PRU INCOME GUARD

Enjoy Annual Cash Back

- Receive cash back starting from the 1st policy year

- Be Worry free with life coverage uo to 200% of sum assured

Underwriting Conditions

| Eligible Age: | 20 – 55 years |

| Coverage Period: | 20 years |

| Premium Payment Period: | 10 years |

| Sum Assured: | A minimum of 50,000 Baht |

| Mode of payment: | Annually, Bi-annually, Quarterly and Monthly |

| Medical Check-up: | Prudential Life Assurance (Thailand) PLC. reserves the rights to require a medical check-up under the company’s underwriting policy. |

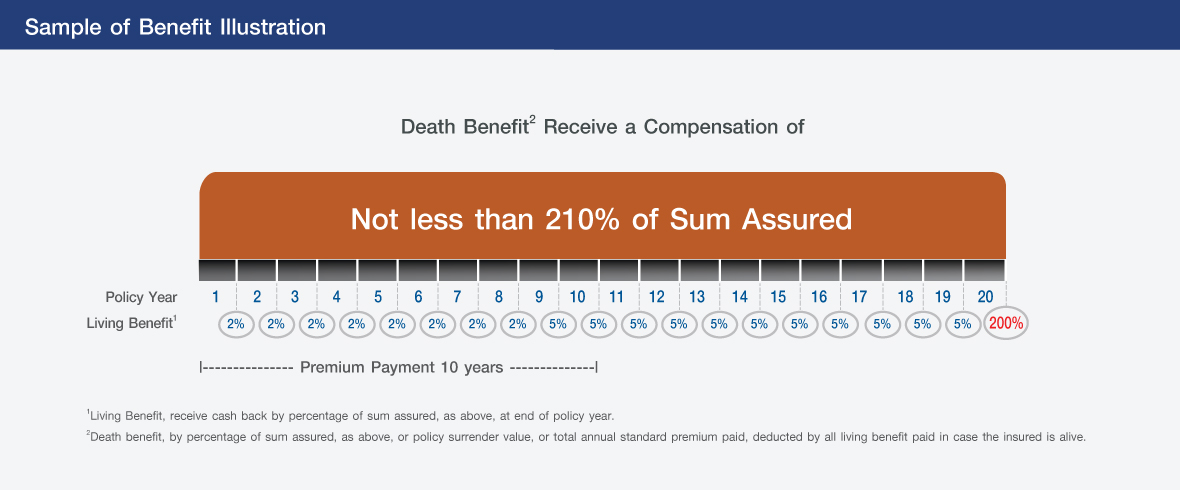

Benefit

| Living Benefit | |

| At end of policy year 1-8 | Receive a 2% cash-back of sum assured |

| At end of policy year 9-19 | Receive a 5% cash-back of sum assured |

| At end of policy year 20 | Receive a 200% cash-back of sum assured |

| Total cash-back throughout the policy term of 271% of sum assured. | |

| Death Benefit | |

| Policy year 1-20 Receive a compensation not less than 200% of sum assured | |

| Remarks: Living Benefit, receive cash-back by percentage of sum assured as above at end of policy year. Death benefit, by percentage of sum assured, as above, or policy surrender value, or all annual standard premium paid of the main policy deducted by all living benefit paid in case the insured is alive. |

|

- Premium paid for life insurance policies with coverage period of 10 years and above can be entitled for personal income tax deduction for up to the maximum of 100,000 Baht per year (as per the Department of Revenue’s regulations).

- This product is a life insurance product and is not a deposit. To secure the complete benefit of the policy contract, the policyholder should make premium payments thoroughly throughout the premium payment period as well as holding the policy contract until its maturity. In case the policy contract is terminated prior to its maturity, the policyholder is subject to risk of not getting the premium paid or not getting the premium paid back in the full amount.

- It is the responsibility of the insured to make premium payments. Life insurance brokers only facilitate the service.

- Buyers have to study and understand policy terms and conditions before making a decision to buy a life insurance policy.

- Conditions for non-coverage:

- In case of material misrepresentation or false statement, the Company shall void the policy within 2 years from the policy effective date or the renewal date or the reinstatement date or the date the Company approves the increase of sum assured, only for the increased amount.

- The Insured commits suicide within 1 year from the policy effective date or the renewal date or the reinstatement date or the date the Company approves the increased sum assured, only for the increased amount, or is murdered by the beneficiary.

- The insured has rights to cancel the policy within 15 days from the date of receiving it. The company will then return the outstanding premium paid after deducting 500 Baht per policy for actual medical check-up expense and any other expenses.

- The Insured has right to exercise the policy surrender and get the policy surrender value in the amount equivalent to what is stated in the Policy Surrender Schedule, plus any policy benefits to be entitled to (if any) less the outstanding debts (if any).

- This document is not an insurance contract. Details of coverage and exclusions are stated in the life insurance policy.

- PRUincome guard is the marketing name of Endowment Plan “PRU Aomsub 20/10” (Non-participating).

UOB, in its capacity as the insurance broker license number Chor 00026/2545 will facilitate the insurance transaction and premium payments only, while Prudential Life Assurance (Thailand) Public Company Limited will be responsible for providing the coverage and benefits as stated in the insurance contract.