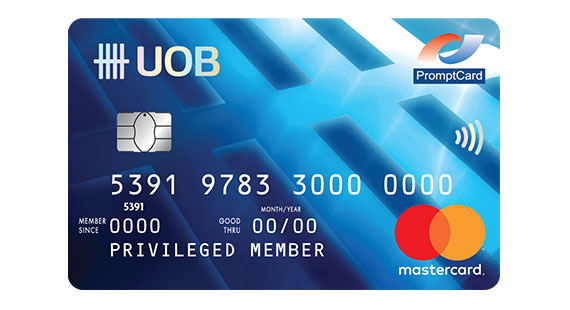

UOB Mastercard Debit

FAST CASH ALL OVER THE WORLD

- 2-in-1 card combines the convenience an ATM card and Debit card all in one card.

- The daily maximum cash withdrawal is up to THB 100,000.

- Able to use Debit card for spending at participation merchants with PromptCard or MasterCard Sign and Online Merchants worldwide. The daily maximum spending is total up to THB 100,000 both EDC and Online Spending.

- Fast and convenient. Tap to pay for purchasing goods and services at any store with Contactless Payment symbol . No PIN required for transaction under THB 1,500.

- Withdraw cash just like an ATM card from nationwide and worldwide ATMs displaying Promptcard or MasterCard sign.

- Track your spending from monthly statement for free.

- Phone Banking 24-hour service 0-2285-1555

Terms and Conditions

Qualifications of Applicant

Qualifications of Applicant

- 15 Years of age

- Have a Saving Account with UOB Bank

Conditions of Applications

- 1person / card

Required documents

Certified Copy of ID Card / Passport

Fees

- Entrance fee THB 100

- Annual fee THB 300

Information about debit cards

UOB ATM Regional Switch

UOB ATM Services throughout Singapore, Malaysia and Indonesia

-

UOB Mastercard Debit Cardholder can make cash withdrawal and balance inquiry transactions at UOB ATM throughout Singapore, Malaysia, and Indonesia.

- Free of Charge

Disclosure of Foreign Currency Exchange Risk Premium

When cardholder uses debit card to make payment for goods and/or services and/or cash withdrawal in a foreign currency, the expense incurred will be collected in Thai Baht. The collected amount is converted at the exchange rate applicable by each credit card company of which United Overseas Bank (Thai) Plc is a member as of the date such expenses were collected from the Bank on actual collection basis where the expense is not incurred in USD, the credit card company may convert it into USD then from USD to Thai Baht.

Debit cardholders may view the exchanges rates via the below links for preliminary reference:

- For MasterCard

(https://www.mastercard.us/en-us/consumers/get-support/convert-currency.html) - For VISA

(https://www.visa.co.th/th_TH/support/consumer/travel-support/exchange-rate-calculator.html)

For the purpose of risk protection, the Bank will charge an exchange risk-hedging premium on the top of the converted amount at a rate not exceeding 2.5% of the expense incurred.