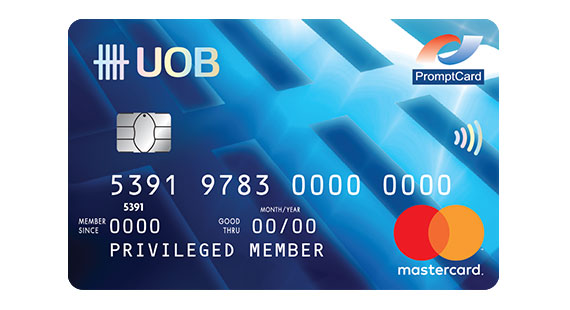

UOB Mastercard Debit Basic Banking

UOB Mastercard Debit Basic Banking is aimed to help promoting financial inclusion and widening opportunities to support Thai unbanked people to access financial services and digital banking by designing to linked with Basic Banking Account under the concept of encouraging all sectors of society to access financial services for sustainable economic growth.

- The daily maximum cash withdrawal is up to THB 100,000.

- The daily maximum spending by a UOB Debit card is up to THB 100,000 at participant merchants with PromptCard and MasterCard signs. (excluding cash withdrawal)

- Withdraw cash just like an ATM card from nationwide and worldwide ATMs displaying Promptcard or MasterCard sign.

- Phone Banking 24-hour service 0-2285-1555

Terms and Conditions

Applicant Requirements

Applicant Requirements

- An Individual person aged 15 years and over (at the date of application) who is the holder of state welfare cards that has not expired or Thai senior citizens aged over 65 years

- Have a Basic Banking Account (conditions determined by the bank)

Application Condition

- 1 person/card

Required Documents

Certified Copy of ID Card or Passport

Fees

- Entrance fee: THB 0

- Annual fee: THB 0

- Card Re-issuance fee: THB 100/issuance

Information about debit cards

UOB ATM Regional Switch

UOB ATM Services throughout Singapore, Malaysia and Indonesia

-

UOB Mastercard Debit Basic Banking Cardholder can make cash withdrawal and balance inquiry transactions at UOB ATM throughout Singapore, Malaysia, and Indonesia.

- Free of Charge

Disclosure of Foreign Currency Exchange Risk Premium

When cardholder uses debit card to make payment for goods and/or services and/or cash withdrawal in a foreign currency, the expense incurred will be collected in Thai Baht. The collected amount is converted at the exchange rate applicable by each credit card company of which United Overseas Bank (Thai) Plc is a member as of the date such expenses were collected from the Bank on actual collection basis where the expense is not incurred in USD, the credit card company may convert it into USD then from USD to Thai Baht.

Debit cardholders may view the exchanges rates via the below links for preliminary reference:

- For MasterCard

(https://www.mastercard.us/en-us/consumers/get-support/convert-currency.html) - For VISA

(http://corporate.visa.com/pd/ consumer_services/ consumer_ex_rates.jsp)

For the purpose of risk protection, the Bank will charge an exchange risk-hedging premium on the top of the converted amount at a rate not exceeding 2.5% of the expense incurred.