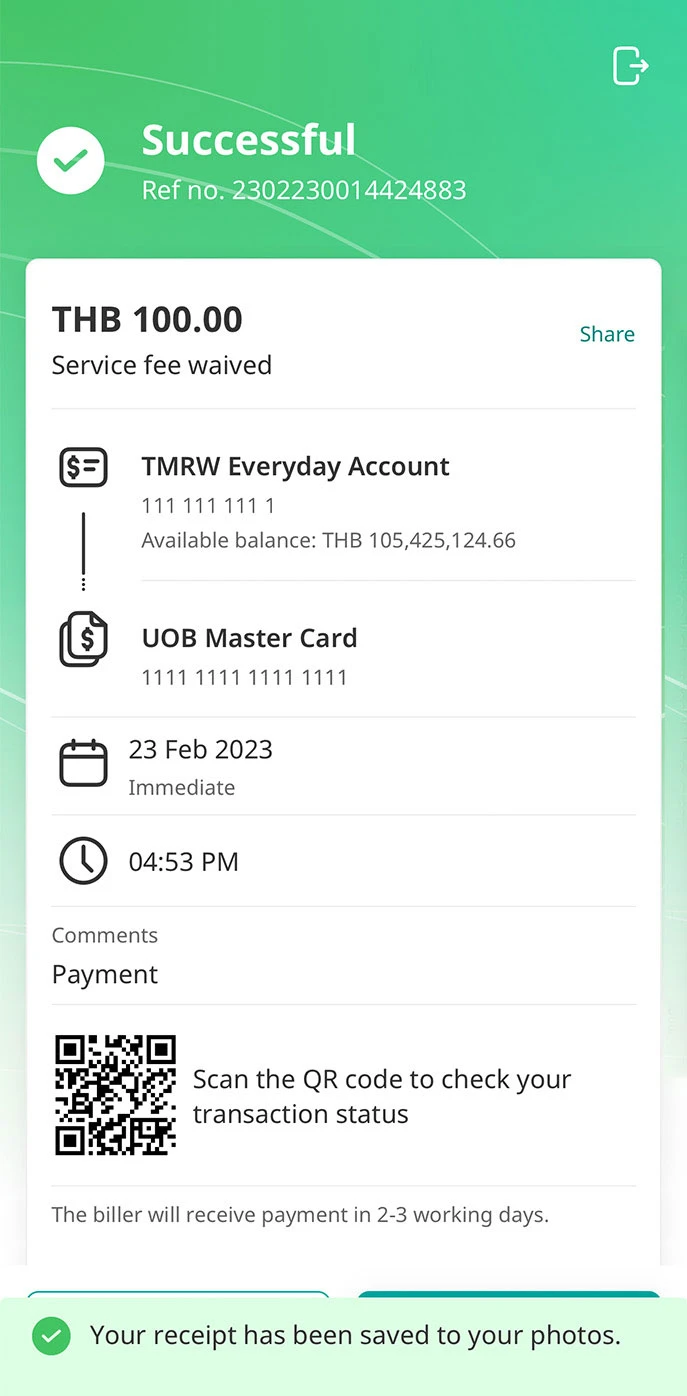

5. Payment successful, receipts are saved in your photo album.

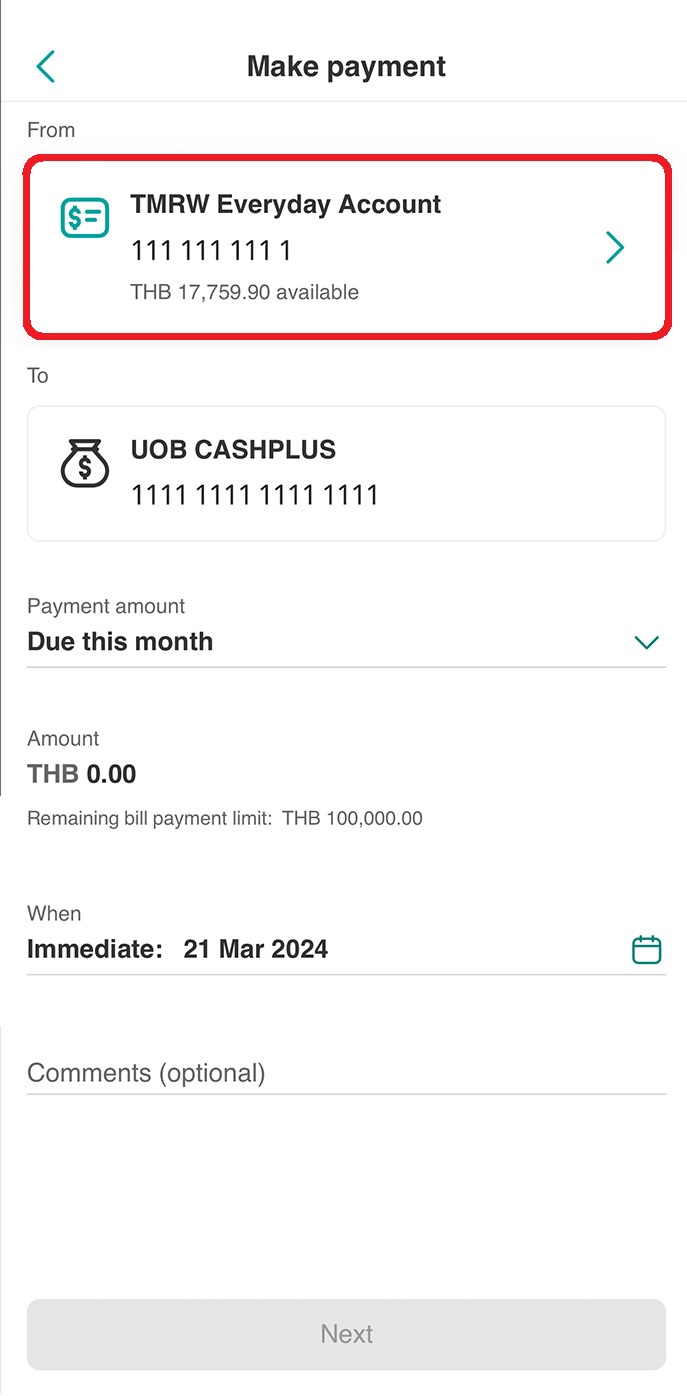

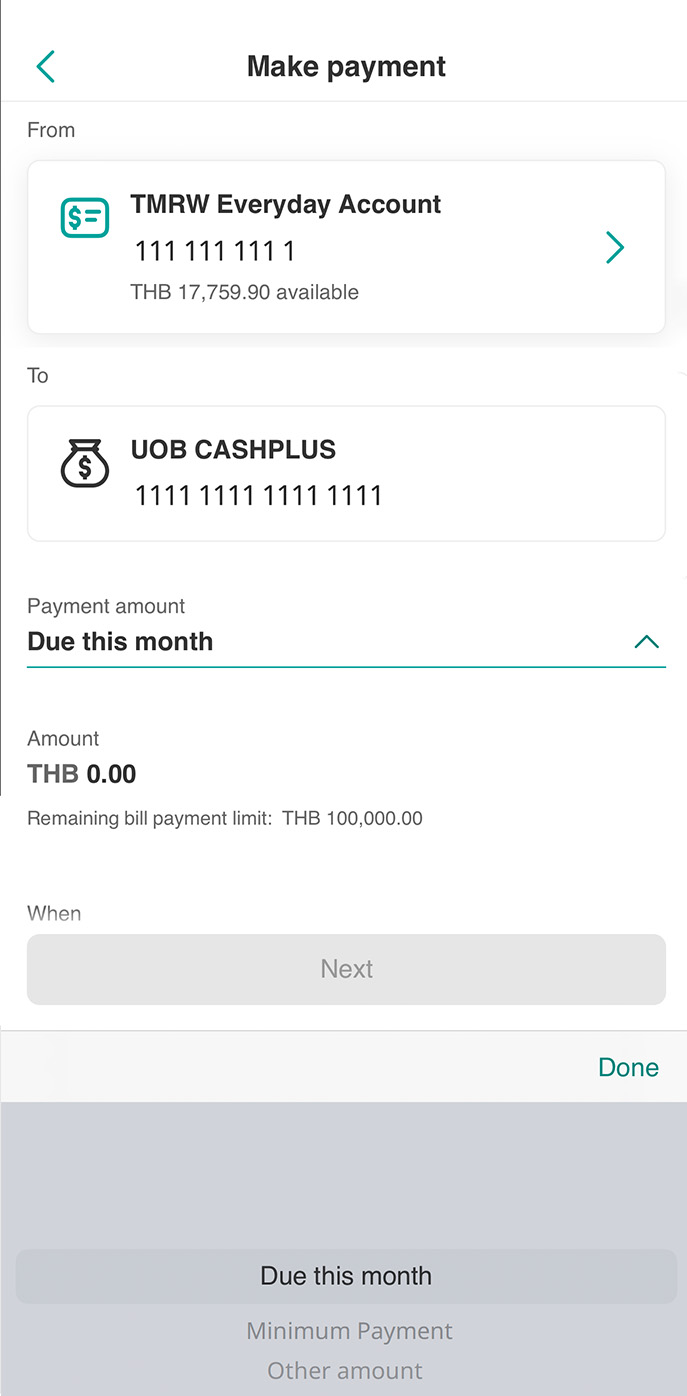

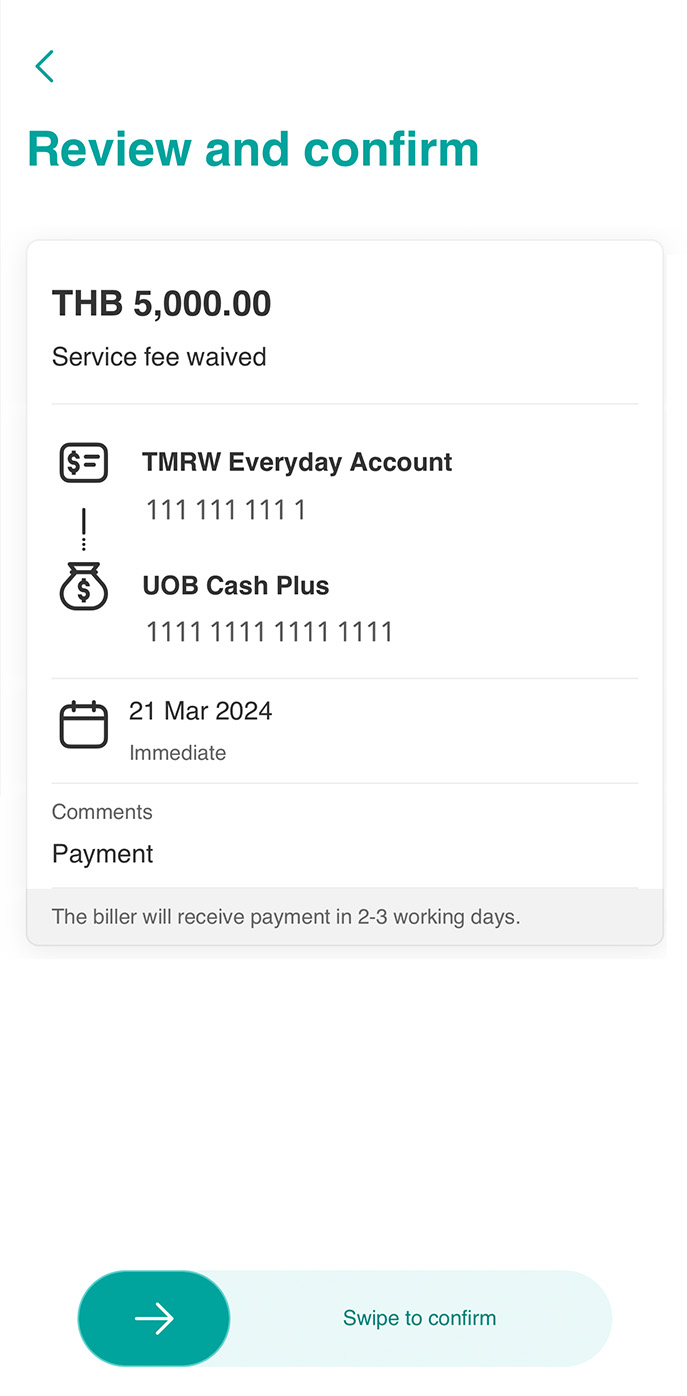

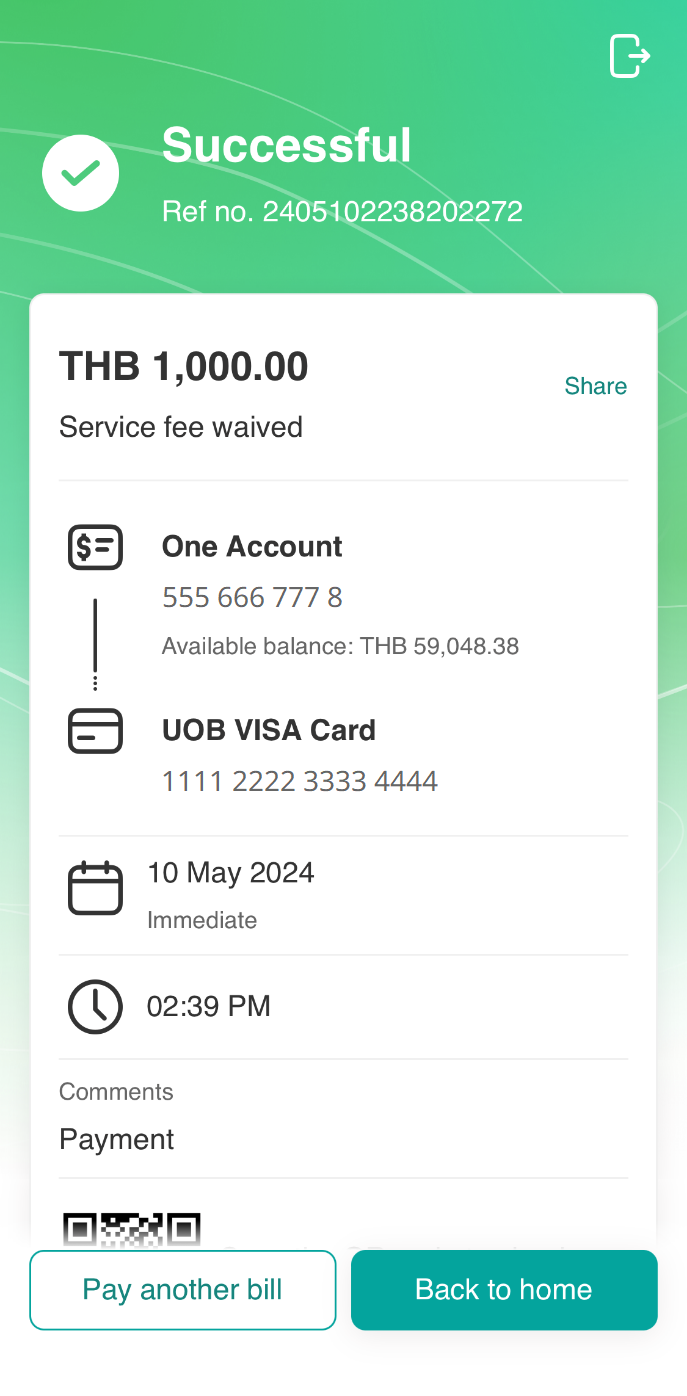

2. Repay UOB Cash Plus loans from your UOB deposit account

1. Log in to UOB TMRW and select “Make Payment” on your UOB Cash Plus account.

2. Select your UOB deposit account to pay from.

3. Select the amount and date of payment.

4. Review the details and swipe to confirm your transaction.

5. Payment successful, receipts are saved in your photo album.

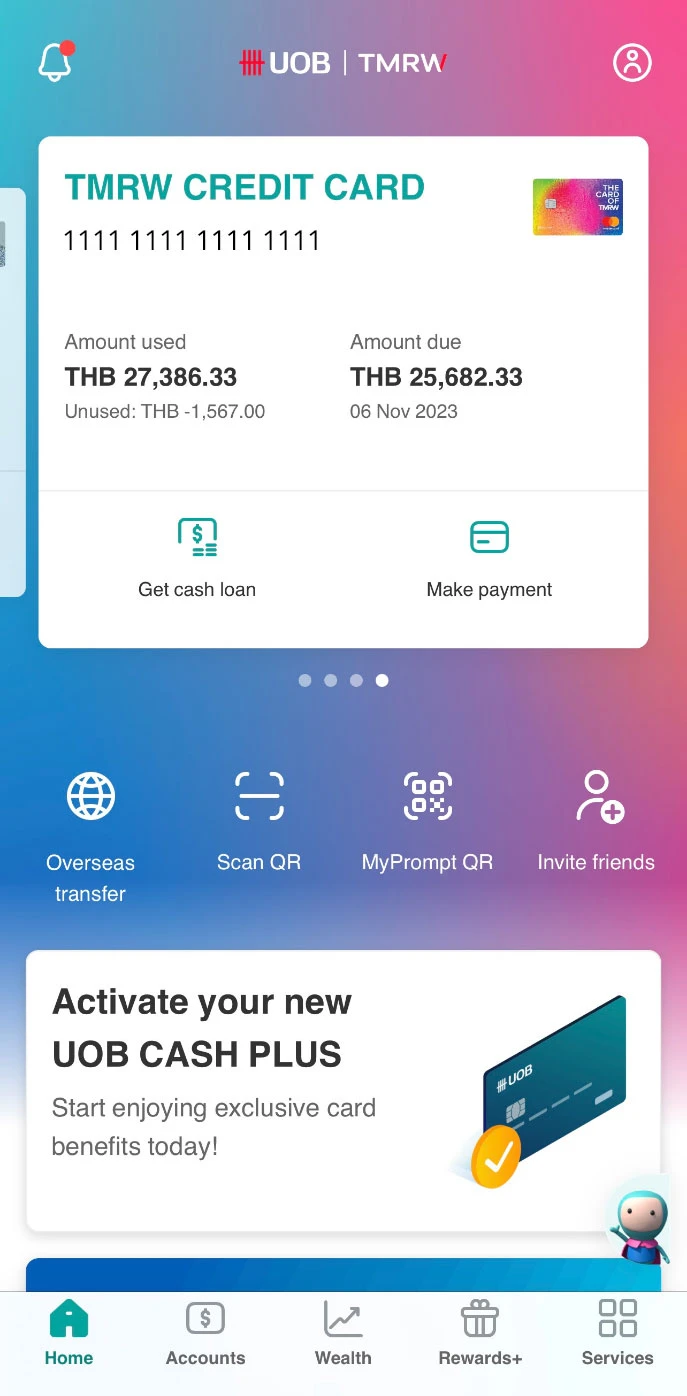

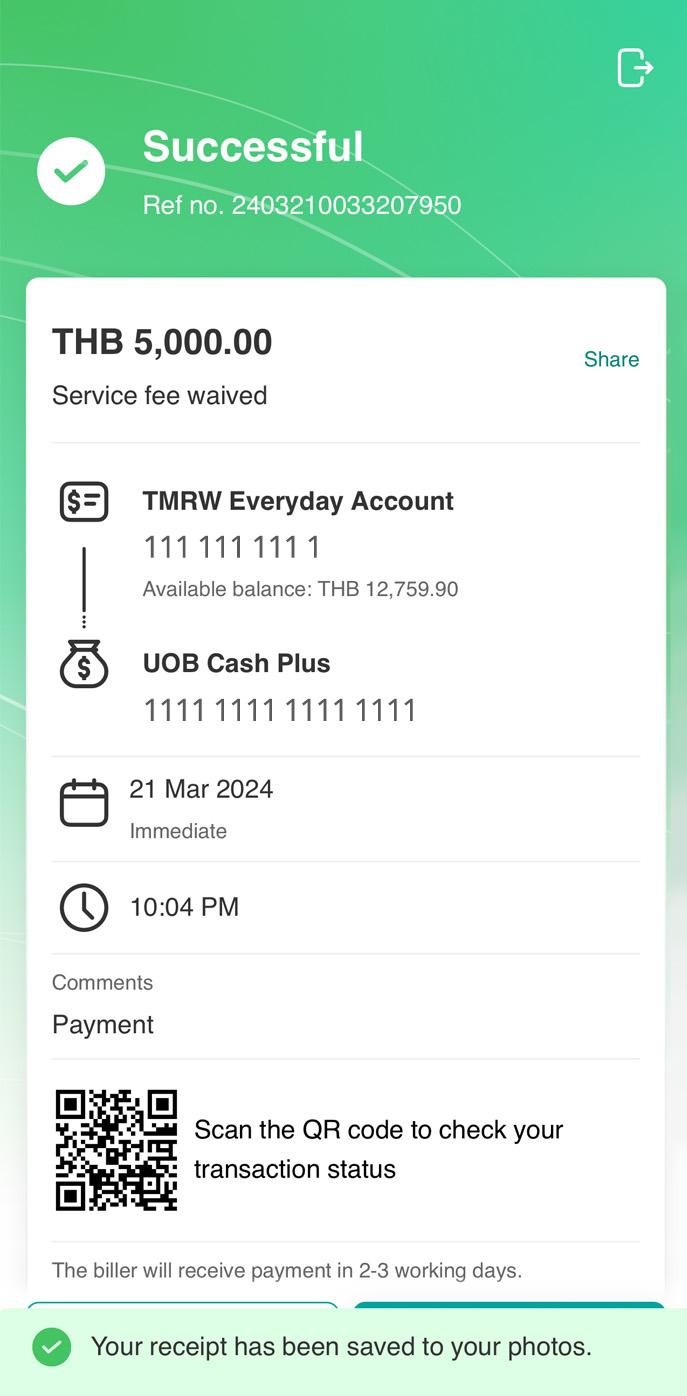

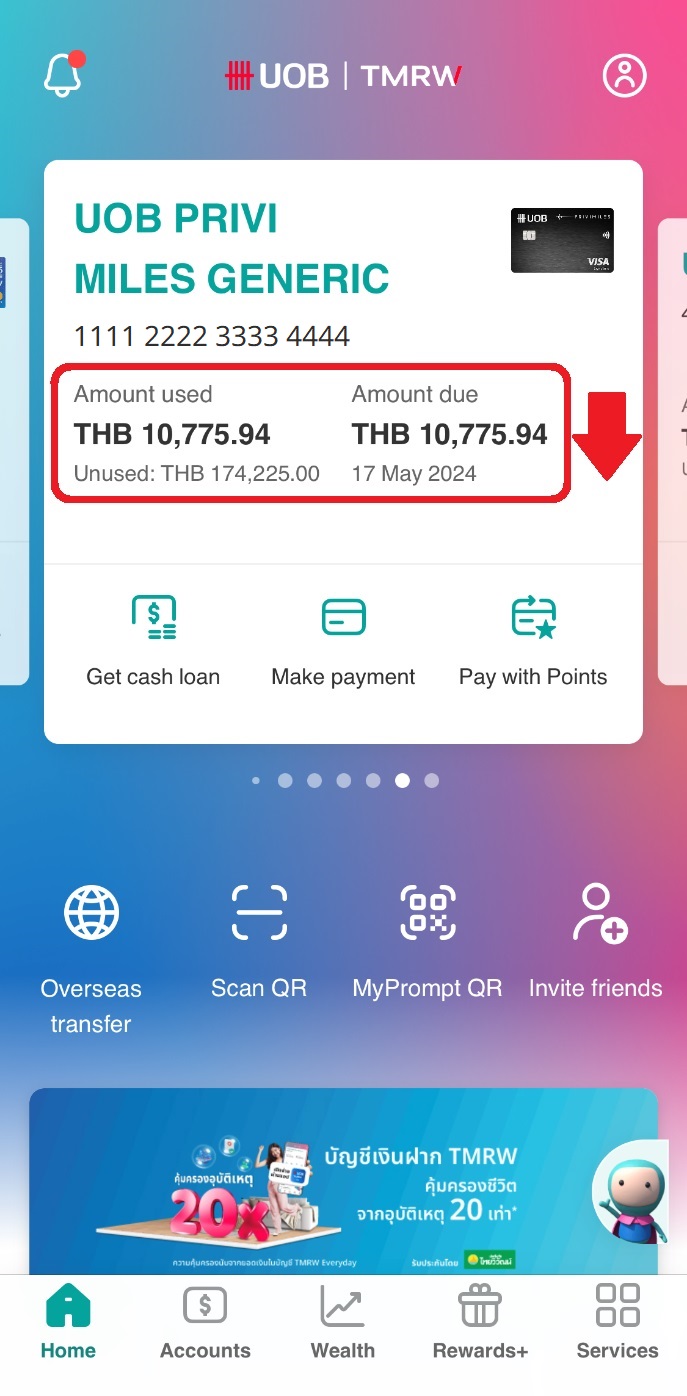

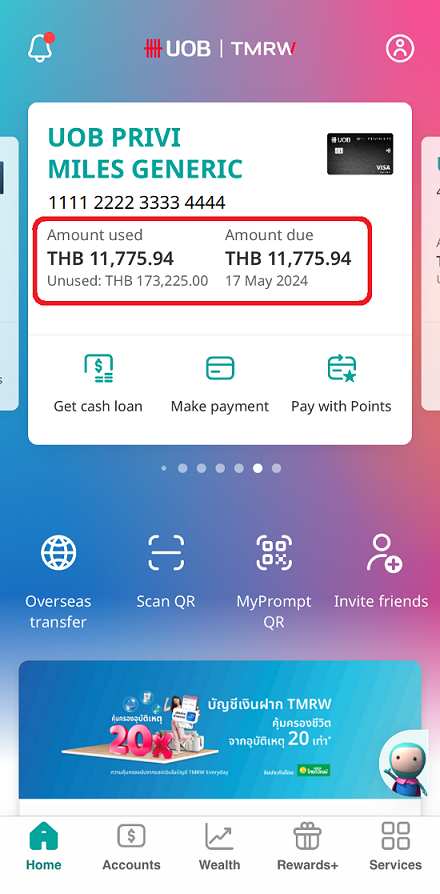

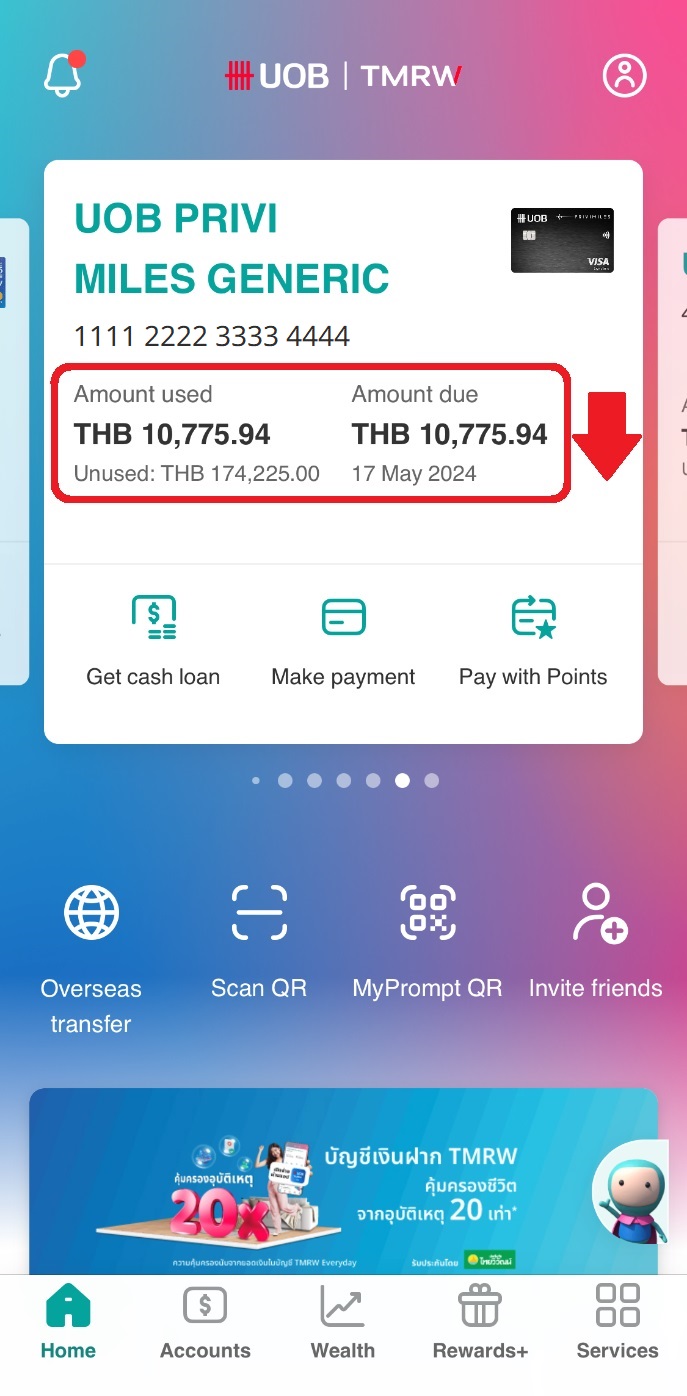

3. How to check payment amount after making payments (for payments made through channels where the amount will be credited immediately)

To check details after making payments for your card, you can refer to “Amount used” and “Amount due” on your card account, which will be decreased according to the paid amount.

Prior to making payment (the amount used and amount due before payment in this example were THB 11,775.94)

Payment made (Example – a payment of THB 1,000 was made)

Post payment – the “Amount used” and “Amount due” have decreased according to the paid amount (in this example, the amount was decreased by THB 1,000)

If you have more than one credit card and pay the full statement amount by the payment due date; in the case that there are any interest charges due to incorrect payment allocation, we will automatically correct this in the next statement.

Instalment Payment Plan (IPP)

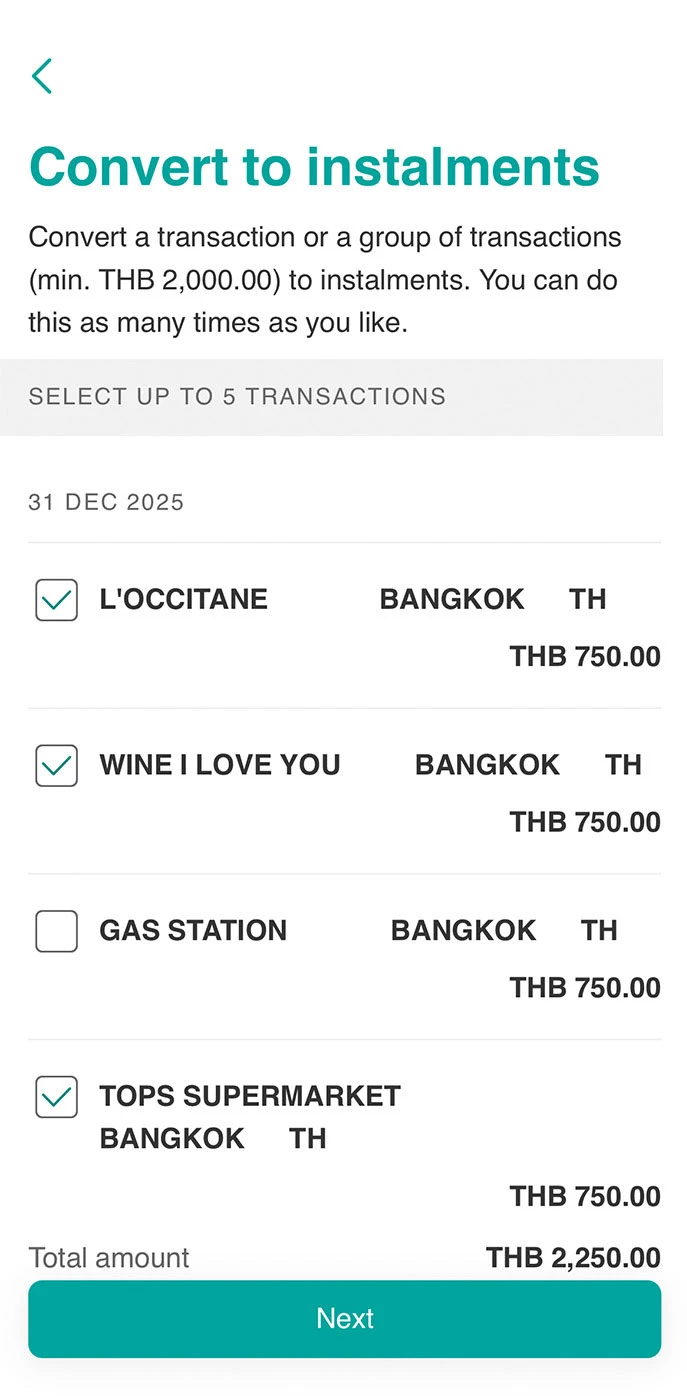

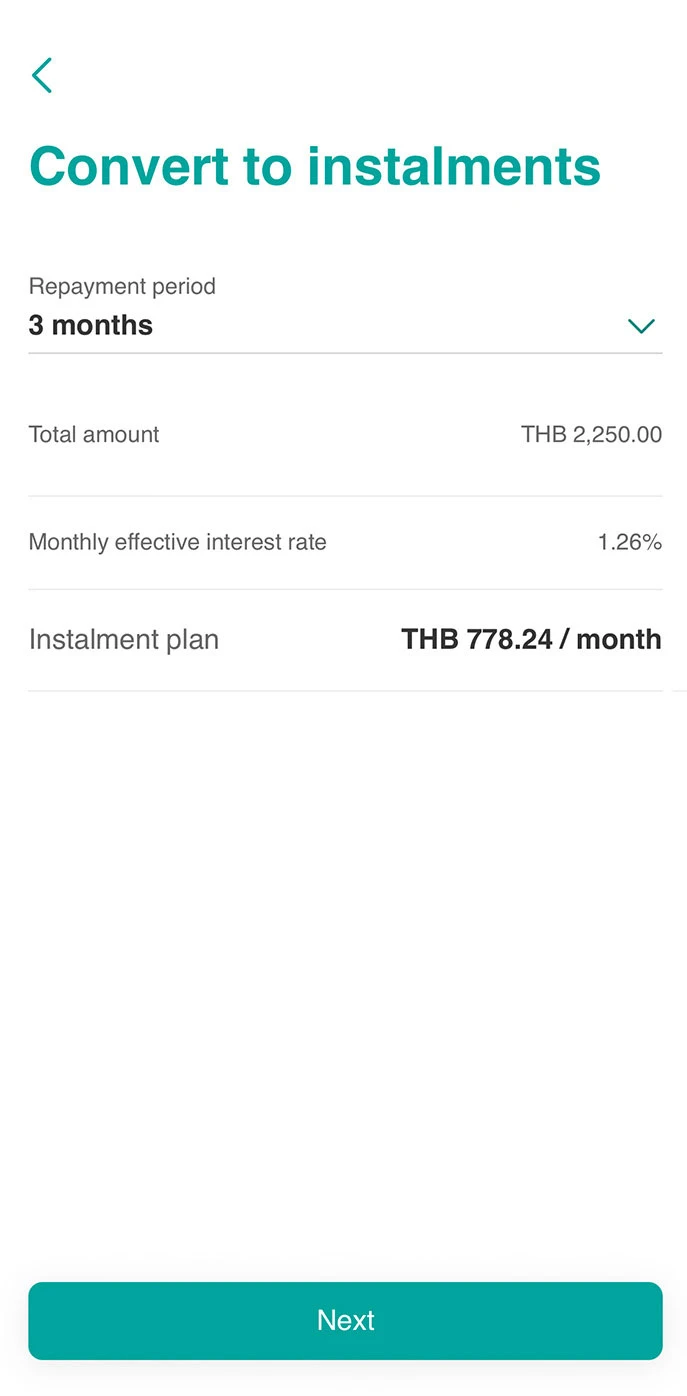

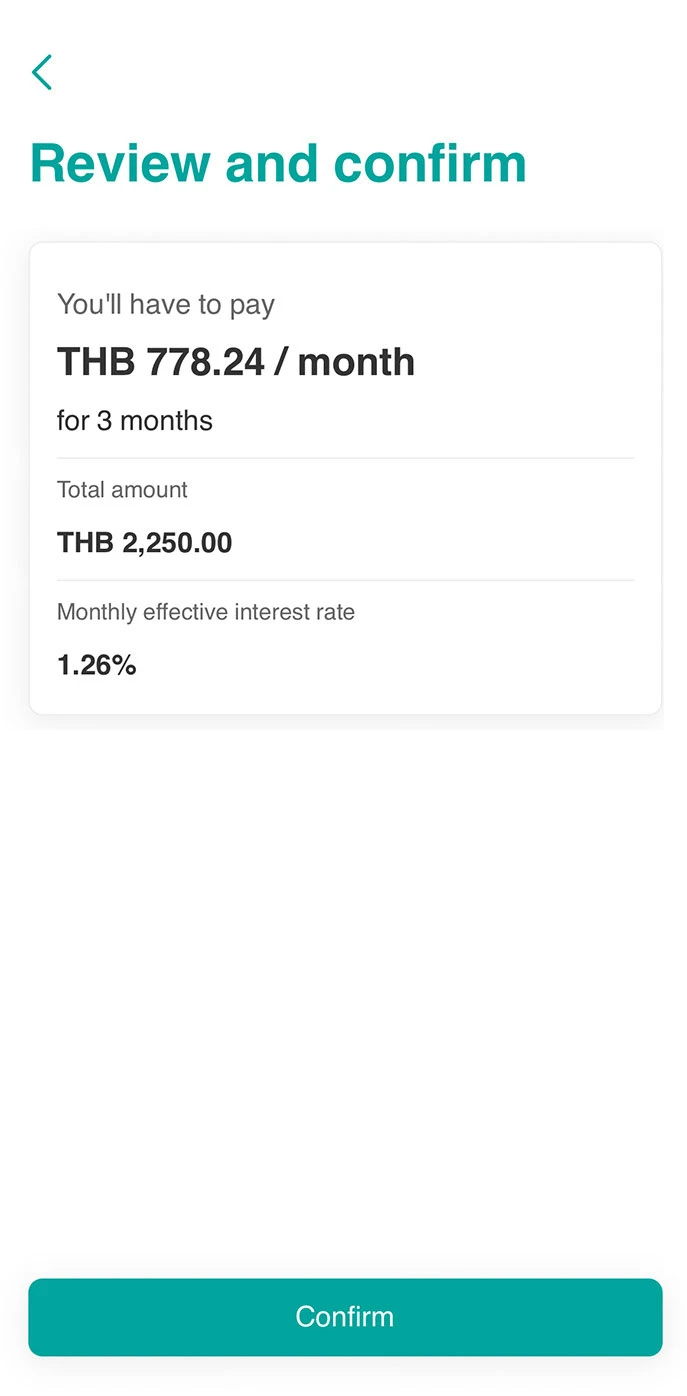

1. Convert credit card transactions to monthly instalments

1. Log in to UOB TMRW and select the credit card to activate instalment plan.

2. Select “Transactions”, then tap on “Convert to instalments” at the bottom of the screen.

3. Select up to 5 transactions with a minimum sum of THB 2,000.

4. Select repayment period.

5. Review and tap confirm to activate your instalment payment plan.

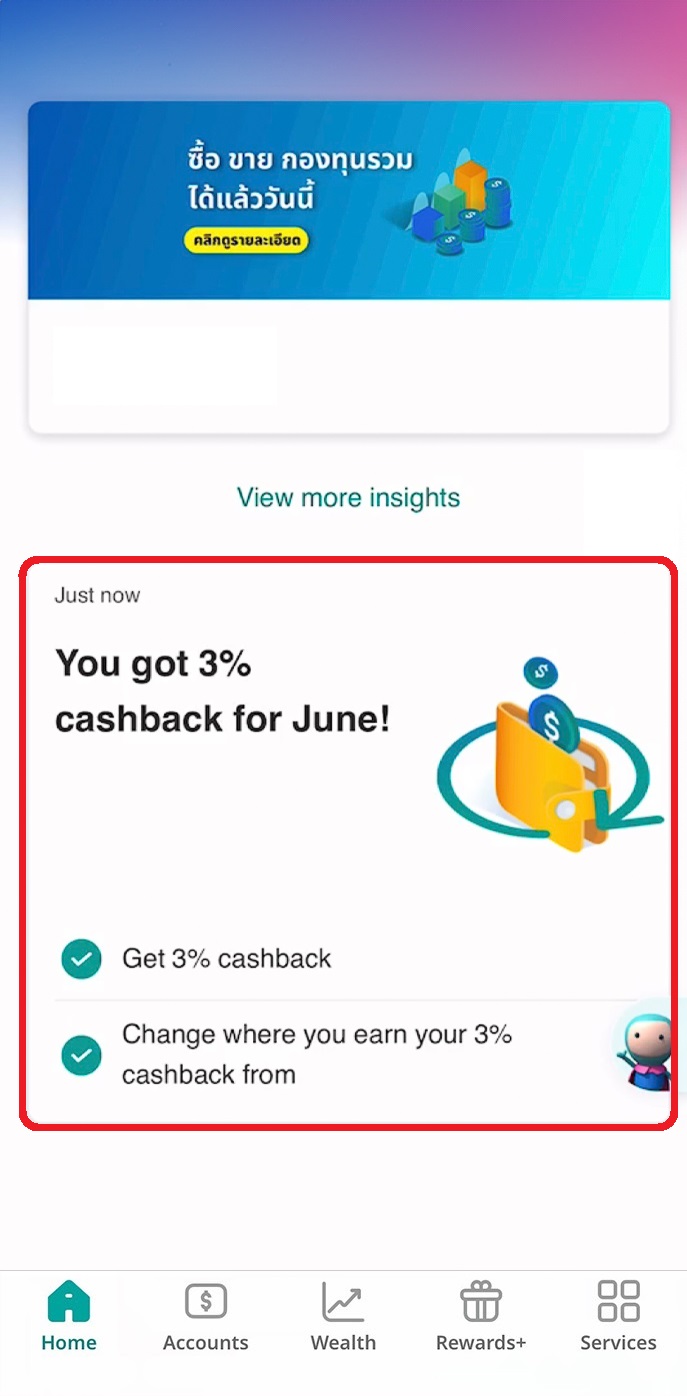

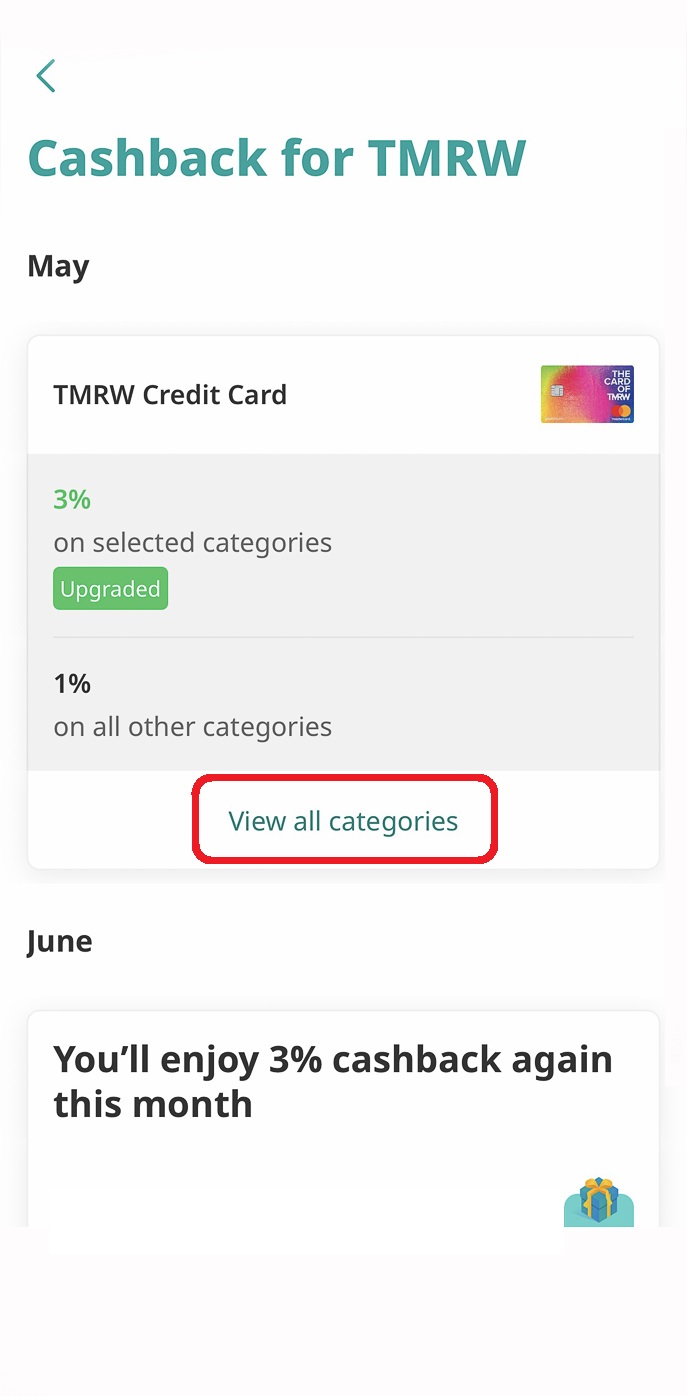

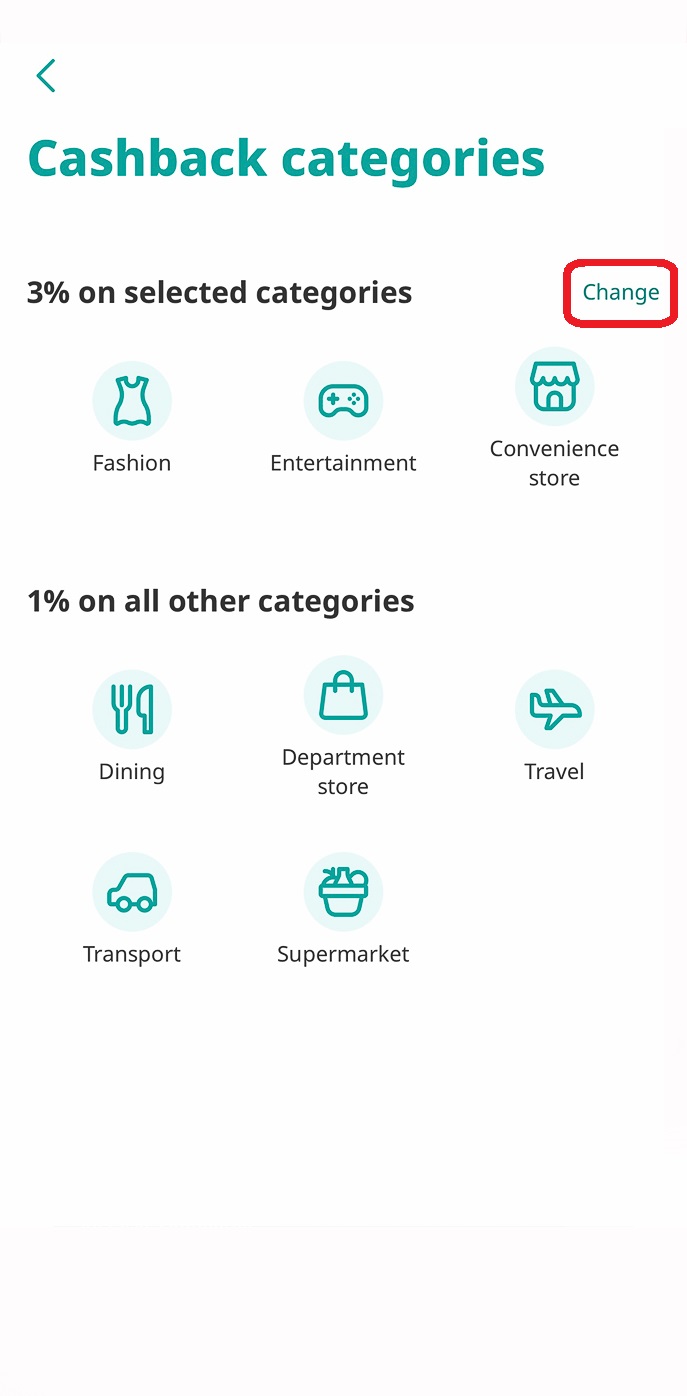

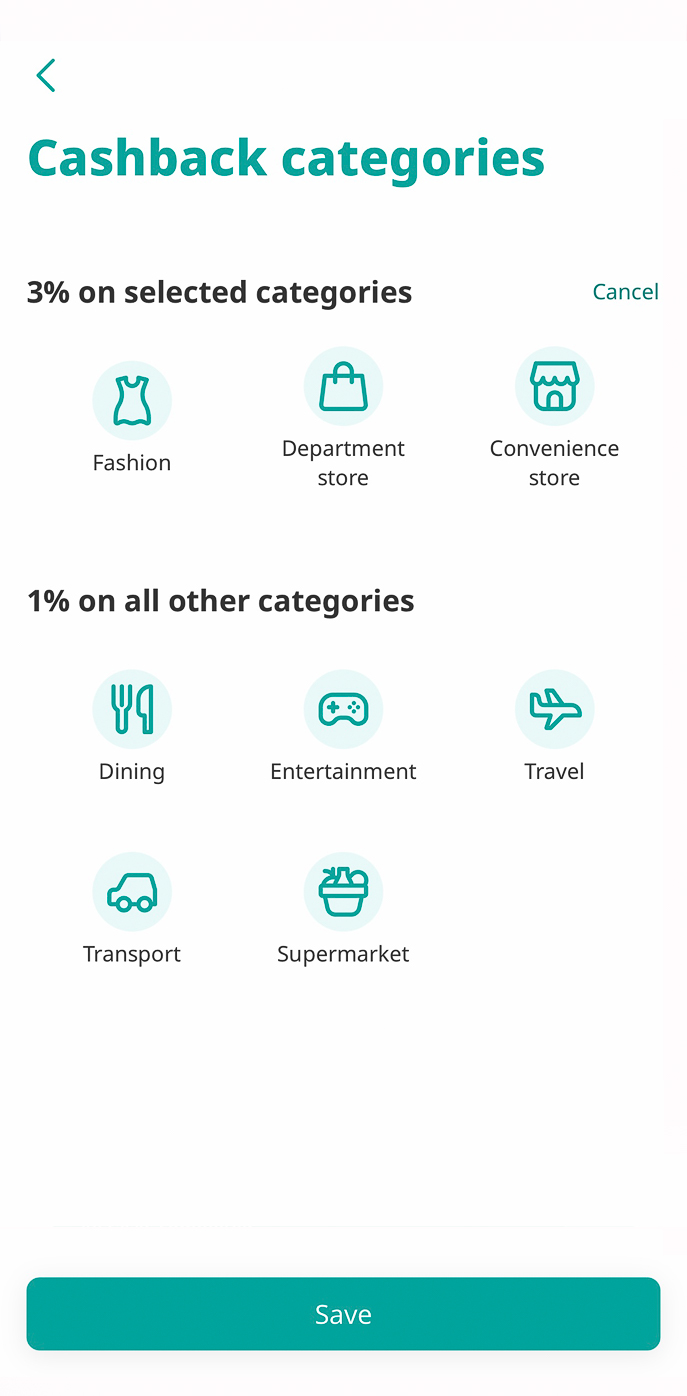

Customise categories to receive cashback on TMRW Credit Card

1. Change spending categories to receive 3% cashback

1. Log in to UOB TMRW, scroll down and select the card on the dashboard that informs about receiving 3% cashback.

2. Tap on “View all categories”.

3. Tap on “Change”.

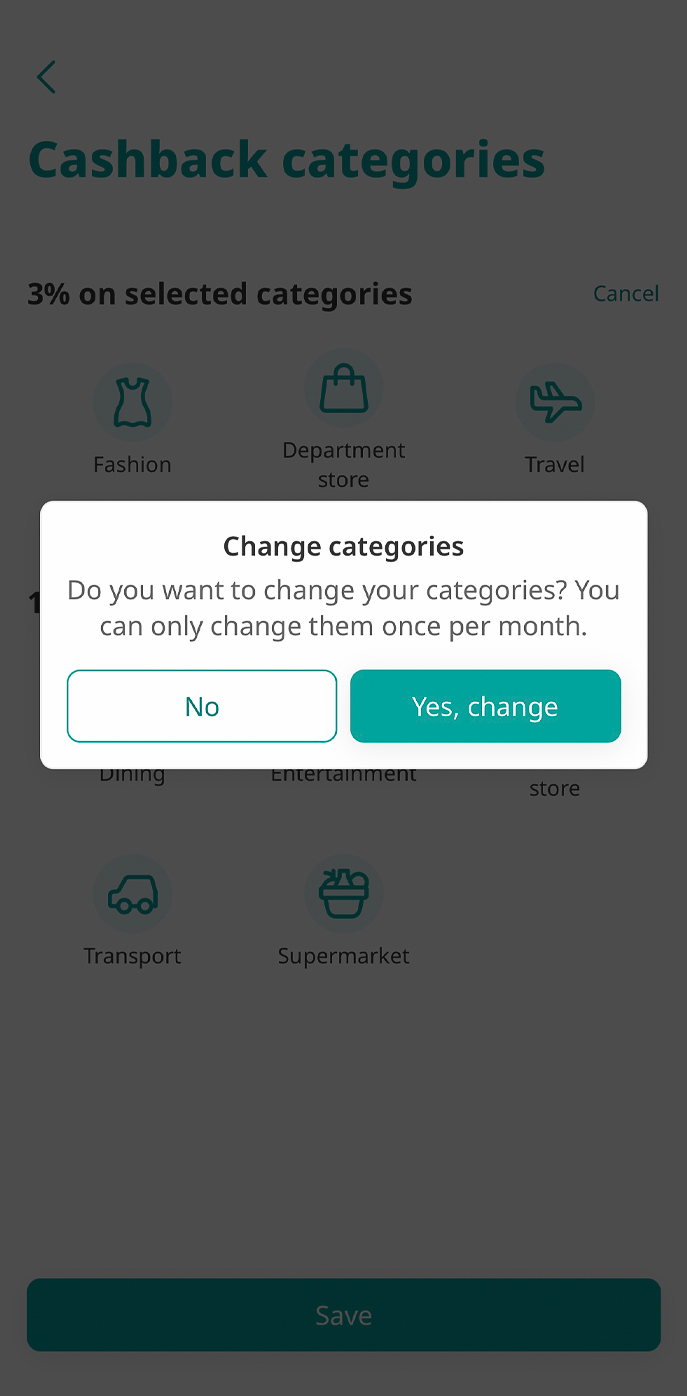

4. Drag the category icon(s) you wish to change to receive 3% cashback then tap save.

5. Confirm your change (you can only change categories once per month).

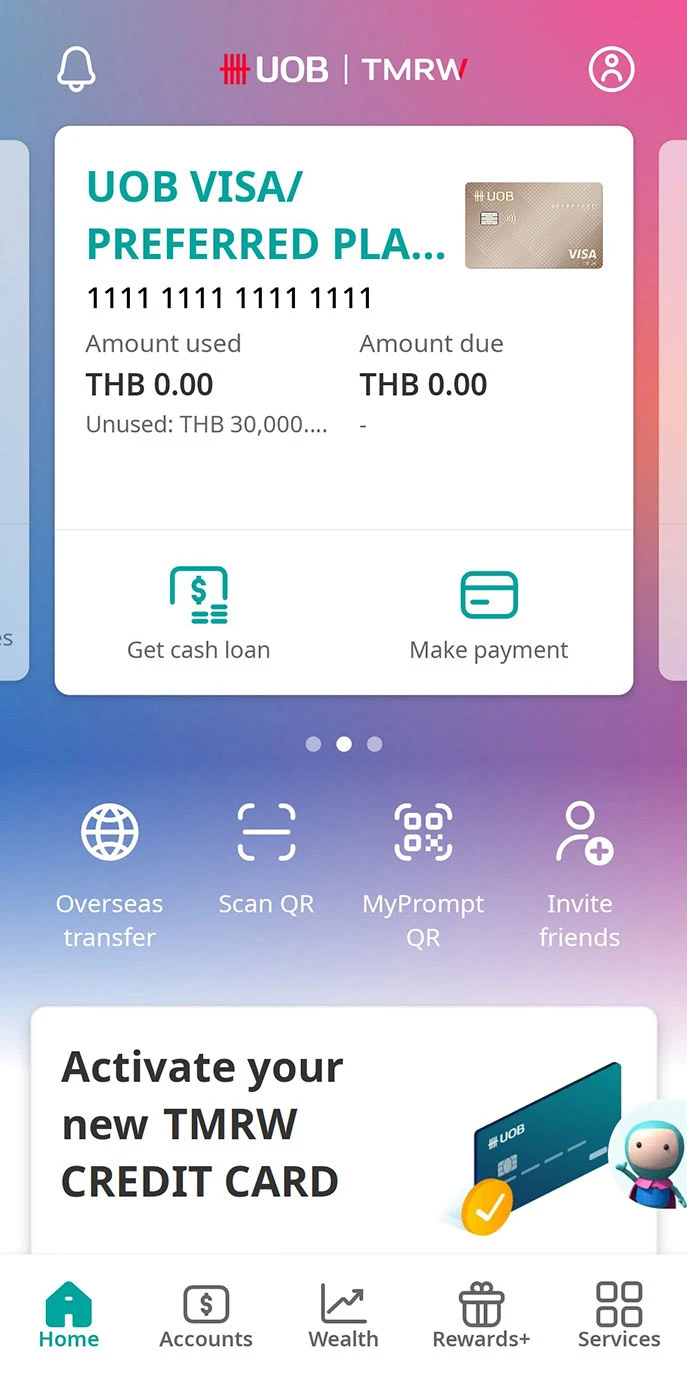

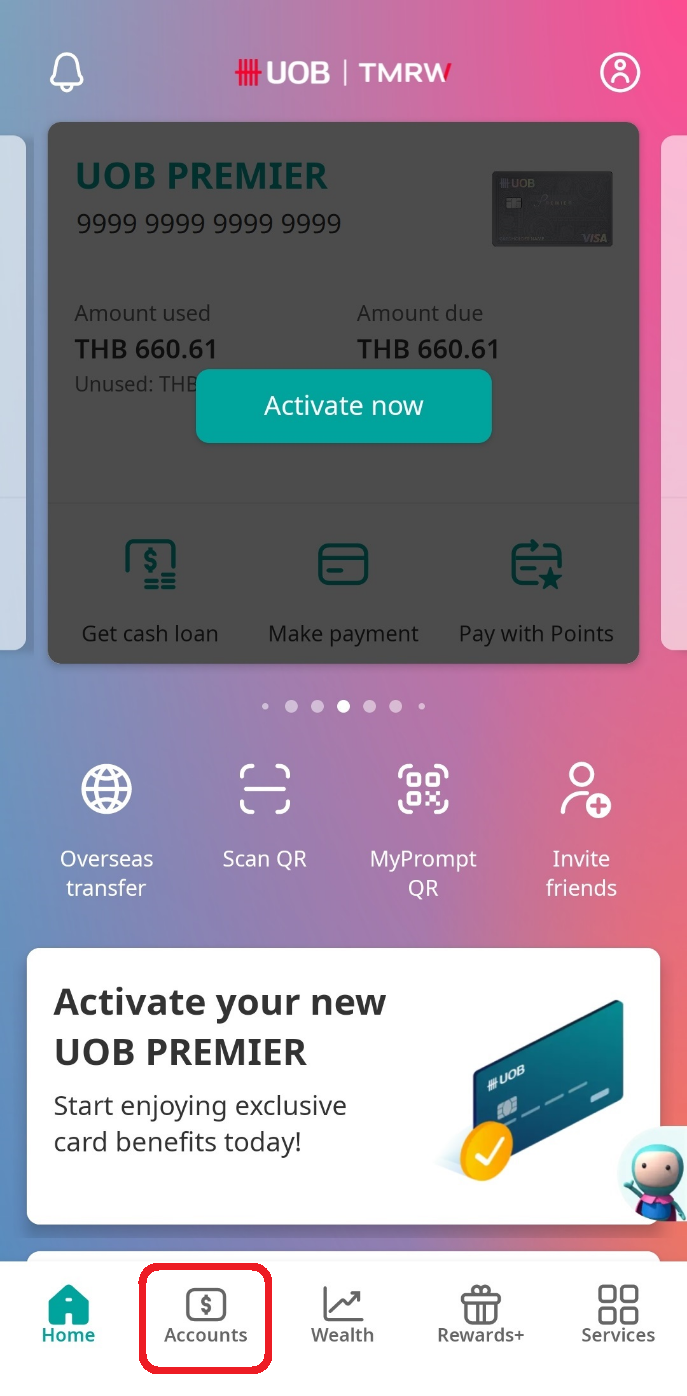

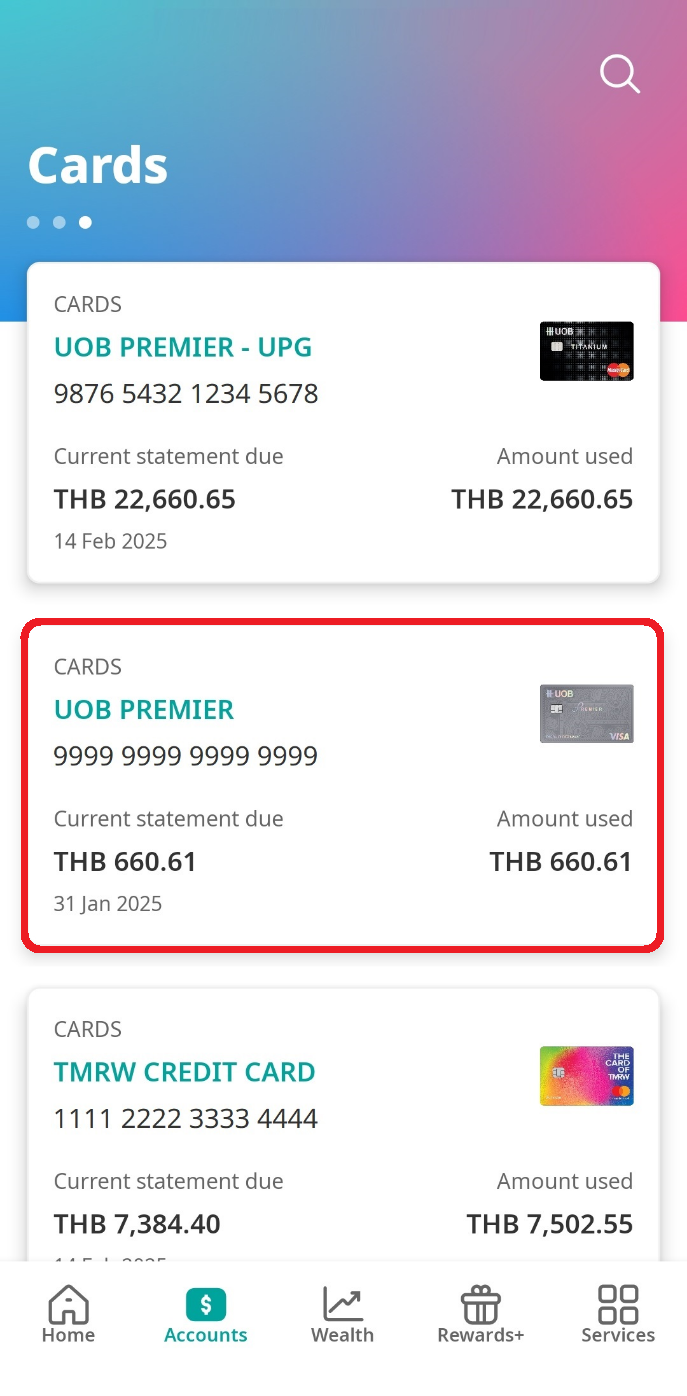

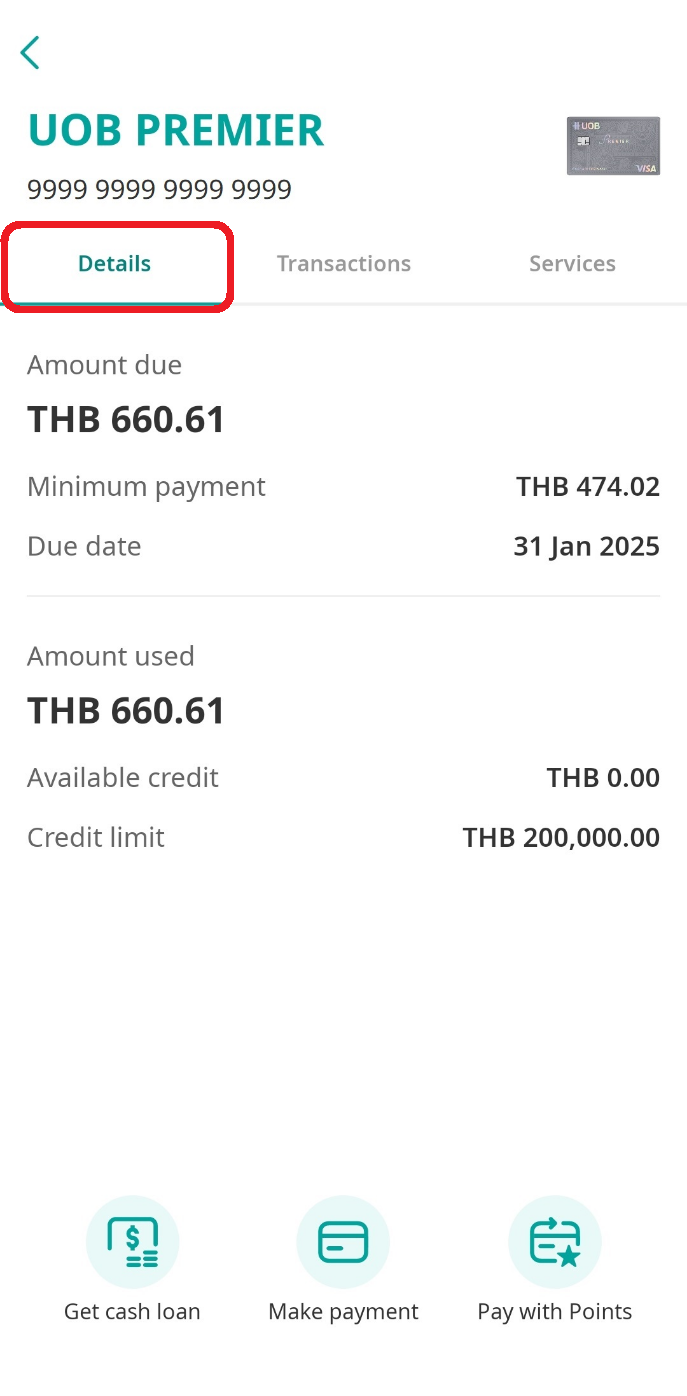

View credit card details on UOB TMRW app during re-carding process

1. How to view credit card details and transactions during re-carding process

Select “Accounts” menu to view your current card details.

Note: During re-carding, “Activate now” button will appear on your account. Tap it only after receiving your new card.

Select the card to view details.

You can view details of your card and make transactions as usual.

View your card transactions.

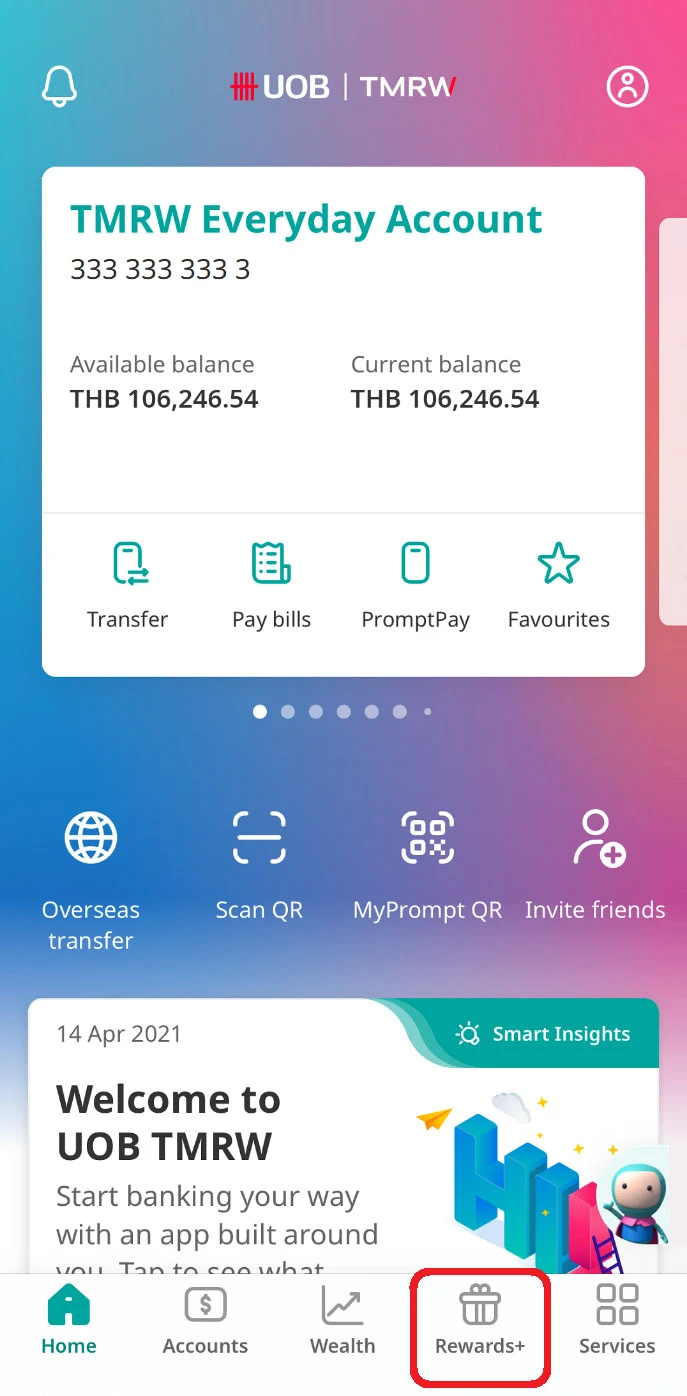

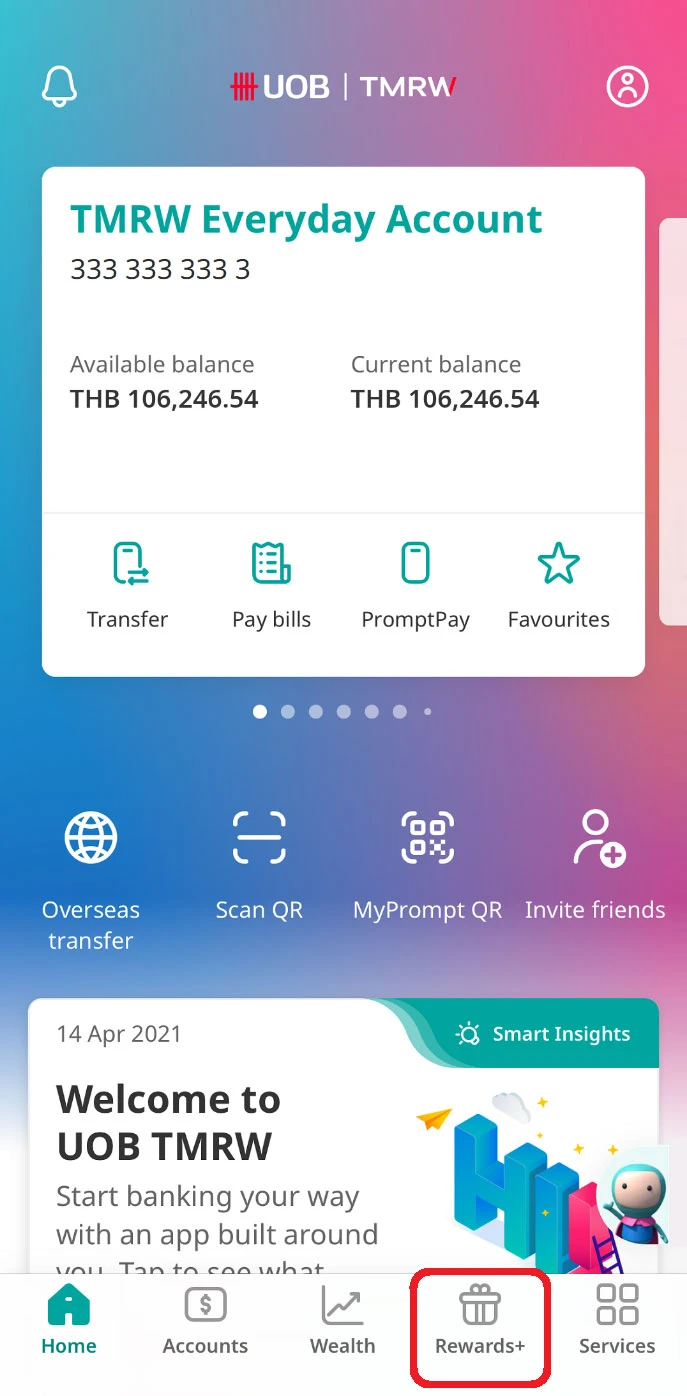

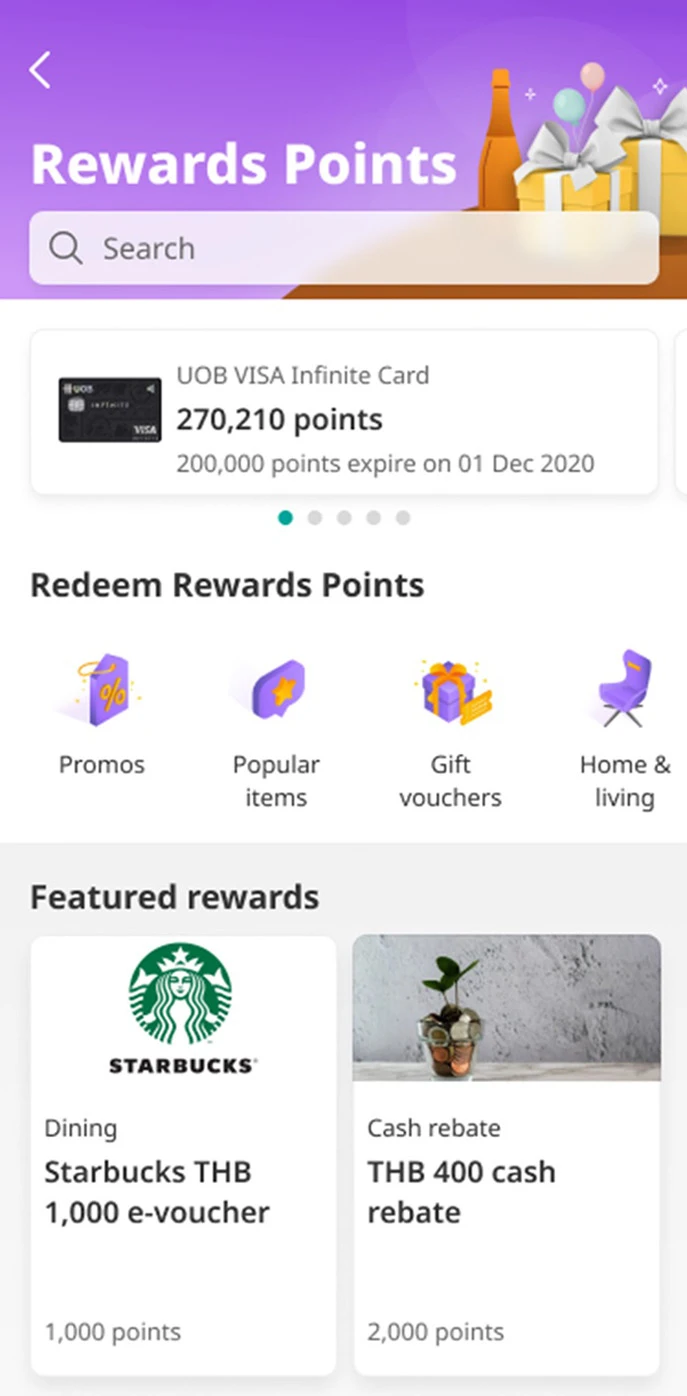

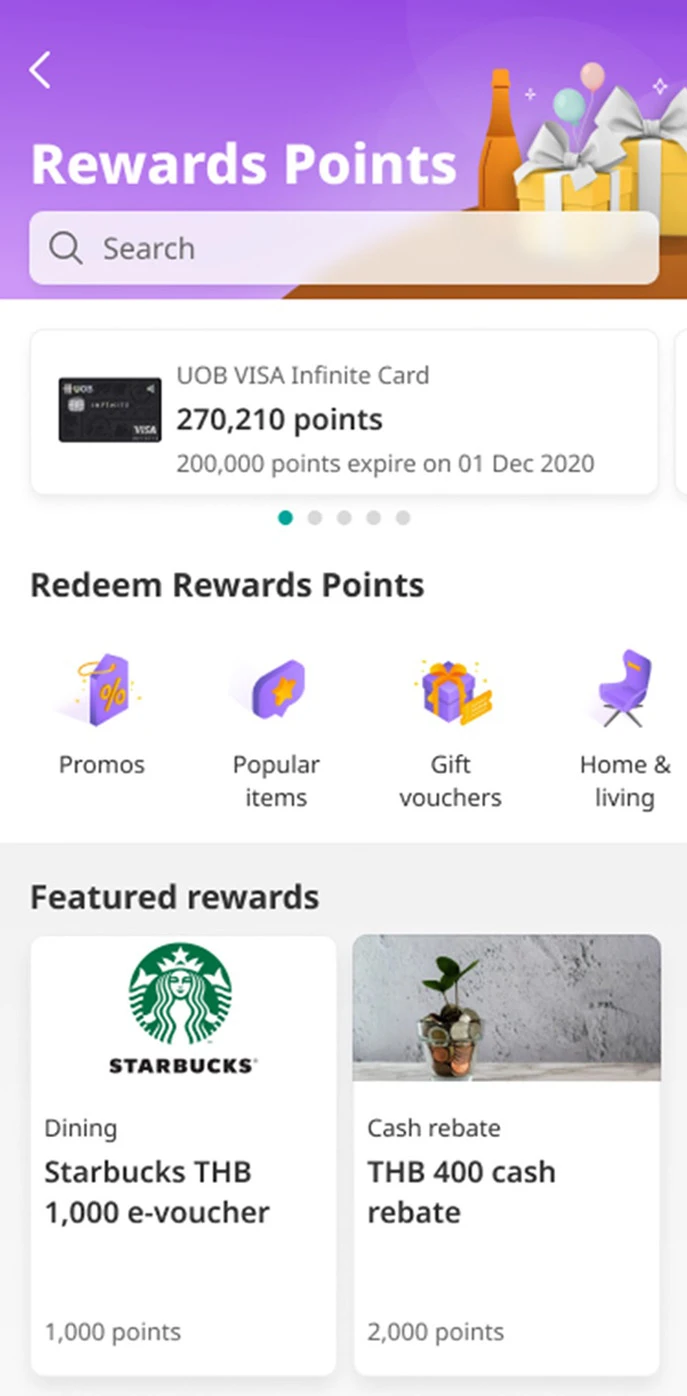

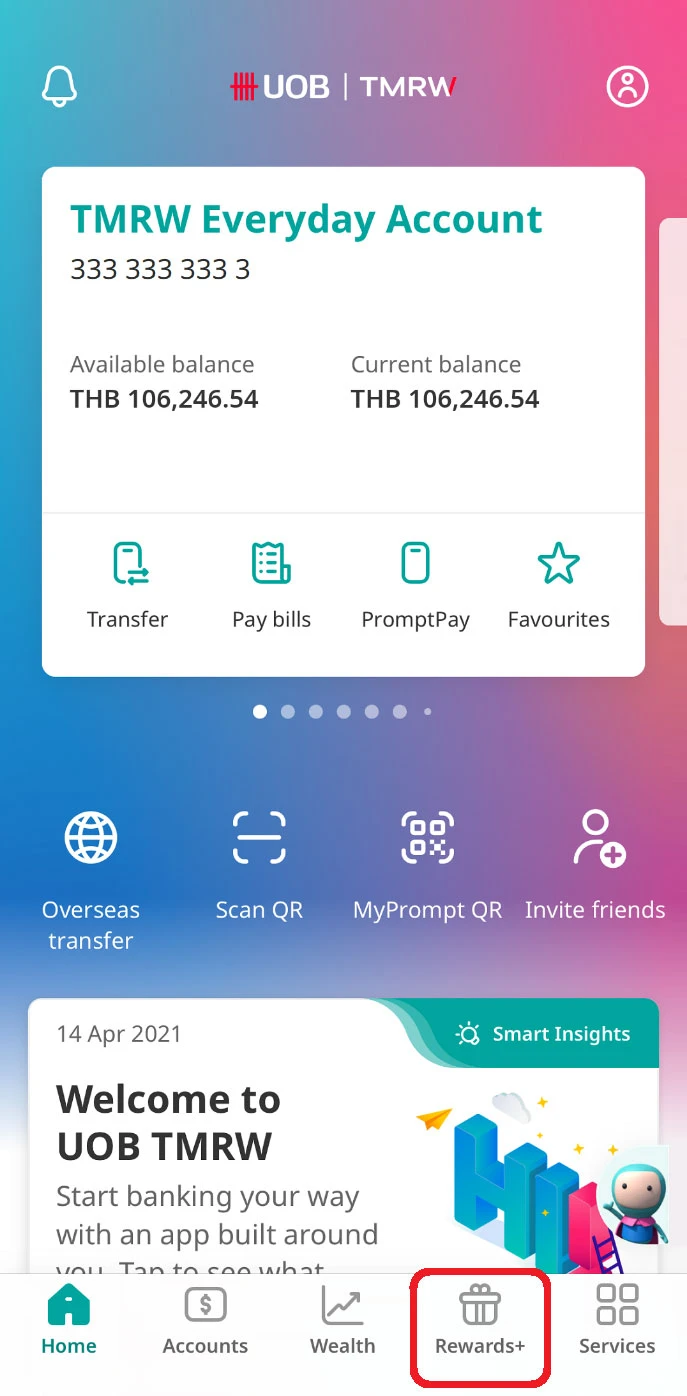

Rewards+

Manage rewards points

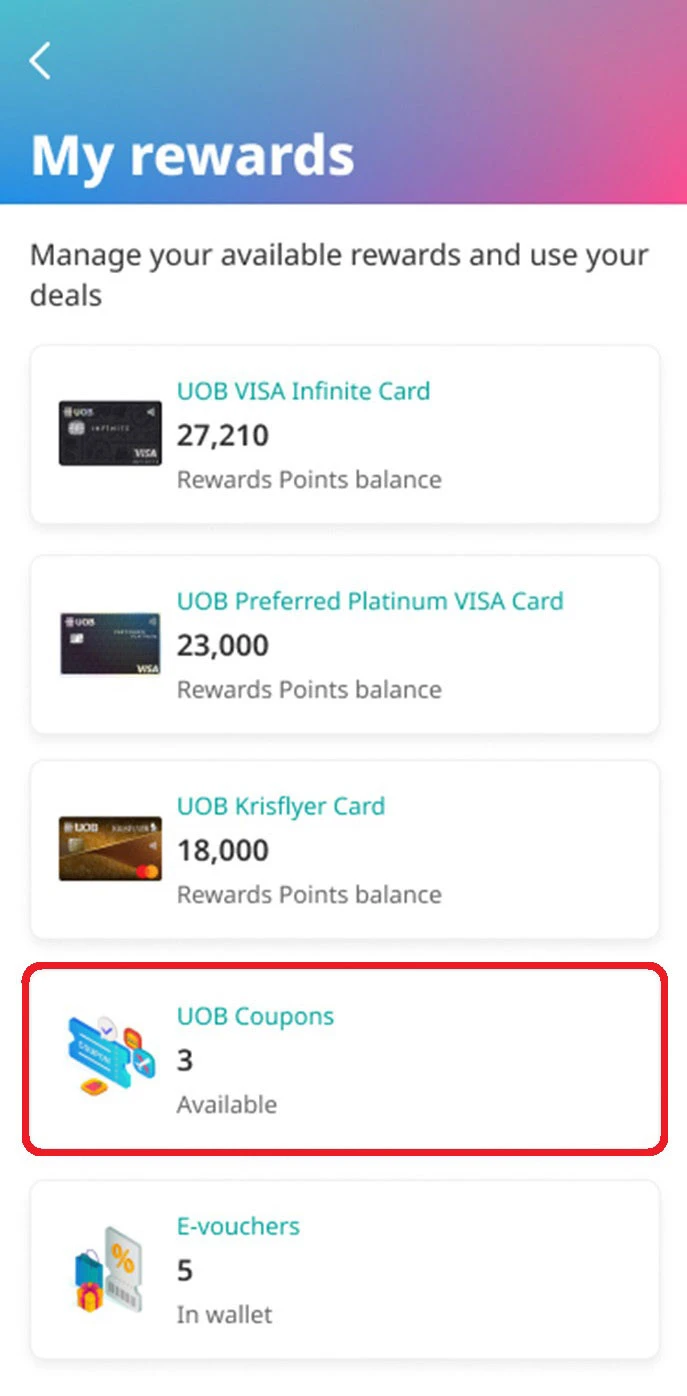

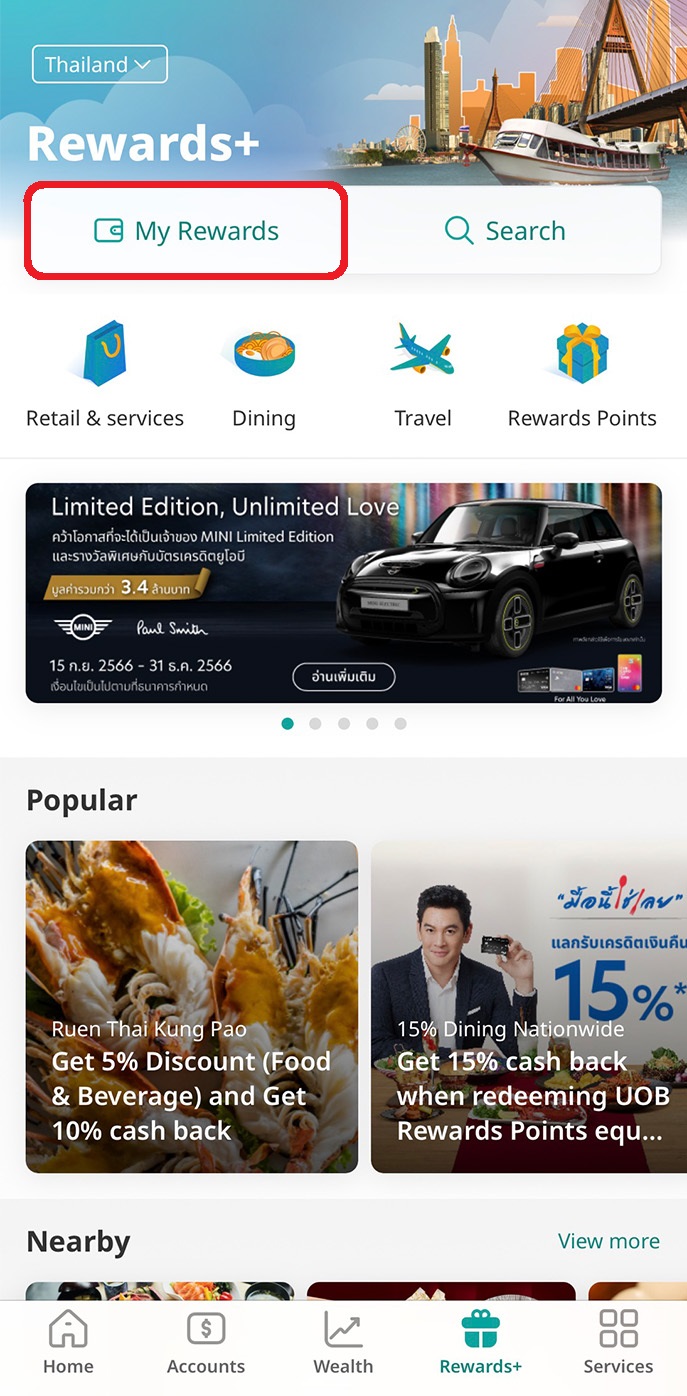

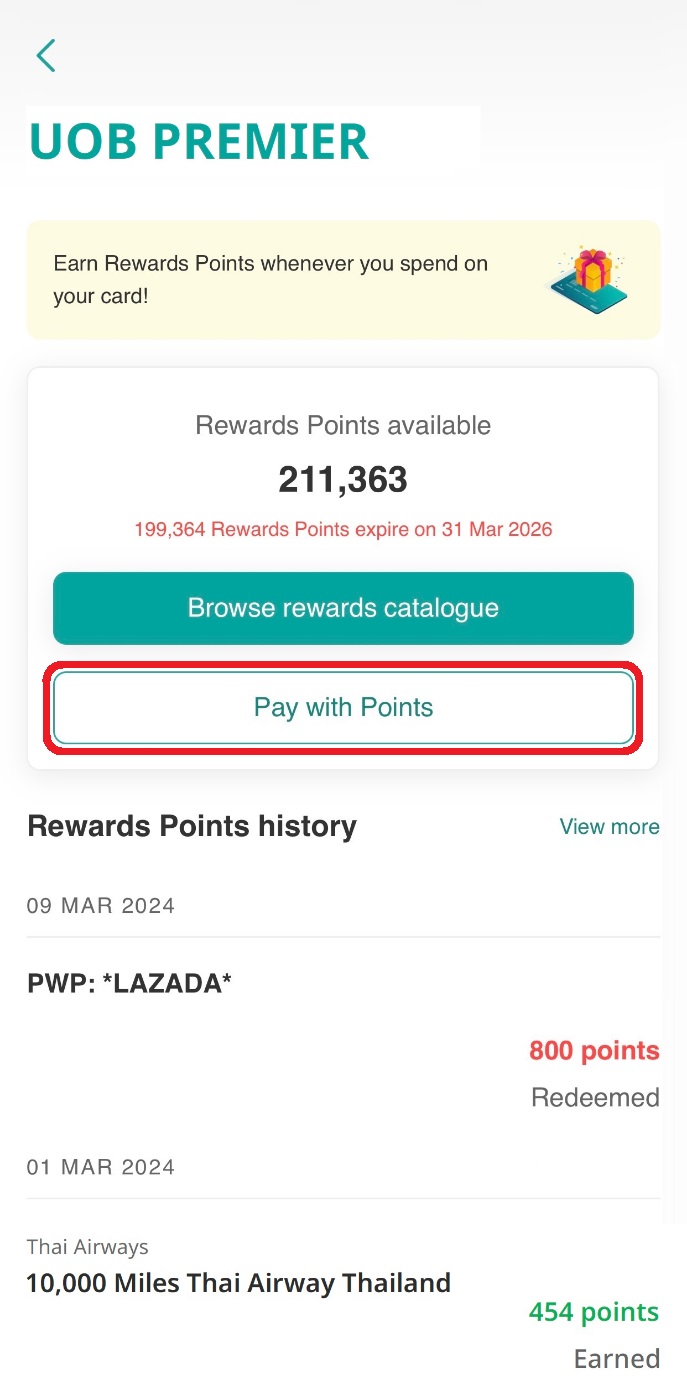

1. View rewards points balance and history

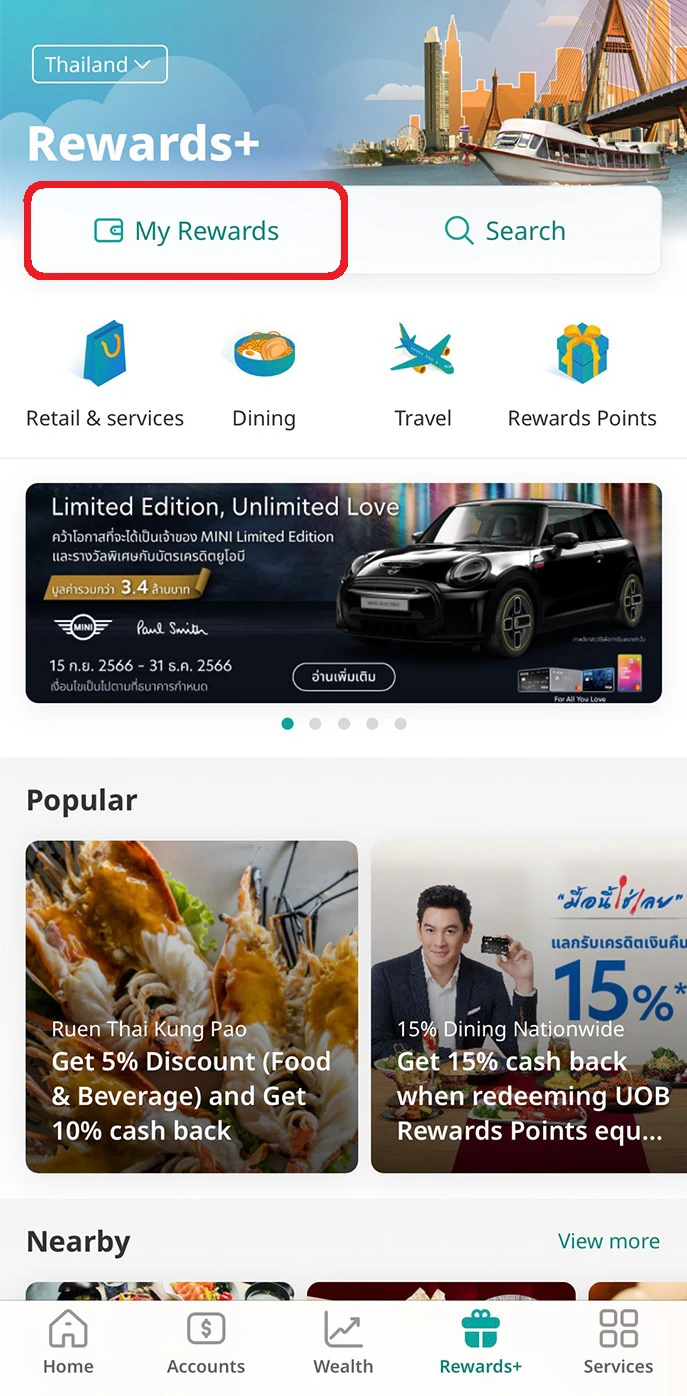

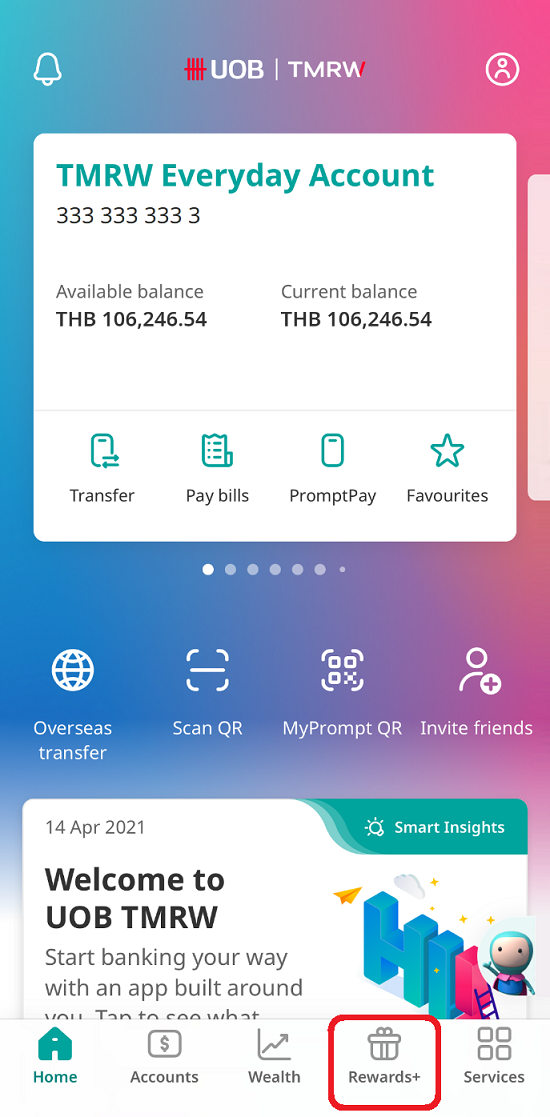

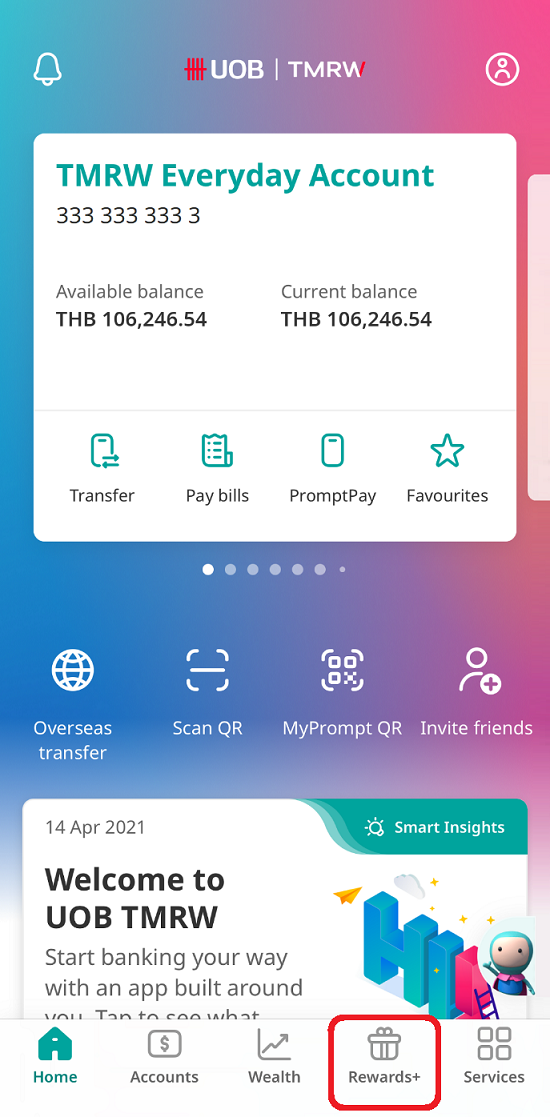

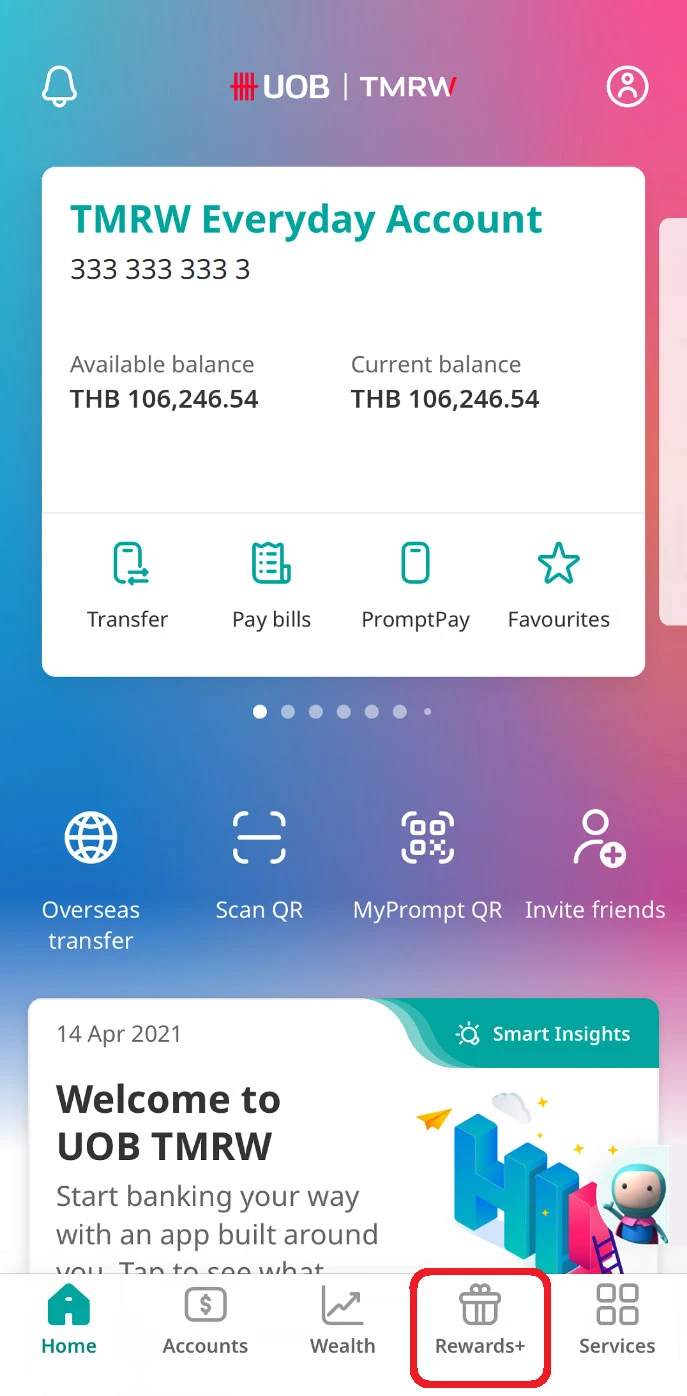

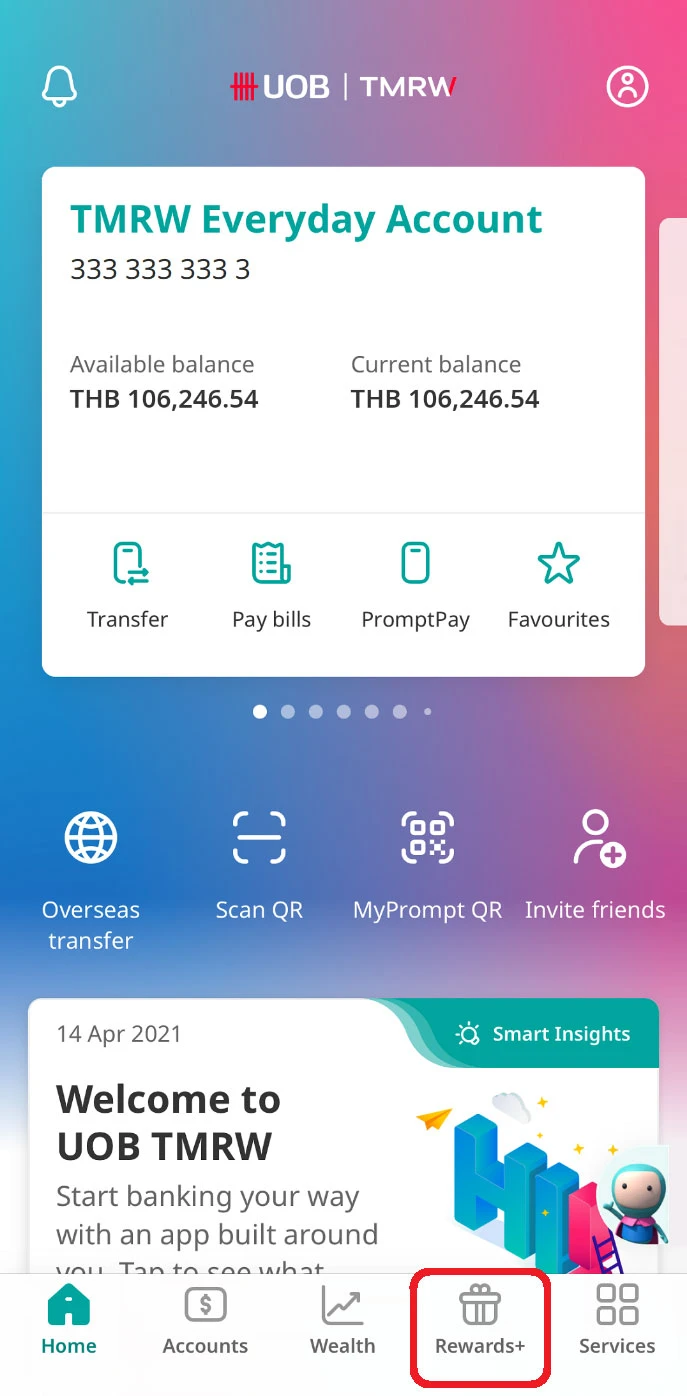

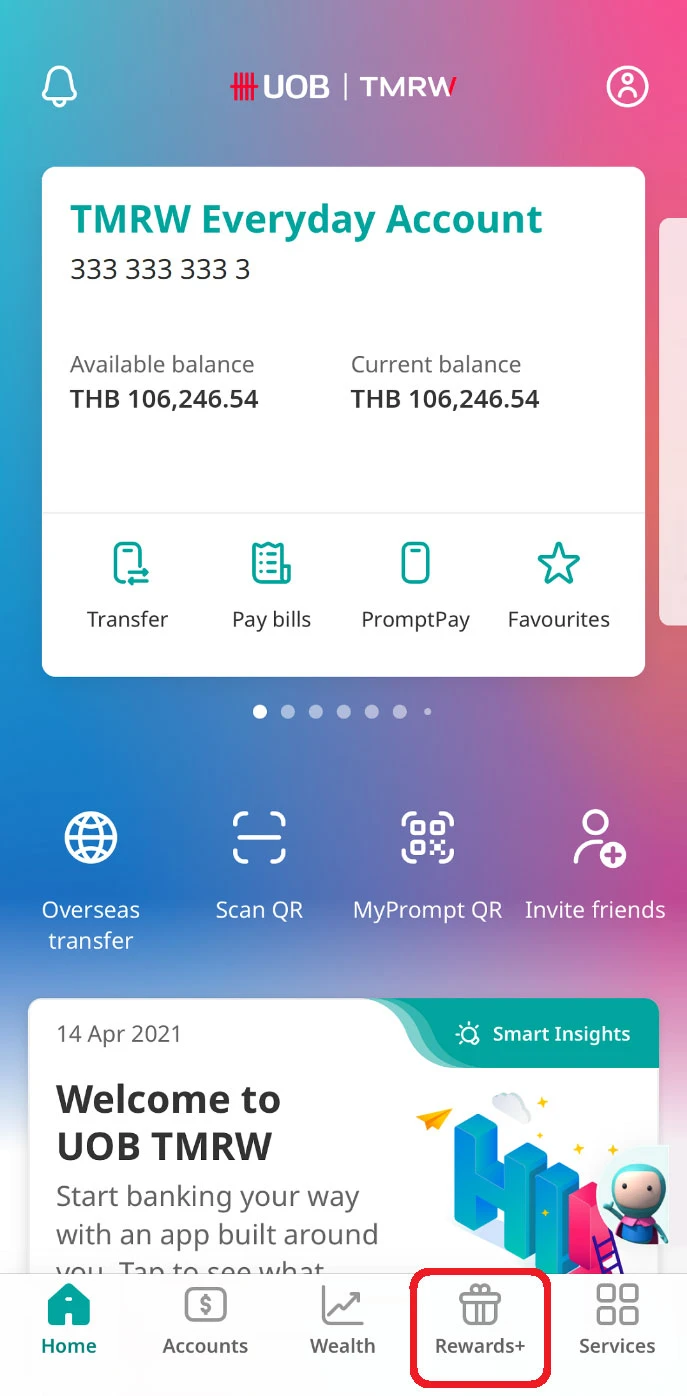

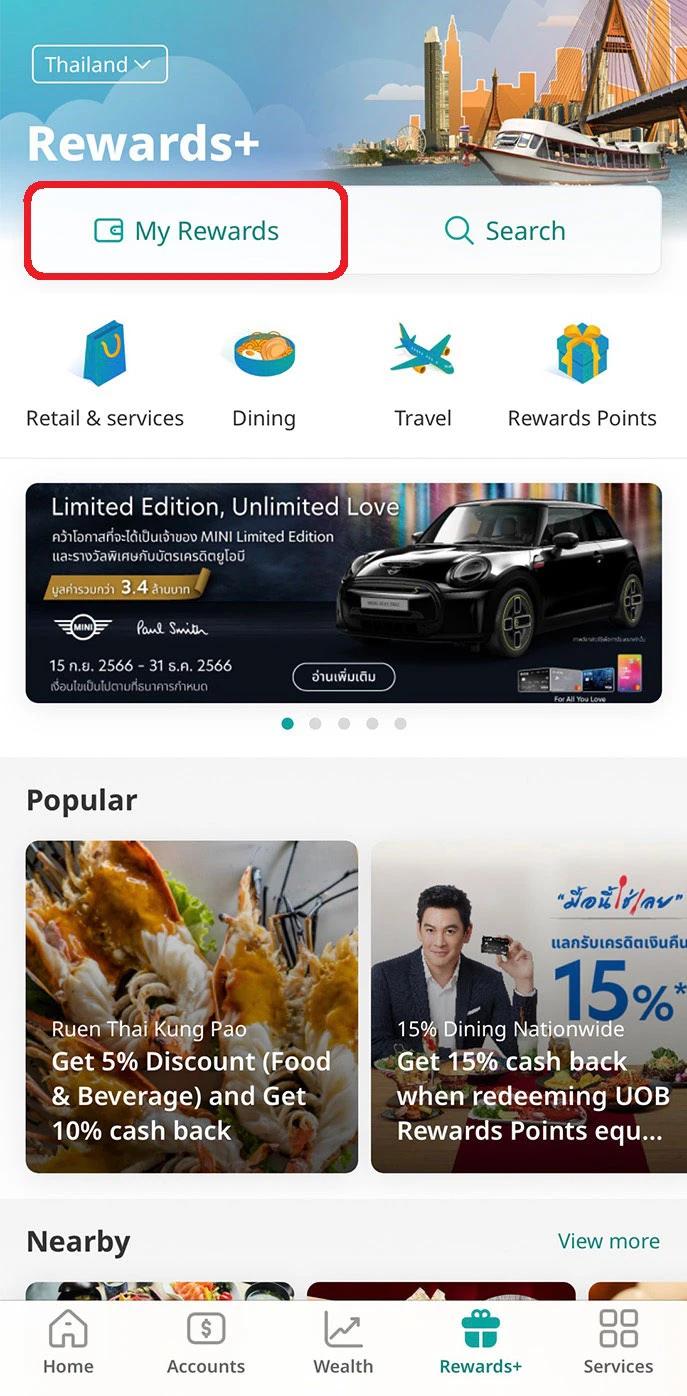

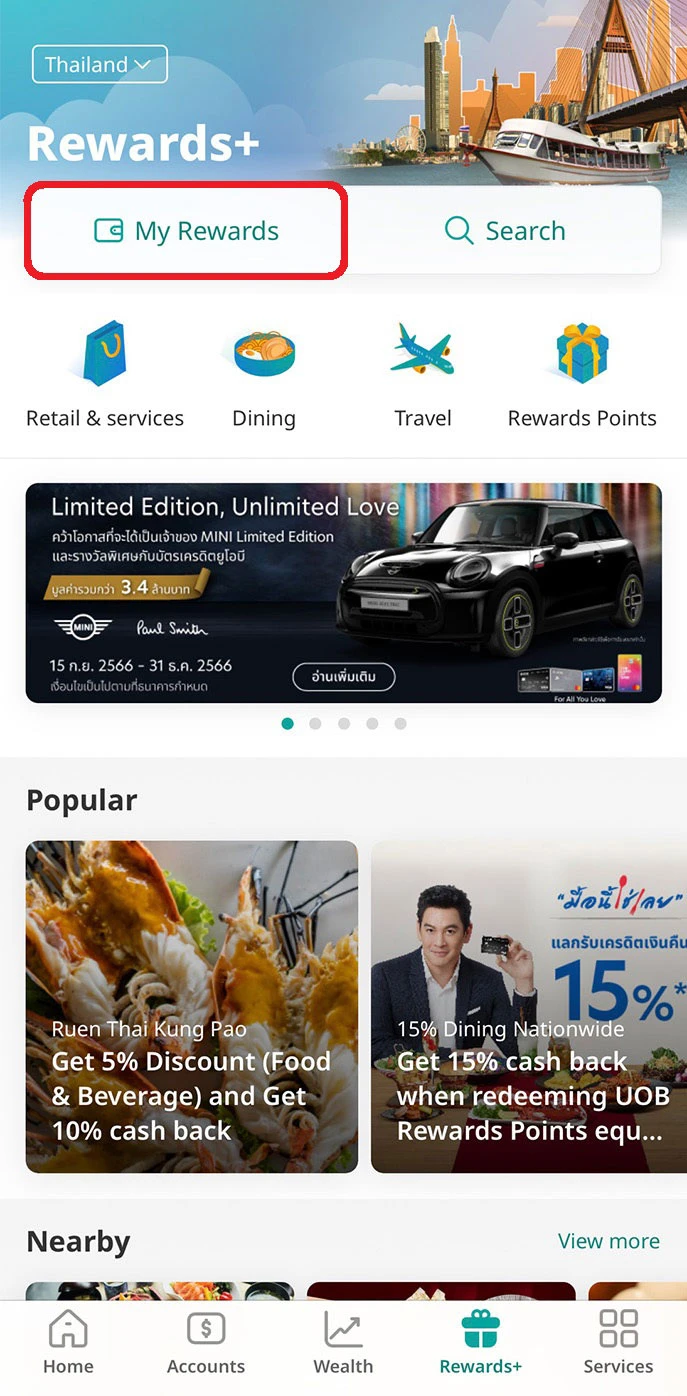

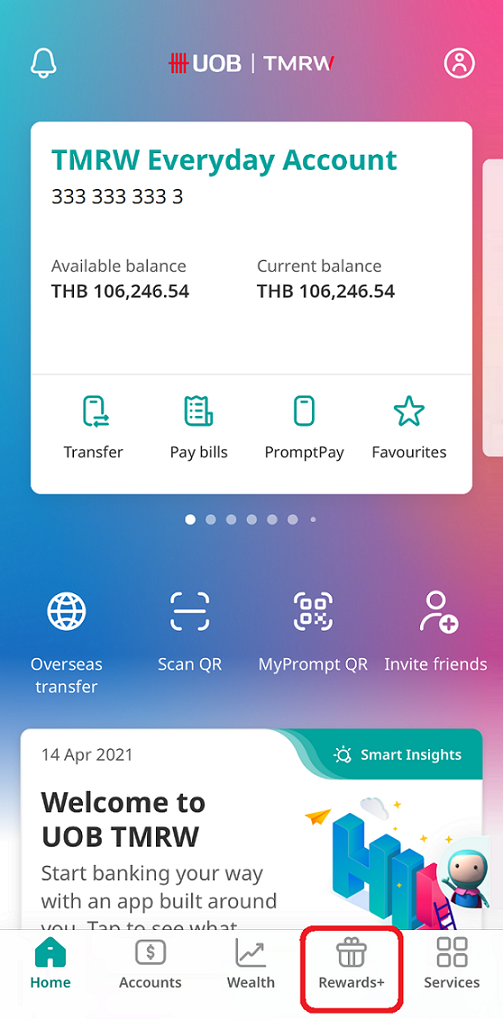

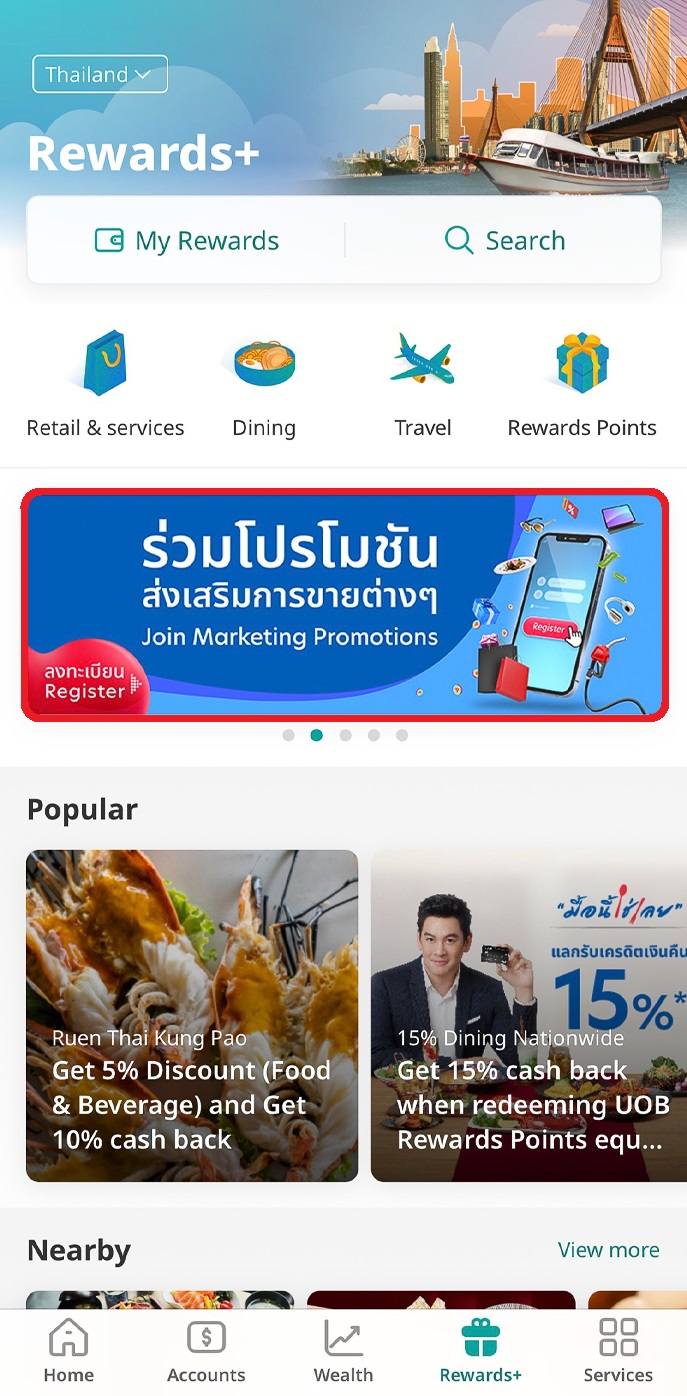

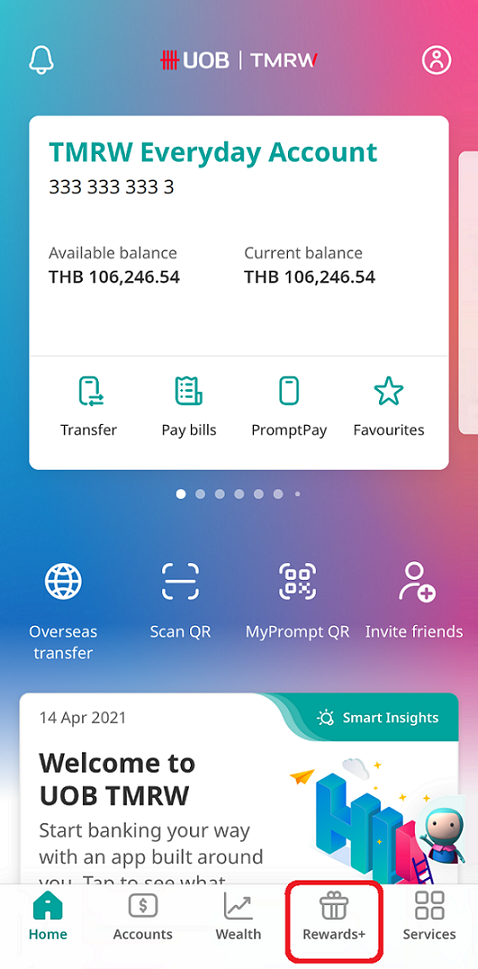

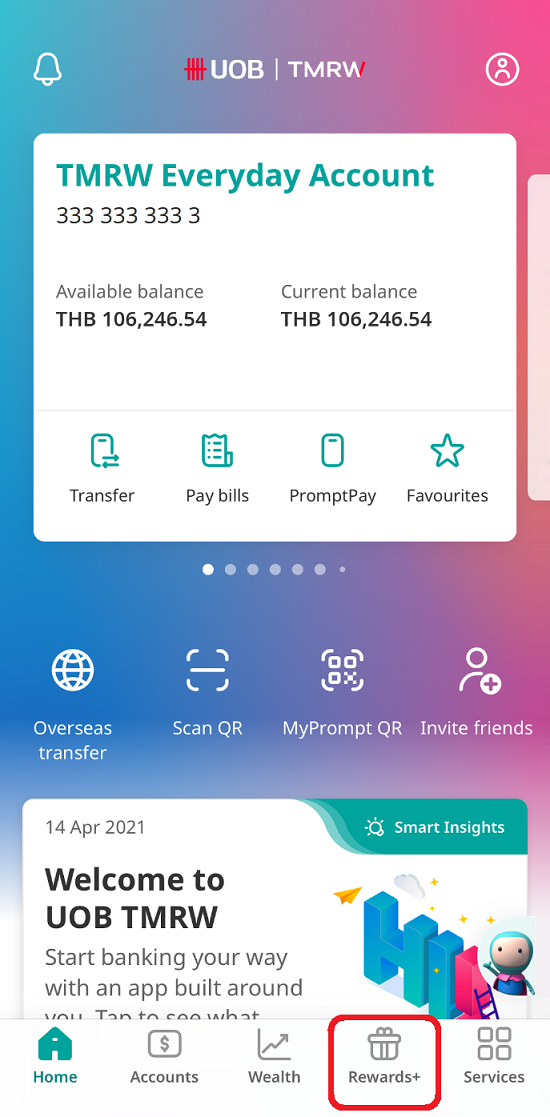

1. Log in to UOB TMRW and tap on “Rewards+”.

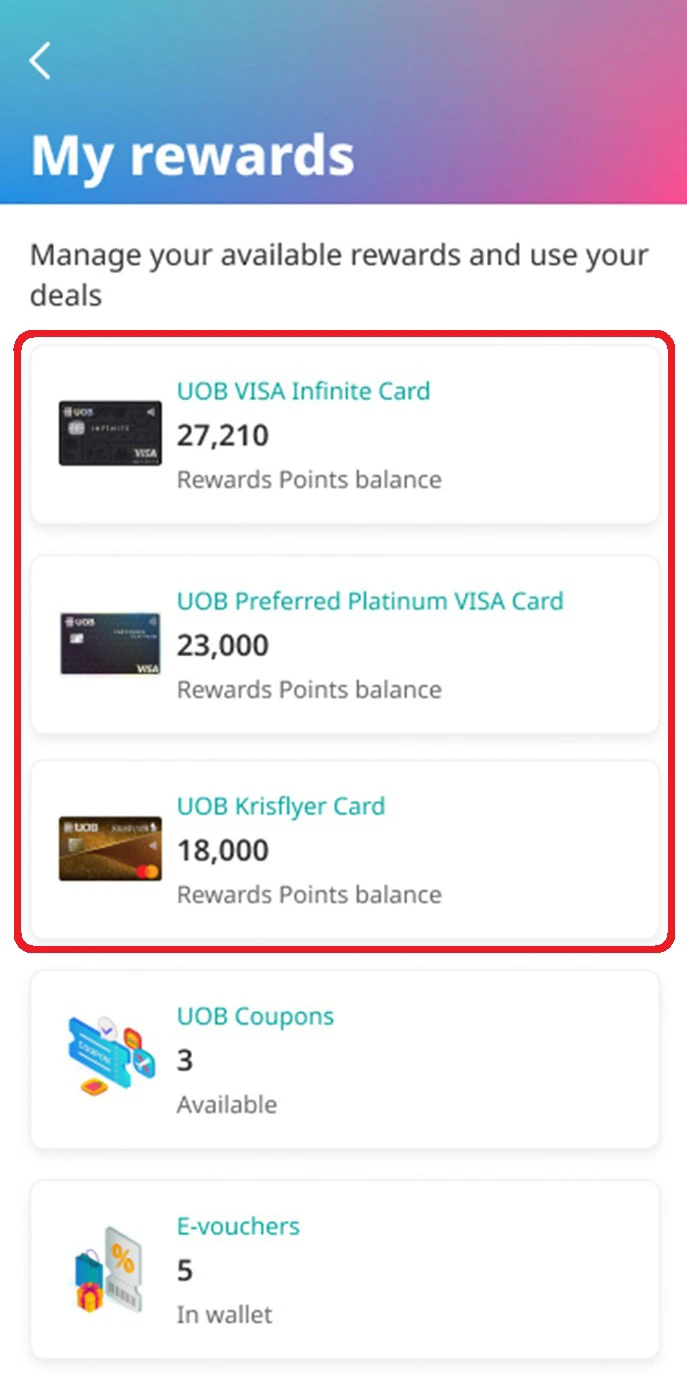

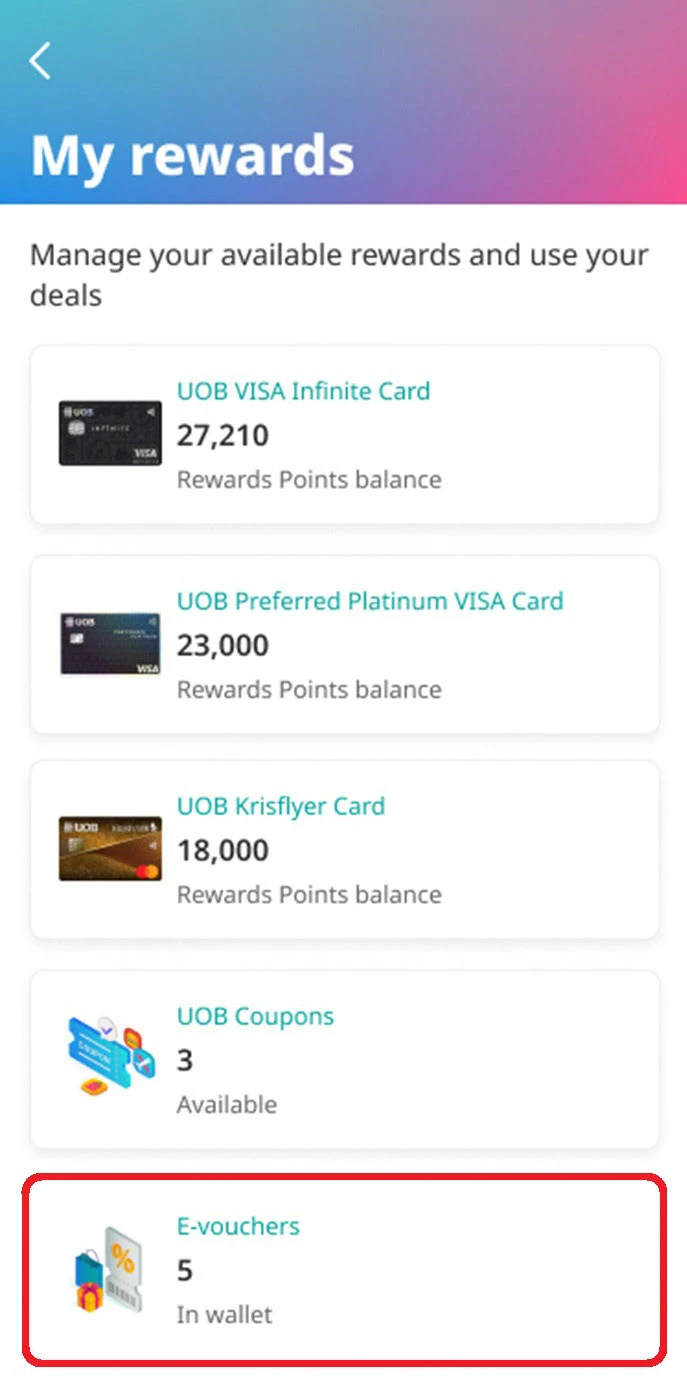

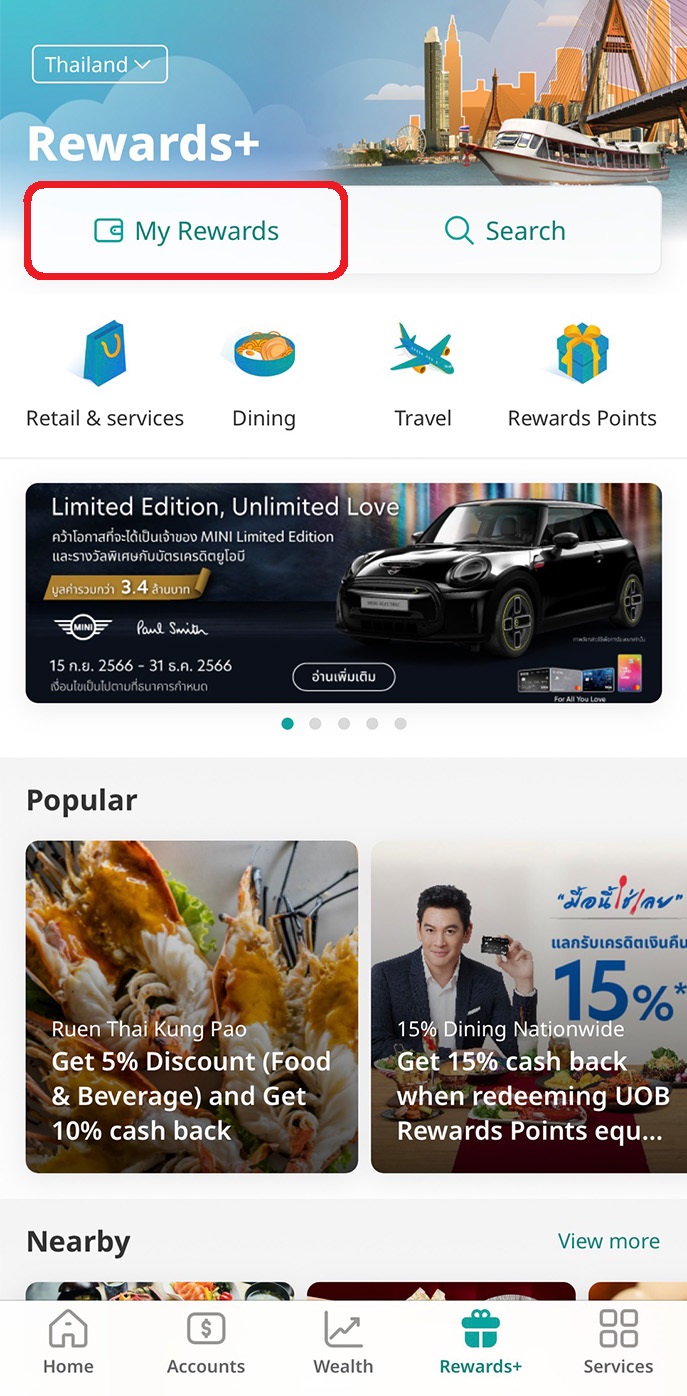

2. Tap on “My Rewards”.

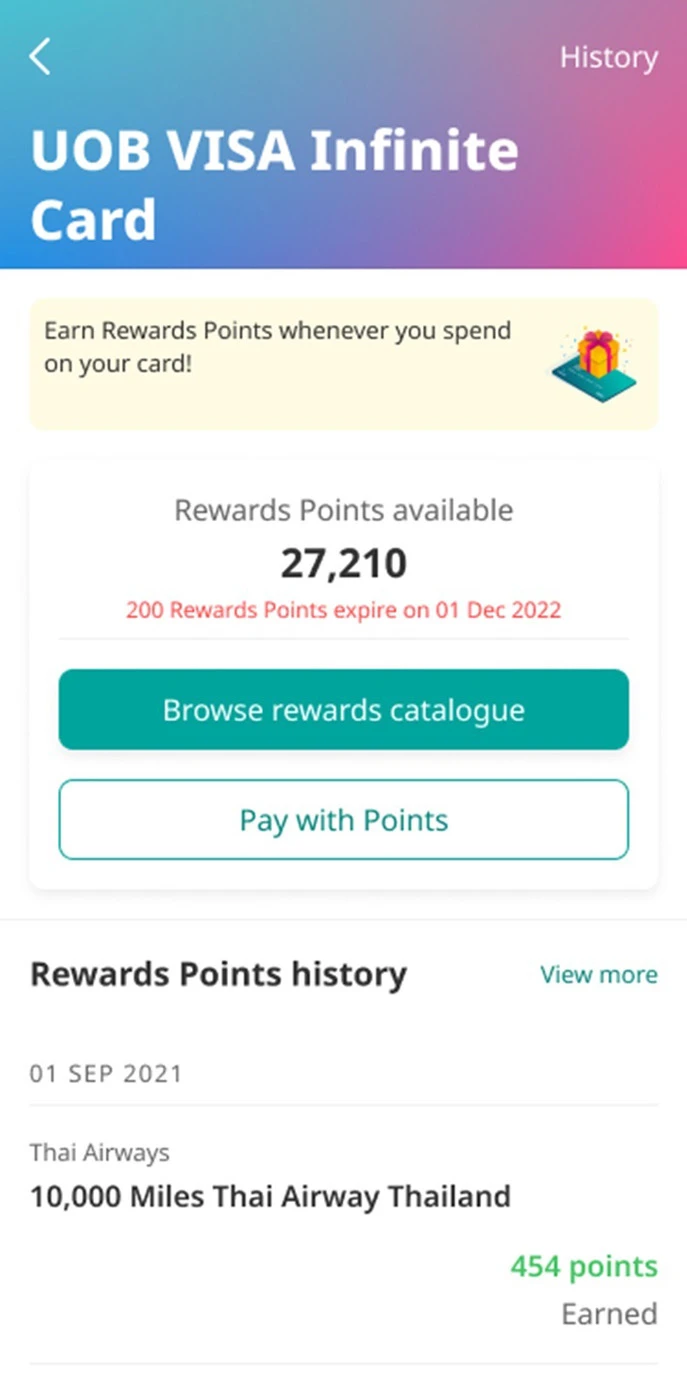

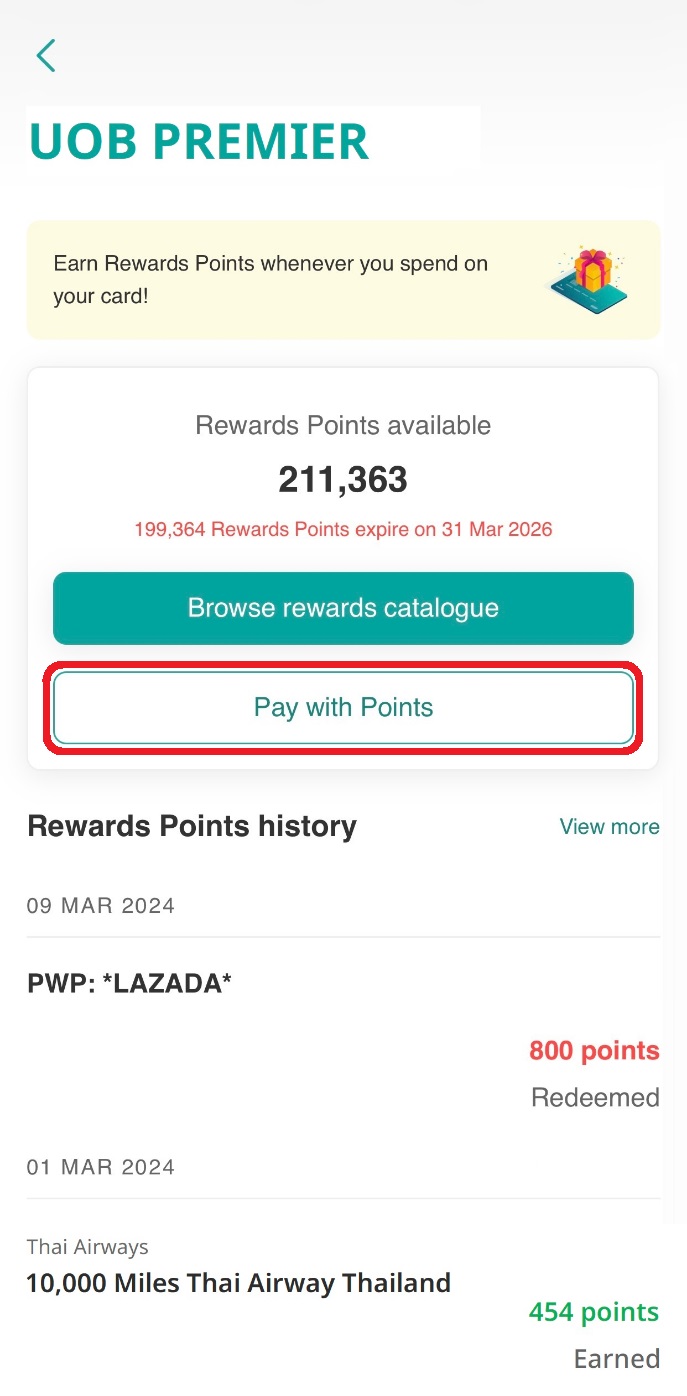

3. View your available points for all cards and select a specific credit card to see more details.

4. View remaining points, expiring points, and points history of the specific card you selected.

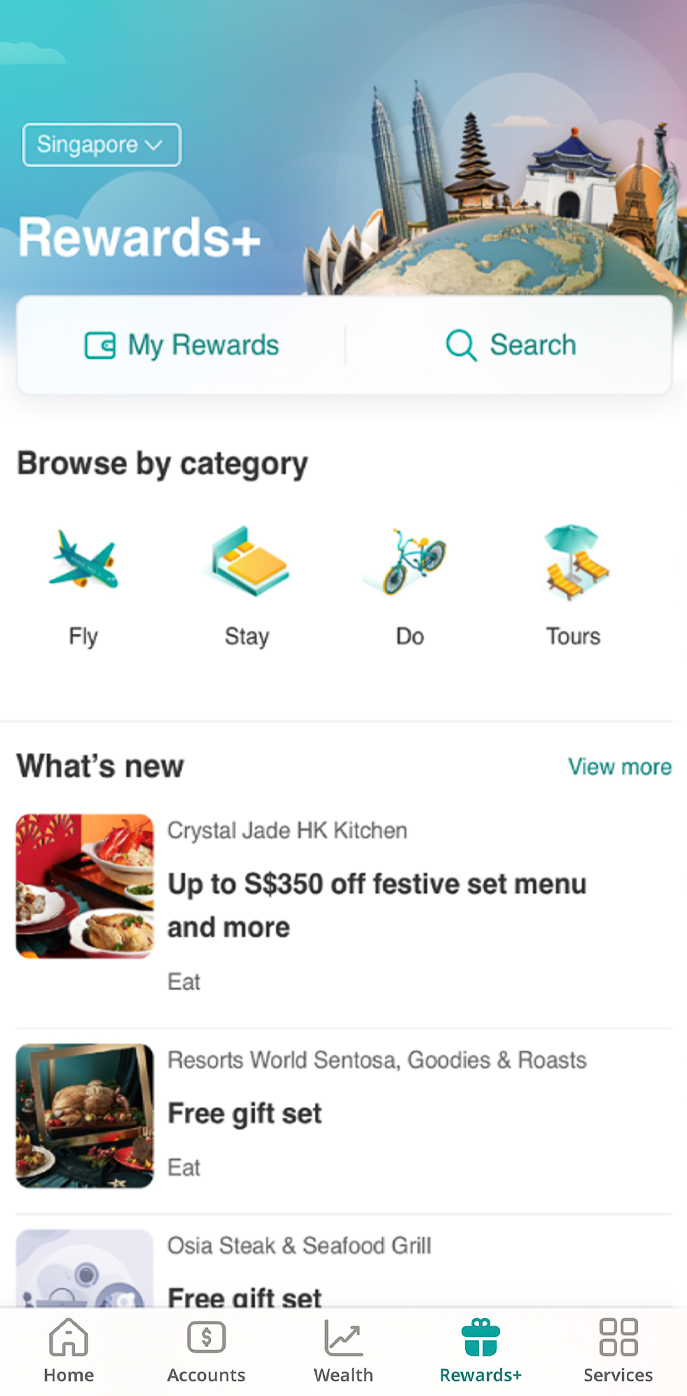

View deals and promotions in UOB Rewards+

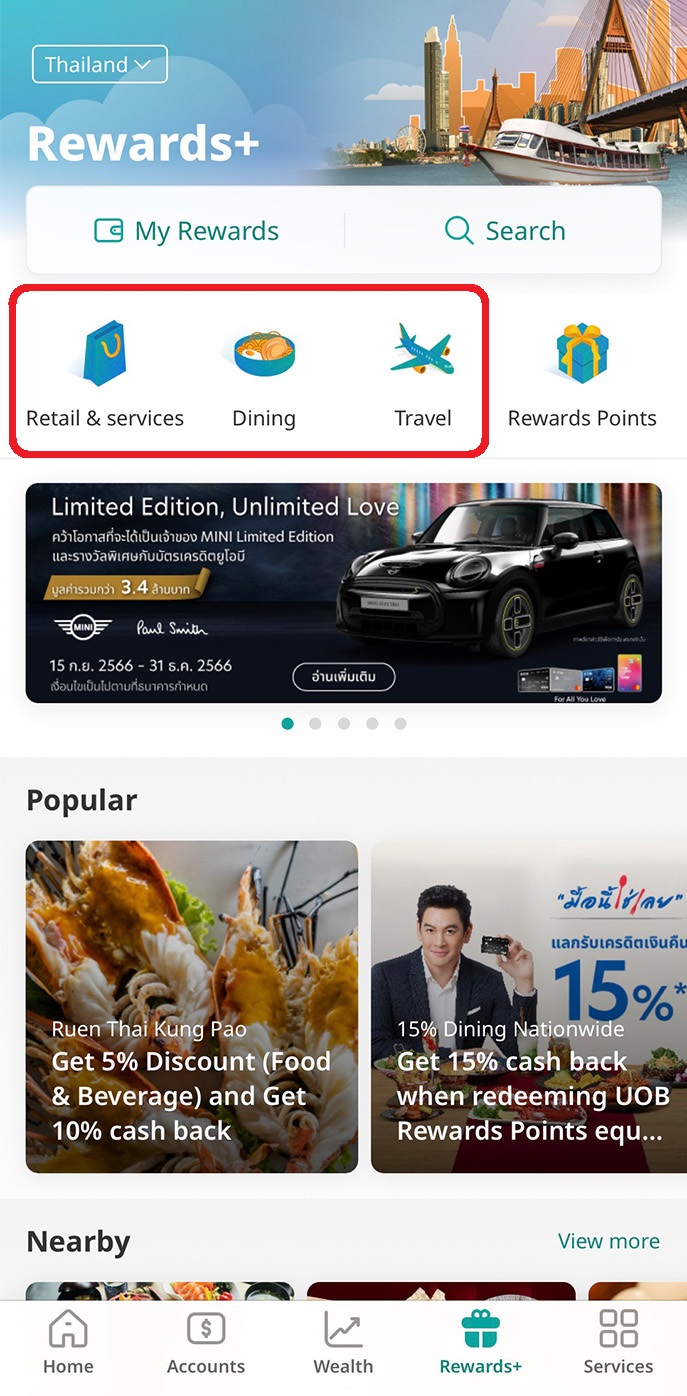

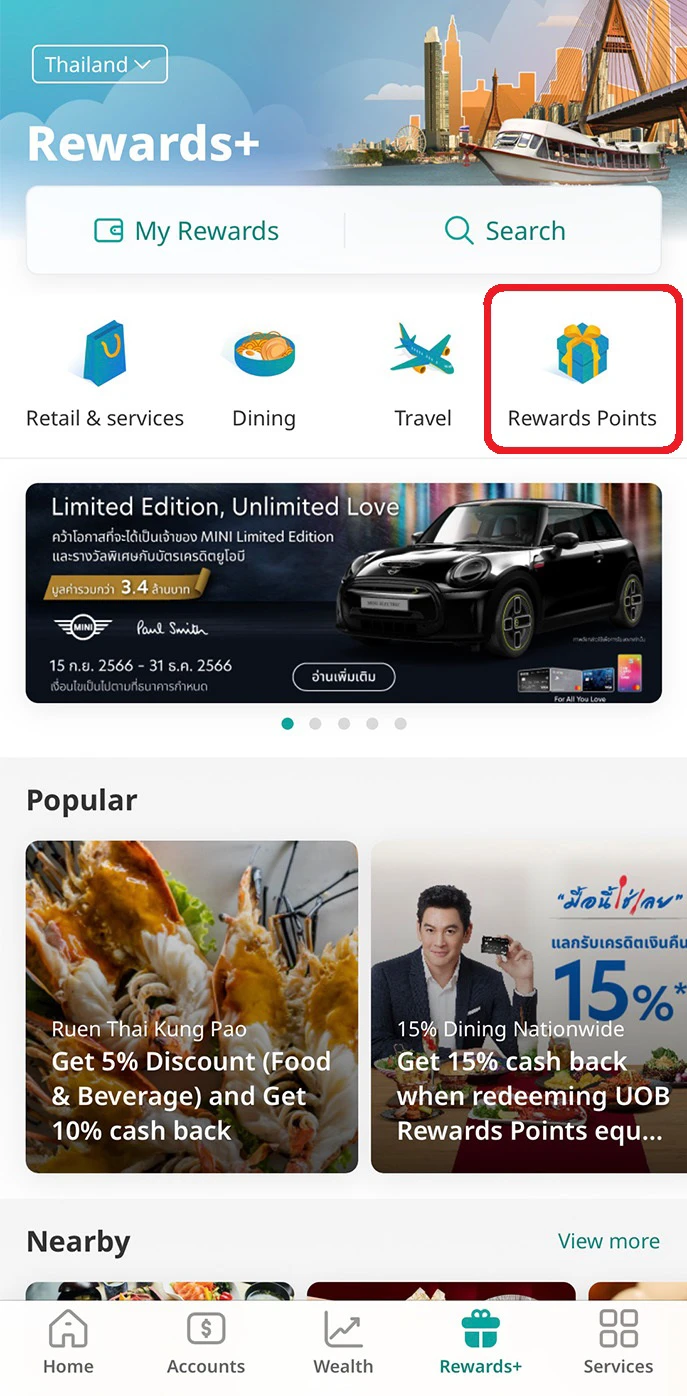

1. Browse deals by categories

1. Log in to UOB TMRW and tap on “Rewards+”.

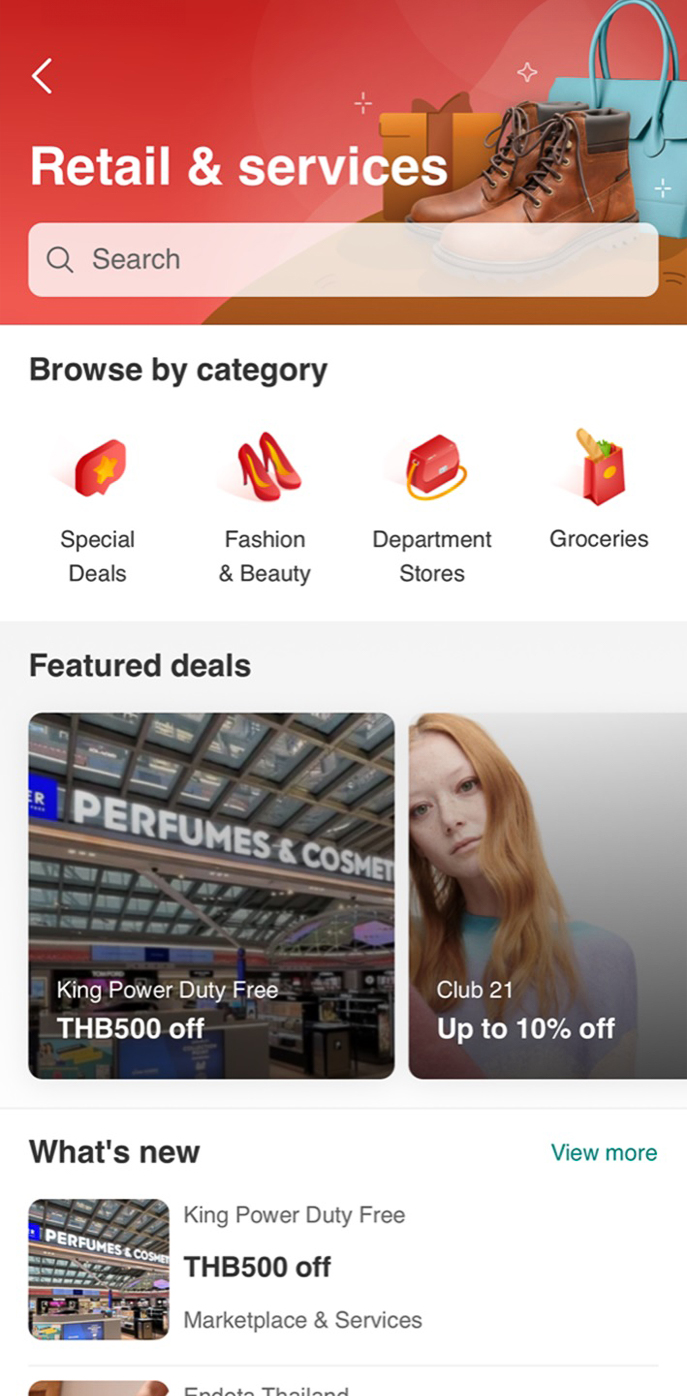

2. View deals according to categories of your choice such as Retail & services, Dining, and Travel.

3. The screen will display relevant and special deals under the selected category.

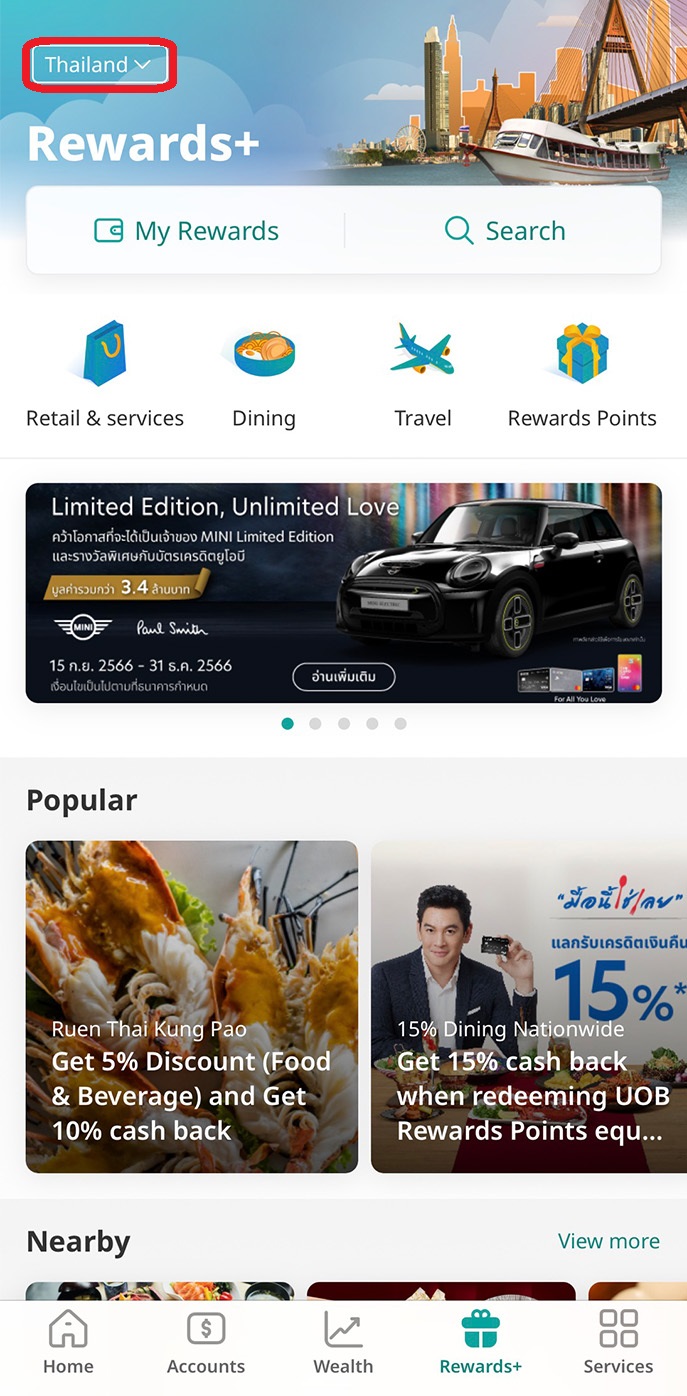

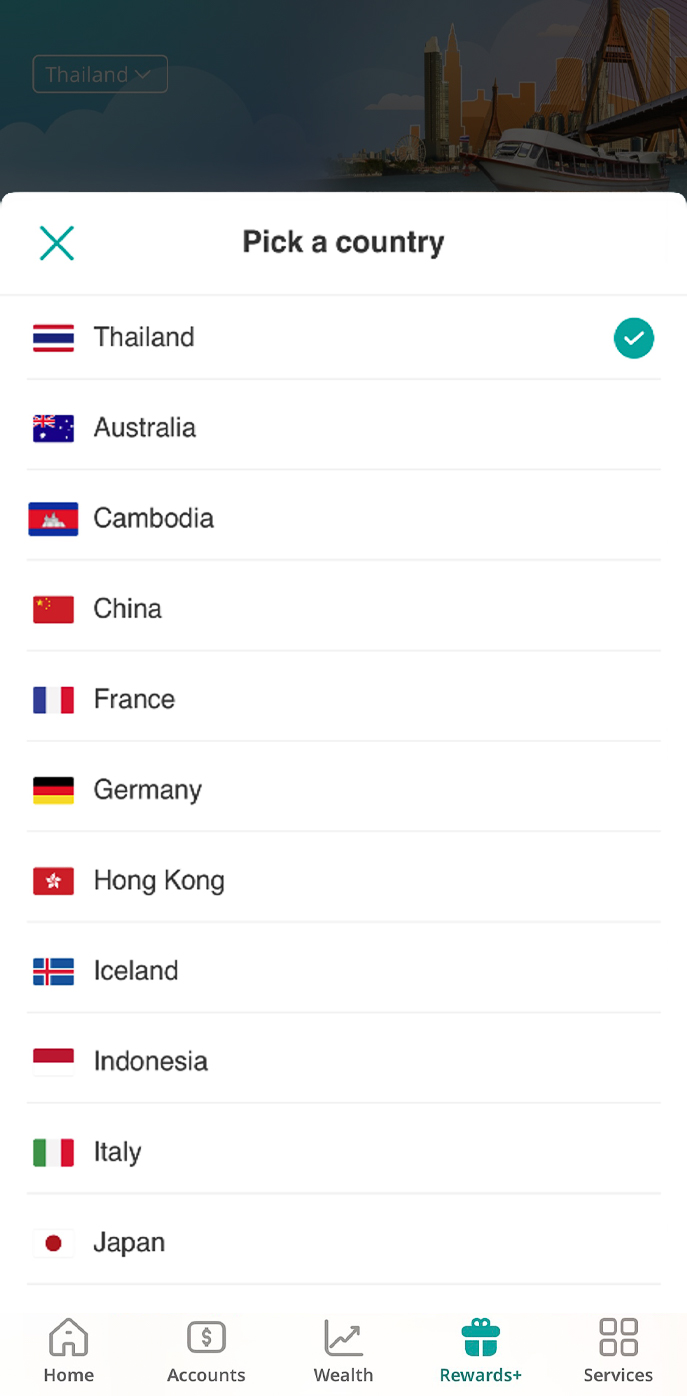

2. Browse deals by location (country)

1. Log in to UOB TMRW and tap on “Rewards+”.

2. Tap on the top left corner to view special deals by country.

3. Select the desired country to view special privileges.

4. The screen will display relevant and special deals under the selected country.

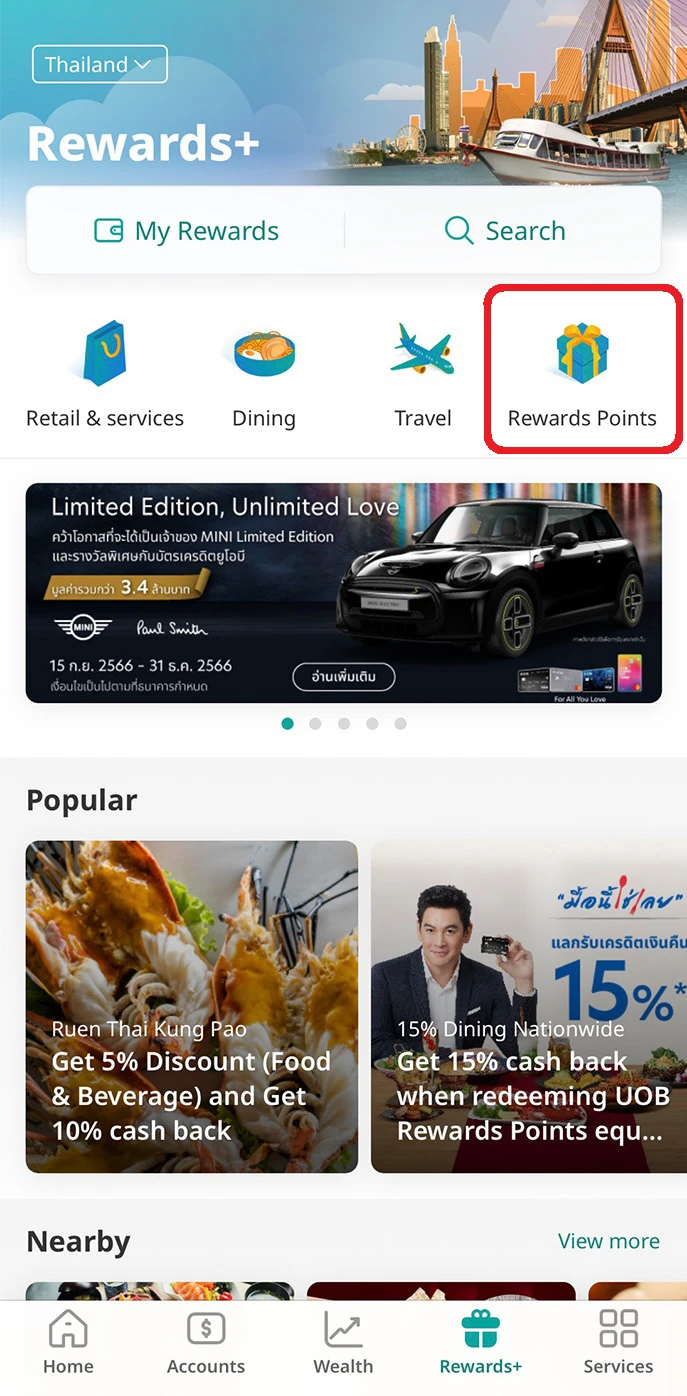

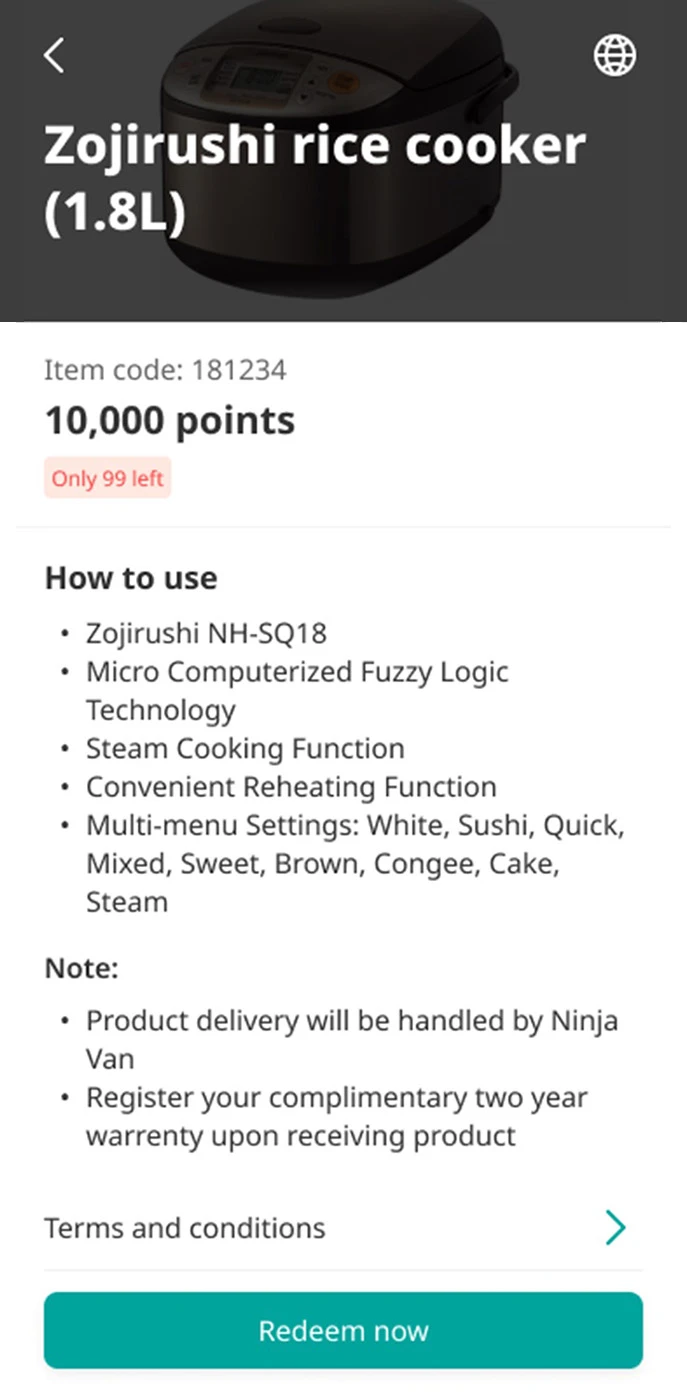

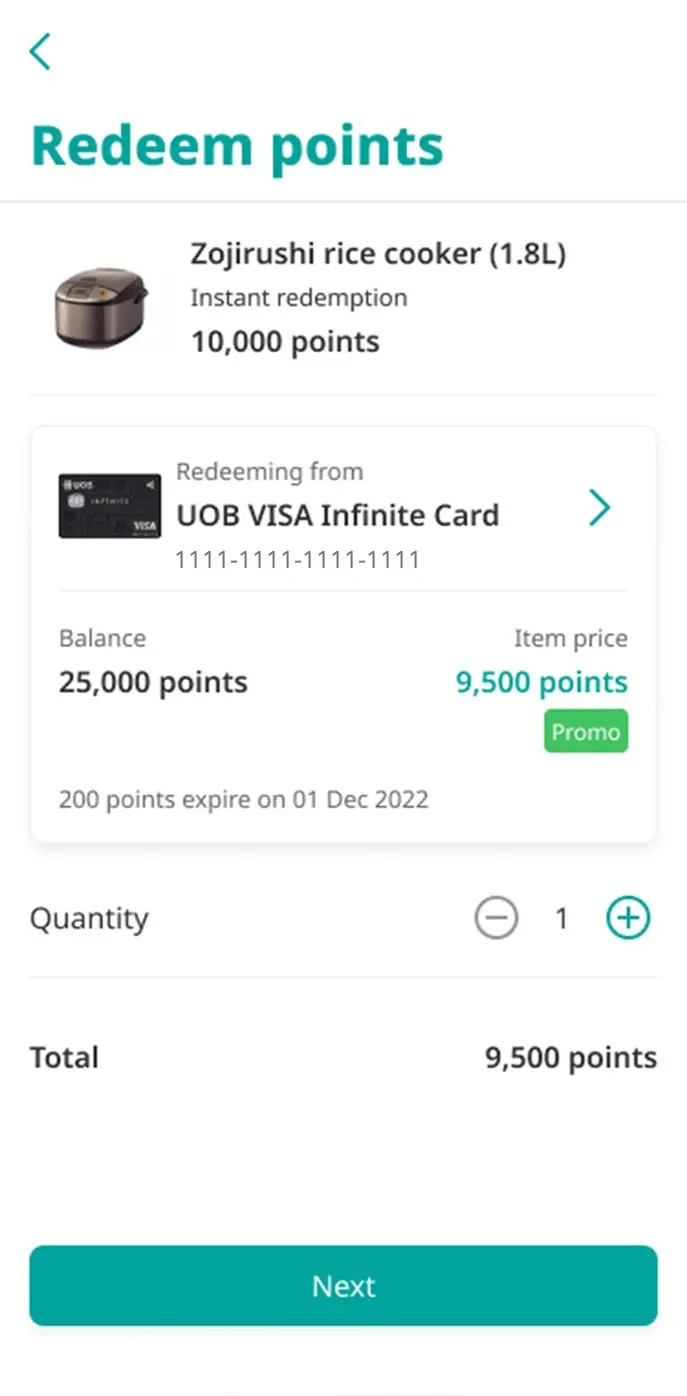

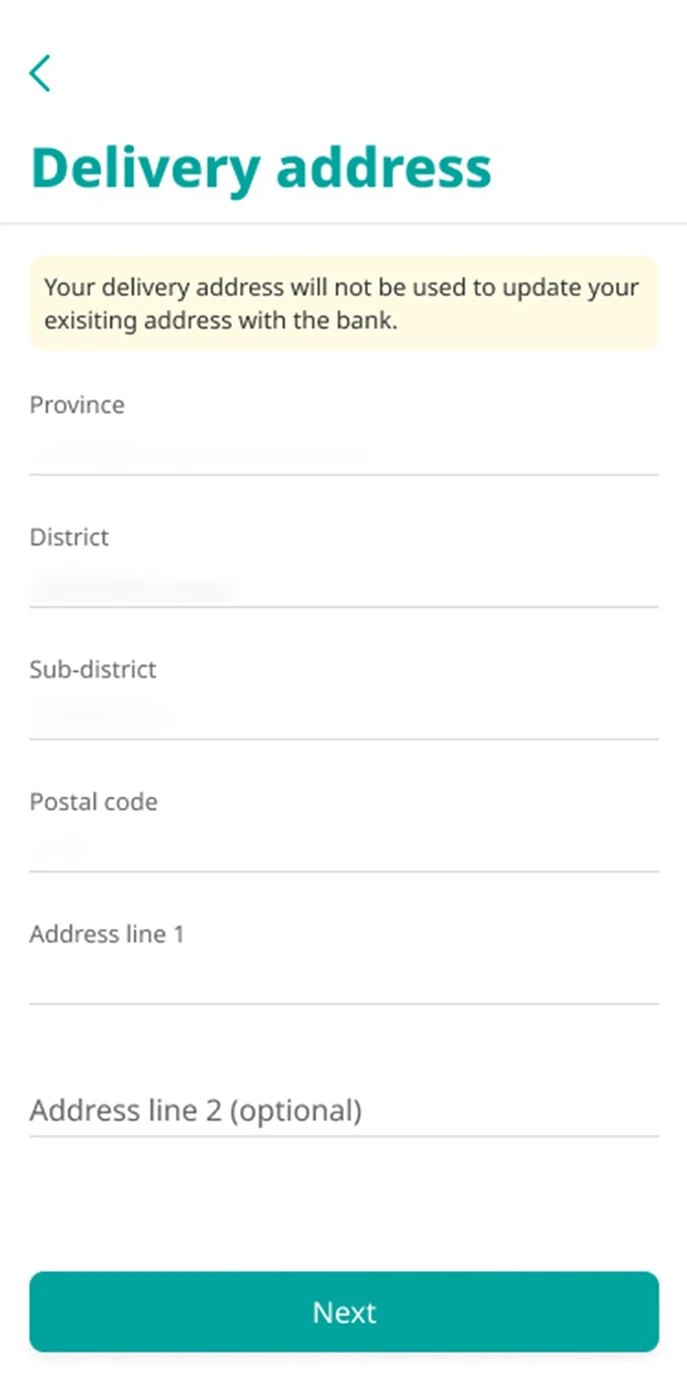

Rewards points redemption

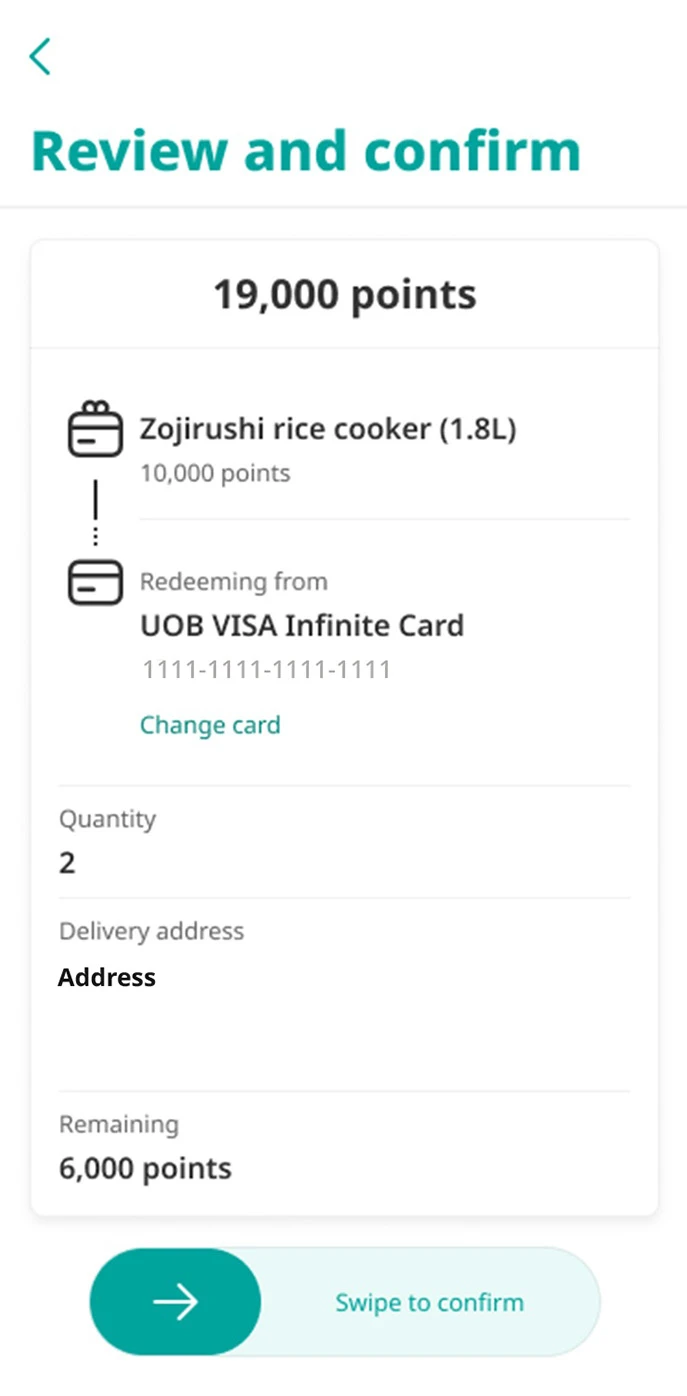

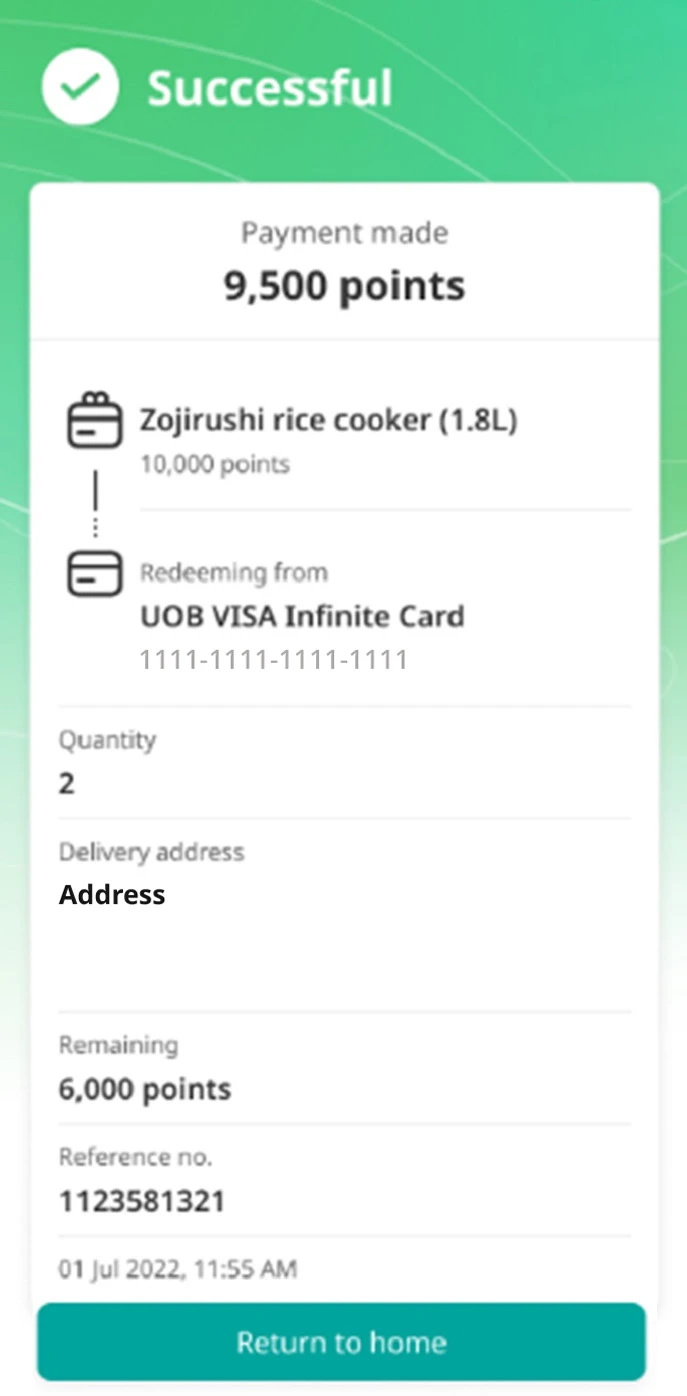

1. Redeem points for gifts, gifts cards and e-vouchers

1. Log in to UOB TMRW and tap on “Rewards+”.

2. Tap on “Rewards Points”.

3. Select the item to redeem.

4. Read the details and T&Cs and tap on “Redeem now”.

5. Select the credit card to use points from and select the quantity of item to redeem.

6. Enter your delivery address (required for redemption of merchandises only).

7. Review the details and swipe to confirm points redemption.

8. Points redemption successful.

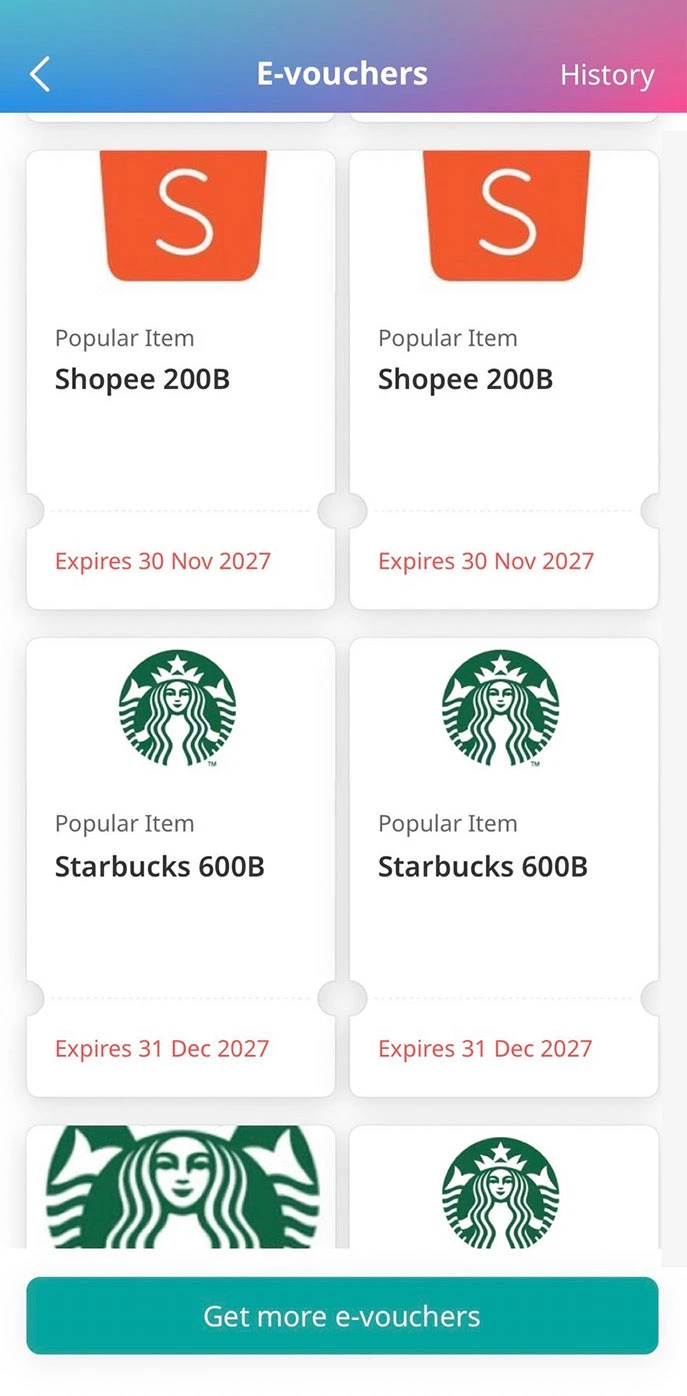

Note: Redeemed e-vouchers are kept in “My Rewards”.

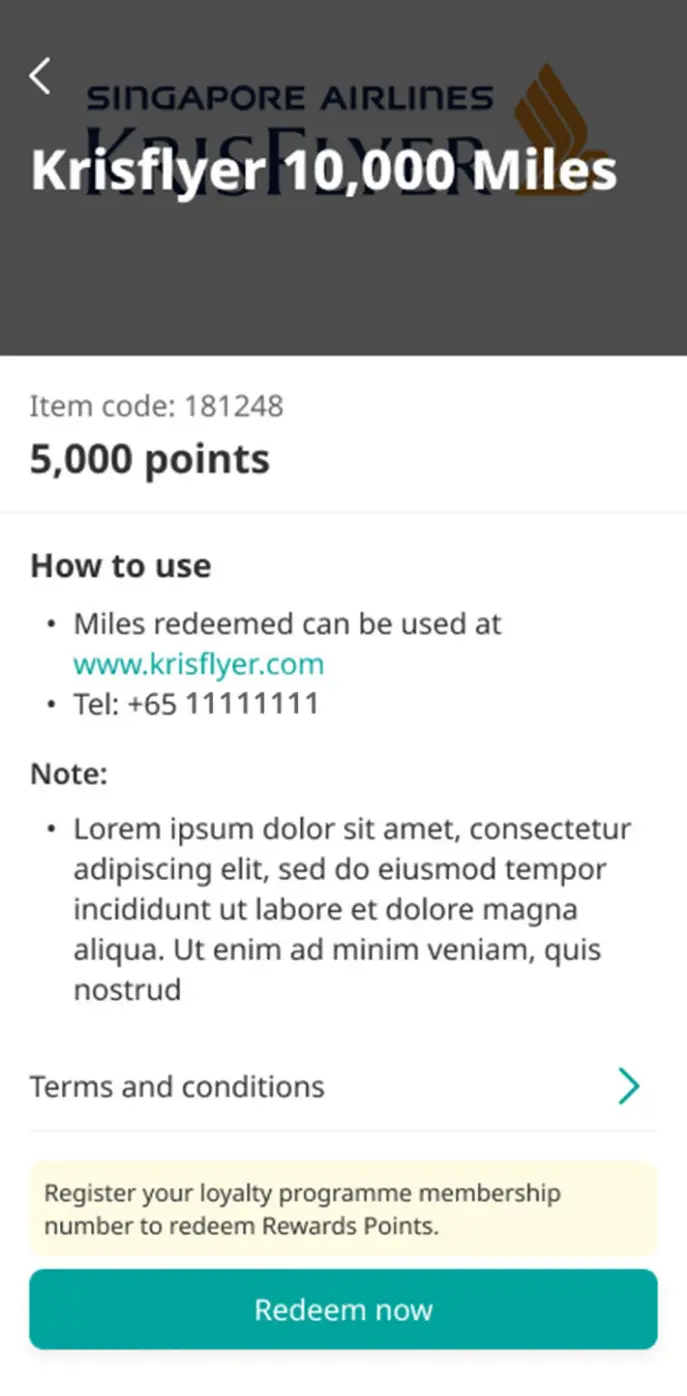

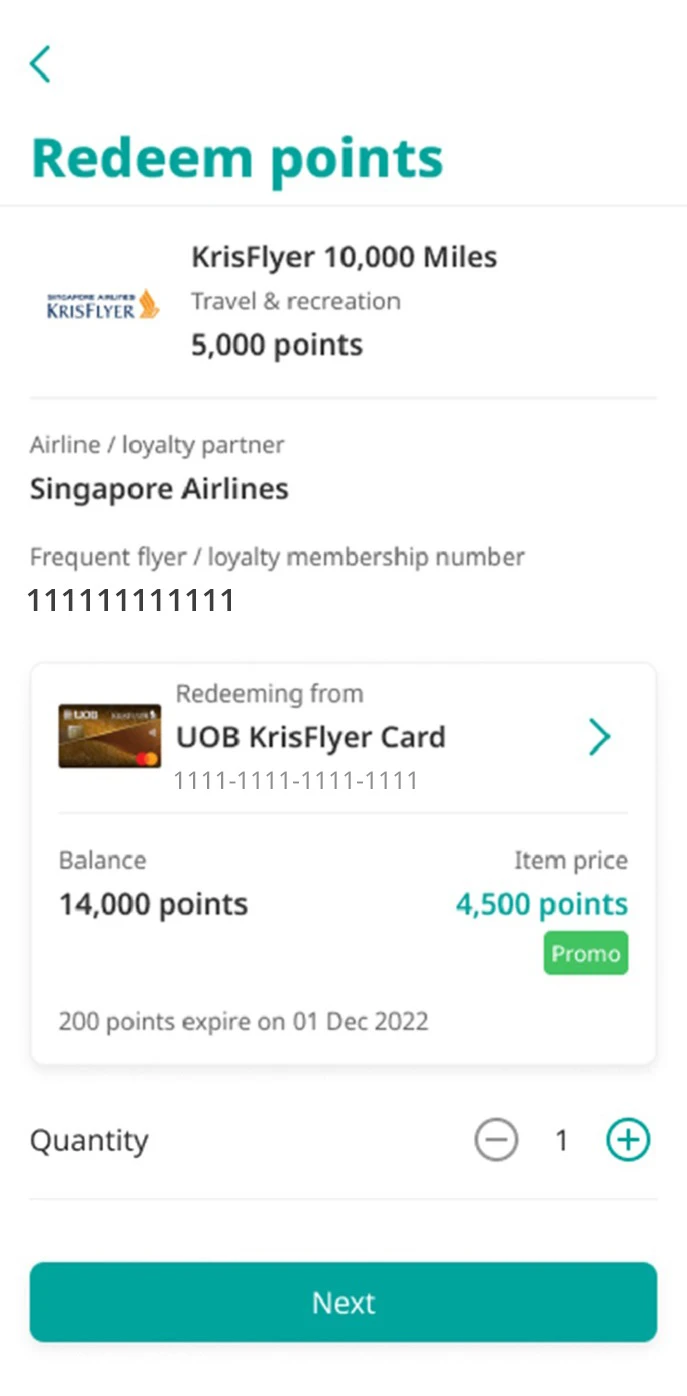

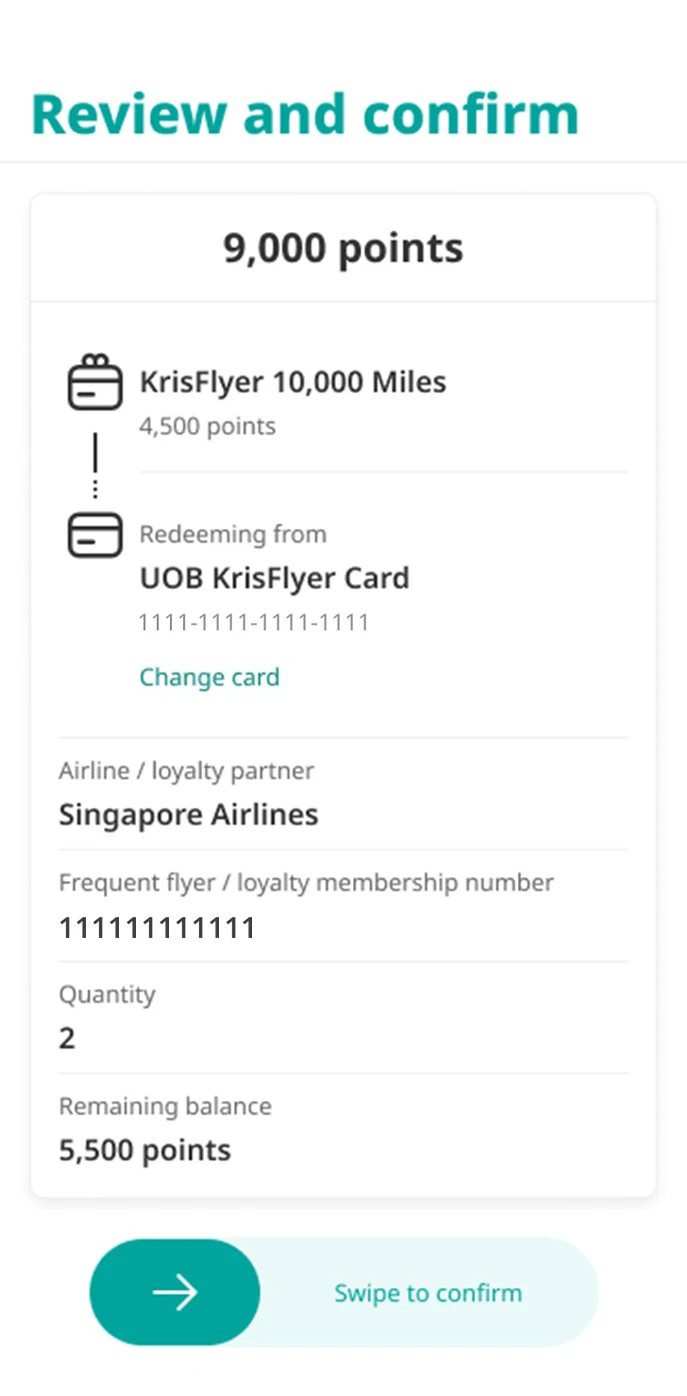

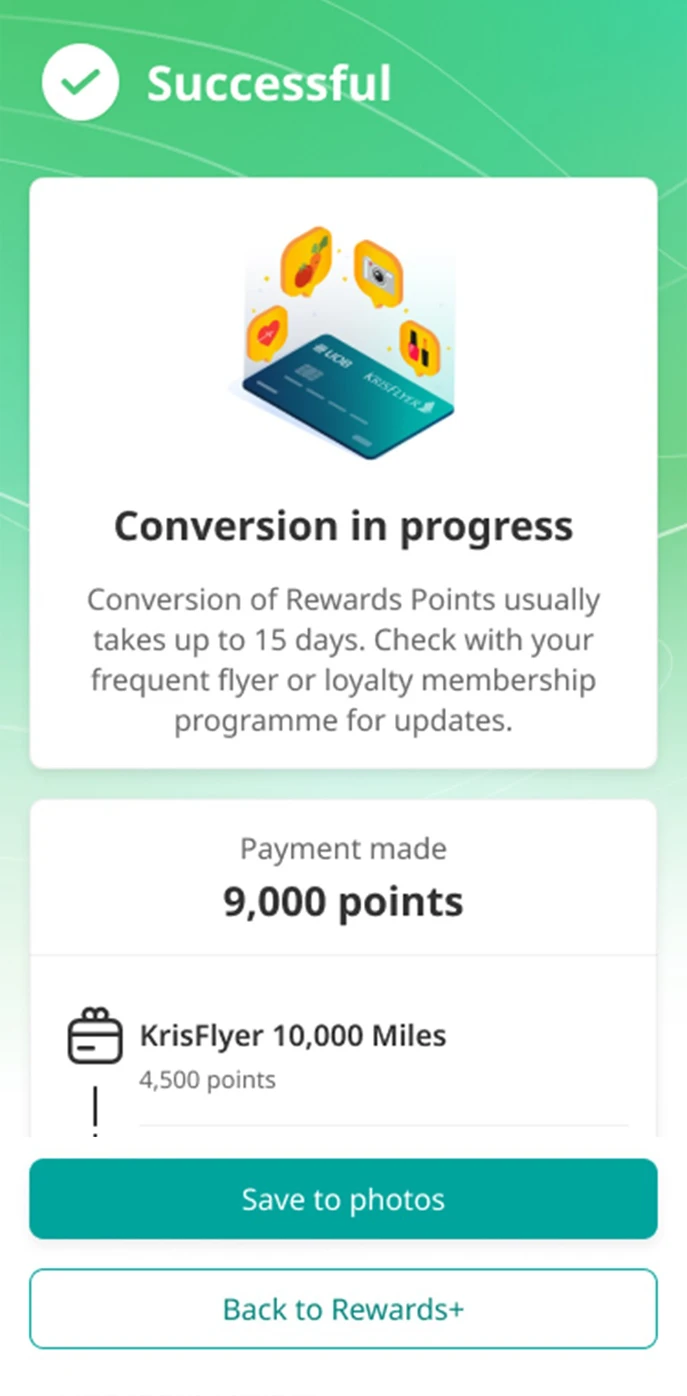

2. Redeem points for mileages or loyalty points programs

1. Log in to UOB TMRW and tap on “Rewards+”.

2. Tap on “Rewards Points”.

3. Select the item to redeem.

4. Read the details and T&Cs and tap on “Redeem now”.

Note: If you haven’t registered your loyalty membership number, you’ll be redirected to register it on our website first.

5. Select the credit card to use points from and select the quantity.

6. Review the details and swipe to confirm points redemption.

7. Points redemption successful.

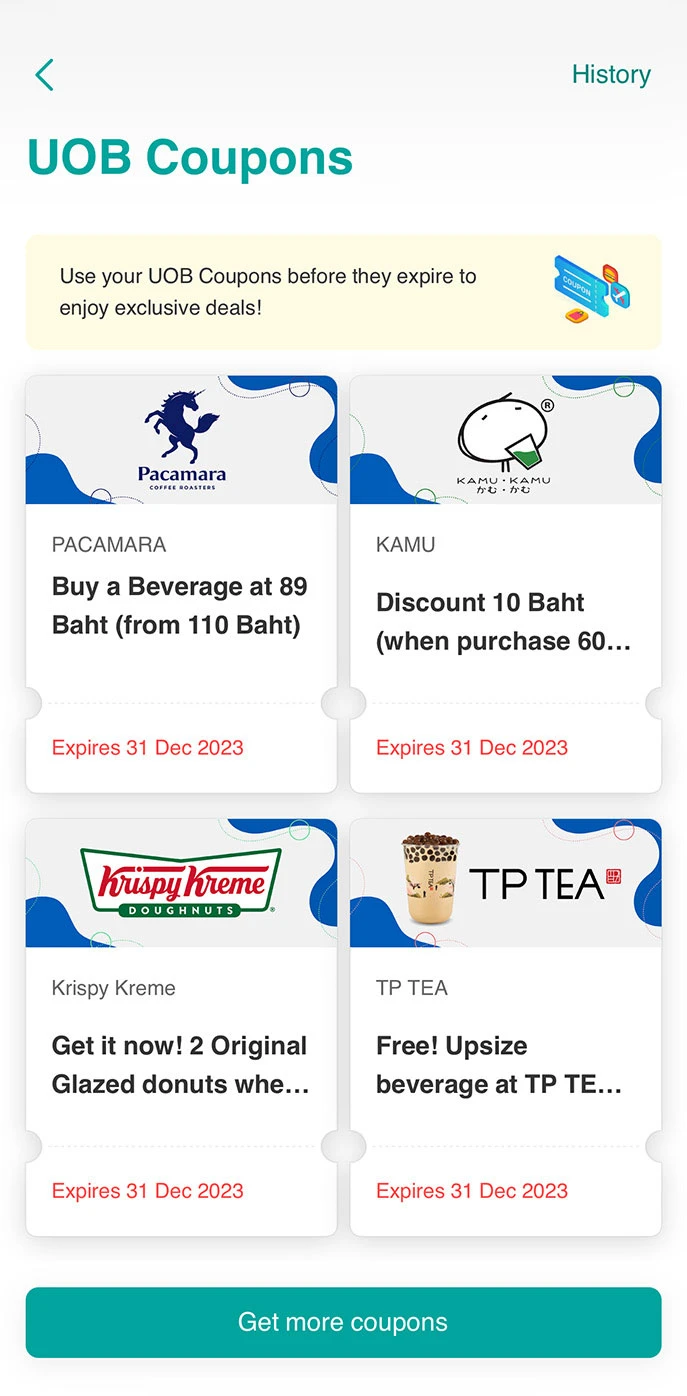

UOB Coupons and e-vouchers

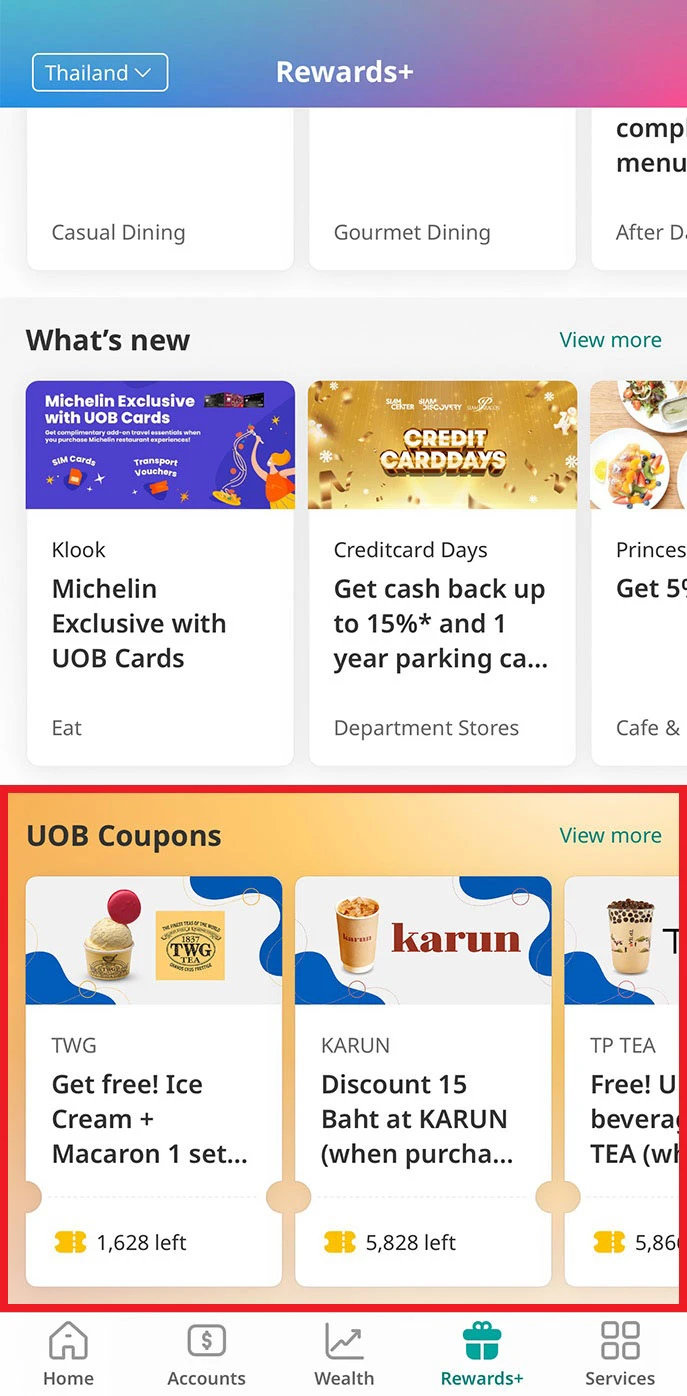

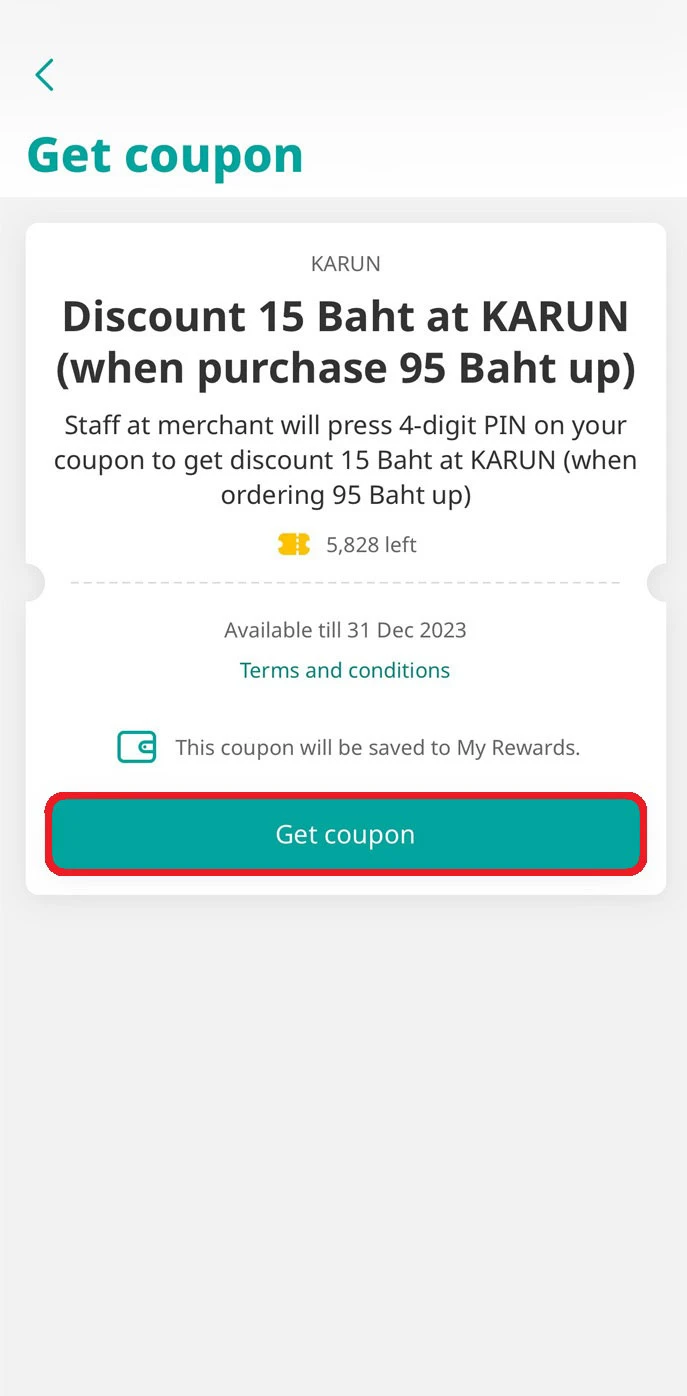

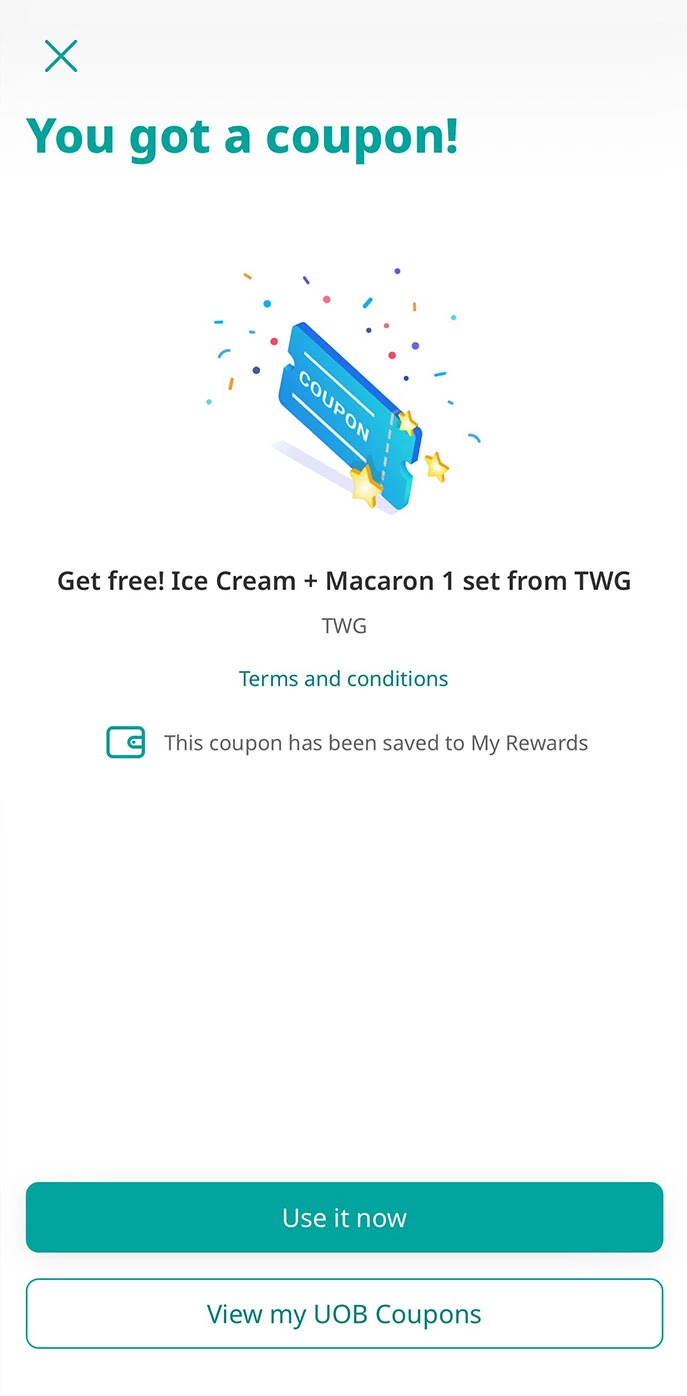

1. Get UOB Coupons

1. Log in to UOB TMRW and tap on “Rewards+”.

2. Scroll down to “UOB Coupons” section and select the coupon of your choice.

3. Read the coupon details and T&Cs and tap on “Get coupon”.

4. You can use the coupon instantly or view your UOB coupons in “My Rewards”.

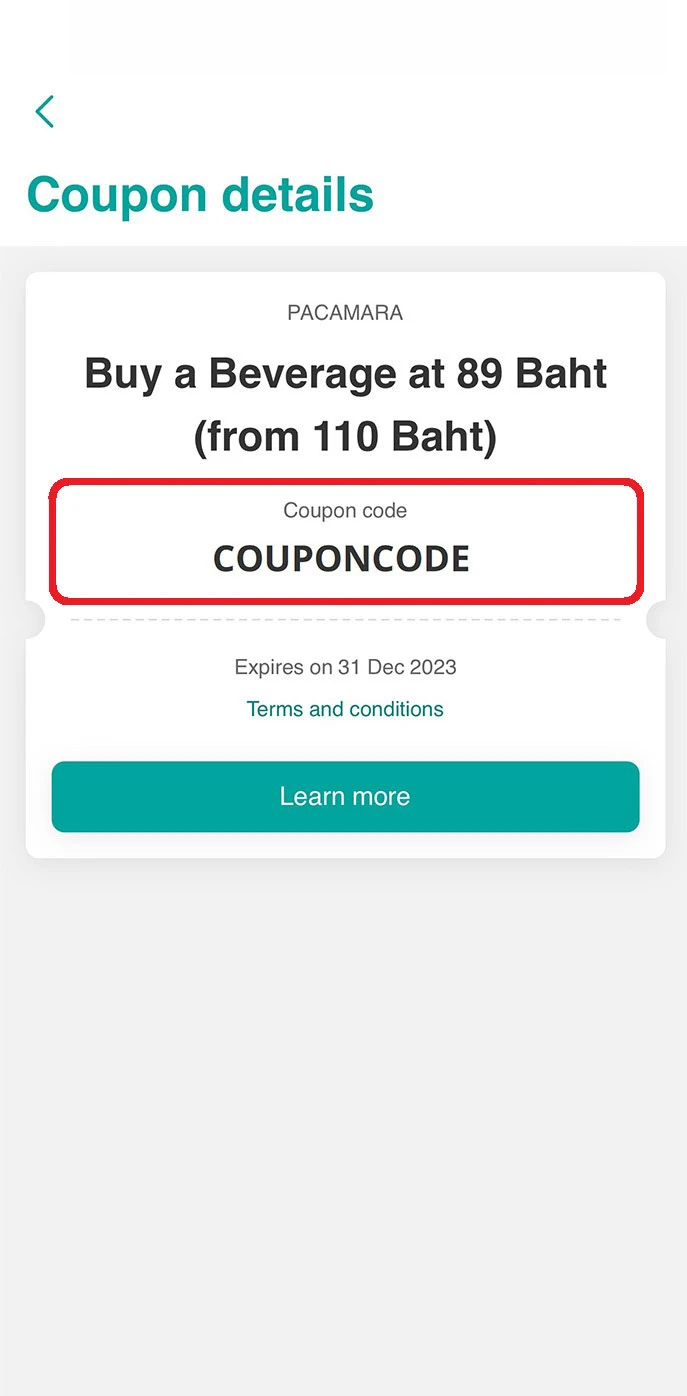

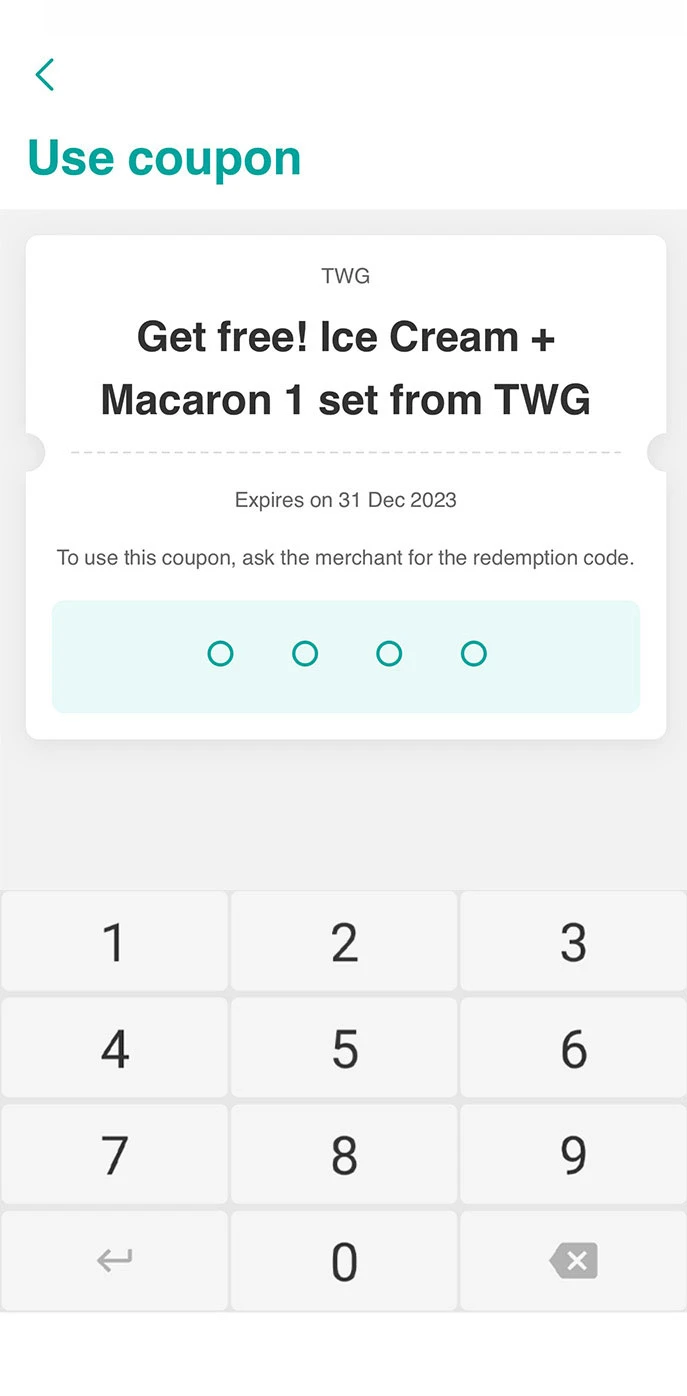

2. View and use your UOB Coupons

1. Log in to UOB TMRW and tap on “Rewards+”.

2. Tap on “My Rewards”.

3. Tap on “UOB Coupons”.

4. Select the coupon to use.

5A. For online coupons, use the coupon code at the merchant’s store or in the merchant’s application.

5B. For offline coupons, tap on “Use it now” and ask the merchant staff to enter the PIN to use the coupon.

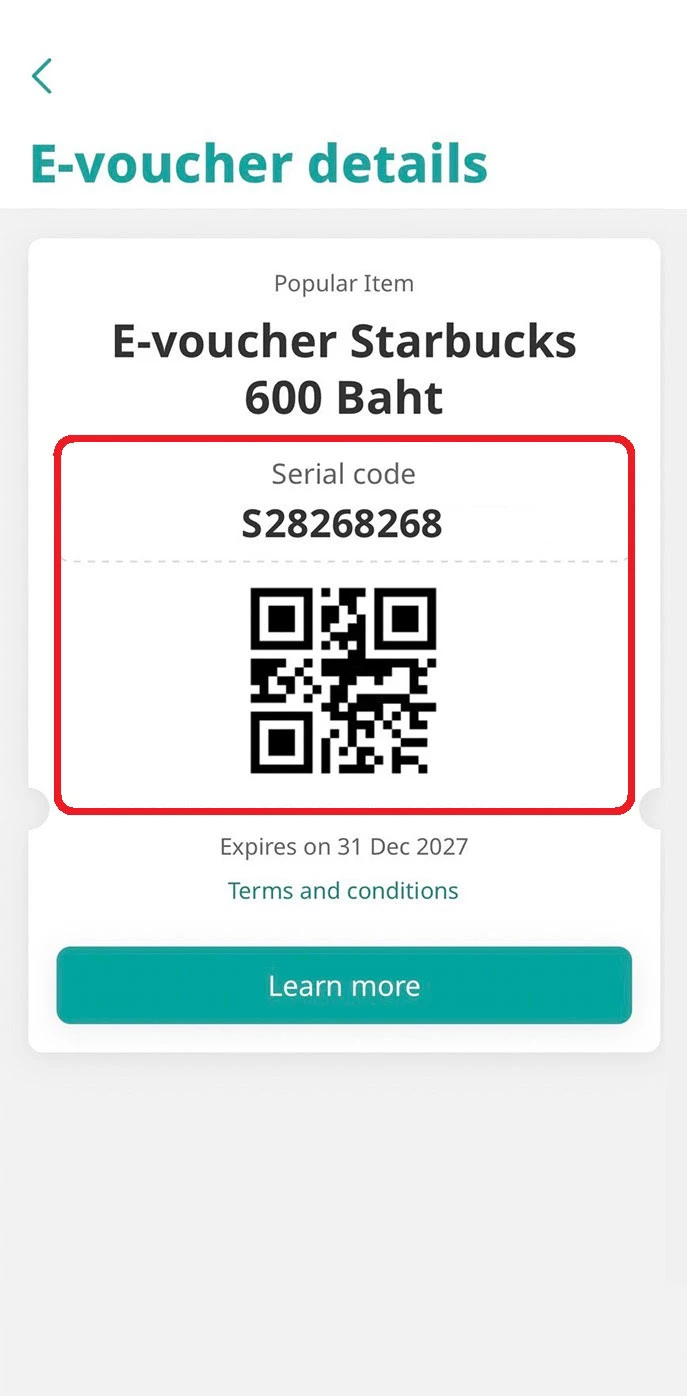

3. View and use your redeemed e-vouchers

1. Log in to UOB TMRW and tap on “Rewards+”.

2. Tap on “My Rewards”.

3. Tap on “E-vouchers”.

4. Select the e-voucher to use.

5. You can use the e-voucher instantly.

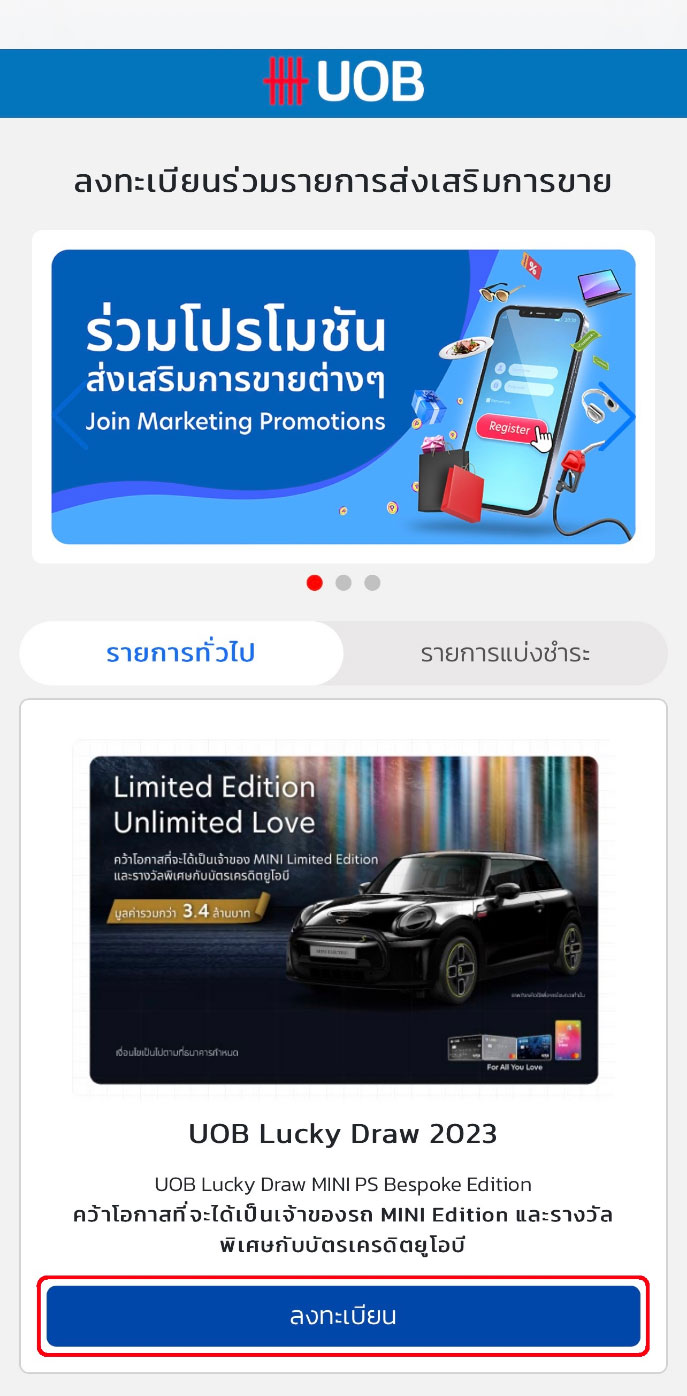

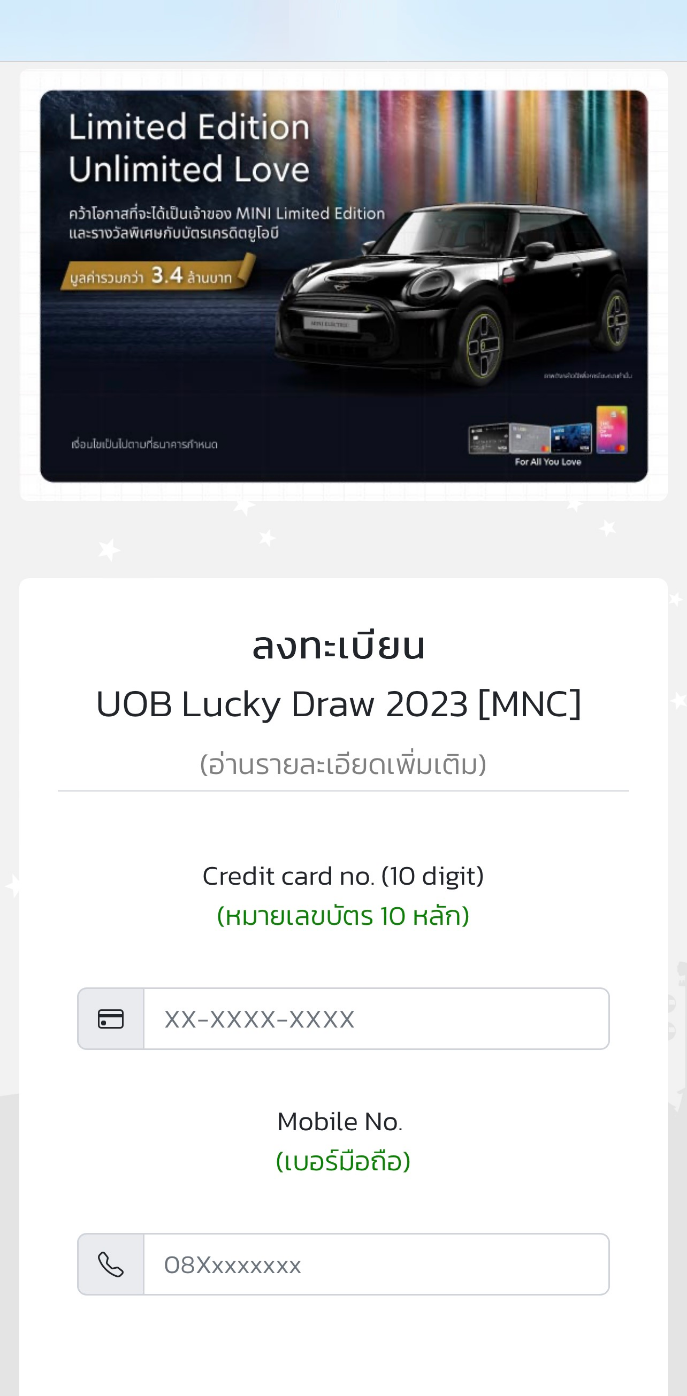

Join marketing promotions via UOB TMRW app instead of SMS registration

1. Register for promotional campaigns via UOB Rewards+ (free of charge)

1. Log in to UOB TMRW and tap on “Rewards+”.

2. Select the banner “Join Marketing Promotions”.

3. Select the promotional campaign of your interest to register.

4. Fill in information to register and participate in the selected program. You’ll receive SMS confirming successful registration.

Pay with Points

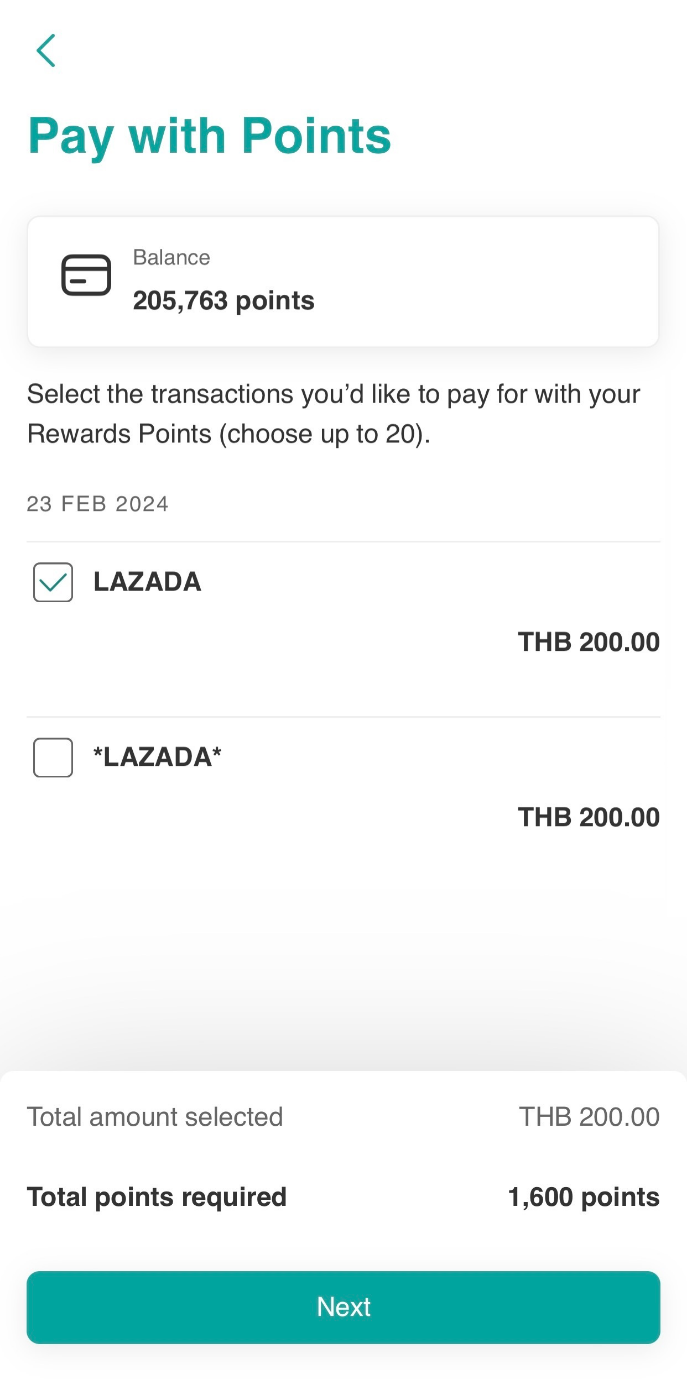

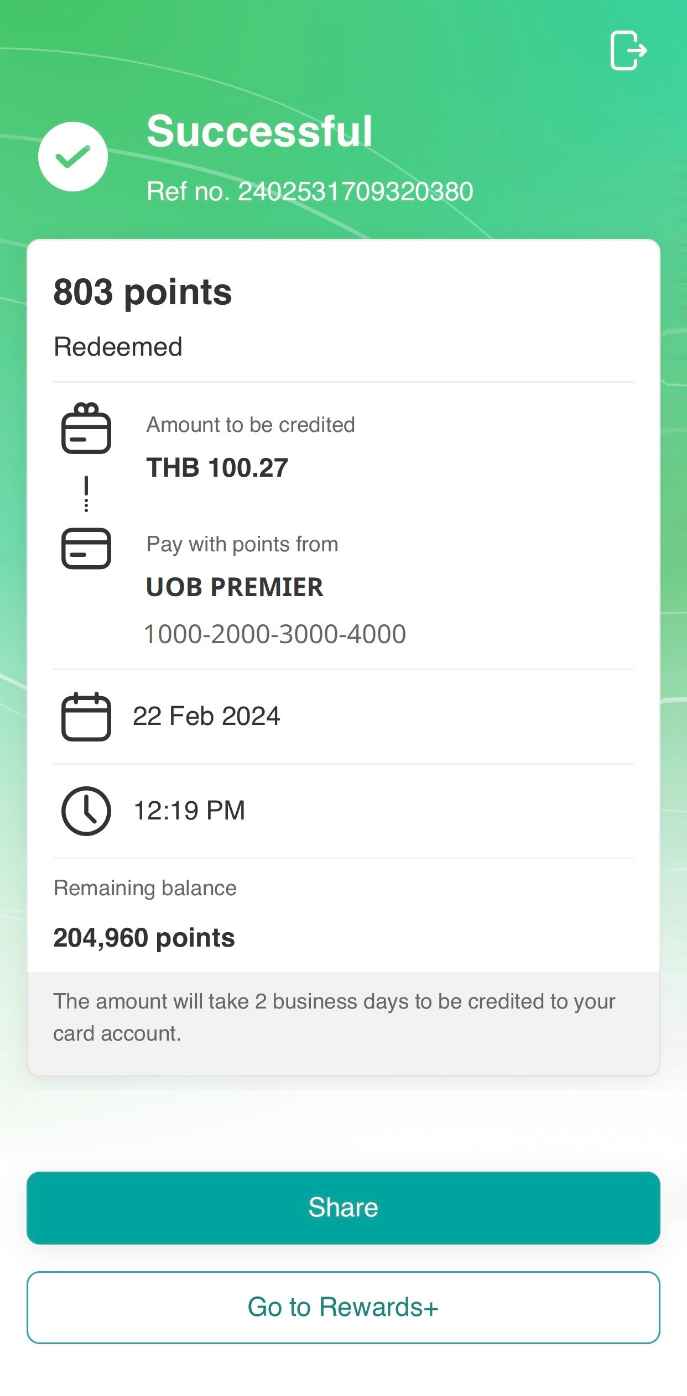

1. Pay credit card billing with points in full amount (multiple transactions)

1. Log in to UOB TMRW and tap on “Rewards+”.

2. Go to “My Rewards” to select your credit card.

3. Tap on “Pay with Points”.

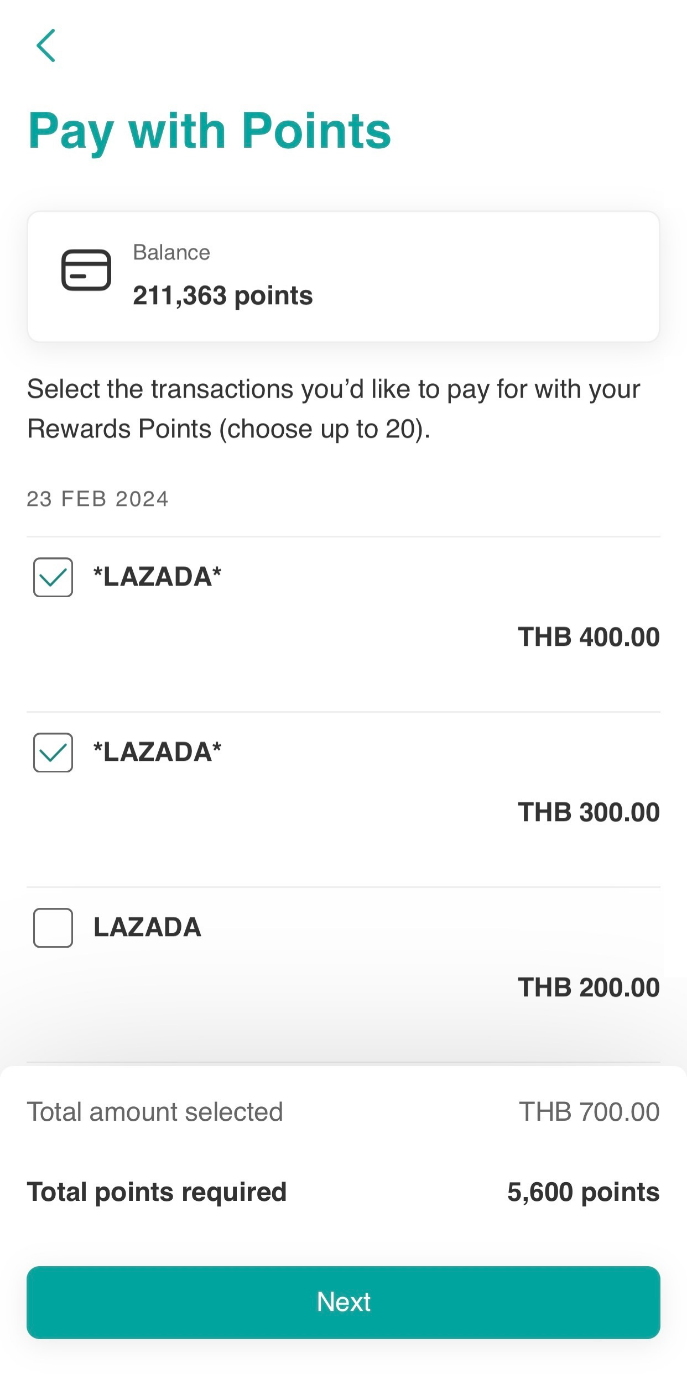

4. Choose item(s) to pay off in full amount with your points (up to 20 items within 60 days).

5. Review the details and swipe to confirm.

6. Cashback will be credited to your card account within 2 business days.

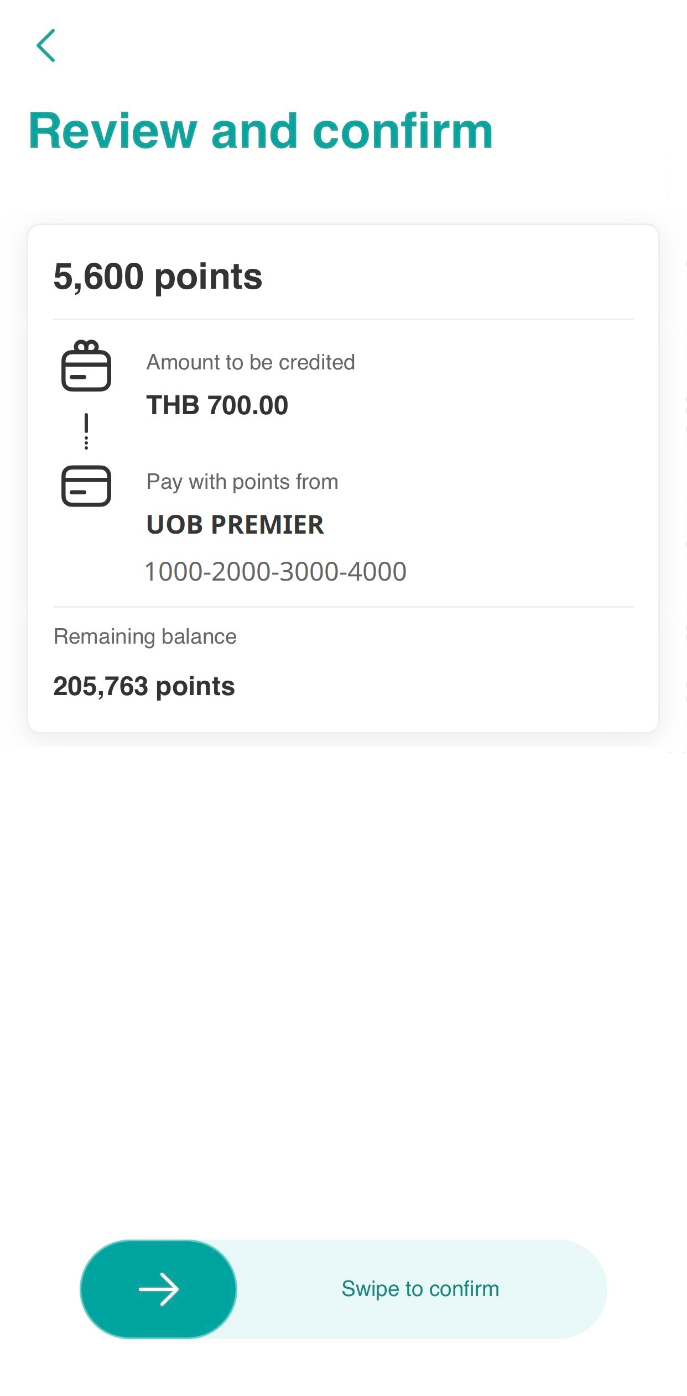

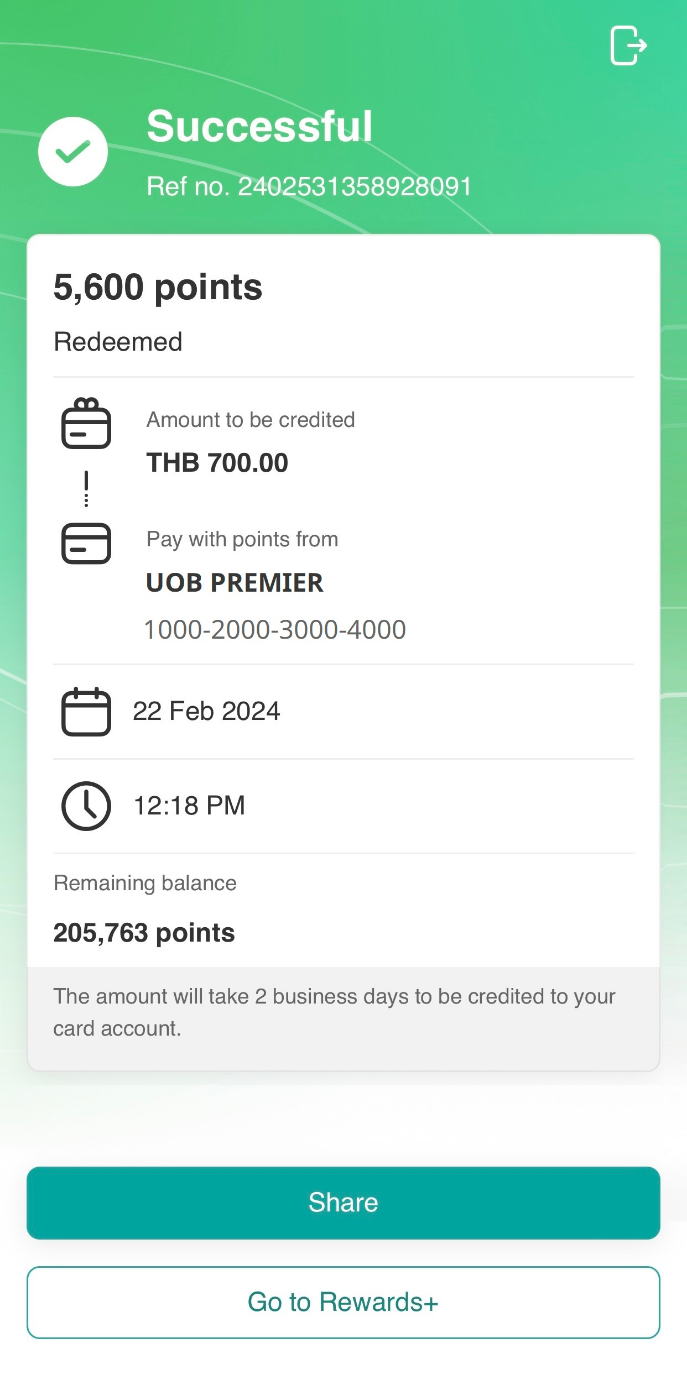

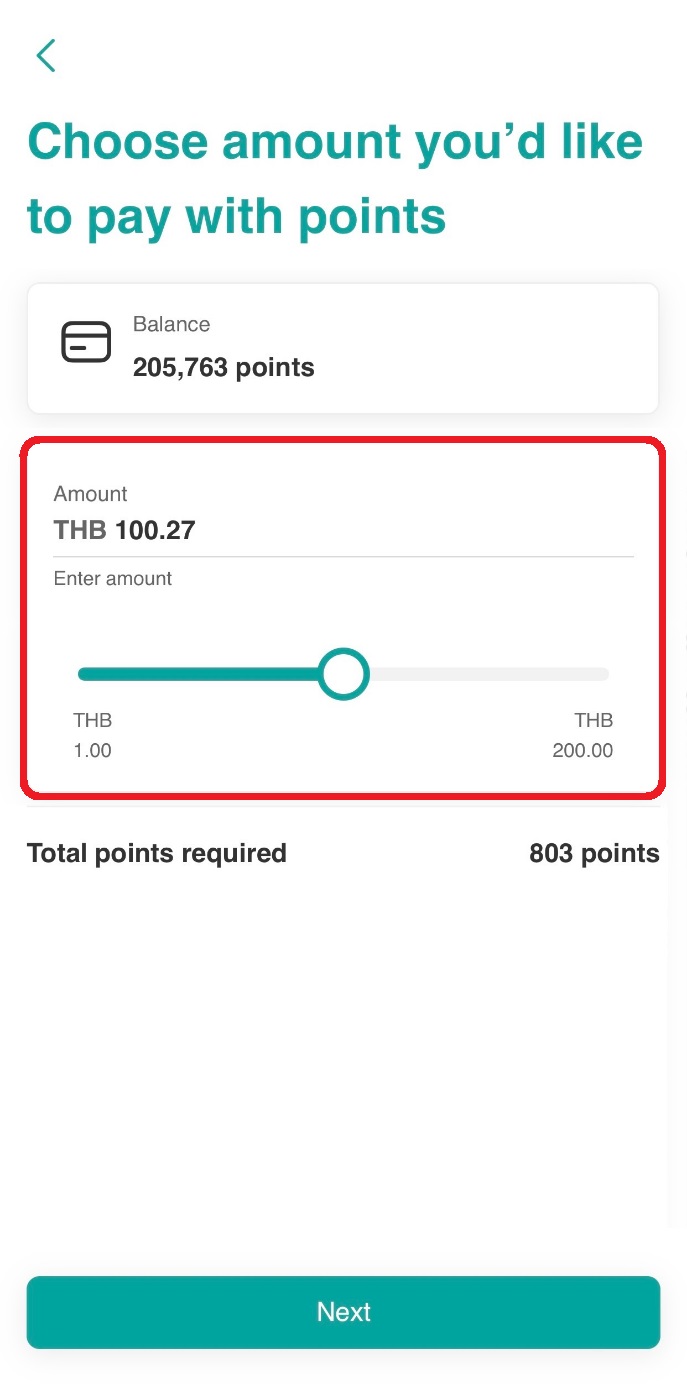

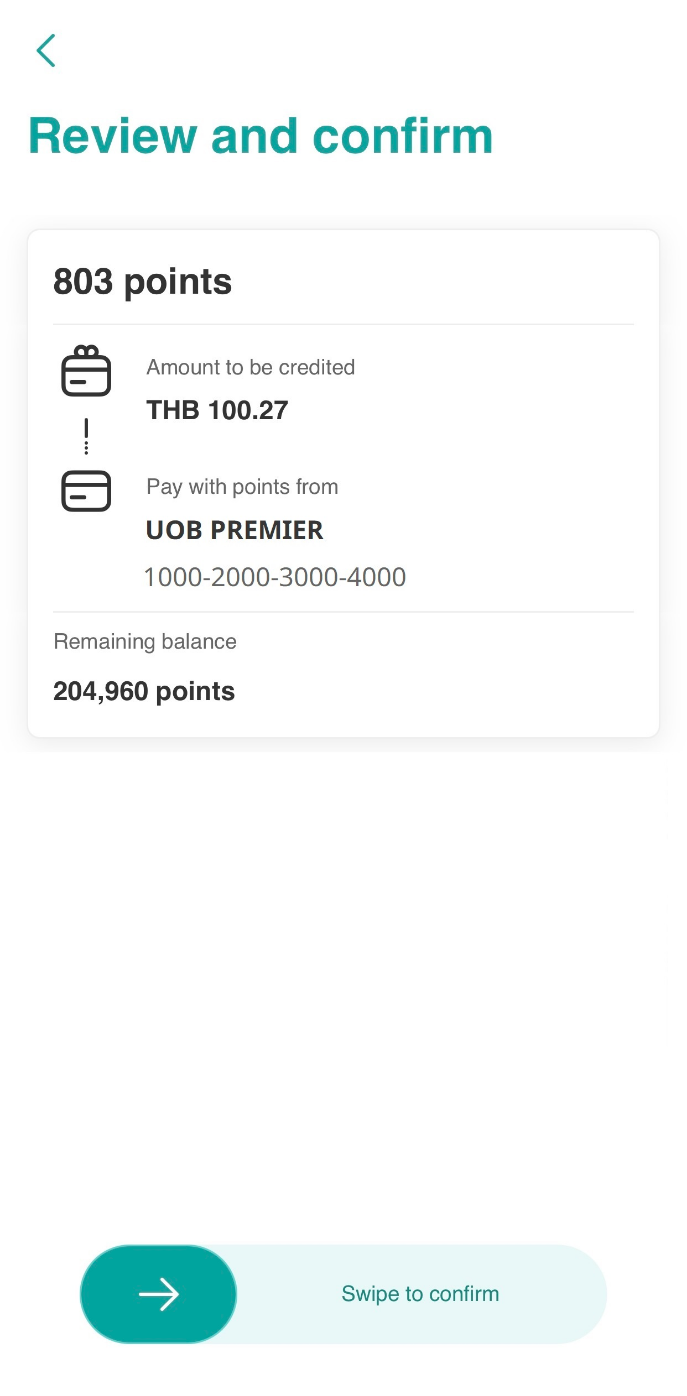

2. Pay credit card billing with points in partial amount (single transaction)

1. Log in to UOB TMRW and tap on “Rewards+”.

2. Go to “My Rewards” to select your credit card.

3. Tap on “Pay with Points”.

4. Choose one item to pay off in partial amount with your points (transaction within 60 days).

5. Specify the amount to pay with points.

6. Review the details and swipe to confirm.

7. Cashback will be credited to your card account within 2 business days.

Wealth & Investment

Wealth portfolio view on UOB TMRW

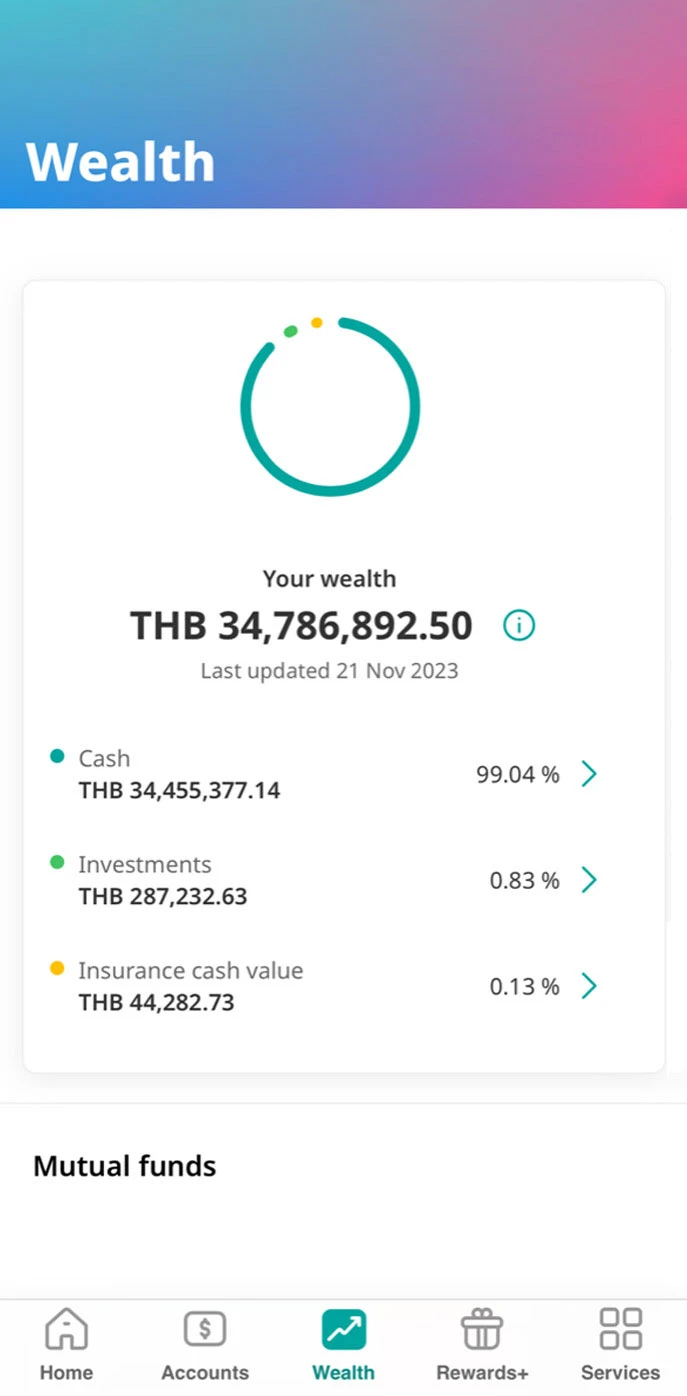

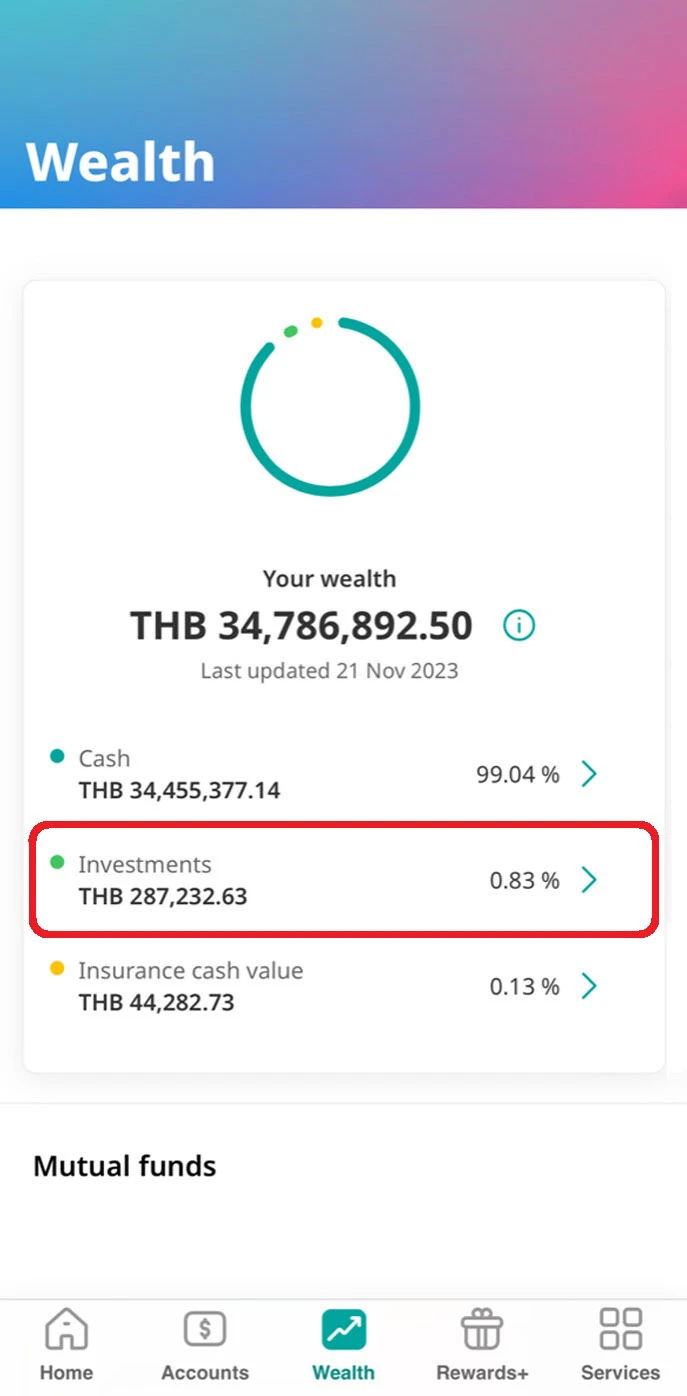

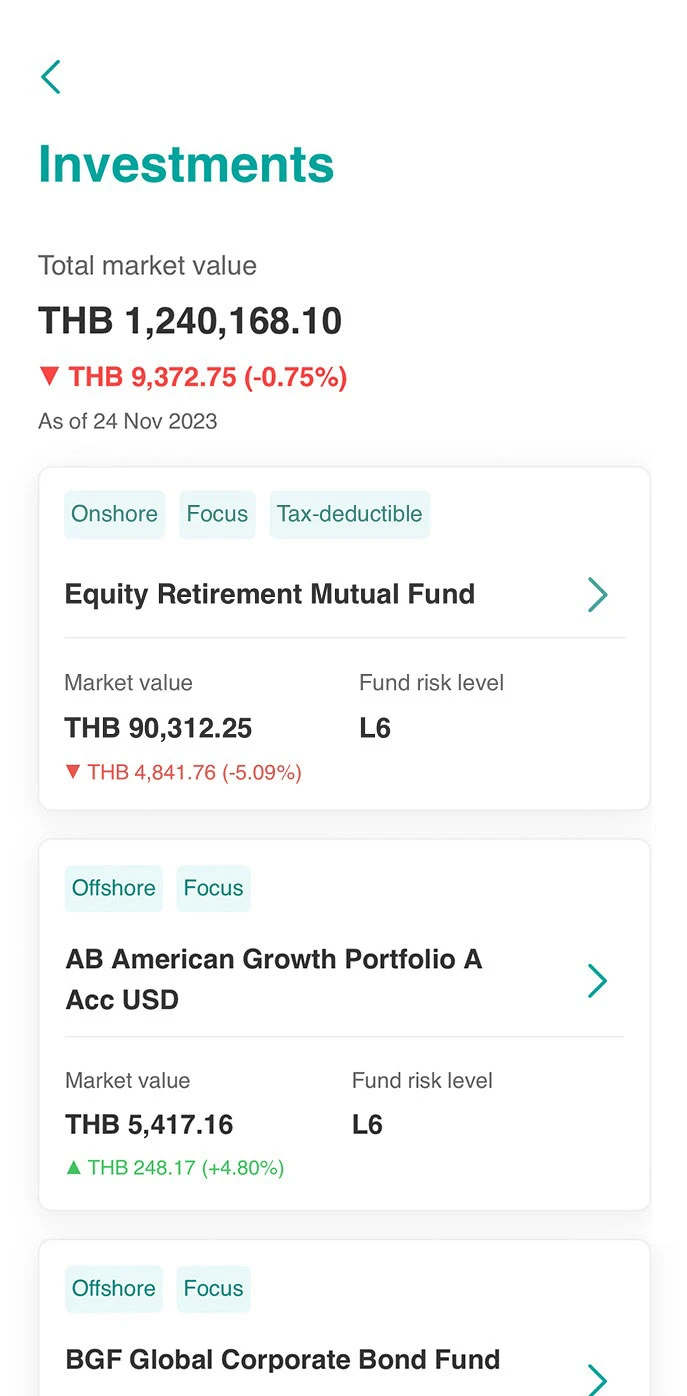

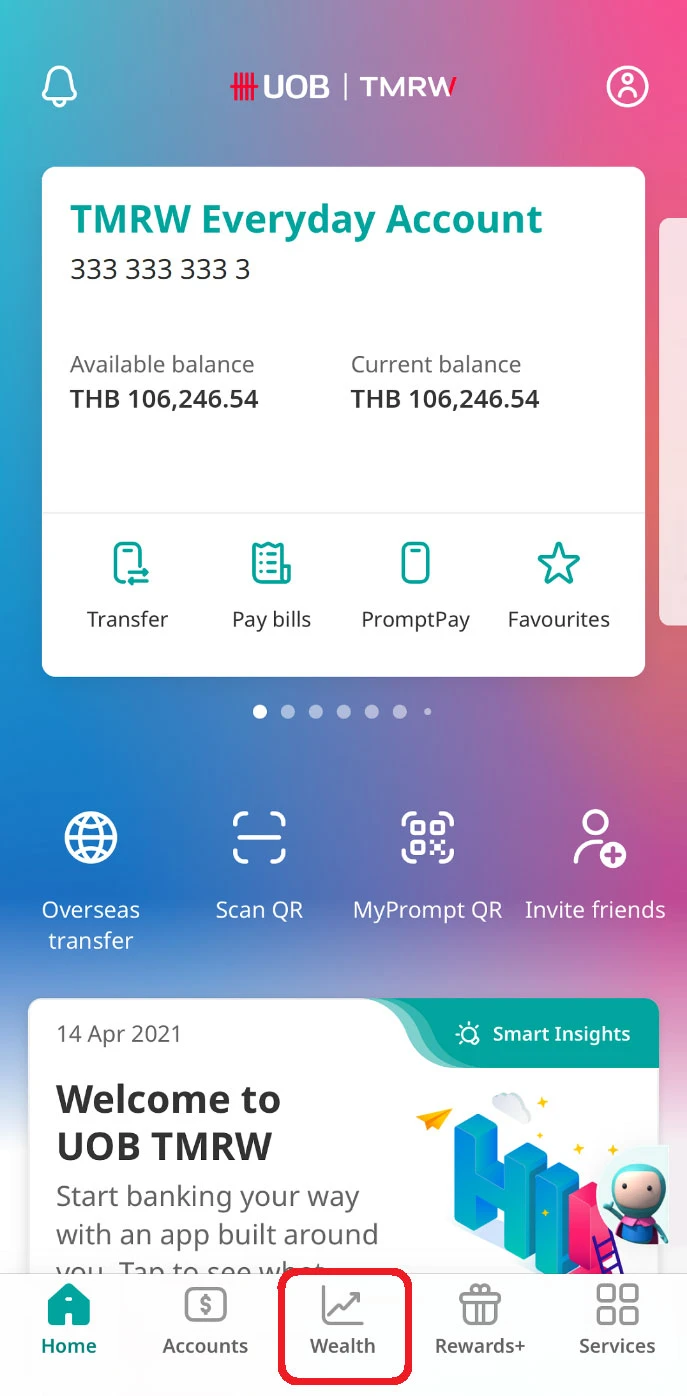

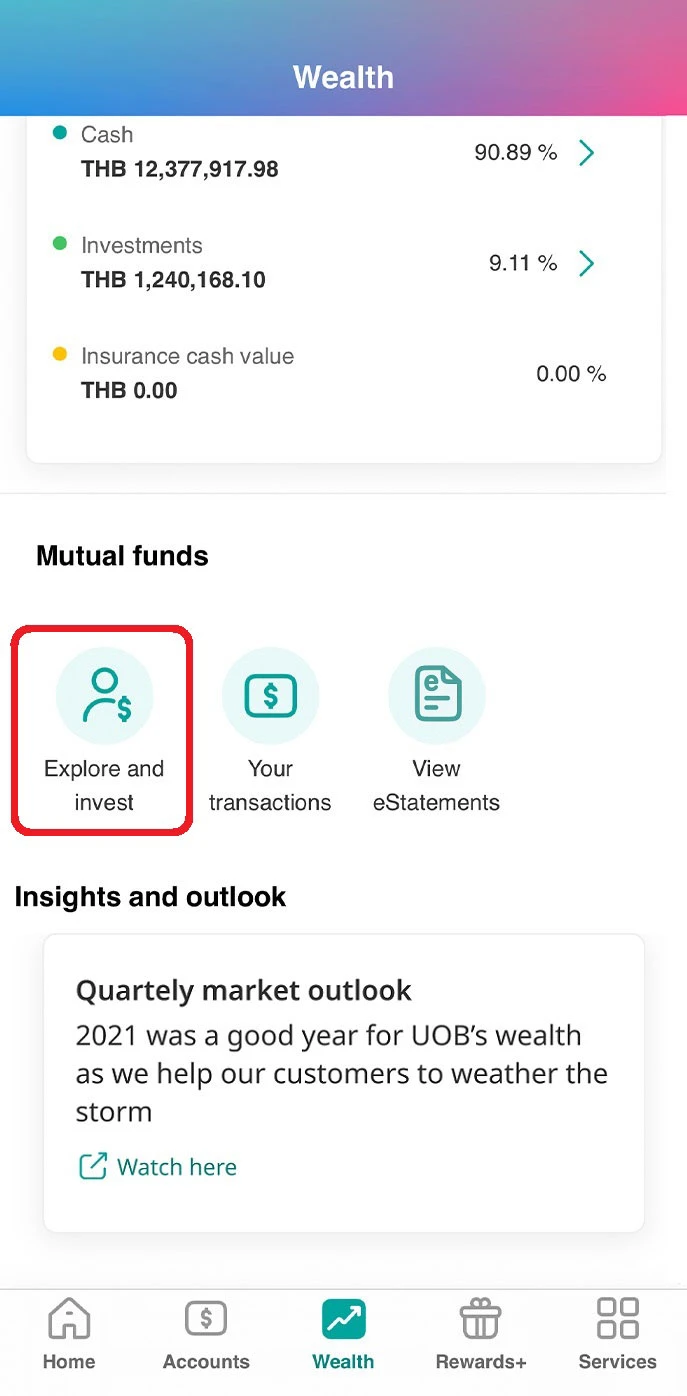

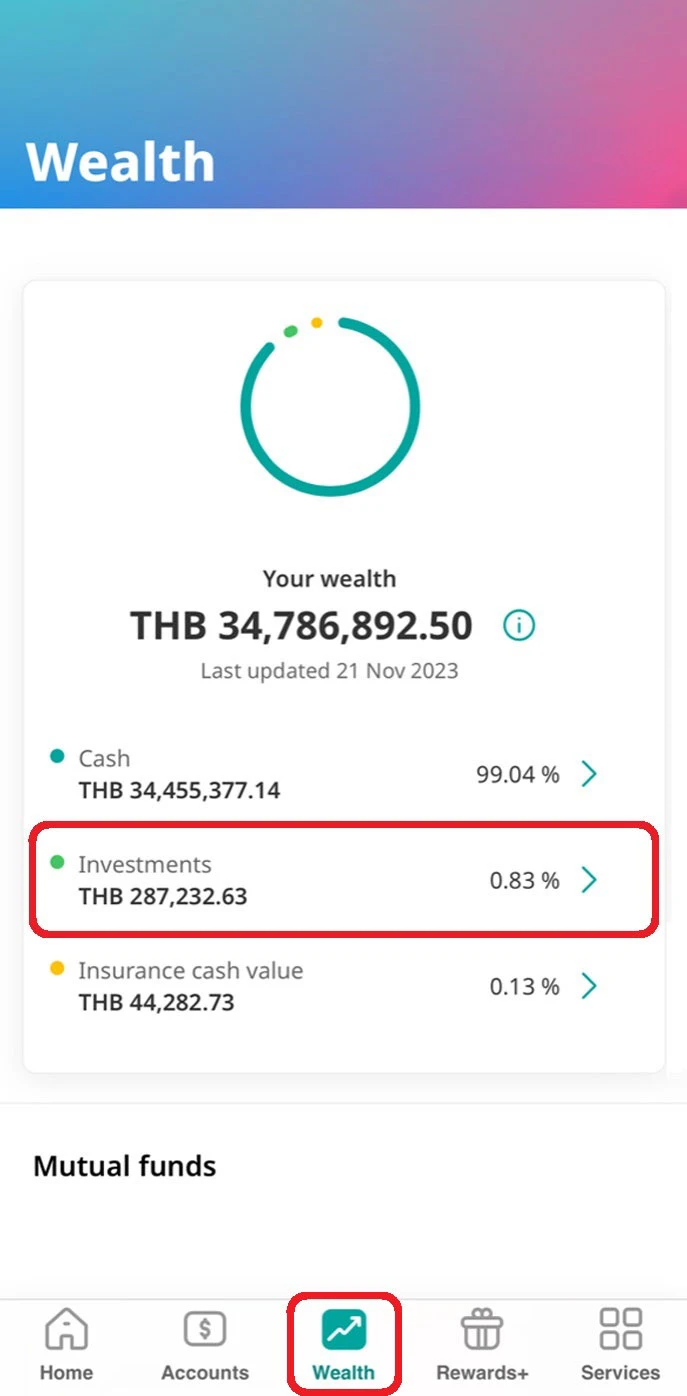

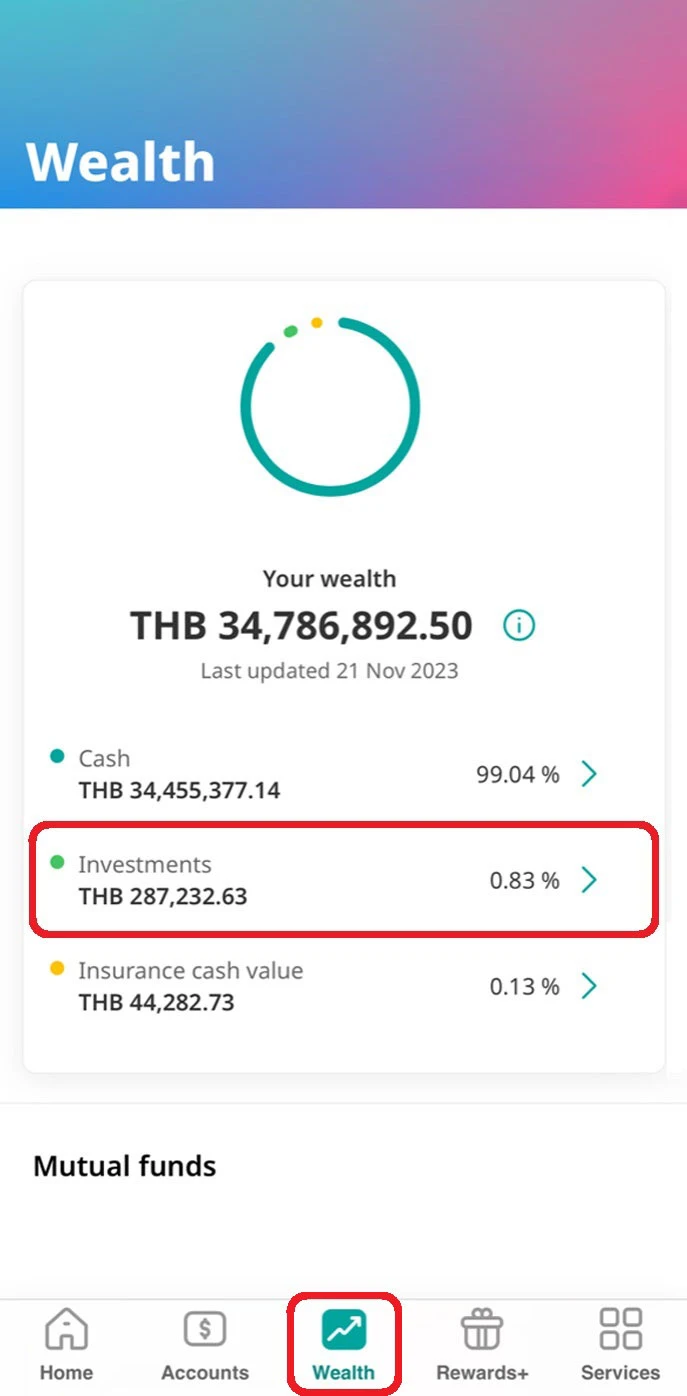

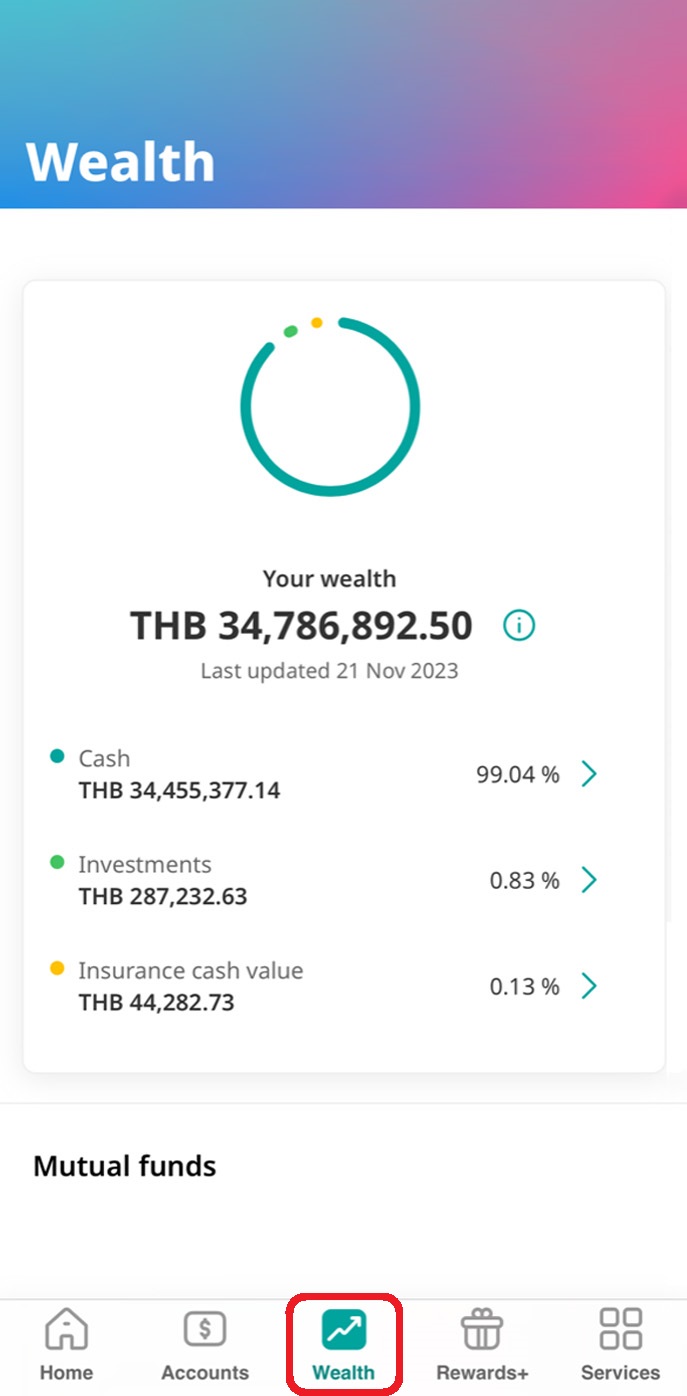

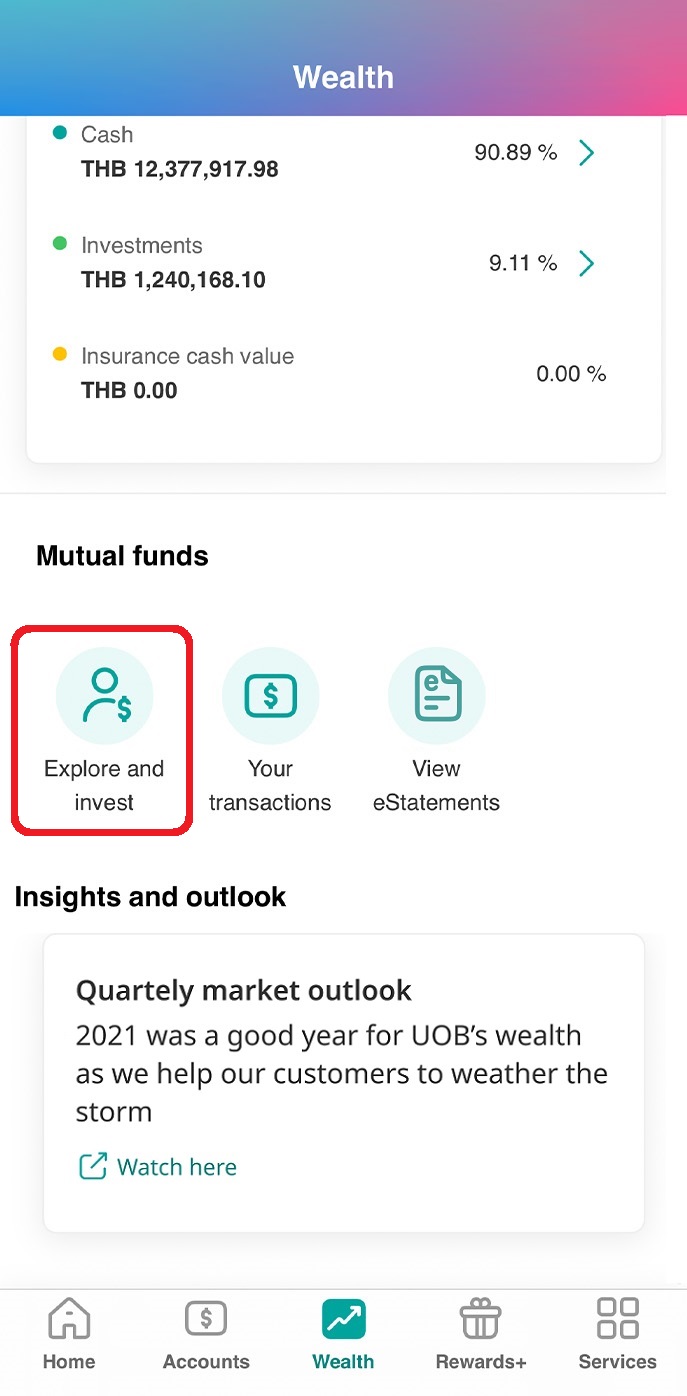

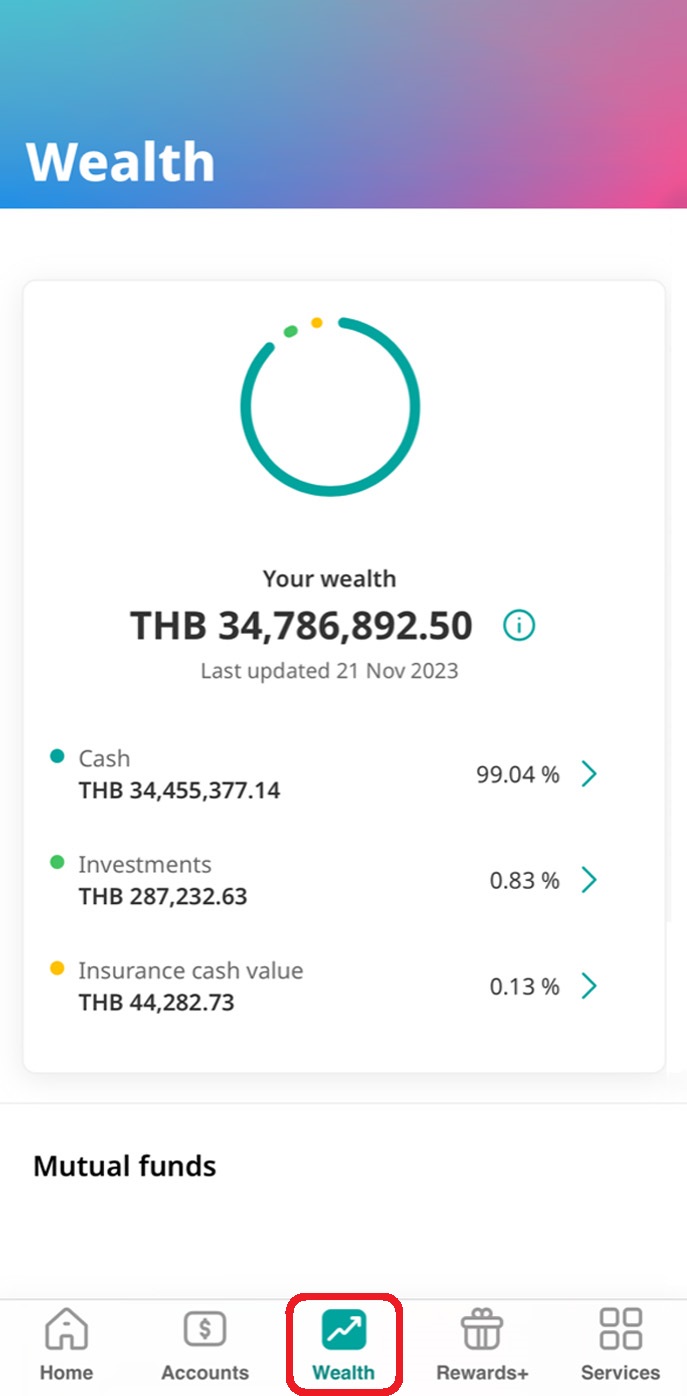

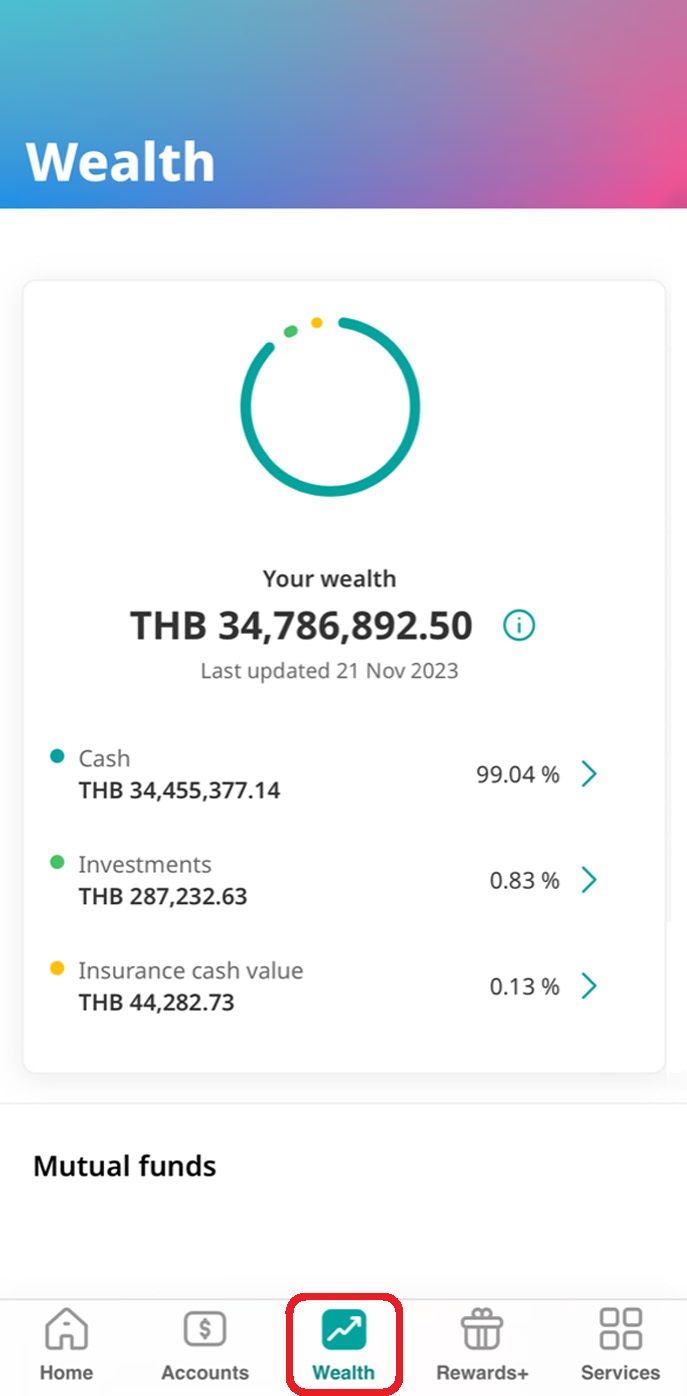

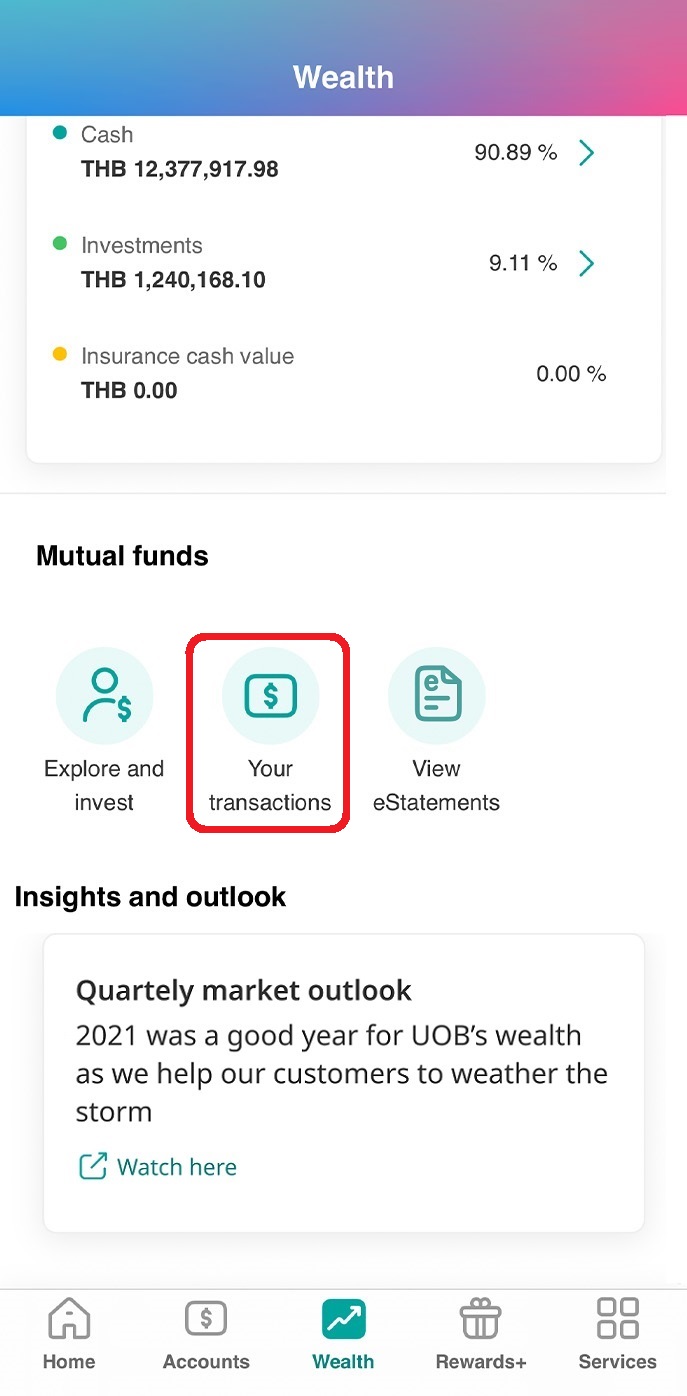

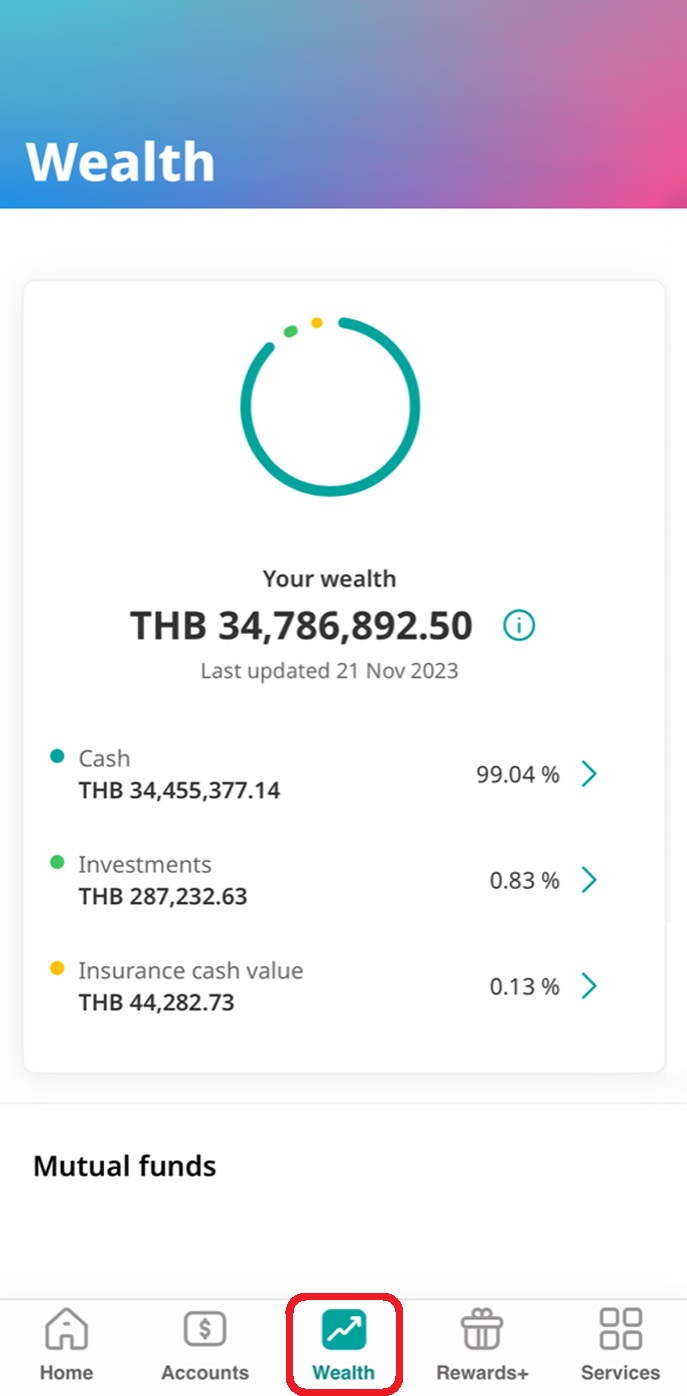

1. View your total assets

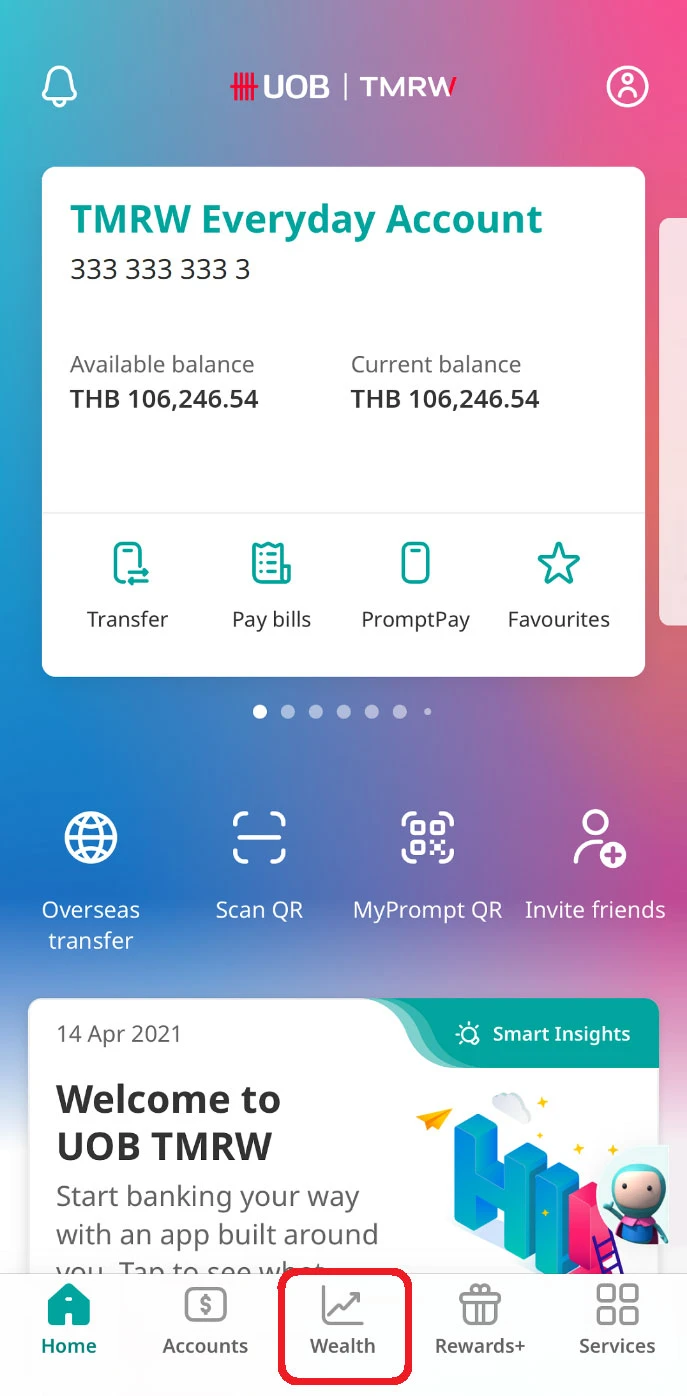

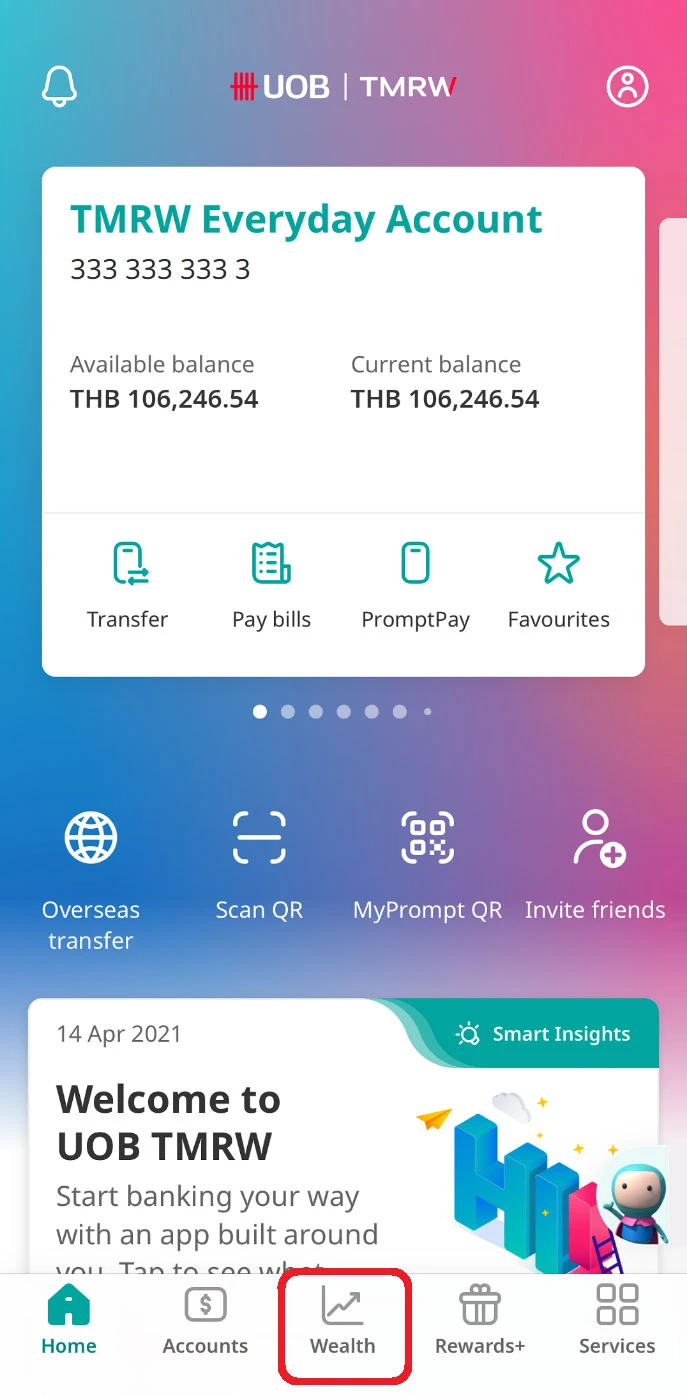

1. Log in to UOB TMRW and tap on “Wealth”.

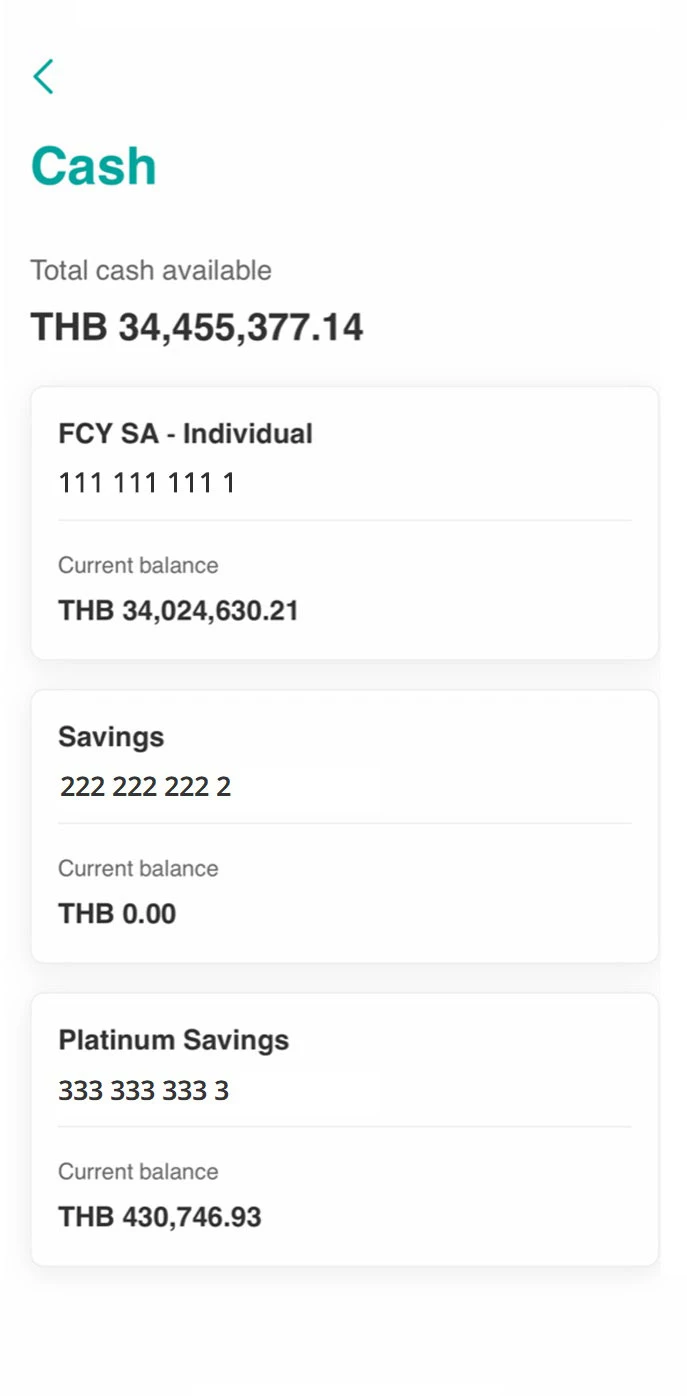

2. View the THB equivalent of your total assets including

- Cash

- Investments

- Insurance cash value

3. Tap on “Cash” to view total cash available in all your deposit holdings.

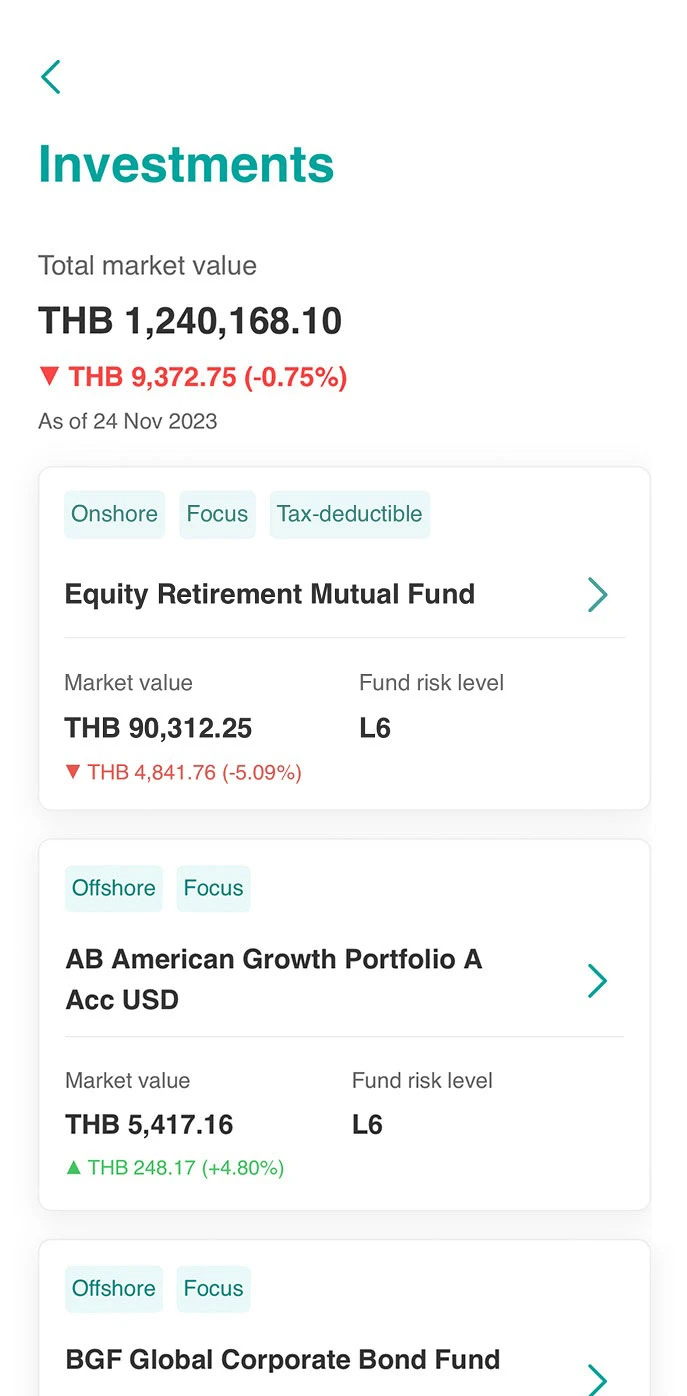

4. Tap on “Investments” to view market value and list of all your mutual fund holdings.

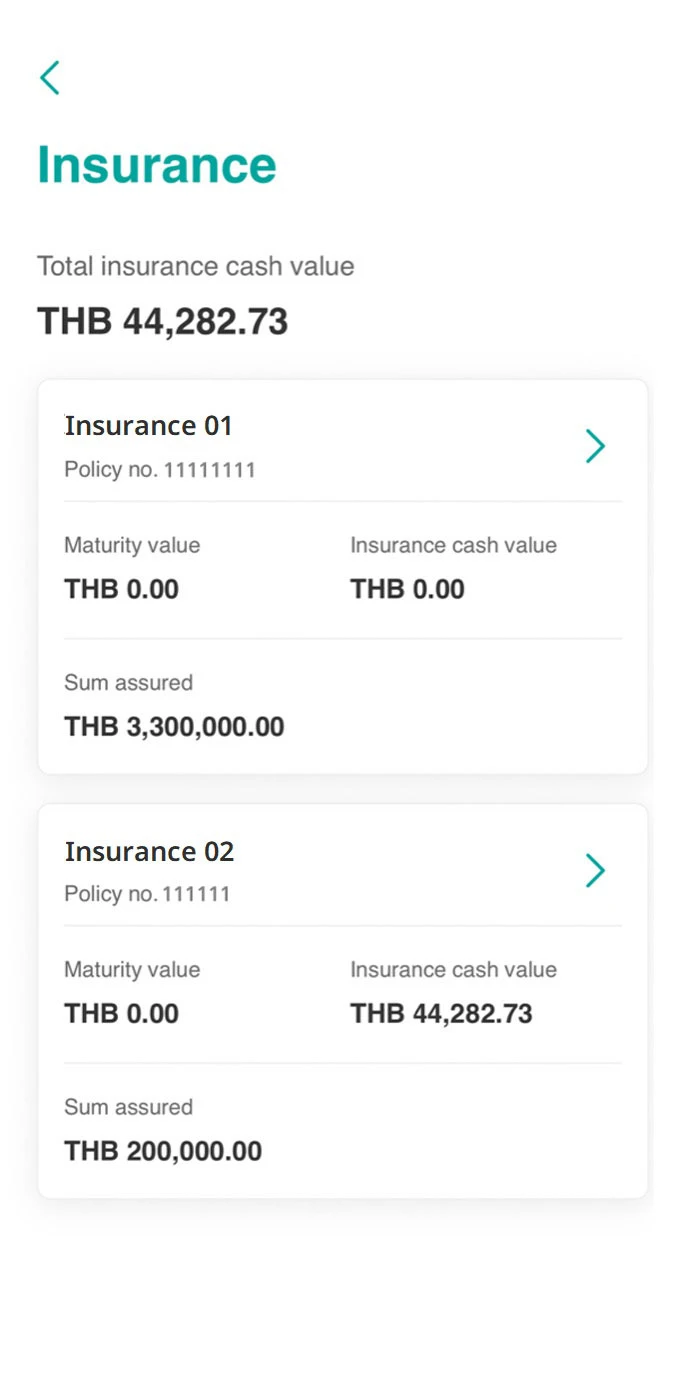

5. Tap on “Insurance cash value” to view total cash value and list of your insurance policies purchased through us.

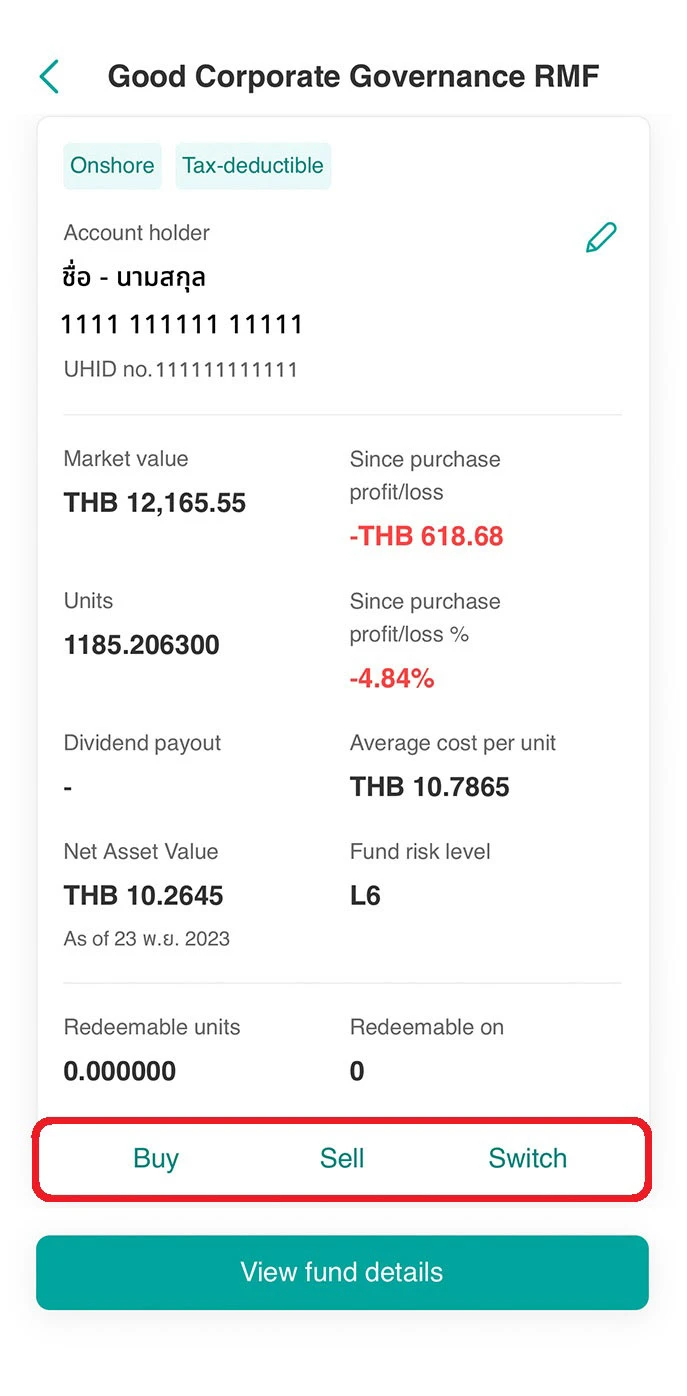

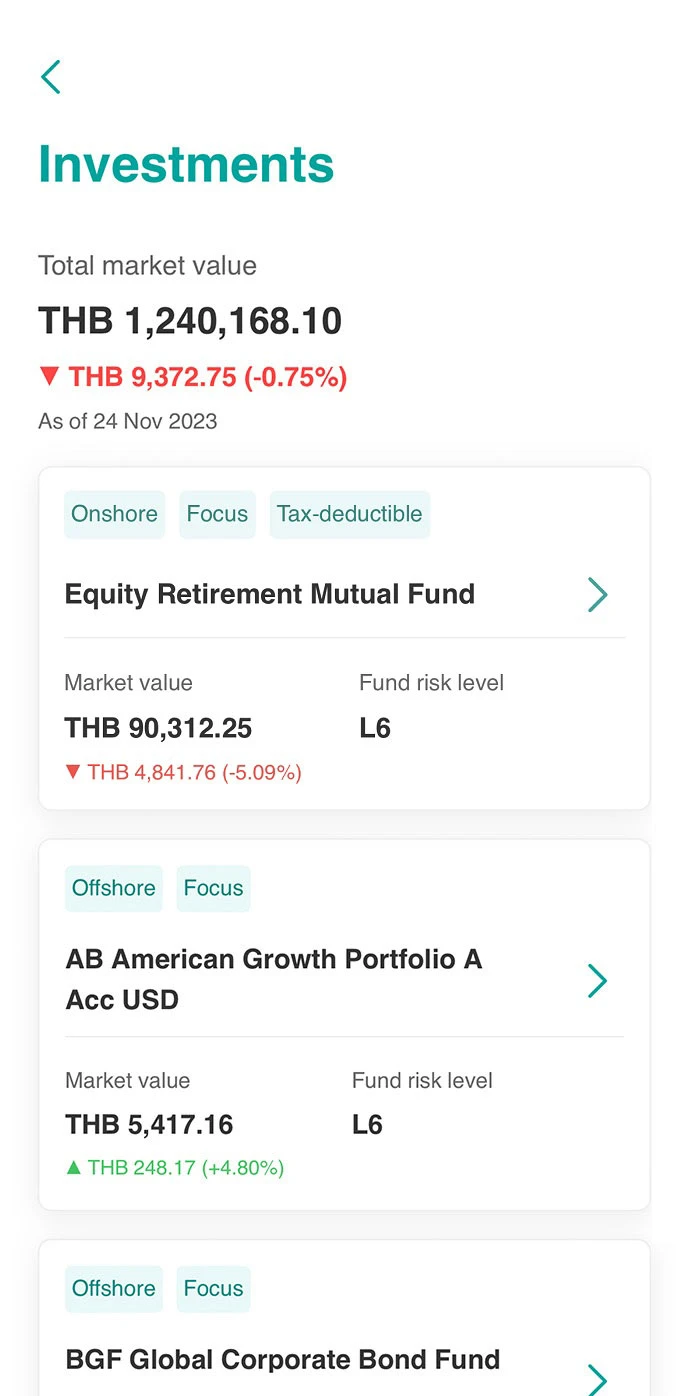

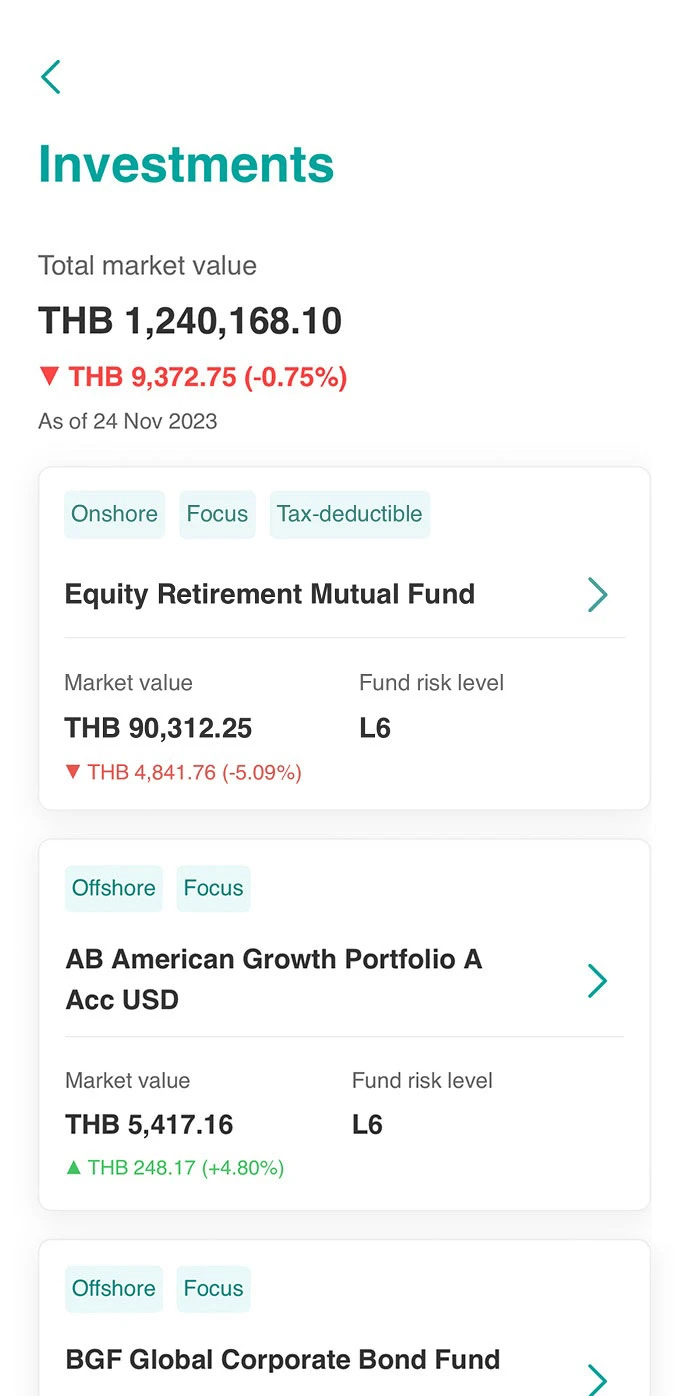

2. View your mutual fund holdings

1. Log in to UOB TMRW and tap on “Wealth”.

2. Tap on “Investments” to view market value and list of all your mutual fund holdings.

3. Select a specific fund to view more details.

4. You can view the fund details and choose to buy, sell or switch.

Buy, sell, and switch mutual funds

1. Buy mutual funds

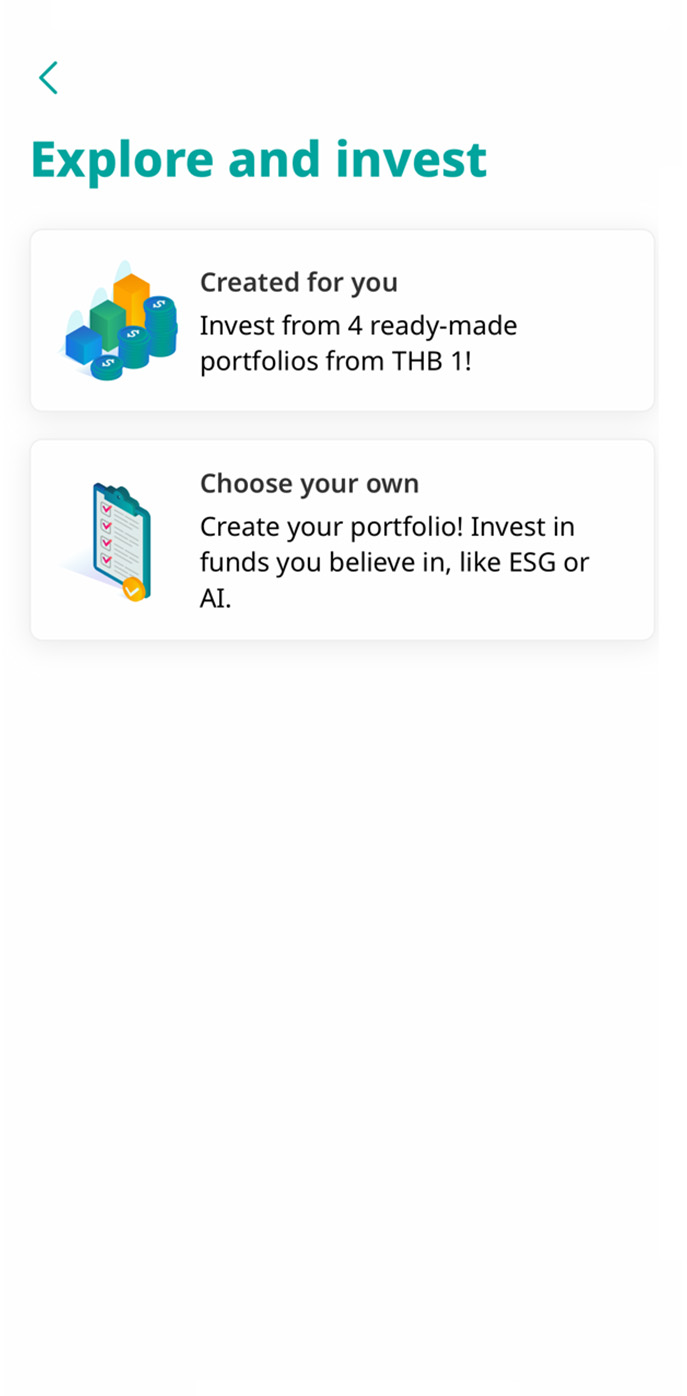

1. Log in to UOB TMRW and tap on “Wealth”.

2. Scroll down to Mutual funds section and tap on “Explore and invest”.

3. Pick from two options to invest:

- (1) Created for you

- (2) Choose your own

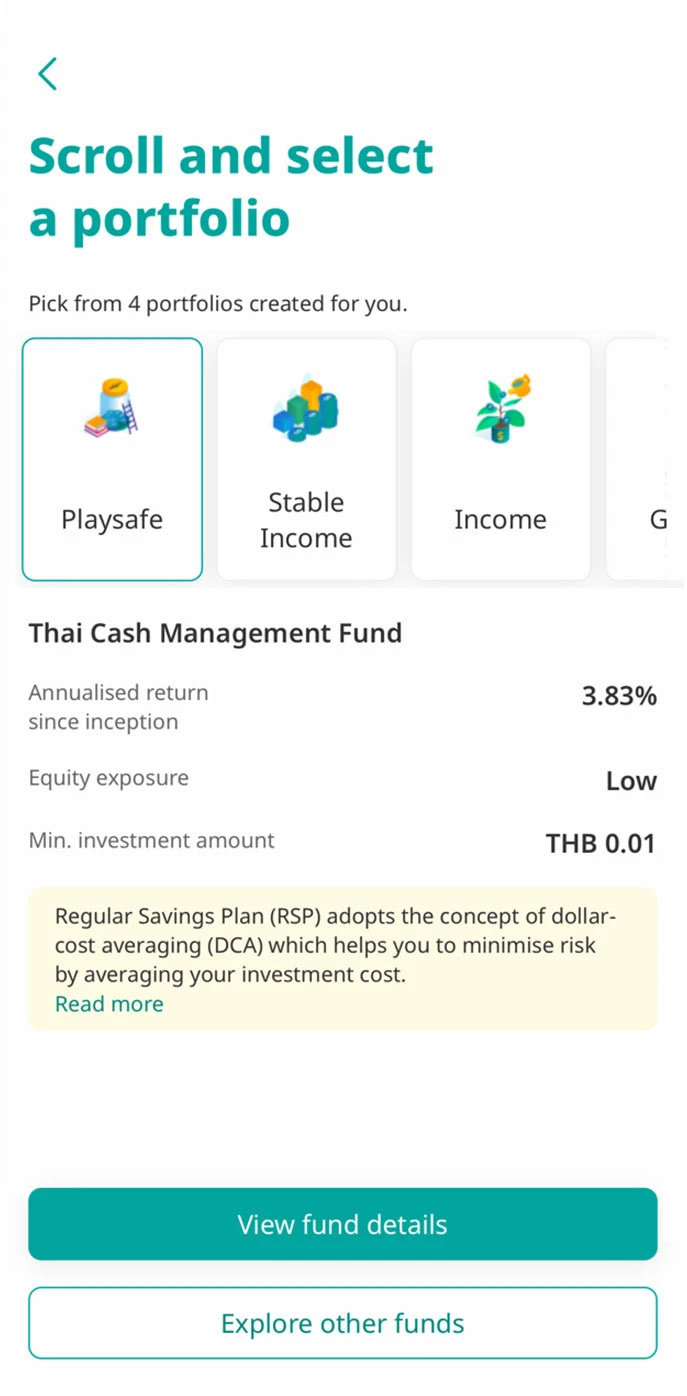

4A. Created for you – choose from four curated fund portfolios depending on your goal and risk appetite.

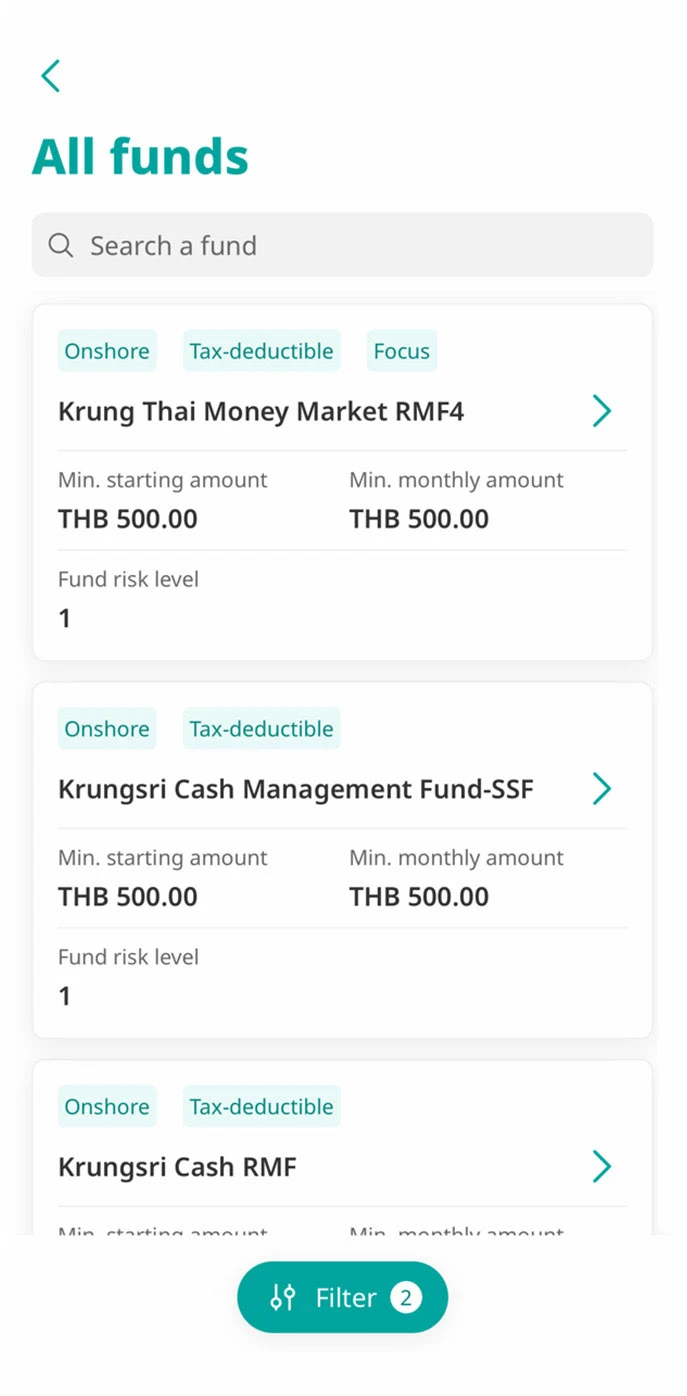

4B. Choose your own – search for a specific fund name or browse and filter from all funds available at UOB.

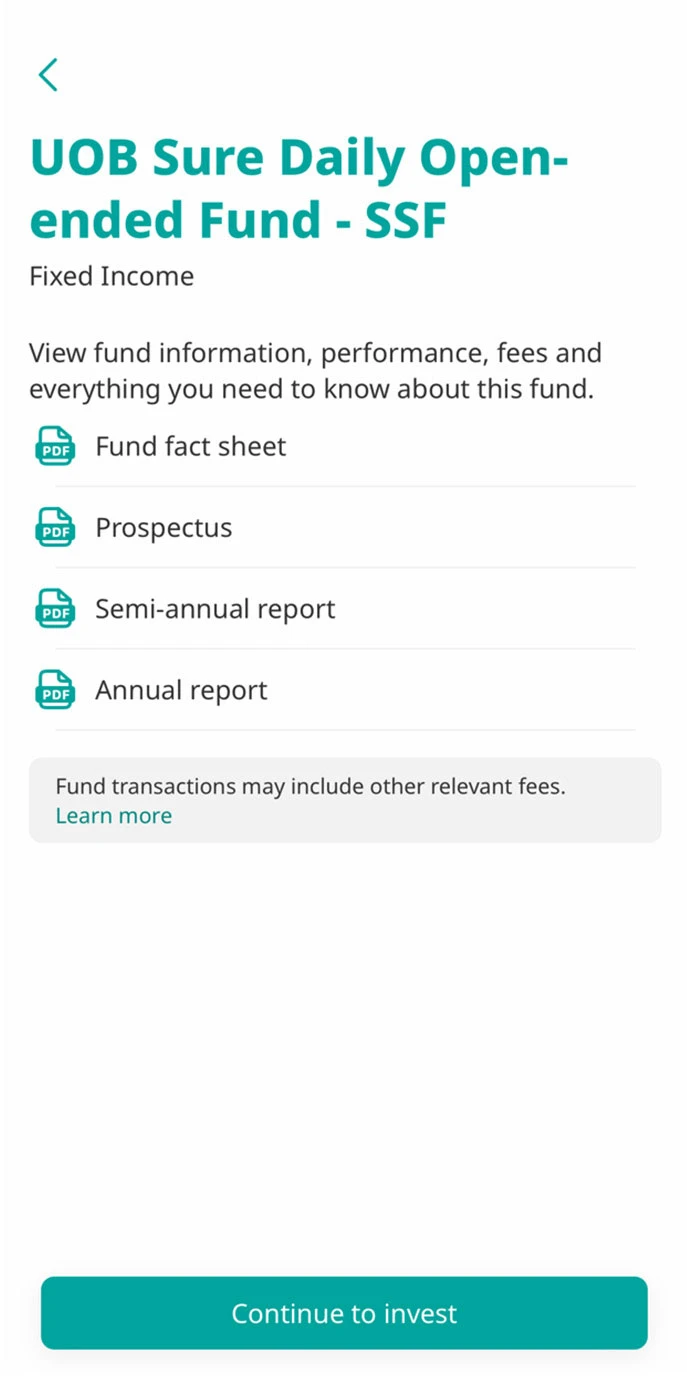

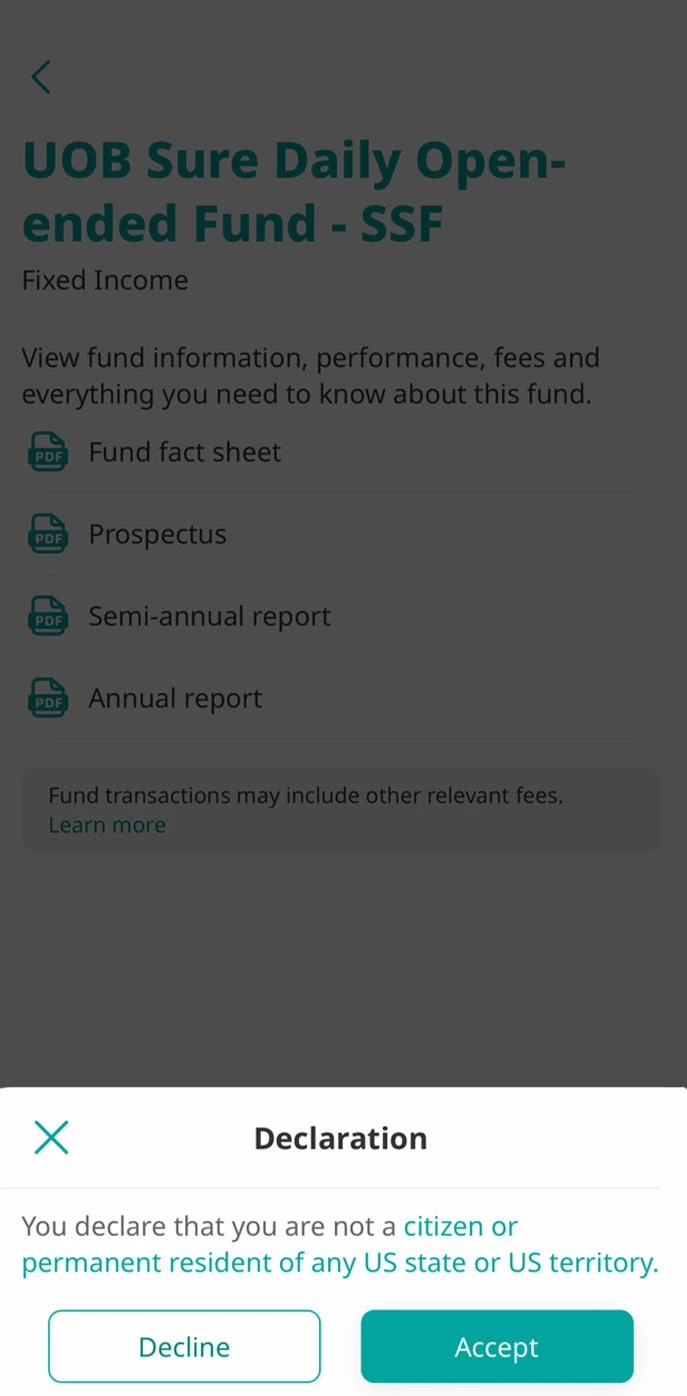

5. Select the fund you wish to buy and view fund details, then tap on “Continue to invest”.

6. Tap “Accept” to declare that you are not a citizen or permanent resident of any US state or US territory.

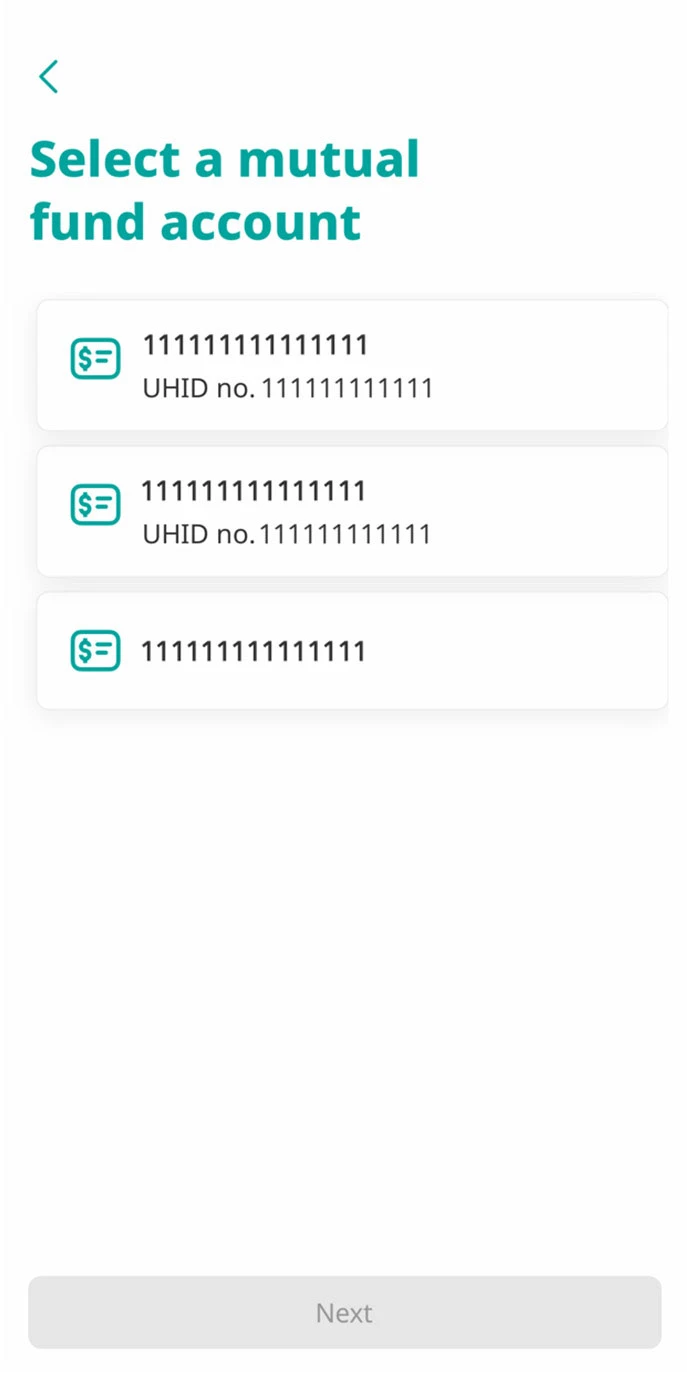

7. Select a mutual fund account to proceed.

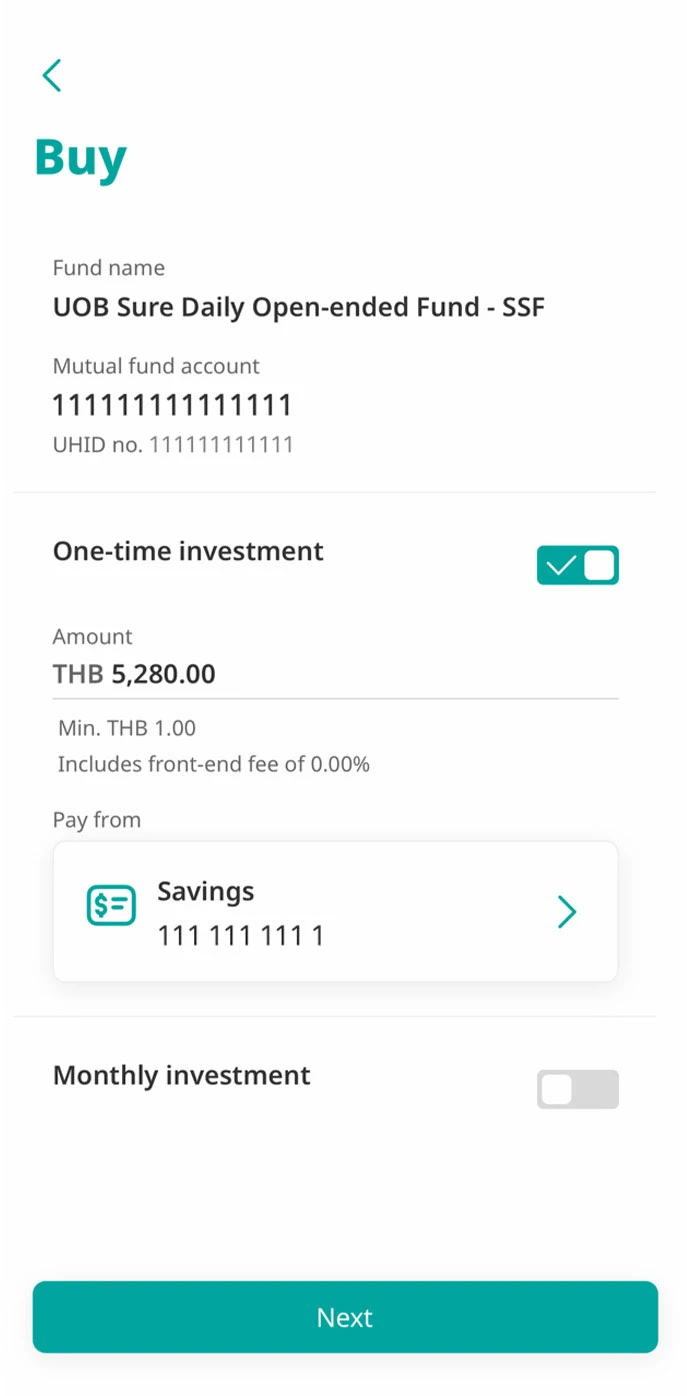

8. Enter the amount to invest, as one-time investment or as recurring monthly investments, and select the UOB account to debit investment funds from.

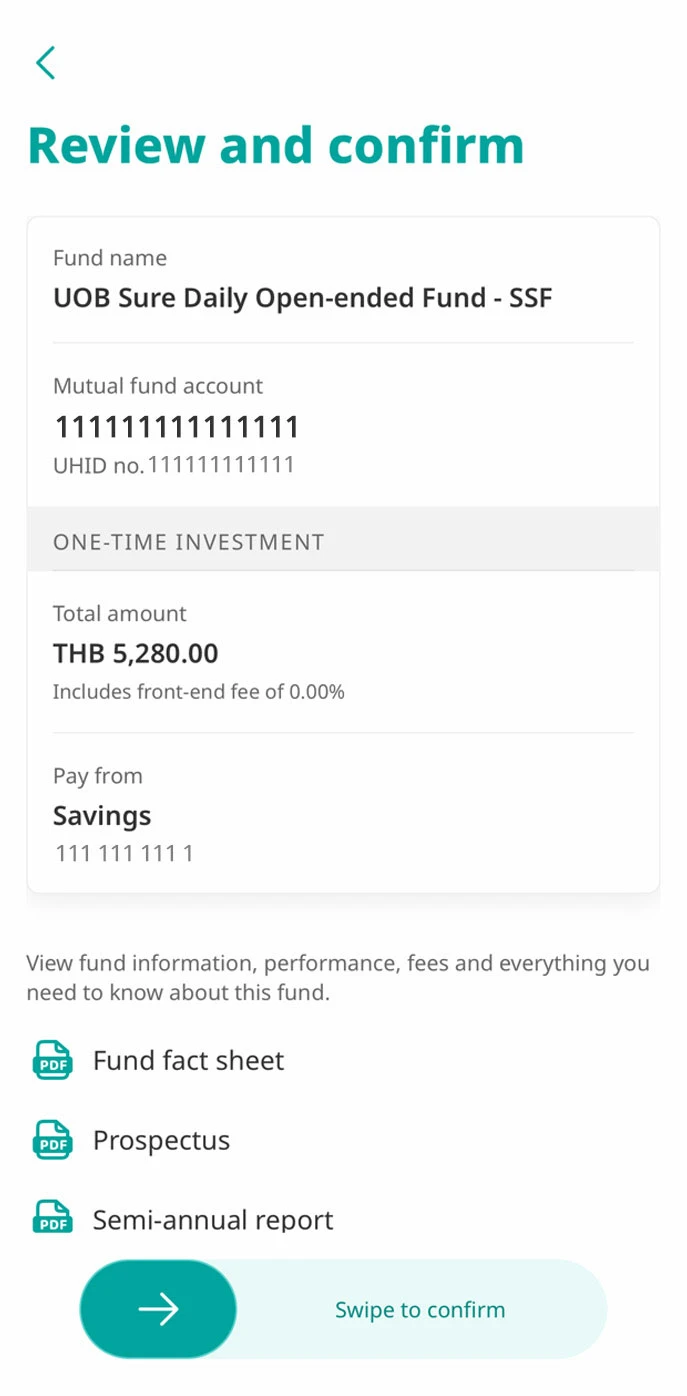

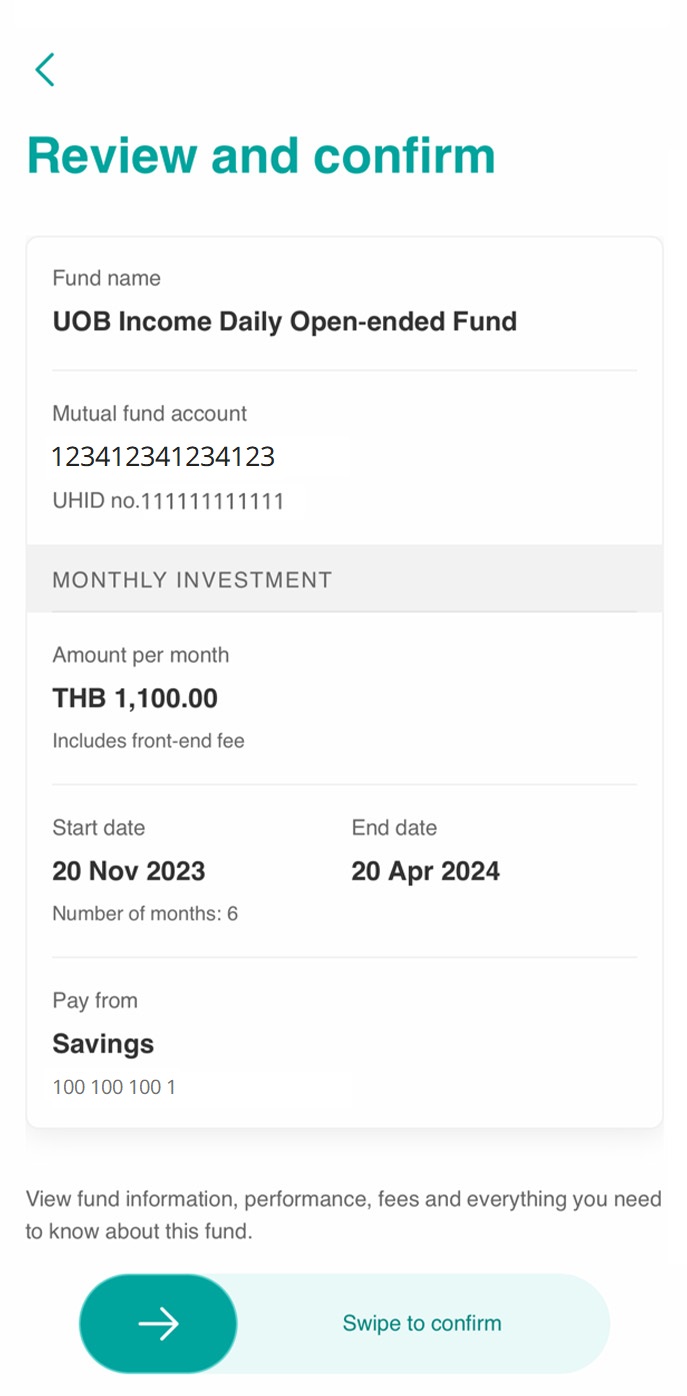

9. Review details and swipe to confirm with your Secure PIN.

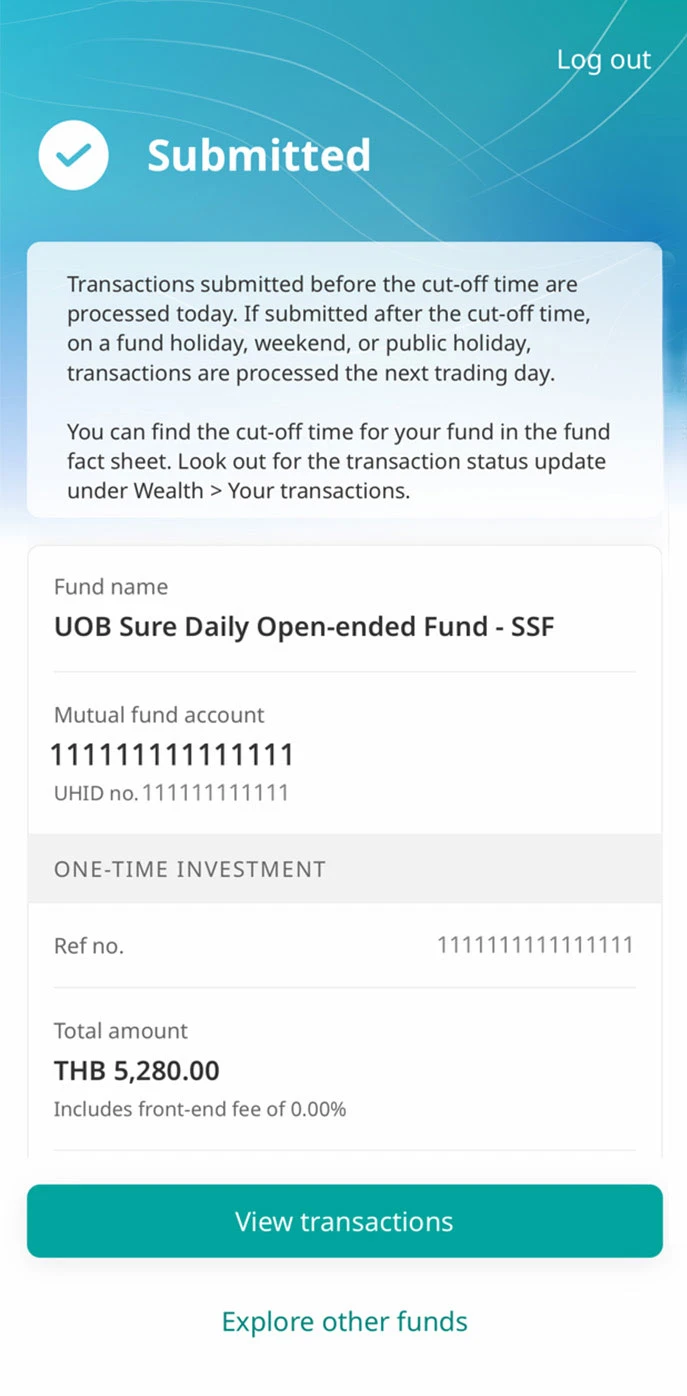

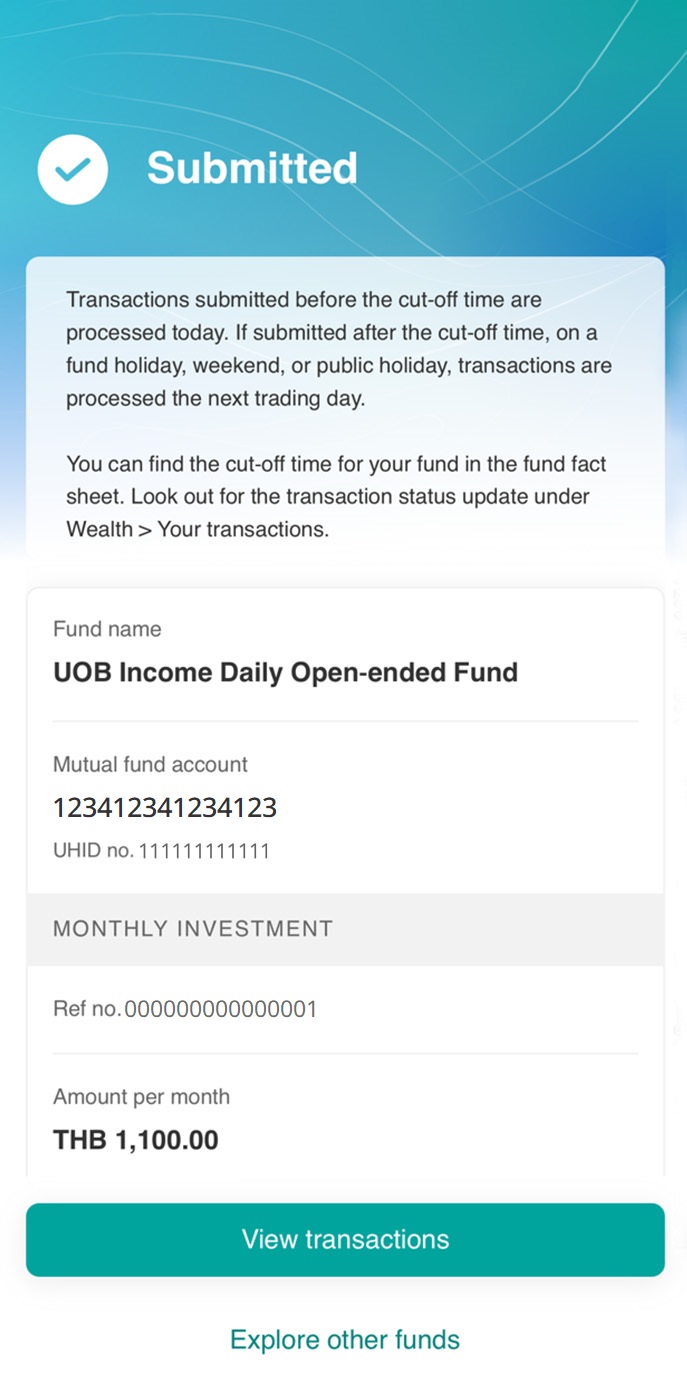

10. Transaction submitted and can be checked for status update under Wealth > Your transactions.

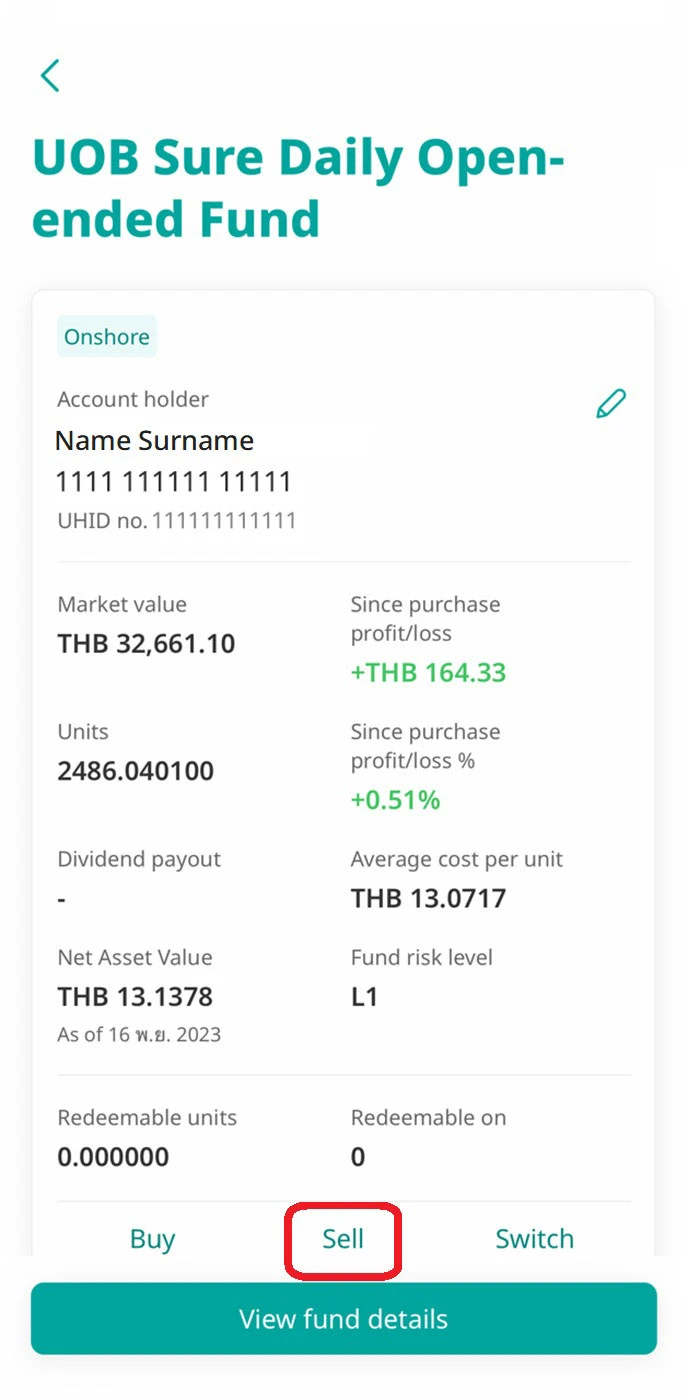

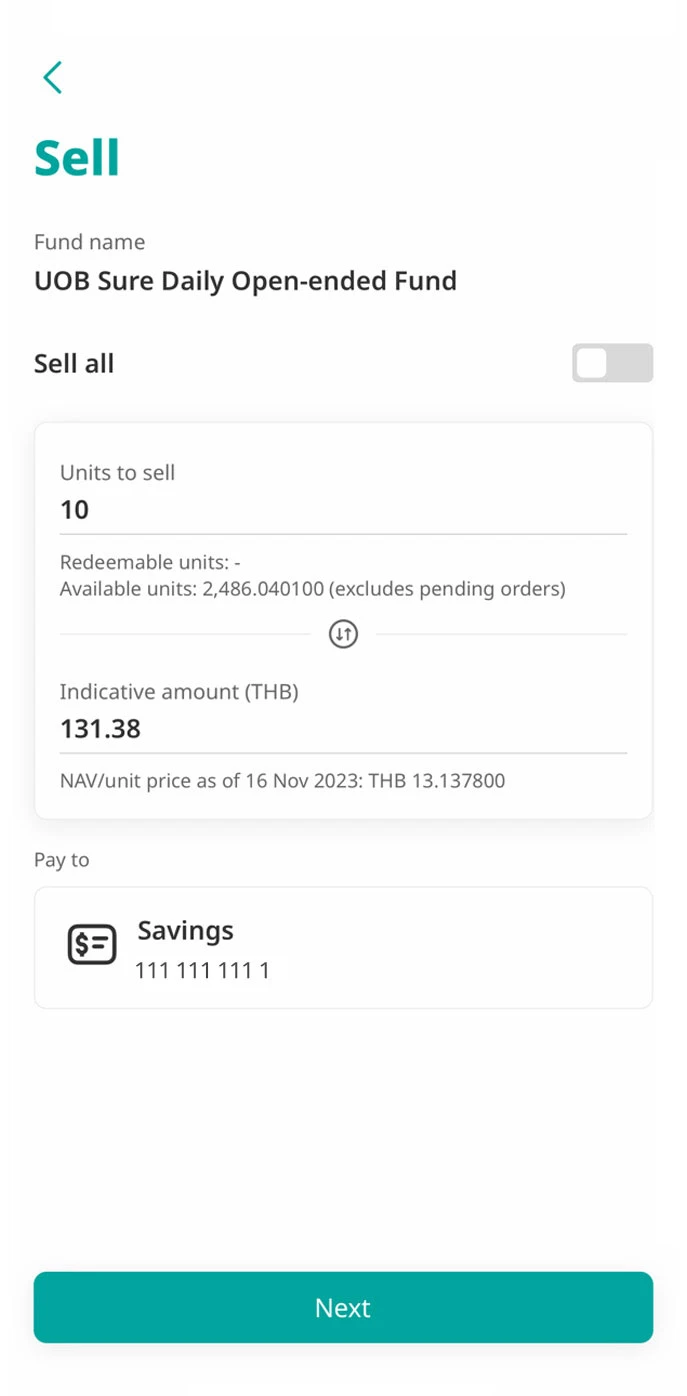

2. Sell mutual funds

1. Log in to UOB TMRW and go to Wealth, then tap on “Investments”.

2. Select the fund you wish to sell.

3. Scroll down to the bottom of the detail screen and tap on “Sell”.

4. Read the details then tap continue or take questionnaire for selling tax-deductible funds.

*Tax-deductible funds managed by KSAM and KTAM can’t be redeemed through UOB TMRW.

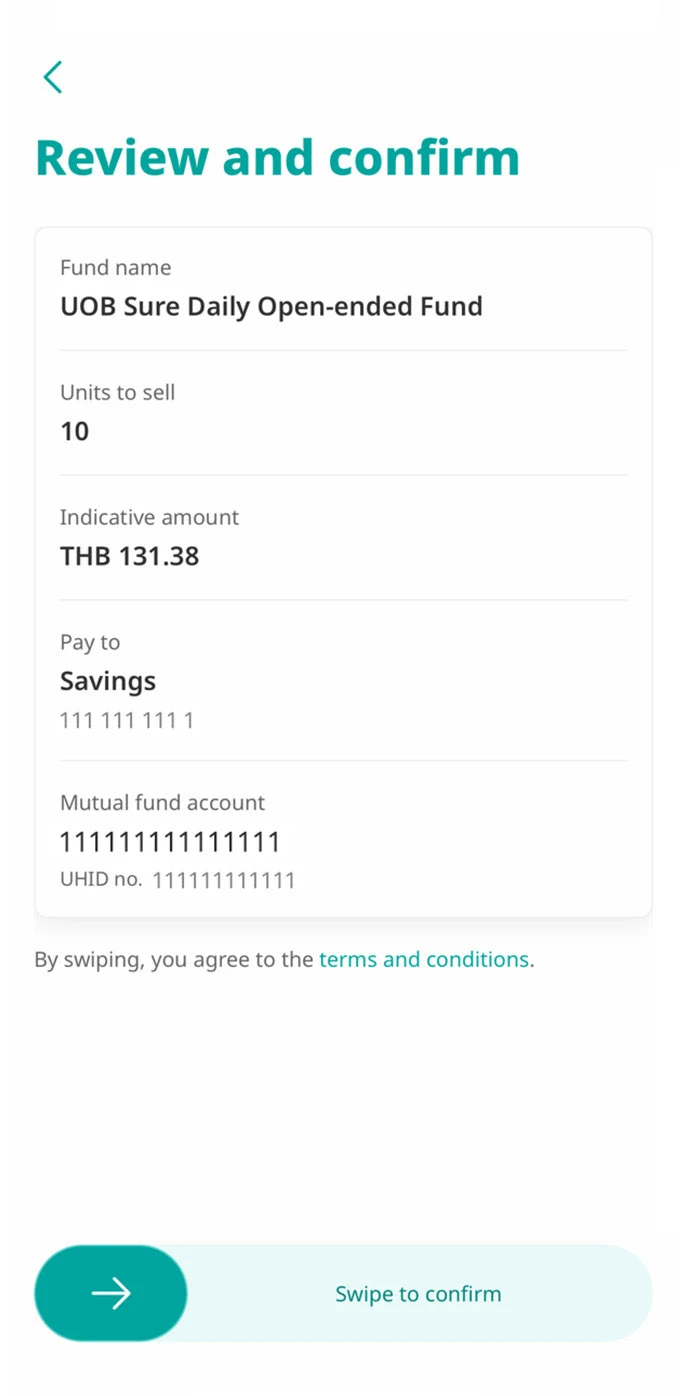

5. Enter the number of units or the THB amount (indicative) you wish to redeem.

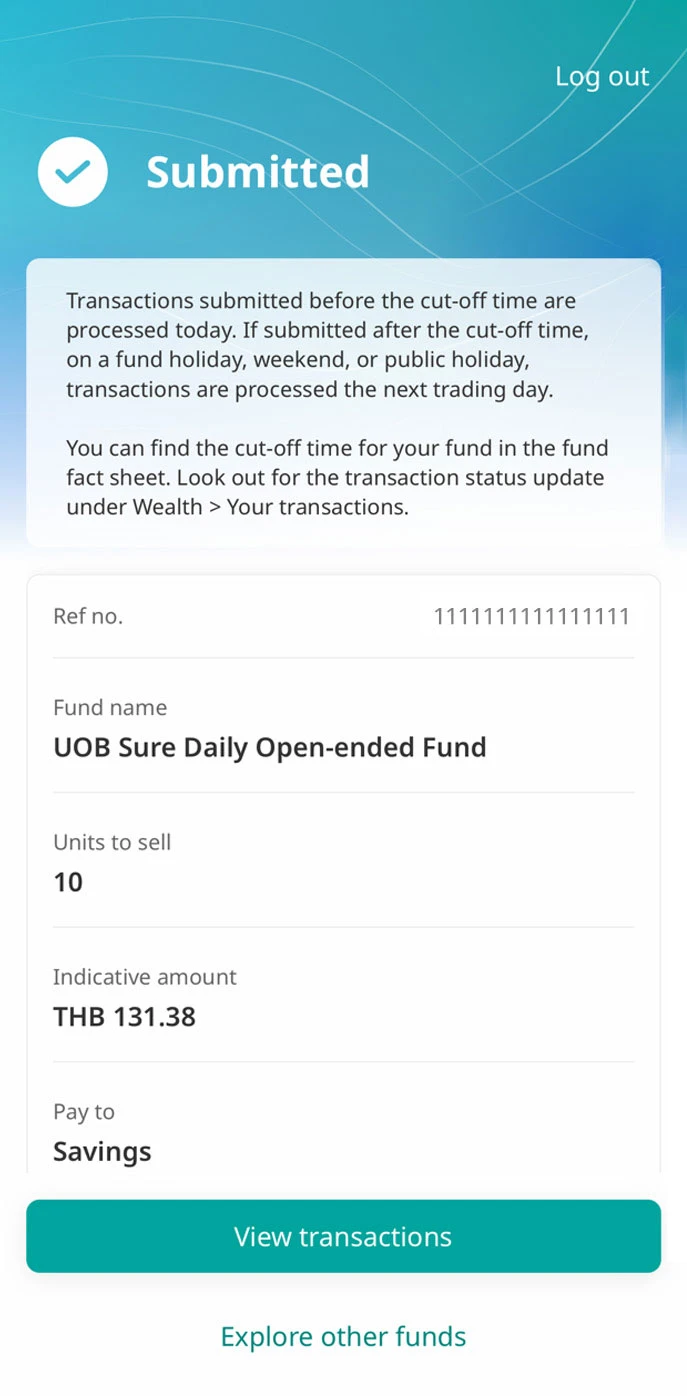

6. Review details and swipe to confirm with your Secure PIN.

7. Transaction submitted and can be checked for status update under Wealth > Your transactions.

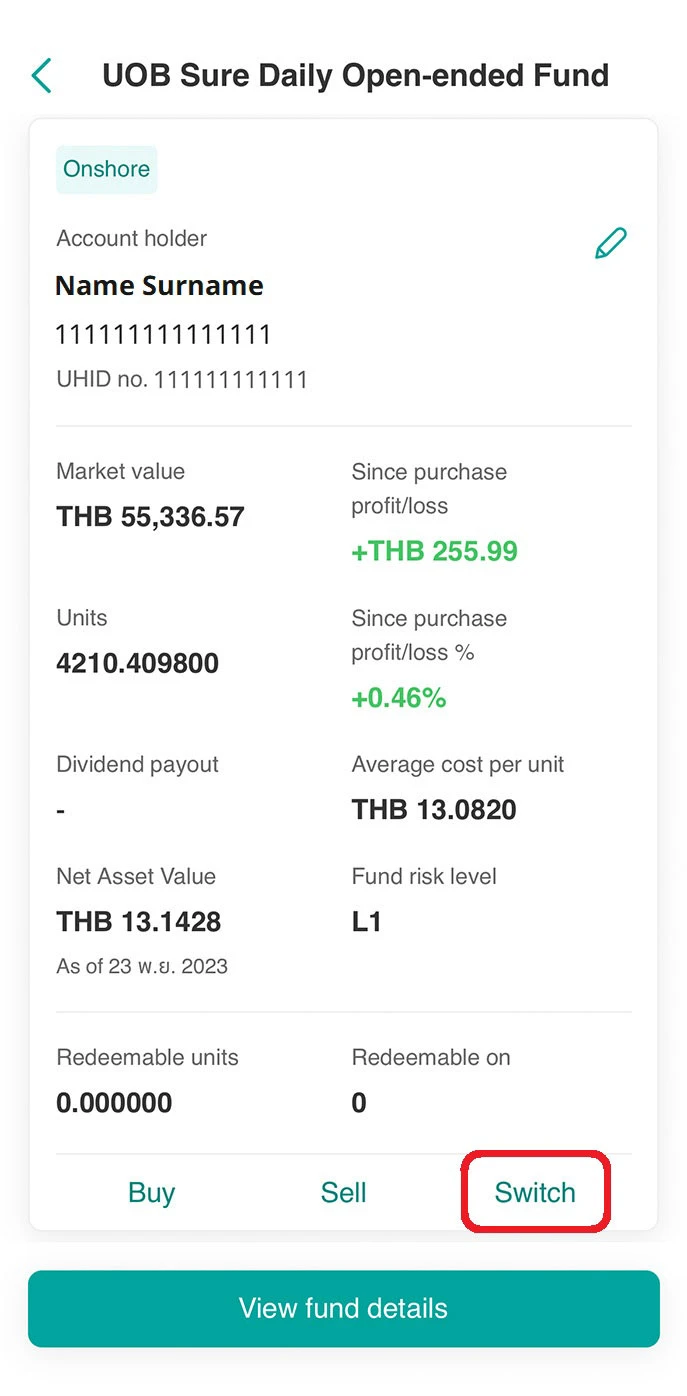

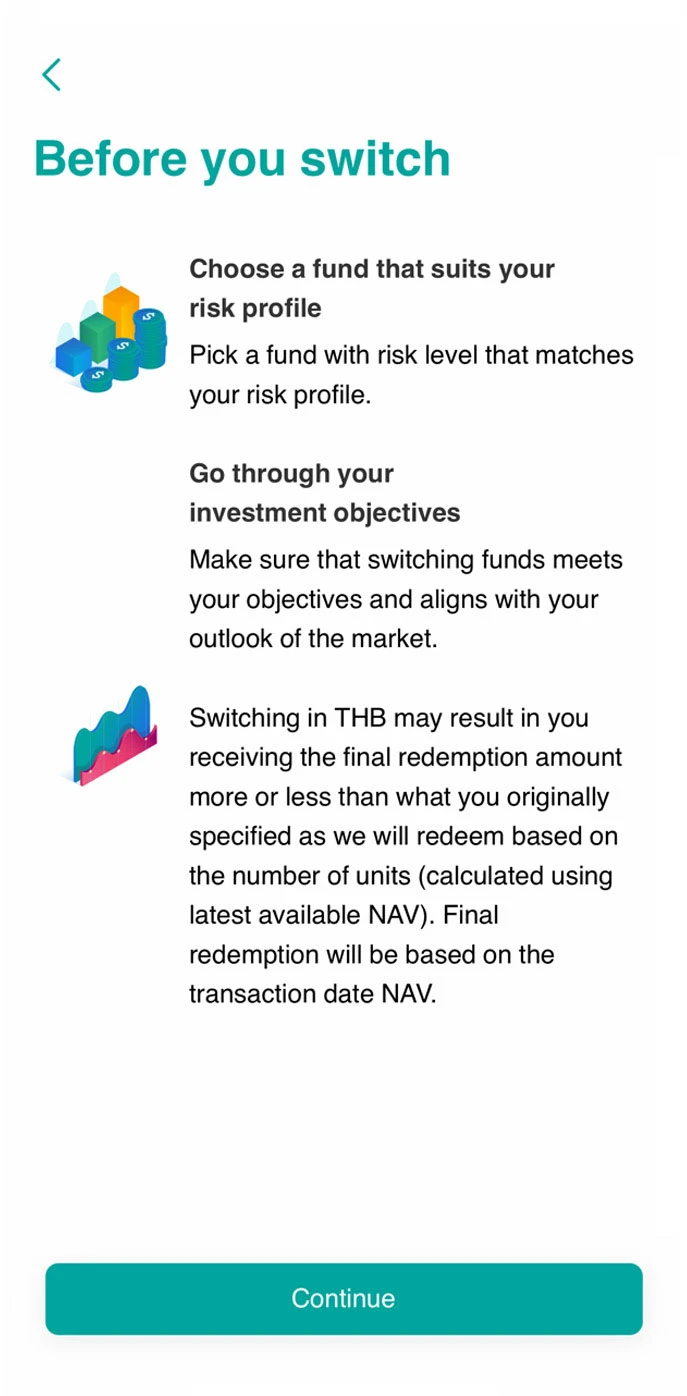

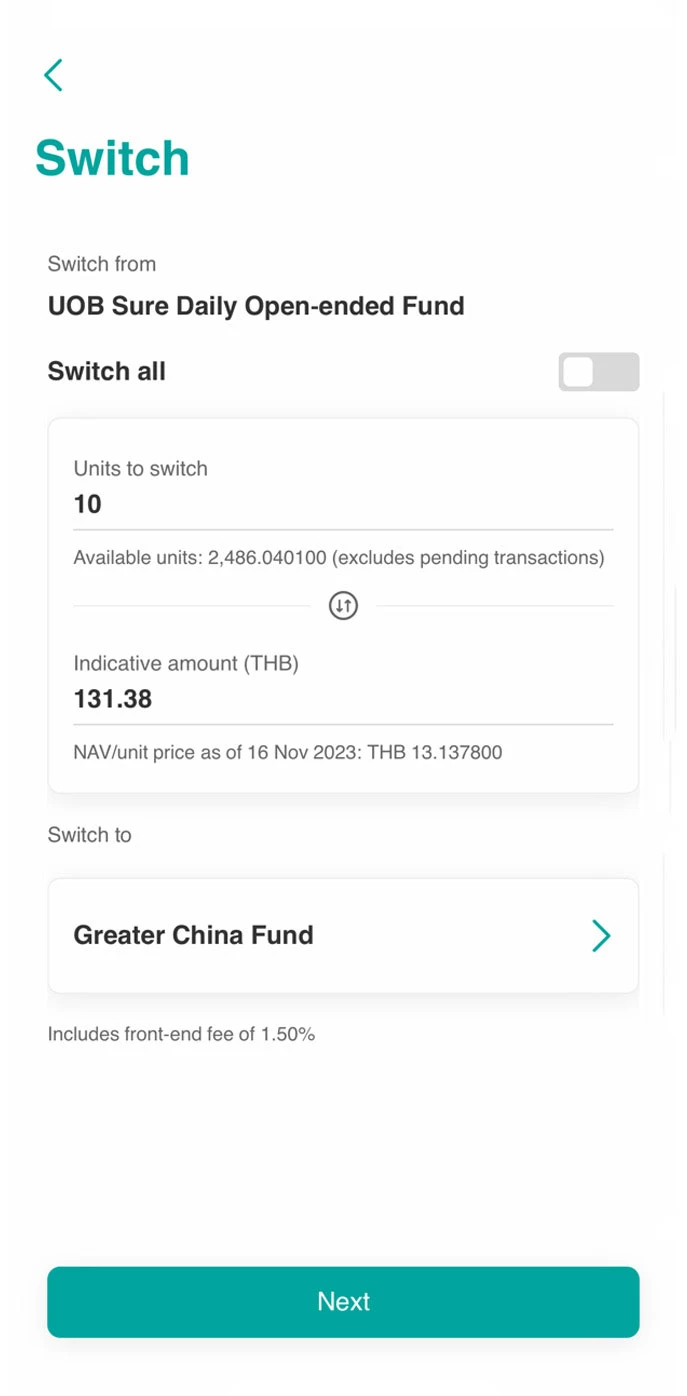

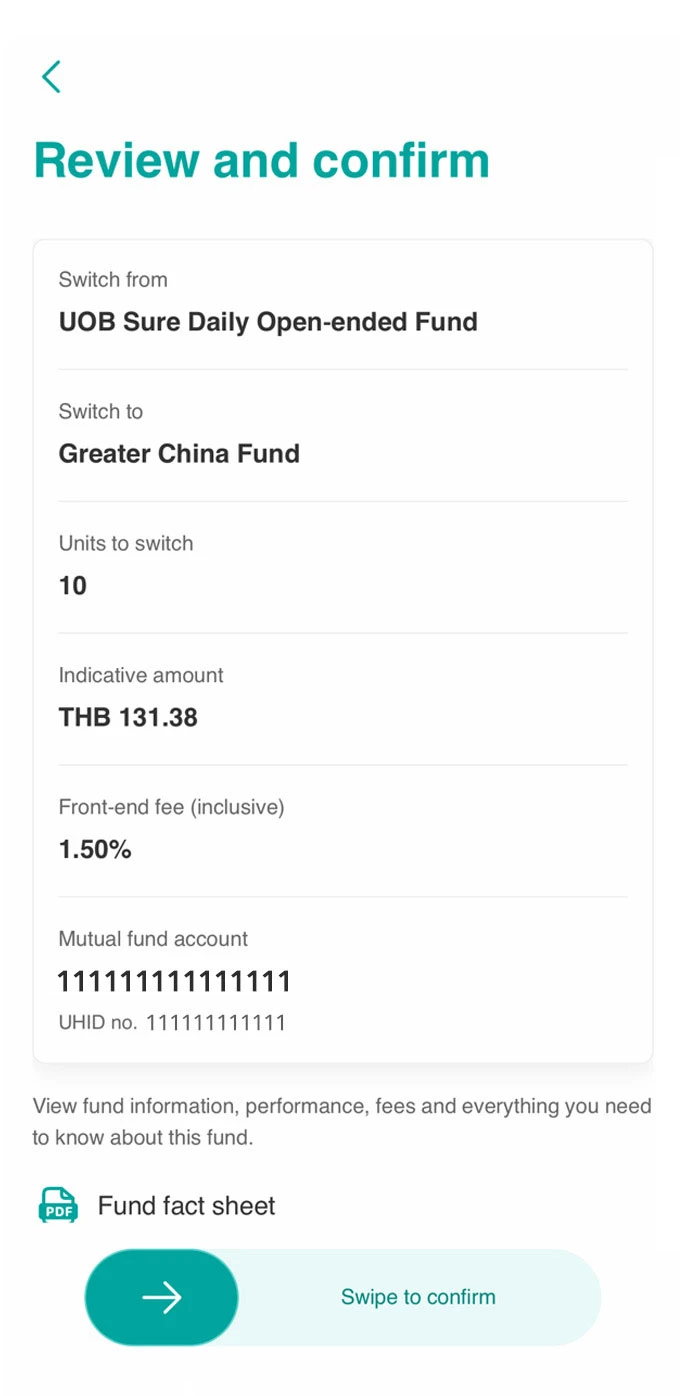

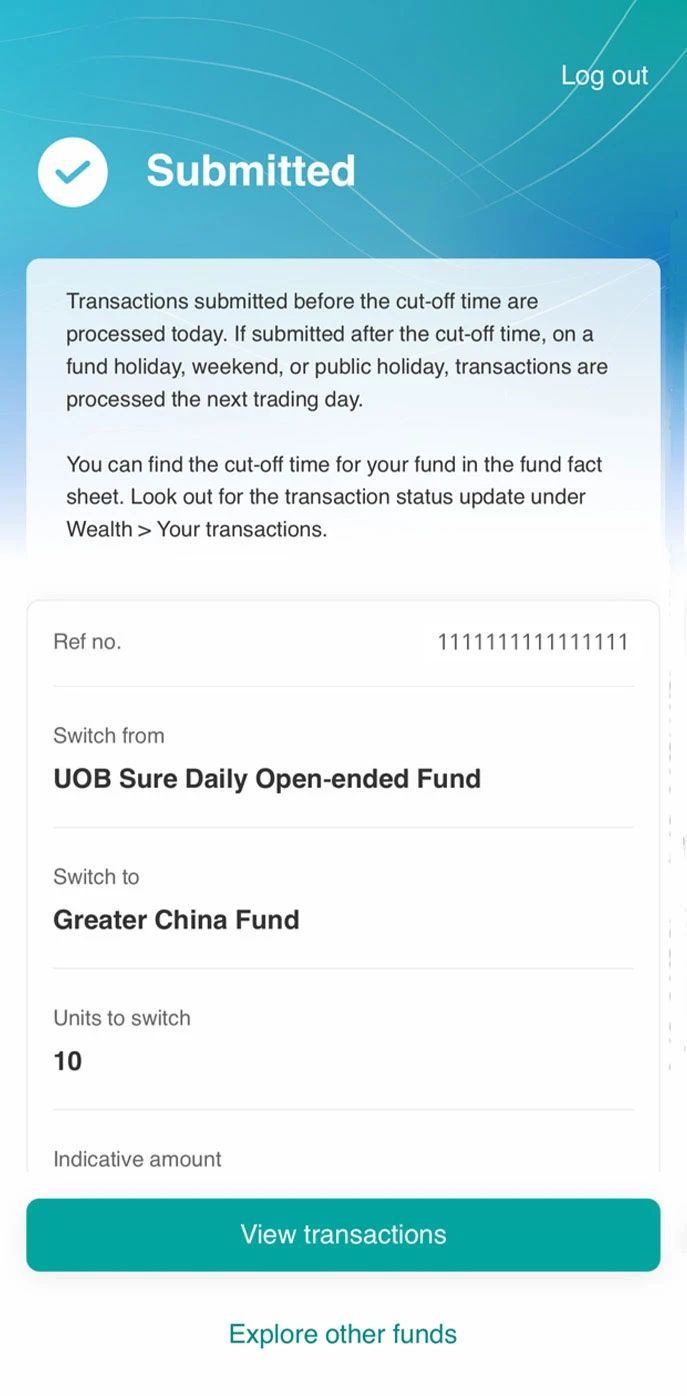

3. Switch mutual funds

1. Log in to UOB TMRW and go to Wealth, then tap on “Investments”.

2. Select the fund you wish to switch out.

3. Scroll down to the bottom of the detail screen and tap on “Switch”.

4. Read the details before switching then tap continue.

5. Enter the number of units or the THB amount (indicative) and select the fund you wish to switch in.

6. Review details and swipe to confirm with your Secure PIN.

7. Transaction submitted and can be checked for status update under Wealth > Your transactions.

Manage Regular Saving Plan (RSP)

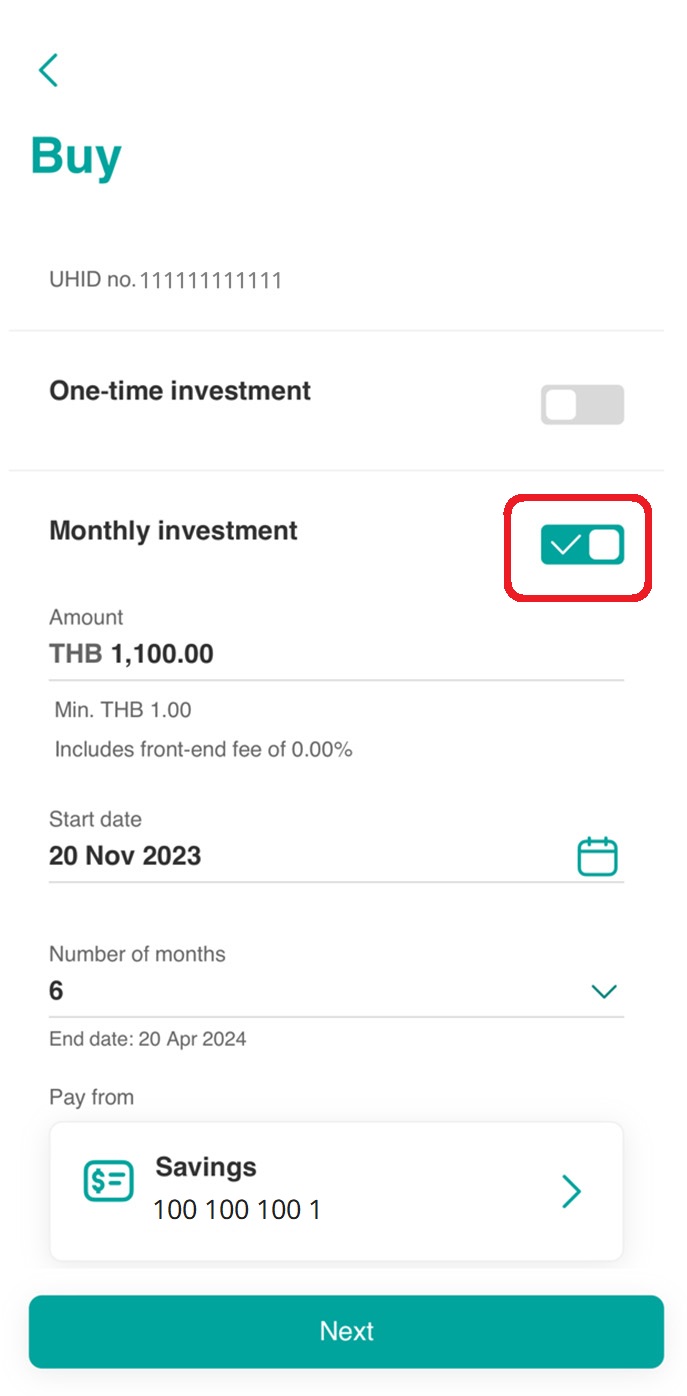

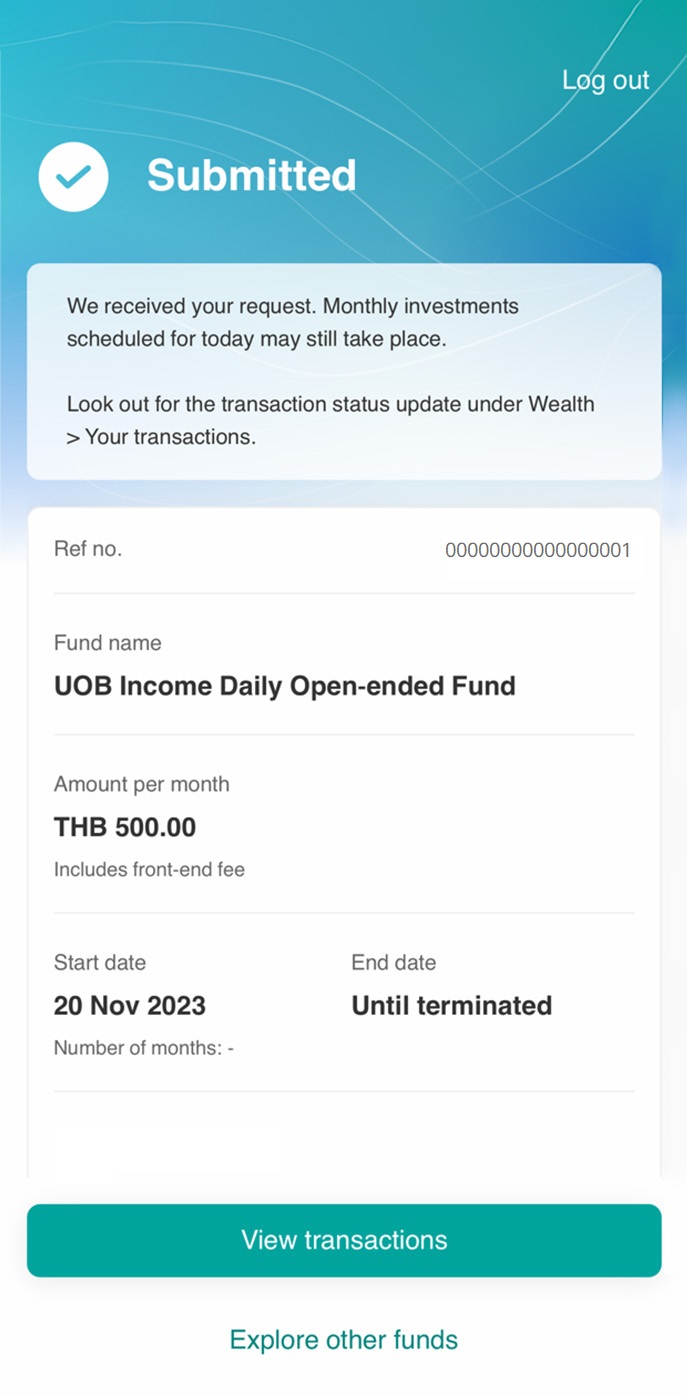

1. Set up Regular Saving Plan (RSP) for recurring monthly investments

1. Log in to UOB TMRW and tap on “Wealth”.

2. Scroll down to Mutual funds section and tap on “Explore and invest”.

3. Select the fund you wish to buy and continue with the buying steps.

4. Enter the amount to invest and tap to enable “Monthly investment” then select the start date, number of months, and the UOB account to debit investment funds from.

5. Review details and swipe to confirm with your Secure PIN.

6. Transaction submitted and can be checked for status update under Wealth > Your transactions.

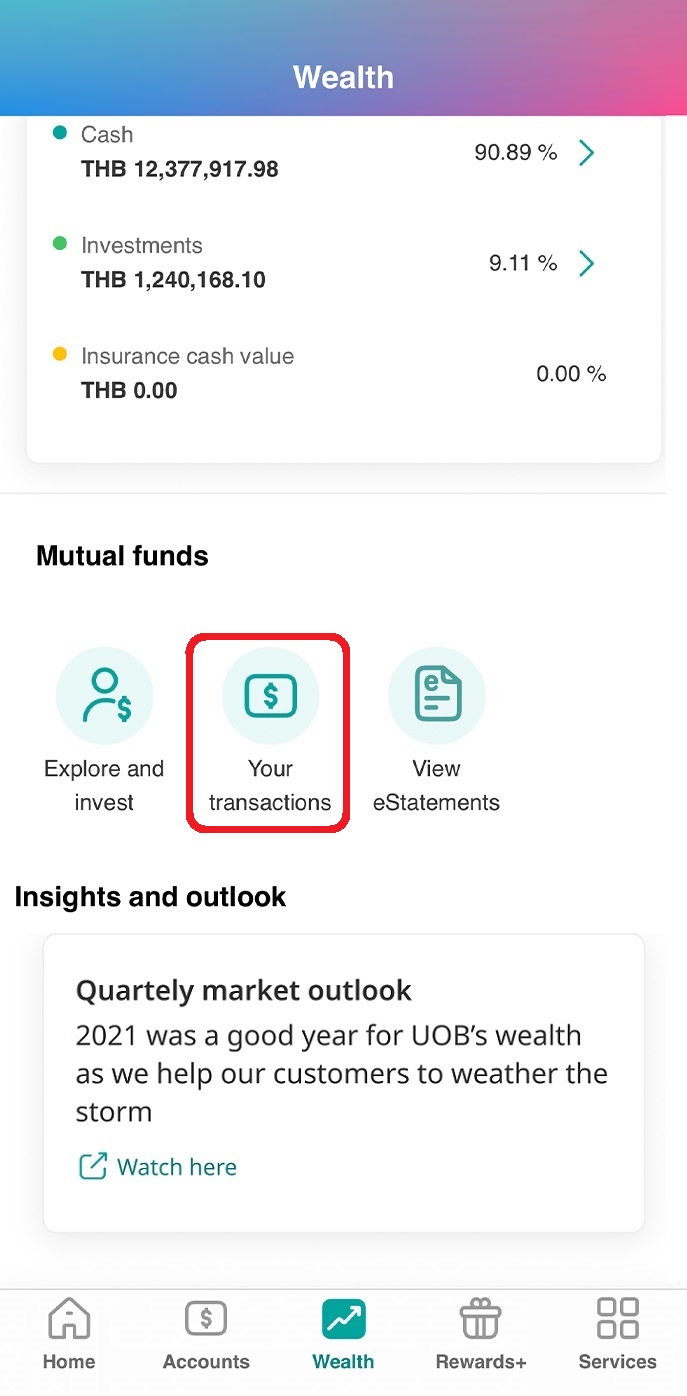

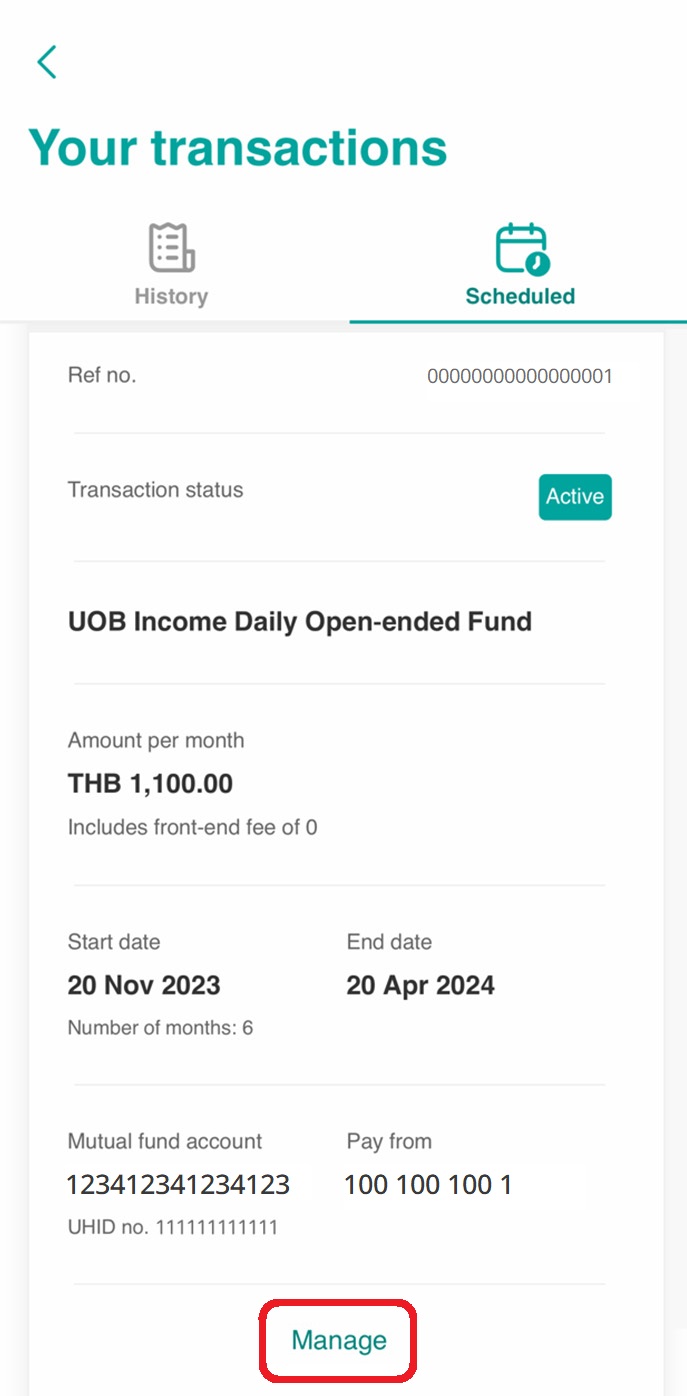

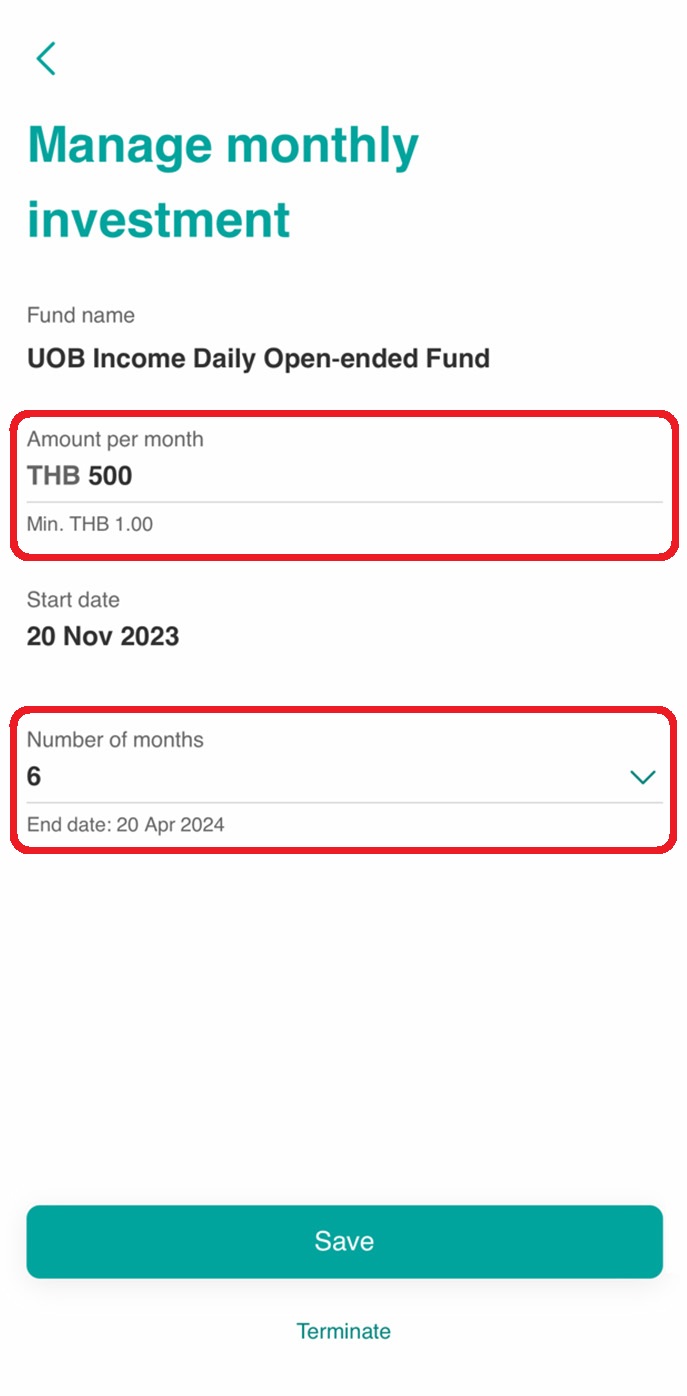

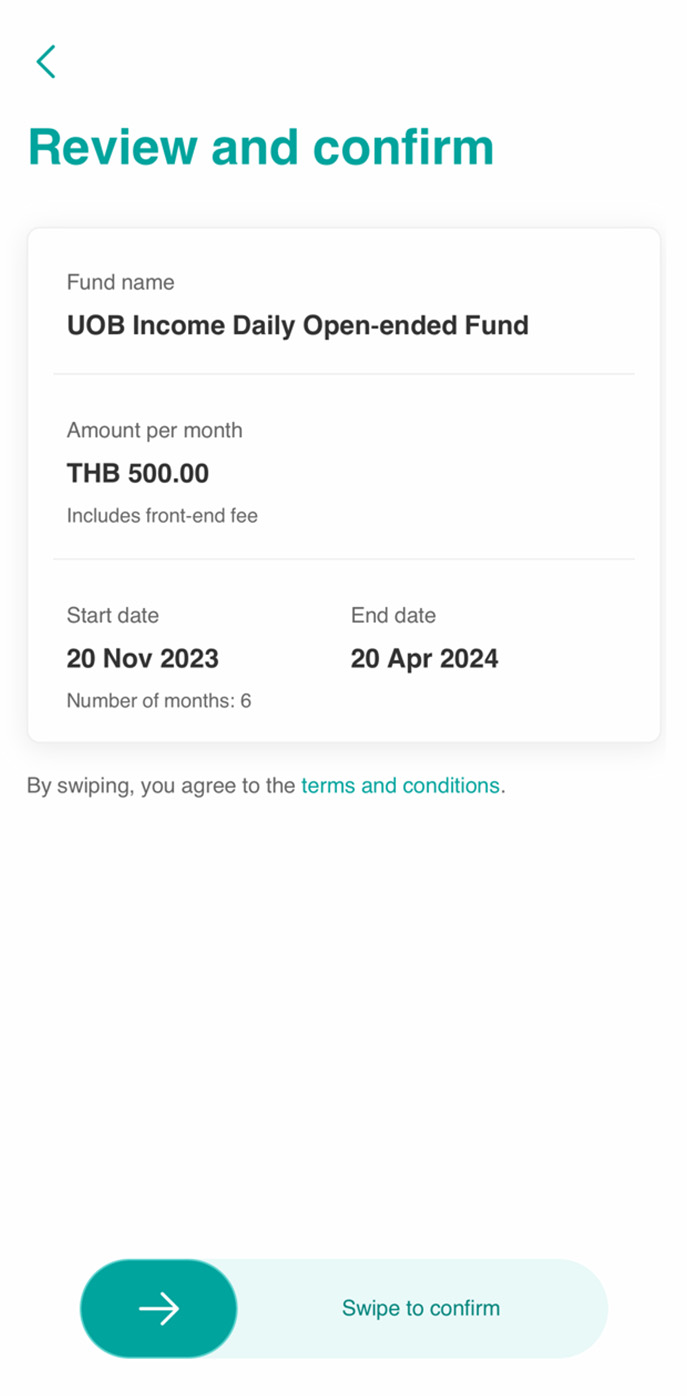

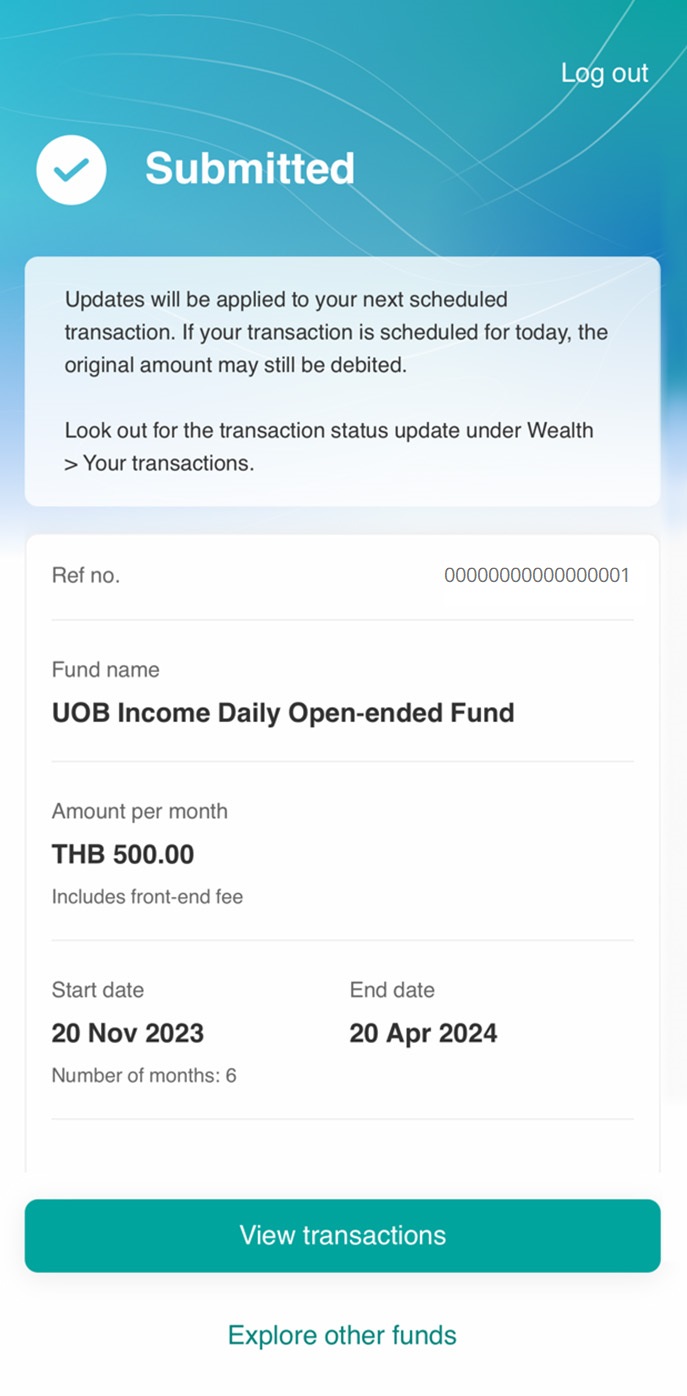

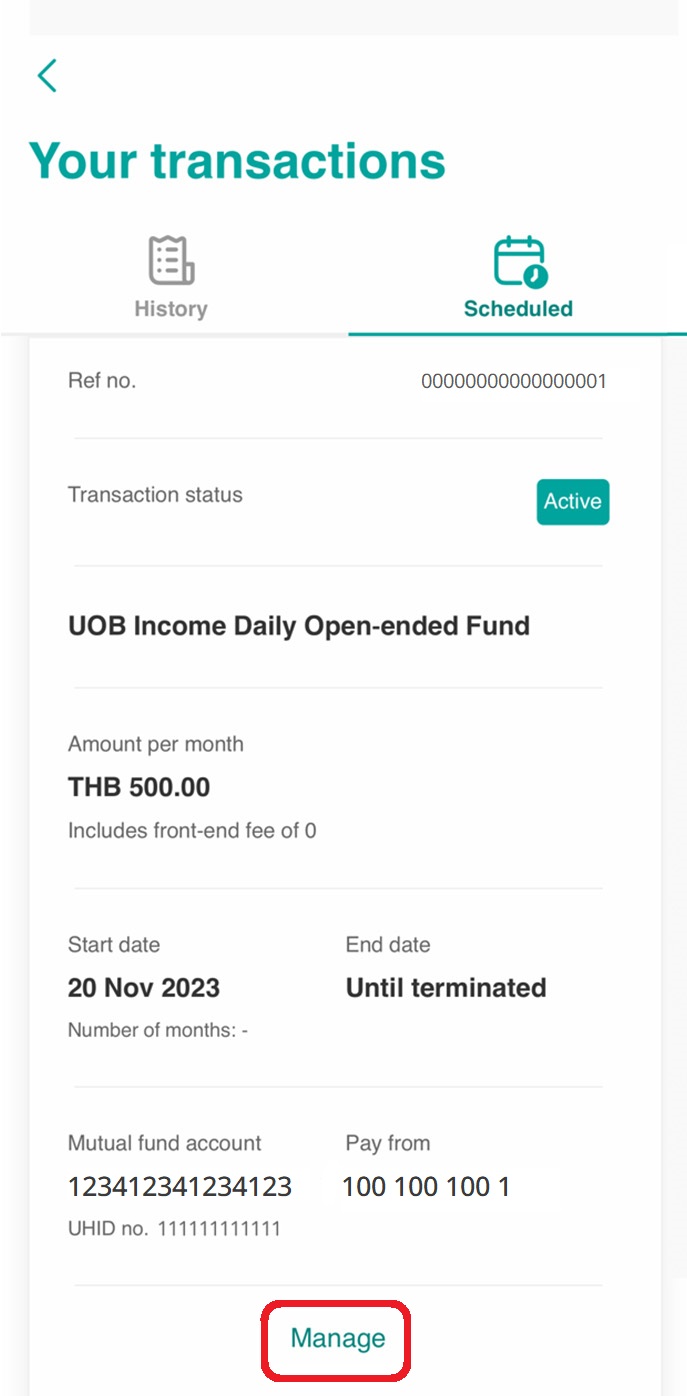

2. Edit scheduled transaction or Regular Saving Plan (RSP)

1. Log in to UOB TMRW and tap on “Wealth”.

2. Scroll down to Mutual funds section and tap on “Your transactions”.

3. Select “Scheduled” then scroll to the transaction you wish to edit and tap on “Manage”.

4. Change the amount per month and/or number of months, then tap on “Save”.

5. Review details and swipe to confirm with your Secure PIN.

6. Transaction submitted and can be checked for status update under Wealth > Your transactions.

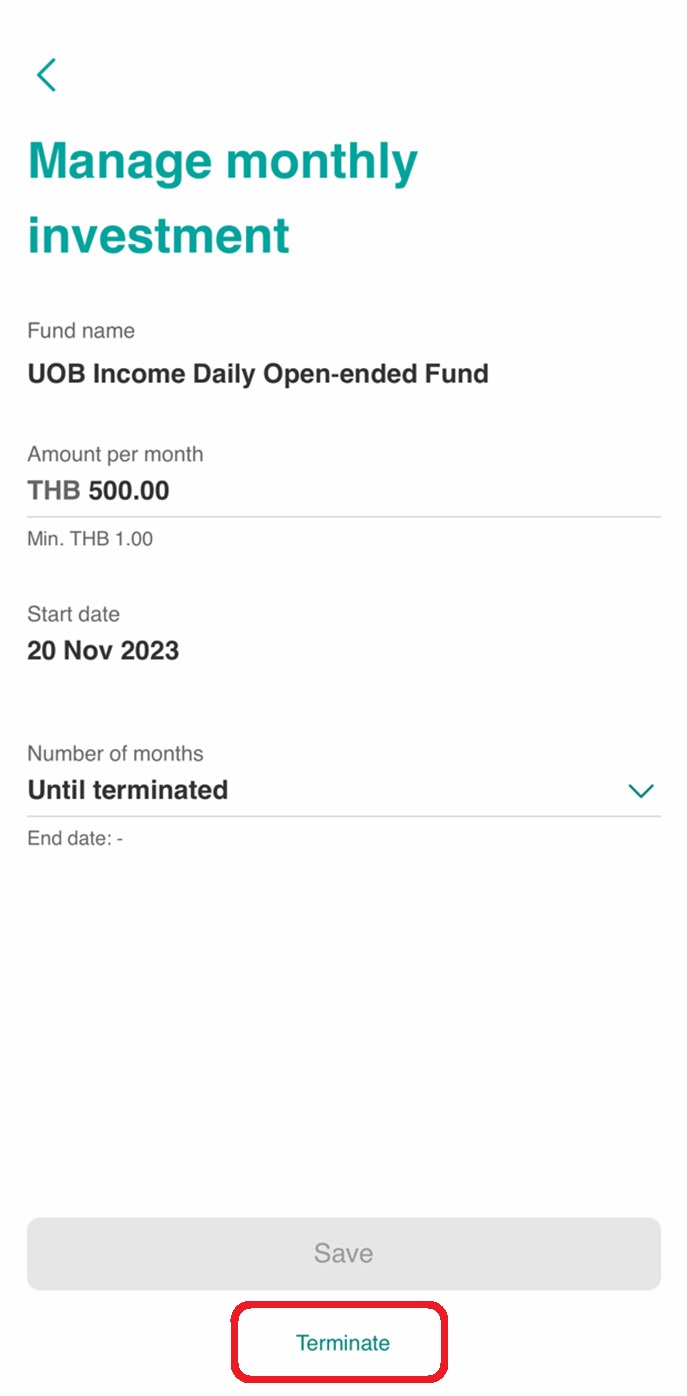

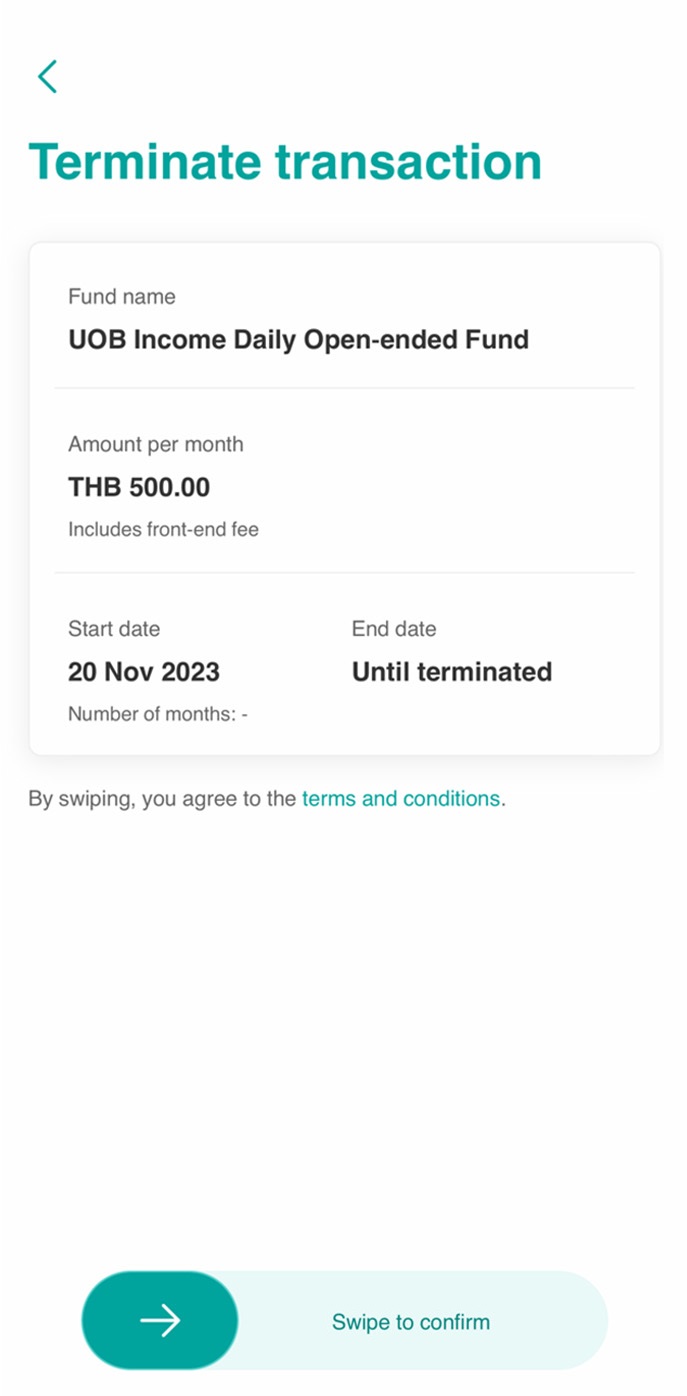

3. Terminate scheduled transaction or Regular Saving Plan (RSP)

1. Log in to UOB TMRW and tap on “Wealth”.

2. Scroll down to Mutual funds section and tap on “Your transactions”.

3. Select “Scheduled” then scroll to the transaction you intend to terminate and tap on “Manage”.

4. Tap on “Terminate”.

5. Review details and swipe to confirm with your Secure PIN.

6. Transaction submitted and can be checked for status update under Wealth > Your transactions.

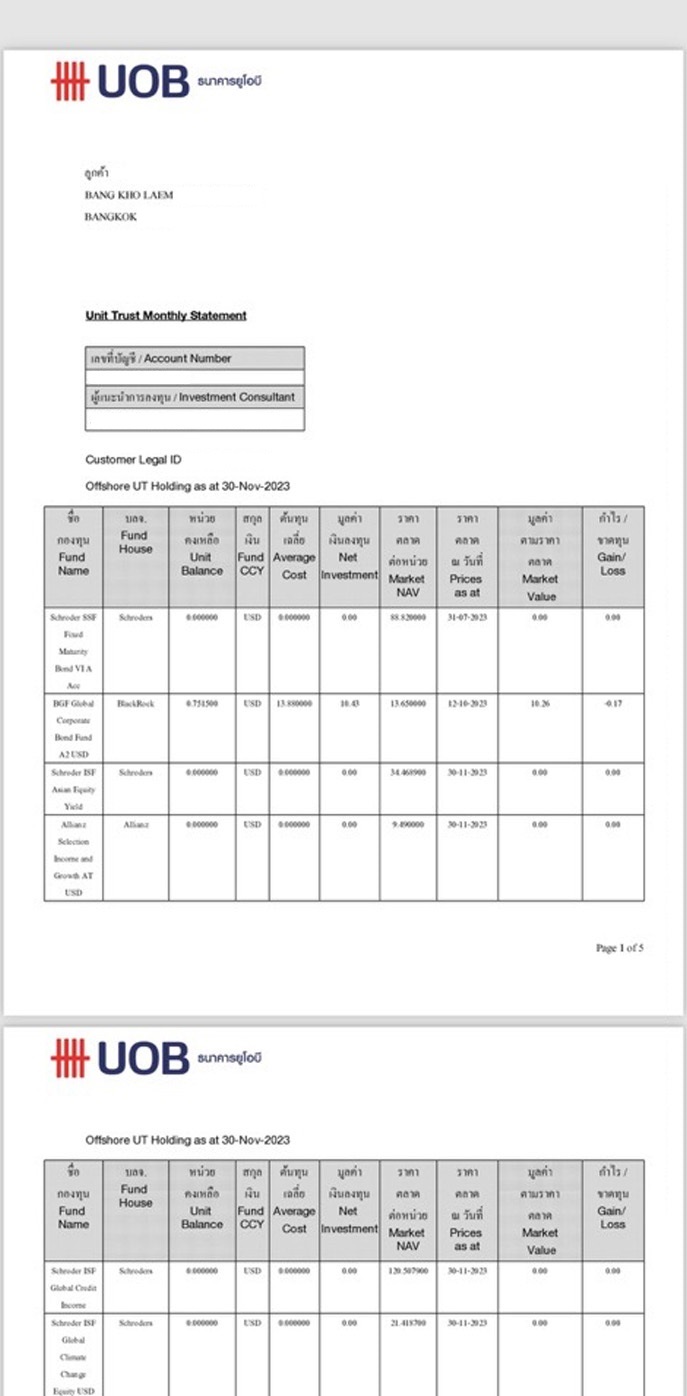

Unit trust monthly statements on UOB TMRW

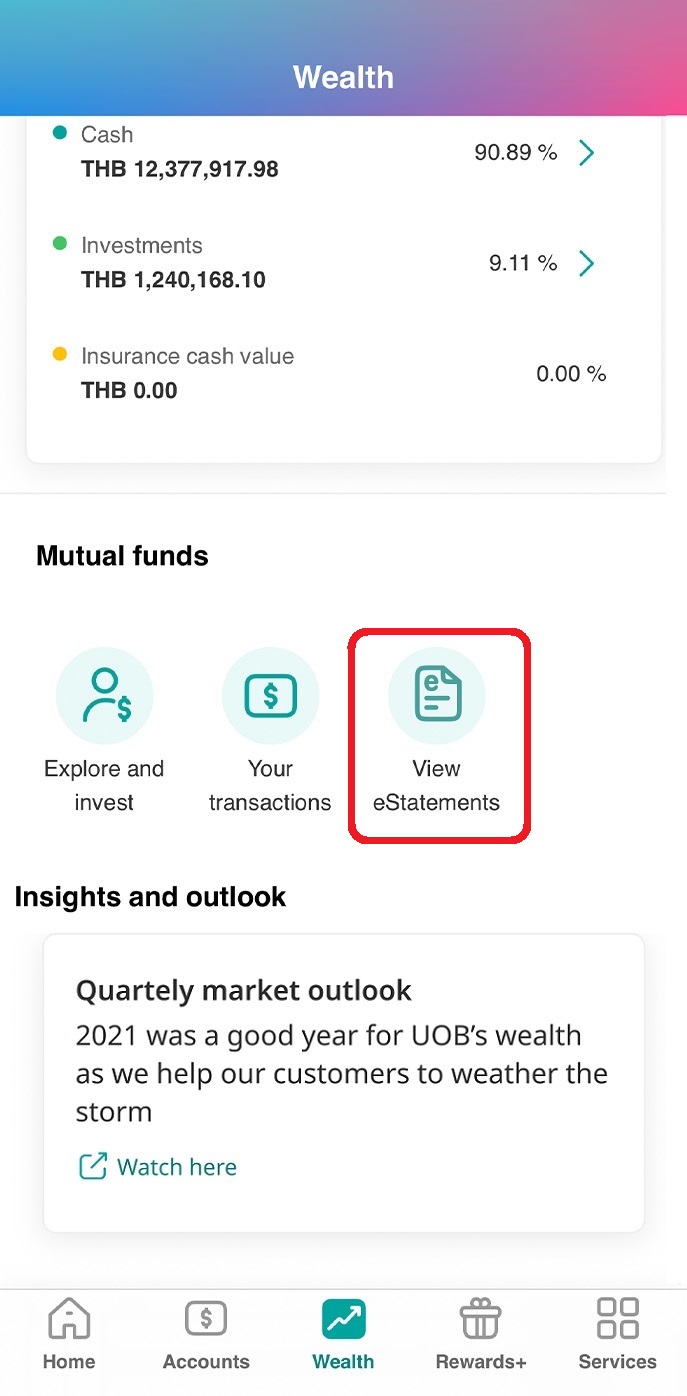

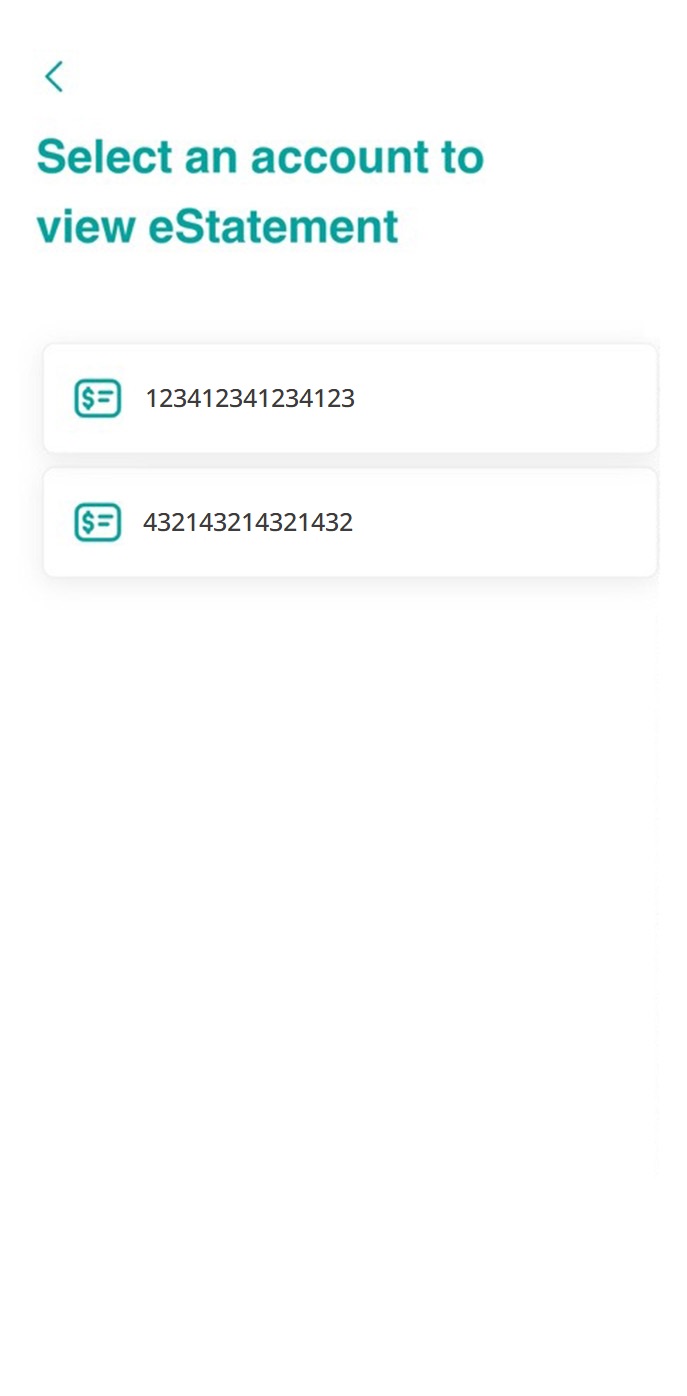

1. View eStatements for mutual fund accounts

1. Log in to UOB TMRW and tap on “Wealth”.

2. Scroll down to Mutual funds section and tap on “View eStatements”.

3. Select the mutual fund account you wish to view eStatements.

4. Select the month to view details.

5. The PDF of your eStatement can be downloaded or shared via email instantly.

Other Settings

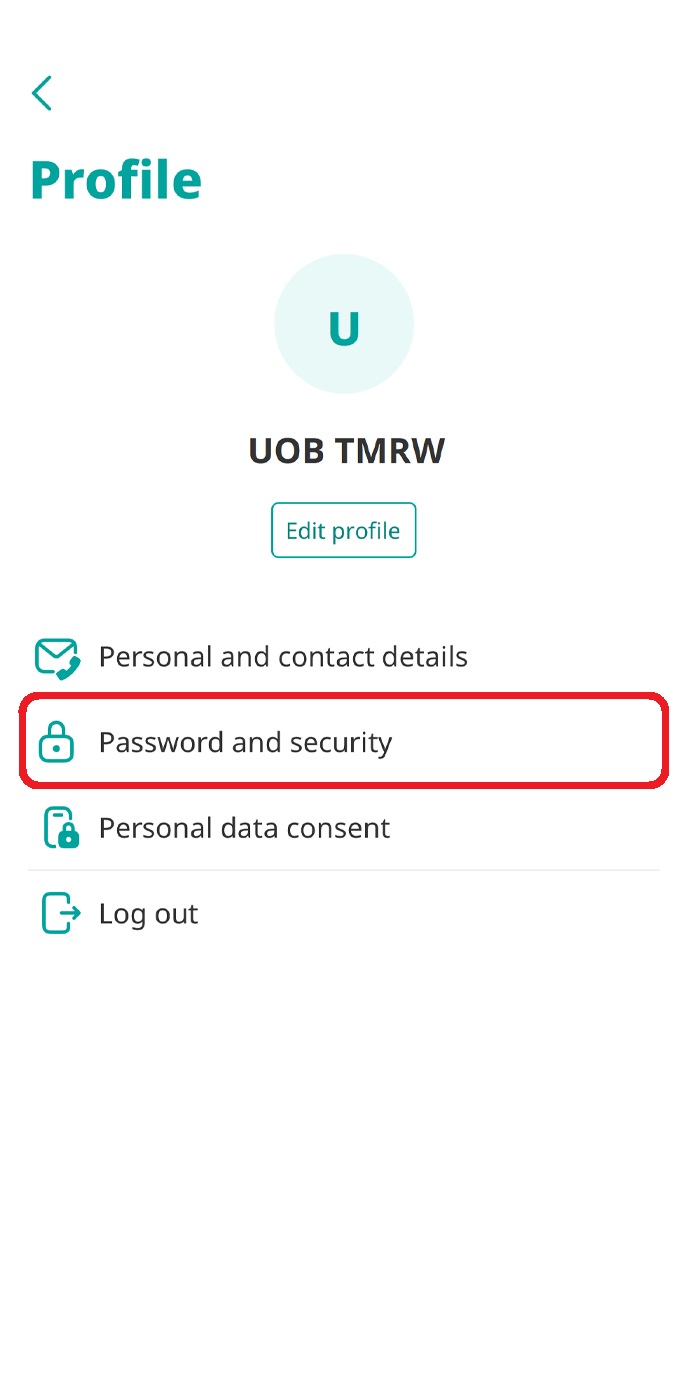

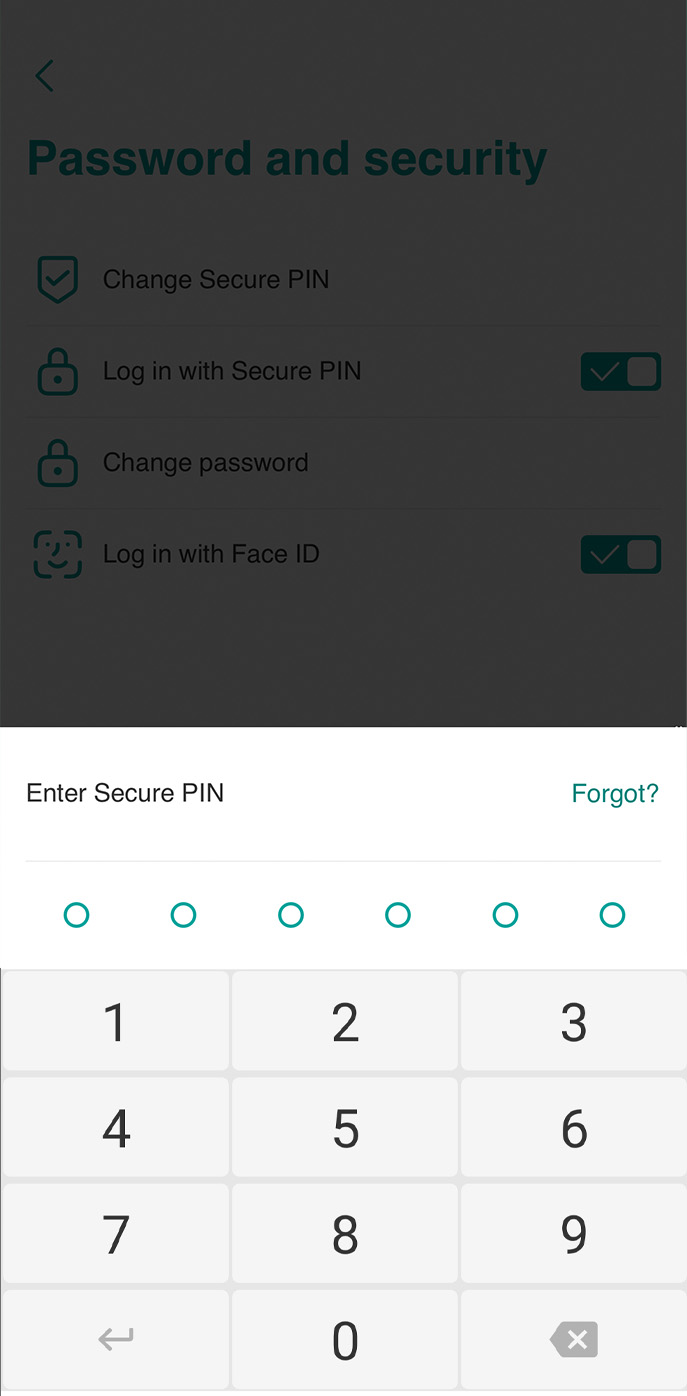

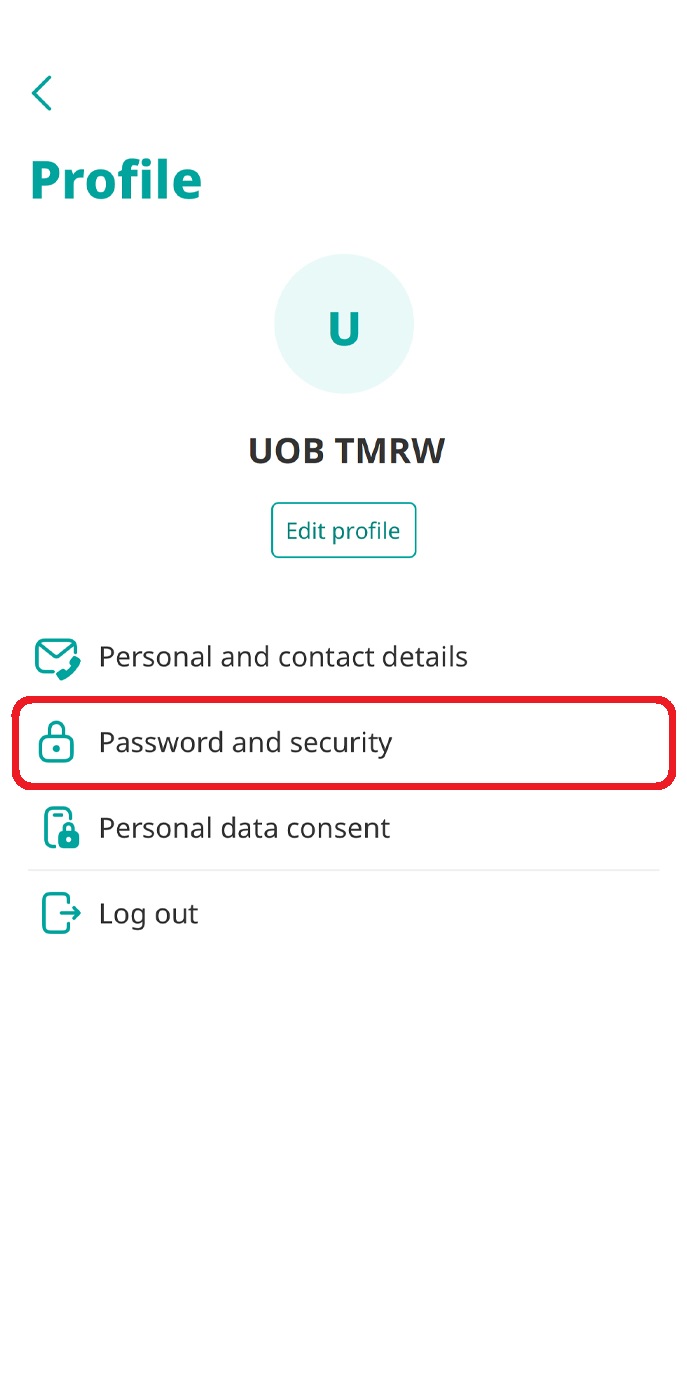

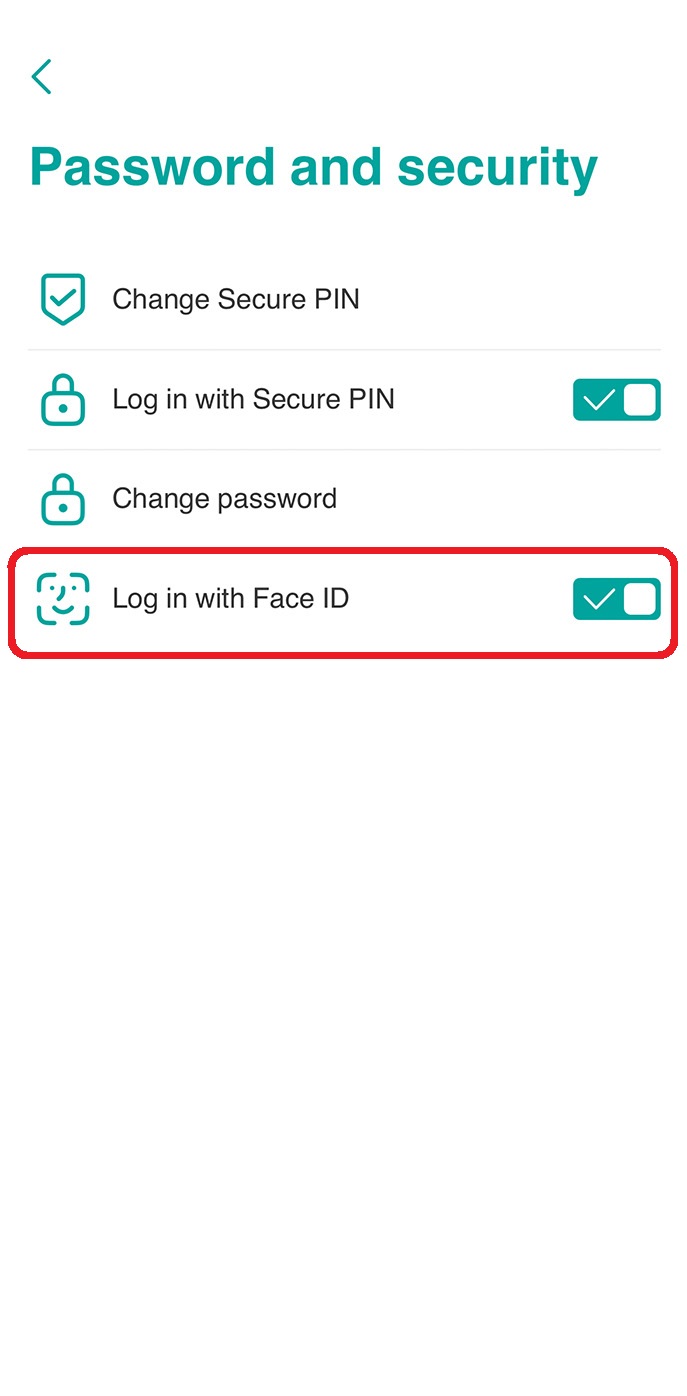

Password and security settings

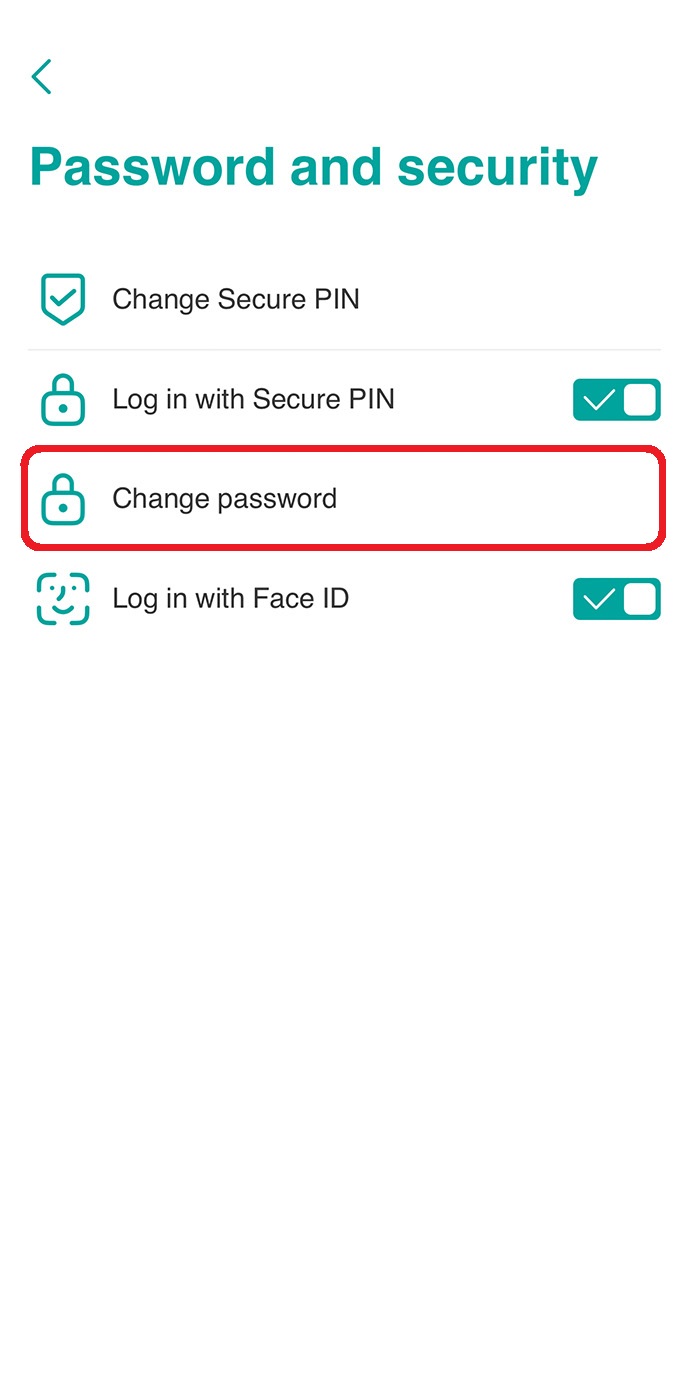

1. Reset forgotten Secure PIN

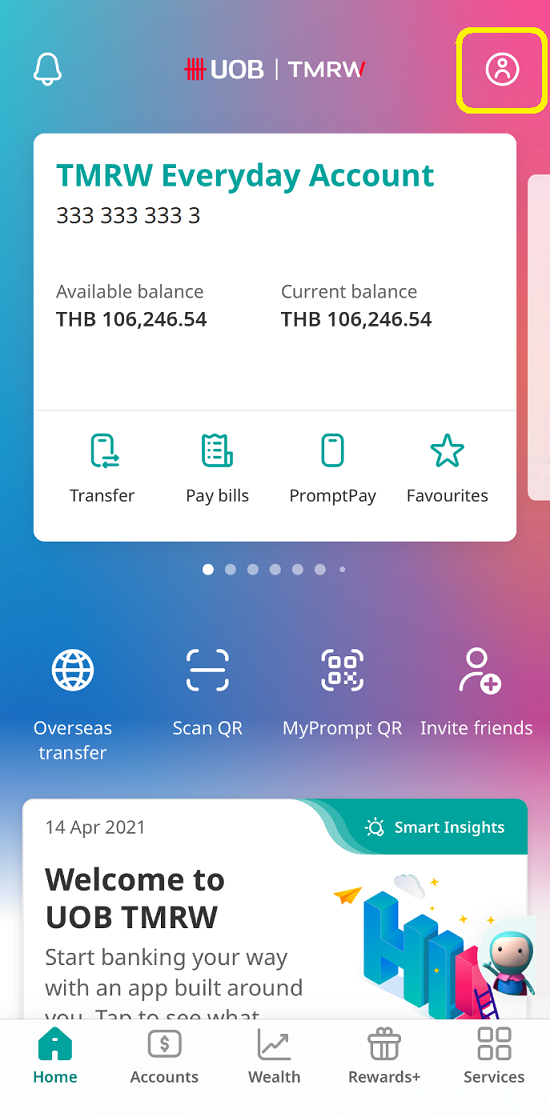

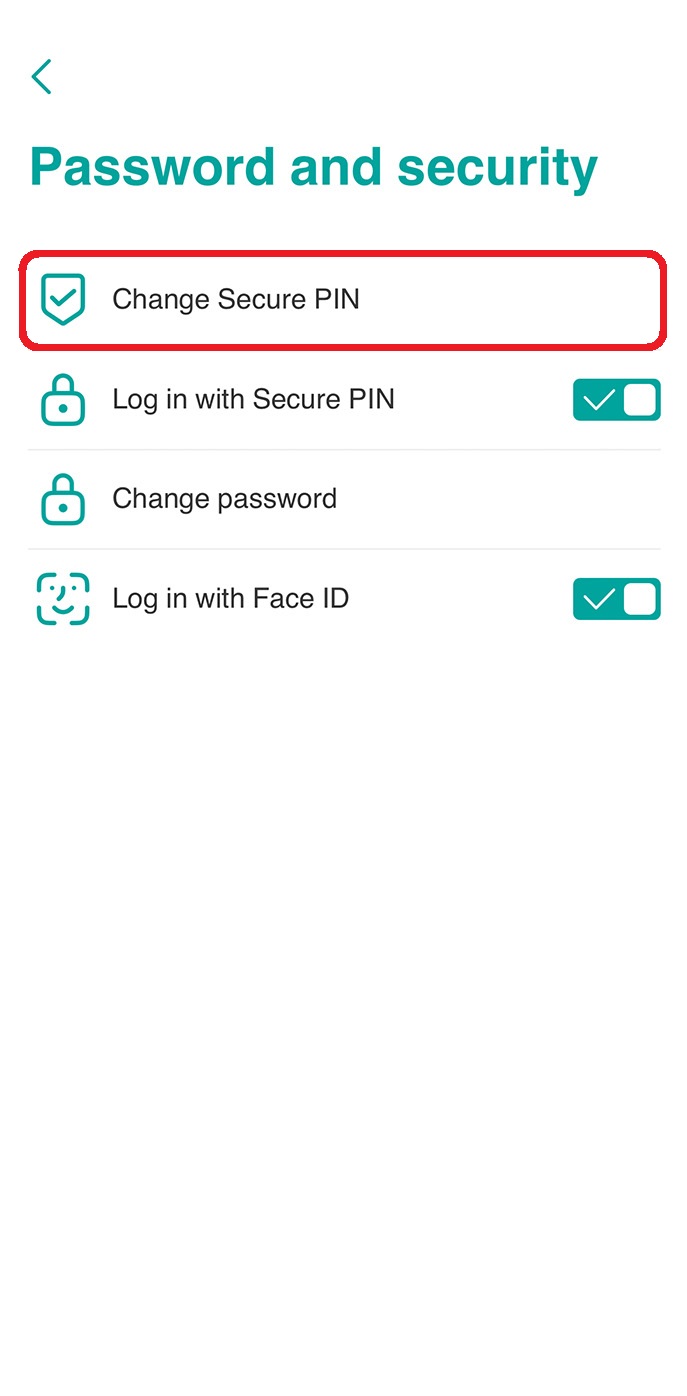

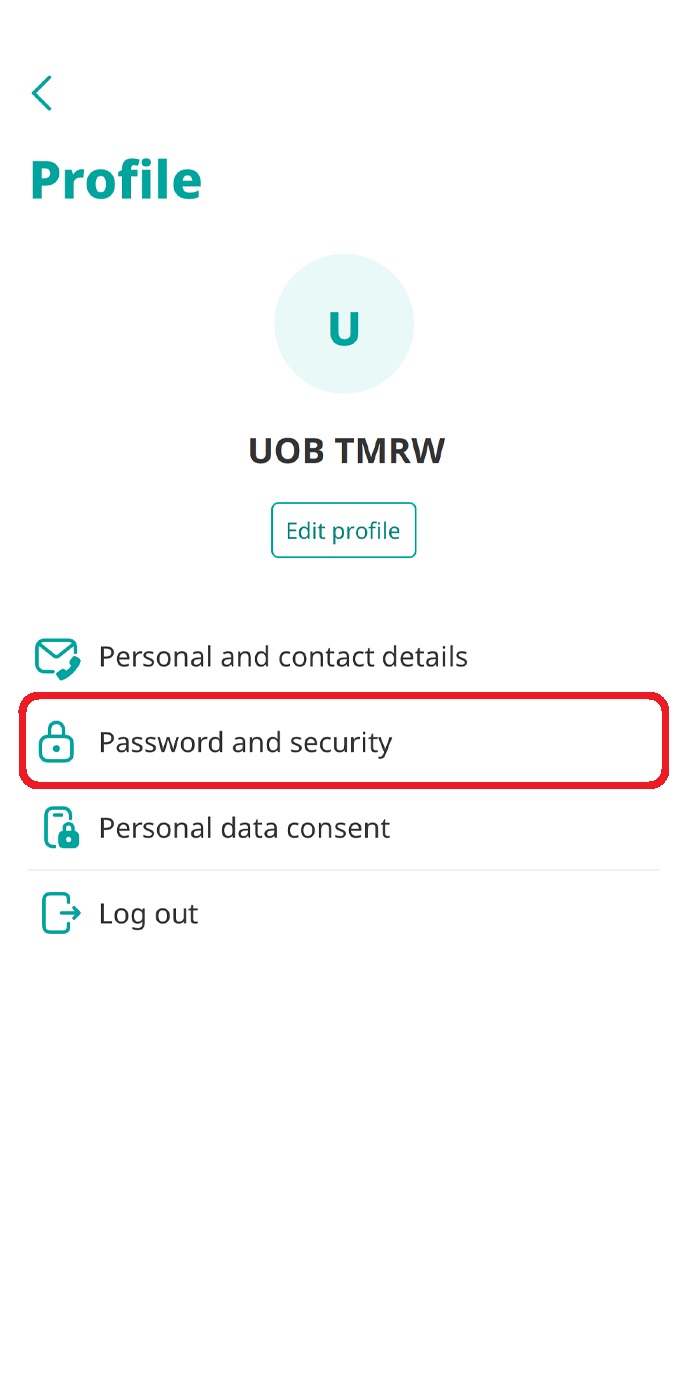

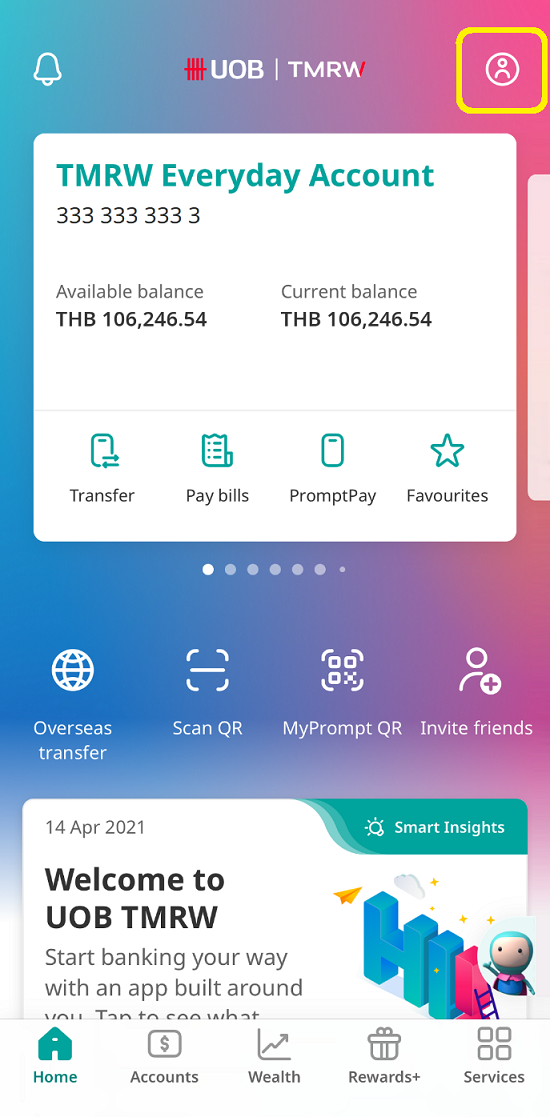

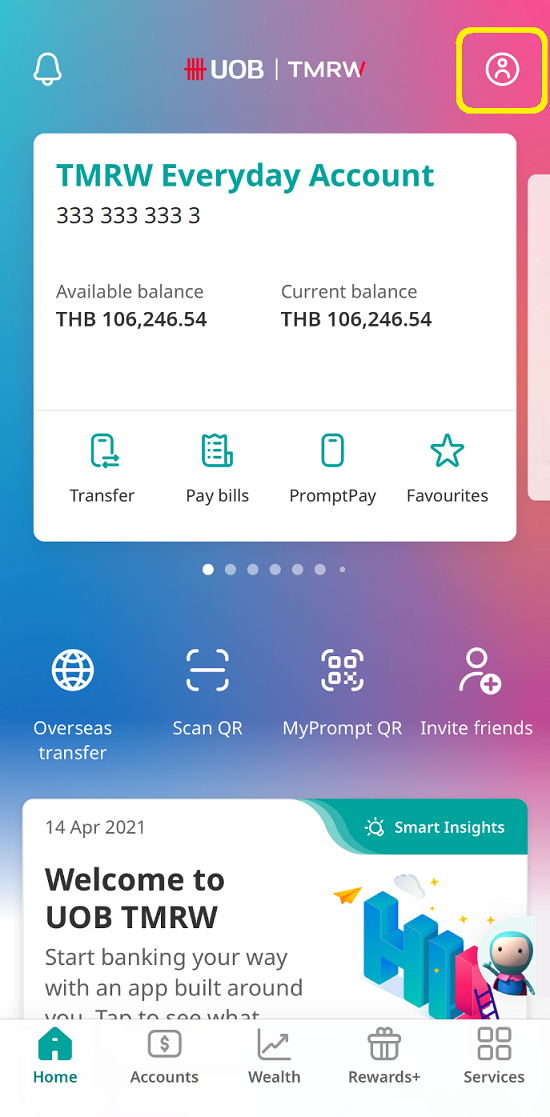

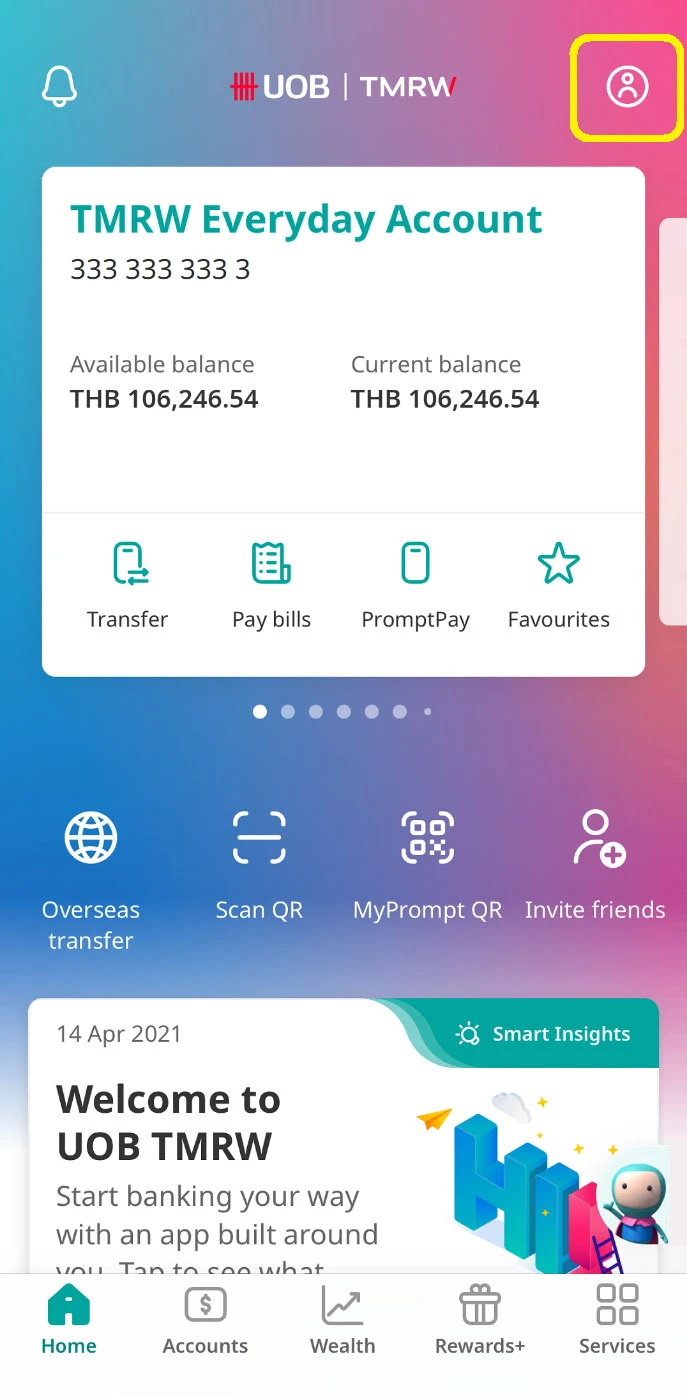

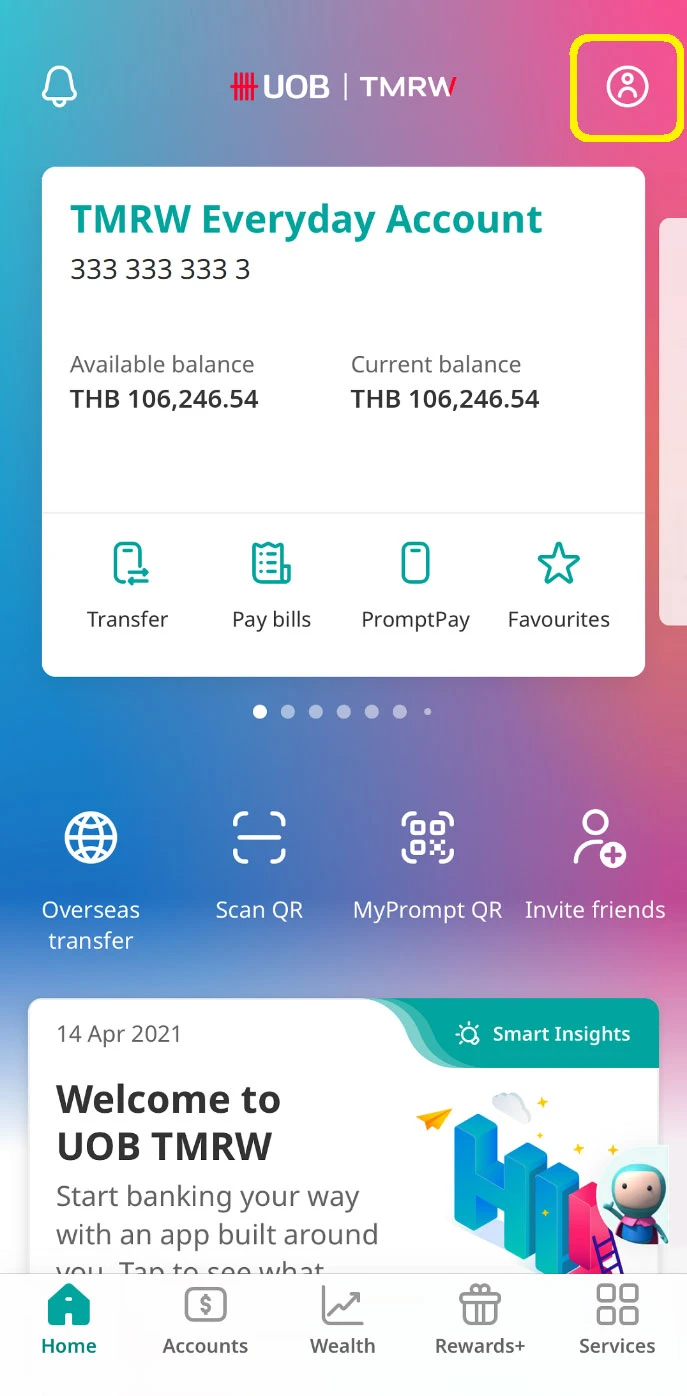

1. Log in to UOB TMRW and tap on Profile icon at the top right corner.

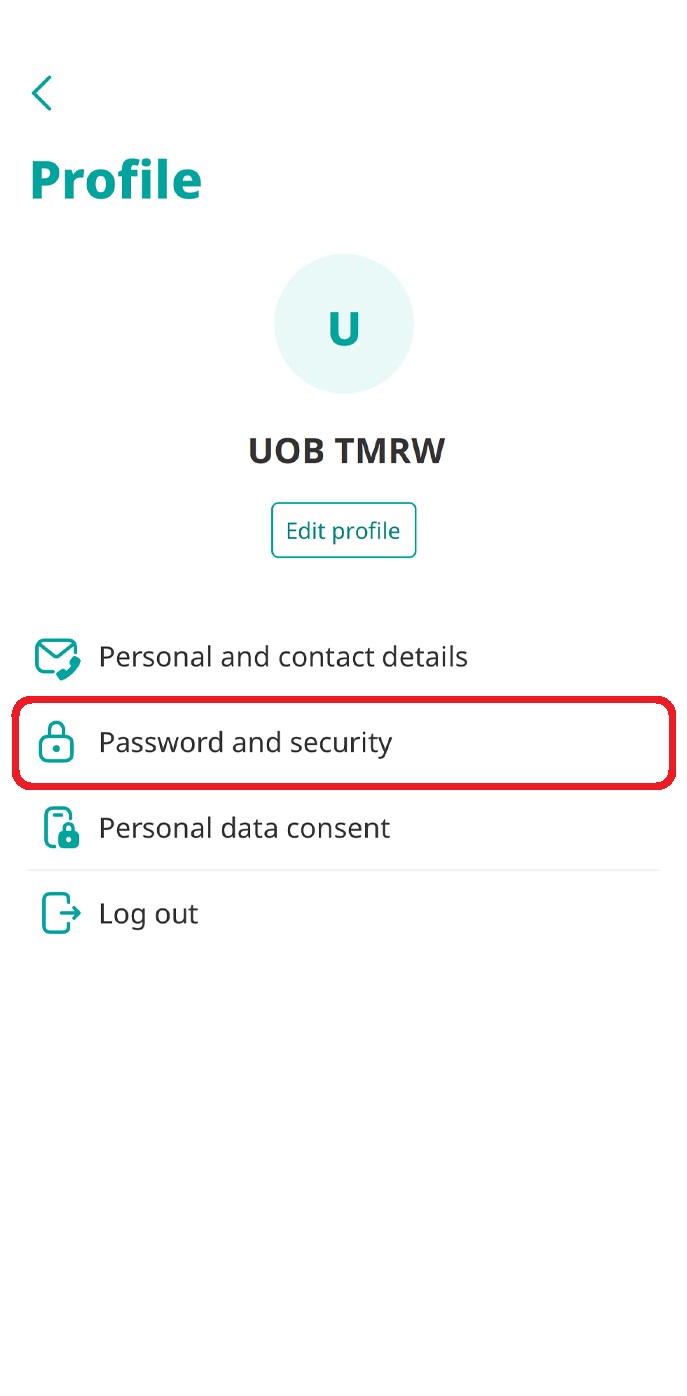

2. Select “Password and security”.

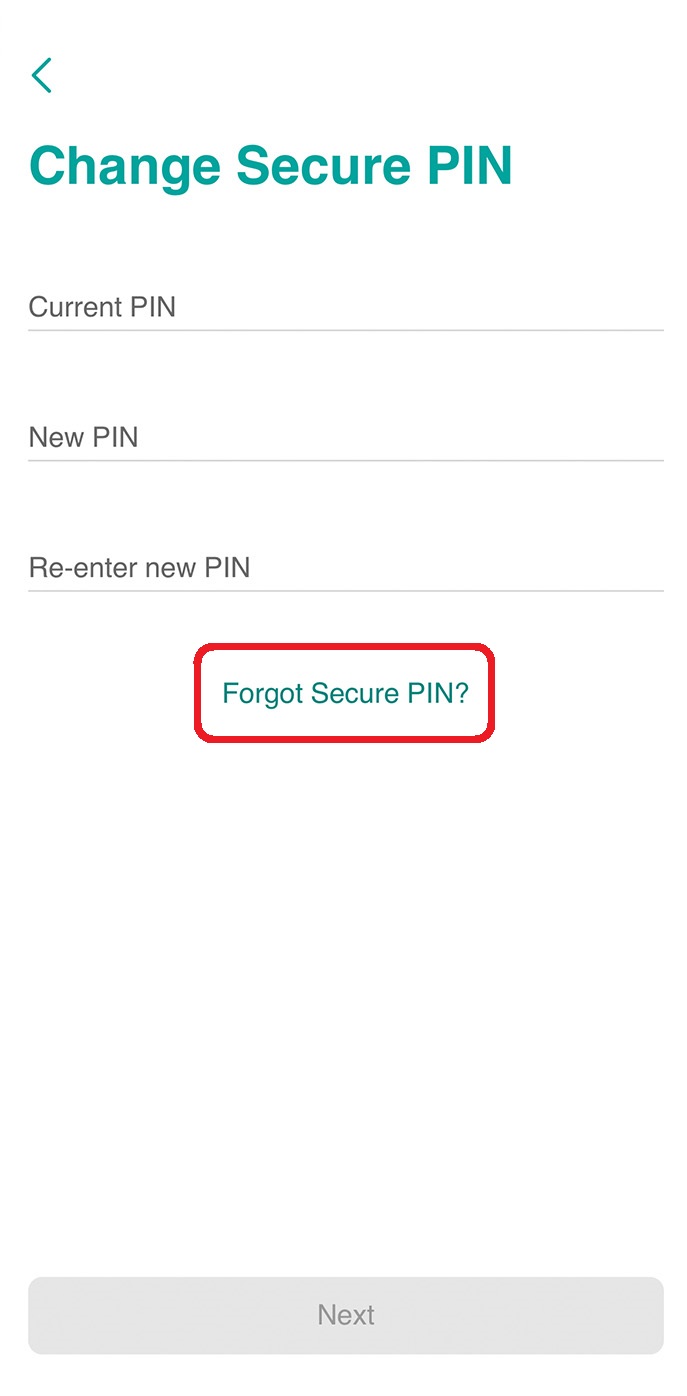

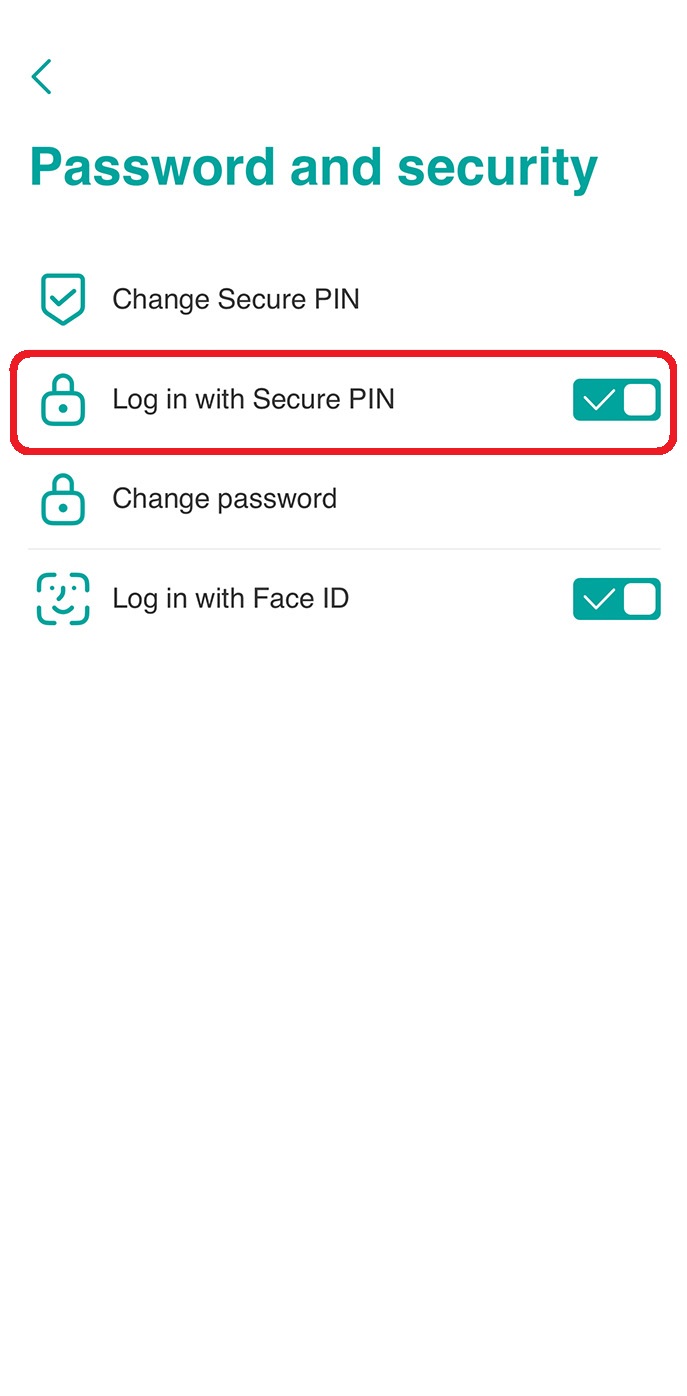

3. Select “Change Secure PIN”.

4. Tap on “Forgot Secure PIN?”.

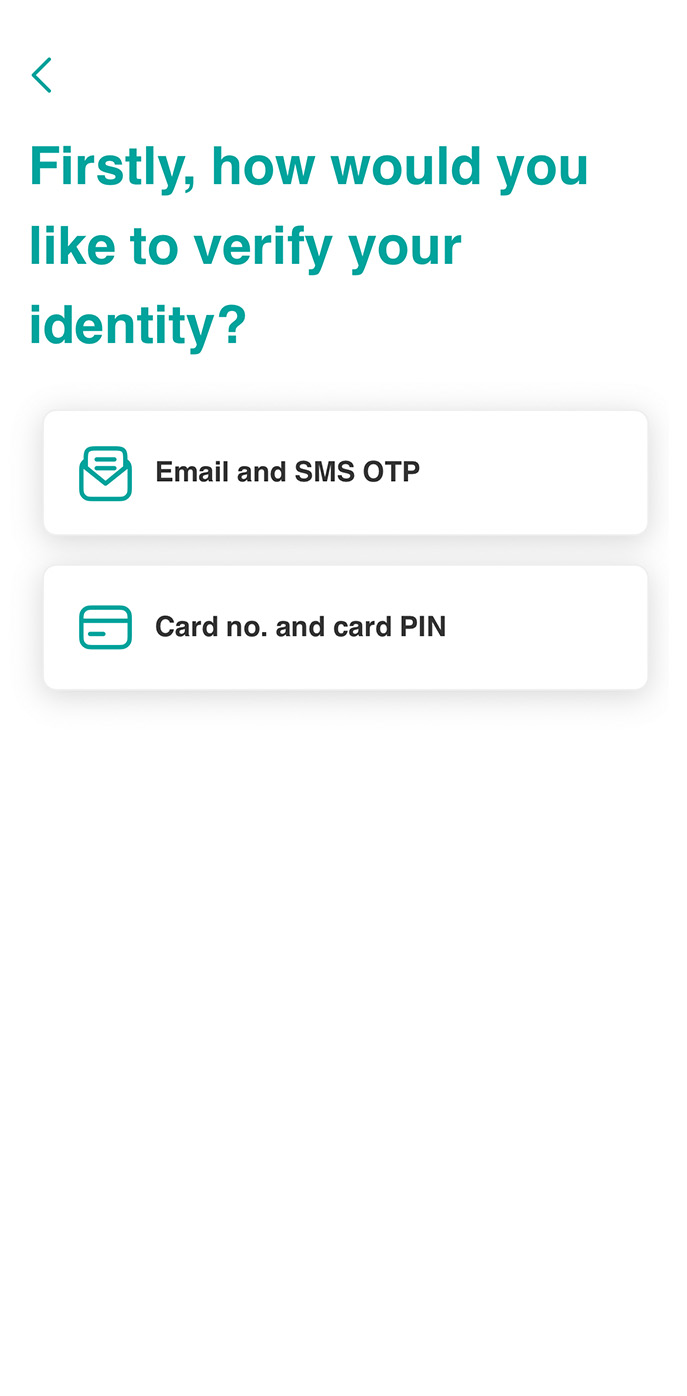

5. Select an option to verify your identity:

(1) Email and SMS OTP

(2) Card no. and card PIN

6. Create your new 6-digit Secure PIN and re-enter the new PIN to confirm.

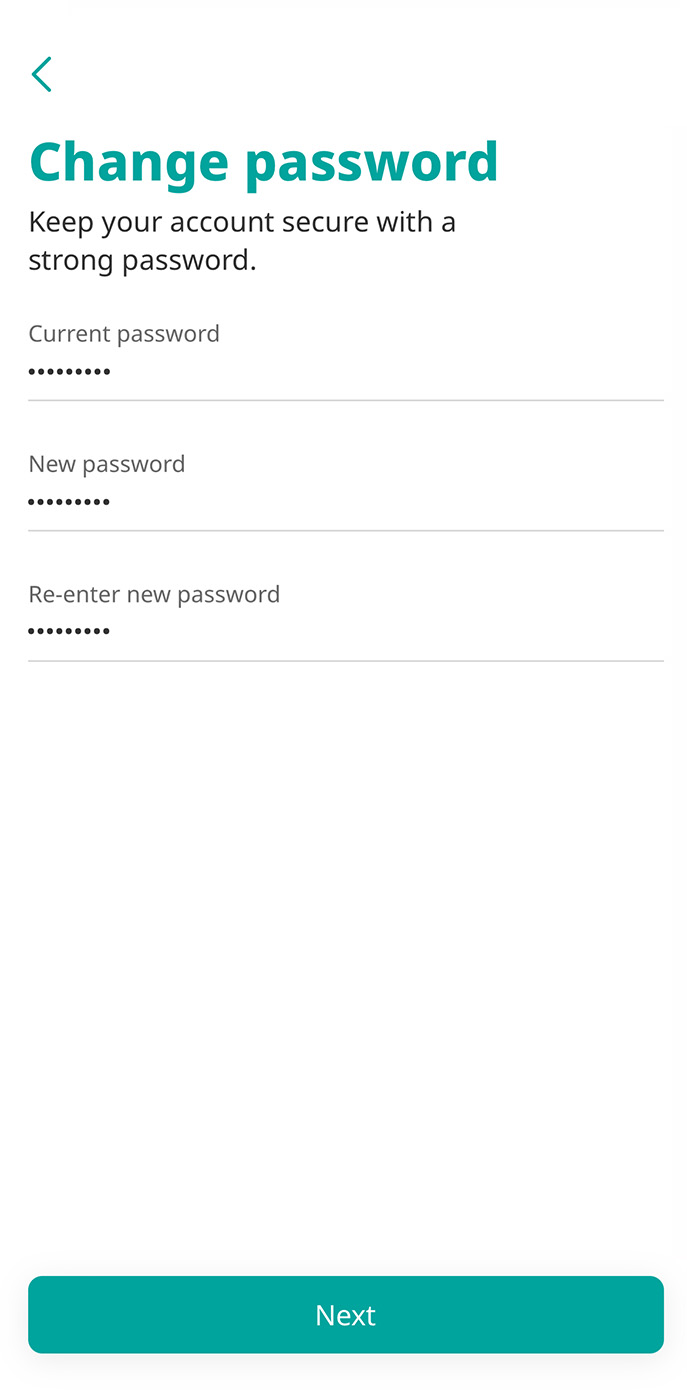

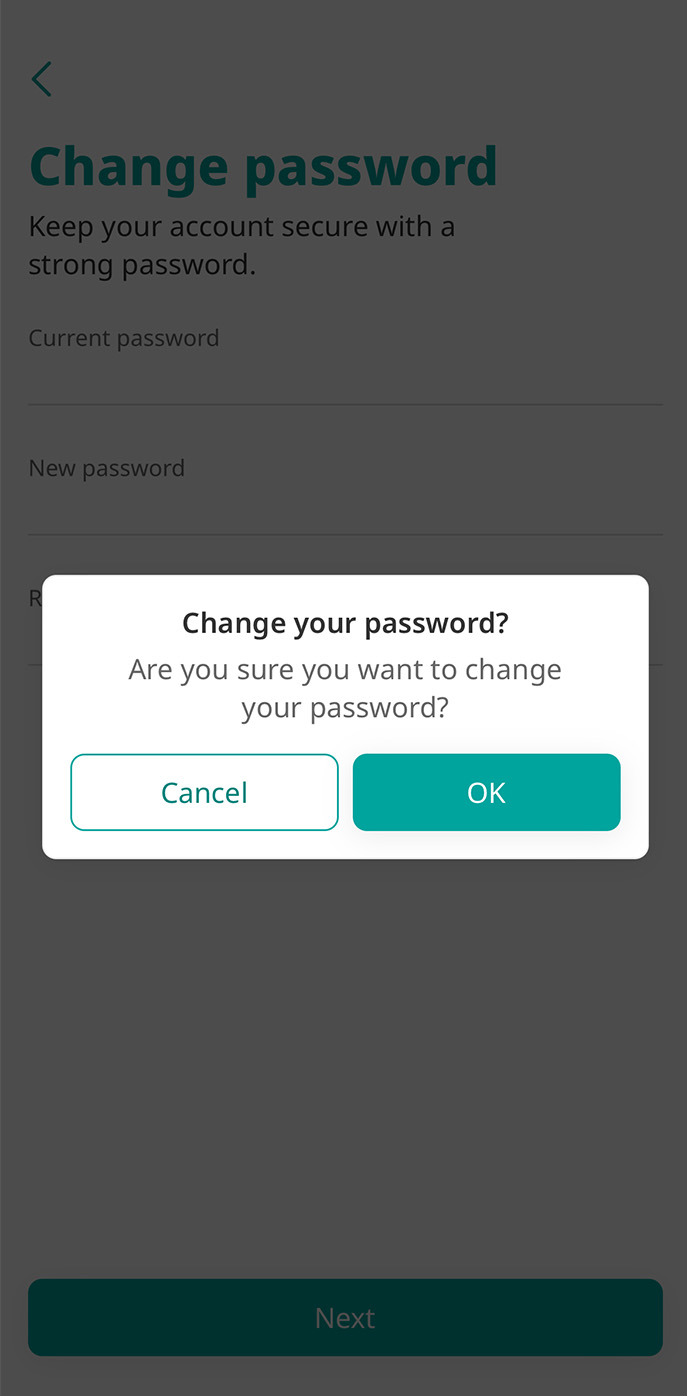

2. Change password (current password not forgotten)

1. Log in to UOB TMRW and tap on Profile icon at the top right corner.

2. Select “Password and security”.

3. Select “Change password”.

4. Enter current password and new password.

5. Confirm changing your password for UOB TMRW app and PIB (Personal Internet Banking).

3. Enable/ disable login with 6-digit Secure PIN

1. Log in to UOB TMRW and tap on Profile icon at the top right corner.

2. Select “Password and security”.

3. Tap the toggle on the right to enable/ disable the “Log in with Secure PIN” feature.

4. Enter your Secure PIN code to confirm (in case of enabling).

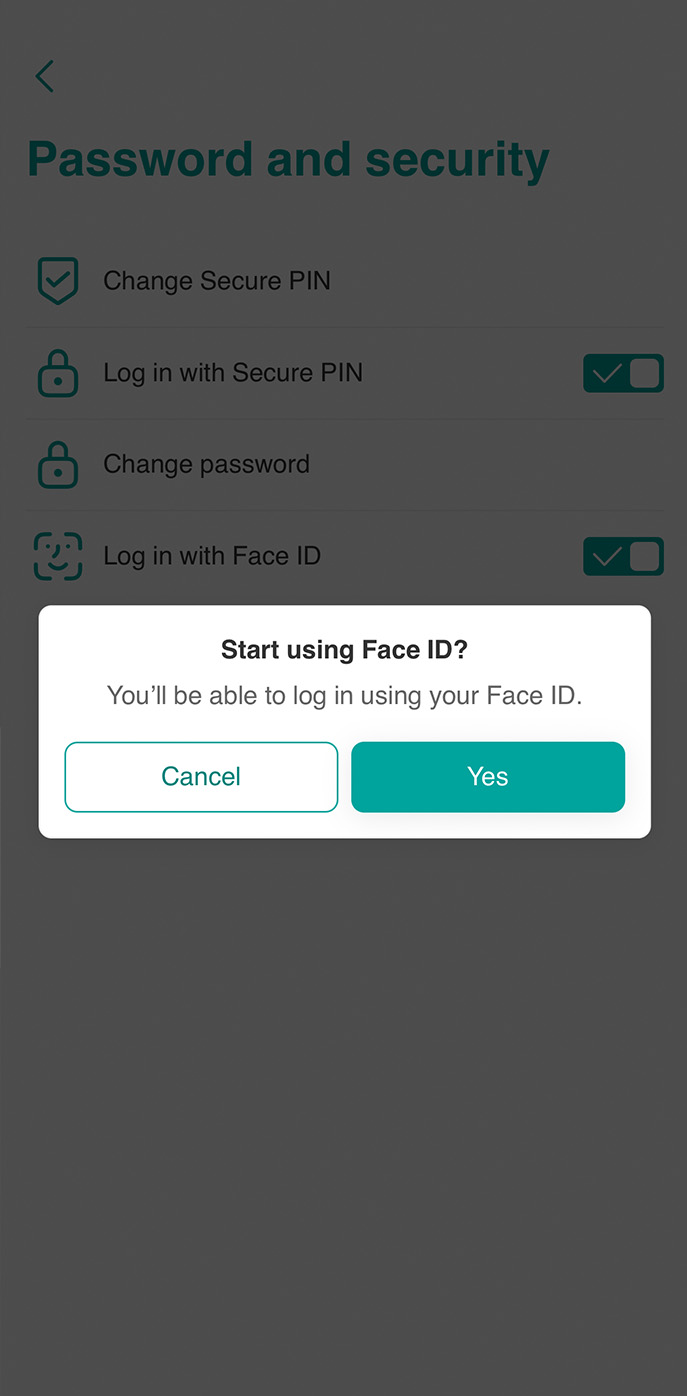

4. Enable/ disable login with Face ID or fingerprint

1. Log in to UOB TMRW and tap on Profile icon at the top right corner.

2. Select “Password and security”.

3. Tap the toggle on the right to enable/ disable the “Log in with Face ID or Fingerprint” feature.

4. Confirm activate/ deactivate of Face ID or Fingerprint to log into the app.

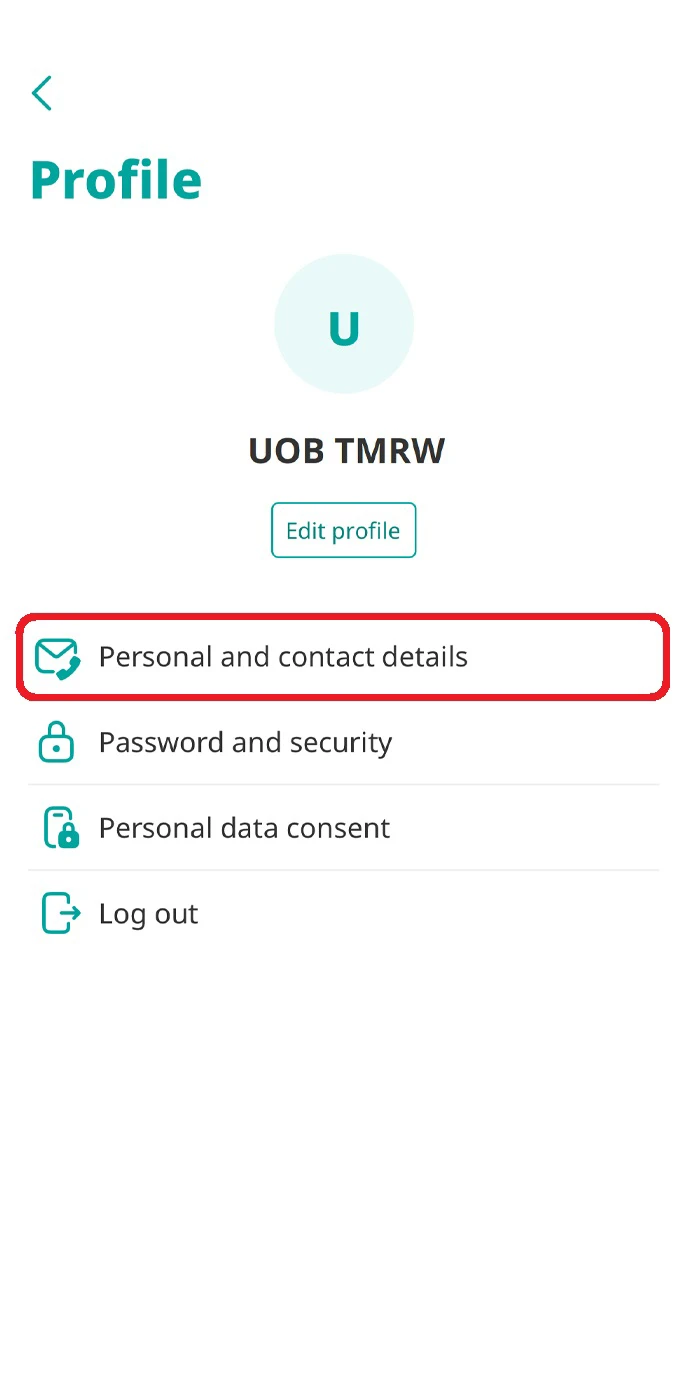

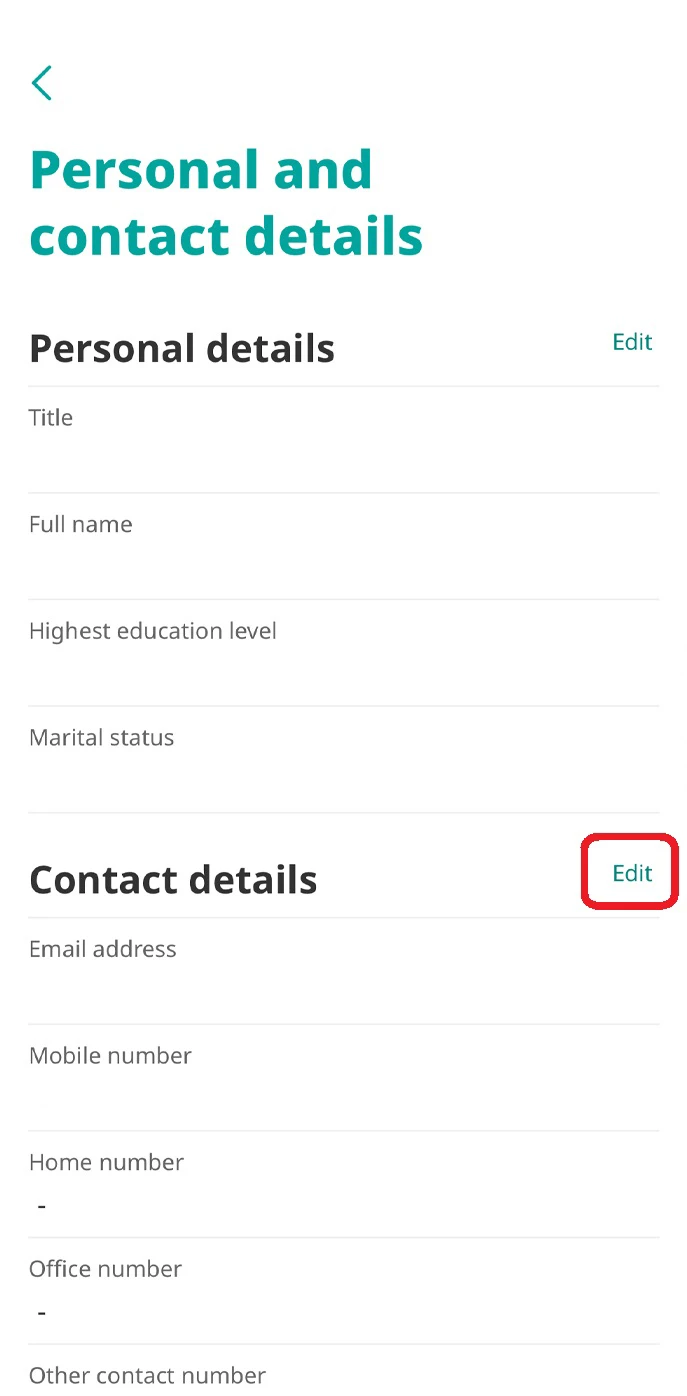

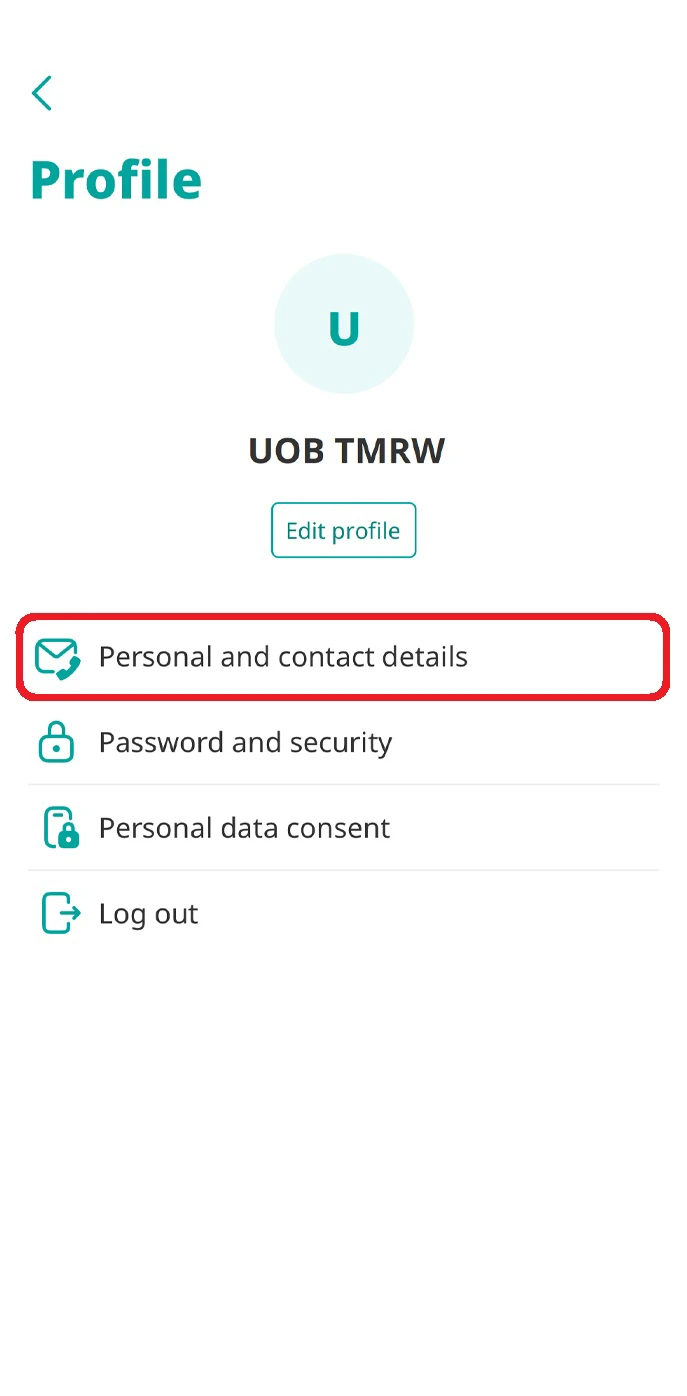

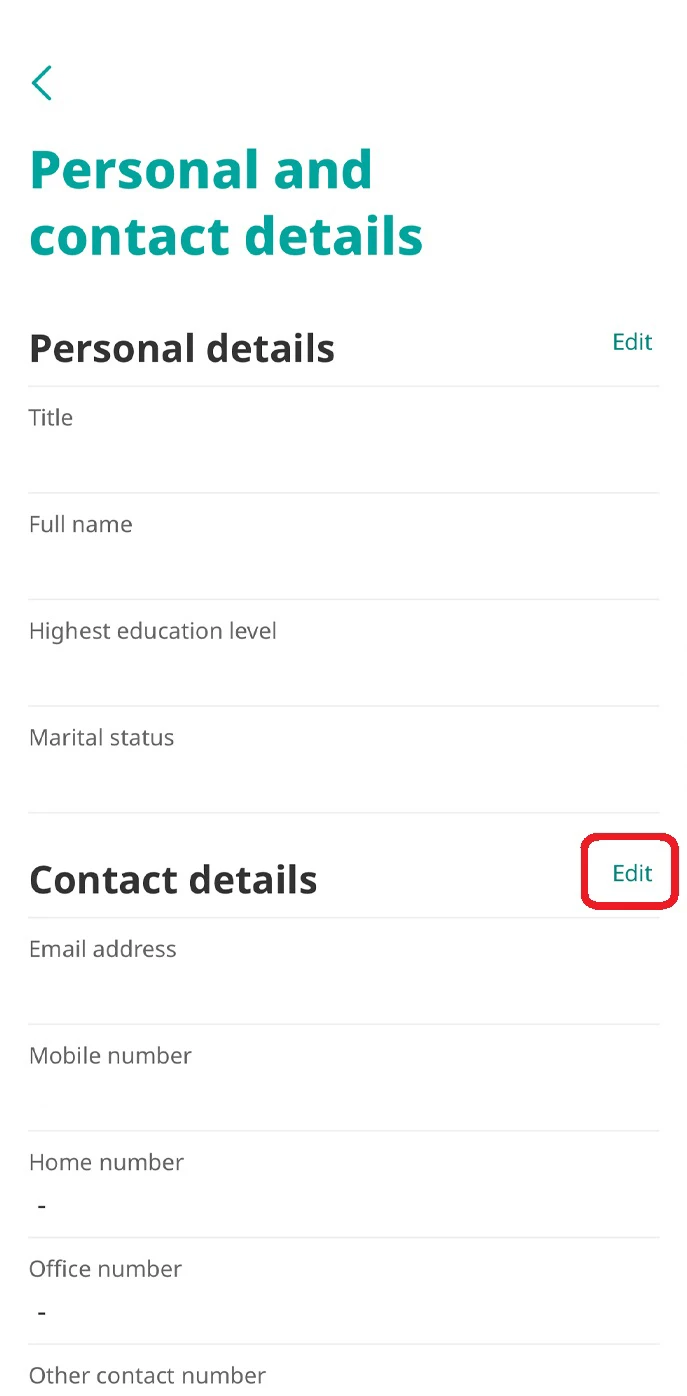

Update personal contact details

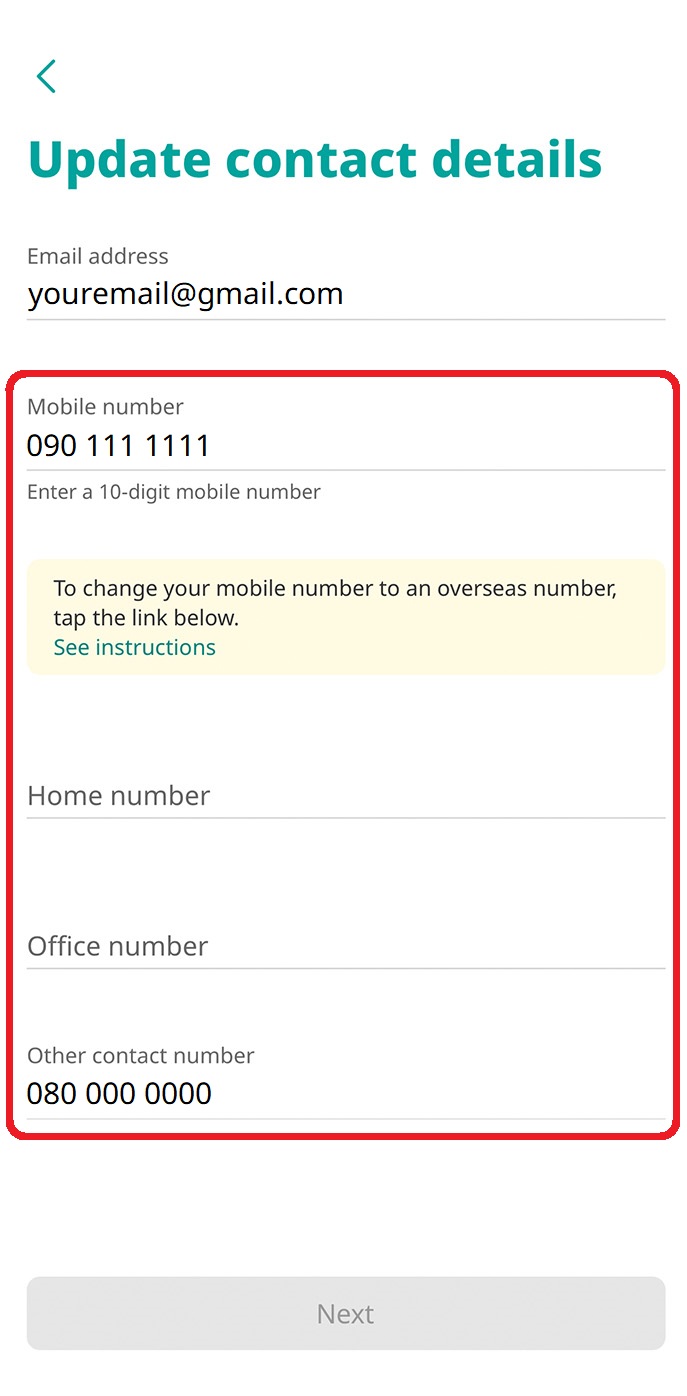

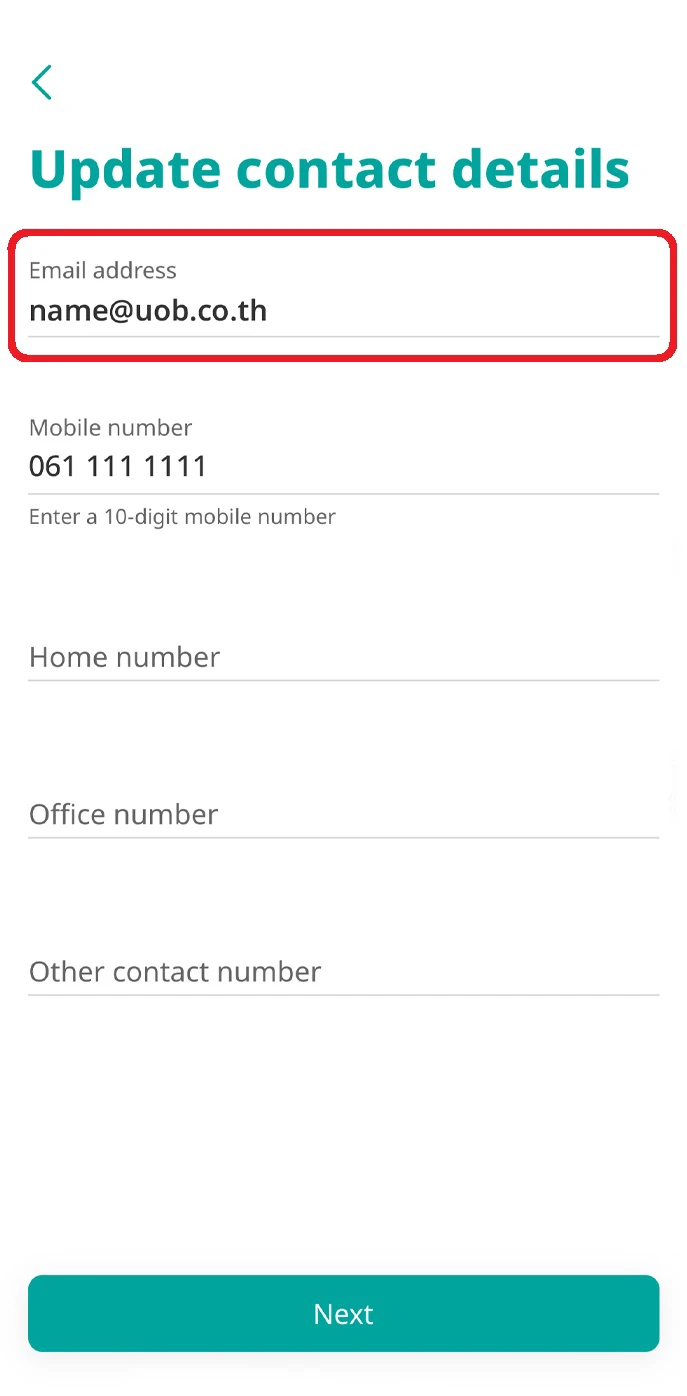

1. Edit phone numbers

1. Log in to UOB TMRW and tap on Profile icon at the top right corner.

2. Select “Personal and contact details”.

3. Tap “Edit” at Contact details.

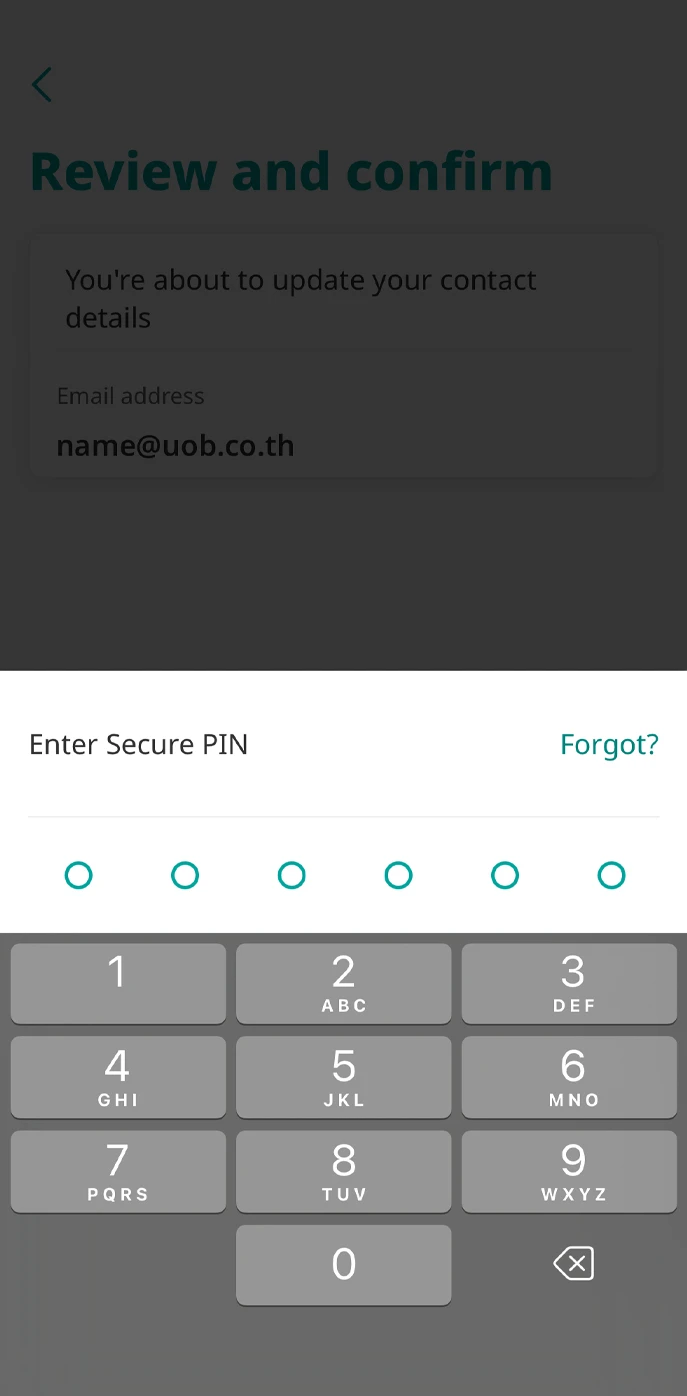

4. Update your phone number (Thai phone number).

Note: To change your mobile number to an overseas number, tap the “See instructions” link and follow the steps.

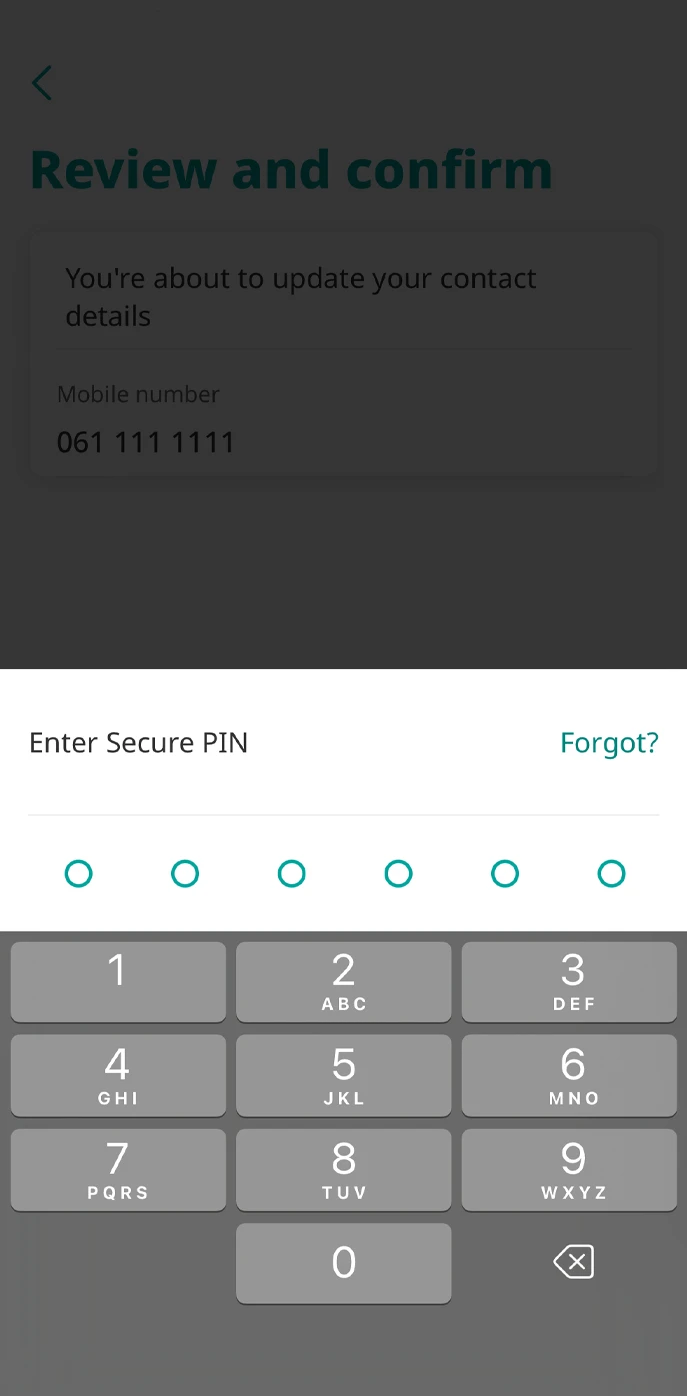

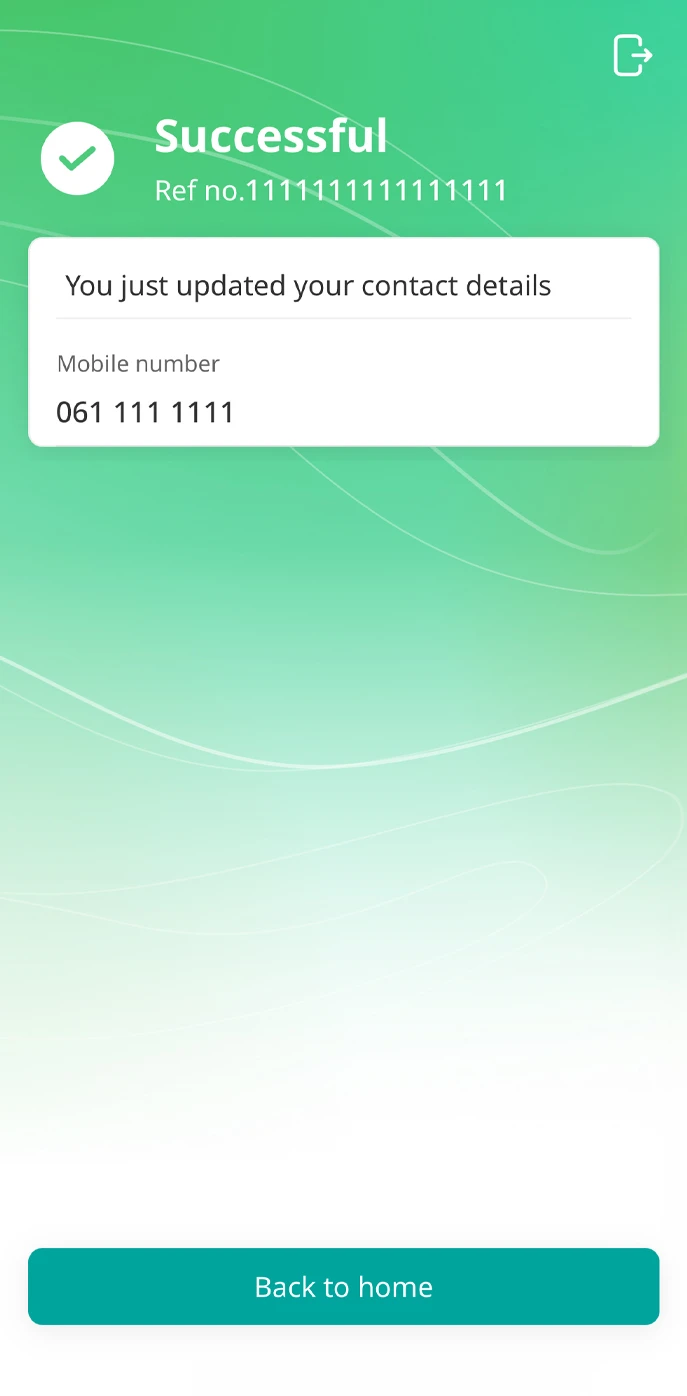

5. Review and confirm change with your Secure PIN.

6. Your change will be updated within 1 working day.

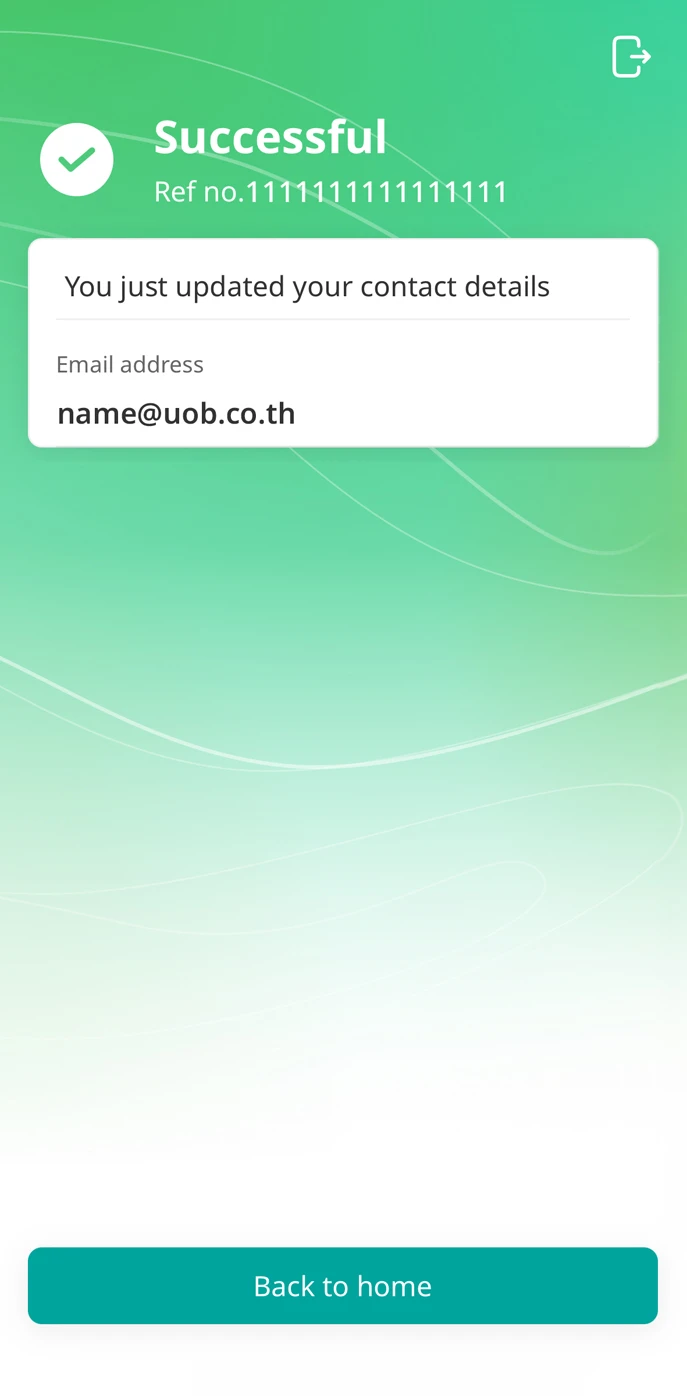

2. Edit email address

1. Log in to UOB TMRW and tap on Profile icon at the top right corner.

2. Select “Personal and contact details”.

3. Tap “Edit” at Contact details.

4. Update your email address.

5. Review and confirm change with your Secure PIN.

6. Your change will be updated within 1 working day.

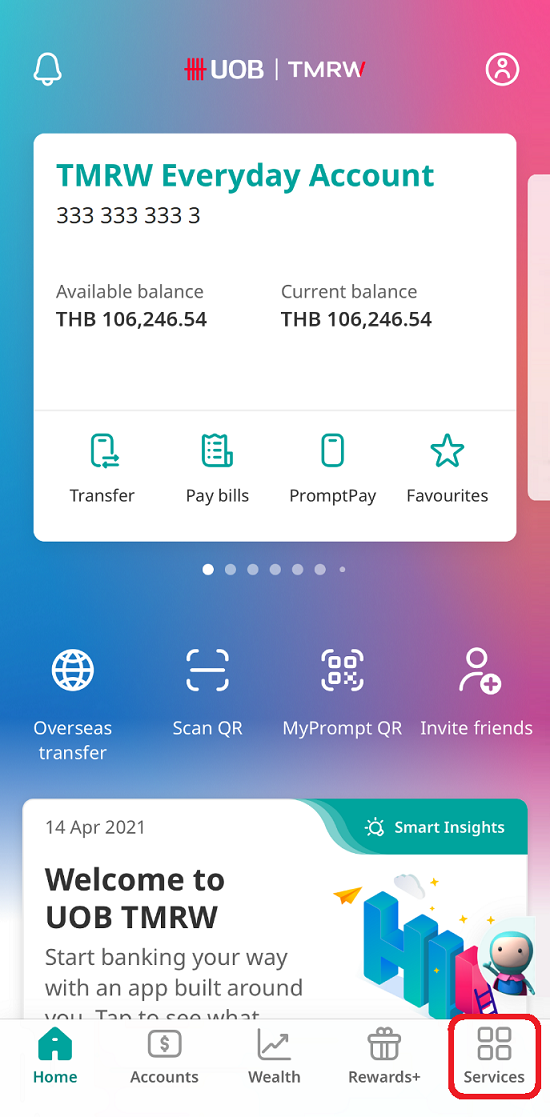

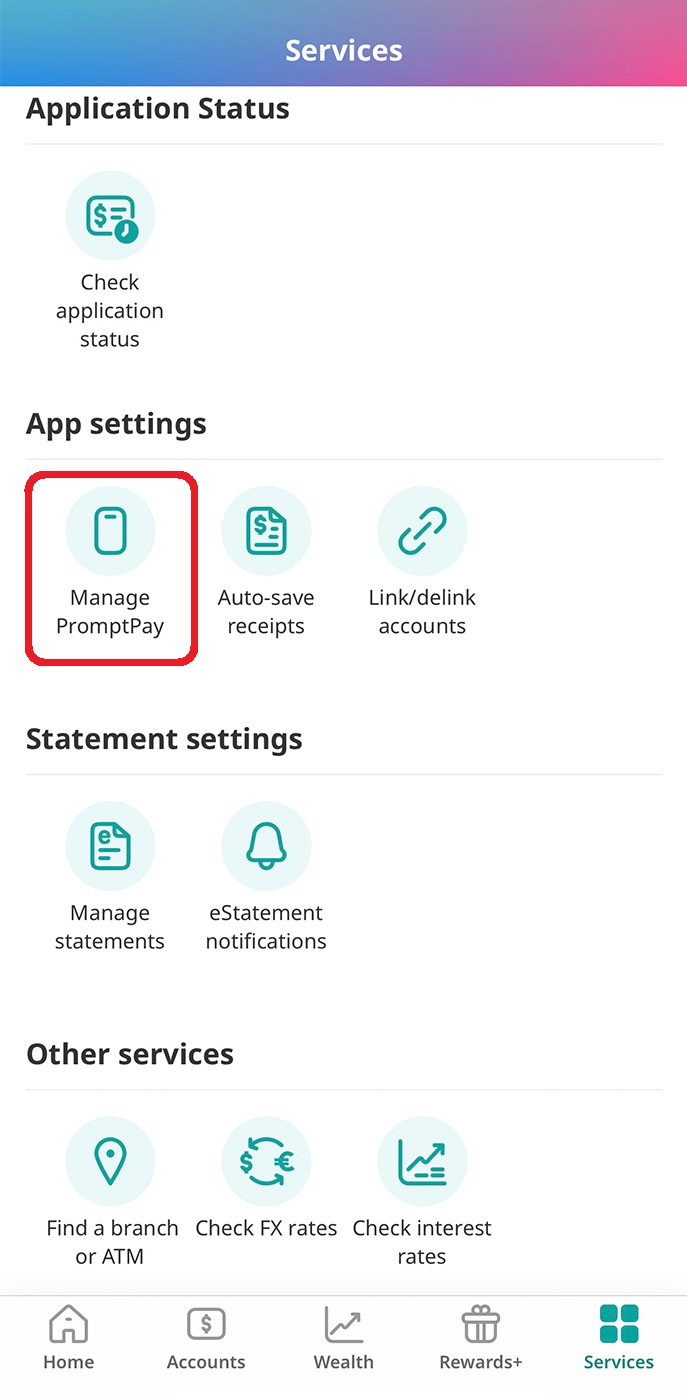

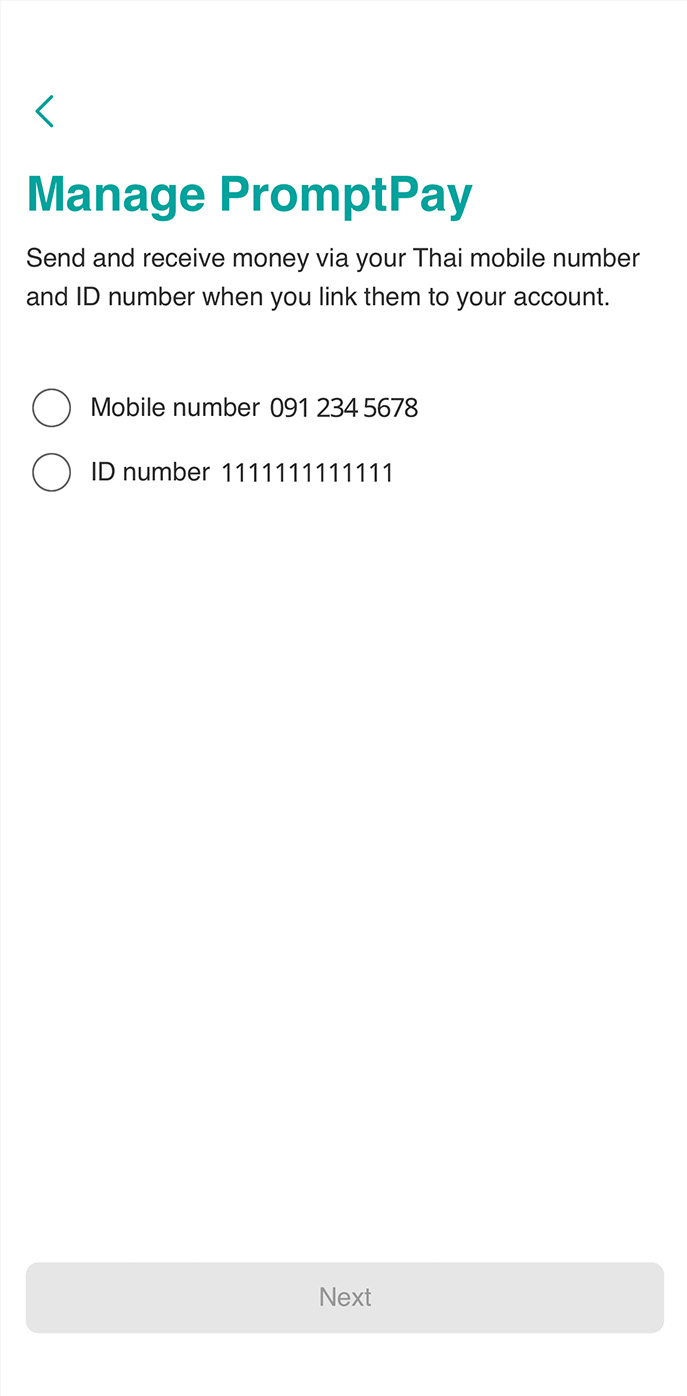

Manage PromptPay

1. Link PromptPay to your UOB deposit account

1. Log in to UOB TMRW and select “Services” menu on bottom right corner.

2. Select “Manage PromptPay” under App settings.

3. Select ID card number or mobile number to connect with PromptPay.

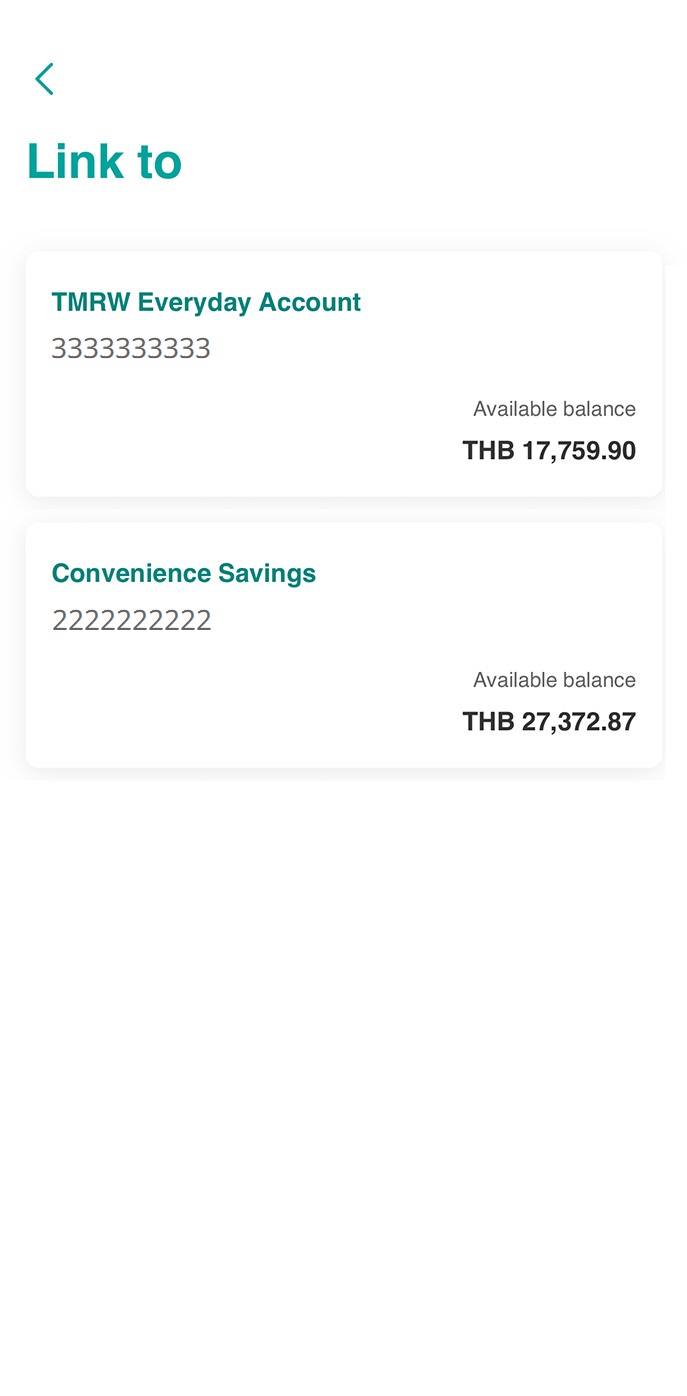

4. Select your UOB deposit account to link with PromptPay.

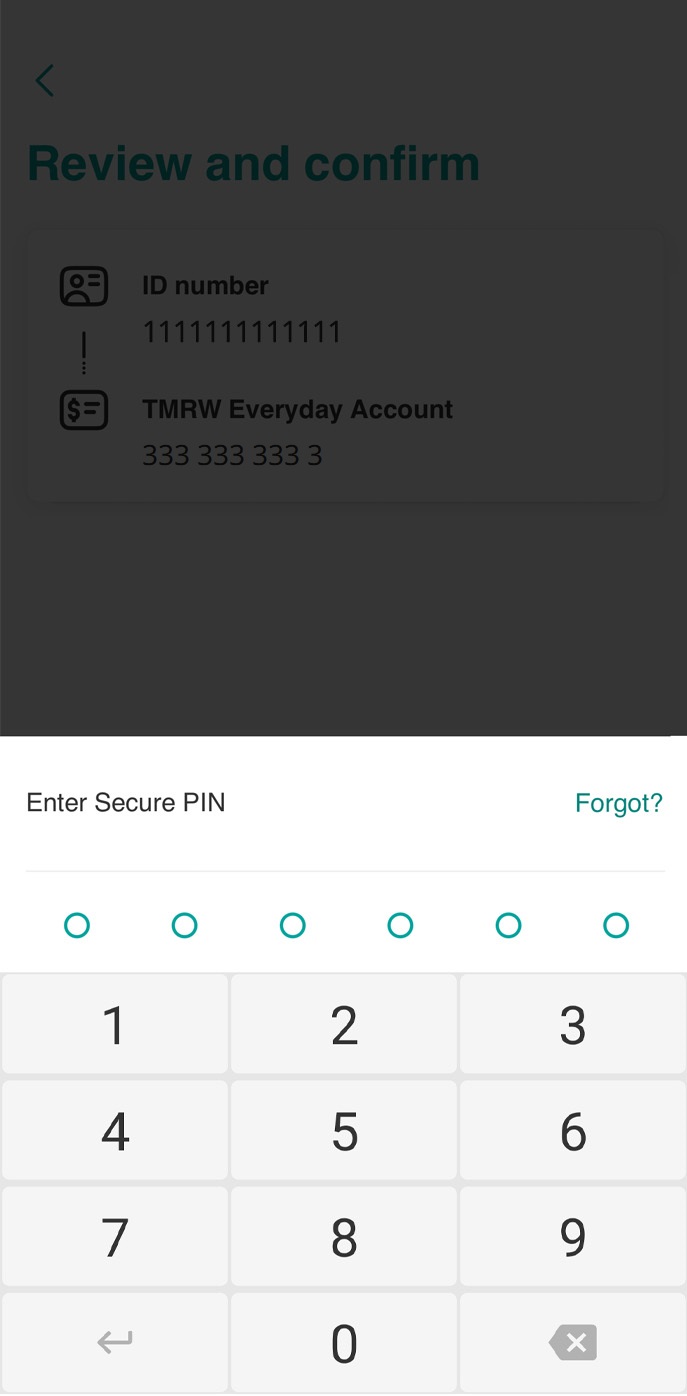

5. Review and confirm with your Secure PIN.

Statement settings

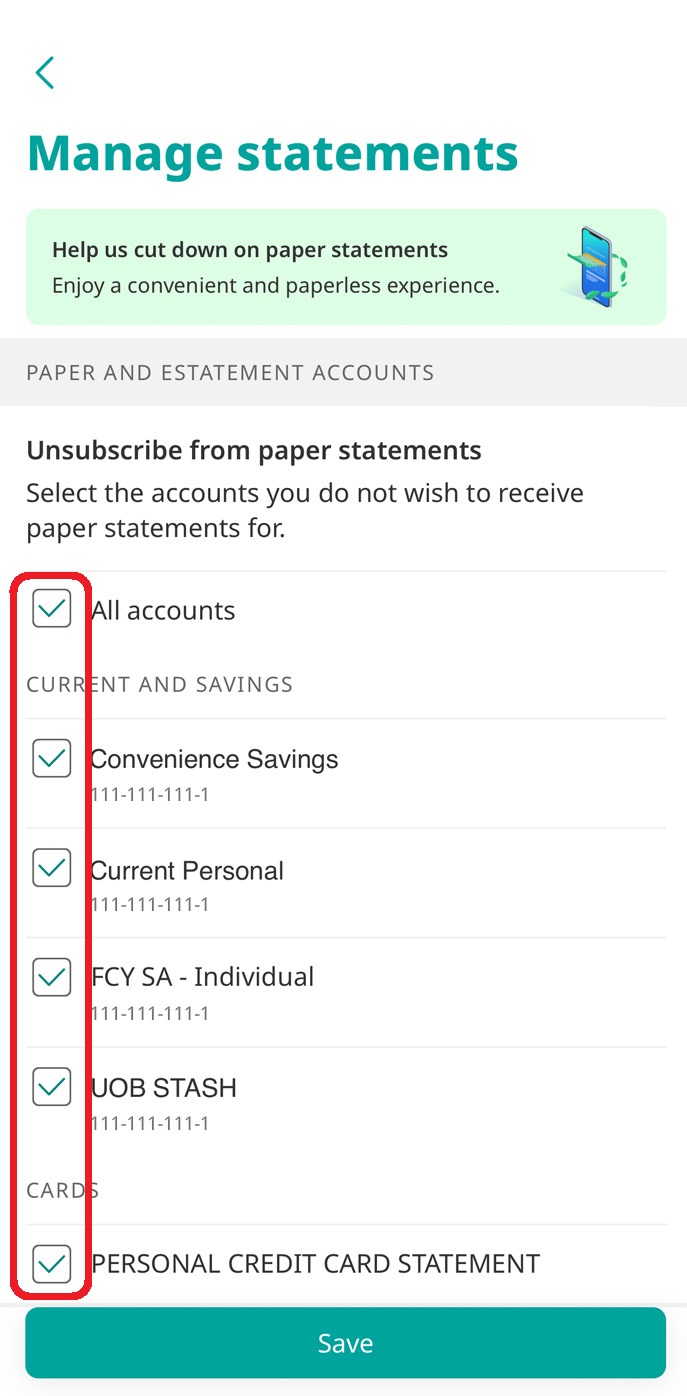

1. Unsubscribe from paper statements

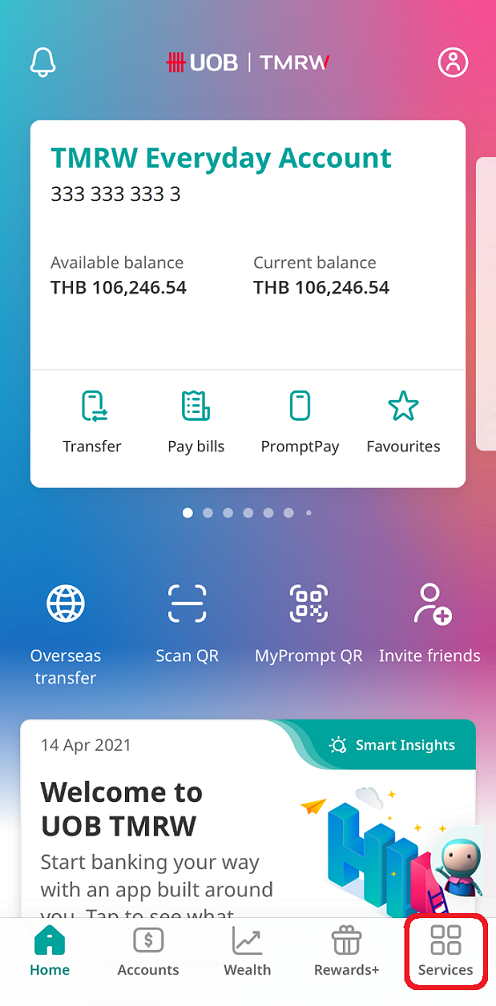

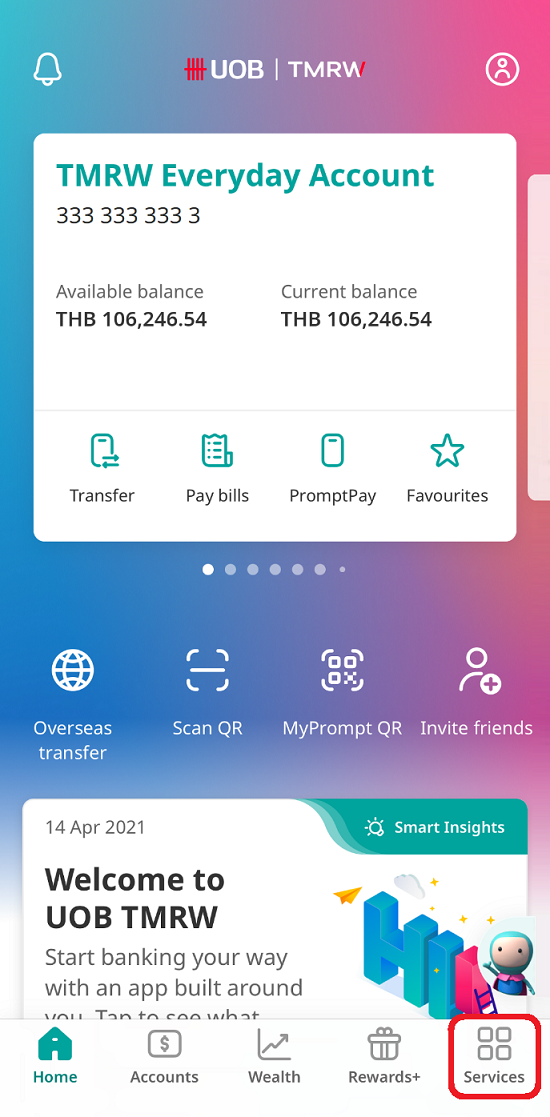

1. Log in to UOB TMRW and tap on “Services”.

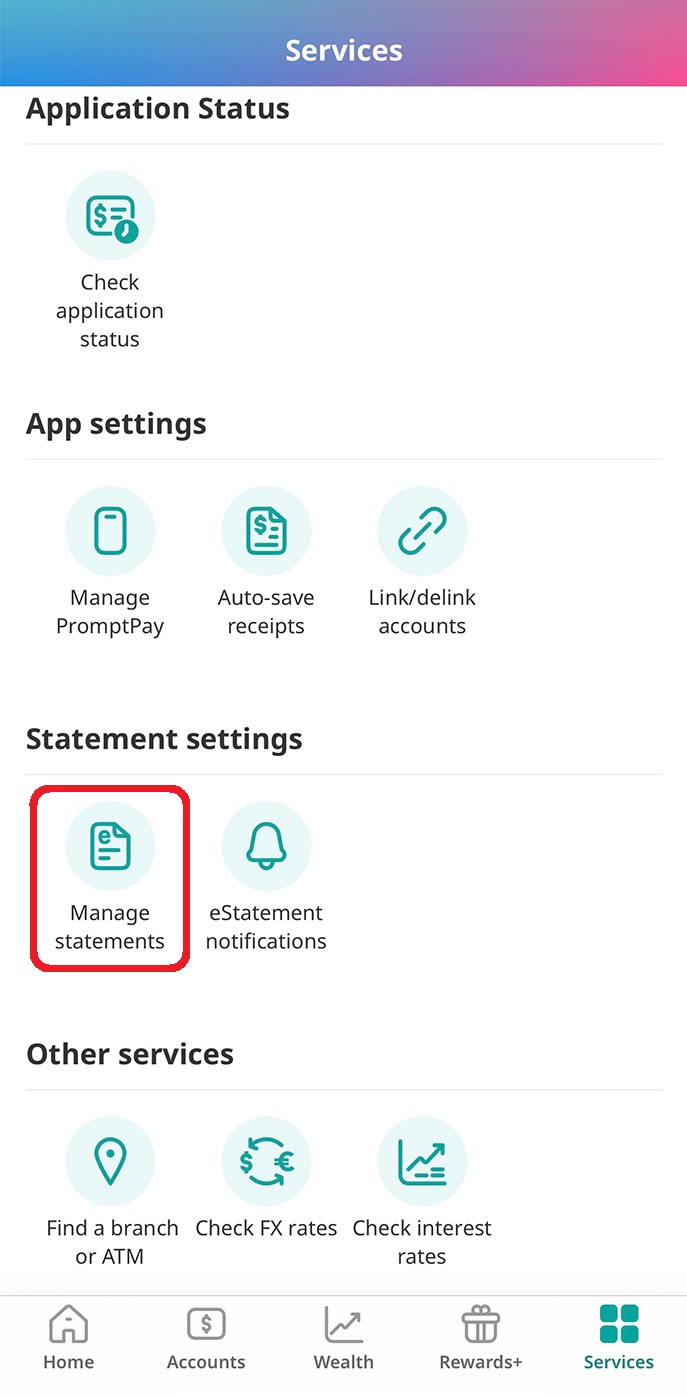

2. Under Statement settings, select “Manage statements”.

3. Select (✔️) accounts you do not wish to receive paper statements for (your eStatements will still be available on app).

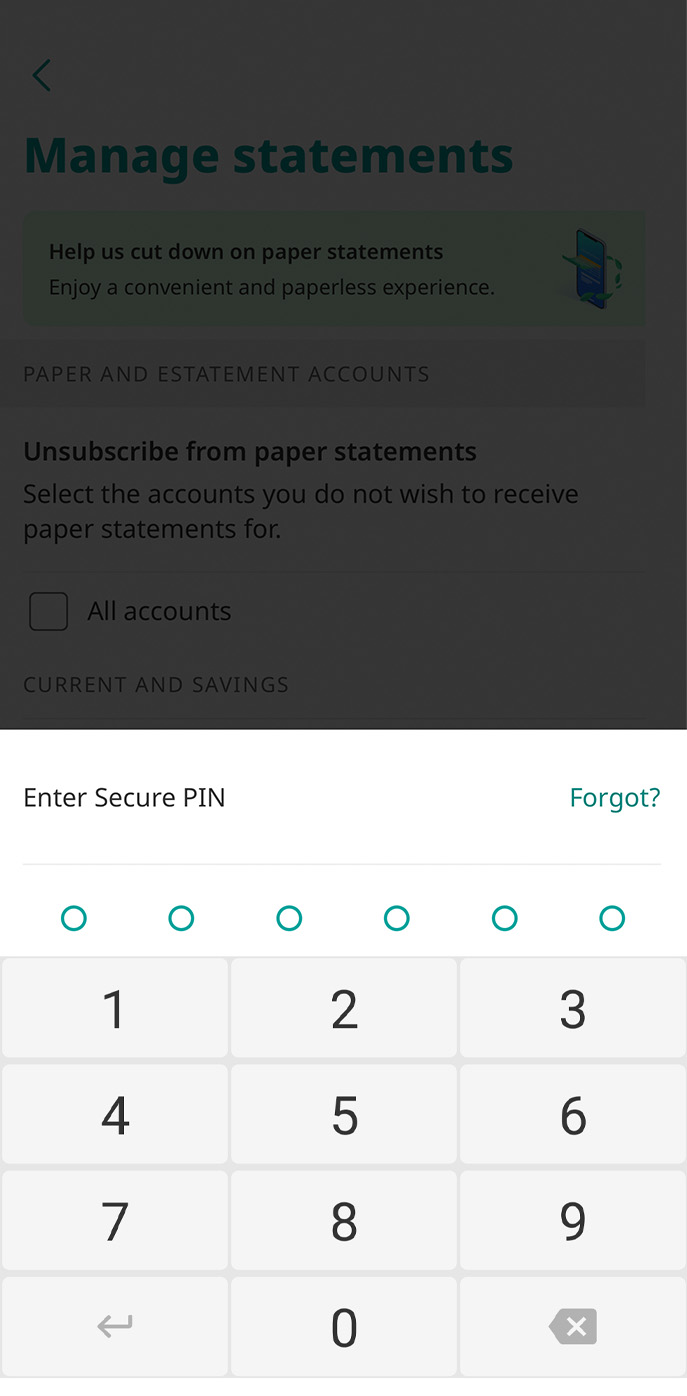

4. Enter your Secure PIN to confirm the setting.

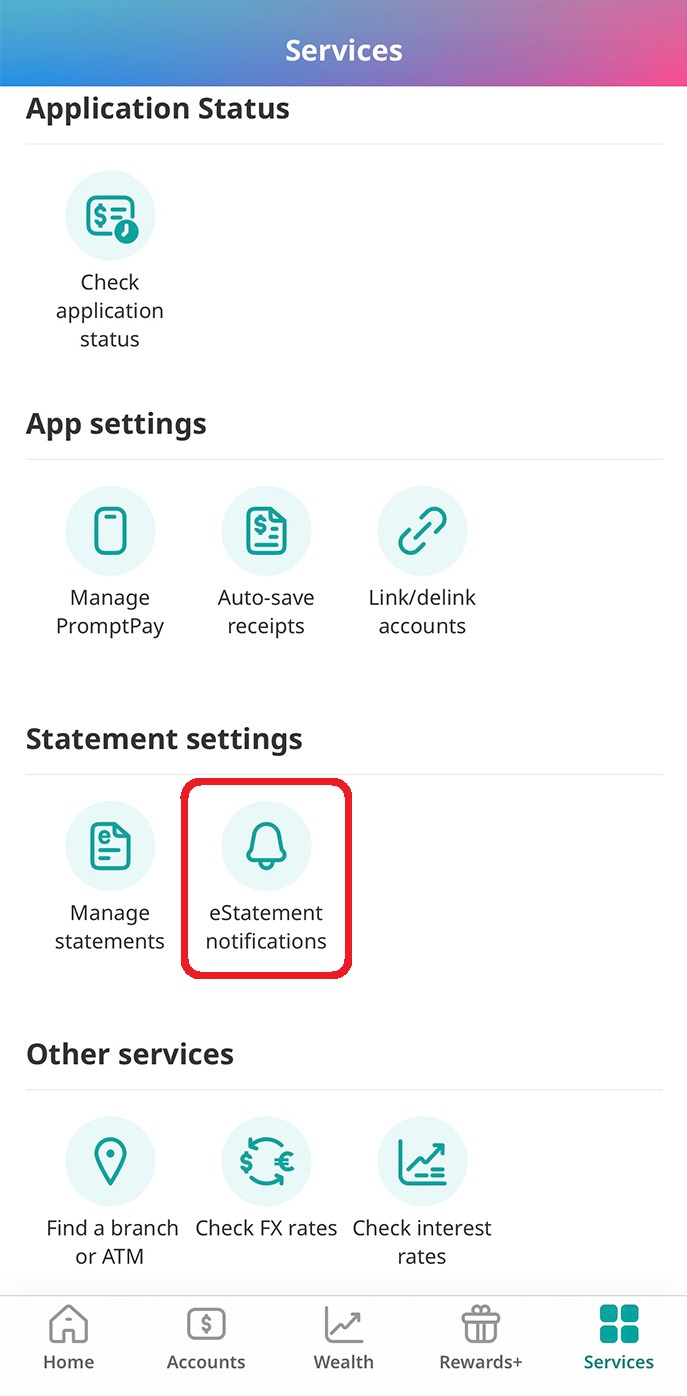

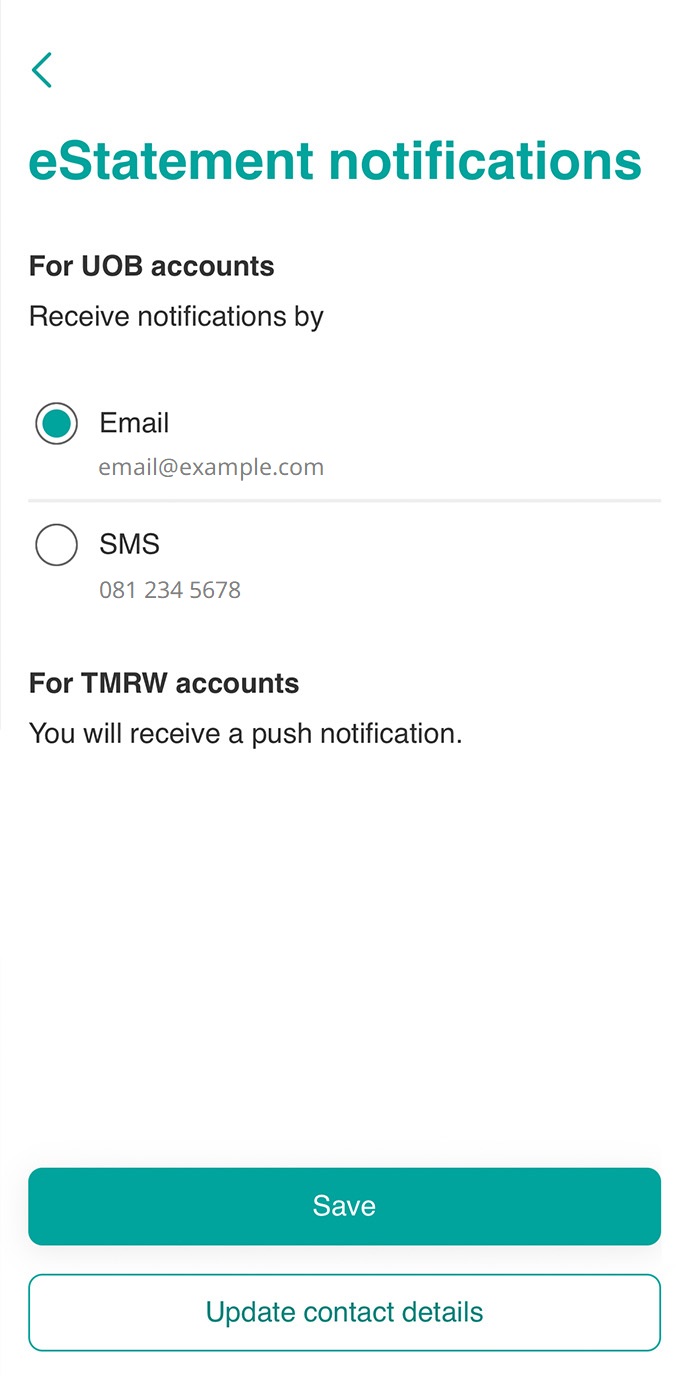

2. Change eStatement notification channel

1. Log in to UOB TMRW and tap on “Services”.

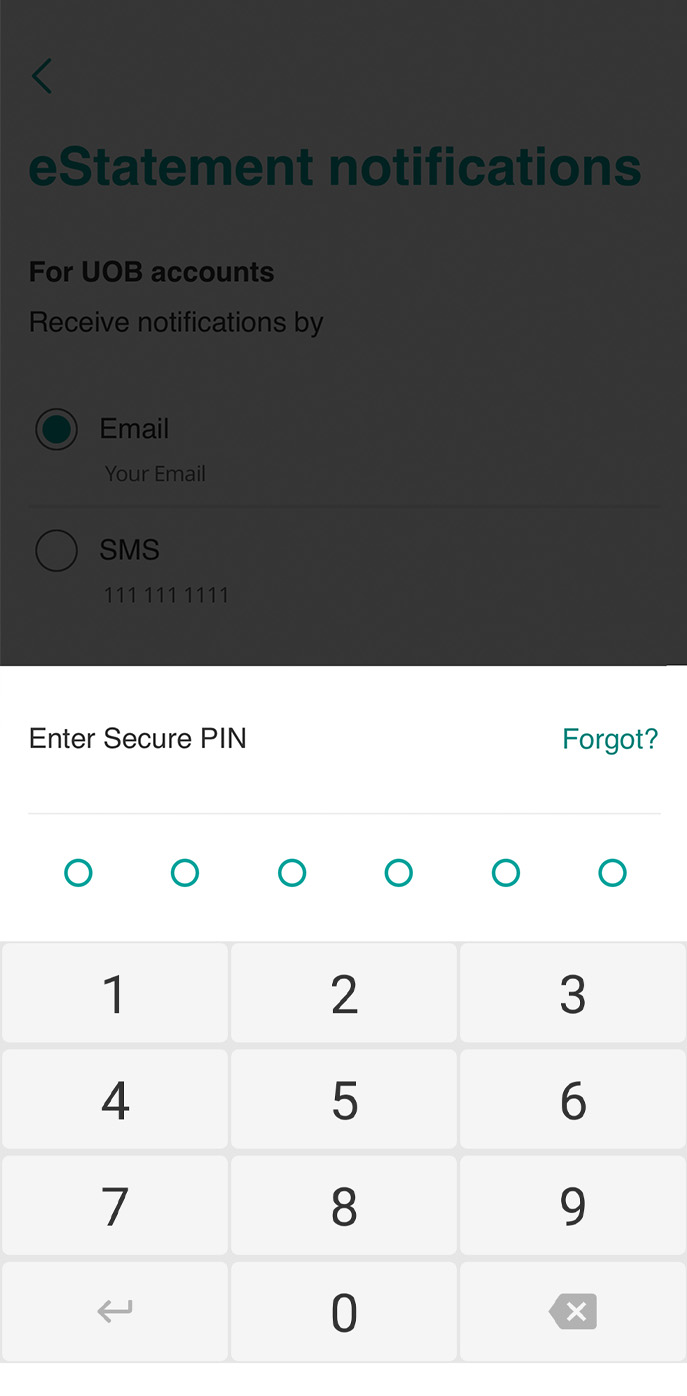

2. Under Statement settings, select “eStatement notifications”.

3. Select SMS or email as the channel to receive notifications when your eStatement is ready to view on UOB TMRW, then tap save.

4. Enter your Secure PIN to confirm the setting.