Invest in Mutual Funds via UOB TMRW

Subscribe, redeem, and switch mutual funds with ease and convenience like never before.

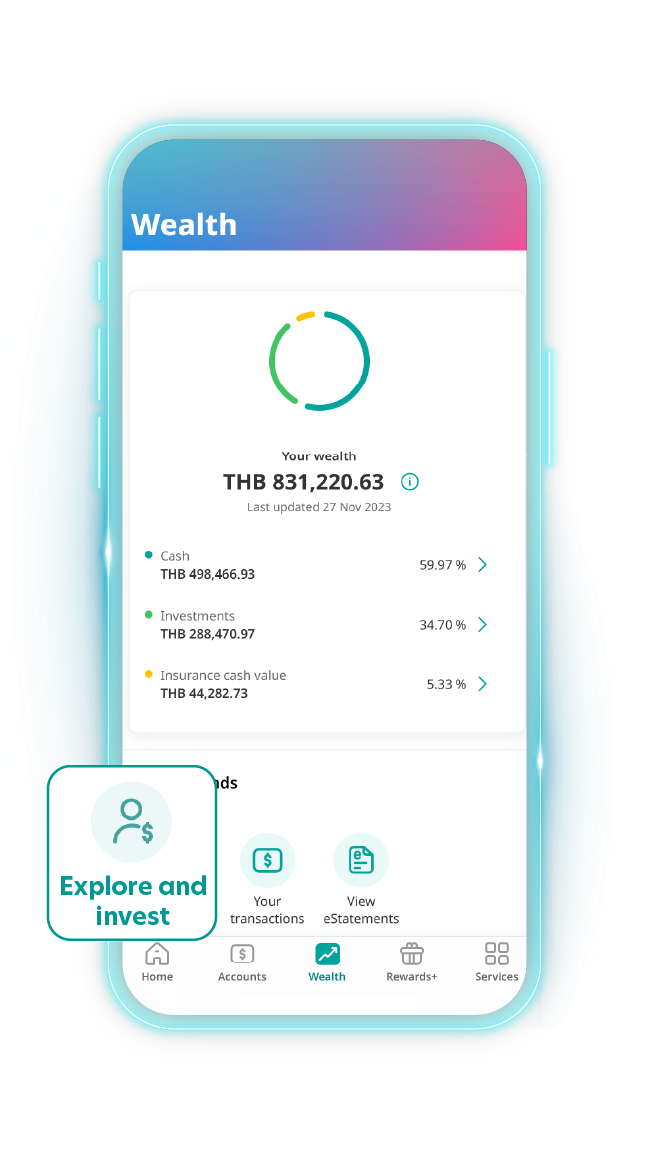

Wealth on UOB TMRW

Access to open architecture platform

Provides you with an opportunity to access varieties of mutual funds that have been carefully selected from various asset management partners

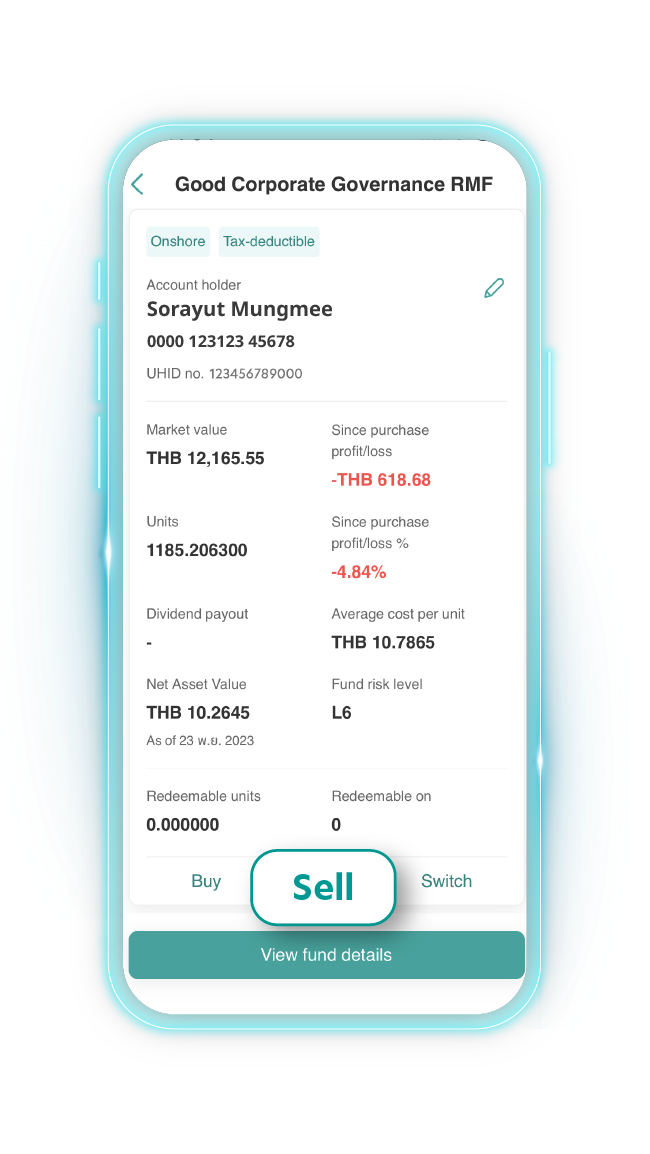

View consolidate portfolio from all fund houses partners

Simply view your current asset under management with current unrealized gain/loss at a glance

Invest with flexible amounts

Easily invest starting from THB 1 (minimum investment amount is as per indicated in factsheet depending on each fund)

Invest Anywhere at Anytime

Conveniently trade on the go with our UOB TMRW App

2 Simple Ways to Invest

Whether you're a beginner or a seasoned pro investor for mutual fund trading, UOB TMRW app simplifies investing through 2 options.

- Kickstart your investment journey with our 4 expertly crafted fund portfolios based on your desired returns, investment goals and risk appetite. Tap on insights and research from our CIO team (Chief Investment Office of UOB Private Bank Singapore) with Income and Growth portfolios.

LIQUIDITY: Thai Cash Management Fund (TCMF)

Consistent and reliable, it prioritises safety and security while protecting your liquidity.

- A mutual fund that focuses on investing in bank deposits or short-term fixed income securities with a remaining maturity of up to 1 year.

- Expected risk: Low

- Estimated return: 0.3%-0.4% per year

STABILITY: United Quality Income Fund (UQI-N)

Delivers stability and a regular income, enabling you to receive steady income even during market downturns.

- A mutual fund that focuses on investing in high-quality fixed income securities.

- Expected risk: Low to medium

- Estimated return: 4%-5% per year

INCOME: United Income Fund (UIFT-N)

(CIO Fund) A robust, well-rounded portfolio of income-generating investments that offers regular payouts. Leverage on insights from the UOB Private Bank CIO team.

- A mutual fund that focuses on investing in fixed income securities and stocks around the world.

- Expected risk: Medium

- Estimated return: 6%-8% per year

GROWTH: United Growth Fund (UGFT)

(CIO Fund) Offers variety and higher returns by investing in higher-risk assets to help you achieve long-term capital appreciation. Leverage on insights from the UOB

- A mutual fund that focuses on investing in fixed income securities and stocks around the world.

- Expected risk: High

- Estimated return: 8%-10% per year

- Take control of your investment portfolio by selecting individual funds from our extensive range of over 200 options from leading fund houses.

Core Solutions

Suitable for first-timers or those looking to build a stable foundation for their portfolio given less volatile characteristic funds to help you better ride out market cycles.

Top Ideas

Compelling market opportunities investors should consider and are suitable for those focusing on capturing targeted, short-term opportunities.

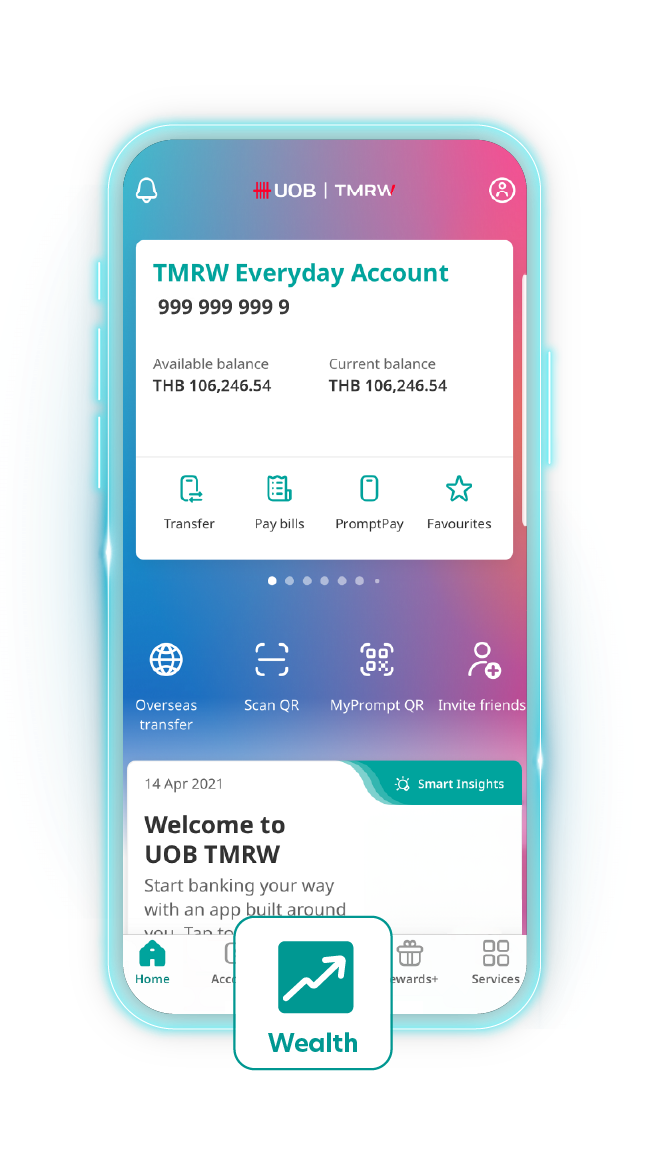

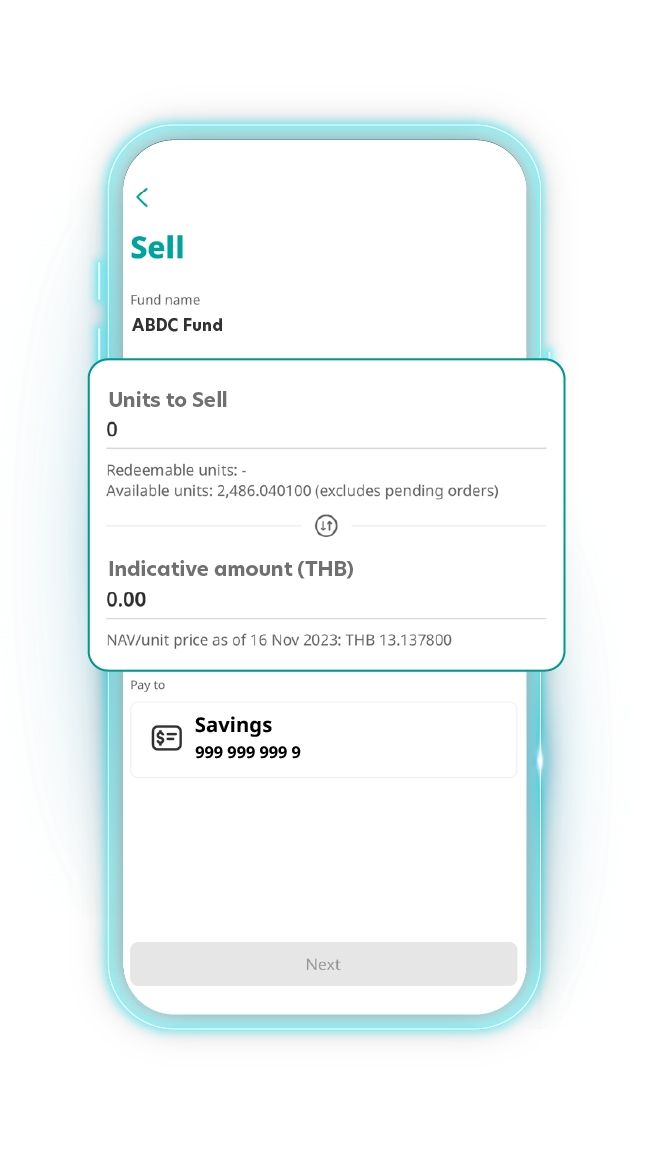

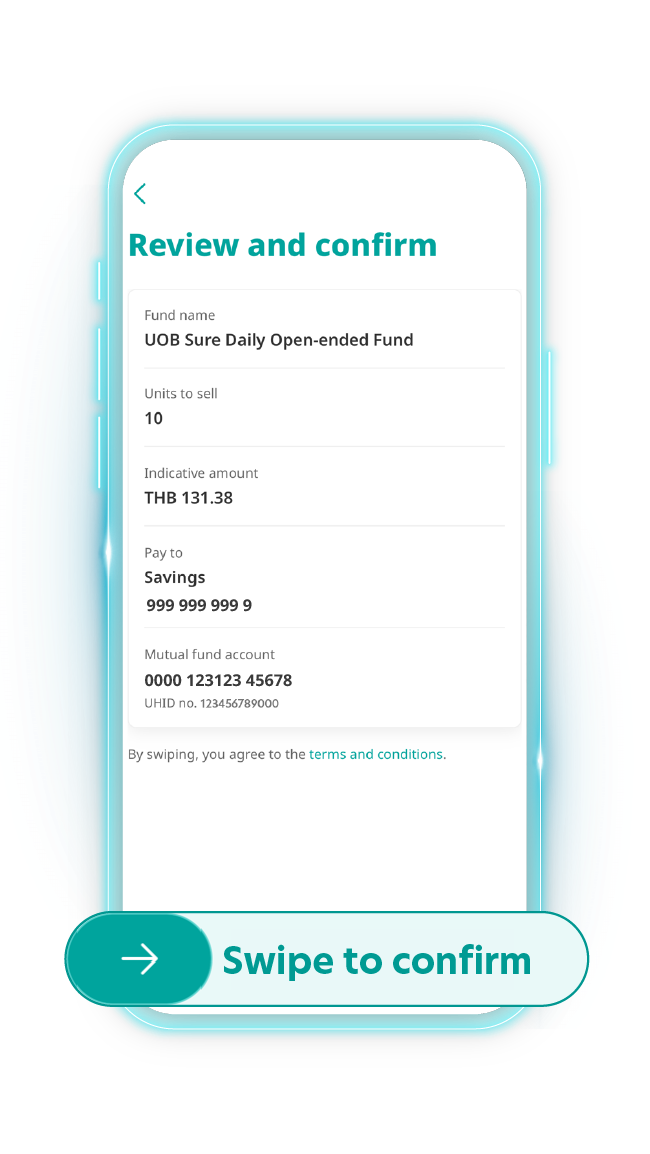

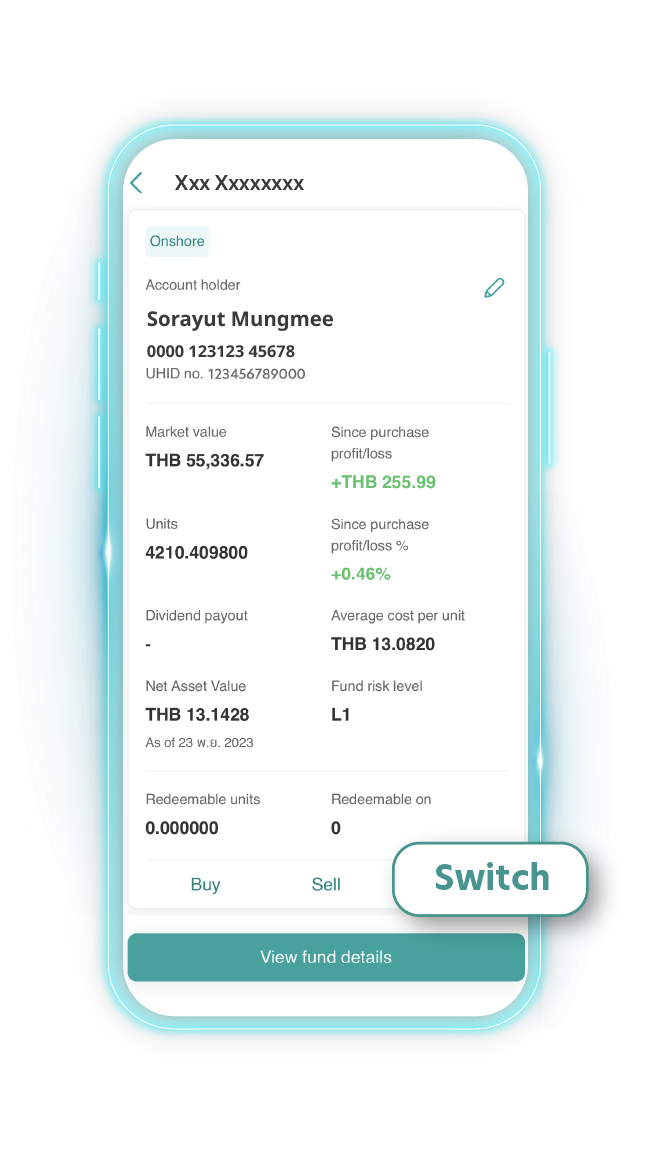

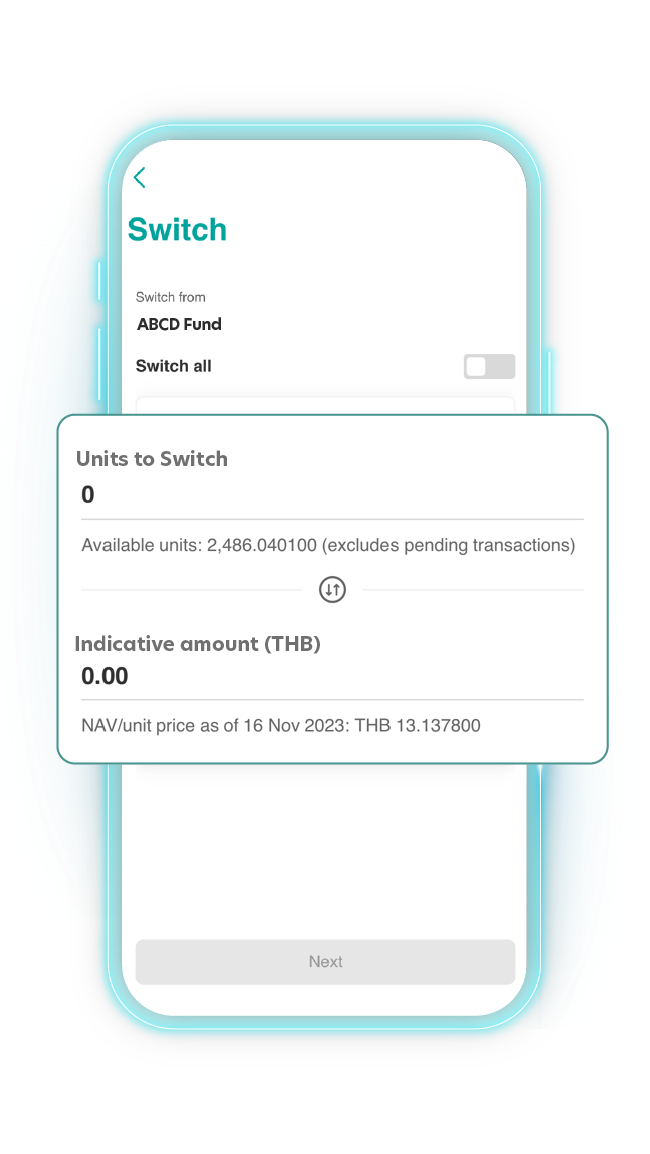

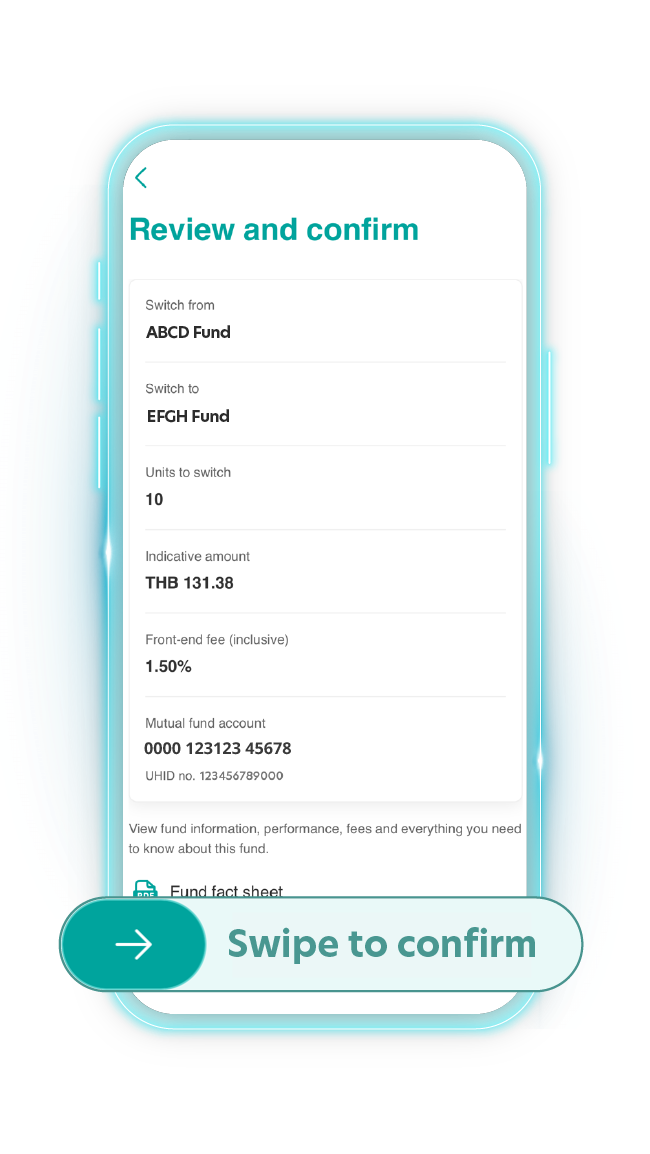

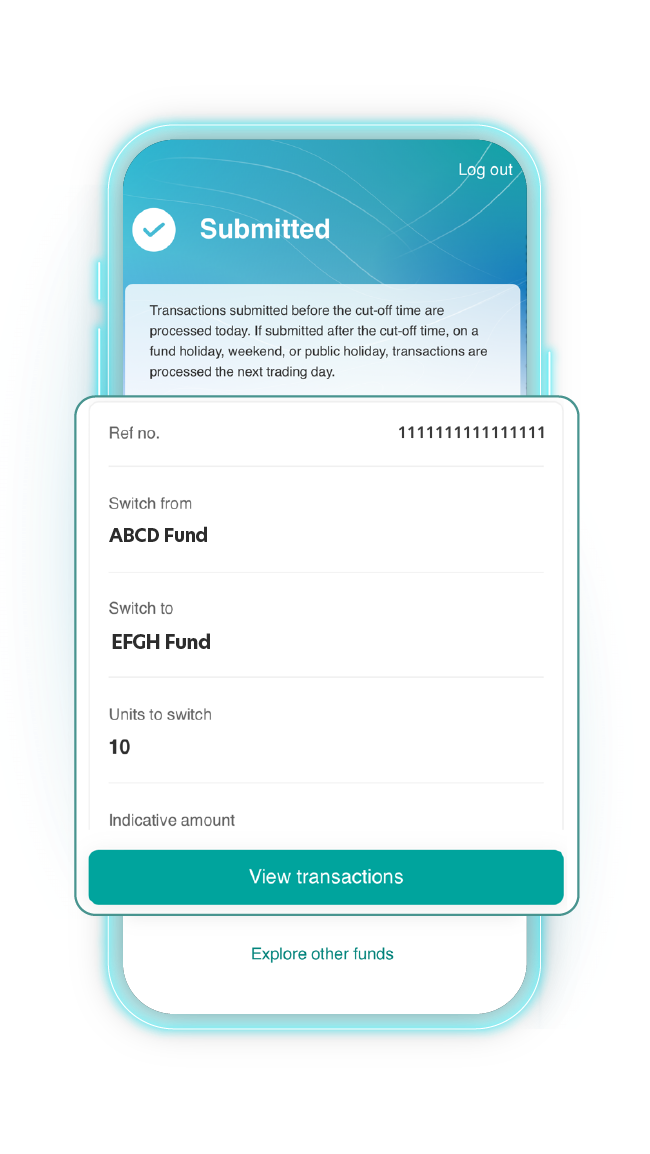

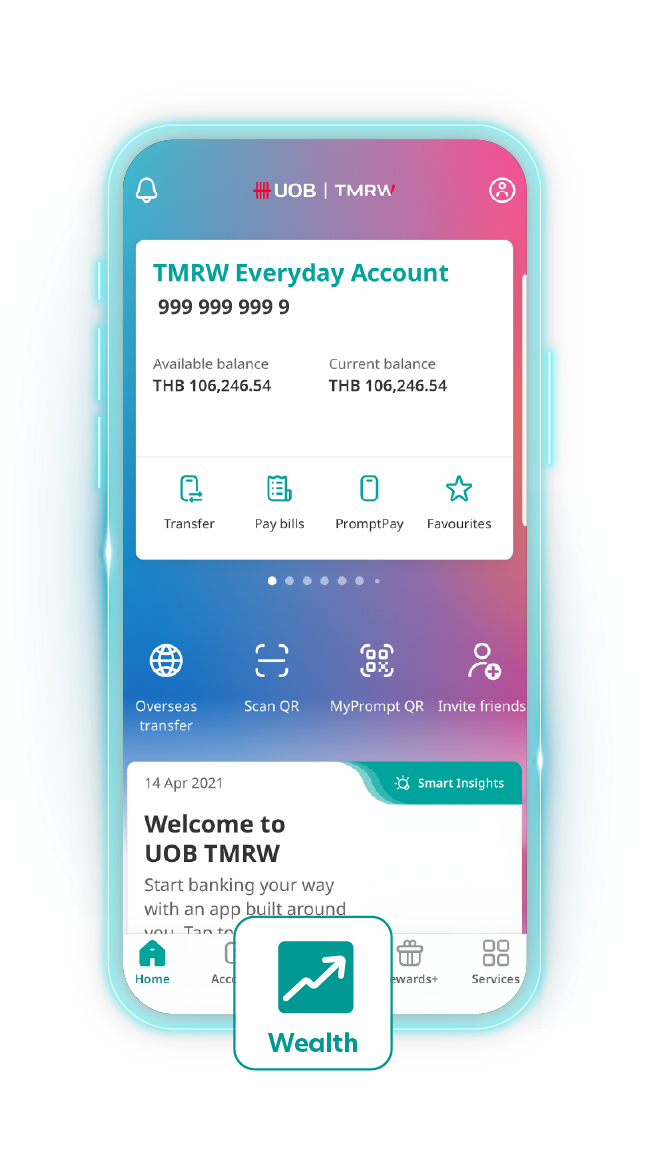

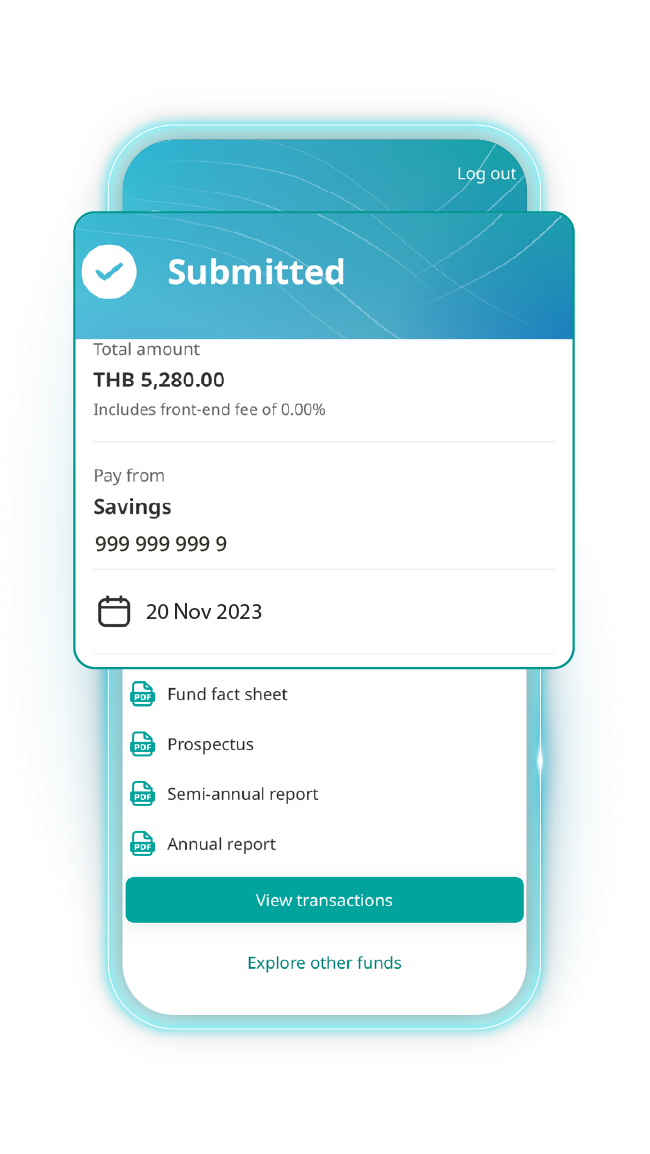

How to Trade Mutual Fund

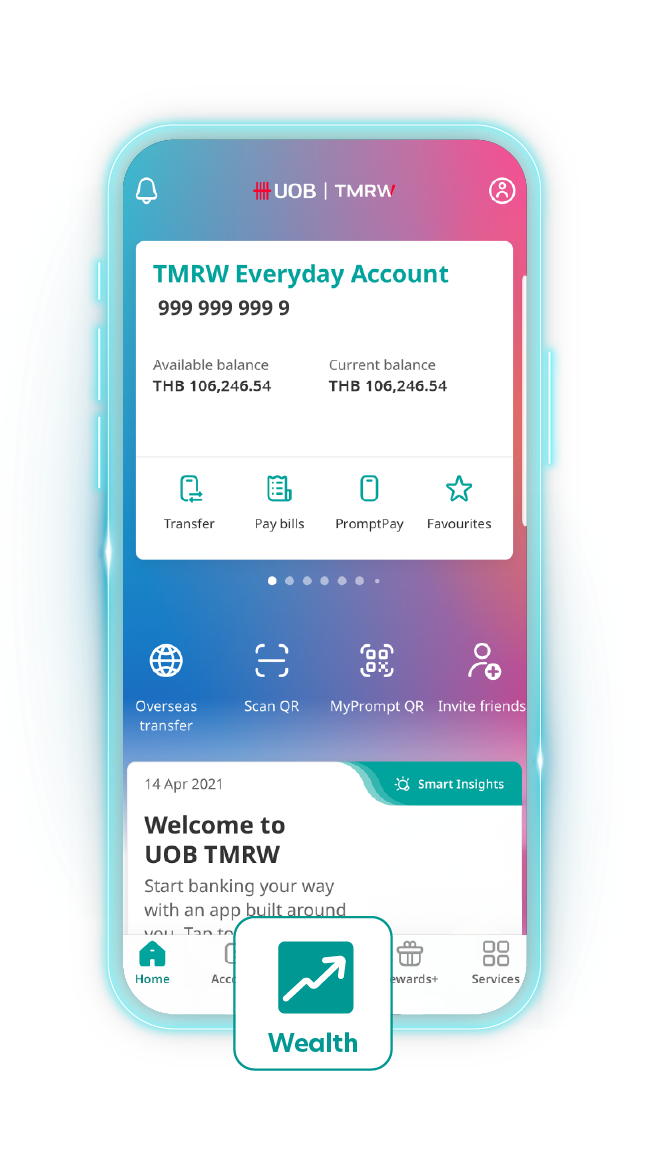

1.Log in on UOB TMRW app and tap on “Wealth”

2. Tap on “Explore and Invest”

3. Choose your fund from two options

- Created for you or

- Choose you own

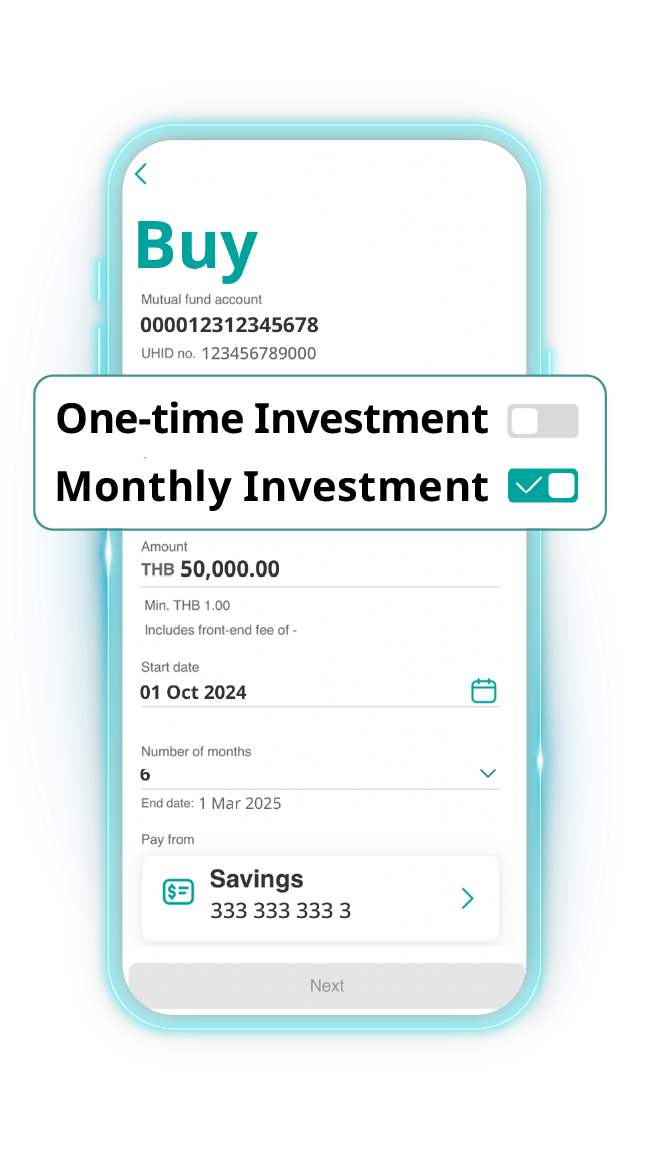

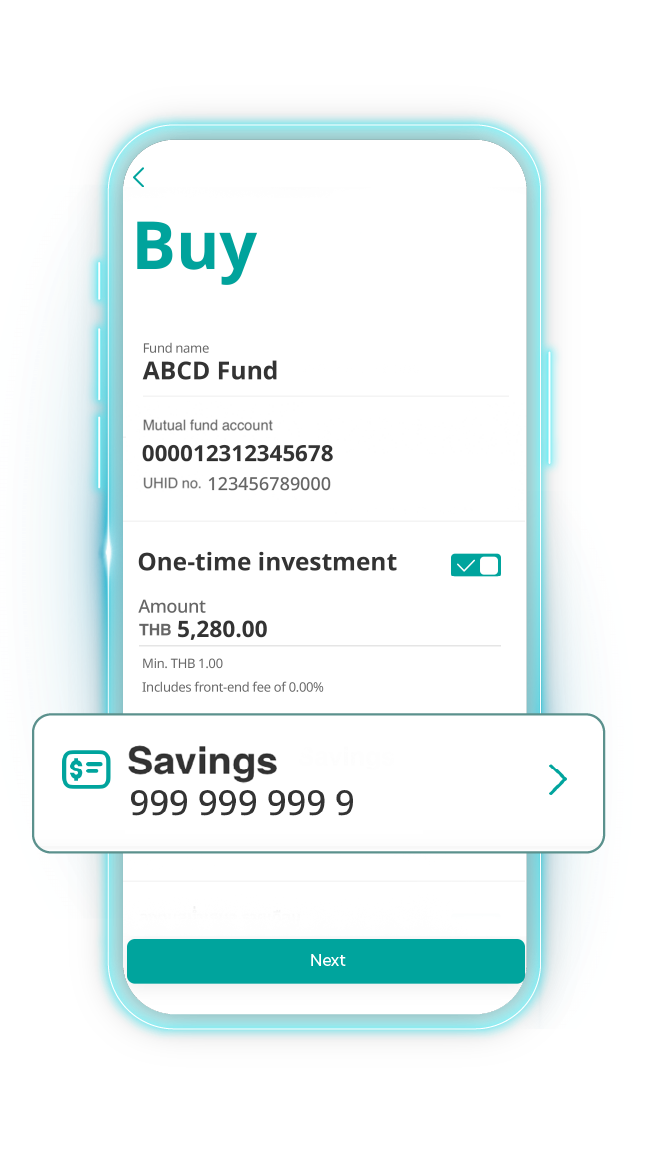

4. Choose your mutual fund account and enter the amount to invest, as one-time investment or as recurring monthly investments.

5. Select your UOB savings account or credit card to pay from, then review and confirm the transaction.

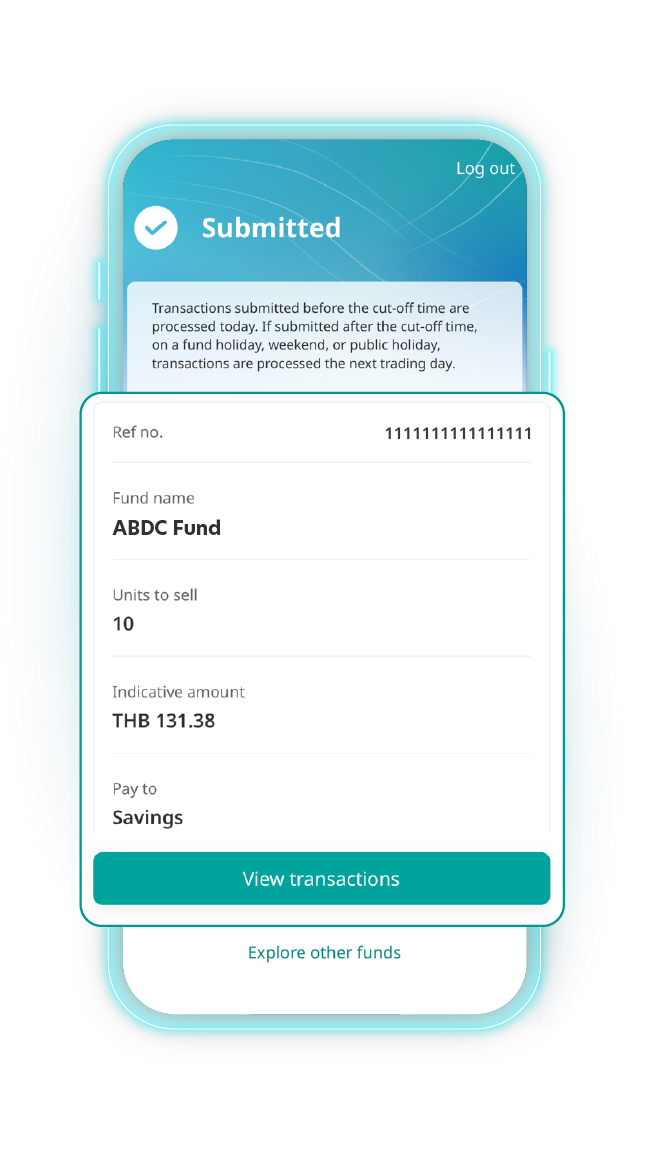

6. Transaction completed (subscription order processing time as specified in the factsheet)

Set up your monthly investment plan today for steady growth and reduced risk. Learn more

Important Notice

- The option to settle payments through your UOB credit card is available for tax-benefit funds of UOBAM and require a minimum investment of 1,000 Thai Bath. Use when necessary and pay back full amount on time to avoid 16% interest rate

- Customers holding UOB deposit and mutual fund accounts can seamlessly purchase mutual funds through the UOB TMRW app.

- Onshore funds: Mutual funds managed by asset management companies registered in Thailand.

- Offshore funds: Mutual funds managed by asset management companies registered outside of Thailand. To invest in offshore funds, you will require a savings account in either USD or EUR . Additionally, you must open a Foreign Investment account. For assistance, please contact your Relationship Manager or visit any UOB branch.

- To subscribe to tax-deductible funds, investors must complete the CRS tax residency self-certification form. If this has not been done, please visit a UOB branch before making purchases via UOB TMRW app.

Caution: Investment contains specific risk. Please understand characteristic of goods, condition, return and risk before making investment decision and study tax benefits in the investment handbook of such fund.

For those who are interested in opening a mutual fund account, please contact UOB Branch.

Invest in a diverse range of over 300 mutual funds from various asset management companies. View our investment partners

If you already have UOB mutual fund and deposit accounts, then you're set for investment trading via 'Wealth' menu on UOB TMRW app. See how-to guides

Things You Should Know

Read more

Do I need to pay a platform fee when I invest via UOB TMRW?

There is no annual platform fee.

How do I start investing?

You must have UOB mutual fund account and UOB savings account then you can register for UOB TMRW app. You need to be 20 years old and above to invest. For those who are interested in opening a mutual fund account, please contact UOB Branch.

I'm not a Thailand citizen or PR. Can I invest?

Yes, foreigners can invest except for citizens or permanent residents of any US state or US territory.

I have already completed a customer suitability assessment elsewhere. Must I do it again?

For customers who have not completed suitability assessment through UOB branches or UOB TMRW app, you need to complete the assessment again at a UOB branch or through the UOB TMRW app. The assessment will be displayed on the app before you make a subscription, redemption or switching transaction.

Will I get regular payouts for my investments? If yes, which account do they go to?

The dividend share class fund will have a regular payout for onshore funds. The dividend will be credited to your UOB savings or current account that is linked to your mutual fund account. While dividend share class funds for offshore fund will be reinvested into money market fund in the same currency with offshore dividend share class funds (USD or EUR).

How can I set up a monthly investment (Regular Saving Plan or RSP)?

Monthly investment or regular saving plan (RSP) uses the dollar cost averaging (DCA) strategy of buying mutual funds for the same amount on regular schedule, typically monthly. You can set up a regular monthly investment list by following these steps.

- Select the Wealth menu and choose to purchase a mutual fund.

- Select the fund you want to invest in regularly/monthly.

- Select Invest regularly monthly by tapping the button on the right to bring up the check mark symbol (✔️)

- Specify the amount Start date, number of months, and select the account to pay for the purchase of investment units.

- Check details and confirm the item and enter the 6-digit Secure PIN code.

Read more details about the steps for monthly investment.

What fund houses can I buy funds from?

You can choose to buy over 300 funds, see the list of our partner.